A triple net (NNN) lease agreement is a commercial lease agreement where the tenant is responsible for paying the total expenses of a property (three nets) – real estate/property taxes, common area maintenance (CAM), and property insurance.

In most triple-net (NNN) commercial leases, these expenses include all utilities and property services used by the tenant.

An estimate of the yearly expenses is determined and then incorporated into the monthly rental rates. This estimate is ordinarily based on the expenses incurred during the previous year.

If the total costs of the three ‘nets’ are lower than the estimated value at the end of the year, the tenant is refunded accordingly. Still, if the total surpasses the estimate, the tenant is expected to pay the difference. Triple-Net (NNN) leases are common with retail, industrial property, and free-standing spaces/buildings.

Free NNN Lease Agreement Template

NNN- An Overview

A triple net commercial lease agreement is an official document that is used for letting out commercial real estate. It details the rights and responsibilities of the landlord and the tenant alike.

Under this lease agreement, the tenant or lessee pays all the expenses that pertain to the property. Real estate taxes, maintenance, and building insurance are examples of these. These expenses are independent of the standard expenses which any tenant ordinary incurs. Some of these are utility expenses, monthly rent, and regular inspections.

Meaning of NNN

The Ns are representative of the three ‘nets’ (Net, Net, Net). This shows that the tenant is expected to pay for;

- The Net– Real Estate Taxes

- The Net-Property Insurance

- The Net-Common Area Maintenance (CAM)

Triple net lease vs. other leases

It goes without saying that the triple net lease is not the only one that is in existence at the moment. Indeed, there are several kinds of leases that may also deliver more or less similar degrees of satisfaction. We devote this segment to the comparison between this lease and some of the other lease agreements in place.

- Triple net lease vs. single net lease: Under the single net lease, the tenant assumes the responsibility of remitting property taxes over and above the rental payment. Other than that, all the liabilities and expenses are borne by the landlord. It is somehow cheaper to come by than the triple net lease.

- Triple net lease vs. double net lease: The double net lease entails the incurrence of the property taxes and insurance premiums by the tenant, hence the designation, double lease. For this reason, it is more expensive than the single net lease yet still more affordable than the triple net lease.

- Triple net lease vs. bondable lease: A bondable lease is more comprehensive than a triple net lease. Under this contract, the tenant incurs every other expense that is associated with the real estate property as well as those that have to be incurred when rebuilding the same after a causality. This is a very expensive contract to get into.

- Triple net lease vs. ground lease: The ground lease is a kind of agreement that permits the tenant to develop some piece of property on the land on which the rental facility stands. Upon the expiry of the lease agreement, this piece of property is passed on to the property owner. Thus, it is more liberal than the standard triple net lease agreement.

- Triple net lease vs. gross lease: A gross lease is perhaps the cheapest and the most common kind of lease in existence today. Under this scheme, the tenant pays a flat rental amount each period. It is the landlord who incurs all expenses involved in the process like utilities, water, taxes, and premiums. Many prefer it because it is also less restrictive than other kinds of lease agreements.

- Triple net lease vs. percentage lease: Lastly comes the percentage lease. This one requires the tenant to pay a base rent and a small percentage of any revenue which arises in the course of utilizing the rental premise. Many business properties adopt this kind of approach as it is the most lucrative of all the agreements.

Common Things to Know

To clearly understand a Triple-Net (NNN) type of lease, there are various aspects and terms one should familiarize themselves with.

We shall look into some of them:

Common area maintenance (CAM)

Standard area maintenance represents the expenses that are incurred when maintaining the property. What constitutes standard area maintenance is subject, and as a result, what is defined as CAM should be outlined in the lease agreement.

Some of the ordinary expenses categorized as CAM include:

- Building repairs

- HVAC expenses

- Landscaping

- Cleaning (common areas)

- Security

- Management (on-site repairman)

- Parking lot maintenance

- Outdoor lighting

- Signage

- Snow removal

Capping NNN expenses

Capping means setting an upper limit (maximum) price. NNN expenses are capped to protect the tenant. The maximum cap is determined through negotiation and given as a price per square footage ($/SF). For multi-year leases, the amount ordinarily increases by a 5-10% margin every year.

Pro-rata share

Pro-rata means proportionally. A tenant should be liable for their pro-rata share of property taxes for the entire property.

EXAMPLE

Say a tenant rents a retail shop of 1000 square feet in a 10000 square feet mall, their pro-rata share of real estate taxes should be a percentage of the total NNN expenses.

Landlord’s responsibilities

Although the tenant is responsible for raising money to cater for the triple nets, the landlord has designated roles in a triple-net (NNN) commercial lease agreement. This includes making actual payments through check deposits, bank deposits, etc.

The landlord will be the one who directly pays the real estate taxes, property insurance, and CAM expenses. They are, in turn, reimbursed through periodic payments of triple nets.

The landlord is also responsible for the accounting of all the property expenses. At year-end, the calculations should be done. Where the expenses were lower than anticipated, the tenant should be refunded accordingly. Where they were more than the estimated rate, the tenant should be billed to cover the difference.

Calculating the Rent

There are two ways of calculating the rent – one can opt to use online rent calculators or calculate it themselves. The annual rent, monthly rent, and price per square foot are all related, and we will demonstrate how below.

Annual rent ($/yr.)

The annual rent is the total amount the tenant should have paid by the end of the year as rent.

It is given by:

Annual Rent ($/Yr) = Price per square foot ($/SF) x Total square footage

EXAMPLE

For a 1000 square foot warehouse being leased at $50/SF, the annual rent will be given by multiplying the $50/SF by 1000 to give $50000/Yr.

Monthly rent ($/mo.)

The monthly rent is the amount of rent a tenant is expected to pay at the end of the month.

It is typically given keeping the following method in consideration:

Monthly rent ($/mo) = Annual rent ÷12 (months)

The formula of annual rent remains the same, as demonstrated above.

EXAMPLE

For a $30/SF office space with 2000 square footage, the annual rent will be $30/SF multiplied by 2000, which will give $60000/yr. the monthly rent will be equal to $60000/yr ÷ 12 = $5000/mo.

Price per Square Foot ($/SF)

Price per square foot is the amount charged per square foot of the property. It is given by;

Annual rent ÷ square footage = price per square foot

EXAMPLE

For a 2000 square foot space with $1000/mo rent, the annual rent will be $1000 multiplied by 12, giving $120000/Yr. The price per square foot ($/SF) will be given by dividing $120000 by 2000, giving $60/SF.

Triple net vs. Gross net

Triple-net and Gross differ regarding who between the landlord and the tenant is responsible for paying for various property expenses.

| Expense | Gross | Modified Gross | Triple-Net (NNN) |

| Real estate Taxes | X | O | T |

| Property insurance | X | O | T |

| Common area maintenance (CAM) | X | O | T |

| Utilities | O | O | T |

| Repairs | X | O | T |

T- Tenant pays

X – Tenant does not pay

O – Conditional

Writing a NNN Commercial Lease Agreement

Coming up with a written triple-Net Commercial lease is a procedural process. We shall look into the various steps one can follow when writing one.

The steps guide coming up with an effective up to standard NNN commercial lease agreement.

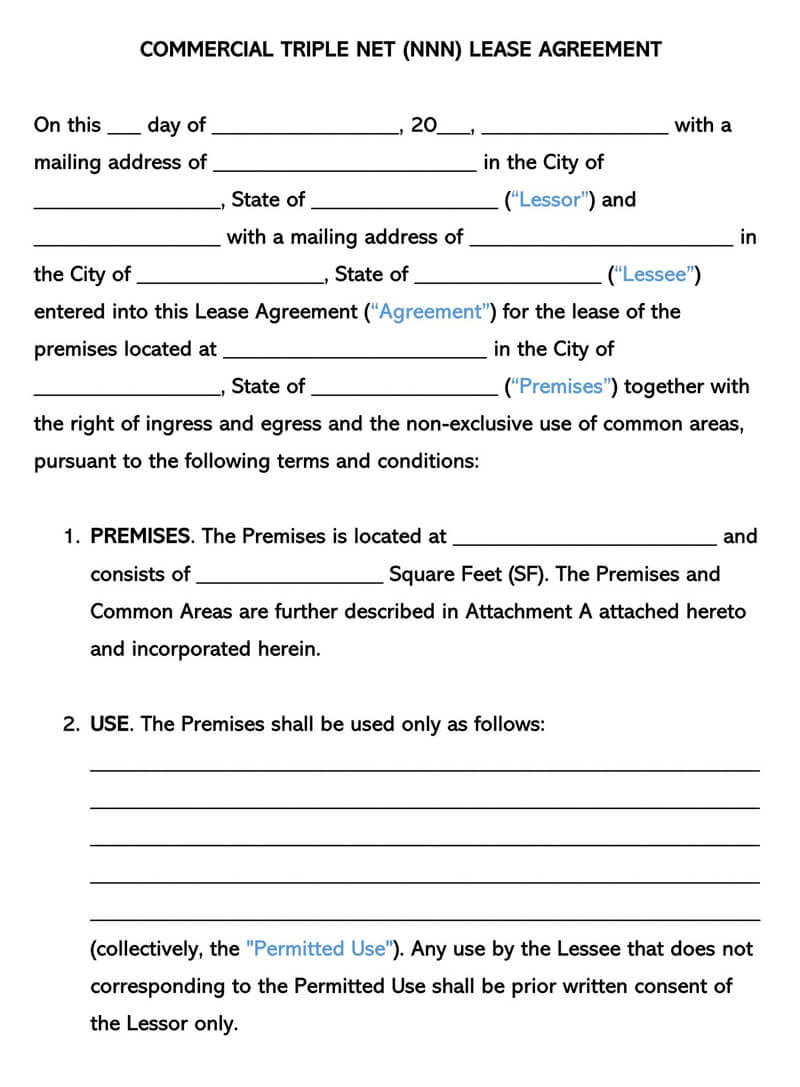

Get a copy of the NNN agreement

To have a visual idea of how a Triple-Net lease agreement should be structured and what it contains, one should get a Triple-Net agreement sample. Careful review should be done so that no section in the agreement is left out when writing.

Add personal data

Secondly, after conversing with how to format the lease agreement, they can write one. The first item to include is personal information and the date of the lease agreement.

- Date of agreement – The date when the landlord and the tenant agreed should appear first. Dating the agreement is crucial as it is a means of identifying the document, and it guides the calendar of the lease term. It should clearly show the date, month, and year.

- Introduce the landlord – After the agreement is dated, the landlord/property owner must be introduced and identified. This is done by stating their official/legal name and mailing address. A suffix declaring their status if it is a company or corporation should be included with the name. The mailing address should be current and reliable.

- Name the tenant – Once the landlord has been identified, the tenant should be introduced. Their entire legal name should appear together with the tenant’s current mailing address.

Describe rental place

The next step or section should be a description of the property being leased. The property/space should be described by outlining some of its attributes which we shall look into below. Some of these attributes should be delved into to provide a concise description.

- Define the location – Location should be the first specification outlined in a agreement. The location has a significant influence on the tenant’s decision as most people want a place that is accessible, near transportation routes, has traffic flow, etc. Location helps them determine a property’s convenience. The location should be given by stating the property’s address – street address, city, state, and zip code.

- Define the space being leased – The size of a space determines if a tenant will effectively carry out their business operations. It should be given by stating in square feet. For retail and offices, it should be the square footage of the space being rented.

- Indicate the property use – How the property/use shall be utilized should be agreed on by the two parties. Once established, it should be declared in the agreement as clearly as possible. The description can include additional details of the tenant’s business, such as its goals and means of operation.

Requirements of agreement

Once the property has been defined, the next section of the NNN lease agreement should look into further guidelines of the lease agreement.

- A definition of the lease term is to expressly state when the lease is expected to start and end. It is the period within which the lease agreement shall remain valid. This period is alternatively referred to as the ‘Initial term.’ Under normal circumstances, it is initiated by the tenant through payment of rent for the right to occupy and use the property. The first and last tenancy days should be vividly defined by the date, month, and year.

- The agreed-on amount of Rent for The First Term – The amount of rent the tenant and the landlord have agreed on for the initial term, declared above, should be stated. Rent should be stated in words and figures and monetary units (USD). This is the date when rent is expected, which is usually the 1st of every month.

Financial aspects in agreement

The next section of the lease agreement should outline how the security deposit, rent, and late payment will be handled throughout the lease term.

- The status of the rental rates as the lease Progresses – As the lease term progresses, some rental rates will remain fixed while others tend to increase by a certain amount throughout the lease term. Whichever the case, it should be declared in the agreement. If the rent is expected to increase, the increment should be stated, and the effective date when this increment is expected to start. Any other subsequent increments should be outlined accordingly – from which date to which date.

- Security Deposit Requirements – A security deposit is essential as it is taken as a gesture of good faith and commitment by the tenant to the lease. It is held if the tenant causes damages to the property or fails to pay a certain amount of rent. The security deposit should be declared by stating the amount in figures and words, and a declaration that it does not bear any interest should be made. The date when the landlord is expected to return the security once the lease term is completed should be stated in the agreement – it usually is thirty days (30) after the lease expiration.

- Late Rent Payment – Late payment should be defined. This is done by indicating when the last due date of rent payment is allowable, implying that payments past the specified date constitute late payment, and as a result, a penalty shall be imposed. For example, it should be given in days, five (5) days after the rent due date.

- Consequences of a Late Payment – This section addresses how late rent payments should be handled. Most landlords will opt to penalize tenants who make late payments, but some opt not to penalize. How much the tenant shall be penalized should be declared in the agreement. Late payment penalties could be a fixed rate or a percentage of the payment due. If the penalty is a flat rate, it should be given in words, figures, and monetary units (USD). If it is a percentage, it should be written accordingly.

- Renewal Options for This Lease – Most agreements allow tenants to renew the lease after completing the initial term. However, it is not a must; some landlords may choose not. Whether renewal is an option or not, it should be declared in the lease agreement if the tenant will be given the option to renew, whether there will be additions to the previous rental rates, this should be stated. The amount of days the tenant has to renew the lease should be given, usually 30 days. Additionally, the agreement should state how many times the tenant can renew the lease, could be one, two, three, etc. details of each renewal should be outlined, that is, the duration of the renewals (from which date to which date) and the applicable rental rates during that period.

- The total upfront payment Required – Upfront payment includes the total sum of money the tenant should pay the landlord to initiate the agreement. It is usually the first month’s rent, security deposit (if any), and any other. The amount should be written out and then given as figures. Each payment must be defined.

General things to be added

Any other pending information that should appear in the agreement should be included at this point in the lease agreement. These inclusions are meant to improve the effectiveness of the agreement.

- First Day of tenancy – The first day that the tenant will physically occupy the space should be outlined. It should be given in the format of month, date, then the year.

- Insurance Coverage the Lessor Must Maintain – With commercial leasing, liability for when a person is hurt or dies within the property or property gets damaged is usually a concern. As a result, landlords/lessors must obtain insurance coverage for such incidences to protect and compensate the tenant if they happen. This is a requirement of the agreement; it should be stated and defined regarding what the lessor is insuring against. Landlord’s liability is usually limited to common areas.

- Assign the proportionate space of each tenant where there are multiple tenants on the property. On large properties where multiple tenants have rented spaces, it is essential to declare how much space as a percentage of floor space or square footage each tenant has been allocated.

- Advertisement for replacement tenants before the end of the lease term – Once the lease term expires, the landlord will more often than not seek to find new tenants for the property. This will often be a couple of days before the end date of the tenancy. The agreement should declare how many days before termination of the lease can the landlord access the property, specifically for such advertising.

- Notice for termination of lease as a response to (Natural) Destruction – Sometimes property can be destroyed by natural events to a point where rebuilding or repairing is not a viable option. This would, in turn, necessitate termination of the agreement, and a notice would be necessary soon after the destruction. This option should be outlined in the agreement in definition and the number of days after the destruction when the notice for termination should be issued. This inclusion protects the landlord from being legally liable to repair the property to the initial conditions.

- Additional information on Notices – At this point, the mailing addresses where notices should be sent should be provided in writing the lease agreement. Firstly, the landlord’s mailing address is given, followed by that of the lessee.

Additional terms and conditions

It is important to note that either party can only be held accountable for the contents written in the NNN lease agreement. Therefore, it is imperative that any further concerns that either party might have be addressed at this point in the agreement. Any point that was agreed on and not included should be inserted here.

Report on all attached documents

A NNN lease agreement can be accompanied by other documents such as disclosures, inspection results, additional provisions, etc. A list detailing all and any attached documents should be provided before hard copies are attached.

Acknowledgment declaration

The next step should be a formal acknowledgment and acceptance of the laid-out duties and responsibilities. It is meant to bind the parties to be named after the agreement.

- Landlord’s information – The first signatory should be the lessor/landlord. They should provide their signature, date of signing, and official name as it appeared earlier in the lease agreement.

- Tenant’s Official Signature – The tenant should then follow and sign the document, give the date of signing and their official name as it appeared earlier in the agreement.

- Agent’s signature (if applicable) – The next step when writing the agreement should be to let the agent, if one was used, sign as a party involved in the agreement. They should give their name, signature, and date of signing.

Proof of notarization

Notarizing is the last step of writing the agreement. As the parties must sign in the presence of a notary public, there must be proof that this was the case. The notary public indicates the state and county represented, the date of witnessing, and names the lessor and lessee as established. After which they can sign, give their name and indicate the date of signing. Once notarized, the agreement is legally binding.

Frequently Asked Questions

Customarily, the landlord is responsible for structural repairs of a property in a triple-net (NNN) commercial lease agreement. The tenant is responsible for operating expenses only, including property taxes, standard area maintenance, and property insurance.

No. However, there are negotiable areas in a triple-net lease that can make the agreement more favorable. For instance, the base rent and requesting the landlord to remain responsible for certain utilities and repair and maintenance costs can be negotiated.