A promissory note release form is a legally binding document that the lender typically writes, signs, and gives to the borrower to free them from all obligations under a promissory note.

The document is typically signed after the debt has been settled in full and all conditions outlined in the original note have been met. A promissory note is a contract outlining the terms of a debt owed between a creditor (lender) and a debtor (borrower). The contract is then signed by both parties.

It includes a document outlining the precise terms and conditions of the arrangement between the lender and the borrower, including the interest rates, repayment schedules, criteria for determining damages, and methods for repaying the debt. If a loan obligation is satisfied along with all of the contractual requirements, or if the lender forgives the debt, a release of promissory note should be issued.

The agreement between the lender and the borrower has been completed, according to the document. It also exempts the parties to the promissory note from their legal obligations and protects them from any legal ramifications that may arise in the future.A promissory note release form can be referred to by various names depending on the context in which it is used.

The alternative names include:

- A release of debt form

- Promissory note payoff letter

- A loan satisfaction letter

- Debt relief form

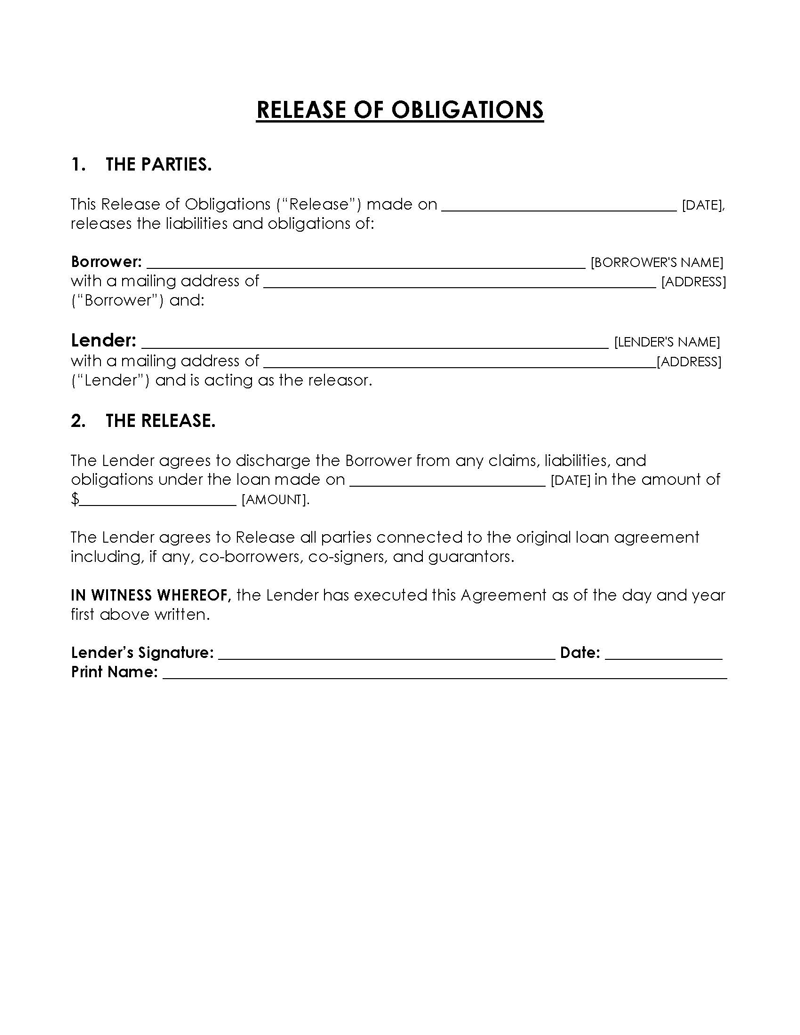

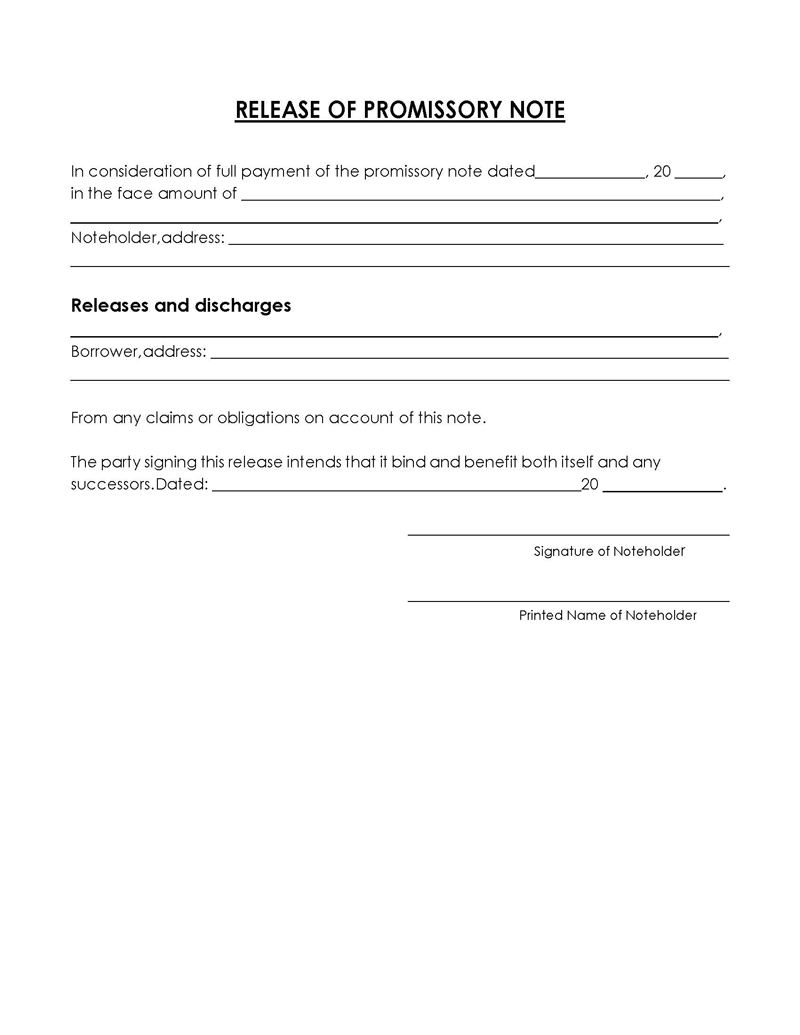

Free Forms/Templates

When to Use a Promissory Note Release Form

The form is typically issued after a borrower has fulfilled their original debt obligation. This usually means repaying the entire amount owed to the lender, including the principal plus interest and any applicable late fees or penalties (if any). The release of debt form is signed by the lender and given to the borrower as proof that the transaction has been completed. The original note must then have the release form attached for the borrower’s records.

It may also be sent when a creditor forgives a borrower’s outstanding debt or forgives and cancels an existing obligation under certain conditions. In this case, the form releases the borrower from all obligations under the loan contract and protects them against any legal actions if they arise.

The release of a debt relief form before it is fully paid off is also known as a “cancellation and release of the promissory note” and is done for various reasons. These include situations in which the lender no longer wishes to take legal action against the borrower in the event of a default or when the borrower is unable to repay the loan. The IRS-Internal Revenue Service may consider such an action to be taxable income for the borrower. The total amount of debt forgiven may also be considered a gift and subject to the gift tax.

It is important to note that a borrower’s death does not automatically result in the release of the debt. This is entirely subject to the terms of the original promissory note and any other provisions that may have been discussed and settled upon by the lender and the borrower during the course of the contracting process. The debt becomes an asset of the borrower’s estate if the original note does not specify that the debt is canceled upon the borrower’s death.

The Process

The form is a legal document that must be written carefully. It must include all pertinent details, such as the date it was issued and language that declares any obligations under the original promissory note to be void.

You can write a successful promissory note release using the steps listed below as a guide:

Step 1: Check all legal terms

Before you write and sign the release form, make sure you understand all of the legal terms of the original promissory note. Ensure that the borrower has fully met all pending debt obligations and that any legal terms related to the money owed, such as interest rates, late fees, penalties, and deadlines, have been followed accordingly.

This step ensures that you are protecting your interests because signing the release of debt form legally relinquishes the borrower’s liabilities and obligations and renders the original promissory note null and void.

Step 2: Address any liens

An effective release form must identify any legal issues that may arise from the original promissory note. If, for example, the borrower’s property was used to secure the promissory note, any liens and encumbrances on the property must be addressed in detail in the form of a lien discharge. Your release of debt form should clearly state that the borrower is no longer obligated under the lien. An acknowledgment that any mortgages on the property are now void should be signed if the promissory note was secured by a real estate mortgage.

If there is a deed of trust, a deed transferring the property to the borrower must be attached. If a creditor decides to file a UCC (Uniform Commercial Code), which indicates the existence of a security interest and is filed at the secretary of state’s office, an acknowledgment should be included stating that the lien is canceled and any active UCC on the property is released.

Step 3: Fill in the template

The third step in creating and using the release form is to draft the note itself. You can prepare one yourself, hire an attorney to prepare it on your behalf or use pre-designed forms or templates that are usually available online. If this is your first time creating a promissory note payoff letter, it is recommended that you use a pre-made template to ensure that your document is accurate and well-articulated.

Consider using online, downloadable templates to save money, time, and effort when creating a promissory note release. The templates are editable, and they have fields where the necessary information must be entered. Each field has clear instructions on how to fill it out. When the template has been customized to meet your specific requirements, make sure it is fully filled out, save your changes, and print it out to use.

Step 4: Notarize it

Generally, the form does not need to be notarized. Although it may not be a legal mandate to notarize the form in your state, this step is crucial to avoid any future litigation relating to the validity of the release of the debt. However, you can sign the note without the presence of a witness or notary public. If you choose to do so, consider deleting any mention of a notary or witness from your final form.

Step 5: Send and save the form

The last step in creating the form involves issuing the form to the borrower and any interested parties. When sending the form to the borrower, consider using registered mail to ensure there is a record of your action.However, before sending it off, review the form to be certain that all steps, conditions, and procedures prescribed in the document are complete, then attach the final form to the original promissory note and keep a record of the same for reference purposes.

It is essential to have a record of these signed documents because they will be referred to later on when there is a random tax audit or when a borrower is asked to prove that their old debts have been fully settled by other potential lenders. Likewise, in the event of a clerical error at the Credit Bureau, the documented, signed form may be used as proof that the debt was indeed paid off.

What to Include in Promissory Note Release Form

All pertinent details regarding the original promissory note and the debt release must be included in an effective form. The document must also be clearly written in simple language that can be understood by everyone involved. Additionally, the recordation language should state that the borrower’s obligations under the original loan contract are discharged.

The following essential details must be incorporated in any promissory note release form:

Names of the borrower and lender

The form should contain the identifying information of the involved parties. This includes the borrower’s full name and the lender’s full legal name, as well as their corresponding addresses. The names provided in the initial promissory note should match those on the release form.

note

If a single noteholder signed the original promissory, the release form should not contain any language suggesting a second noteholder, such as “we.” To prevent misunderstandings, make sure the release form is filled out accurately and avoid including any statements that need to be retracted.

Dates of both the release and the initial promissory note

The dates on which the release was issued and when the parties involved signed the original note must be included in the loan satisfaction letter. Accurately dating the form ensures there is no confusion regarding when the release is executed and its related documentation.

Reference to the original note

Any release form should clearly state the name of the initial contract to which it is related and include any relevant unique numbers. The document must also state the purpose of the loan as well as any other terms or conditions outlined in the original promissory note. A release of the debt obligations specified in the original note should also be explicitly stated in the release document. Lastly, for compliance and documentation needs, duplicates of the original signed note should be included with the release form.

The total amount of debt settled

The form should clearly state the total amount that has been paid under the original loan contract. The statement should show the amount of principal paid off, any fees paid to settle the debt, such as late fees or penalties, as well as the interest paid.

Signatures of both the lender and the borrower

The form should then be signed by both the lender and the borrower to show that all requirements have been met and the deal is final. However, it is not legally necessary for the borrower to sign the form.

note

A secured promissory note is a formal agreement associated with tangible collateral in the form of real estate property, stock, equipment, or any other personal property. The collateral ensures that the borrower fulfills all their loan obligations and liabilities. Regardless of whether a promissory note is secured or unsecured, releasing a borrower’s loan obligation is typically the same. However, there are some extra steps that need to be taken in the case of a secured promissory note in order to release the collateral. For example, if the borrower’s real estate property was used to secure the promissory note, the lender must also execute a discharge of security or release of lien. A release of the mortgage must also be completed if the real estate has a mortgage.

Frequently Asked Questions

The form is an official and legal document. In essence, once the lender signs it, it becomes binding, and it automatically nullifies and voids the terms of the original promissory note agreement.

A promissory note is generally very similar to a loan. Both are legally binding contracts between a lender and a borrower in which the borrower agrees to repay the loan in full within a specified timeframe. They are different, though, in that a promissory note is frequently less precise and rigid than a loan contract.