Health insurance companies often deny claims for treatments and procedures that they consider medically unnecessary or unprocessed, for example, due to factors such as incorrect documentation, errors in the information, etc. Such denials are usually caused due to inadvertent errors made by the patient during the initial application process. In some cases, these denials are apparent, but it can be challenging to get the claim approved.

Some mistakes will inevitably be made, but you have a right to appeal such a health insurance claim denial through an appeal letter and fight for the proper treatment. Below is a guide on what to do when appealing for health insurance, items to include in your appeal letter, including a sample letter for appealing a health insurance claim.

tip

A health insurance claim can be denied or rejected, two distinct technical terms in the insurance sector. Denial implies expressed disapproval of the claim. This means the insurer will not cover the requested payment. Rejection infers that the claim was not processed due to specific reasons such as paper mix-up, insufficient details, paperwork error, rules not followed, etc. As a result, claim rejections are easier to correct than denied claims.

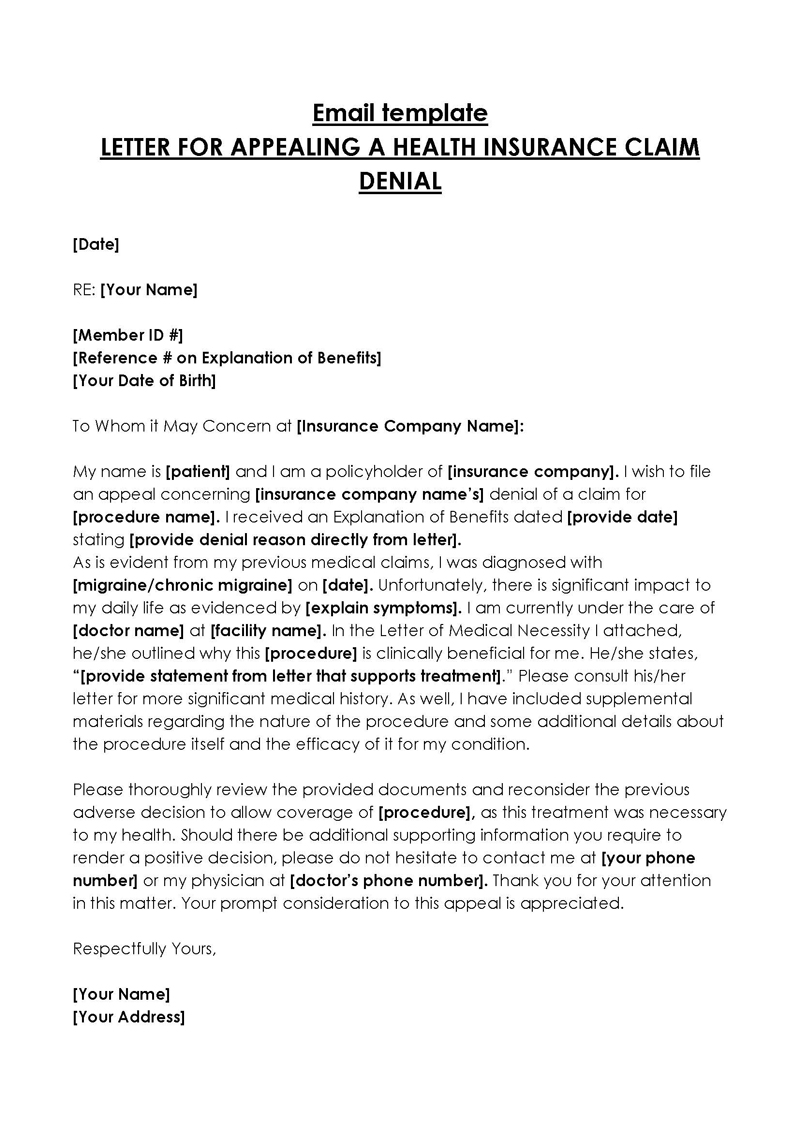

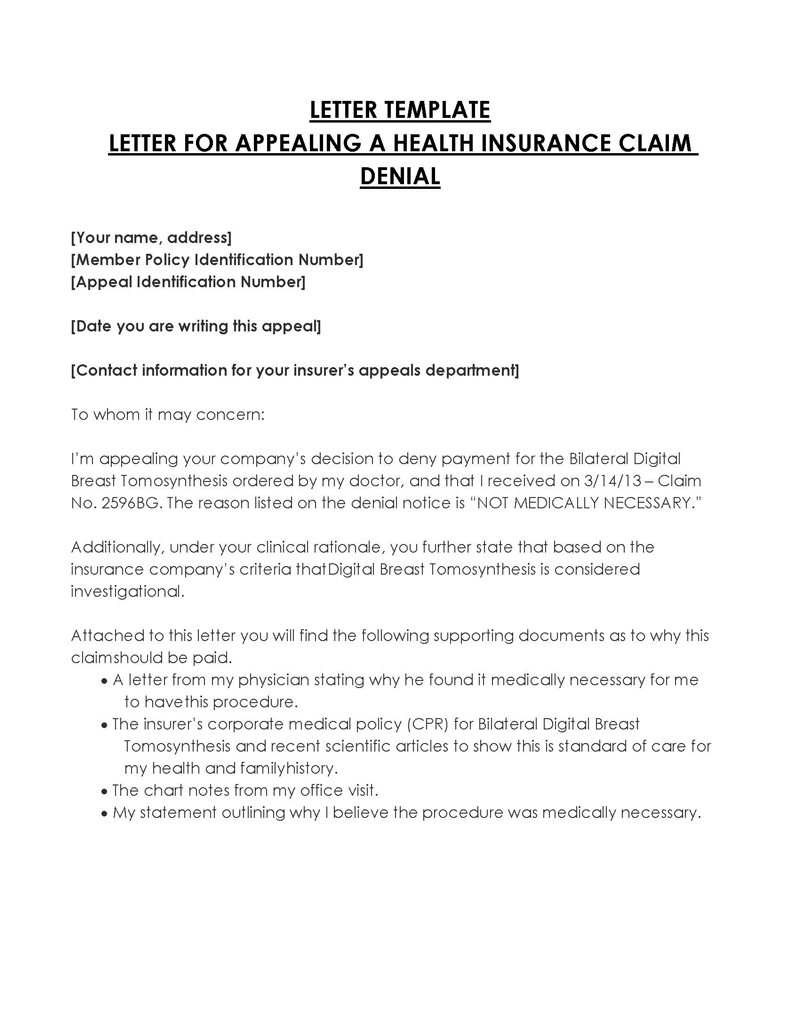

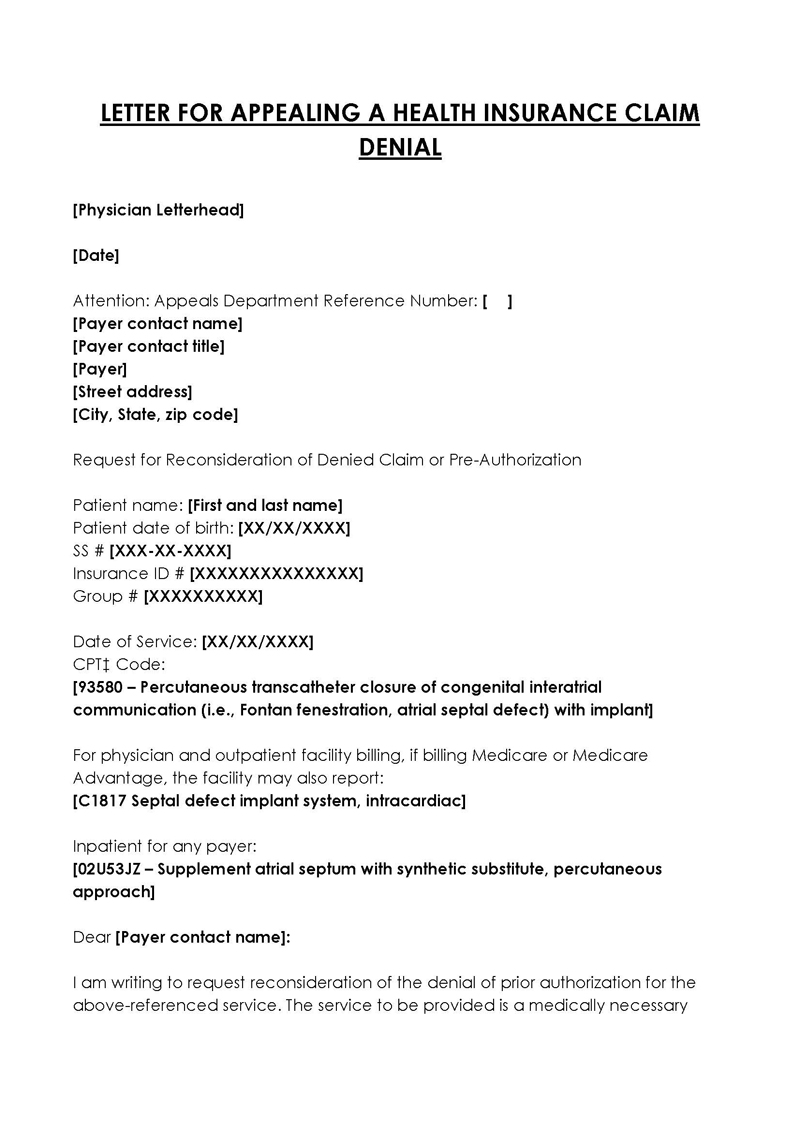

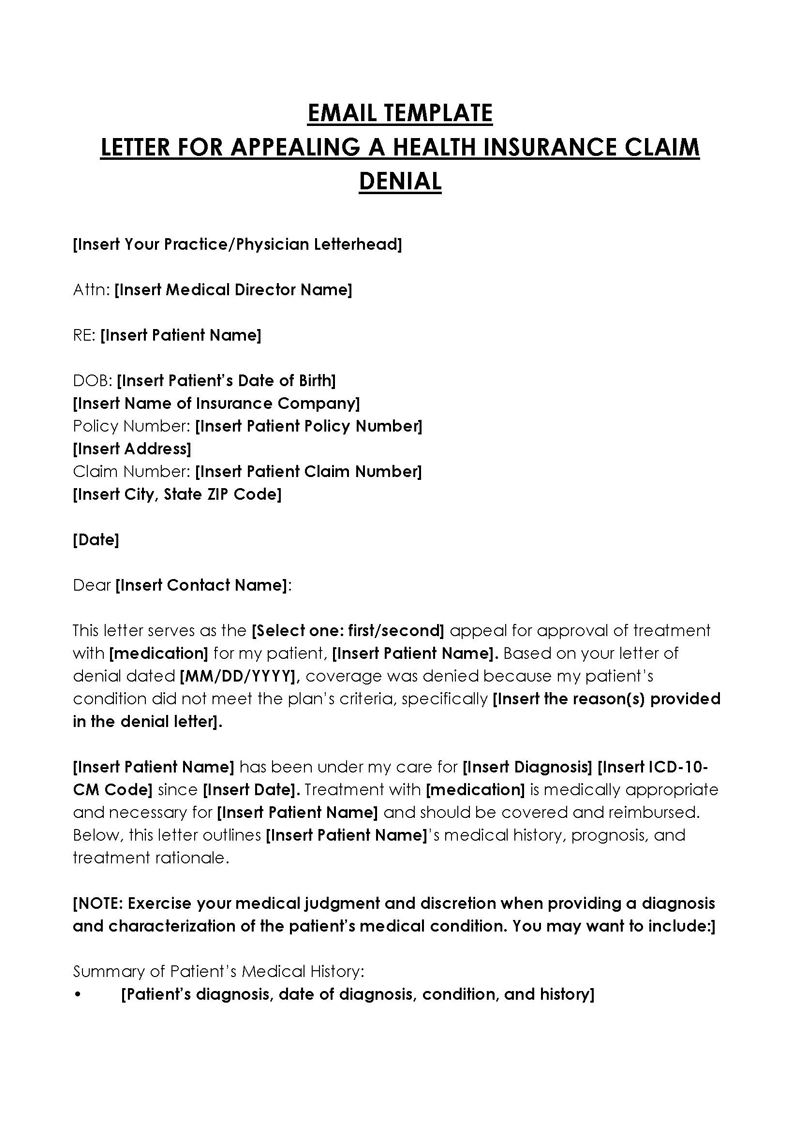

Free Sample Letters

Common Reasons for Denial of the Claim

There is no shortage of reasons why insurance claims can be denied. Insurance companies are businesses whose intention is to make profits and will often find ways of doing so, with insurance claim denials being one way to do so.

Some of the common reasons health insurers will deny your claim include:

Not medically necessary

Health insurers typically approve medical claims that are deemed medically indispensable or compulsory. As a result, any unnecessary, unjustifiable, or unjustified medical treatment or procedure will ordinarily not be covered. Therefore, an appeal letter appealing the health insurance claim would not be enough to overturn such a denial.

Experimental treatment

The health insurance company is not obligated to cover treatment or procedures outside of the benefits you have paid through your premiums. Thus, the health insurance company will deny coverage if you seek any experimental or recommended surgeries that do not fit within the benefits you have paid through your premiums.

However, experimental treatment can be covered if it satisfies the following criteria:

- If it can be proven that the experimental treatment is the only medical intervention that will work. However, you must show other treatments that were administered but didn’t work.

- If deemed a standard treatment within the medical community, the procedure will be covered.

- It can be paid for if the treatment is less expensive than standard treatment procedures.

- The procedure will be covered if the health insurer has covered it for the same patient in the past.

Out of network

In many cases, health insurers will only cover treatment from doctors within the network of the clinic that you have signed your contract with. Therefore, you may be denied the claim if a claimed service is provided outside of the network. This can often be avoided by ensuring that all services are provided within the network.

Health care settings

It is essential to be careful with the healthcare settings where you have been admitted. If it is a hospital, then ensure that all services are provided within the hospital. If it is an out-of-network clinic, ensure that all services are provided through clinics where you have paid your premiums. If the doctor recommends in-home services or treatment, then ensure that the cost of such services is lower than hospital-based care to ensure your health care plan covers them.

Cancellation of the policy due to lack of money

Health insurers will often cancel your policy if they find out you cannot afford the premiums. Unfortunately, what usually happens is that the insurance company will cancel your policy and, as a result, refuse to pay any claims incurred from that point on. To avoid such an incident, make sure that you pay all future premiums no matter what happens in life or work, and notify your insurer of any errors and changes in payments, for example, an account change.

Pre-Consideration

Before you write your appeal letter against the denial of a health insurance claim, it is essential to first consider and evaluate the reason for your claim. This means that you need to ask yourself whether the company has a legitimate reason for denying your claim, such as that the procedure is not covered by the health insurance policy. If yes, you can move on to the next stage, as an appeal wouldn’t reverse the decision. If not, then deal with the reasons for the denial before proceeding with the appeal. A notice of insurance claim denial will typically be sent, detailing the deadline for appeal and the reason for the denial.

What Should I Include?

An appeal letter appealing a health insurance claim denial should be directed to the point. It should thus cover the specifics and facts and make a professional, convincing appeal. The specifics will ultimately vary from one situation to another. However, regardless of the situation, ensure the appeal letter covers the fundamental details of appealing against a health insurance claim denial.

A letter for appealing a health insurance claim should include the following:

Opening statement

Start with an opening statement that indicates the reason for submitting the appeal. Suppose the appeal letter is appealing a health insurance claim that is believed to be an error on behalf of the insurance company. In that case, it is better to state this in the opening statement, as, in most cases, the claim will be approved if it was indeed an error on their part.

Avoid making general statements such as “permission was refused” or “the claim was denied in error.” Instead, cite the specific reason for the denial and utilize the details and information gathered to support the claim. The letter’s opening statement should be direct, professional, and honest.

The health condition of the patient

The patient’s health condition is the following vital information to be included in the appeal letter against the denial of a health insurance claim. The letter should indicate a cure or an effective treatment to help the patient recover from the illness. It is crucial to note that the insurance company will only cover treatments and procedures that are medically essential.

Thus, it is imperative to explain why the surgical procedure was deemed medically necessary and how it relates to the associated health condition. The letter can also state the services rendered for the claim and include details of all expenses incurred due to treatment.

A doctor’s supporting note

Doctors’ notes are essential, especially in appealing health insurance claims. Ensure the letter for appealing the health insurance claim has a supporting note from an experienced or respected doctor who can attest to the patient’s condition. The supporting doctor must have first-hand knowledge of the patient’s condition, not just a second-hand opinion. It is essential to include all details about your treatment, including test reports, diagnosis, and prognosis.

A list of any medical, legal, or professional medical specialists, the claim form, and any supporting documents submitted by the patient (appeal form) can be referenced in this section. A good appeal letter for appealing the denial of a health insurance claim should be very detailed so that the company can easily understand the situation and help them conclude whether you deserve it or not.

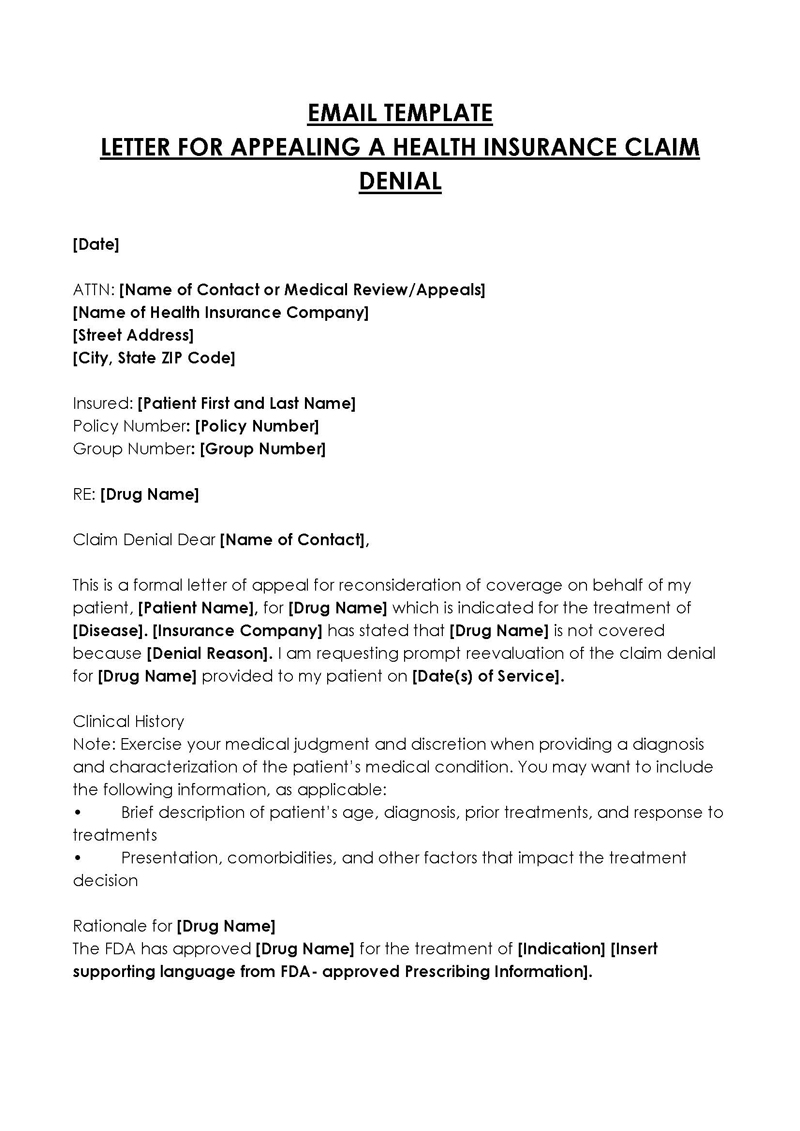

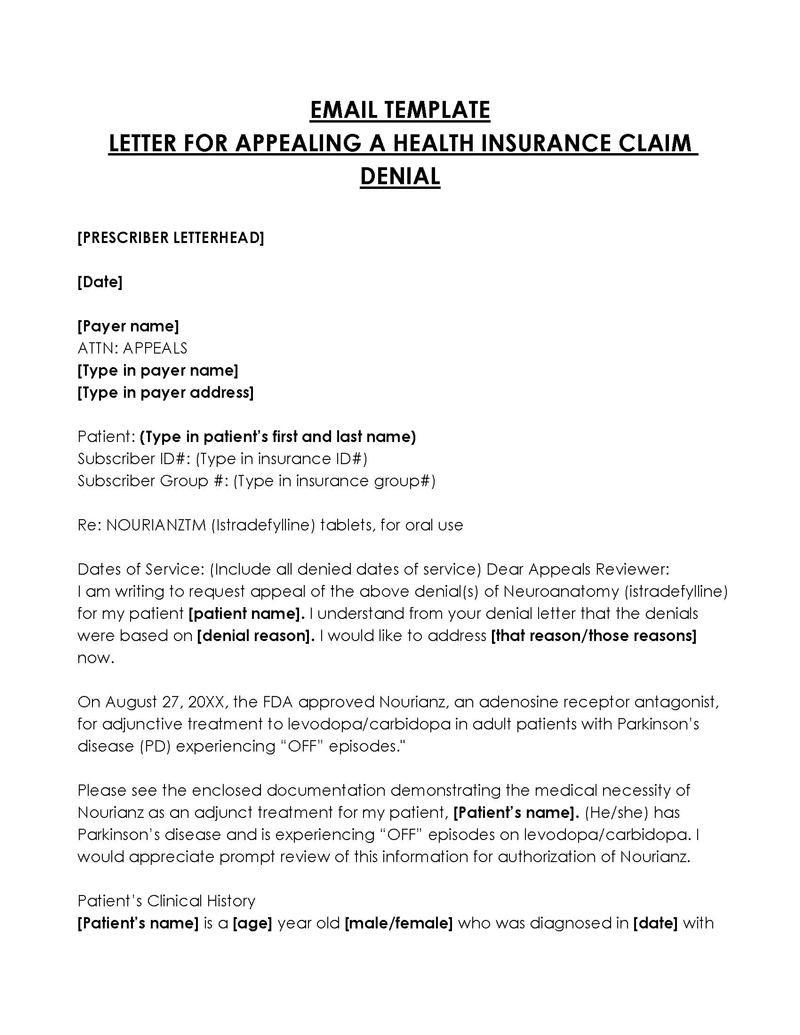

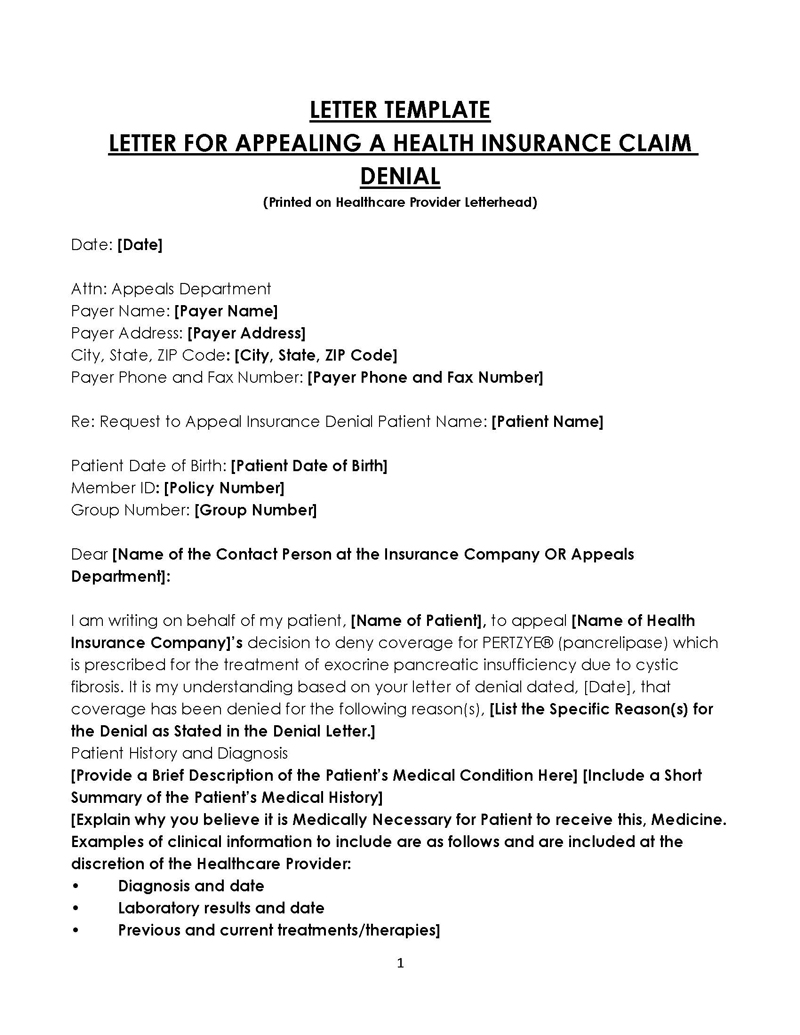

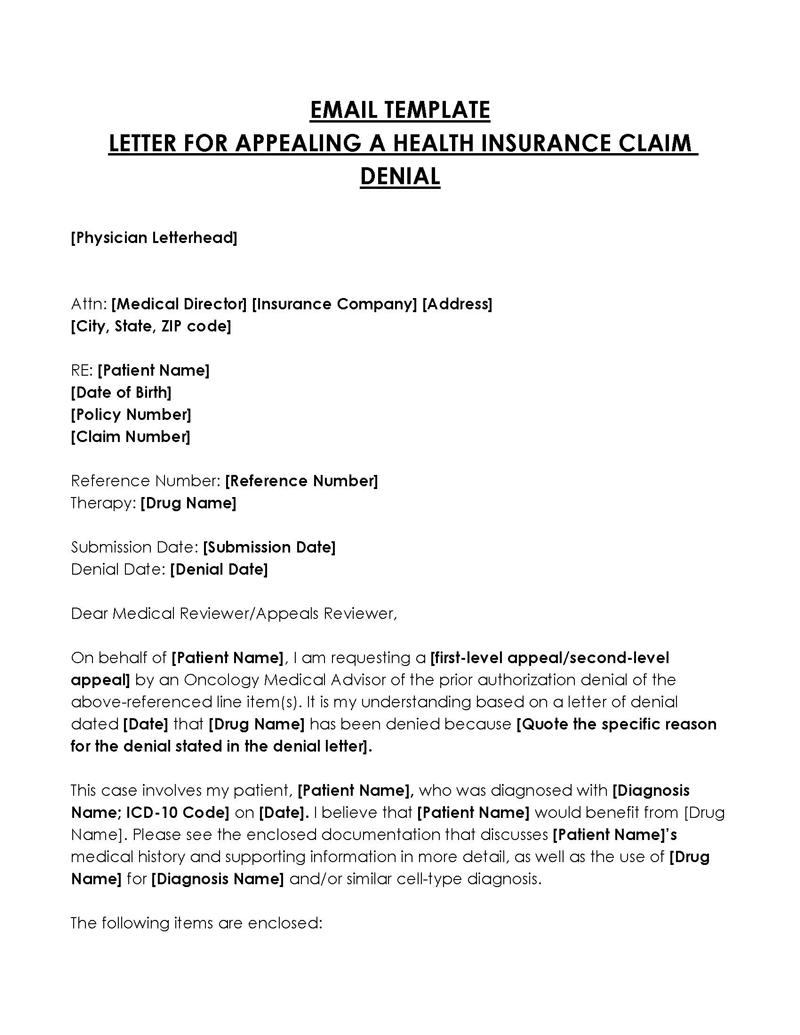

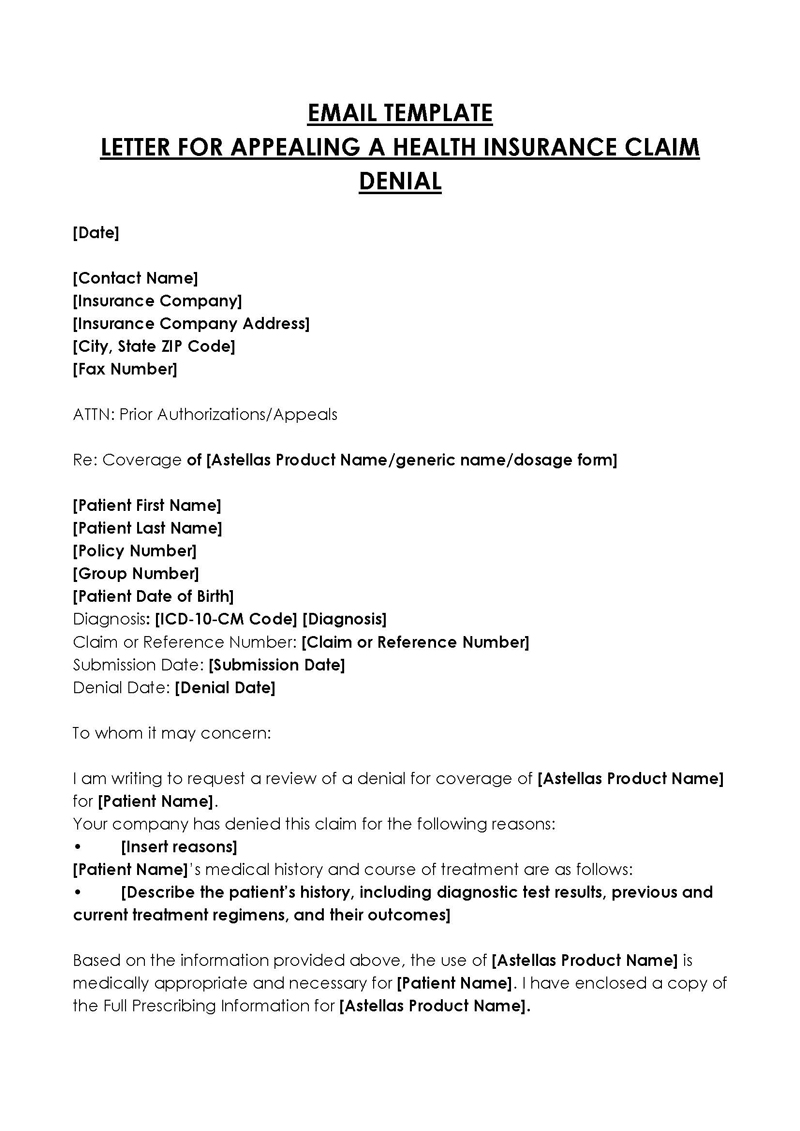

Free Template for an Appeal Letter

[Your Full Name]

[Your Street Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Date]

[Insurance Company Name]

[Claims Appeal Department]

[Insurance Company Address]

[City, State, Zip Code]

Dear Claims Appeal Department,

Subject: Appeal for Claim Denial – [Your Claim Number]

I am writing to formally contest the denial of my health insurance claim, which I received on [Date of Denial Letter]. The claim in question is identified by the number [Your Claim Number], and pertains to [specific medical service, treatment, or procedure] that I underwent on [Date of Service]. According to the denial letter I received, the reason provided for this decision was [Reason for Denial as mentioned in the Denial Letter], a rationale with which I respectfully disagree.

The services for which my claim was denied include [specific medical service, treatment, or procedure], administered by [Healthcare Provider’s Name] on [Date of Service]. The denial of this claim was based on [Reason for Denial as mentioned in the Denial Letter], a decision that overlooks crucial aspects of my medical needs and the specifics of my insurance coverage.

The primary basis for my appeal revolves around the medical necessity of the denied service and its coverage under my health insurance plan. The service was deemed essential by my healthcare provider, [Healthcare Provider’s Name], who has been managing my condition of [Your Medical Condition] since [Date]. This treatment is not only critical for managing my condition but is also recognized as a standard and effective treatment for such cases.

Furthermore, upon reviewing my insurance policy, specifically sections [Quote Relevant Policy Sections], it is clear that such services should indeed be covered. The denial of this claim contradicts the terms of my policy and my understanding of the coverage provided.

Enclosed with this letter, you will find comprehensive documentation to support my appeal:

- A detailed letter from [Healthcare Provider’s Name] that discusses the medical necessity of the [specific service, treatment, or procedure].

- Relevant medical records and test results that substantiate the need for the denied service.

- Copies of the specific sections of my insurance policy that I believe support my claim for coverage.

- Any previous correspondence with your company regarding this claim.

I kindly request a thorough review of my appeal and the attached supporting documentation. It is my belief that this additional information will clarify the necessity and eligibility of the denied service under my health insurance plan.

Should you require any further information or additional documentation, please do not hesitate to contact me at [Your Phone Number] or [Your Email Address]. I am fully prepared to provide whatever is necessary to facilitate the review of my appeal.

I trust that upon review, you will find the grounds for my appeal to be valid and reconsider the denial of my claim. I appreciate your attention to this matter and look forward to a resolution that will allow me to continue receiving the necessary medical care for my condition.

Thank you for your time and consideration.

Sincerely,

[Your Full Name]

[Your Signature (if sending a hard copy)]

Attachments:

- Letter from Healthcare Provider

- Medical Records and Test Results

- Relevant Sections of Insurance Policy

- Previous Correspondence

Sample Letter for Appealing a Health Insurance Claim Denial

Dear Appeals Department,

Subject: Appeal of Claim Cancellation – Claim Number ABC12345

I am writing to formally appeal the cancellation of my health insurance claim (Claim Number ABC12345) related to my hospital stay at Cityville General Hospital from January 10 to January 14, 20XX. The reason provided for the cancellation was that the hospitalization was deemed not necessary. I respectfully contest this decision and provide below a detailed account of my situation, along with supporting documentation to substantiate the necessity of my hospital stay.

On January 9, 20XX, I was admitted to Cityville General Hospital following a severe asthma attack, which my primary care physician, Dr. Emily White, deemed potentially life-threatening without immediate and intensive treatment. Despite previous treatments and management strategies for my chronic asthma, this incident required an escalated level of care to stabilize my condition.

Attached is a detailed letter from Dr. Emily White, outlining the circumstances leading to my hospitalization, including the acute exacerbation of my asthma, the treatments administered prior to hospital admission, and the rationale for the necessity of inpatient care.

According to my health insurance policy, hospital stays are covered when deemed medically necessary by a treating physician. Given the severity of my condition at the time of admission, as detailed by Dr. White, my hospital stay falls squarely within the policy’s coverage for necessary medical interventions.

Enclosed with this letter, you will find the following documents to support my appeal:

- A letter from Dr. Emily White detailing the medical necessity of my hospitalization.

- Medical records from Cityville General Hospital documenting my treatment and stay.

- A copy of the relevant sections of my health insurance policy that affirm coverage for medically necessary hospital stays.

- Previous medical records highlighting my history of chronic asthma and the treatments I have received.

I kindly request a thorough review of my appeal, taking into consideration the enclosed documentation and the critical nature of my hospital stay. I believe that this additional information will demonstrate the necessity of my hospitalization and the appropriateness of coverage under my health insurance plan.

Should you require any further information or wish to discuss this appeal in more detail, please do not hesitate to contact me at 555-789-0123 or via email at alexjohnson@email.com. I am fully prepared to provide any additional documentation or clarification needed to expedite the review of my appeal.

I trust that upon review, you will find the evidence supports the necessity of my hospital stay and that the decision to cancel my claim will be reversed. I appreciate your prompt attention to this matter and look forward to a favorable resolution.

Thank you for your consideration and time.

Sincerely,

Alex Johnson

Attachments:

- Letter from Dr. Emily White

- Medical Records from Cityville General Hospital

- Relevant Sections of Insurance Policy

- Previous Medical Records

Key Takeaways

This letter is an effective appeal against the cancellation of a health insurance claim, demonstrating several key elements that contribute to its persuasiveness:

Clear Purpose Statement: The letter begins with a straightforward statement of intent, immediately clarifying the purpose of the correspondence.

Detailed Explanation and Context: It provides a comprehensive background of the medical situation that led to the hospitalization, including the severity of the condition and the medical advice received, which helps establish the necessity of the treatment.

Reference to Policy Coverage: The appeal directly references the health insurance policy’s terms regarding coverage for medically necessary hospital stays, aligning the claim with policy stipulations.

Supporting Documentation: The inclusion of detailed supporting documents, such as a letter from the treating physician and medical records, strengthens the appeal by providing evidence of the medical necessity and the treatment provided.

Request for Review: It clearly requests a thorough review of the appeal, indicating the writer’s expectation for reconsideration based on the presented evidence.

Availability for Further Communication: Offering contact information and readiness to provide additional information or clarification demonstrates the claimant’s proactive and cooperative approach to resolving the issue.

Polite and Professional Tone: The letter maintains a respectful and formal tone throughout, which is crucial for effective communication with an appeals department.

Overall, the structured presentation of facts, reference to policy details, and inclusion of substantial evidence make this letter a strong appeal for the reconsideration of the health insurance claim cancellation.

Frequently Asked Questions

A survey conducted in 2019 on insurance companies that work with HealthCare.gov indicates that an estimated 17% of all their in-network claims were denied. However, 1-50% of health insurance claims with independent insurers were denied. The survey also noted that catastrophic plans are more likely to be denied, with an average rate of 20%. It was also noted that insurers who work with Healthcare.gov are more transparent about their denials.

A survey conducted in 2019 on insurance companies that work with HealthCare.gov indicates that an estimated 17% of all their in-network claims were denied. However, 1-50% of health insurance claims with independent insurers were denied. The survey also noted that catastrophic plans are more likely to be denied, with an average rate of 20%. It was also noted that insurers who work with Healthcare.gov are more transparent about their denials.

Affordable health insurance is always a priority for everyone. Individuals can get affordable healthcare through their employers or government-initiated programs such as state-initiated health insurance such as Medicaid. Always strive to understand the terms of each policy before enrolling to ensure you apply for a healthcare policy that befits your income and financial ability.