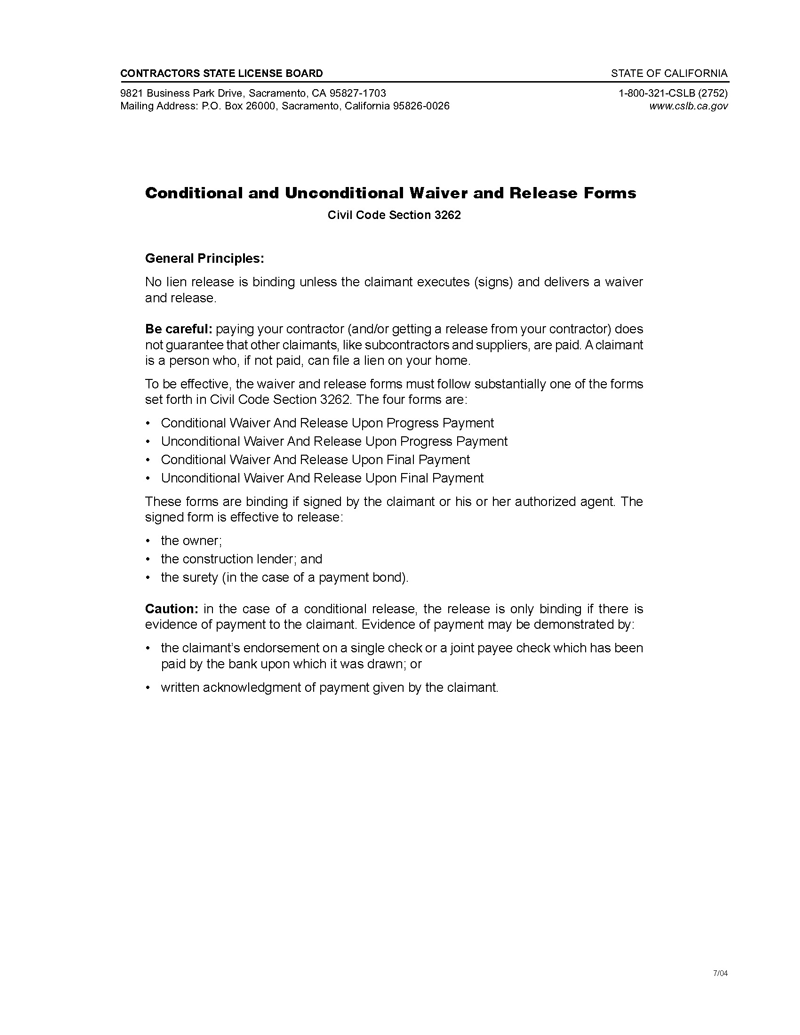

Lien release forms are generally used in construction projects to ensure contractors and suppliers receive payment for the work or service rendered. It is meant to be signed by the contractor or supplier, indicating that they have been paid in full for the work they completed. In some states, these forms are standardized, while in others, they are not. In states where lien release forms are not standardized, they generally come in two types: conditional and unconditional.

A mechanic’s lien is often used by skilled laborers who are looking to collect money owed to them. It could be labor service or material supply for a construction project where payment has been impossible to receive as promised. It offers the security of getting paid.

Filing a lien can be complex, so it is important to understand the attached conditions. This article will shed more light on the unconditional contractor’s (mechanic’s) lien release form.

Unconditional Mechanic’s Lien Release Form

When a claimant files a release form, they are stating that the claim settlement amount has not been fully paid (having received a progress payment) by the individual or financial institution to which the claimant is returning the property ownership.

It is important to note that a waiver and release do not release the debtor from their obligation to pay the final amount due. Instead, they protect the claimant if the debtor fails to do so.

An unconditional lien release means that the holder is releasing their rights regardless of whether they have been fully paid. On the other hand, a conditional lien release means that the holder is only releasing their rights if they have been paid. If the payment is not received as anticipated, the holder still has the right to file one or otherwise pursue payment. As the name suggests, it is only effective if the details on the form match reality. Other details, such as the payment date and the completed work description, must also be aligned.

Suppose a conditional waiver is brought up as a defense to a mechanic’s lien. In that case, the claimant will need to document where the form differed from reality, such as showing that a check bounced or that the check amount differed from what was written. Good documentation processes are critical in these situations. It is essential to look for exceptions associated with a conditional and unconditional waiver, review them, and ensure that they comply with all local and state regulations before signing.

When should I Use a Lien Release Form?

You may need it if you have provided goods or services in the construction project and have yet to have been paid. Although the conditions and rules on what constitutes appropriate work vary across states, the following professionals, artisans, and contractors qualify for a lien release when owed:

Materials and goods sourcing

This entails the provision of goods for the construction of a building or other structures, including sourcing materials such as plumbing supplies, electrical equipment, cement, aggregates, metals, bricks, roofing materials, and so on. In these cases, the lien release form helps to protect the rights of suppliers who have supplied goods or services to the project.

Labor services

As a mechanic, tiler, plumber, electrician, carpenter, or mechanical/HVAC contractor, filing one may be needed to get paid in full after completing your work.

Professional and designer expertise

Designer professionals such as architects, construction managers, or civil engineers may also be required to get paid for their proficient project planning, specialization, and expert service on a project.

Fabrication work and parts assembling services

Fabricators whose work is to assemble peculiar components and install special features later in the construction project may also need to file one to protect themselves and ensure that they secure payment for the work performed.

As much as they have provided goods or offered services in a construction or property project but are yet to get paid, this form solves their problem. It doesn’t matter if the contractor’s agreement is not directly with the owner of the property. For example, a tiler or flooring installer may have a direct agreement with a home remodeling company or general contractor but still file a lien directly with the homeowner or property owner.

How does It Work?

Construction projects can be complex endeavors involving many contractors and subcontractors. To help ensure that everyone is paid for their work, mechanic’s liens are often filed. Sometimes, the property owner may require all contractors and subcontractors to sign an unconditional mechanic’s lien release before beginning work. Depending on the contract’s requirements, a subcontractor may request another subcontractor or material supplier to sign it if they have received payment.

It is not uncommon for progress payments to be made during the course of a project. In some cases, these progress payments may be made before the final payment is due. In such instances, it can be used. This waiver ensures that the claimant has received payment in full and releases them from any future claims or liens on the property in question.

It is important to note that exceptions may apply in certain cases, so it is always best to review the details of the waiver and release prior to signing. Once all parties have signed the unconditional mechanic’s lien release, it is then enforceable by law. Keep in mind that state regulations do vary, so it is important to ensure that the waiver and release are compliant with local state laws.

Lien Release Vs. Lien Waiver

While the two forms may seem similar, they serve different purposes and should not be confused. A lien release is a form that a property owner provides to a contractor after payment, which indicates that the work has been completed, the payment has been satisfied, and the contractor’s right to a lien on the property has been removed.

On the other hand, a waiver is a document to be signed by a contractor before work begins, forfeiting their right to file one. Both release and waiver have unique functions, and it is vital to understand the difference between them before signing any documents.

Lien releases are typically used when an owner wants to ensure that they will not be responsible for any liens that may be filed against their property due to work that has been completed. On the other hand, waivers are often used by contractors or trade contractors who want to avoid having to file one.

While lien releases provide more protection for owners, they also require that payments be made entirely and on time to be effective. On the other hand, waivers may be signed before any work has begun, making them more convenient for both parties involved. Ultimately, it is up to the parties involved to decide which type of document will protect their interests.

Precautions to Observe

Considering that the unconditional mechanic’s lien release involves contractors, subcontractors, and material suppliers giving up all their rights on the project, getting it wrong is accompanied by severe consequences.

However, there are a few things to keep in mind before signing such a delicate document:

- It is important to consult with legal counsel to ensure that the document is accurate, legally binding, and complies with local and state laws.

- The contractor, subcontractor, or material supplier must confirm that their financial institution has entirely cleared the funds. The check must be completely funded before signing and authenticating a waiver, as it could be returned due to insufficient funds or other vices, leaving them (contractor, subcontractor, and material supplier) with no payment and rights.

- As a general rule, the date on an unconditional mechanic’s lien release should correspond to the time during which the work was performed. In other words, if the waiver is being used to release the payment for work completed on December 1, the date on the waiver should be December 1 (or earlier). This helps to ensure that the payment dates listed in the waiver are accurate and that there is no confusion about when the work was performed.

- It should be confirmed that the payment is complete and matches the amount stated for the progress payment.

- In a situation where the direct contractor resides in a different state from where the work is being executed, it is essential to note that it must still comply with the local laws of the job site’s state. Failure to do so could result in serious legal consequences.

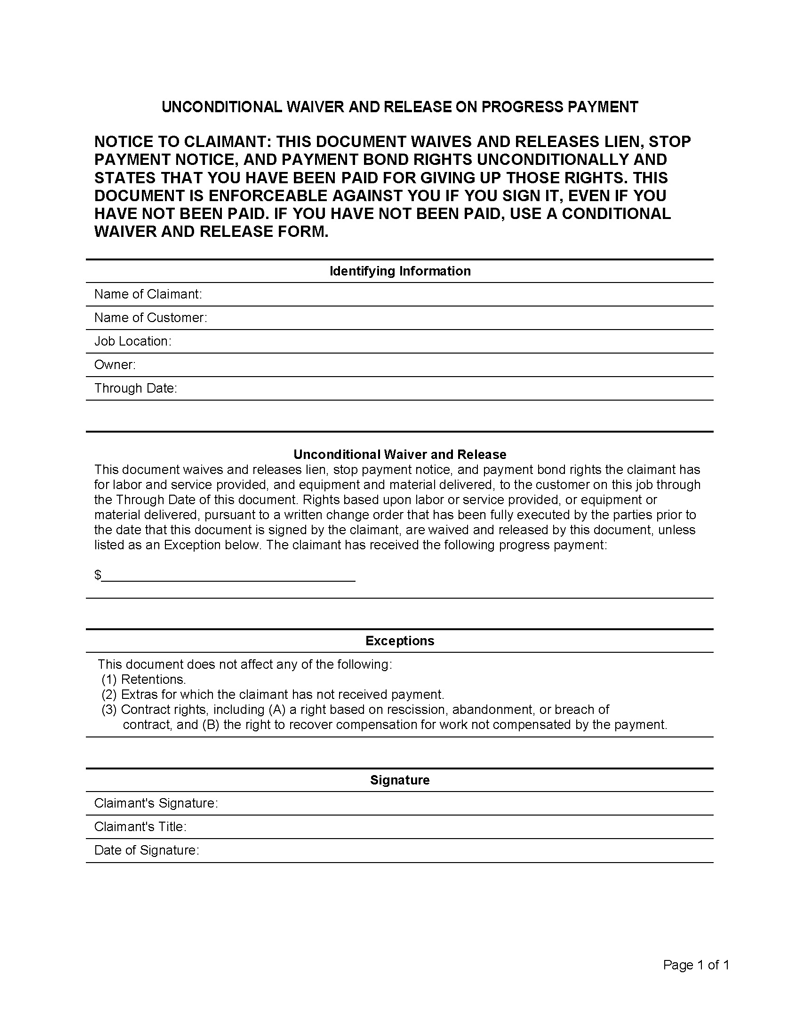

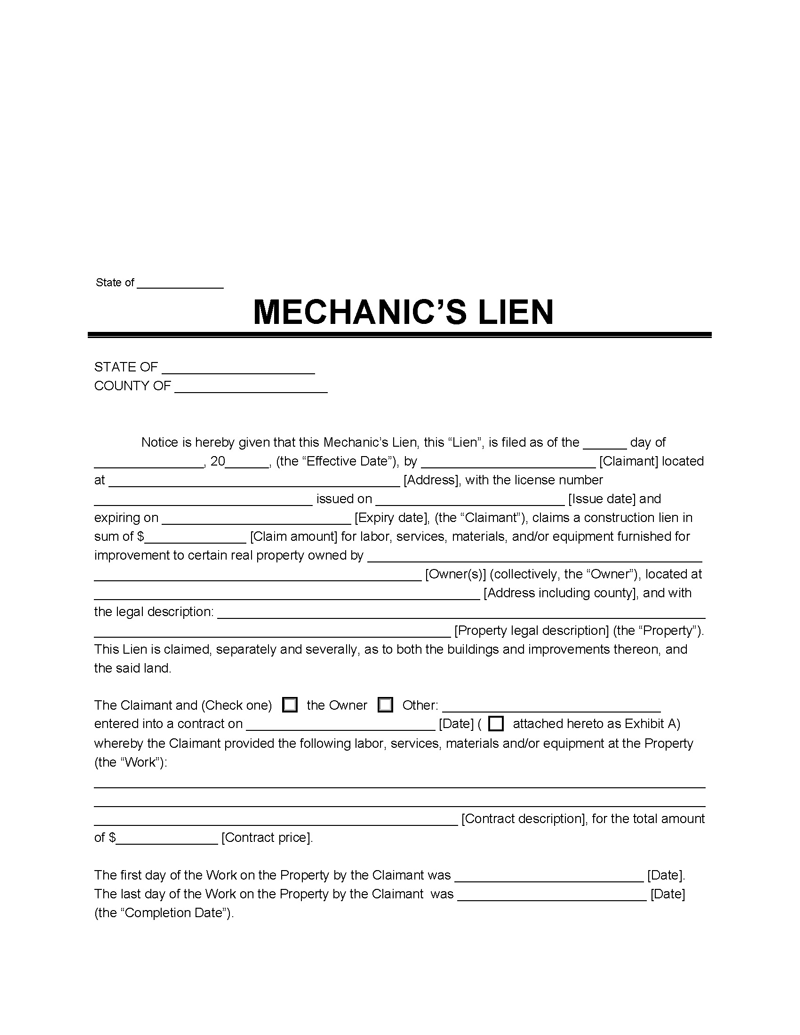

Information to Include in the Release Form

There are mandatory pieces of information that must be included in the form. Each of them is explained below:

Notice to the property owner

The release form must include notice to the property owner that a lien has been placed on their property. This notice can be in the form of a statement included in the form itself or in a separate letter attached to it. It must include comprehensive details such as the goods supplied, service rendered, and/or labor performed, as well as the date the work began and was concluded.

Notice about the beginning of work

The form should also include a notice that the work has begun and that the contractor may file a lien if payment is not received, serving as a record of the contractor’s claim to payment.

Notice that the beginning of the work has different names in different states. It can be called an affidavit of commencement, a notice of project commencement, or Notice of Commencement. It contains information about the beginning process of a project and must be sent instantly as soon as the work starts; the actual project start date should be included.

States such as South Carolina, Texas, and South Dakota see the notice about the beginning of work as an optional protection measure, while states such as Georgia, Ohio, Florida, and Iowa require notice about the beginning of work.

Public notice of intention to file

This notice should state the contractor’s intention to file, and it must be done within a specific time frame depending on the state requirement (all states require public notice of intention to file) after either of these events: work has been wholly concluded or materials have been successfully supplied.

This notice is to be made prior to the main filing. It should include the amount due to be paid to the claimant (contractor) and the claimant’s identity. The state will be the one to dictate the acceptable form of delivery for a notice of intention to file.

Notice of claim

The notice of the claim provides all the necessary details about what is being released and why it needs to be done. The notice of the claim must include the claimant’s name and address, the name of the property owner who contracted with the claimant, the date of the contract, a description of the work performed, and the amount owed. Aside from the fact that the homeowner must get a notice that a lien has been filed, there are certain states where contractors that are at the top level within the chain of contractors involved in the project may also get a notice of claim.

There are also state laws (for example, the Illinois Mechanics Lien Act) that mandate that the notice be provided to other lien holders. A notice of claim can either be sent by mail or served by the sheriff, depending on the jurisdiction of the construction project.

Filing suit

Once the notice of claim is given, the claimant may file a lawsuit to foreclose on the property. To avoid foreclosure, the property owner may pay the amount owed immediately or give it to the claimant. In addition, the form should state that the person or company agrees to release the lien on your property. By including all the information mentioned above, the contractor can protect themselves from future legal action and ensure that they are paid for their work.

There are certain states where the action has to be served by the owner. It must include the property owner’s information about their rights under the Residence Lien Restriction and Lien Recovery Fund Act. In addition, it must also include an affidavit that details the homeowner’s rights and how the homeowner can go about exercising their rights under the said act.

Tip

It is essential to read the forms closely before signing, to avoid giving away rights that a contractor does not intend to. For example, the form should only waive and release the right to file it. There are instances when the forms may contain language that implies that the contractor is forgoing the right to file any claim that may concern the work. Such languages should be carefully looked out for. A proper unconditional lien release and waiver form should be clear that it waives and releases only lien and payment claims. It is best to review the form with a lawyer before signing it to avoid misunderstandings.

Consequences of Not Having a Mechanic’s Liens

Some consequences are attached to not having a mechanic’s lien as a contractor, professional, or skilled laborer in the construction business. A contractor risks not being paid for work performed or services provided. In addition, the property owner may be able to sell or refinance the property without paying off the outstanding debt, leaving the contractor unpaid. To protect their interests, contractors should always consider securing one when performing work on a property.

It is one standard legal procedure that gives the contractor interest in the property and allows the contractor to foreclose on the property if payment is not made. Without one, the contractor would have no security interest in the property and no recourse if the property owner failed to pay for the work. A mechanic’s lien should be free of error. If a contractor does not perfect it, it may be invalid, and the property may fail. As a result, contractors must understand the requirements for perfecting it in their state and take appropriate steps to get their lien right.

Frequently Asked Question

Compulsorily, the release form should be signed by both parties involved in the construction project, the contractor or supplier, and the property owner before any work can begin.