A mortgage letter of explanation is a document that an individual seeking to obtain a mortgage loan can send to their lender to explain any discrepancies or inconsistencies found on their mortgage application before the lender approves their application.

The letter is to clarify any perceived inconsistency in an applicant’s documentation on their home purchase or refinance application.

When you submit your documentation to lenders through a mortgage pre-qualification letter or mortgage application, they will review all the information you have provided, including your income and savings documents, bank statements, and proof of funds/assets. Mortgage lenders need to be sure that the applicant can pay back their home loan, which means they will want to verify that your income is sufficient to cover the mortgage payments. If any inconsistencies in your documentation may affect your qualification for the mortgage loan, you will most likely be contacted by the lender and asked to explain these inconsistencies.

Whether it is your first time applying for a mortgage loan or submitting an application to purchase your second home, you need to be mindful of any discrepancies or inconsistencies in your documentation. This article will explain what a mortgage letter of explanation is, why you need one, how it will help you if you have any discrepancies on your application, what information your lender needs to see in your letter, and how using a pre-made template can be helpful.

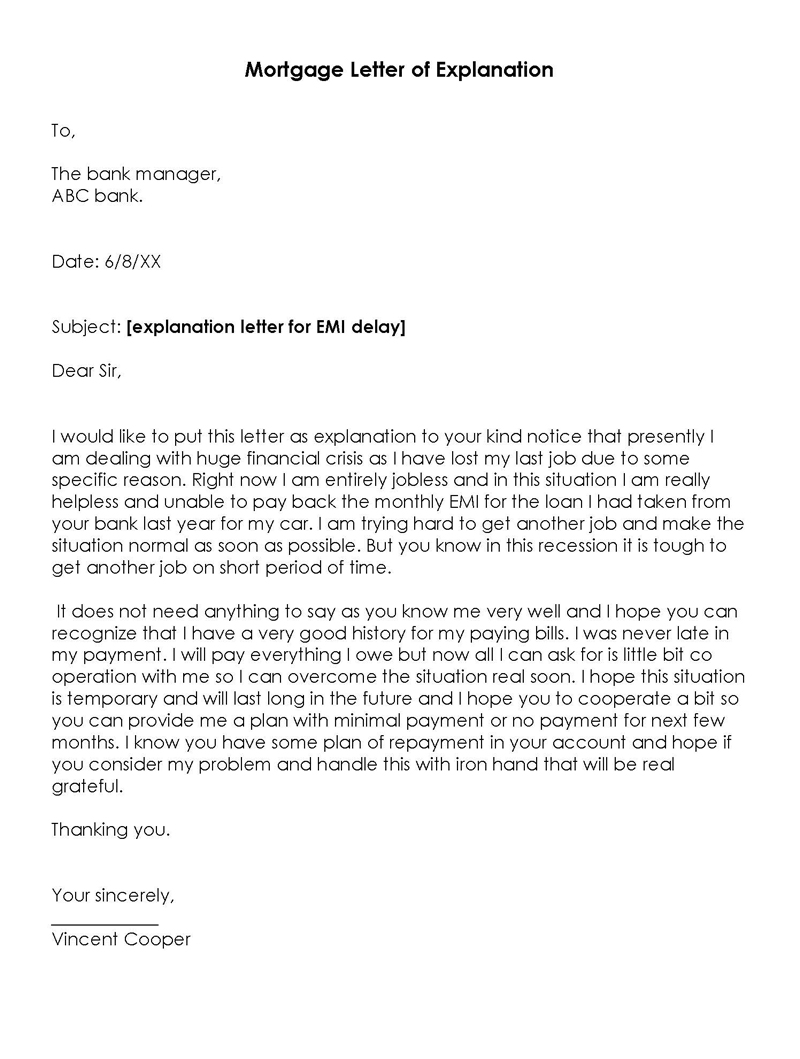

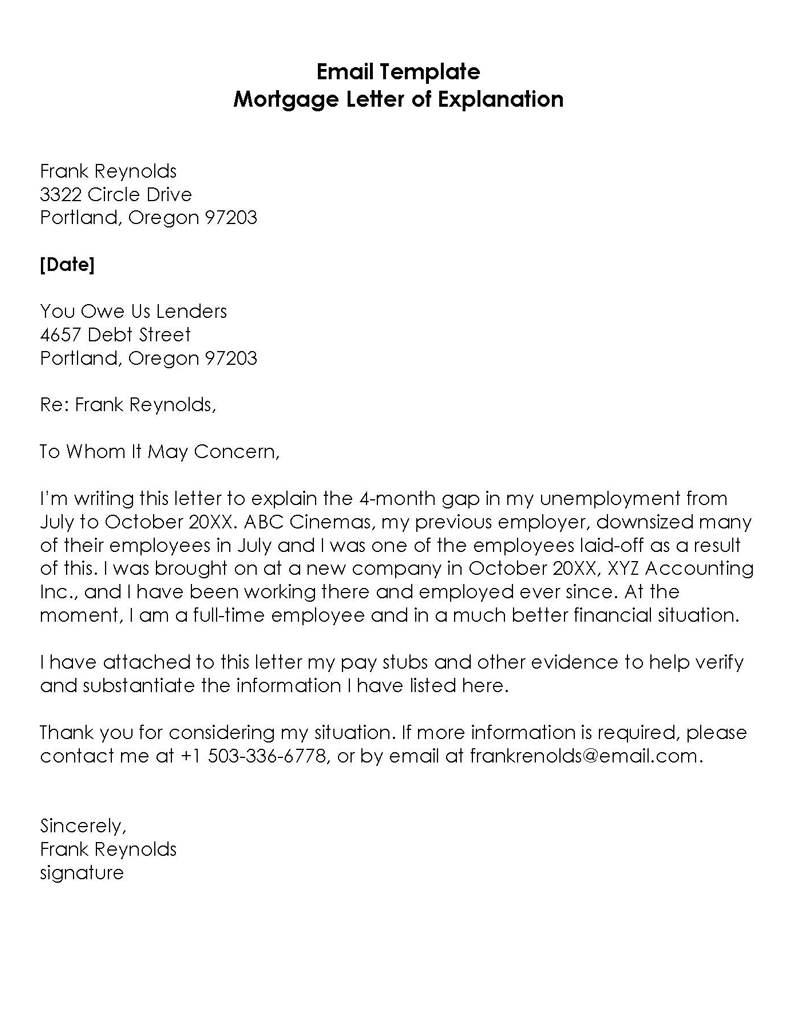

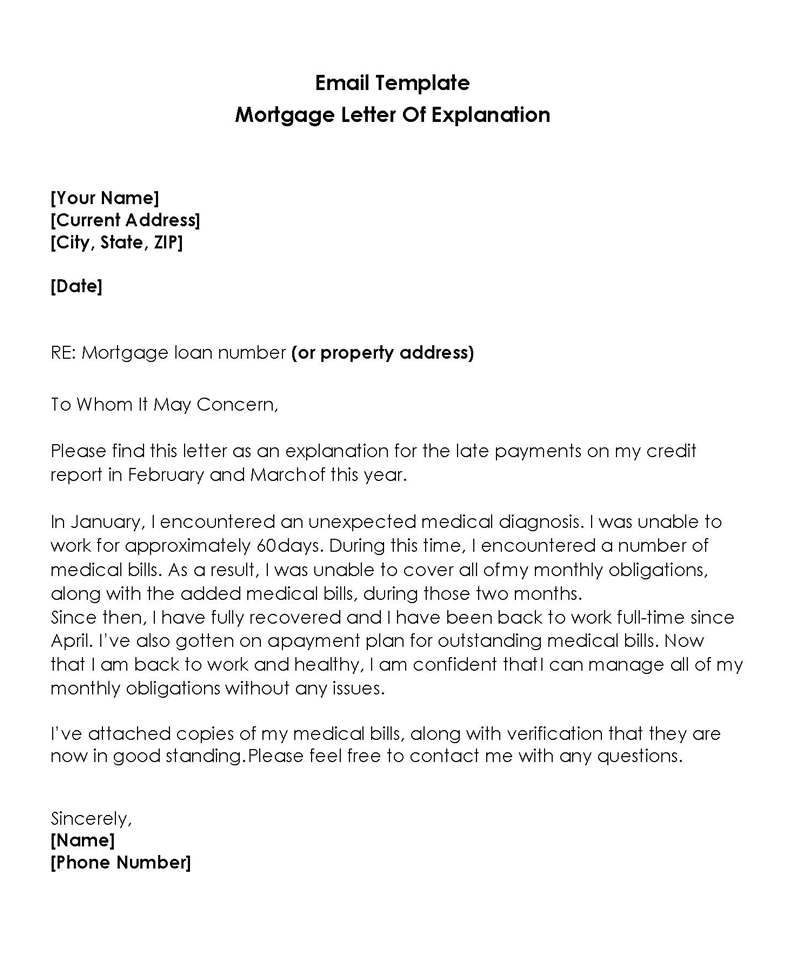

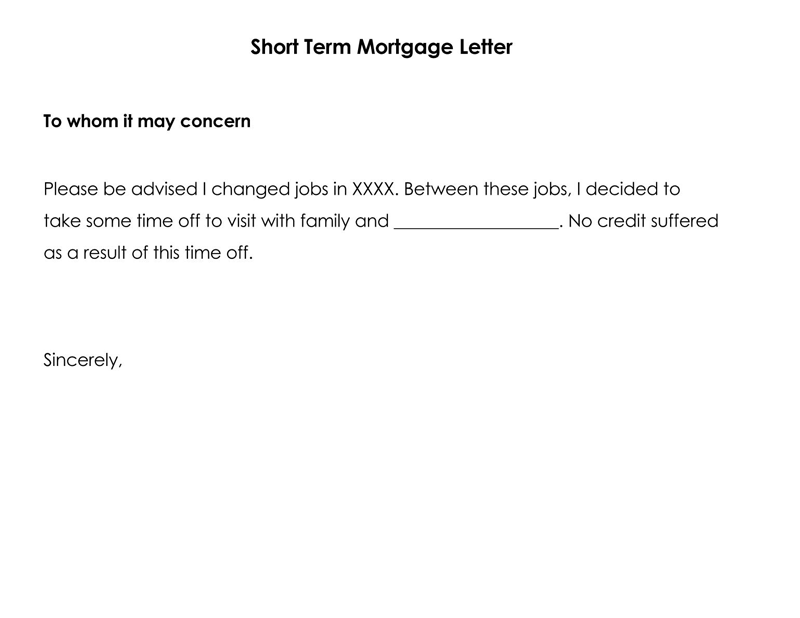

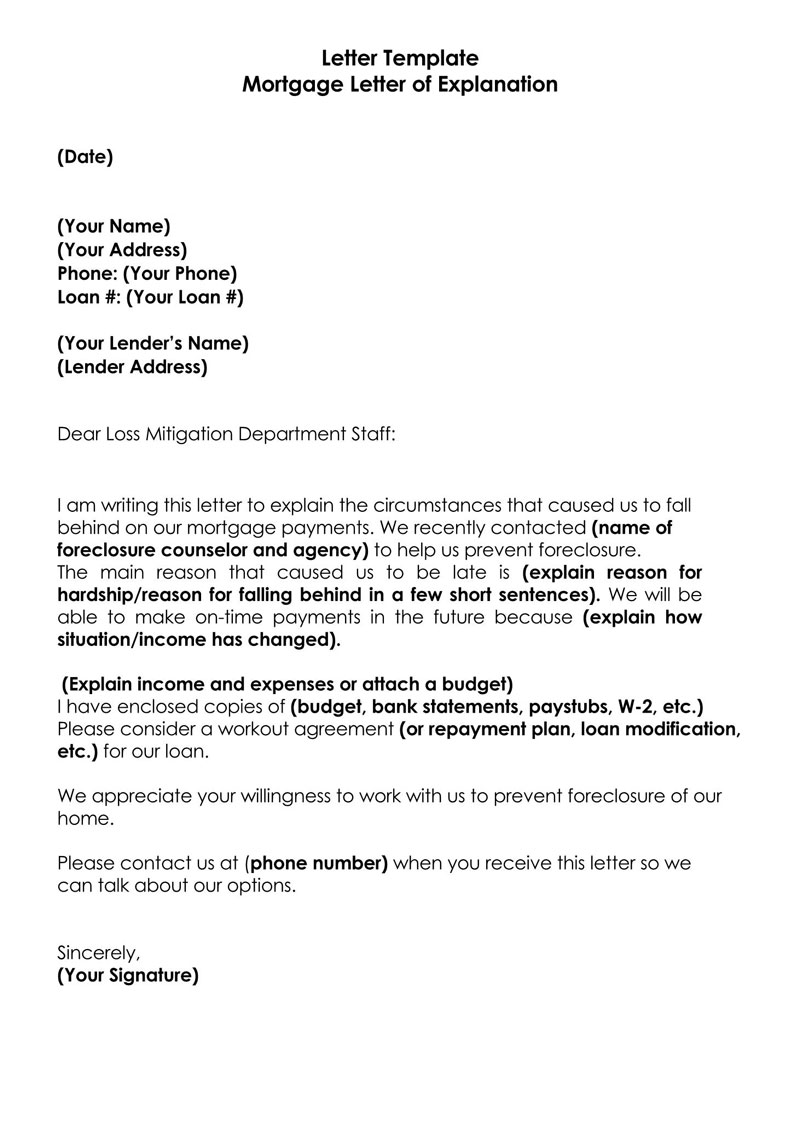

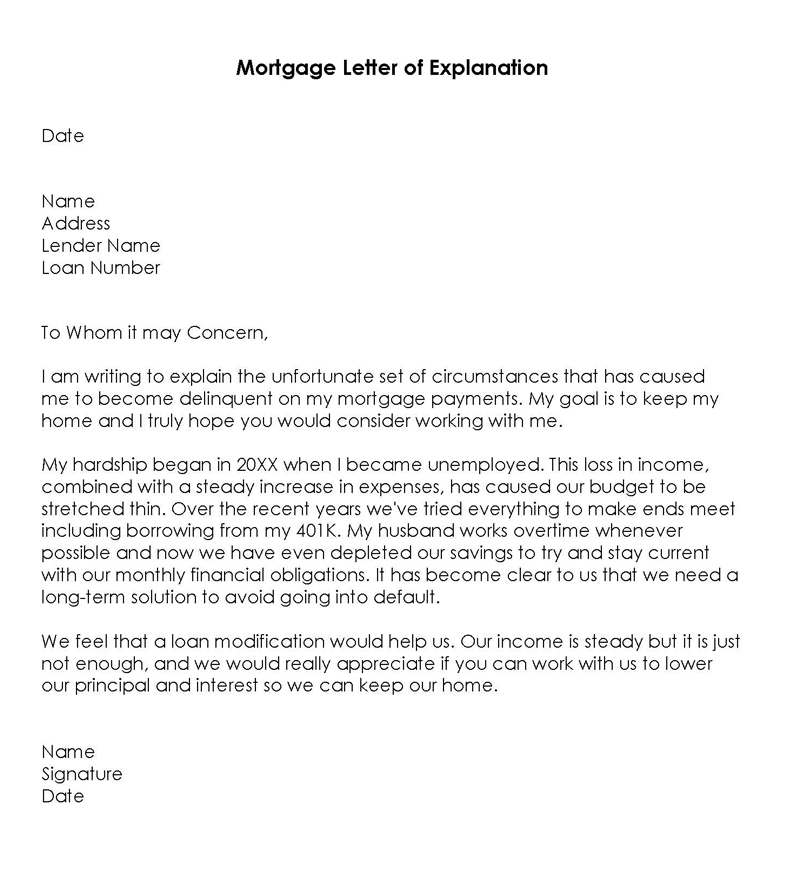

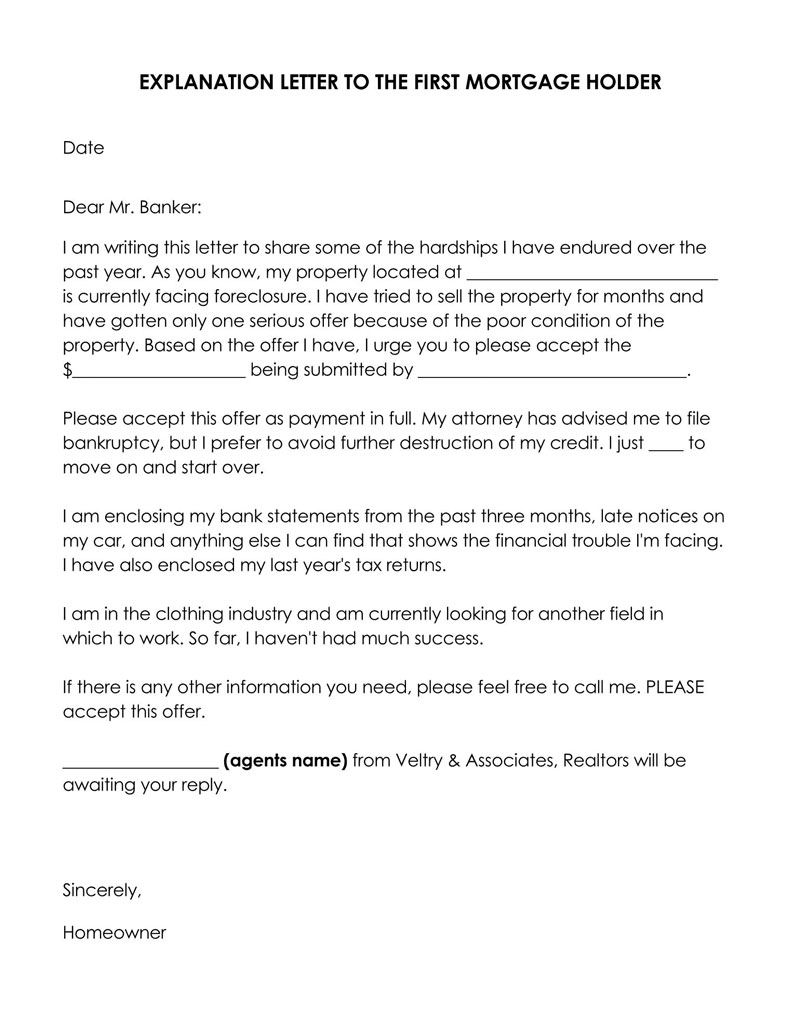

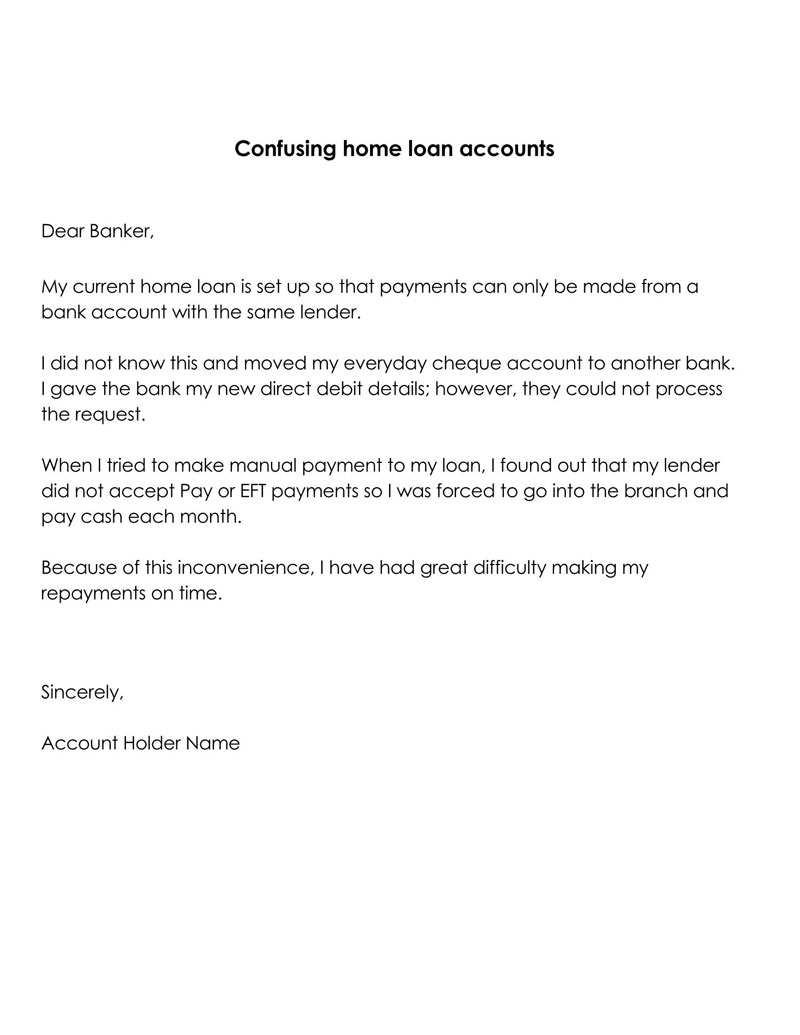

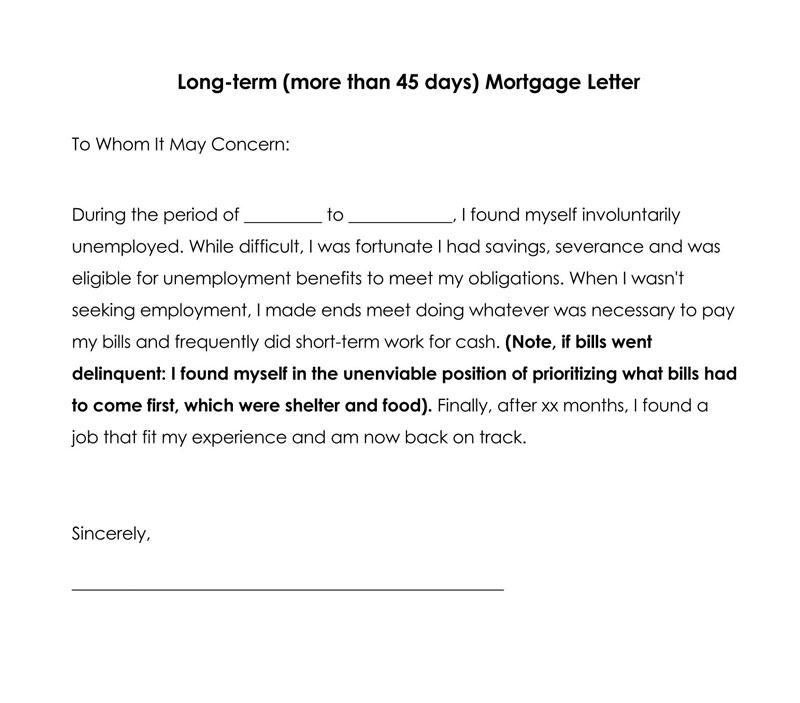

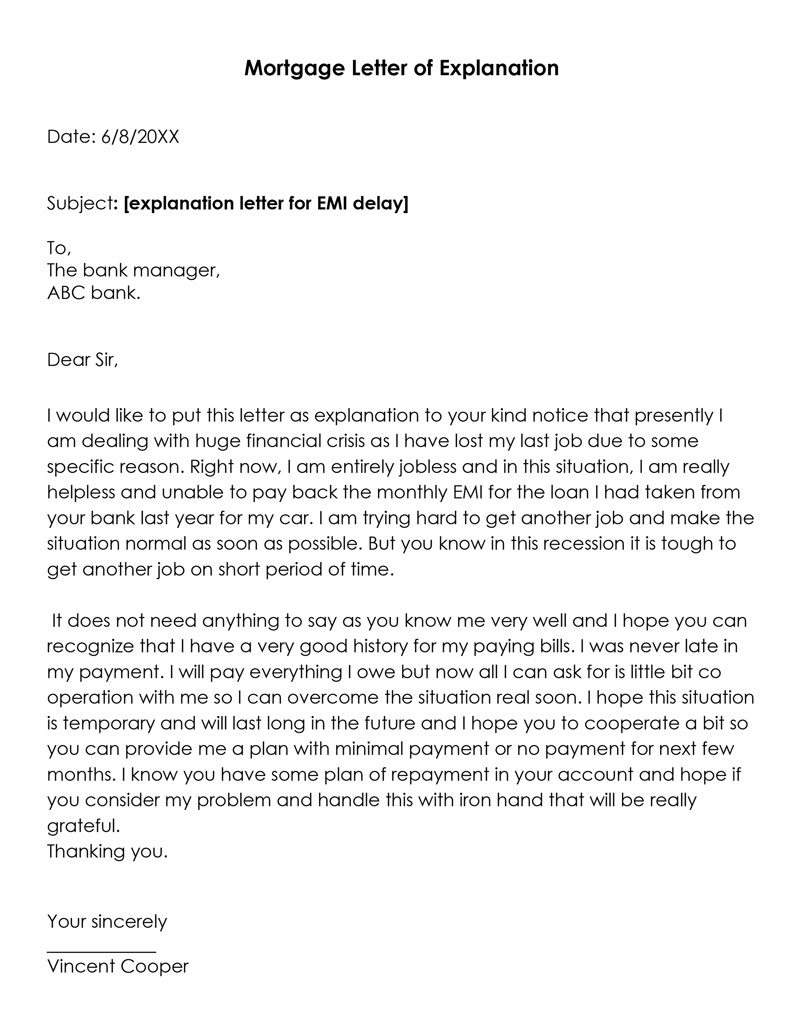

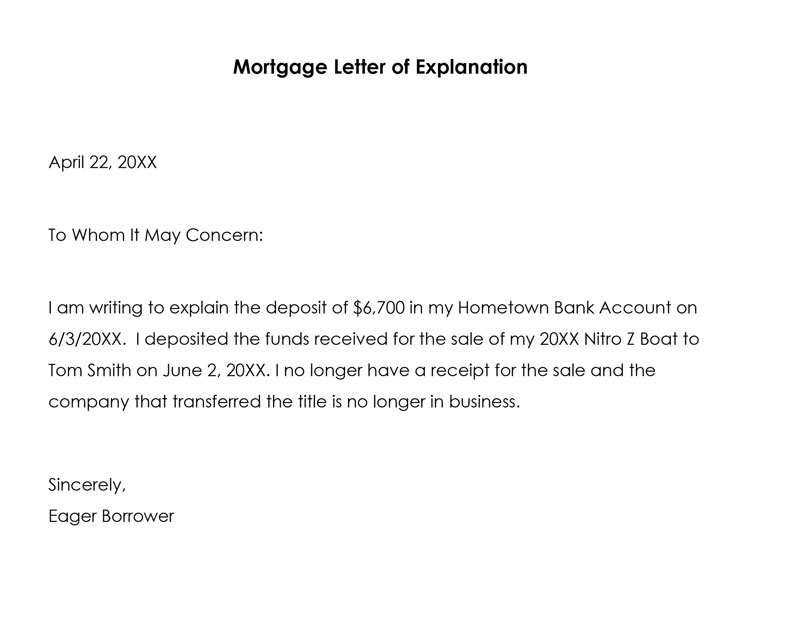

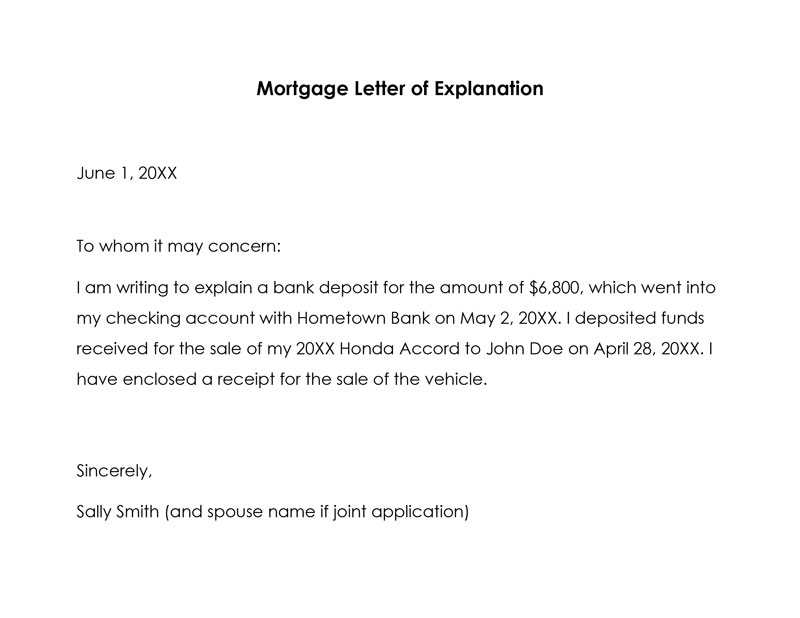

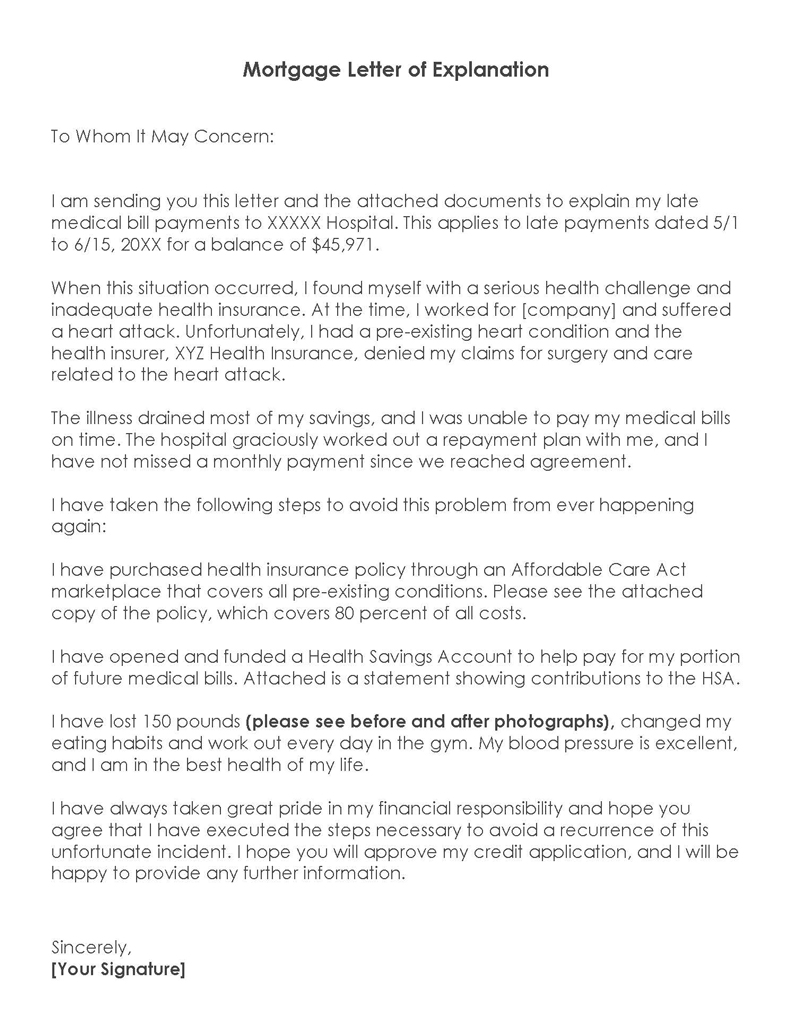

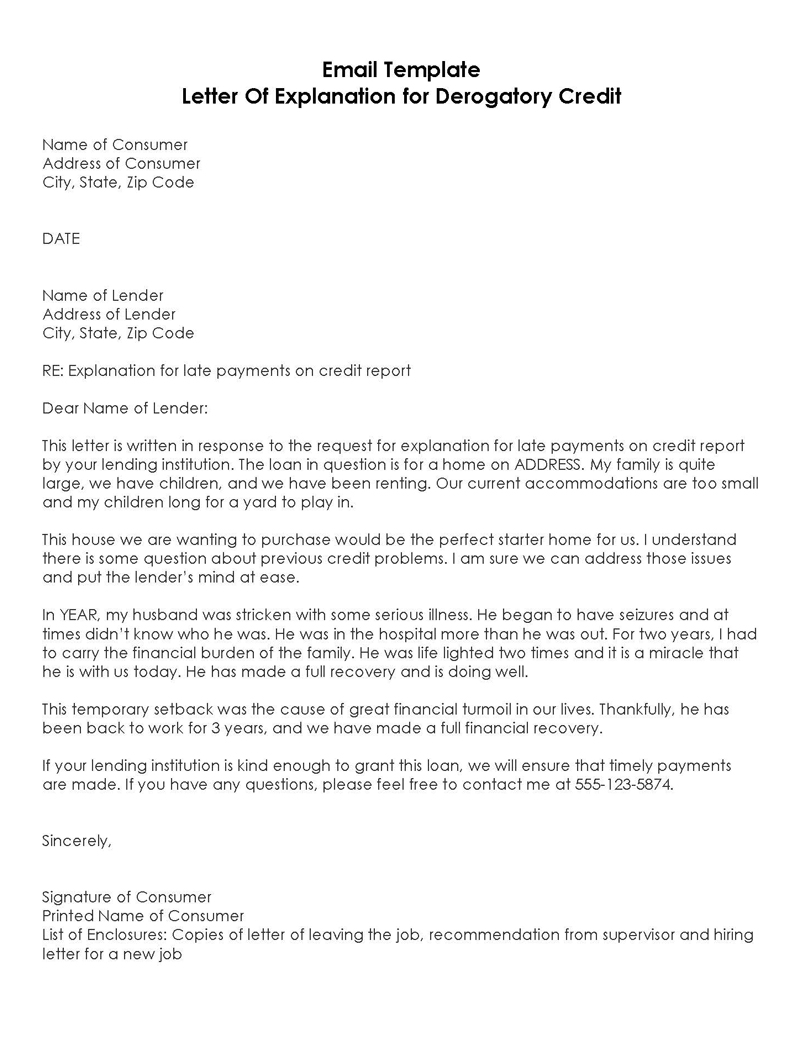

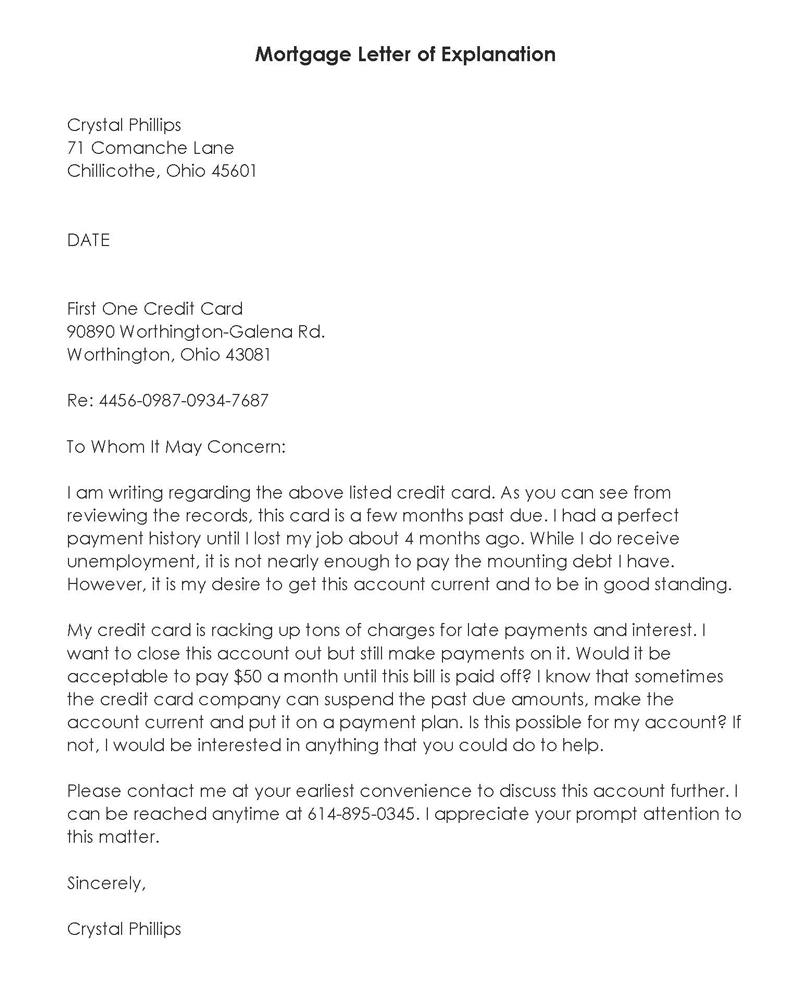

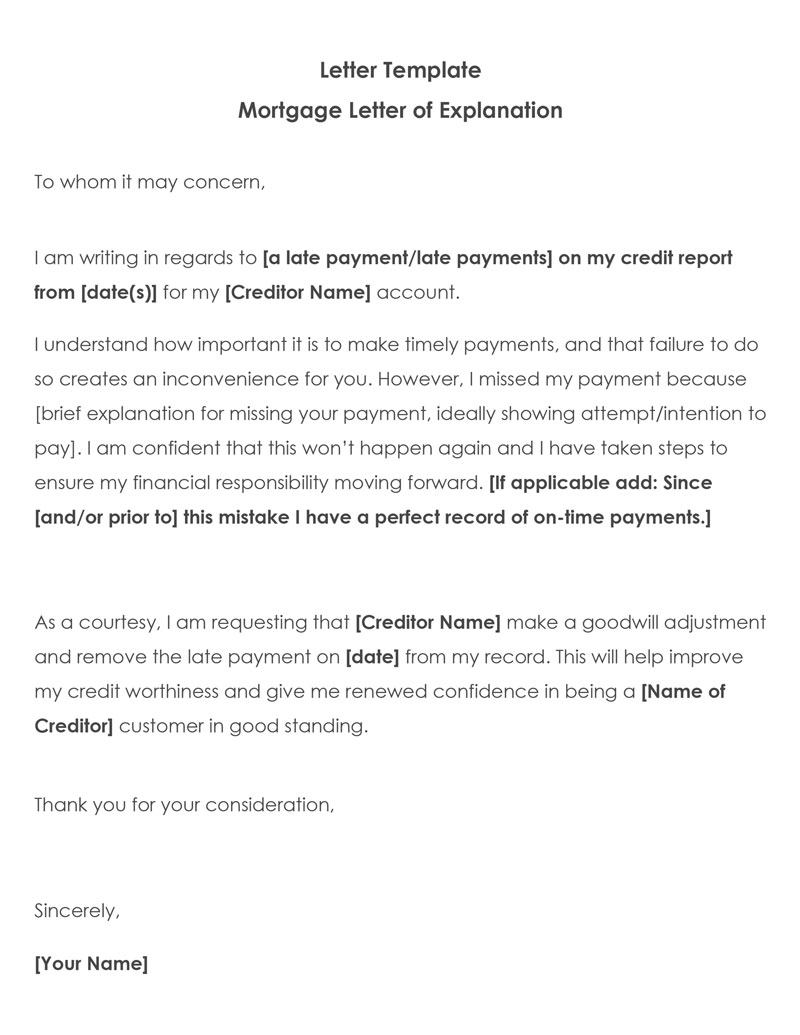

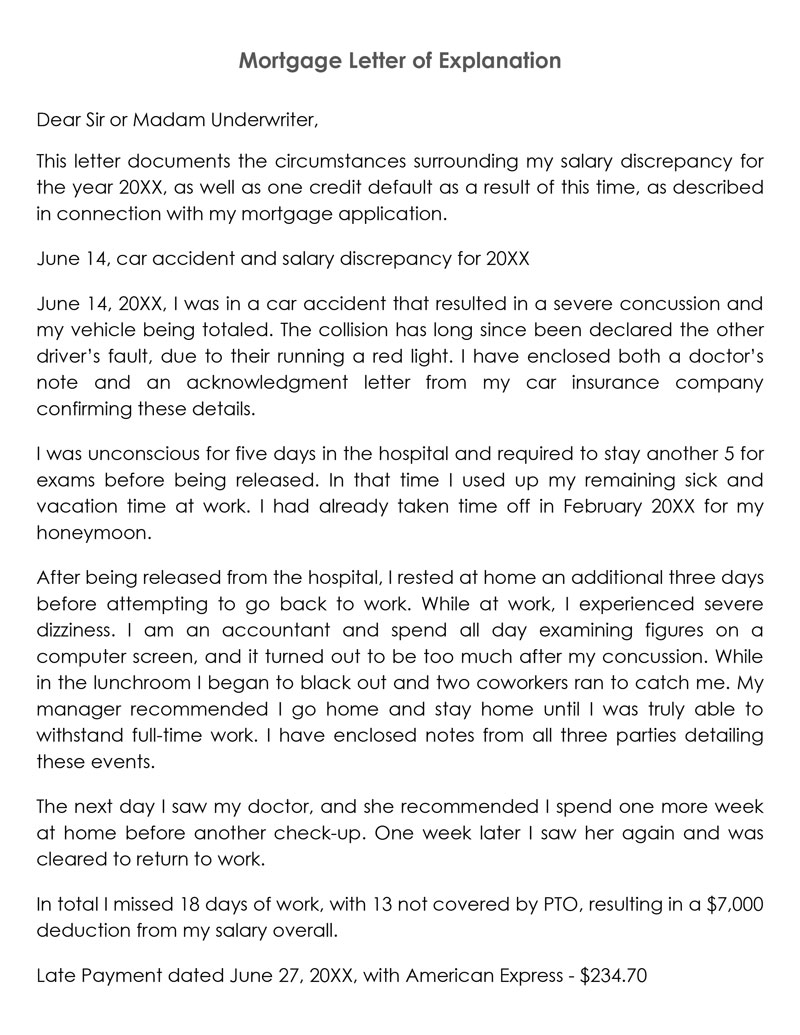

Free Templates

Why do You Need a Mortgage Letter of Explanation?

You will most likely be asked to provide a letter of explanation before your lender processes your application for a mortgage loan.

The most common reasons include:

- Declining credit score

- Declining income

- Foreclosure on a previous property

- Large debt loads

- Large deposits or withdrawals in your account

- Lack of rental history

- Disputed assets and expenses

- Overdraft fees on an account

- Recent credit inquiries

- Late payments on credit cards

- Address discrepancies on your credit report

- Inactive accounts or any other documented inconsistencies may affect your mortgage loan qualification.

Other derogatory items that may prompt a request for the letter include; late payments, collection items, charge-offs, bankruptcy, inconsistency in mailing address, or a short sale or foreclosure.

Additionally, unusual inconsistencies in your work history, such as job gaps, self-employment, frequent job changes, or a different line of work, can also prompt a request for the letter.

How it Works- 5 Steps

Here are some of the things that you will be required to do when preparing the letter:

Step 1: Choose an appropriate template

The first step is to choose the proper template for your letter. Drafting the letter can be a little tricky, especially if you have never written one before. Therefore, it is best to use a template that has been created by mortgage professionals and can be filled in with your details. The template will contain all the appropriate information that your lender needs to see to assess your qualification for the mortgage loan.

Step 2: Give details of your situation

Next, explain why there is a discrepancy or inconsistency in your documentation that may affect your qualification for the mortgage loan. It is important that you make your letter of explanation clear, concise, and easy to read. Tell them the situation you are in, what caused the discrepancy or inconsistency and how you plan to resolve the issue.

Step 3: Explain your resolution

Explain how you will resolve the discrepancy or inconsistency that may affect your qualification for the mortgage loan and how it will improve your qualification for the mortgage loan. Explain how you plan to rectify this situation to improve your credit rating, debts, assets, and income. Your explanation must be convincing enough, as it is out of this that the lender will make their decision on whether or not to approve your mortgage application.

Step 4: Include your acknowledgment

Next, acknowledge the inconsistencies or discrepancies in your documentation that may affect your qualification for the mortgage loan. This way, you show that you are aware of the issues. This will help build a trusting and professional relationship with your lender and reassure them of how aware you are of their requests and concerns.

Step 5: Attach supporting documents

If you have discrepancies in your documentation, your lender will most likely ask you to demonstrate your plans and actions to rectify the discrepancy. If they are satisfied with your plans and actions, they will then ask for some documents that can be used as references in case there is an issue with the mortgage loan application.

Therefore, make sure to include supporting documents such as bank statements, income statements, asset documents, and any other supporting documentation in your letter of explanation. This will help your lender assess your qualifications for the mortgage loan.

What to Include in the Letter

There are various things that you need to include in your letter. Before you start writing your letter of explanation, it is best to either consult a sample or fill out a pre-made template.

Here are some of the basic components that you will find in a template:

Date of writing the letter

The very first item that should be included in your template is the date of writing. You must include the exact date on which you wrote the letter. This way, the lender can easily make out from your letter whether you have written it recently or it was written sometime in the past. This is important as it helps establish the reputation of your efforts toward resolving any discrepancies or issues in your documentation.

Lender’s details

Include the name of the lender and branch. This will enable you to provide the address details for any supporting documentation. The name and branch that you include will depend on the lender or mortgage broker that you are applying with. If your lender only has one branch, then it is best to put down their full name and address details in your letter of explanation. However, if they have more than one branch, you must use their postal code as well as their specific branch number.

Your personal information

This is one of the most important things that you will find in the template. Be as detailed as possible when filling out your personal information. Personal information includes your name, address, marital status, occupation, and any details of your professional qualifications or employment history that you want the lender to know about. This will help them assess the credibility of your explanation.

Loan application number

The loan application number is another essential component that you will find included in a template. The application number that you provide will help the lender verify your documentation and help them match it against their records. This way, they will be able to assess whether what you have stated in your documents is true or not.

Your explanation

The letter of explanation also includes a section for you to give the exact reason why there is a discrepancy or inconsistency affecting your qualification for the mortgage loan.

EXAMPLE

If you have missing documents, it is best to include exactly what you are missing and any details on how and when they were supposed to be posted. This will help them assess the situation without having to have detailed knowledge of your situation.

Contact information for a follow-up

Next, fill in your email address, mailing address, and phone number in the template. This makes it easy for your lender to contact you for further inquiries if needed. You must include all the possible contact methods so that the lender can get in touch with you if needed.

Signature with date

Finally, you need to sign the letter of explanation with your signature. Make sure that it is signed in a professional manner and does not look like a hurried or hurriedly written document. This will help build trust between your lender and you and demonstrate that you have taken the time and effort to prepare the letter of explanation.

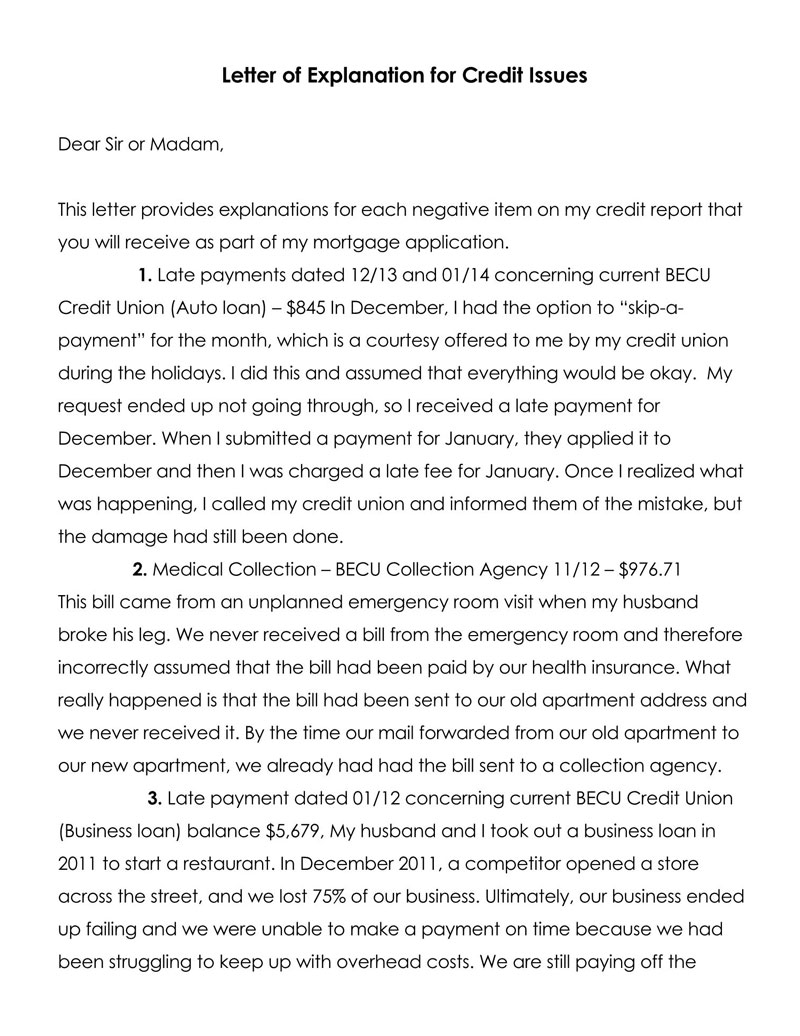

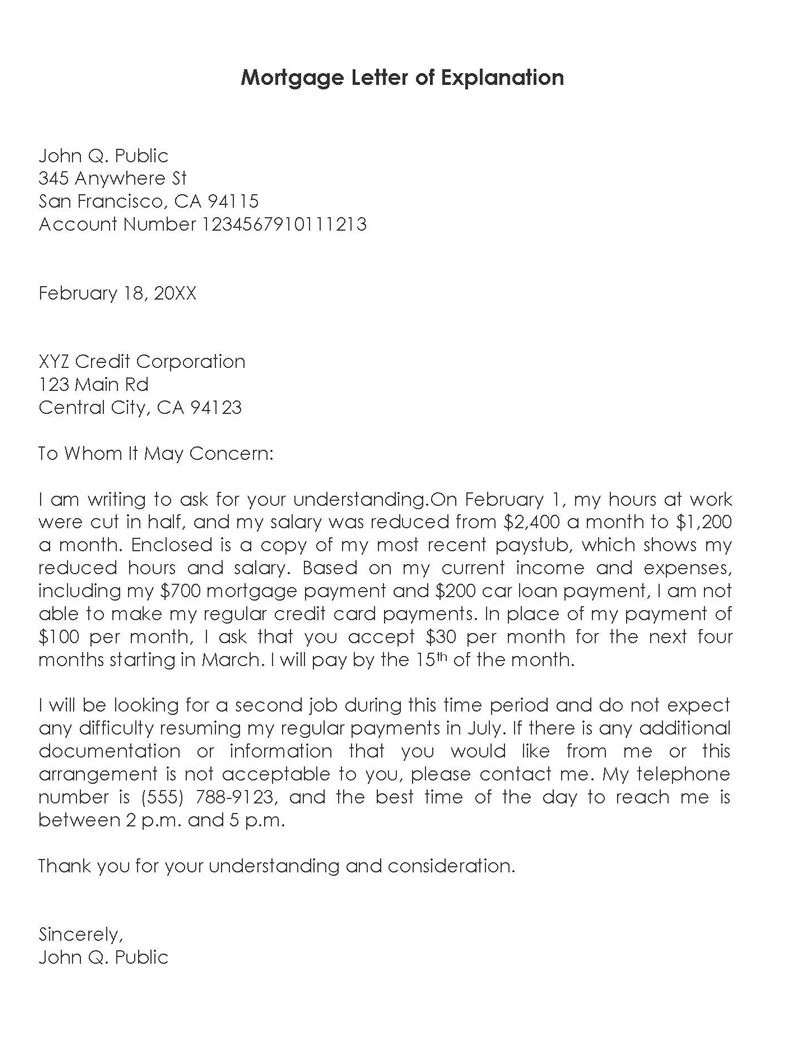

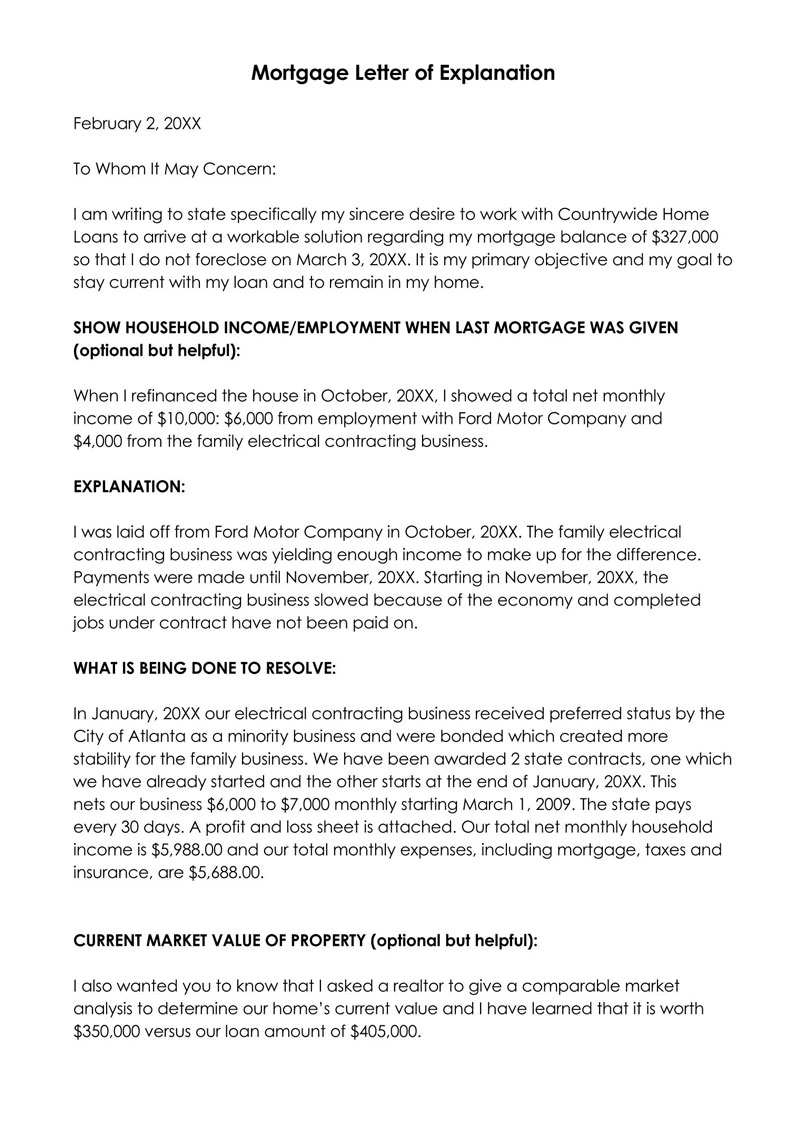

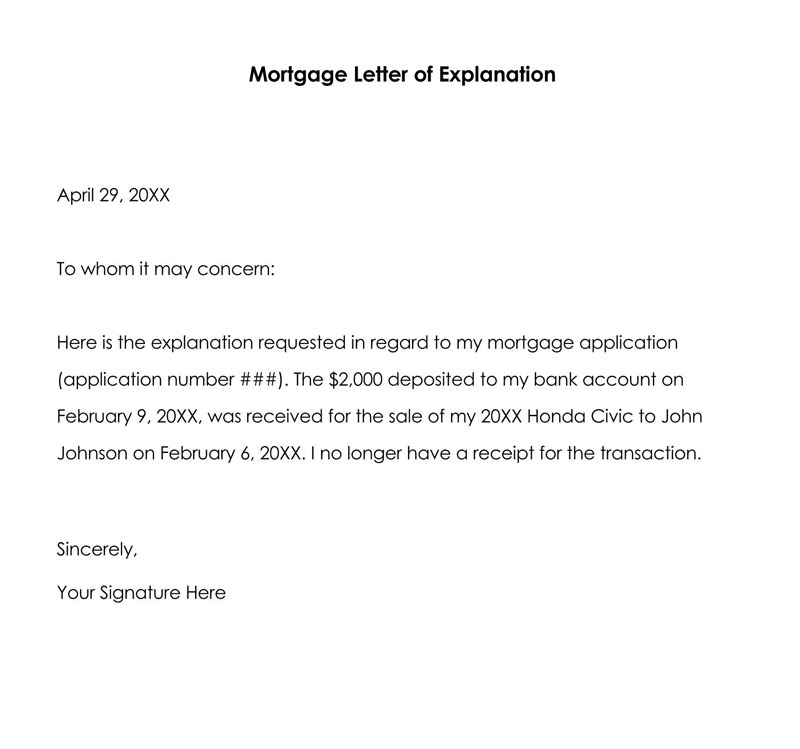

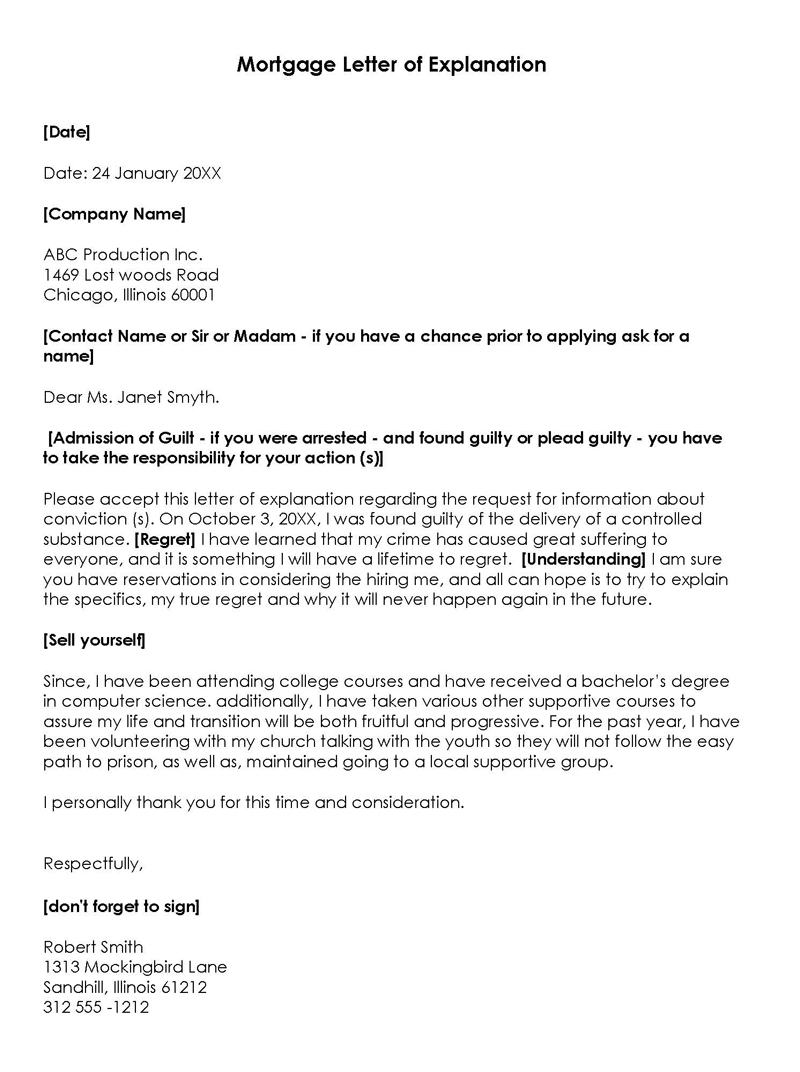

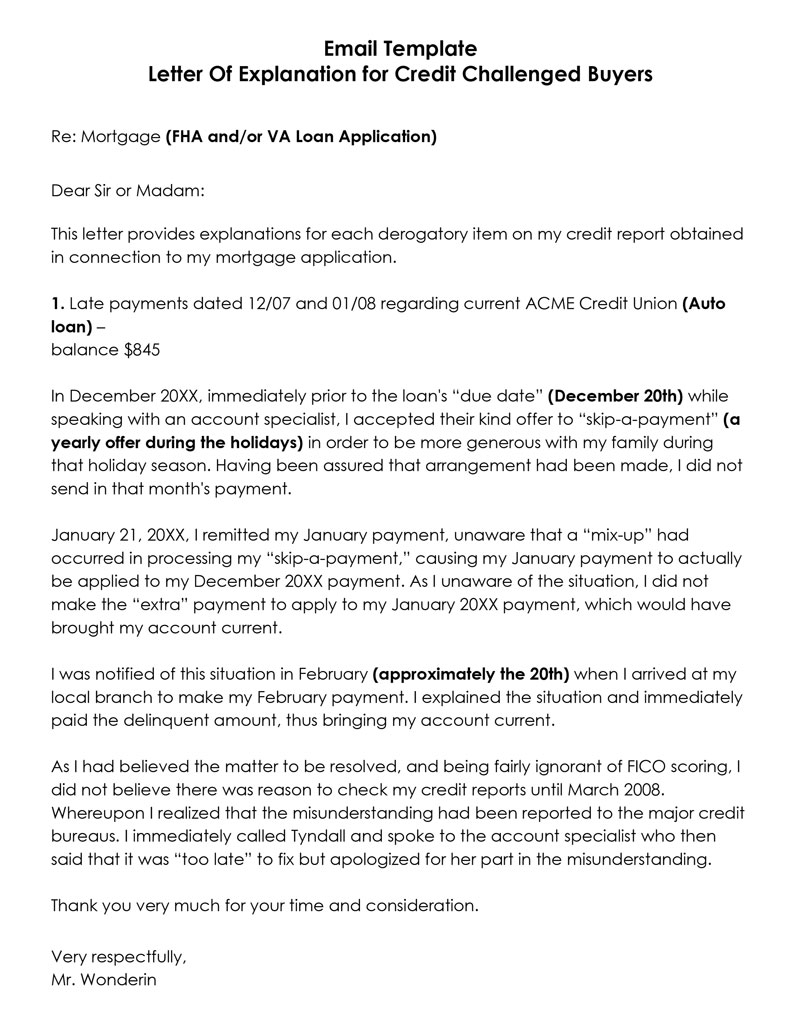

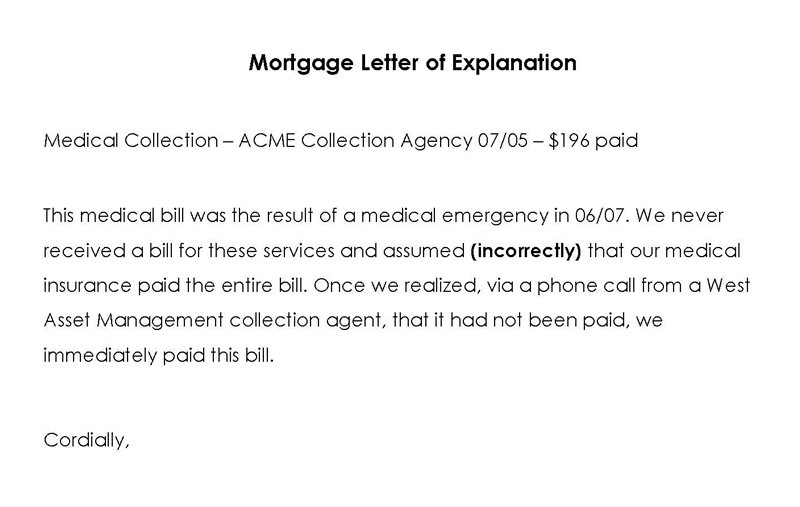

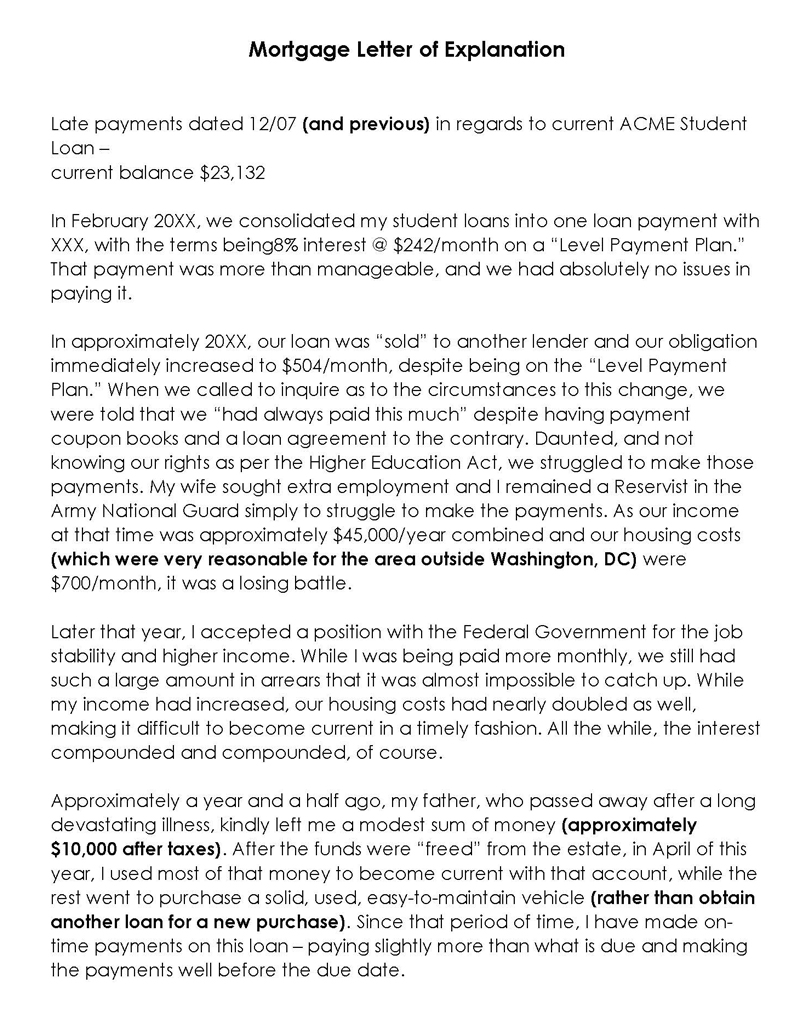

Sample Letter

Here is a sample that you can use as a guide for what should be included in your mortgage letter of explanation.

sample

Dear Mr Malcolm,

I am writing to explain two specific items that have appeared in the review of my credit history and bank statements as part of my application for a mortgage loan with your institution. These items are multiple inquiries on my credit report and several recent overdrafts in my bank account.

Firstly, regarding the inquiries on my credit report, these occurred between March and May of 2024. The reason for these inquiries was my proactive approach to seeking the best possible options for home financing. I applied for pre-approvals from various lenders to compare interest rates, repayment terms, and other mortgage features. It is important to note that these were not applications for new credit cards or loans but solely for the purpose of obtaining the best mortgage conditions. I believe in thorough research before making significant financial commitments, and this was part of my due diligence.

Secondly, I would like to address the overdrafts on my bank account, which were recorded in the last two months. These overdrafts were a result of an oversight in my financial management. I had set up automatic payments for utilities, a car loan, and insurance, all scheduled around the same time of the month. Unfortunately, I failed to account for a delay in my payroll deposit, which usually aligns with these payments. This mismatch in timing led to the account being overdrawn on two occasions. As soon as I was alerted by my bank, I immediately rectified the situation by depositing sufficient funds. I have since reviewed and adjusted my automatic payment schedule and increased the buffer in my checking account to prevent any future issues.

I understand the importance of a strong credit history and prudent financial management, especially in relation to a mortgage application. Please consider these incidents as isolated occurrences that are not reflective of my general financial behavior. I have taken steps to ensure they will not happen again.

Thank you for your attention to this matter and for your consideration of my mortgage application. I am very much looking forward to purchasing a home and am committed to maintaining a solid financial standing.

Sincerely,

John Smith

123 Fictional Lane

Imaginary City, State, Zip

Phone: (123) 456-7890

Email: your.email@example.com

Key Takeaways

This sample letter serves as an excellent guide for someone looking to write a similar letter addressing concerns in their credit history or financial background, particularly in the context of a mortgage application.

Here’s why:

- The letter begins by directly stating its purpose – to offer explanations for specific items in the credit history and bank statements. This clarity sets a focused tone for the rest of the letter.

- The writer provides detailed explanations for the two concerns (credit inquiries and overdrafts). This level of specificity and transparency helps build trust with the recipient.

- The letter is well-organized, addressing each concern in a separate paragraph. This structure makes it easy to follow and understand the explanations.

- For each issue, the writer not only explains what happened but also why it happened. For instance, the multiple credit inquiries were part of a thorough search for the best mortgage options. This rationale helps the reader understand that these were not random or irresponsible actions.

- The writer takes responsibility for the overdrafts and explains the steps taken to rectify and prevent future occurrences. This accountability is crucial in demonstrating a responsible attitude toward financial management.

- The letter maintains a respectful and professional tone throughout, which is essential in formal communications, especially with financial institutions.

- The letter concludes with a thank you note, a reiteration of the writer’s interest in purchasing a home, and a commitment to maintaining a solid financial standing. This positive, forward-looking statement helps end the letter on a constructive note.

Best Practices for Perfect Writing

While you are working on creating a mortgage letter of explanation, it is essential to follow some best practices. This will allow you to create an effective mortgage letter that states your case and helps you win approval for your mortgage loan. While there are no strict rules when writing a letter of explanation, it is always great to use these best practices in order to create effective and convincing documentation.

Here are four main tips that will help you craft your own letter:

Be honest

Always be honest and upfront in your letter of explanation. While you may have been trying to be discreet, your lender will notice the issue if something is wrong. Always state the truth and how the issue may affect your loan application. You should explain the situation upfront before they find out on their own. This will help them assess this information independently without outside influence or opinions clouding their judgment.

Be clear and concise

While you may wish to explain the situation in detail, try not to go into a lot of details. A lender may not be interested in the finer details; they only need to understand the situation and how it may affect your loan application. So make sure to catch their attention by focusing on what is relevant to the application.

Proofread

Proofreading is an essential step when writing any letter, especially a letter of explanation. Make sure to proofread your letter and go over it several times before sending it to your lender. The last thing you want is for your letter to be full of errors or typing mistakes as you may lose credibility.

Format the letter appropriately

Make sure to format your letter of explanation appropriately. While a letter may only be a few paragraphs long, it is essential that you pay attention to how it is presented. Use a suitable font and format the letter with appropriate spacing and borders so that it is easier to read. This will ensure that your lender doesn’t miss any details, as they can focus on your letter if it is easy to read. You can also use a pre-made template for a mortgage letter of explanation that is already appropriately formatted.

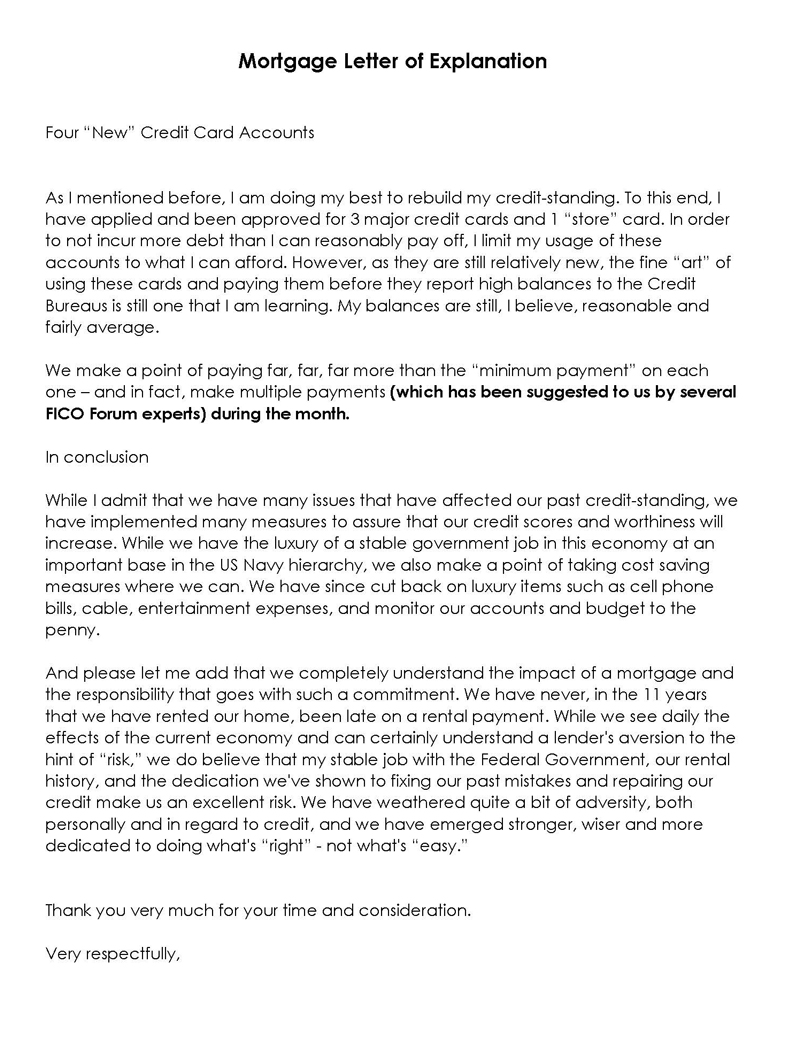

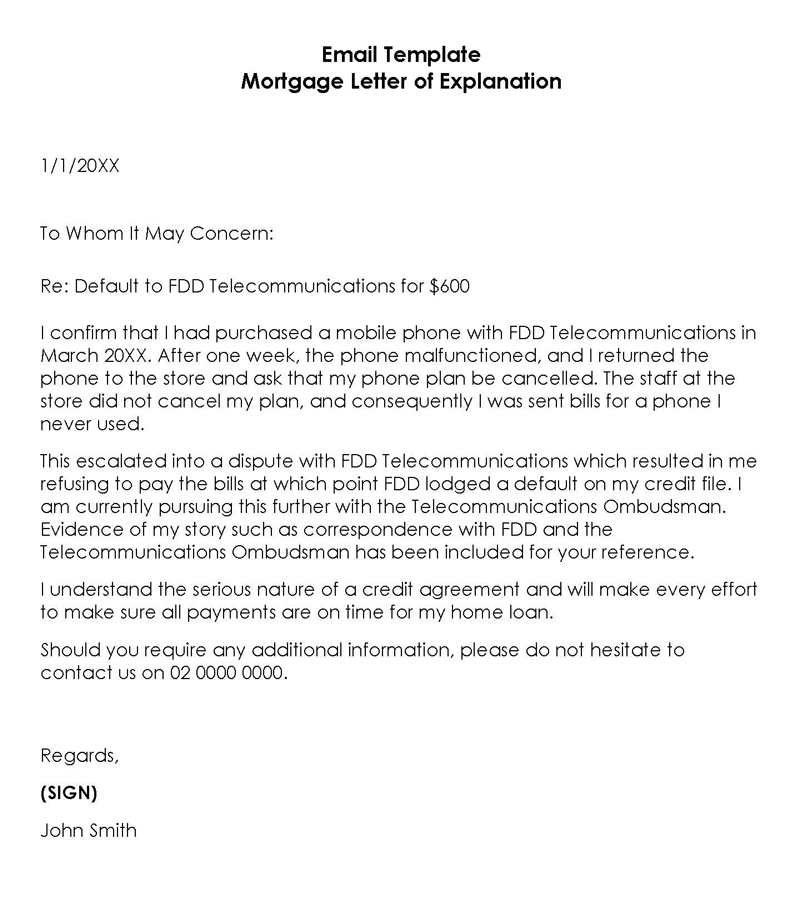

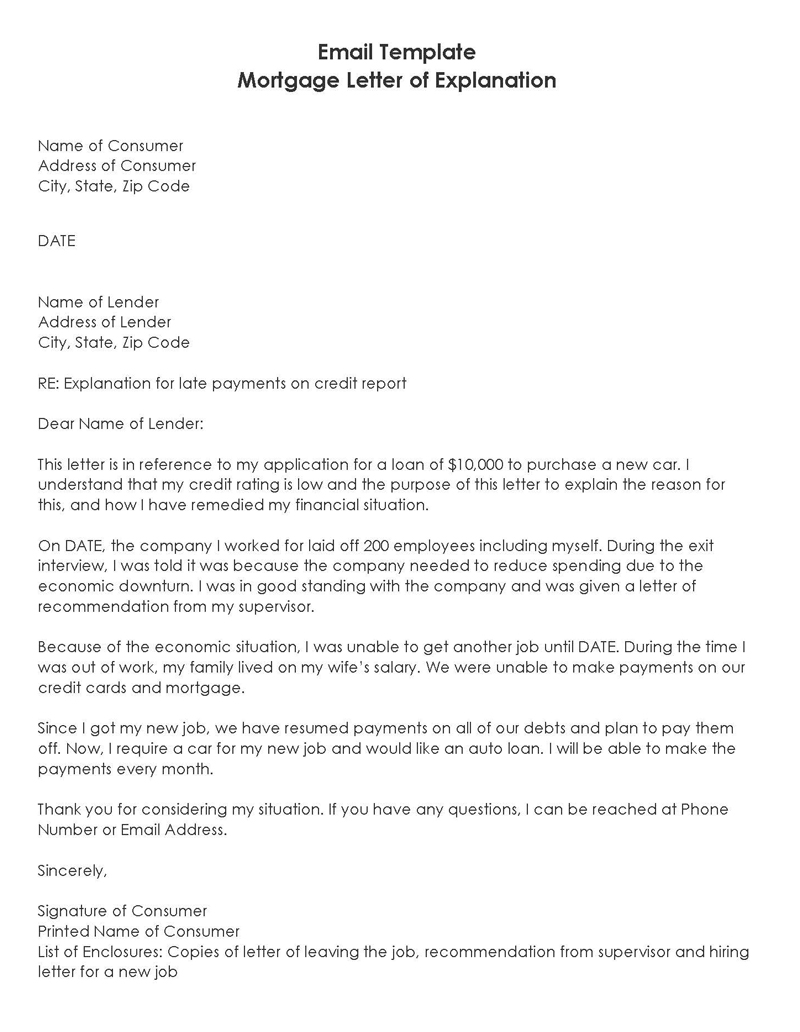

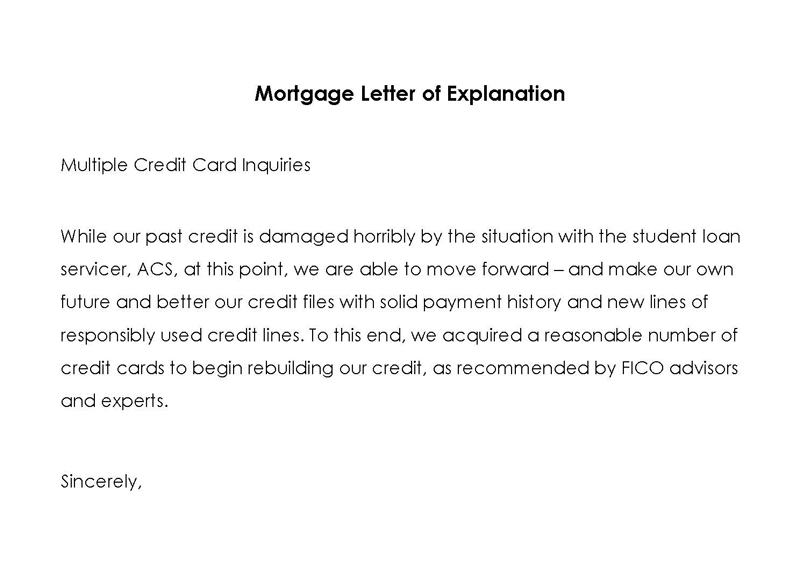

The following are some more free examples of the letter for you to download and use as per your requirements.

Frequently Asked Questions

If your letter is rejected, you can submit a revised or new letter. If the lender’s assessment shows they are not satisfied with your previous attempt, they will clarify this in their communication. This may include requesting that you make some changes or additions to your letter so that they can assess it independently without any outside interference. It is always best to follow their request and resubmit a new letter as soon as possible.

The letter should be no longer than a page; however, some lenders may accept more than one page as long as it is relevant. However, it is always best to keep it brief and to the point so that they can easily read through all the information in one sitting.

Before being approved for a mortgage loan, the lender will assess your credit history and financial situation. Any changes to your financial situation during this period may affect the lender’s decision to approve or deny your loan. It is best not to make any changes as it may increase the risk involved on their part and thus create a possible decline in your application. Keeping your finances stable and consistent when applying for a mortgage loan is always better.