The transfer of a property from one party to another is a legal transaction that must be documented in writing to protect the involved parties. To do so, a general warranty deed is used. The deed should be detailed to ensure it covers all the relevant information about the transaction. Traditionally, it ensures that full ownership of the property is transferred from the seller (grantor) to the buyer (grantee).

This deed warrants that the grantor has full ownership of the title and is legally allowed to transfer ownership and that the property and its title are free of any legal encumbrances. To ensure the deed is legally binding and uses the appropriate legalese, it is best to have an attorney review the document before it is filed. The deed is used for residential and commercial transactions of real property.

What is a General Warranty Deed

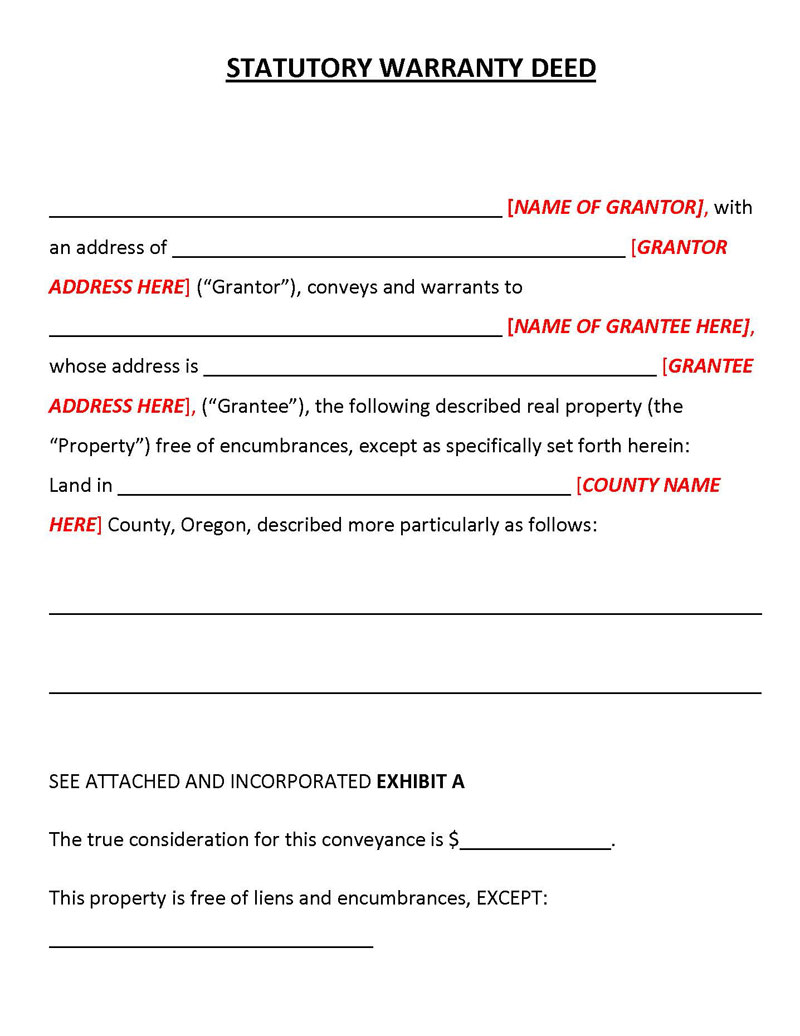

A general warranty deed, also known as statutory warranty deed, is a legal document that guarantees that property being transferred from one party to another in exchange for an agreed-upon sale price and is free of any liens and claims. It is legally binding and enforceable once signed by the seller and the buyer.If any financial or legal claims against the property or title arise in the future, the seller is expected to take corrective actions, as this type of deed offers the most protection to the buyer.

Alternative names

Alternative names used to refer to a general warranty deed form include:

- Full Warranty Deed

- Grant Deed

- Special Warranty Deed

- Deed of Guarantee

Parties involved

A complete deed involves two parties: the grantor and the grantee. Both parties can be individual people or entities such as companies.

However, these parties differ in the following ways:

- Grantor: The grantor or seller is the party selling or giving up their property ownership for specified consideration or as a gift.

- Grantee: The grantee is the party to whom property ownership/title is transferred.

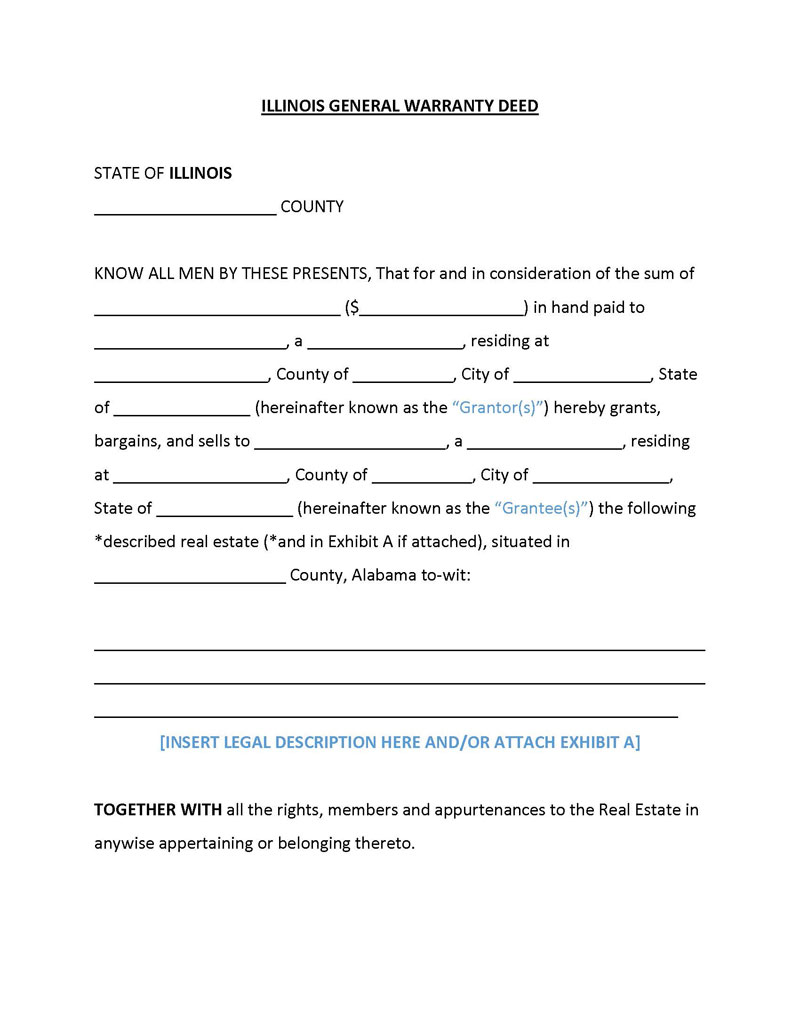

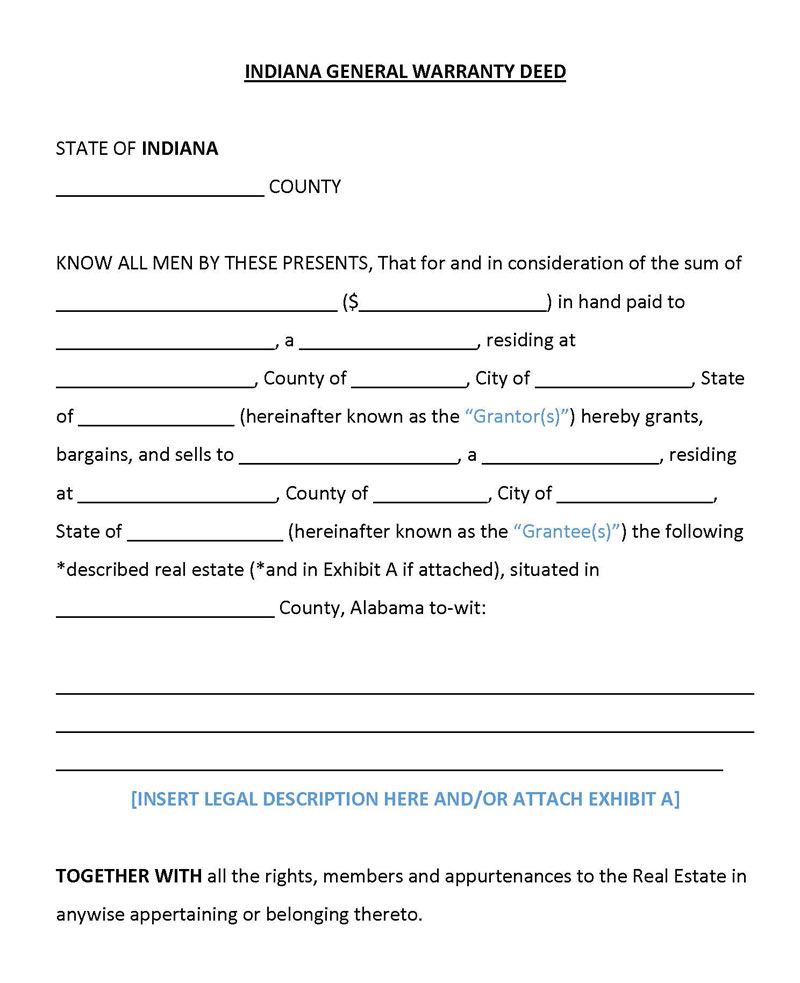

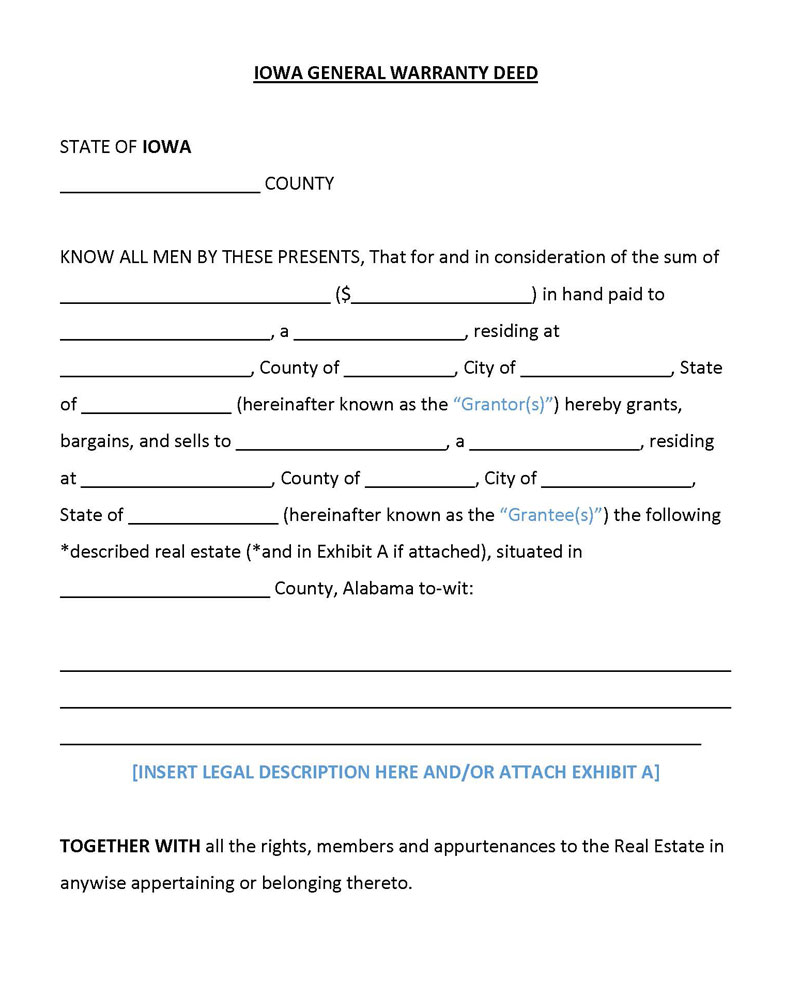

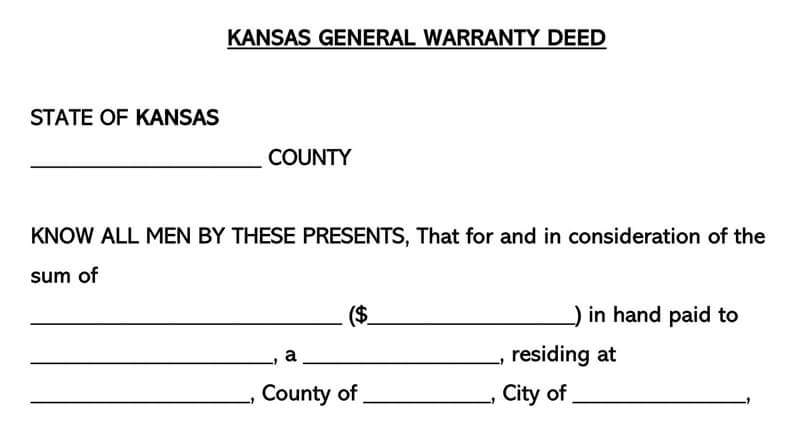

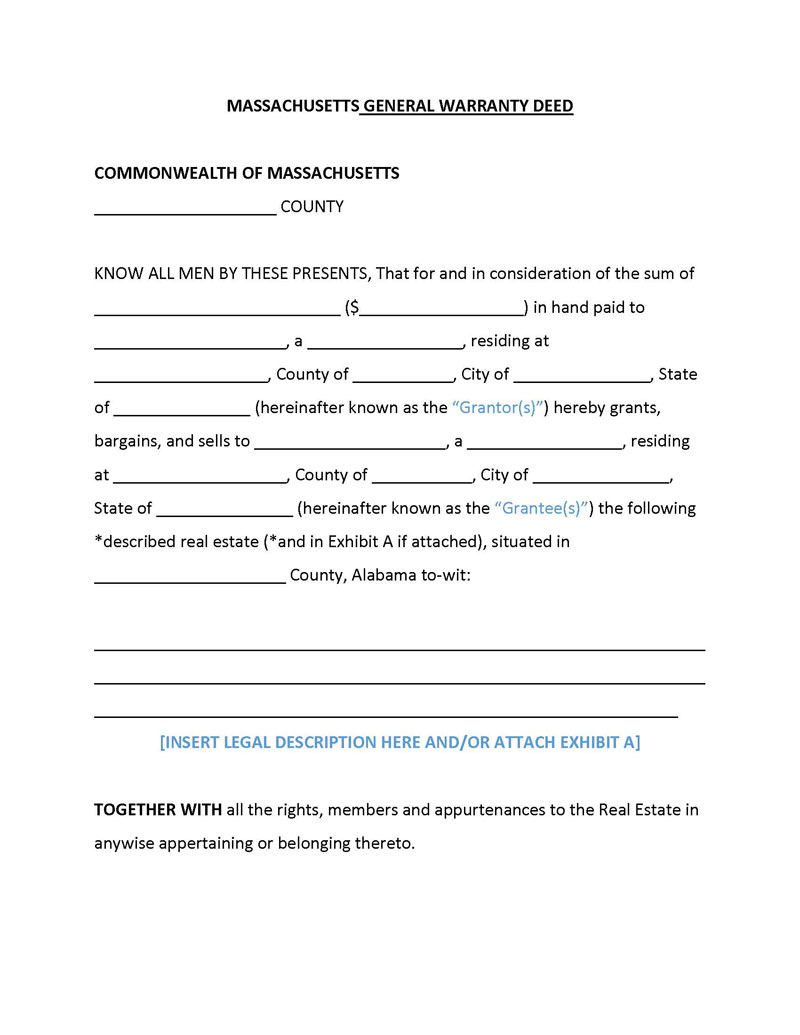

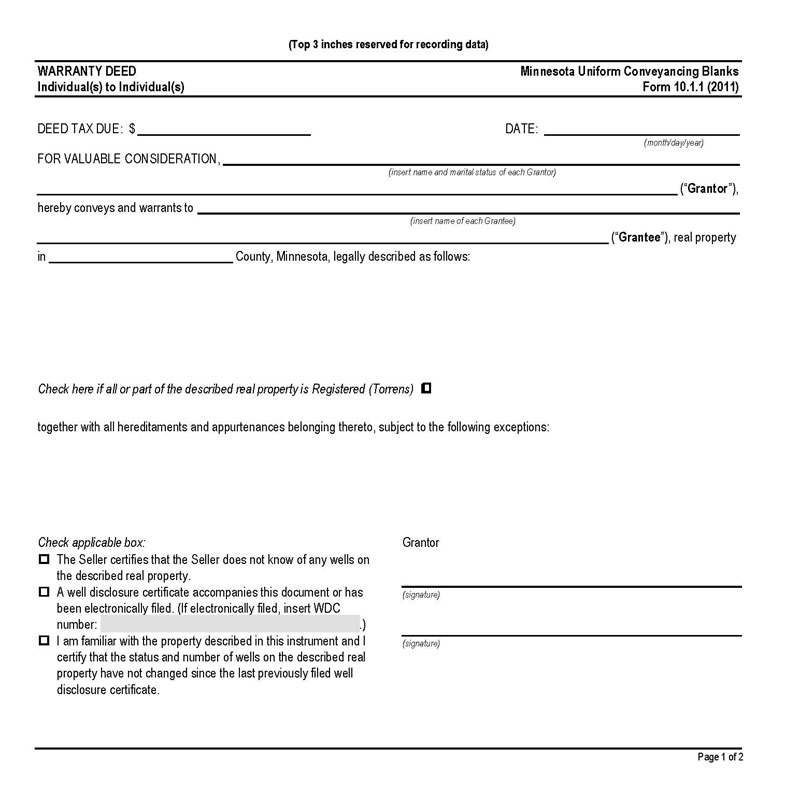

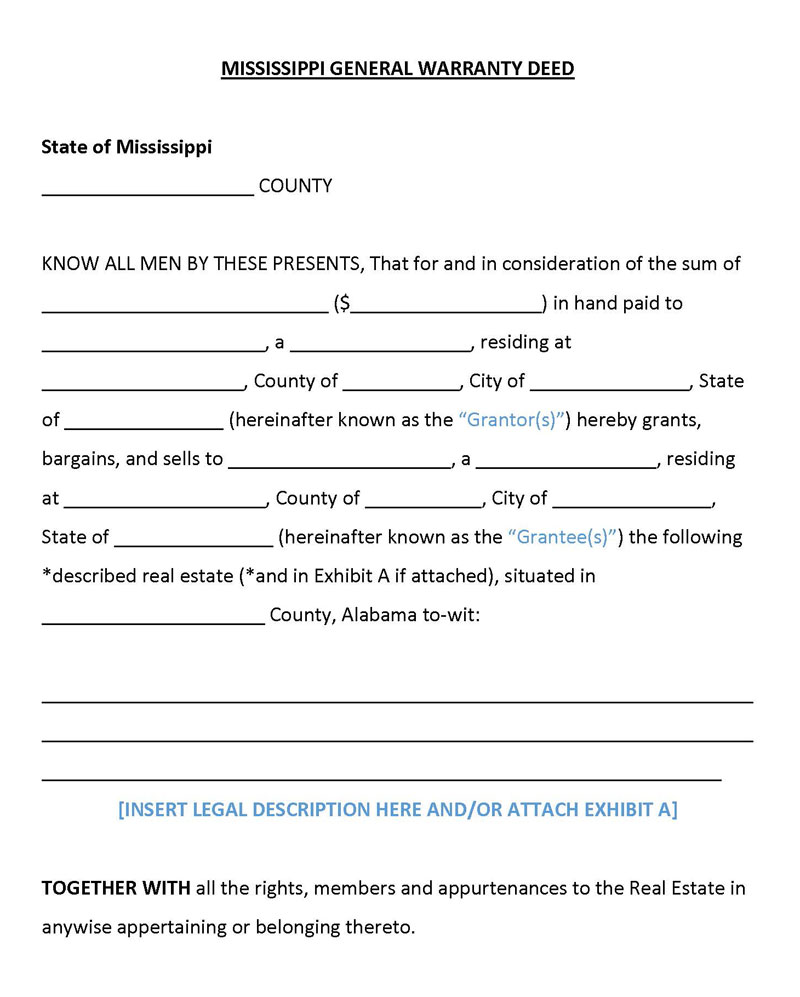

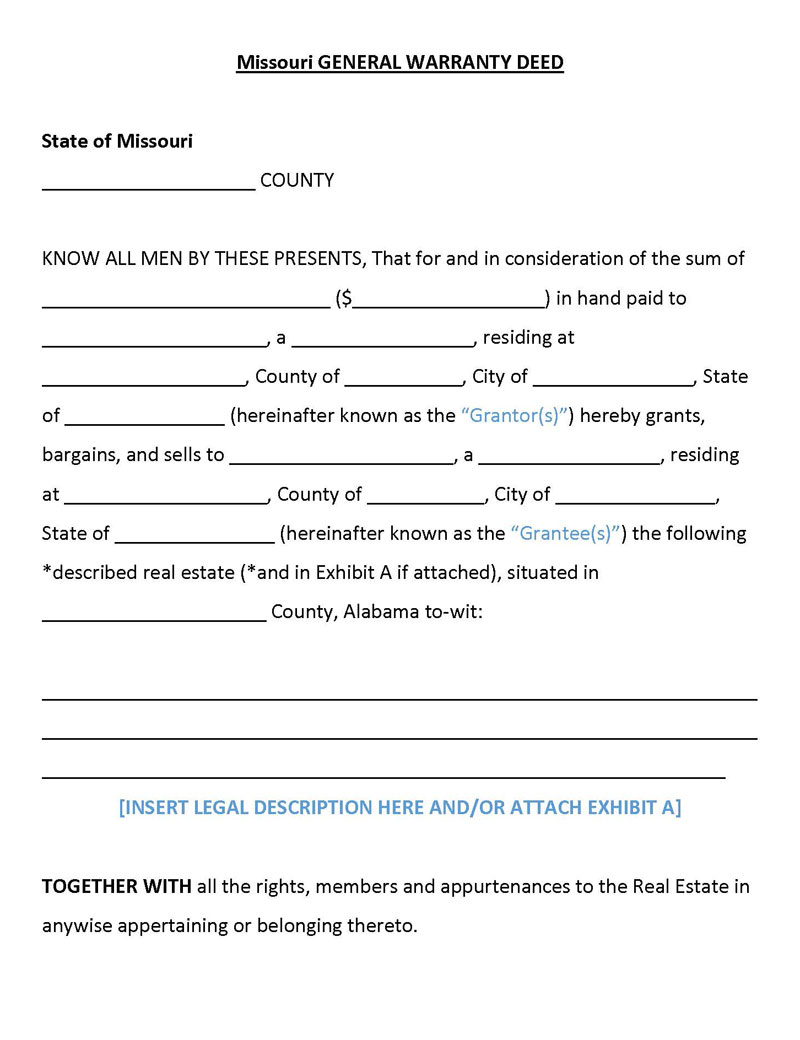

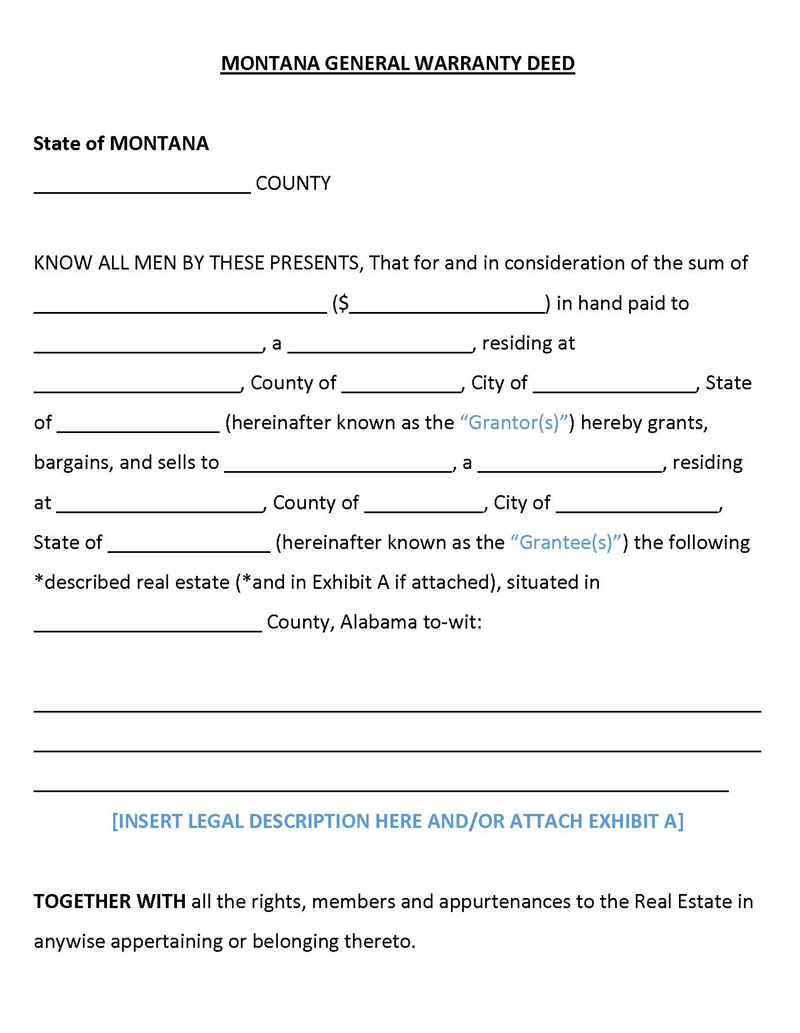

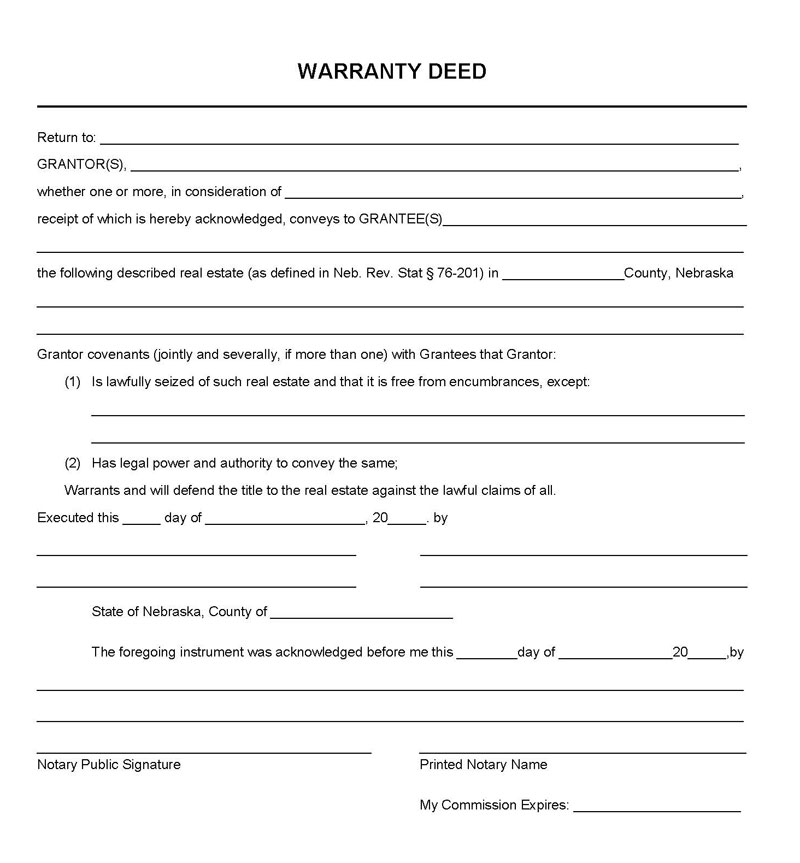

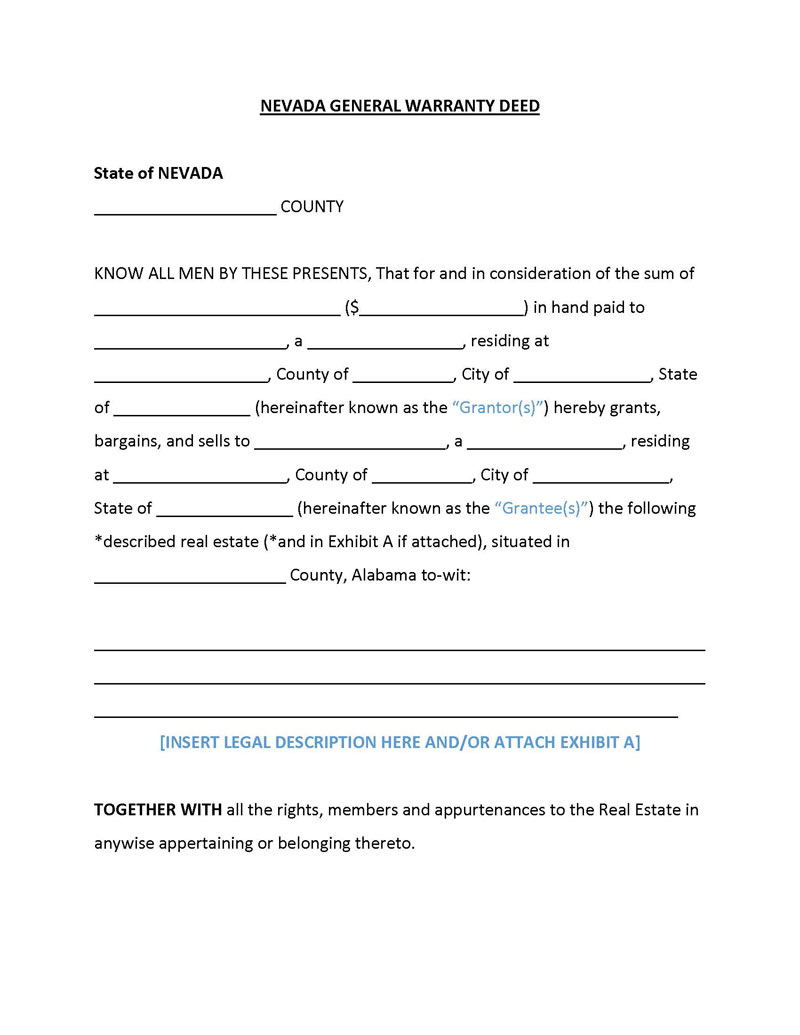

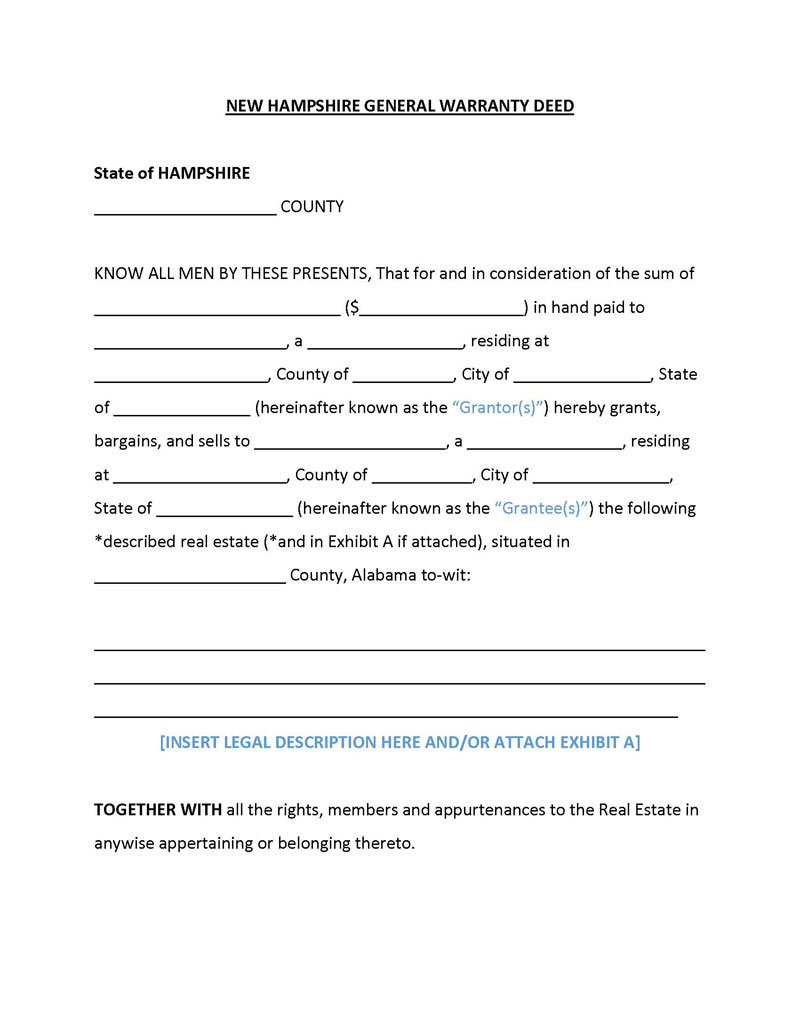

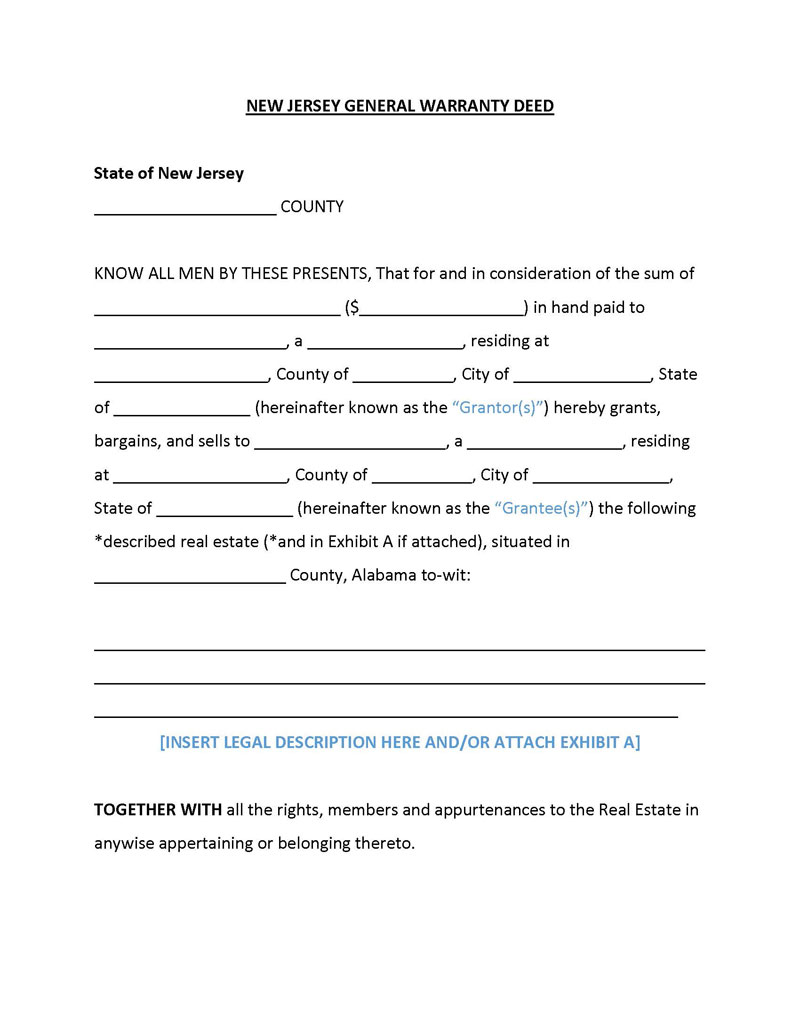

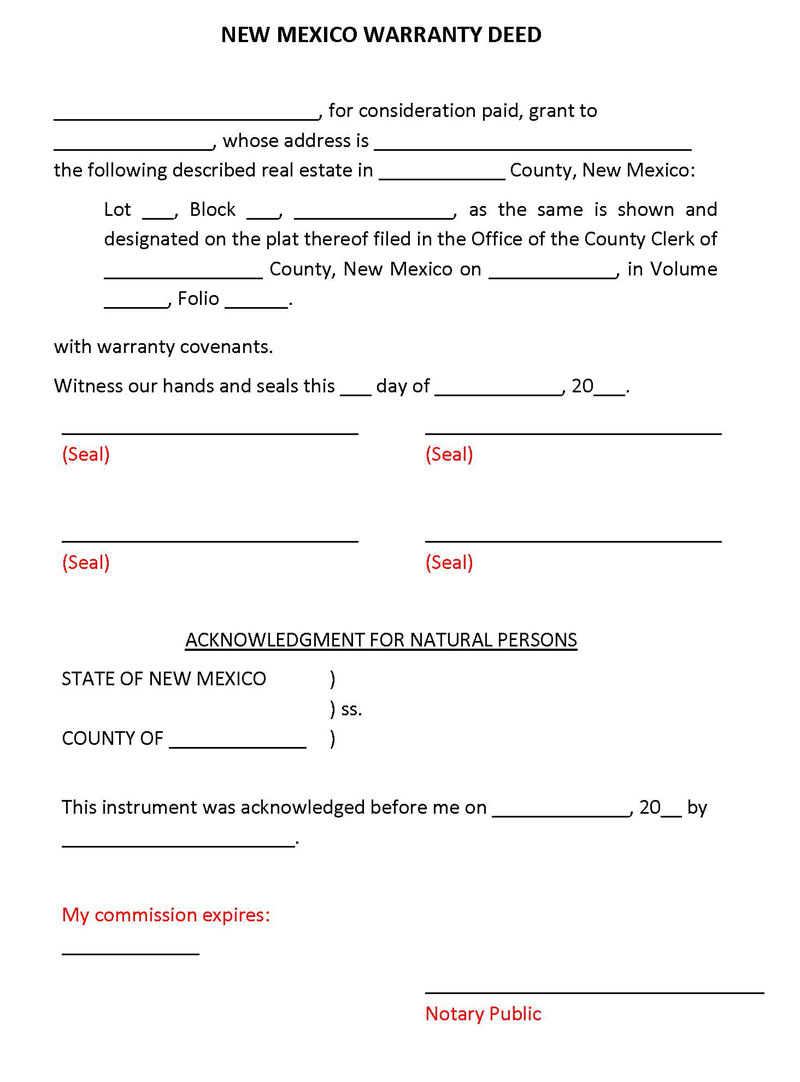

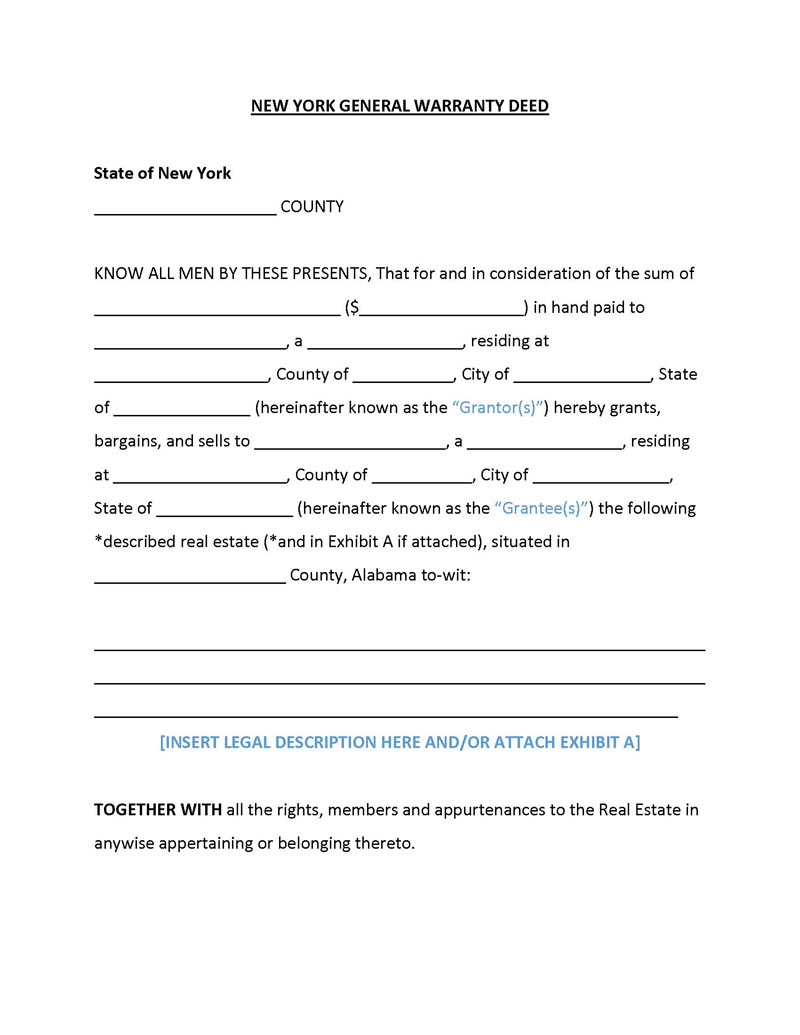

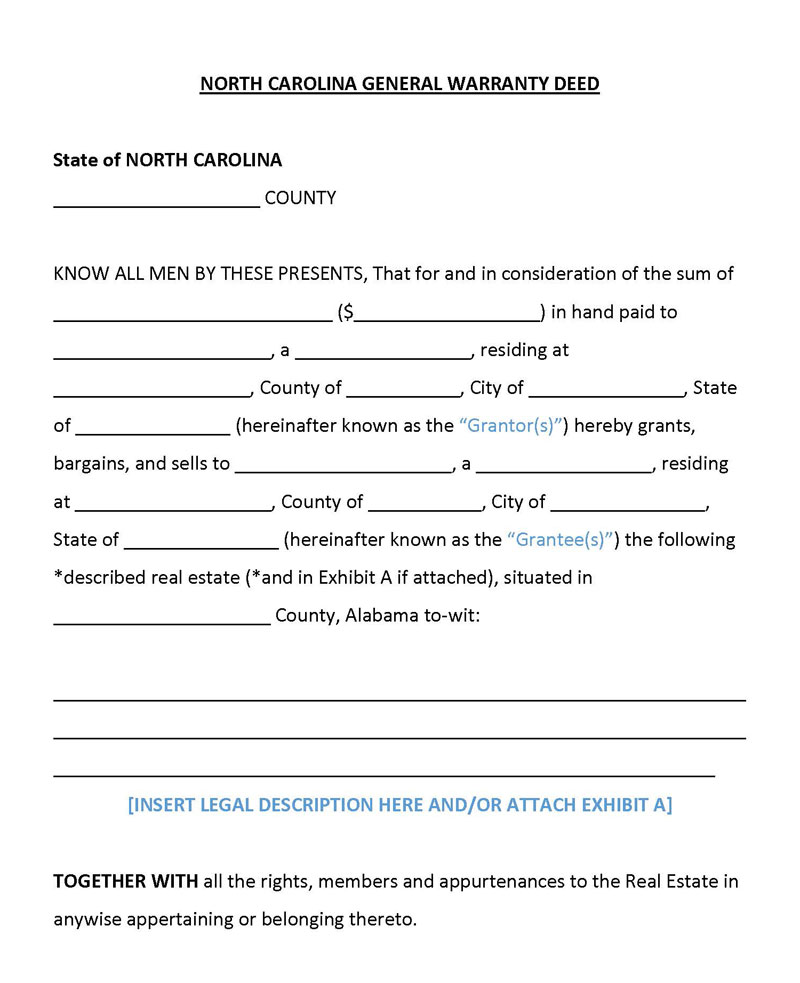

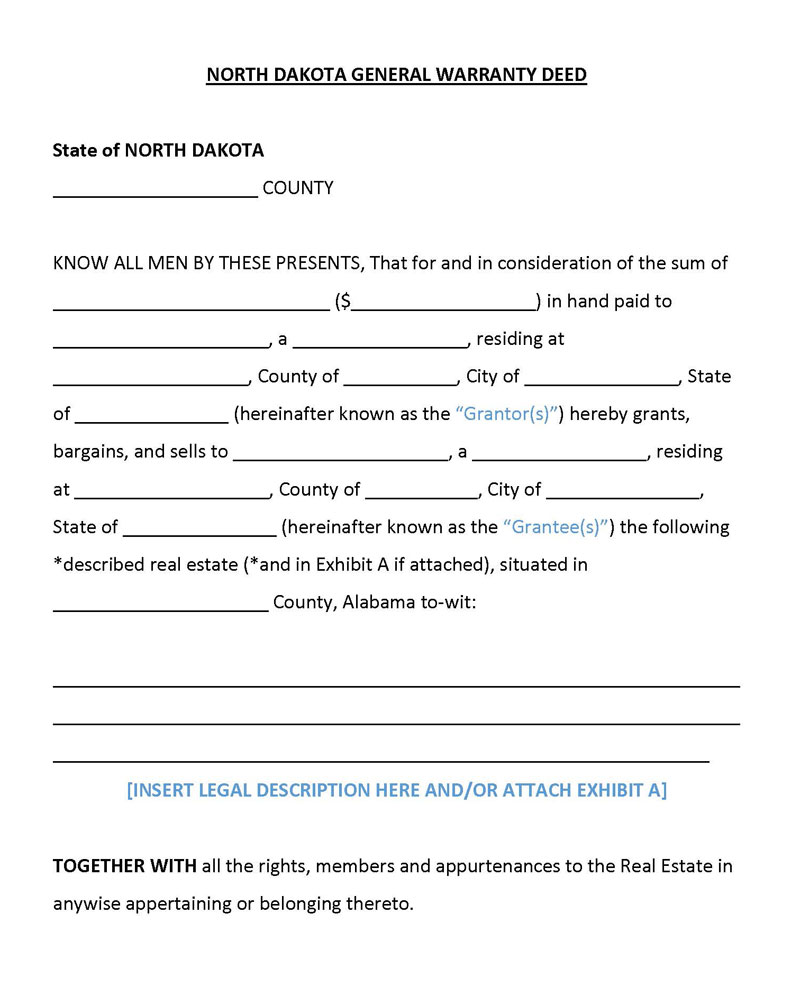

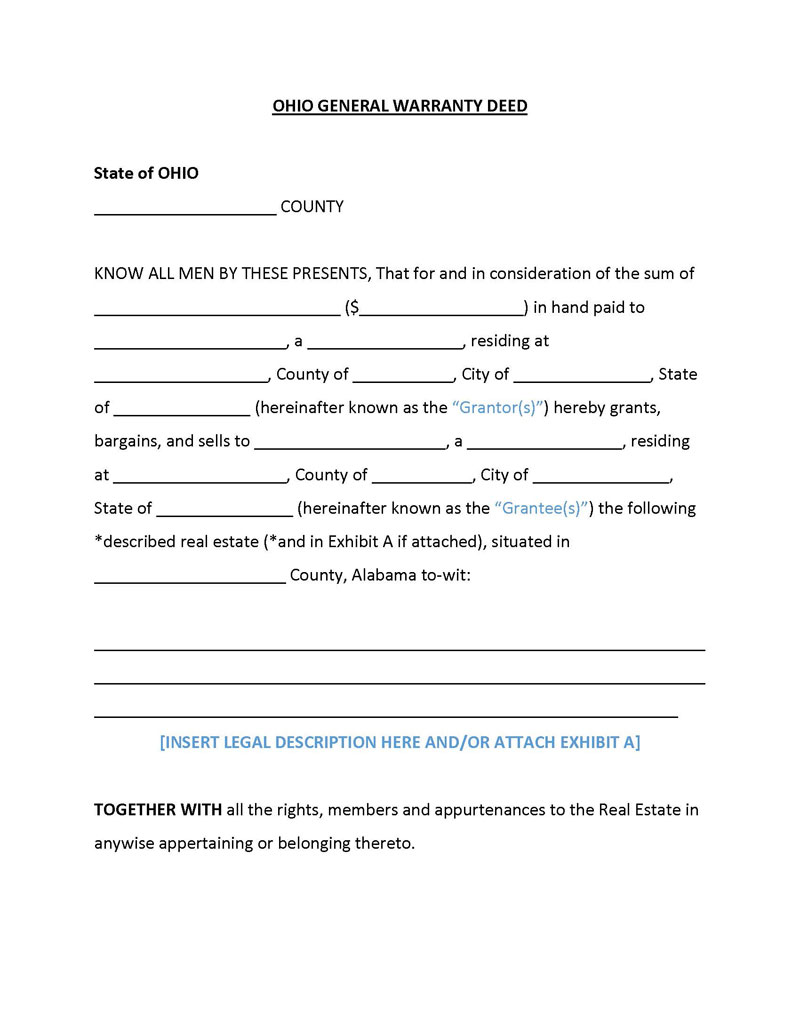

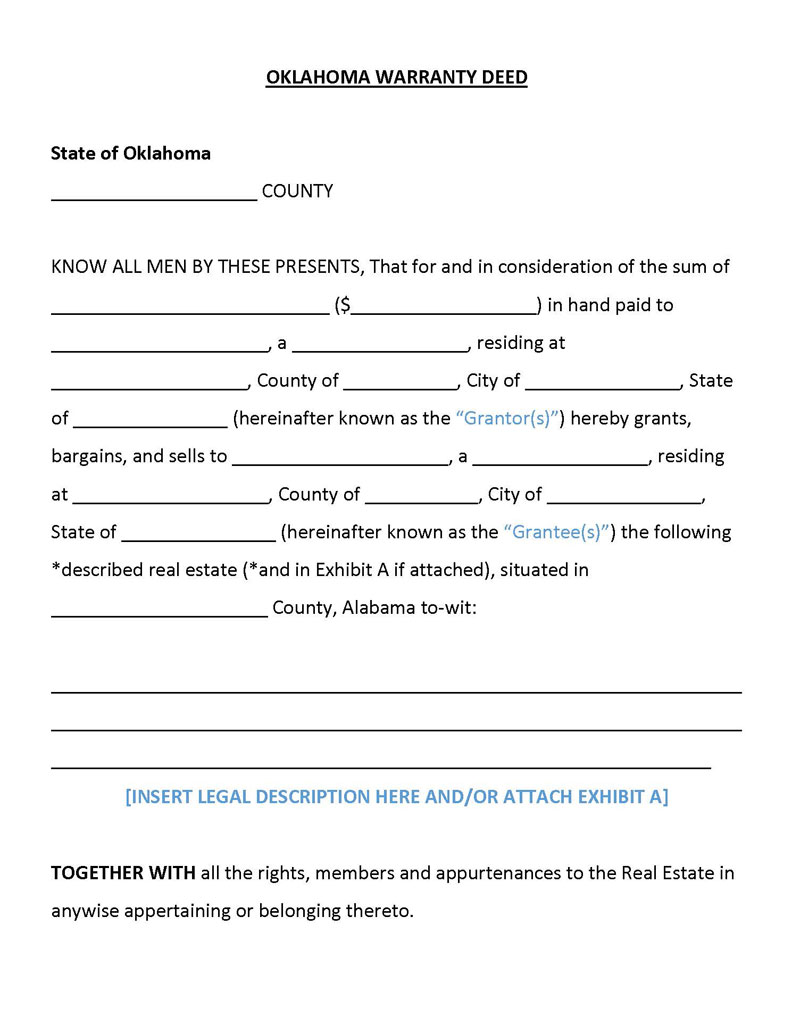

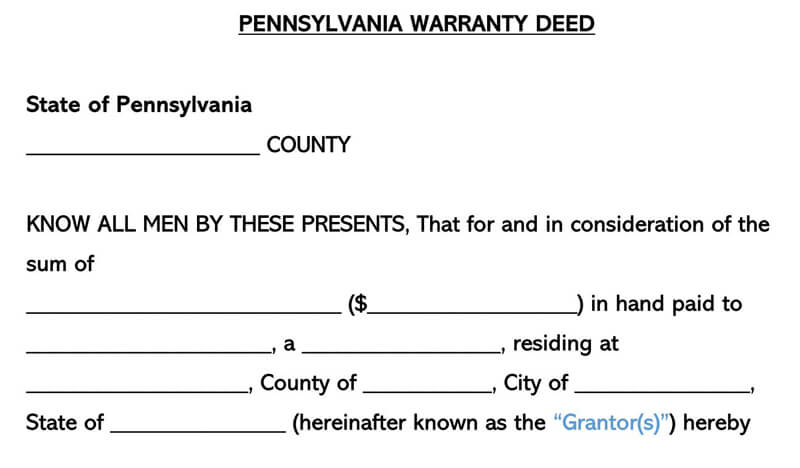

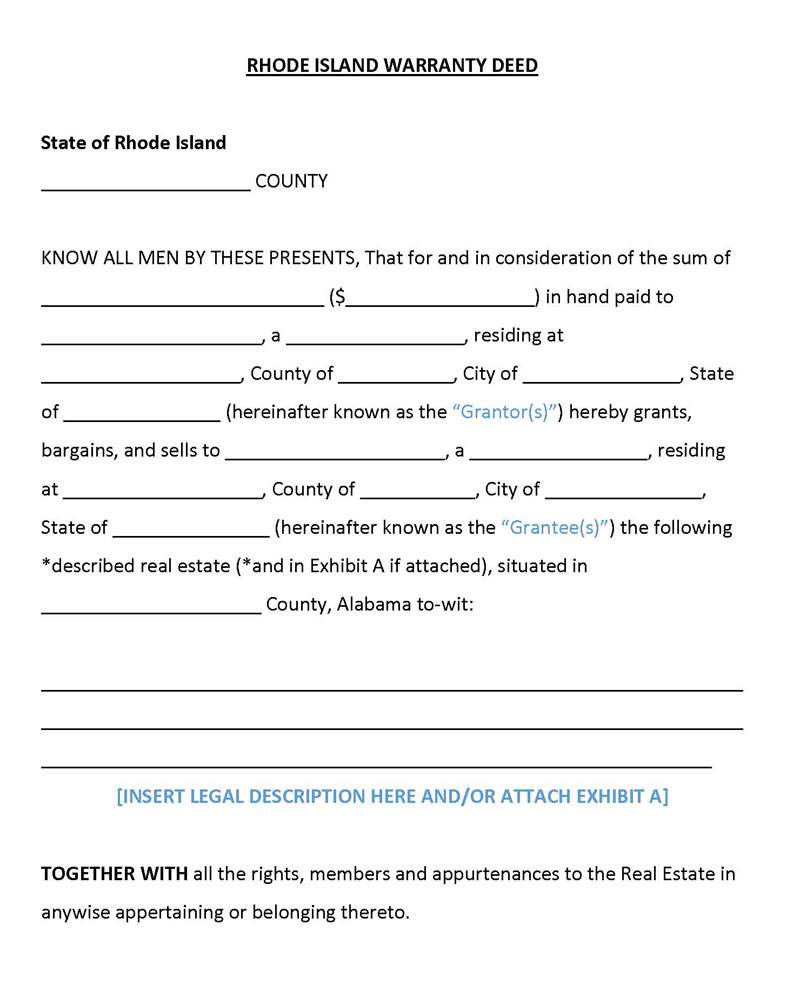

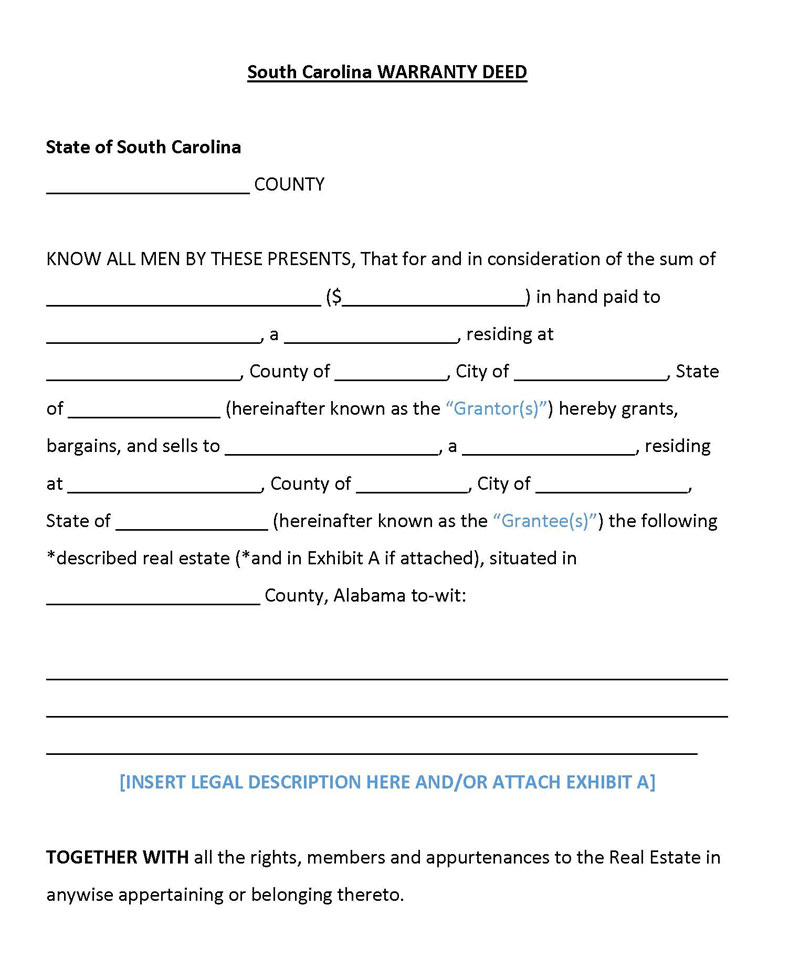

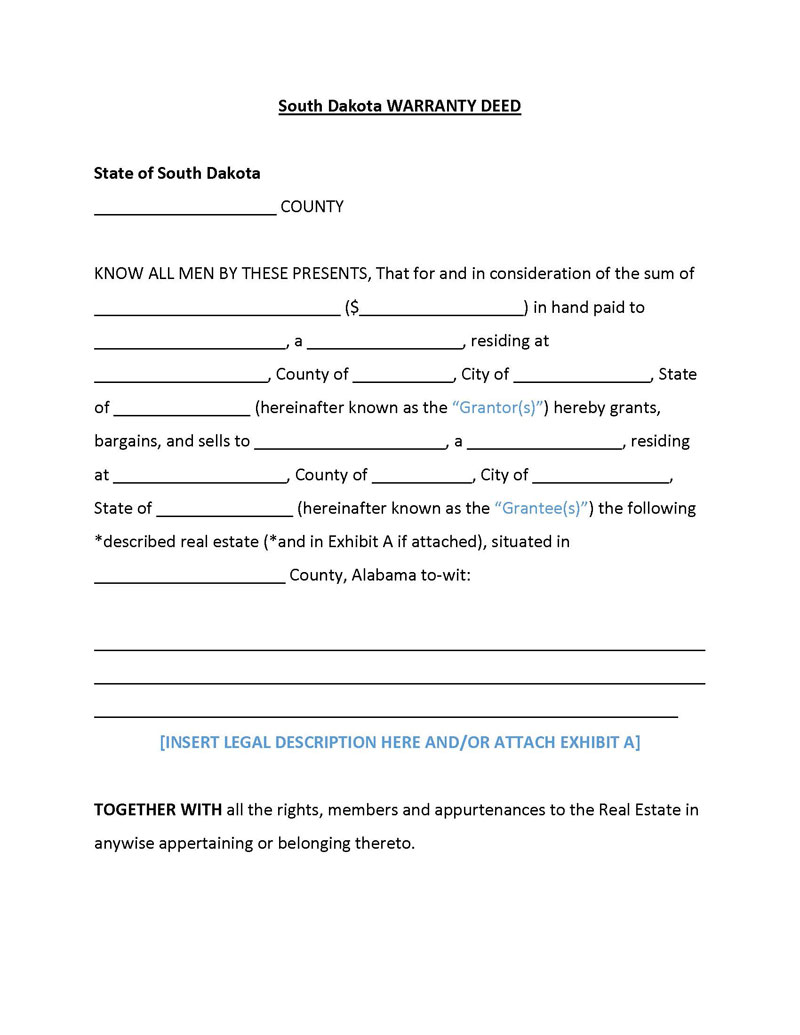

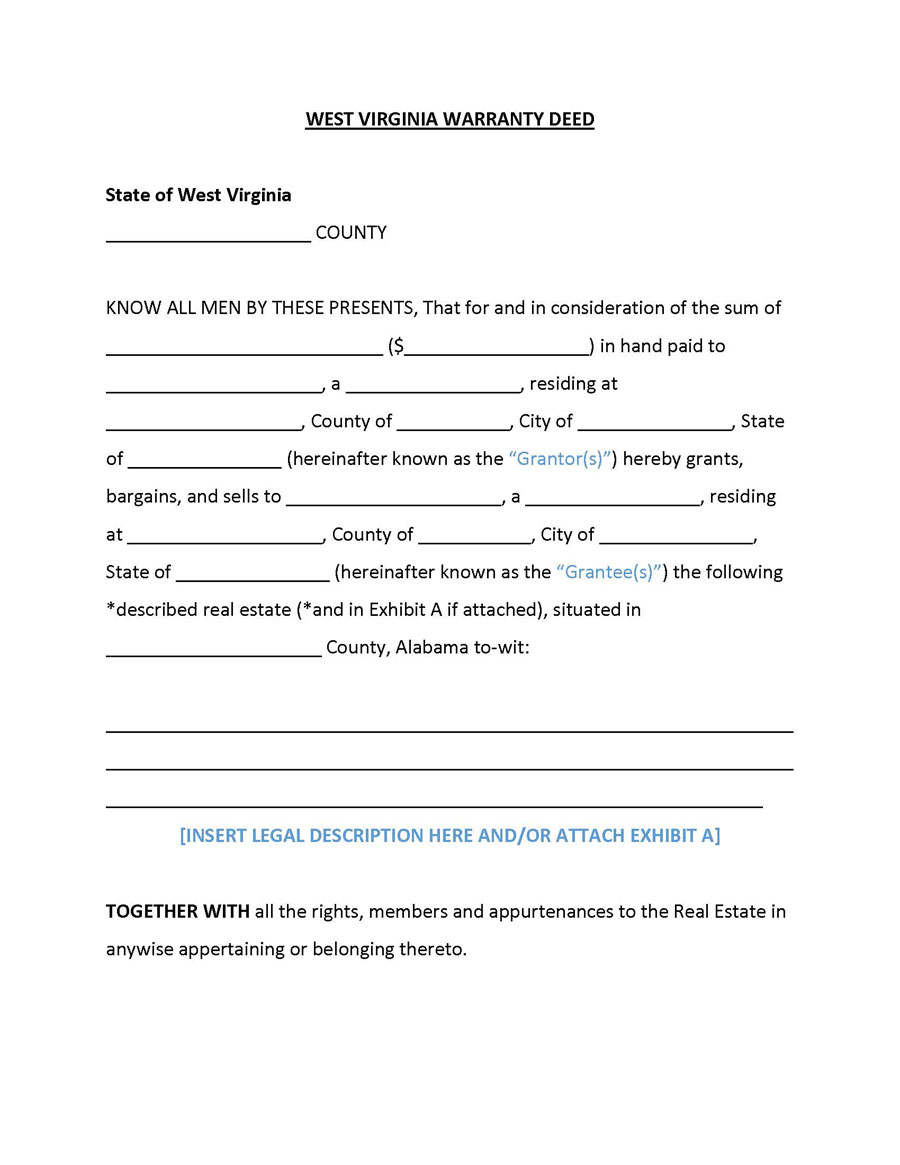

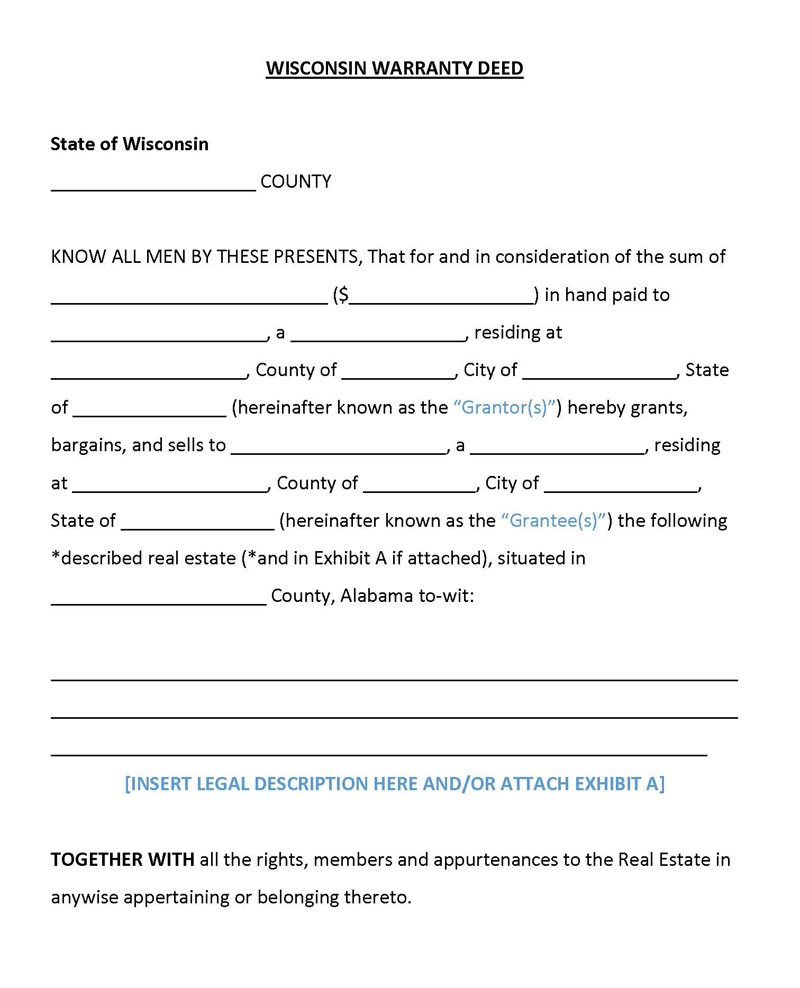

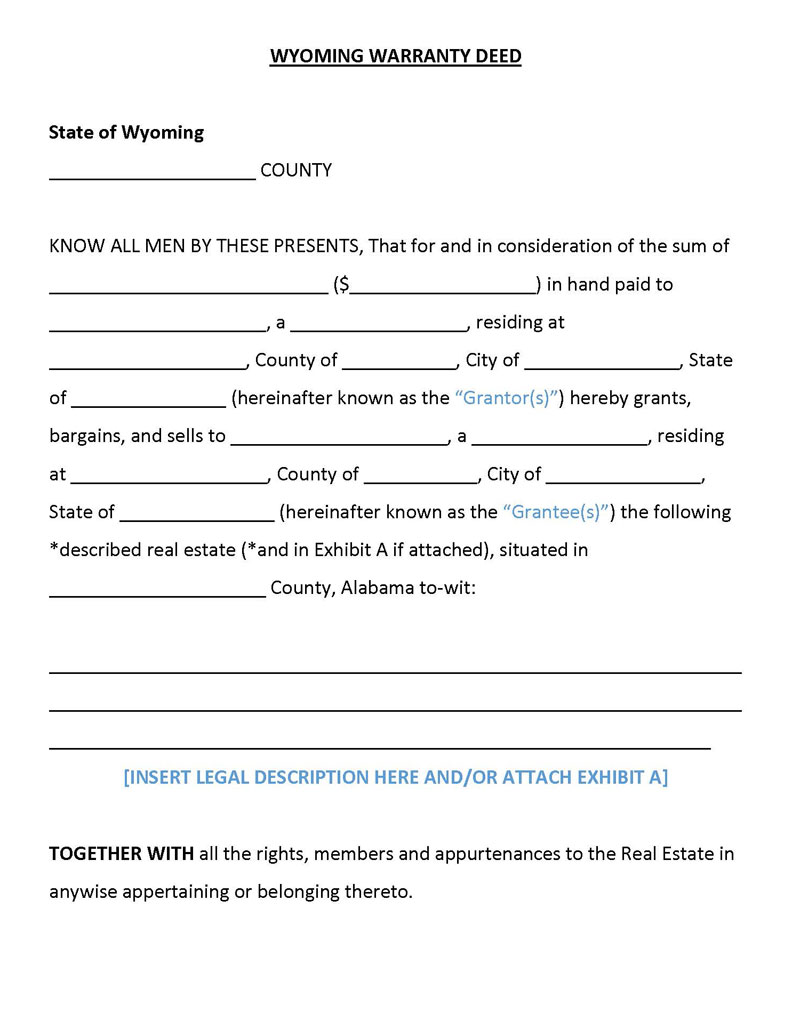

Free Warranty Deed Forms

How Does it Work

This deed outlines the title of the property, the owners of the property (current and previous), legal property description, the sale price of the property, liens (if any), date of transfer, and signatures of the involved parties. The deed, unlike the title, is not proof of ownership but a guarantee that no one else has claims on the property, whether financially or legally. A deed offers six covenants or “warranties” during the transaction.

These covenants offer the grantee a high level of protection and consequently a great deal of risk to the grantor. As a result, most transacting parties involving this document use title insurance. It requires a title company to conduct a title search on the property’s title to determine if there are any claims and liens from the property’s entire history. Depending on the findings, the title company then decides whether to insure the property’s title against any liens and claims or not.

The covenants of the deed are as discussed below:

- Covenant of right to convey: The grantor/seller guarantees that they have the legal right to transfer the property to the grantee.

- Covenant of seisin: The grantee is guaranteed that the grantor is the legal owner of the property and has the legal title to the property.

- Covenant against encumbrances: A covenant that warrants no pending or unspecified encumbrances to the property, or its title, such as mortgage other than those disclosed by the grantor.

- Covenant of quiet enjoyment: assures the grantee that they will enjoy the property without interference from a third party claiming to have a superior title. Therefore, they are assured that they will not be evicted or dispossessed of the property.

- Covenant of warranty: The grantor promises to protect the grantee, legally and financially, against any legal and financial liens and encumbrances, currently and in the future. It also guarantees that the grantor shall compensate the grantee if such claims arise.

- Covenant of further assurances: This covenant assures the grantee that the grantor will take any necessary steps to correct any defects in the title or claims.

When and How to Use It

It is commonly used in real estate such as residential home sales. Examples of situations where such deed would typically be used are as follows:

- Grantors will use the deed when transferring property to a trust.

- It is used when buying and selling property, especially when the buyer and the seller are strangers.

- Grantees use the deed as proof of a free and clear title when obtaining financing for buying property or applying for title insurance.

With that in mind, it is evident that the deed forms can be used for both private and commercial purposes. Grantors present the deed as a promise that they are the legal owners of the property and have the right to sell or transfer it to the grantee. Grantees request the deed to protect themselves from any claims against the property once they buy it. The form must be notarized and then filed with the county’s Registry of Deeds or appropriate government office.

These are not the only deeds used in property transfer. Other types of deeds are also applicable. However, each type of deed offers different levels of protection.

These deeds vary from one another as discussed below:

Special warranty deed

A special deed offers the same warranties as a general deed; however, it is limited as it is only useful for a specified period of time, ordinarily when a property is under ownership of the current grantor. The grantor, therefore, promises that the title has no defects and the property doesn’t have any liens originating from the time of their ownership. Special deeds are customary in commercial real estate between businesses. Due to its timestamp limitation, the grantee cannot seek legal compensation from the grantor for claims stemming from previous owners.

Quitclaim deed

A quitclaim deed is utilized when the grantor wants to relinquish their claim on a property to another party without guaranteeing that the property is free of any liens and encumbrances. As a result, quitclaim deeds are common among people who know and trust each other like relatives and heirs. A quitclaim has the highest risk among deeds used to transfer property, and as a result, title insurance is not used in such transactions.

Deed of trust

A deed of trust assigns a third party, referred to as a trustee, to temporarily hold the title during a property transaction where the buyer buys property via financing. The trustee is legally allowed to foreclose the property if the grantee fails to reimburse the loaned money. A deed trust is therefore common in mortgage financed property purchases.

Grant deeds

A grant deed offers the same protections as a general deed to a great extent. However, it does not warranty against third-party claims. Grant deeds are, therefore, common among foreclosures.

Bargain sale deed

Another document that is used to transfer property is a bargain sale deed. A bargain sale deed implies that the grantor has interest or claim to a property and has the legal right to sell without guaranteeing the validity of the title or promising that it is free of any liens or claims. As a result, it is common in foreclosures and tax sales.

Real estate

Real estate is a property that cannot be moved, such as land and any permanent improvements (natural or built) on the land. Examples of land improvements include buildings and boundaries etc.

Making a Deed

A warranty deed has to be legally viable to offer its protection. This will often be dependent on how well-written the document is. The deed ought to include all the relevant details of the transaction.

Below is a guide on how to write a legally enforceable deed that covers all the necessary sections:

Preparers information

It should indicate information of the person who prepared it. Traditionally, this will be the grantor. The deed must show the preparers name and address. The name should be exactly as it appears on the property’s title in question. The address must include the street address, city, state, and ZIP code for correspondence.

Discuss future recipients

After the deed form is filed with the registry, it must be forwarded to a named party. After recording, the recipient of the deed should be identified by name and address. Whether it is the grantee, trustee, or attorney, they must provide a valid mailing address.

Add the requested information

It should then state any additional information needed to complete the form. For example, it should indicate the jurisdiction of the deed and indicate the amount of money (if any) paid by the grantee for the property. Transfers between family members such as inheritance will usually not require any compensation. The deed must also identify the parties involved in the transaction and their respective roles – that is, it must distinguish the grantor from the grantee and a statement declaring that the property is being transferred from the grantor to the grantee.

It should also declare that the seller is the legal owner of the property and is legally allowed to transfer it. A statement stating that the property is free of any legal claims, such as creditors, can be added. Lastly, the deed can outline a written guarantee by the grantor that they will be legally liable to compensate the grantee if any claims emerge after the transfer.

The legal description of the property

Next, the form should provide a detailed legal description of the property. A property’s legal description can be obtained from the title. It must indicate the parcel number, boundaries, acreage, and property location. The property’s location should include the County, City, and State.

Grantor signature

To finalize the deed, the involved parties should sign it before a notary public and two witnesses or as per the state’s deed signing requirements. There should be space in the form for each party to input their name, signature, and address. A notary public should then sign the document. The notary public should provide an acknowledgement statement that declares they witnessed the signing before supplying their signature and official seal.

Deed Laws

Deed forms are state-specific and should thus be created and executed under the respective state’s laws and statutes.

Below is a table listing all the states and the respective deed laws:

| AL (§ 35-4-271) | MT (§ 70-20-103) |

| AK ( AS 34.15.030) | NE (§ 76-206) |

| AZ (§ 33-402) | NV (NRS 111.312) |

| AR(§ 18-12-102) | NH (§ 477:27) |

| CA (§ 1092) | NJ (Section 46:4-7) |

| CO (§ 38-30-113) | NM ((§ 47-1-29 & § 47-1-44)) |

| CT (Sections 47-36c & 47-36d) | NY (NY Real Prop L § 258) |

| DE (§ 121) | NC (§ 47H-6) |

| FL (§ 689.02) | ND (§ 47-10-13) |

| GA (§ 44-5-62) | OH (§ 5302.05) |

| HI (Chapter 13-16) | OK (§ 16-40) |

| ID (§ 55-612) | OR (ORS 93.850) |

| IL (765 ILCS 5/9) | PA (21 P.S. § 5) |

| IN (§ 32-17-1-2) | RI (§ 34-11-12) |

| IA (§ 558.19(3)) | SC (§ 27-7-10) |

| KS (§ 58-2203) | SD (§ 43-25-5) |

| KY (KRS 382.030) | TN (§ 66-5-103) |

| LA (CC 2475) | TX (§ 66-5-103) |

| ME (Title 33, § 763) | UT (§ 57-1-12) |

| MD (§ 2-105) | VT (§ 301) |

| MA (Chapter 183, Section 10) | VA (§ 55-68) |

| MI (§ 565.151) | WA (RCW 64.04.030) |

| MN (§ 507.07) | WV (§ 36-4-2) |

| MS (§ 89-1-33) | WI (§ 706.10(5)) |

| MO (§ 442.430) | WY (§ 34-2-102) |

Where to Record

As previously mentioned, warranty deeds have to be filed with the appropriate office once they are signed and notarized. However, grantors and grantees should be aware that the deed has to be filed in the County where the property is located and not where either of the parties lives. In addition, in some cases, the deed will usually be subjected to specific guidelines that it must meet to be accepted by the registering office.

Below is a table of respective offices where a deed should be recorded depending on the state where the property is located:

| States | Where to record |

| AL (Ala. Code 1975 § 35-4-50) | County Probate Judge |

| AK (AS § 40.17.020) | District Recorder’s Office |

| AZ (A.R.S. § 11-468) | County Recorder’s Office |

| AR (A.C.A § 14-15-404) | Circuit Court |

| CA (Cal. Civ. Code §§ 1170, 1169) | County Recorder’s Office |

| CO (C.R.S.A. § 38-35-109) | County Recorder’s Office |

| CT (C.G.S.A. § 7-24) | County Recording Office |

| DE (9 Del.C. § 9605) | Kent, New Castle, or Sussex County |

| FL (F.S.A. § 695.01(2)) | County Recording Office |

| GA (Ga. Code Ann., § 44-2-1) | Clerk of the Superior Court |

| HI (HAR § 13-16-4) | Hawaii Bureau of Conveyances |

| ID (I.C. § 55-808) | County Recorder’s Office |

| IL (765 ILCS 5/28) | County Recorder’s Office |

| IN (IC § 32-21-2-3) | County Recorder’s Office |

| IA (I.C.A. § 558.13) | County Recorder’s Office |

| KS (K.S.A. § 58-2221) | County Recorder’s Office |

| KY (KRS § 382.110) | County Clerk’s Office |

| LA (C.C. Art. 3346) | Clerk of Court’s Office |

| ME (33 M.R.S.A. § 201-B) | County Registry of Deeds |

| MD (MD Code, Real Property, § 3-104) | Division of Land Records at the Circuit Court |

| MA (M.G.L.A. 36 § 12) | County Registry of Deeds |

| MI (M.C.L.A. 565.201) | County Registry of Deeds |

| MN (M.S.A. § 507.0944) | County Recorder’s Office |

| MS (Miss. Code Ann. § 89-5-1) | Clerk of the Chancery Clerk’s Office |

| MO (V.A.M.S. 442.400) | County Recorder of Deeds |

| MT (M.C.A. 70-21-201) | County Clerk and Recorder’s Office |

| NE (Neb. Rev. St. § 76-238) | County Recorder’s Office |

| NV (N.R.S. 111.315) | See List of County Recorders |

| NH (N.H. Rev. Stat. § 477:3-a) | County Registry of Deeds Office |

| NJ (N.J.S.A. 46:5-5) | County Clerk’s Office |

| NM (N. M. S. A. 1978, § 14-9-1) | County Clerk’s Office |

| NY (N.Y. Real Prop. Law § 291) | County Court Clerk’s Office |

| NC (N.C.G.S.A. § 47H-2) | County Registry of Deeds |

| ND (NDCC, 47-19-07) | County Recorder’s Office |

| OH (R.C. § 5301.25) | County Recorder’s Office |

| OK (16 Okl. St. Ann. § 16) | County Clerk’s Office |

| OR (O.R.S. § 93.760) | County Recorder’s Office |

| PA (21 P.S. § 351) | County Recorder’s Office |

| RI (Gen. Laws 1956, § 34-11-1) | City/Town Office (varies by area) |

| SC (Code 1976 § 30-7-10) | County Recorders of Deeds |

| SD (SDCL § 43-28-1) | County Recorder’s Office |

| TN (T. C. A. § 66-5-106) | County Recorder’s Office |

| TX (V.T.C.A., Property Code § 11.001) | County Register of Deeds |

| UT (U.C.A. 1953 § 57-3-101) | County Recorder’s Office |

| VT (27 V.S.A. § 402) | County Clerk’s Office |

| VA (VA Code Ann. § 55.1-407) | Clerk of the Circuit Court |

| WA (RCW 65.08.070) | County Recorder’s Office |

| WV (W. Va. Code, § 39-1-2) | County Clerk’s Office |

| WI (W.S.A. 706.05) | County Register of Deeds |

| WY (W.S. 1977 § 34-1-118) | County Clerk’s Office |

Frequently Asked Questions

A warranty deed is signed by the grantor, grantee, and typically two witnesses in the presence of a notary public. Once signed, it legally binds the grantor and the grantee and can be presented in court as evidence if any issues arise after the property transfer.

Anybody preparing a warranty deed can do so using a template from online sources, through a general warranty deed form obtained from a local realtor’s office, or have a real estate lawyer prepare one on your behalf. It is always advisable to have a real estate lawyer review the deed before presenting it to the other party.

Other documents used in real estate transactions include grant deed, property agreement, contract of the deed, quitclaim deed, affidavit of title, bargain of sale deed, etc