A Grant Deed is defined as a legal document used during property transfer from a grantor (seller) to a grantee (buyer).

The party transferring the property, or it can be an individual, a business entity, or an estate. A business entity may include a corporation or LLC.

A grant deed protects the buyer in two main ways when the transfer of ownership of real property is taking place:

- The document acts as a legal and formal record that the property’s title has not been given to any other person.

- It also assures the buyer that no complications surround the property’s title before the buyer (grantee or transferee) is given the title by the seller (grantor or transferor).

This document acts as a legal guarantee of protection that the property they are receiving from the grantor has no financial obligations, like loans or mortgage, which might cost after purchasing it.

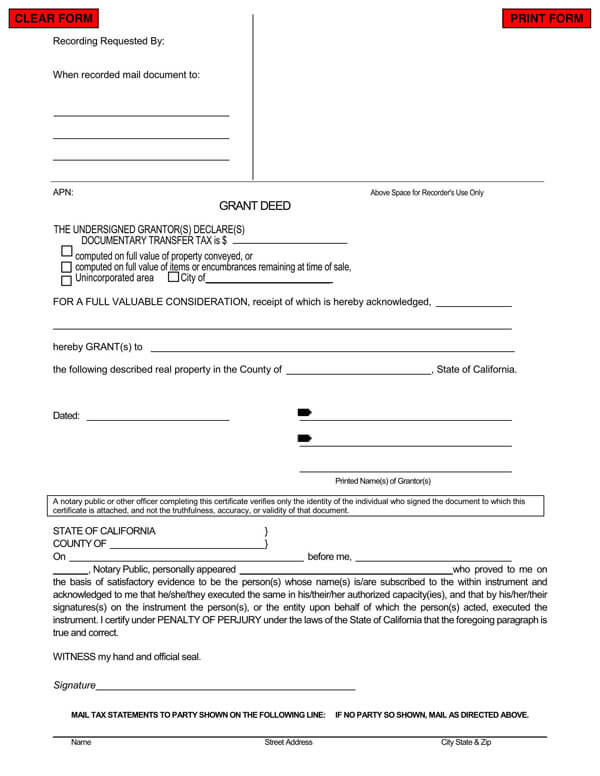

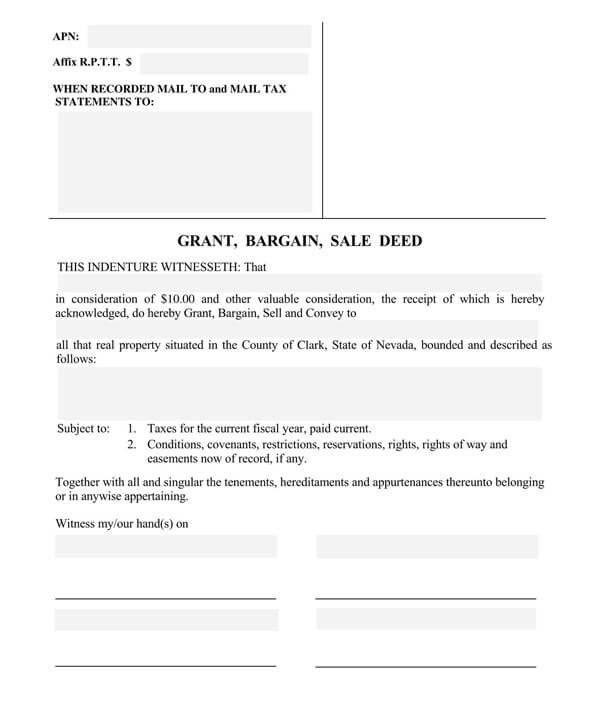

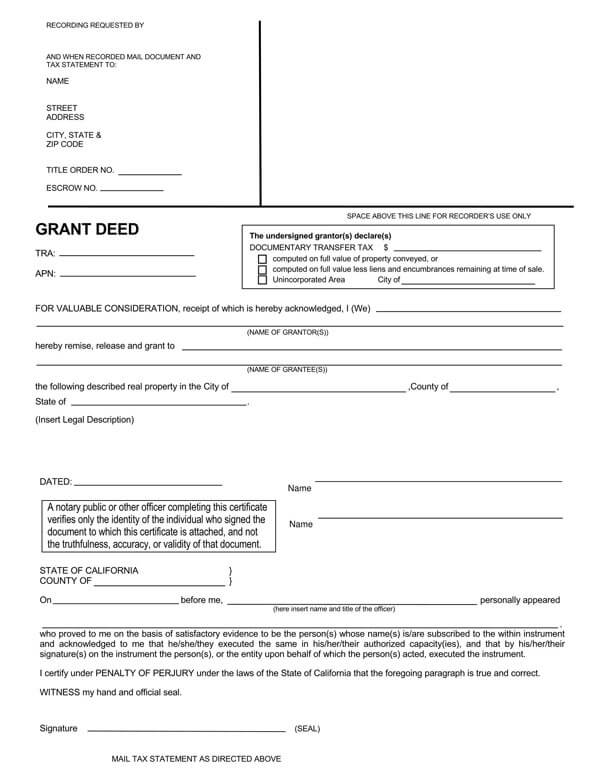

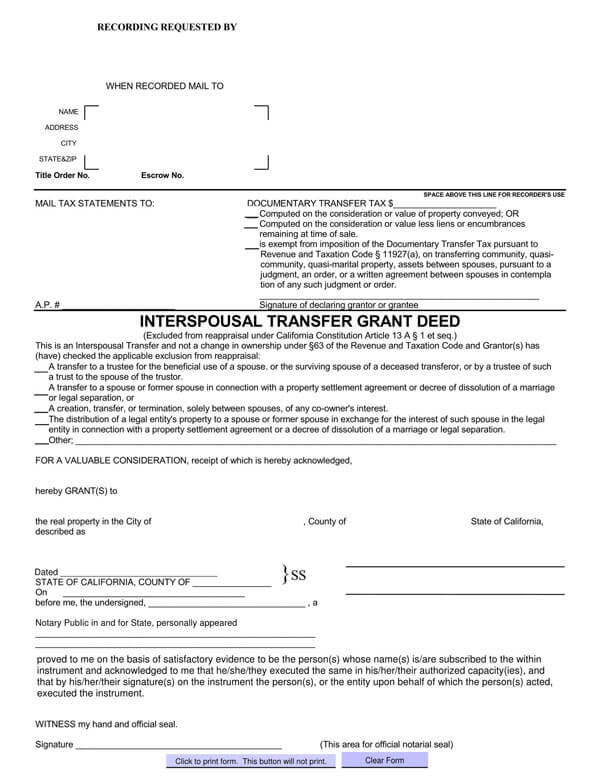

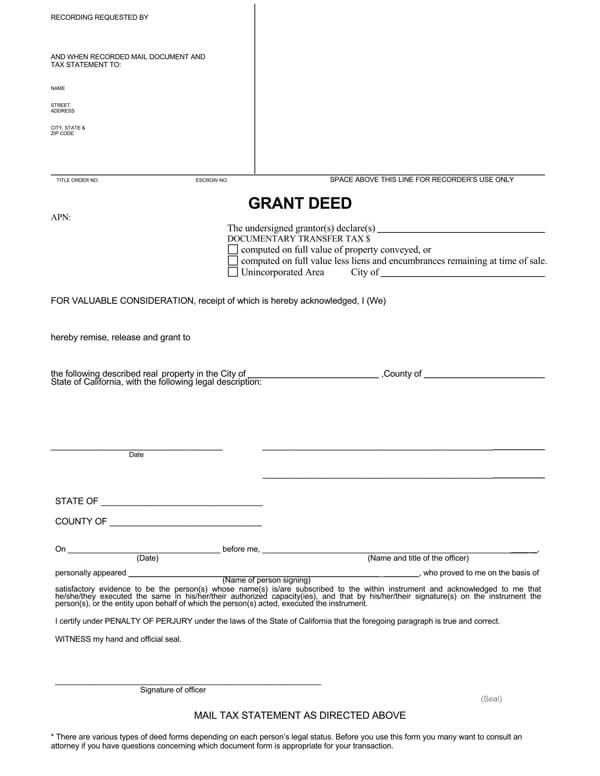

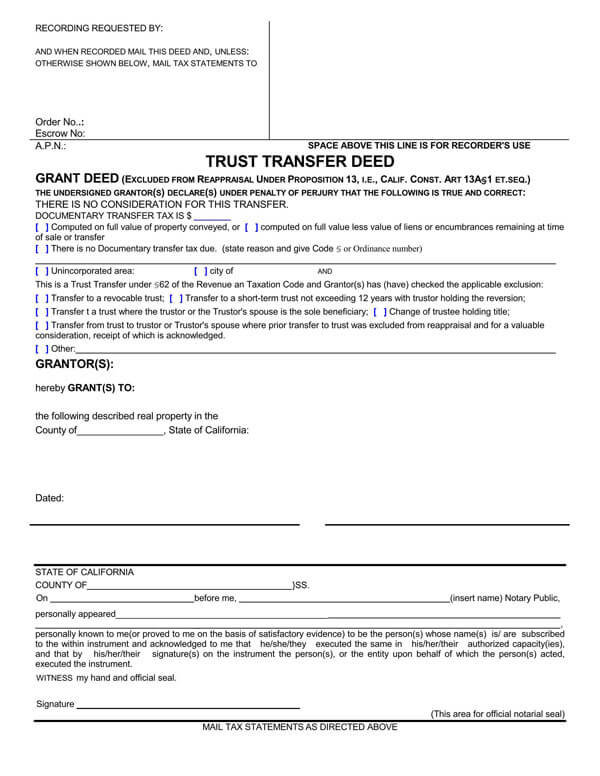

Templates- by type

Following are some free templates of this form, categorized by type for your ease of access and usage. Download them according to your preference and use them as guides during the process of preparing your own, or modify them for direct use.

When it Can be Used

There are a few situations in which such a deed is used.

It can be used when:

- A grantee or buyer is looking for guarantee that the property they want to buy will not be sold to another person.

- A buyer needs evidence that the property is free from financial restrictions and liens.

- A grantor needs assurance that the buyer will commit to buy the property.

- A property owner wants to transfer ownership of their property to a business or trust.

- A property owner wishes to give the property to another person or entity.

How it Works

Once a deed has been signed, this legal document allows the buyer to access the purchased assets, but only if they meet the set conditions. Some of the assets include land and automobiles. It helps to transfer ownership of the property and grants the buyer the title of the assets.

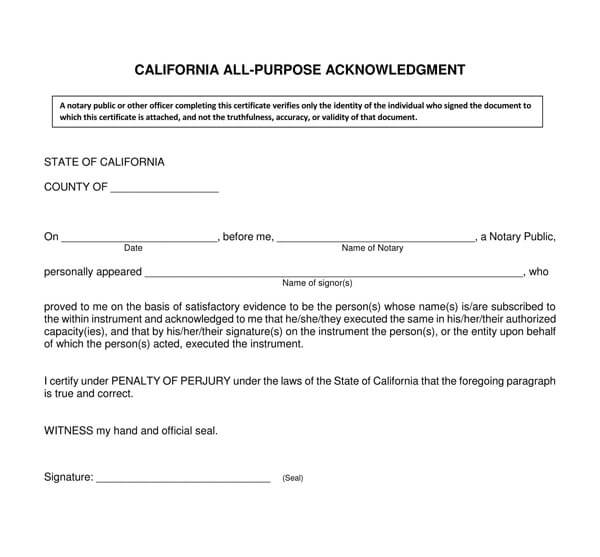

When it comes to a deed, it ensures that the buyer of the property or assets has a full guarantee that the property’s title has not been given to anyone else and there are no restrictions or liens attached to the title. The grantee should notarize the deed to ensure that it is valid and legal for their protection, although this is not a requirement.

It usually deals with the assurance of transfer of ownership of land. With land, everything attached to it, that is, property and rights, belongs to the grantee once this document is signed. This may include roads, buildings, machinery, rights to control the land, and even rights to use the land.

Although the deeds usually work in the same manner, they tend to be different. The difference arises from the grantor (person transferring the property or seller).

EXAMPLE

Interspousal transfer.

It is used during divorce for the transfer of ownership of real property from one spouse to another.

Difference B/W a Title and a Grant Deed

There is a difference between a title and a grant deed. A title is a document that acts as proof of ownership. This document contains details about the owner, that is, their name and signature.

On the other hand, a deed is used to transfer ownership of property from a grantor to a grantee. It is a document that proves that the property has been “granted” by a particular person to another person or entity.

Requirements for Getting a Deed

To get it, particular requirements need to be fulfilled.

These requirements are as follows:

Property details

For the deed, information relating to the property will be required. This includes the parcel number of the property to be sold and its legal description. The grantor or seller can also include a picture of the property, although this is optional.

Details of the recipient

The details of the recipient of the original deed, in this case, may be an attorney, a grantor, a grantee, or even a trustee which may include their full name, their phone number, and email address.

Details of who is granting the property

The person can be an individual, several persons, a trust, or a business. The required contact information includes their full name, email address, and their phone number.

The amount of money exchanged

The amount of money to be received by the seller from the buyer is necessary for preparing a deed. The purchase price, in this case, should be mentioned. However, if the property is meant to be a gift, the seller should specify zero dollars regarding the amount to be exchanged.

Oil, mineral, or other similar rights

This information is not usually granted along with the property. However, the seller may choose to retain these for their benefits in the future. If it is to be granted or not to be granted along with the property, the seller should indicate it.

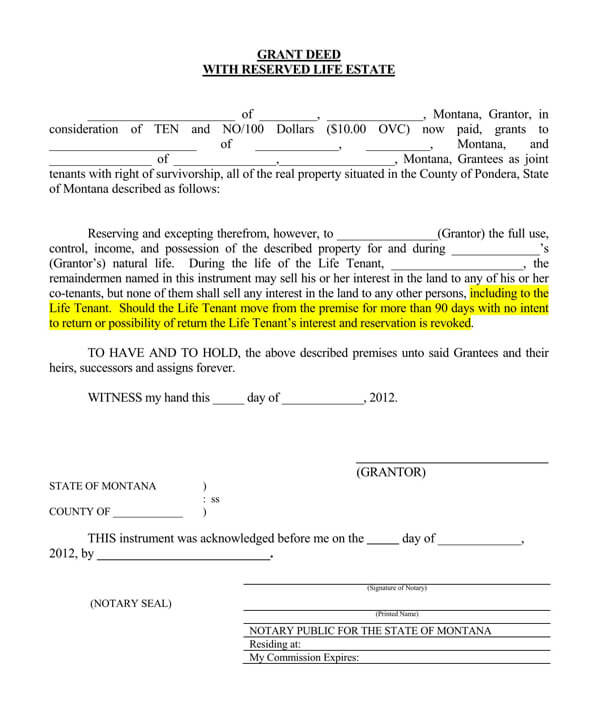

Rights to the property

For this information, sellers must provide the required information about the property rights that have been given to the grantee and the ones they have retained. This will help to prevent mishaps once it has been signed.

EXAMPLE

In the case of a life estate, the grantor or seller should provide details about their intentions of living on the property for the rest of their lives and only grant the property rights to the grantee once they die.

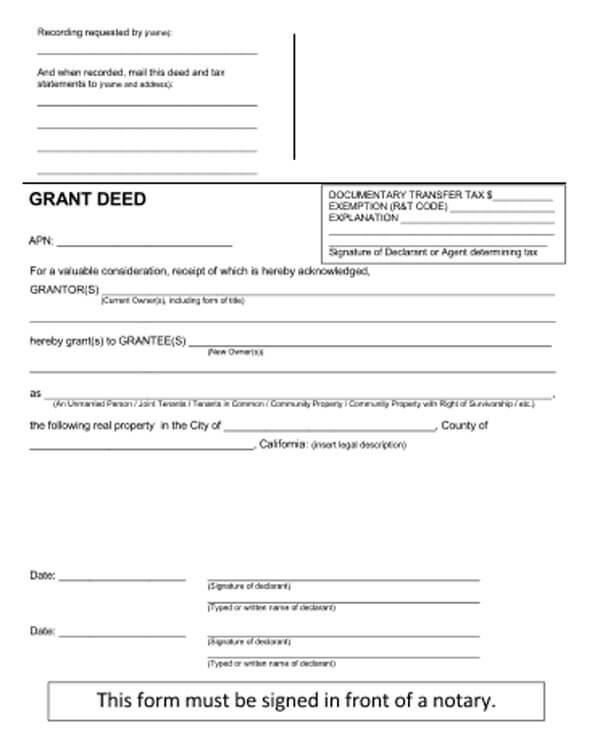

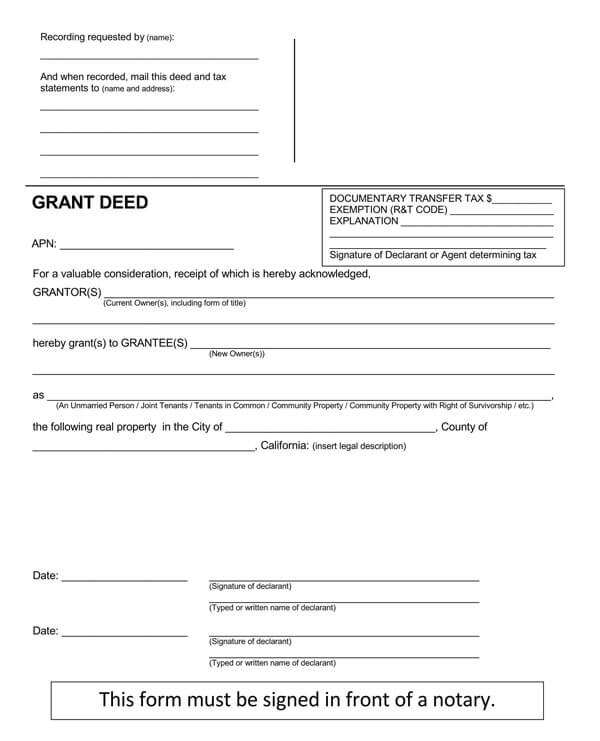

What is a Deed Form?

It is a document that contains spaces that the grantor and grantee need to fill to have a complete and legal grant deed during the transfer of property ownership. In addition, the form has spaces that require details about the grantor, the grantee, and the property description.

Essential Elements

The different States tend to have different laws concerning a deed form. However, there are essential elements that must be contained in it to make it valid.

They include:

- A grant deed must be a written document.

- It must have the granting clause. This clause establishes the transfer of the property title.

- This document must also contain the names of the grantor and grantee.

- The document must have a clear description of the property being sold.

- A grantor’s signature is needed, and only a grantor who is considered competent can sign the document to make it valid. Minors are not considered competent grantors.

- The deed should be awarded to the buyer when the seller is still alive and must be accepted by this buyer.

- Based on the State’s law, witnesses’ signatures or notarization should also be included.

- A statement about the warranties is also an important element that should be found in the deed.

EXAMPLE

“Seller warrants that Seller has no notice of any outstanding violations from any town, city or State agency relating to the property”

NOTE

Any property transferred from seller to buyer does not need to be re-assessed for tax purposes.

Other Types of Deed

Apart from a deed, other types of deeds are created for different purposes.

These other types of deeds include:

Quitclaim deed

A quitclaim deed is commonly used during a divorce to transfer property interest. It is used to release an individual’s (maybe the owner or not) interest in the property being sold or transferred without having to mention the nature of the interest.

After the quitclaim deed is signed and the grantor lacks the property’s title or the title has issues, the grantee has no power to take any legal actions against the grantor.

Apart from divorces, this deed is used for the transfer of property ownership between family members. It usually occurs in or out of the grantor’s business or trust. The deed is also used to correct any error that might have happened in the warranty deed.

Warranty deed

It is used when the grantor and grantee are strangers, and there is money involved in the transaction. It protects both parties. The warranty deed offers a similar guarantee as to the grant deed with an additional assurance that the grantor will secure and defend the property’s title against any claims.

The warranty deed is also a requirement if the grantee or buyer of the property wants to get a mortgage to use it as payment for the property. A warranty deed is proof that there are no liens, loans, or claims against the property’s title and also assures the buyer that they are the only ones buying the property.

Tax deed

Tax deed grants ownership of the property to the government if the owner fails to pay any associated property taxes.

It authorizes the government agency to sell the property, once they have the ownership, in order to collect the delinquent taxes. After the property has been sold, its ownership will then be given to the purchaser.

These transactions usually occur at auctions and are known as tax deed sales. The tax deed transfers the title of the property to the buyer.

NOTE

The number of years that are regarded as delinquent years are different from one State to another.

Interspousal transfer grant deed

Interspousal transfer grant deed is a deed used during a divorce to transfer ownership of real property from one spouse to another.

Gift deed

A gift deed is usually used when the transfer of property ownership happens between related people with no money exchange. The money section of this deed is referred to as “love and affection.”

Trust deed

A trust deed acts as a mortgage. It is used during a sale of property that is financed, in that, the title of the property will be held until the loan is paid in full.

Frequently Asked Questions

The grantor or seller is the one who is subjected to the grant deed. Although the information of the grantee or recipient of the property should be included in the grant deed, they do not need to sign the document.

Notarization depends on the State’s laws. However, since dealing with the real estate process is a serious affair, notarization and recording of the deed are required.

The other States even request for witnessing of the process to make it valid and legal.

The time it takes to record a grant deed depends on the jurisdiction where the process occurs. The grant deed is usually recorded in the County Recorder’s Office, Register of Deeds, or a Land Registry office. They usually have their timeline that varies based on how busy the office is.

Both parties can access a copy of the deed once filed since they become public records. Accessing a copy will depend on the county the property is located. In some counties, the copy can be obtained online, while in others, the copy is obtained from the local recorder’s office. The copy is not accessed immediately, but a small fee must be paid after a while and through the mail.

While a deed is used during the transfer of property ownership from a grantor to a grantee, a quitclaim deed is used to transfer property interest from a grantor (who may not be the legal owner) to a grantee.

A grantor uses a deed to assure the grantee that no claims are made to the property, and the property will not be given or sold to anyone else. On the other hand, a warranty deed is used as protection for both a grantor and a grantee, especially if they are strangers and money exchange is bound to happen.

While a deed assures the grantee that the property they are receiving has no financial obligation like loans and mortgages, a trust deed is used when the property sale involves a financed property, and the property title is held as collateral until the loan is paid in full.