The benefit of an insurance policy is the promise of financial protection in an emergency. Of course, having that protection denied in a moment of need is painful and disappointing. However, you don’t have to accept the denied promise, especially if you believe the benefit is genuinely deserved.

The Affordable Care Act (ACA) gives an insurance policyholder the right to appeal a denial of an insurance benefit claim to pay for a medical expense. A denied insurance claim can be overturned through this process, and the appropriate benefits are awarded. Taking full advantage of this privilege under the Act begins with creating an insurance appeal letter.

An insurance appeal letter is a written request issued by a policyholder to an insurance company asking for a reassessment of an earlier decision of the company to deny a benefit.

The letter details the matter regarding which benefit was denied and why the policyholder believes this should not have been so. In this way, the insurance company is made aware of the complaint by the policyholder. The company can then review the earlier decision, taking into account whatever argument the policyholder makes, and choose to either overturn the decision or reaffirm it.

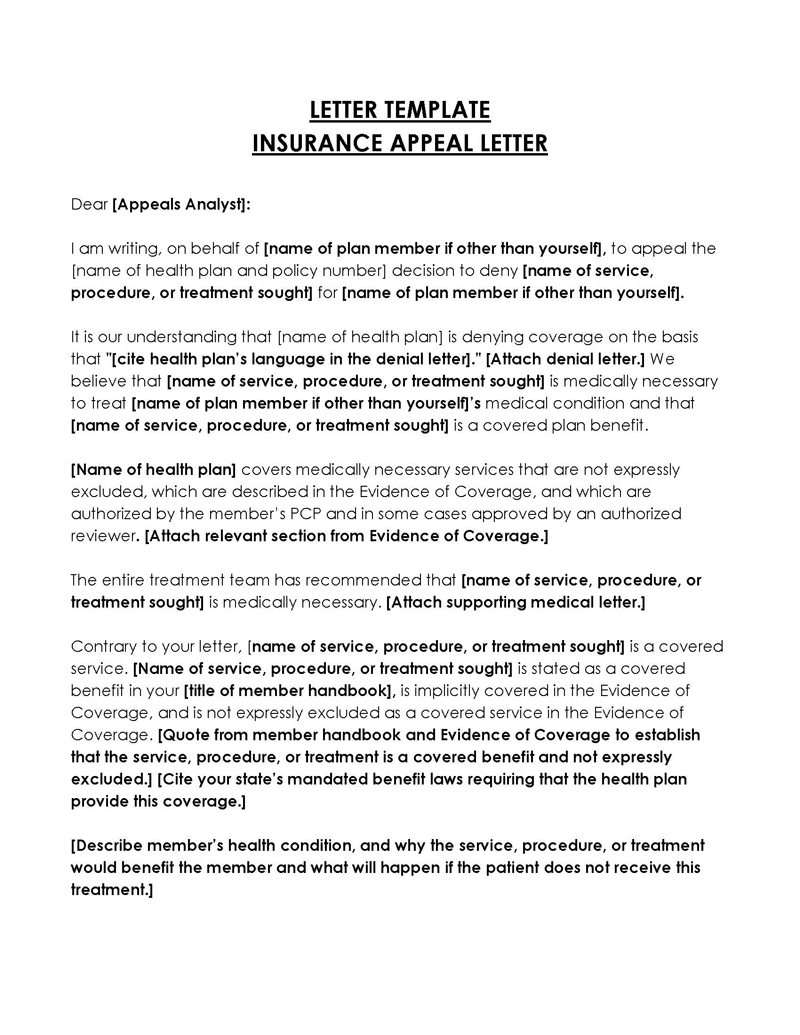

Free Templates

Purpose of Insurance Appeal Letter

An insurance appeal letter aims to inform an insurance company of a complaint from a policyholder about a denied benefit. This letter is a means of tabling this complaint and presenting relevant information to convince the insurance company to reconsider. The letters are used following a notification from an insurance company that expresses an expense will not be covered under an insurance plan.

The letter is used to challenge the reason stated why. The purpose of the letter is to request money that has already been deposited with the insurance company, either as a refund or as a claim.

Essential Elements of Appeal Letter

The complete letter must include the following essential elements to be relevant:

- Current date

- The sender’s name and contact information

- The policy holder’s name, contact information, and policy number.

- The purpose of writing the letter

- The matter regarding which a benefit was denied.

- The reason cited on the denial notification letter and the letter’s date was received.

- Closing remarks

How to Write an Appeal Letter?

Starting an insurance appeal begins with drafting the letter and submitting it to your insurance company. Use the following guidelines to create your appeal request:

1. Start with the basics

The first thing in your letter is all the necessary details the insurance company needs to identify your case. Start your letter by stating your full name. Follow this up with the policy number. Further, state your contact information, including telephone, email, and mailing address.

After this, state the purpose of writing the letter and present the matter regarding which denial was issued, the reason cited on the notification letter for the denial, and the date the letter was received. The health care provider’s name and contact information should also be included (in case of medical issues).

2. Include details

After presenting the apparent facts about the case, begin your argument about why you believe your policy covers the expense and the denial be overturned. The first argument to present is a direct reference to the section or sentence in the policy that states eligibility for the requested coverage. Be very particular about wording, as the words used on the policy must correlate with the description of the expense to be covered.

Upon establishing that the wording on the policy does indeed support your claim, the following argument is to include a professional opinion. This can be a written statement from a doctor or healthcare provider (if it is a medical case) explaining why a particular procedure is/was necessary for medical matters.

If the provider wrongly stated the service description for which coverage is being requested, the correction should be included in this statement. It is vital to go straight to the point in the letter, but all relevant details relating to the denied claim should still be present.

You can also back up your case with records of past similar or identical expenses that have been covered under that same policy.

3. Send your letter

The final action is to send your letter to the insurance company. Make a copy of the letter and all other documents before sending it. Choose a transmission method based on what the company accepts, either fax or snail mail. Upon sending, keep evidence of successful submission.

If the letter is sent through the mail, use certified mail and obtain the return receipt. You should receive a confirmation notice after your appeal request has been received in about ten days. If not, contact the insurance company and inquire about the letter.

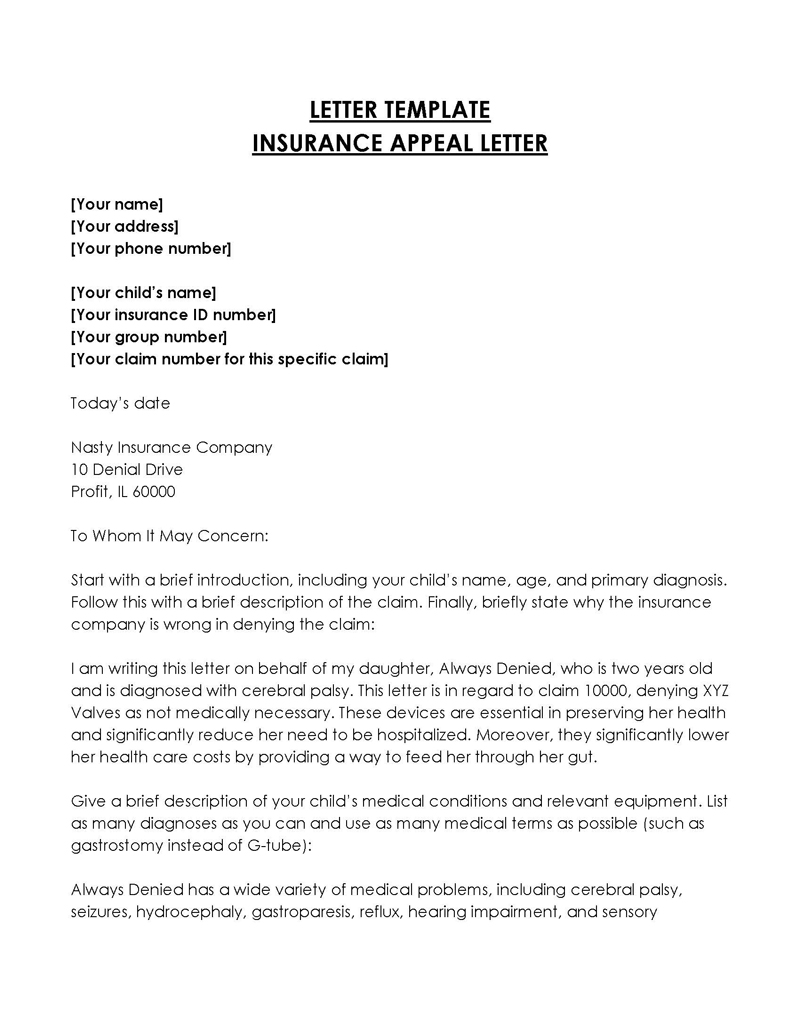

Free Appeal Letter Templates

[Your Full Name]

[Your Address]

[City, State, Zip Code]

[Phone Number]

[Email Address]

[Date]

[Insurance Company Name]

Claims Appeal Department

[Company Address]

[City, State, Zip Code]

Subject: Appeal of Denied Claim – [Your Claim Number]

Dear Claims Review Officer,

I am writing to formally appeal the denial of my health insurance claim dated [Date of Denial Letter], with the claim number [Your Claim Number]. This appeal is in response to the decision regarding the medical services provided on [Date(s) of Service], by [Healthcare Provider’s Name]. According to the denial letter I received, my claim was denied for [Briefly state the reason for denial as given by the insurance company].

Upon reviewing the reasons provided for the denial of my claim, I believe that there has been a misunderstanding or an error in the evaluation of the circumstances surrounding my case. Specifically, [Provide a detailed explanation of why you believe the claim was wrongly denied. Reference any specific policy provisions or medical information that supports your position].

Enclosed with this letter, you will find comprehensive documentation to support my appeal, including:

- A detailed letter from my healthcare provider, [Doctor’s Name], outlining the medical necessity of the treatment and its relevance to my diagnosed condition.

- Relevant medical records and test results that substantiate the need for the denied service.

- A copy of the original claim and the denial letter for your reference.

- Sections from my insurance policy documentation that I believe warrant a coverage of the disputed claim, highlighting the specific clauses that support my appeal.

I respectfully request a thorough review of my initial claim and the enclosed documentation. I believe that this additional information will demonstrate the medical necessity and appropriateness of the services rendered, thereby justifying coverage under my health insurance plan.

I trust that upon reviewing the enclosed evidence and the details of my case, you will find sufficient grounds to overturn the initial denial of my claim. I am seeking a prompt and favorable resolution to this matter and kindly request to be informed of the appeal process’s progress and expected time frame.

Please feel free to contact me at [Your Phone Number] or [Your Email Address] should you need any further information or clarification regarding my appeal. I am eager to resolve this issue and continue to rely on [Insurance Company Name] for my healthcare coverage needs.

Thank you for your time and consideration.

Sincerely,

[Your Signature (if sending by mail)]

[Your Printed Name]

Enclosures:

- Letter from Healthcare Provider

- Medical Records and Test Results

- Copy of Original Claim and Denial Letter

- Relevant Policy Documentation

Samples of Insurance Appeal Letters

Here are two samples of insurance appeal letters to guide you while drafting yours:

Insurance Appeal Letter Sample 01

Dear Claims Review Officer,

Subject: Appeal of Denied Claim for Fracture Treatment – Claim #ABC123456

I am writing to formally appeal the denial of my health insurance claim related to the treatment of a fracture, which I received on January 15, 20XX. My claim, numbered ABC123456, was denied on January 25, 20XX, with the reason provided being “treatment deemed not medically necessary.”

The treatment for my fracture, which occurred on January 14, 20XX, during a skiing accident, was not only essential but also urgent, as diagnosed by my healthcare provider, Dr. Emily Thompson. The denial of this claim overlooks the critical nature of the treatment required for a fracture, which, if left untreated, could lead to severe complications, including improper bone healing, chronic pain, or loss of mobility.

To substantiate the necessity and urgency of the treatment received, I have enclosed the following documents:

- A detailed letter from Dr. Emily Thompson, outlining the diagnosis, the treatment administered, and the medical necessity of such treatment for my condition.

- Medical records and imaging results (e.g., X-rays) that clearly show the fracture on my left wrist and the treatment provided.

- A copy of the original claim and the denial letter for your reference.

- Excerpts from my insurance policy that I believe support the coverage of the treatment provided, especially in cases of emergency or urgent care necessitated by accidents or sudden medical conditions.

I respectfully request a thorough reevaluation of my claim, taking into consideration the enclosed documentation and the undeniable medical necessity of the fracture treatment. The treatment was imperative to prevent the aforementioned complications and ensure a proper healing process.

I trust that upon reviewing the additional information and documentation provided, you will find ample justification to approve my claim for the fracture treatment. I am seeking a prompt review and a favorable resolution to this appeal.

Please do not hesitate to contact me at 555-0101 or janedoe@email.com should you require further information or clarification regarding my case. I am eager to resolve this matter and hope for a reconsideration of the decision made regarding my claim.

Thank you for your attention to this appeal. I look forward to your timely response.

Sincerely,

[Signature (if sending by mail)]

Sarah Johnson

Enclosures:

- Letter from Dr. Emily Thompson

- Medical Records and Imaging Results

- Copy of Original Claim and Denial Letter

- Relevant Policy Documentation

Insurance appeal letter sample 02

Dear Claims Review Officer,

Subject: Appeal of Denied Drug Payment Claim – Claim #D456789

I am writing to appeal the denial of payment for the prescription drug Xyliumab, which is essential for the treatment of my rheumatoid arthritis. My rheumatologist, Dr. Sarah Lee, prescribed this medication after other treatments, including methotrexate and TNF inhibitors, failed to adequately control my symptoms. Despite its necessity, my claim for coverage under my ACA-compliant health plan (Claim #D456789) was denied on January 28, 20XX. The reason provided for this denial was that Xyliumab is considered “not formulary.”

Xyliumab is not merely a preference but a medical necessity for my condition, as evidenced by my enclosed medical records and the letter from Dr. Sarah Lee. This medication has been proven to significantly improve my quality of life by reducing joint inflammation, pain, and preventing further joint damage, outcomes that other medications have not been able to achieve.

Enclosed with this letter, you will find:

- A detailed letter from Dr. Sarah Lee, explaining the medical necessity of Xyliumab for my rheumatoid arthritis and the rationale behind choosing it over other formulary options.

- My medical records that document the history of my condition, previous treatments attempted, and their insufficient responses.

- A copy of the original claim and the denial letter for your reference.

Information from Xyliumab’s manufacturer that supports the efficacy of the drug in treating rheumatoid arthritis, including FDA approvals and clinical trial results that highlight its benefits over traditional treatments.

Under the Affordable Care Act, insurance plans are required to provide coverage for a broad range of prescription drugs, allowing for the necessary treatment of a variety of conditions. Given this requirement and the documented necessity of Xyliumab for my condition, I respectfully request a reevaluation of my claim.

I trust that upon reviewing the enclosed documentation, you will understand the critical nature of Xyliumab to my health and well-being. I kindly request a prompt review of my appeal and a reconsideration of the decision to deny payment for Xyliumab.

Please contact me at 555-0202 or alexjohnson@email.com should you need any further information or wish to discuss my case in more detail. I am hopeful for a positive resolution that supports my health needs according to the provisions of the Affordable Care Act.

Thank you for your time and consideration.

Sincerely,

[Signature (if sending by mail)]

Alex Johnson

Enclosures:

- Letter from Dr. Sarah Lee

- Medical Records

- Copy of Original Claim and Denial Letter

- Drug Efficacy Information from Manufacturer

Useful Tips

Going up against an insurance company can seem intimidating, so we have compiled a list of tips that will significantly improve your chances of claiming the benefit you deserve through the insurance appeal letter:

Be patient

Bear in mind that the issue might take a while to resolve. The first hurdle will be the confirmation of the letter submission. The insurance company will issue an official notice to you confirming the receipt of the appeal letter. This can take up to ten days from the time of submission. The review process can take some time, but it must not exceed 30 days. After a decision has been made, a notification letter will be delivered to you about the outcome.

Do not give up

After appealing and still being denied, do not give up yet. There is an option under the Affordable Care Act that allows for a request for an independent external appeal for medical matters. This new review process will be conducted by a third party rather than the insurance company.

Be concise and clear

In every step of your appeal process, present your case clearly and accurately, especially while writing the insurance appeal letter. Have a clear understanding of the matter in controversy and how it applies to your policy. For medical matters, speak to your doctor about the treatment procedure and its chances of success. Finally, present your case with definite facts and professional opinions during the appeal process.

Conclusion

Just because you were denied a benefit does not mean you have to accept it. Instead, fighting for what you rightly deserve is what you should do, and an insurance appeal letter is the best way to do that. When presenting your case, be backed up by facts, be confident about what you are requesting, and don’t give up until you get your due. Safeguard your health today with this letter.