A grant is an act of transferring any interest in property or land from one party to another. It is transferred by signing over the property deeds through a grant deed. This document is used to transfer rights and ownership of any asset (land) between two parties. It can be used to transfer interests like mineral rights, easements, etc.

A Grant Deed is a written document that transfers real property (land) from one person (grantor) to another (grantee).

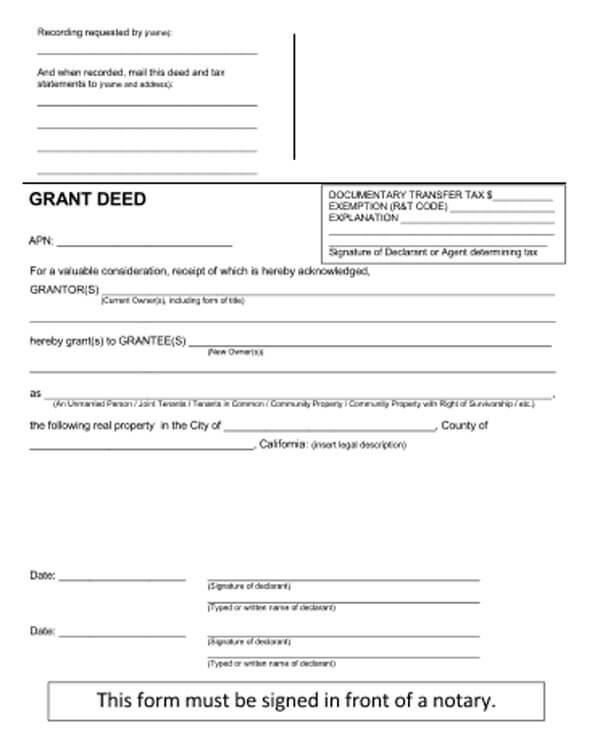

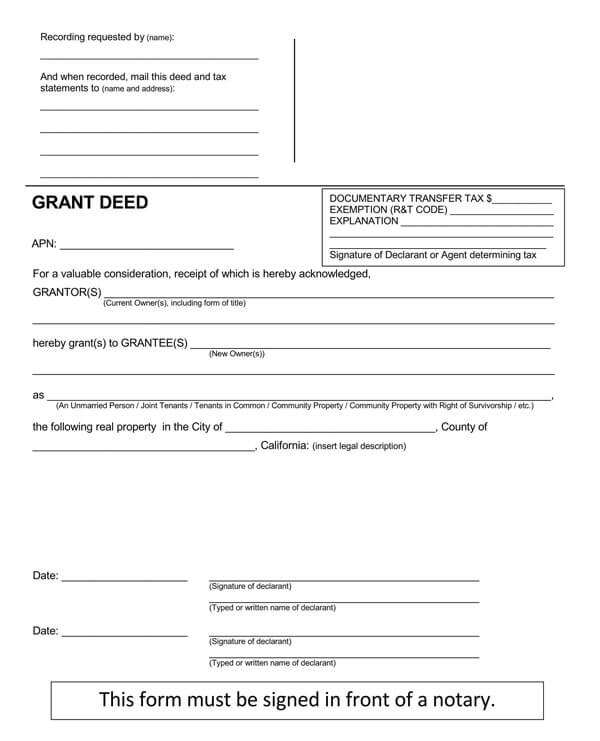

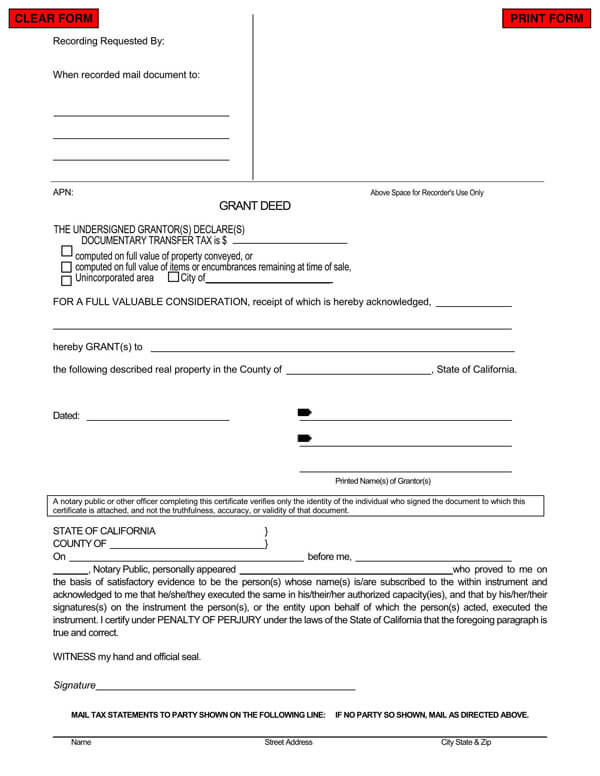

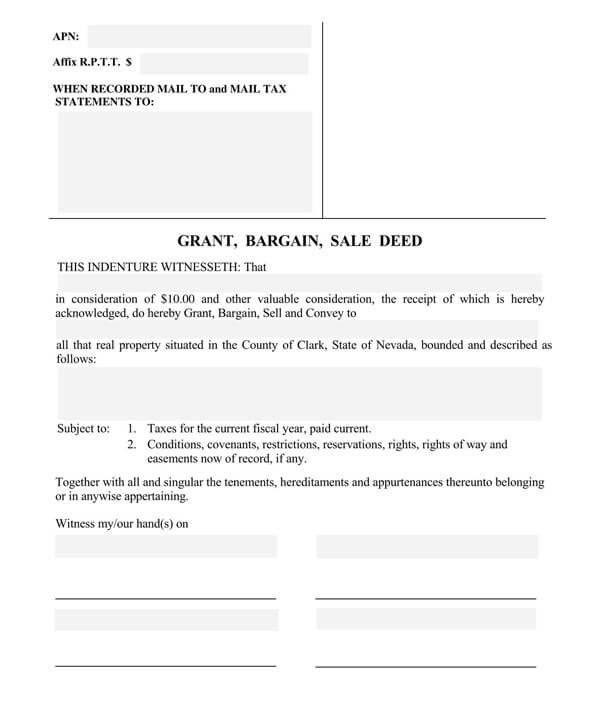

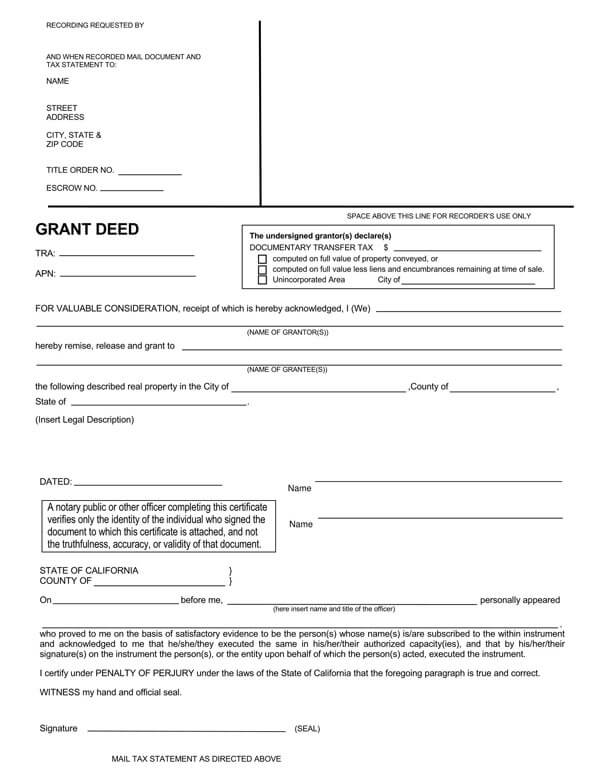

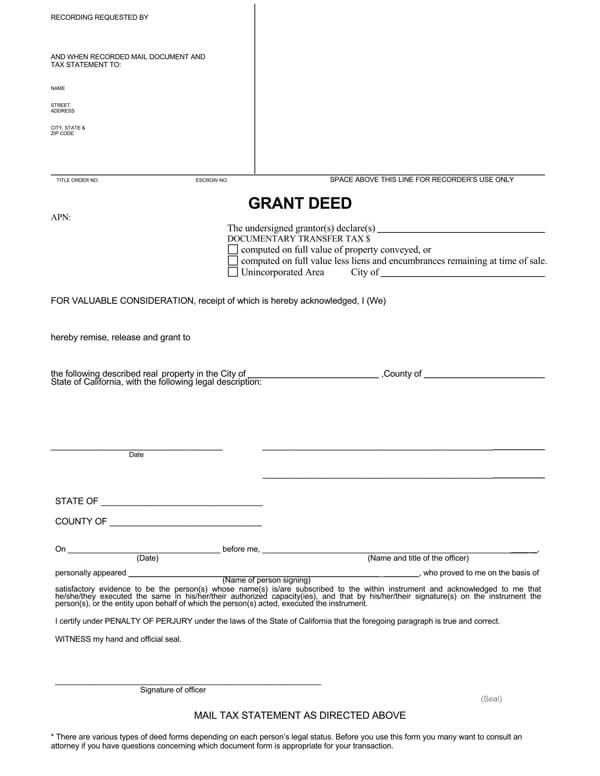

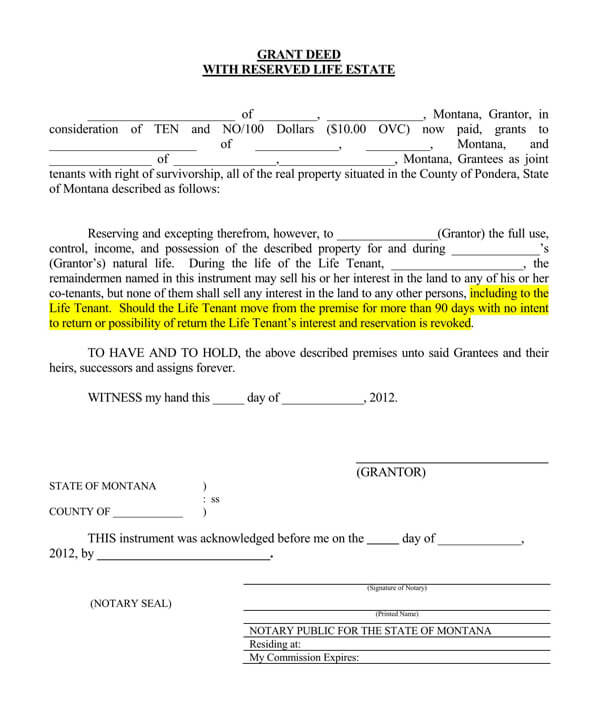

The party can be an individual, business entity, such as an LLC or Corporation, a trust, or an estate. The grant deed form reflects the mutual understanding between the parties of the transaction. It includes information about parties involved, terms of conveyance, limits or conditions on land use, area of land, legal description of the property being transferred, consideration for the transaction, and signatures of the parties involved. Words commonly used in the forms include “Grant,” “Warrant,” or “Assign.” which convey the same message.

Grant deeds are legal documents that help protect the buyers and serve as a guarantee that the property whose transfer is being made is not being contested by any liens or financial institutions. The document also acts as a guarantee to the buyer that the property will not be sold to any other party once it has been transferred to them.

The forms are often used when transferring ownership over land because it helps avoid any disputes about who owns what portion of the land. A grant deed form is simply a pre-made template that you can use to avoid costly mistakes and save time by having all your information in one place. In addition, the form can help you understand exactly what needs to be included in your document so that it complies with the state laws regarding real property transfers.

Free Forms

When Can a Grant Deed be Used?

A grant deed is only used to transfer property from one person to another. For a transaction to be valid, both parties have to sign the document. When a grant deed is used to convey the property, the parties agree on how they would like the property’s title to be transferred.

Common scenarios when a grant deed can be used include:

- During a sale of land between two parties

- During a transfer of property between related parties

- Conveyance to a trustee, personal representative, or agent

- When selling portions of your property to multiple individuals

- When gifting a piece of land to another person or entity

- When selling a piece of land and the buyer needs assurance that the property will not be sold to someone else

How Does a Grant Deed Work?

A grant deed is a legal document that grants its holder the rights to a given property provided that they meet specified conditions. Usually, these conditions are that all debts associated with the property have been paid. Once granted to its holder, the transfer of rights is final unless otherwise specified in the deed itself.

They are commonly used when transferring the ownership of real property such as land or automobiles from one party to another. The primary purpose of a grant deed is to transfer title, i.e., a legal document detailing the ownership of a property or asset to another.

A grant deed is a legal document that is written proof of a transfer of an interest in real property by the seller to the buyer. It can be used as proof that full ownership has been transferred from one party to another and that no mortgages or liens are attached to the property.

A grant deed contains three elements:

- Parties: Identifies those involved in the transaction, i.e., grantor, grantee, and witnesses.

- Property: Identifies the property in question, including a legal description or street address.

- Signatures: The signatures of all parties involved in the transaction must be included at the end of the document to validate it as a legally binding agreement between both parties.

Grant Deed Vs. Title

A Title is a legal document that establishes property ownership and contains a historical account of all transactions involving a specific part of the land. In contrast, a Grant deed is a transfer of title document used to effectuate property transfer from one person or entity to another.

Although both documents are used in the same manner by different individuals and businesses to effectuate ownership of land, a title is used by the government, while a grant deed is used primarily by private individuals and businesses

Documents Required to Get a Grant Deed

There are several documents required to get a grant deed.

They include:

- Property Details: The property deed details include all relevant information such as the name and address of the landowner, land description (location), acreage, zoning/use restrictions, encumbrances on the property (lien, existing mortgages), sellers’ due-on-sale clause information.

- Contact details of the recipient: The contact details of the party who is granted the property transferring their rights to another person, i.e., their name and contact information such as email, phone number, etc.

- Contact details of who is granting the property: The contact information of the party transferring their rights to another person, i.e., their name and contact information such as email, phone number, etc.

- The amount of money exchanged: The amount of money exchanged in the form of cash or other consideration. This is important as this determines if the transfer is taxable or not.

- Oil, mineral, or other similar rights: When oil, mineral, or other similar rights are exchanged as part of the transaction, it needs to be mentioned in the details section of the deed. This helps avoid future complications arising from unclear ownership of certain portions of this property. The grant deed must acknowledge that the rights to this property have been transferred or otherwise disposed of.

- Rights to the property: The grantor must be identified as transferring all their rights to the property. This can include but is not limited to, easements (the right for water and sewer lines), the right to build on a parcel of land, mineral rights, oil, and gas rights, etc. If these are not listed in the deed, they remain with the property owner when the property is sold.

Essential Elements of a Grant Deed Form

There are essential elements that must be included in a form.

These include:

- Date: The date refers to the day the grant deed is signed and either notarized or witnessed.

- Names: It must contain the names of both parties, i.e., the grantor and the grantee. The names on a deed must match the property owner’s names recorded in county records where the property is located.

- Description of Property: The deed must state the legal description, which includes the full name of the state, county, city, or community transferred from one party to another. The description of the property should also include the lot and block number, if applicable.

- A statement detailing what warranties are included: It will be specific regarding the rights being transferred, including whether or not there are any warranties involved. For example, the grantor may be permitted to use the property until they die or until a specific event occurs. Also, the deeds may include a warranty of title, which means that the title is clear and free of any claims by third parties.

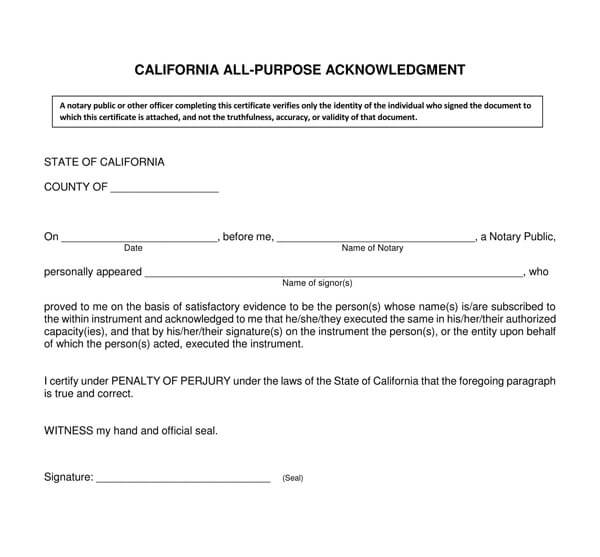

- Signatures: Both the parties involved in the transaction must sign the deed, with their signature being witnessed by either a notary or by two witnesses at the time of signing.

- Notary Public: Although not necessarily a requirement, the deed should be either notarized by a notary public or witnessed by two people who both sign the deed, with their signatures being attested by a notary public. Notaries must include their official seal and identification numbers on the deed when they complete this task. The grantor and grantee should also provide contact information so that interested parties can reach them.

Other Types of Deeds

Several other types of deeds may be used or considered in property transactions. Although these are not as common as grant deeds, it’s best to be familiar with the other types so you can determine which best suits your needs.

Quitclaim deed

A quitclaim (or release) deed transfers the grantor’s interest in the property without any warranties. A quitclaim deed is commonly used to transfer land between family members, especially spouses. Quitclaim deeds can also be used when real estate is transferred as part of a divorce settlement or by someone else who does not have a right to the land. Quitclaim deeds are often used when there is concern or doubt about an interest in the property or about a past deed, and where a warranty deed would be risky.

Warranty deed

A warranty deed provides a written guarantee that grants full legal ownership of the property and includes a pledge or promise by the grantor to defend and support their claim. Warranty deeds are usually used when both the grantor and the grantee are strangers and money is being transferred from one party to the other. A general warranty deed is usually required when the buyer is obtaining a mortgage to finance their purchase.

Tax deed

A tax deed is a form of public sale of property transferred because of a delinquent tax, excess levy, or other liens against a property. For example, when someone does not pay taxes on real estate they own, the government will often auction off the land for the unpaid tax and interest. The winning bidder will receive a tax deed for the property, which includes full rights to the land and guarantees that no one else has any ownership claims upon it either in the present or in the future.

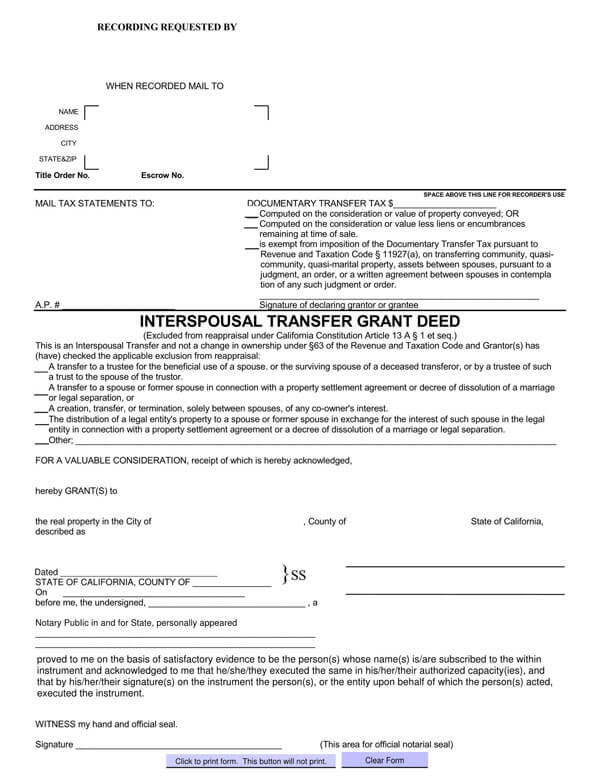

Interspousal transfer grant deed

An interspousal transfer grant (or quitclaim) deed allows the property to be passed from one spouse to another in the event of death or divorce without passing through probate. This type of deed is only available for married couples.

Gift deed

A gift deed is often used when someone wants to transfer real estate ownership free and clear of any legal obligation or debt without selling it. The grantor (the person giving the real estate as a gift) should include all relevant information such as legal descriptions and signatures.

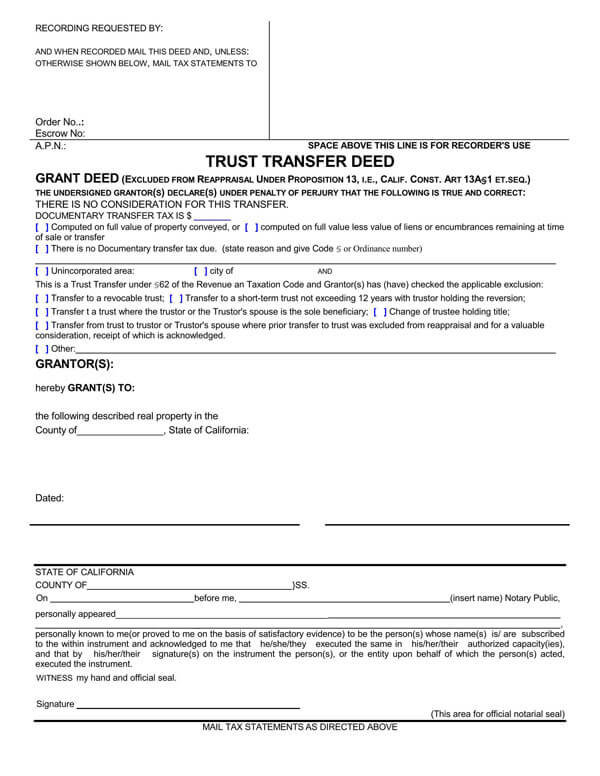

Trust deed

Trust deeds are sometimes used as part of a business or commercial real estate transaction. While this type of deed is also used for other types of transactions, it will often be included in a trust arrangement in which the grantor transfers the property to a trustee who is authorized to hold, sell, or mortgage it. The trust deed requires that the trustee pay all taxes and mortgages before transferring any remaining funds to the trust’s beneficiary.

Frequently Asked Questions

The current owner or their attorney-in-fact should sign a grant deed to transfer absolute property ownership. Although, in some states, it can be executed by the person to receive ownership of the property.

No, it does not have to be notarized for it to be valid. However, if the grant deed is being used out of state or in a different area, it is a great idea to have the deed notarized.

Typically, it takes around 5 minutes for the deed to be recorded and available for public viewing in the land records office of your county or city. However, because recording times vary from city to city and county to county, it is recommended that you check with your clerk’s office to determine their typical turnaround time for recording a deed.

You or your legal representative can request copies of recorded documents, such as deeds, from the land records office in your county or city. The price varies from county to county and is typically around $1 per page.

A grant deed transfers ownership of real property from one person to another. A quitclaim deed only relinquishes any interest the transferor may have in the property but does not necessarily convey ownership to the transferee-grantee. Therefore, the grant deed is more common than the quitclaim deed.

It conveys ownership of real property from the transferor to the transferee, whereas a warranty deed makes specific implied promises or warranties.

A grant deed conveys ownership of real property from one person to another, whereas a trust deed (or “deed in trust”) does not convey any interest in the real property; instead, it creates an equitable lien on the property for the benefit of a third party. The deed in trust is most commonly used for property settlements when transferring property from one person to another during a divorce proceeding.