If you have defaulted on your mortgage, the lender may place a lien on the home until you have paid the debt off. At this point, you would receive a Mortgage Lien Release form, also known as a Satisfaction of Mortgage.

Mortgage lien is a legal claim on your home as an asset, typically done when you are taking out a secured loan (mortgage).

It protects the lender should the borrower fail to make the payment, and gives them the legal right to liquidate the property in order to recoup the money they have lent the borrower.

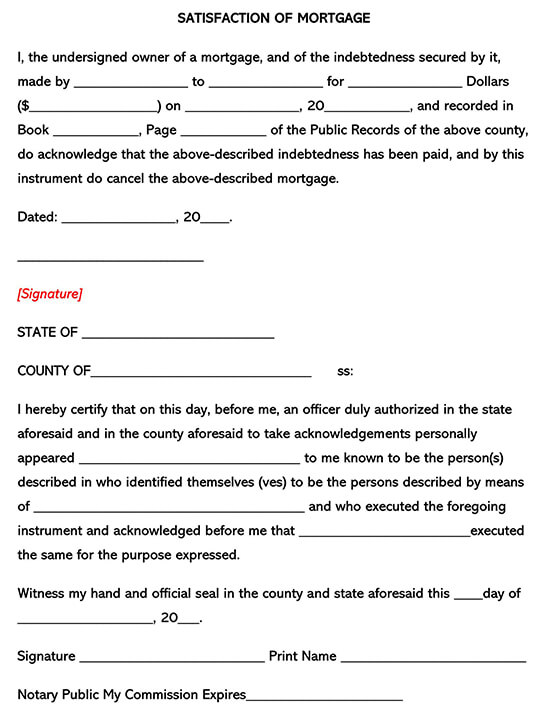

Free Template

What is a Mortgage Lien Release Form?

This is a document that the borrower gets from the mortgage lender. It acknowledges that the borrower has completed making payments on the mortgage and that the debt has been paid in full. This will then be filed with a county or land registry, giving the owner of the land a title that is clear and the line on the property will be removed. It must be recorded with the Recorder of Deeds or with the County Recorder.

You can download one of our free templates or samples to get a better understanding of what the form should look like in your state.

How to Create a Mortgage Lien Release Form

The form may differ from one state to the next; however, there are key things that need to be on it:

- Name of the payee

- Mortgage holder owner

- Amount of mortgage

- Mortgage’s date of execution

- Property’s full legal details, which should include the tax parcel number

- An acknowledgment that payments have been made in full

- An acknowledgment that the lender is released from filing a lien on the property

- The signature of all necessary parties and the date the document was signed

When the borrower has received the form, they must sign it and then send it to the County Recorder or Land Registry Office in order for the lien to be removed. The document may need to be notarized and signed by a witness.

The states that currently require both a notary public and a witness signature are:

- Arkansas

- Georgia

- Michigan

- Ohio

- South Carolina

- Vermont

Some counties in some states that are not on the above list may also require a deed to be witnessed, so it is best to check if this is needed with your county recorder.

When the Lender has Not Sent a Mortgage Lien Release

By law, the lender must issue the borrower with this Release once the debt has been satisfied. Without this paperwork, the lien cannot be released. It can generally take up to 3 weeks to receive the paperwork for a Mortgage Line Release. However, if you still haven’t received one, you may be able to release the line from your end. This will depend on if the state or county that you live in allows this.

You would need to bring documentation that shows evidence you have paid the debt in full:

- The Deed of Trust or Recorded Mortgage – can be obtained from a title attorney, title company, or your County Public Records office where the property in question is registered

- Recorded Assignments

- Recent title commitment, title search, or attorney’s title opinion

- Proof the mortgage has been paid in full – payment check copies, settlement statements, paid notes, etc.

NOTE

The state of California only allows the removal of a lien by the lien holder. Lenders must also send the release form within 30 days.

What Happens If a Mortgage Lien Release is Not Filed?

You will need to check what the statutory limit is for the lien release to be filed in your state. If a lender fails to sign the release, they are liable for any damage done and must pay the borrower any penalties.

If the borrower fails to submit the Lien Release, they may not be able to sell the property if proof that the debt was paid in full cannot be presented.

Frequently Asked Questions

You can obtain a replacement of the Mortgage Lien Release from the company that holds the lien.

Yes. While both documents are used for the same purpose, there are some states that prefer one of the other. A Deed of Reconveyance is used when transferring the property title back to the mortgagor (borrower). Its purpose is to acknowledge that all payments and contingencies have been met and are used when the borrower will be refinancing their mortgage.

A Notary Public is an official who has been appointed by the state to authenticate and authorize specific legal documentation, such as deeds, contracts, mortgages, acknowledgments, and declarations.

Yes. Having it notarized ensures the document was authenticated by a registered official appointed by the state.