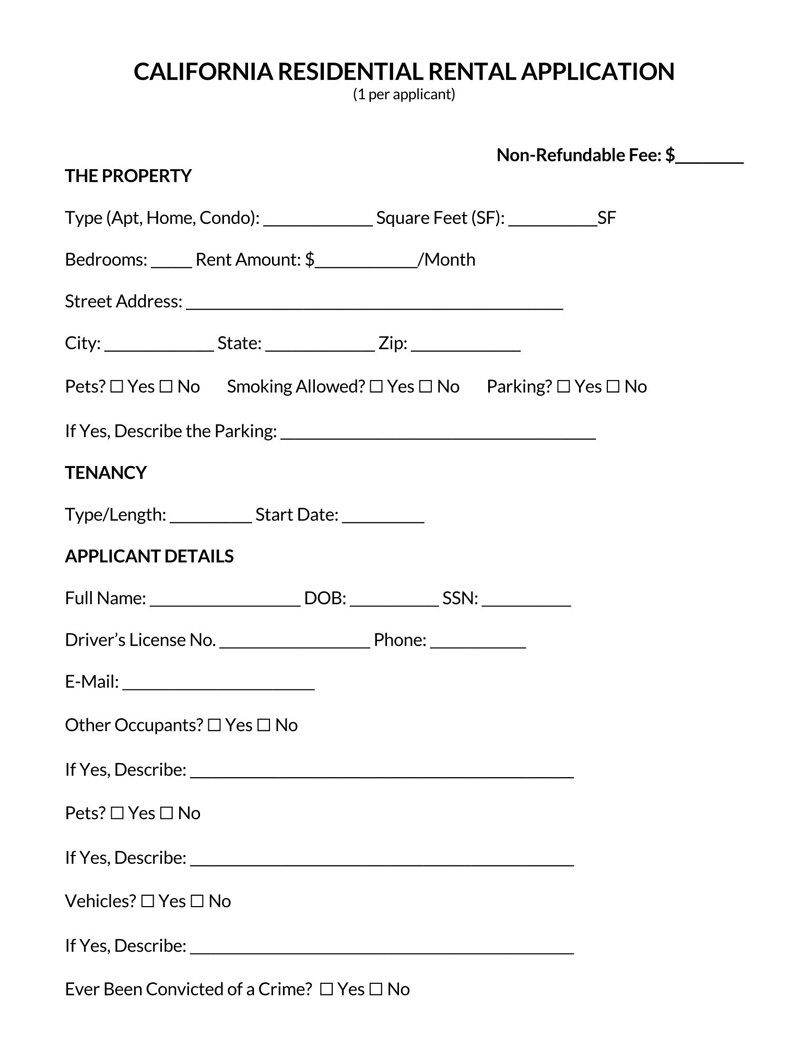

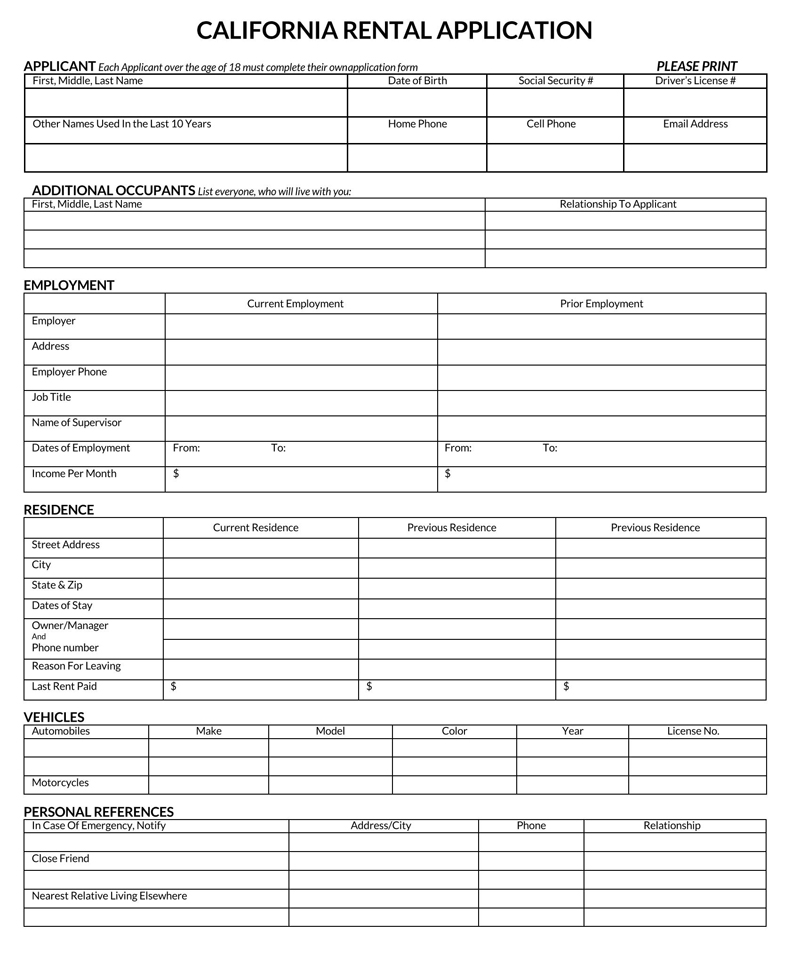

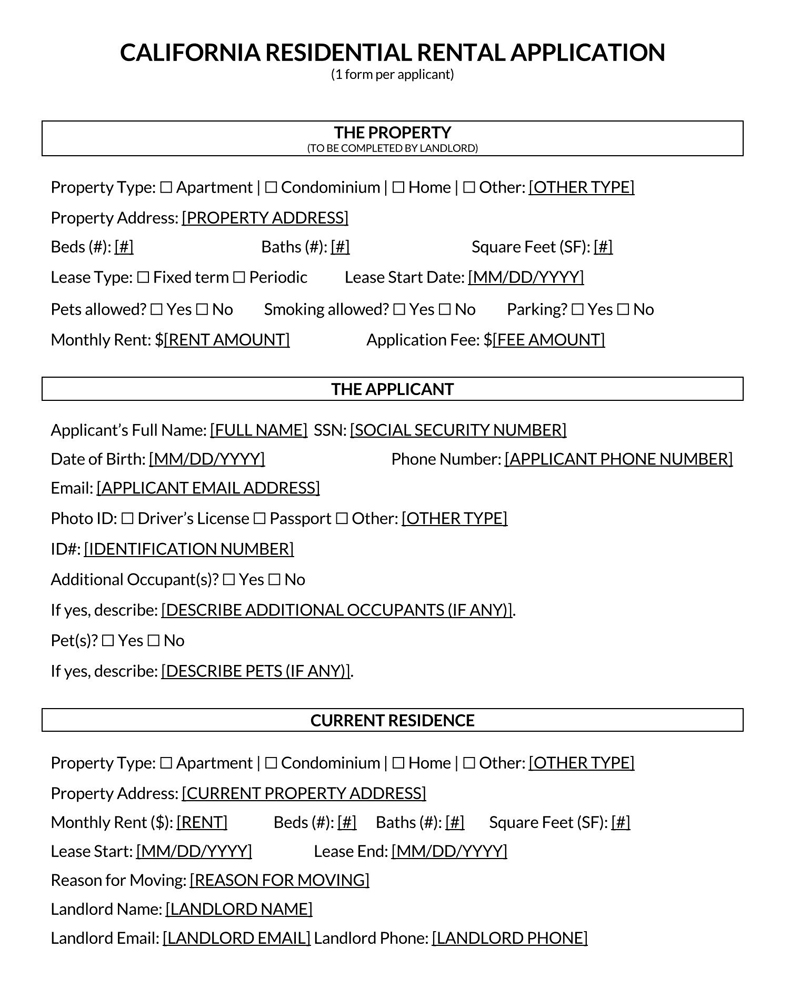

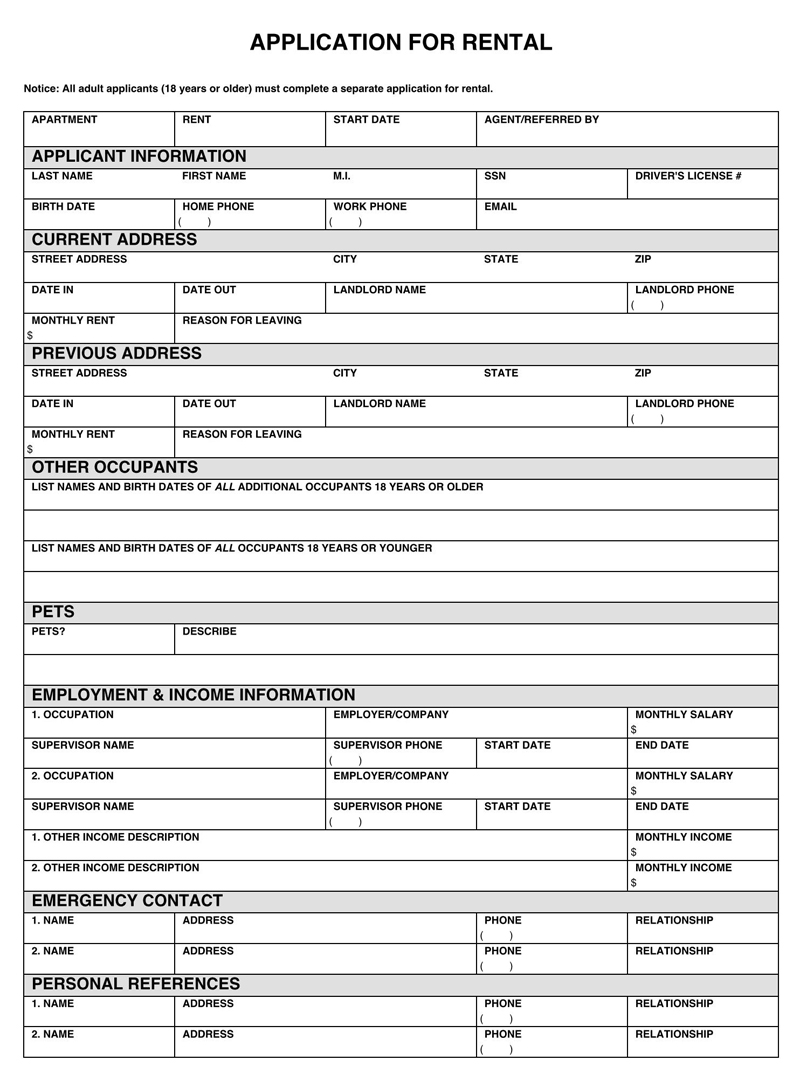

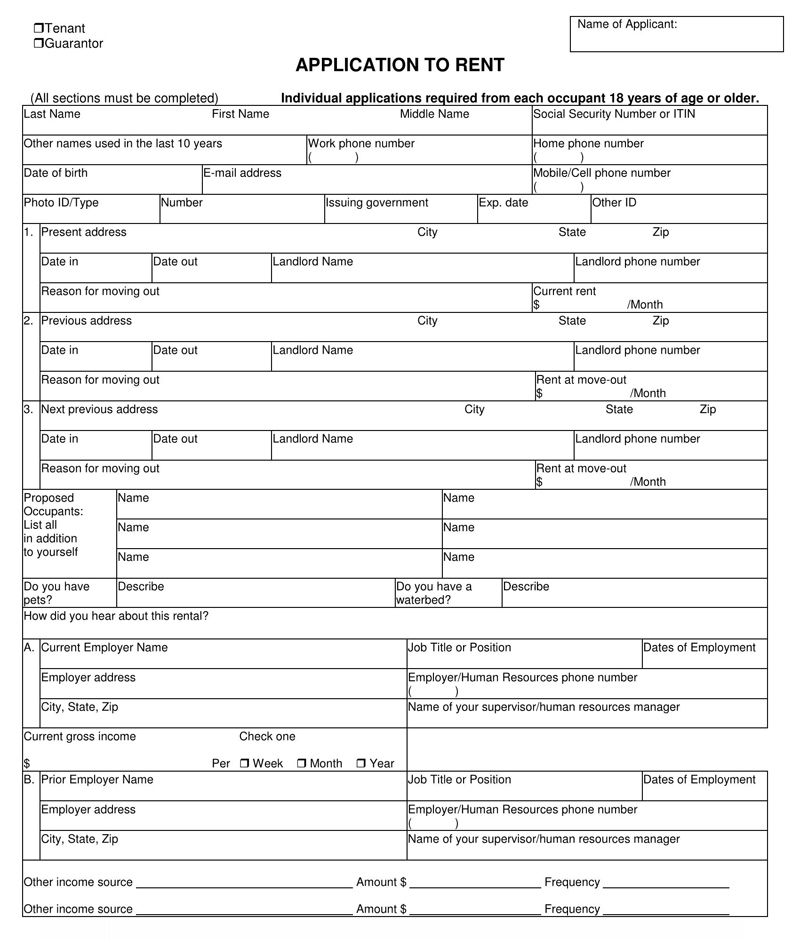

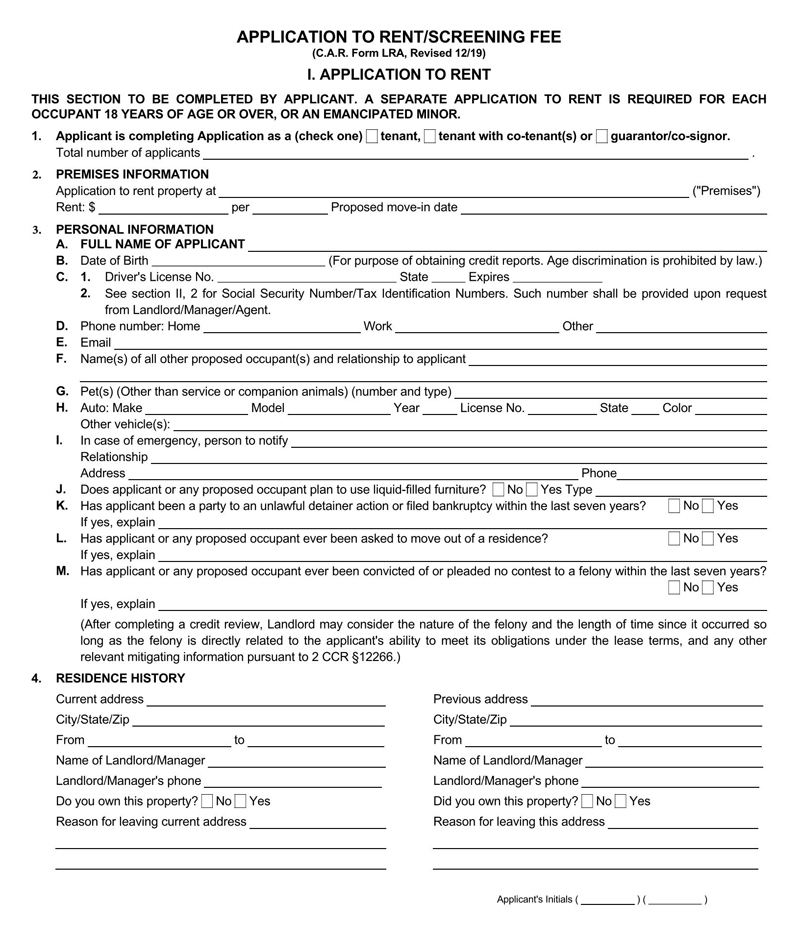

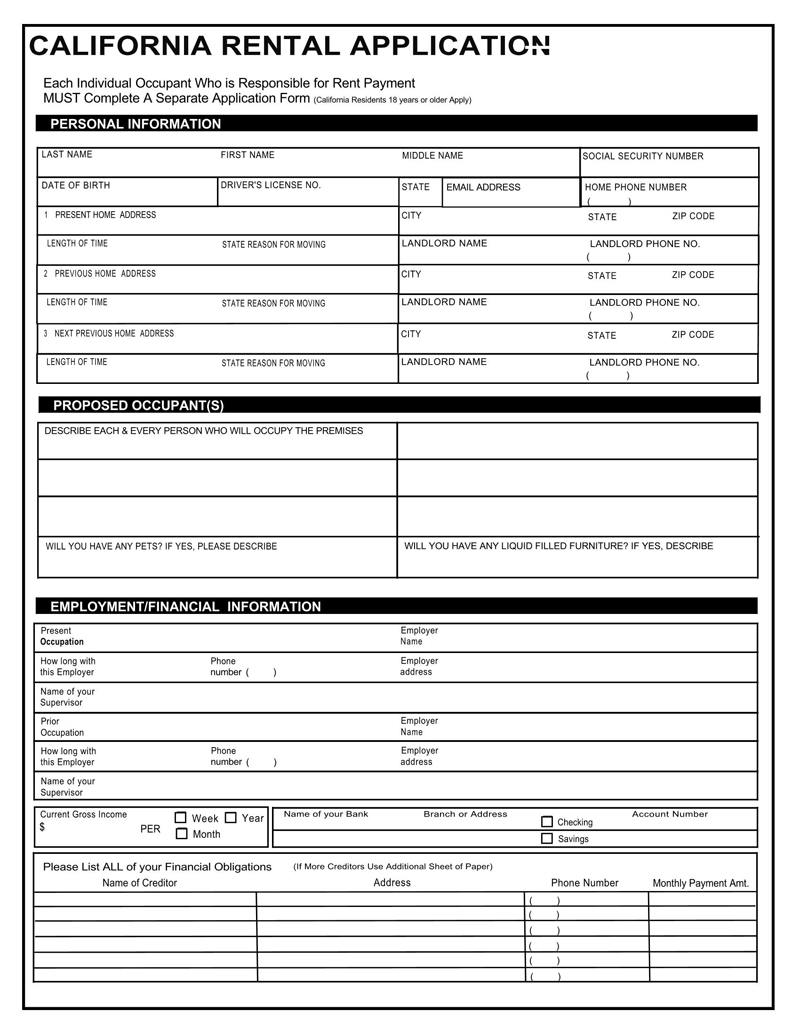

California rental/lease application form is a document that property managers and landlords use to screen prospective tenants.

The form allows property managers and landlords to collect detailed information from a potential renter, enabling them to determine whether the renter will be a safe and responsible tenant before offering them a lease agreement.

In addition, by completing the rental application form for California, the applicant (potential renter) authorizes the residential property owner to do a background check on them. Along with the form, property owners may charge applicants a non-refundable rental application fee to cover the background and credit history check costs.

A rental application form may also be referred to as a lease application, a rental lease application, a residential lease/residential rental application, a tenant application, or an application for a rental property.

Free Forms

Criterion of Screening Tenants

It is essential to make the right tenant decision before signing a rental agreement as a property owner. Whereas it is not always easy to identify a responsible tenant from a lousy one, landlords must give it their best from the beginning to help avoid future lease non-compliance concerns such as non-payment of rent, property damage, or eviction.

Qualifying a new applicant means putting them through a standard tenant screening. During the screening process, landlords must follow thorough and consistent tenant screening criteria that do not discriminate against a class of persons. This ensures that they follow best practices and any applicable laws they are subject to, such as the Fair Housing Act and local housing laws.

The following is the criterion for screening prospective tenants by landlords

- Inquire about the applicant’s credit history

- Check whether the prospective tenant has any criminal offenses on their record

- Conduct a past rental and eviction history to ascertain whether the applicant has a positive rental history

- Current and past employer contact information

- Sex offender status

- Verify the prospective tenant’s employment and income for assurance that they have the means to pay rent.

State Laws in California

California has explicit state laws that regulate the rental application form process. These laws give renters more control over their background and credit report history and protect them from paying too much when applying for a rental unit. In addition, federal tenant screening laws also apply. The following are the state laws that affect the rental application form process in California:

Application fee

California state laws set a maximum rental application fee based on the consumer price index and adjust inflation. Therefore, the point of charging the non-refundable rental application fee is not to make profits but to cover the costs associated with screening the applicant.

When California Civil Code §1950.6 was passed in 1997, the cap on rental application fees was set at $30. However, the limit is not fixed, and property owners or agents may legally increase the amount annually based on the consumer price index. As of the year 2018, the application fee cap had risen to $50.94.

Important considerations

- An application screening fee must not exceed the prospective landlord’s actual out-of-pocket costs of running a background check on the applicant, including, but not limited to the cost of using a consumer credit reporting service and the value of time spent by the landlord or agent in screening the applicant.

- Landlords must provide each applicant with a written receipt upon payment of the application screening fee. The receipt must itemize all costs associated with obtaining the information.

- If the landlord does not run a background check or credit check on the applicant, they must return any amount of the screening fee that is not used for the intended purpose to the applicant.

- Suppose the property owner or their agent knows that no rental units are currently available within a reasonable period. In that case, they are legally prohibited from charging an applicant an application fee. However, this may be allowed if the applicant agrees to be put on a waiting list in writing.

- If the applicant pays an application fee, they have a right to receive a copy of the credit report used to decide tenancy.

Security deposit

Per the California tenancy laws, (Cal. Civ. Code § 1950.5), a security deposit means any payment, deposit, fee, or charge that is imposed at the beginning of the rental agreement that can be used to reimburse the landlord for costs associated with processing a new tenant or that is imposed as an advance payment of rent. The security deposit may come in handy in the future for purposes such as compensation of the landlord for a tenant’s default in rent payment, to repair any damages caused to the rental unit (exclusive of ordinary wear and tear), to cater for cleaning of the residential property upon termination of the rental/lease agreement and to remedy future defaults by the tenant in any obligation under the rental agreement.

Standard limit/maximum amount

California state laws allow landlords and property managers to charge a security deposit of no more than two months’ rent for unfurnished rentals. If the residential unit is furnished, the security deposit can be increased to three months’ rent. Given that the prospective tenant is an active service member, the landlord should charge them a security deposit no greater than one month’s rent for an unfurnished apartment and two months’ rent for a furnished rental unit. If the tenant intends to have a waterbed in the residential building, the landlord may add one and half months’ rent on the security deposit.

Requirements of receipt

The California tenancy law does not require property owners to issue written security deposit receipts to a tenant after receiving payment for the security deposit. However, having written proof is essential to both the landlord and the tenant.

The security deposit receipt is usually issued along with the security deposit lease agreement, which details the terms of the lease and the policies and procedures for the security deposit. Both these documents serve as proof of the existence of the security deposit and the amount paid. In addition, a standard security deposit receipt includes the following essential information:

- The date the receipt is written

- The tenant’s name

- The name and location of the financial institution where the security deposit is being held

- Account number and account type if applicable

- Amount deposited

- Date the security deposit was made

- Lease terms relating to the holding deposit

- The depositor’s name, signature and date of signing the receipt

Financial holdings

The property owner holds any security deposit made by a tenant in California during the tenancy period. The property owner is not legally required to place the security deposit in a separate bank account, and the deposit is not required to earn interest.

Note: California lease agreements should never characterize the security deposit is non-refundable. The deposit is usually refundable upon termination of the lease agreement, less any authorized deductions. Once the tenancy agreement has been terminated, the landlord should return the security deposit within 21 calendar days along with an itemized notice indicating the total deposit received, the deductions made (including the amount of reasonable faith estimate of the charges that will be incurred to repair damages if they are not completed within the 21 days), and the amount of security deposit being returned.

Federal Laws in California

Property owners or property managers in California should make it a point to understand the Fair Housing laws in the state and what they can say and do when selecting tenants for their rental units. This includes how they advertise a rental, the screening questions they can ask on a rental application or during interviews, the screening fee they can charge tenants, and generally how to deal with tenants who rent their property. The bottom line is that California landlords must abide by the federal, state, and local fair housing laws when selecting qualifying tenants from non-qualifying ones, failure to which they may be subjected to costly discrimination complaints and lawsuits.

The following is a detailed note on Federal housing laws in California:

Housing discrimination

All states are required to conform with the Federal Fair Housing Act. In addition, the state of California has extended housing discrimination laws to cover other protected groups. The Fair Employment and Housing Act and Civil Rights Act are California’s primary fair housing laws, though other laws directly impact the fair housing rights of California residents. These laws apply to landlords, tenant screening companies, real estate management companies, real estate agents, home sellers, among others.

- Fair Housing Act: California landlords should not discriminate against prospective tenants based on their race, religion, gender, national origin, familial status, ethnic background, disability (mental or physical), or color. Moreover, the California Fair Housing Act outlaws discrimination in housing because of a prospective tenant’s source of income, sexual orientation, arbitrary characteristics, gender identity and gender expression, marital status, age, among others.

- Exemptions to Fair Housing Laws: The California Fair Housing Act covers most housing. Whereas the Federal Fair Housing Act has additional exemptions, these do not apply in California. The main exemptions in California only apply to:

- An owner-occupied single-family home, where the owner does not rent to more than one individual, and they conform with the Fair Employment and Housing Act’s prohibition against discriminatory statements notices or rental advertisements.

- Exemptions in California also apply to housing operated by organizations and private clubs that limit occupancy to members and statements indicating a preference for same-sex roommates in shared housing situations.

Specifications for Landlords and Tenants

California law imposes unique requirements on landlords screening prospective renters and tenants’ rights under the screening process. The following are the specifications for California landlords and tenants:

Landlords

California landlords are legally required to conform with the following specifications:

- Source of income: Landlords will generally want to verify a prospective tenant’s employment and income to ensure the applicant makes enough money to afford the rent. However, they should never discriminate against applicants based on their source of income, as long as the source is legal, regular, and verifiable.

- The number of tenants: A landlord may set reasonable limits for the number of people that can occupy a rental unit per square foot, but they are generally not allowed to use overcrowding as a basis for denying tenancy to families and tenants with children.

- Holding deposit: California landlords are legally required to ask a tenant to pay a holding deposit to hold the rental unit for a specified period until the first month of rent is paid.

Tenant

Before sending rental application forms to prospective landlords in California, certain specifications protect tenant’s rights that a tenant in California needs to know:

- Application fee: As of 2012, the maximum amount of money an applicant can pay as a rental application fee is $ 49.50, although it can shift depending on the current consumer price index. However, this amount should never exceed the landlord’s actual out-of-pocket costs.

- Holding deposit: Before a tenant agrees to pay a holding deposit to hold a given rental unit for a specified period, they should consider asking the landlord if the deposit will be applied to the first month’s rent or if any part of the deposit is refundable upon the tenancy agreement termination. However, tenants should note that no lease agreement in California should indicate that the holding deposit is non-refundable.

- Timeframe to file a complaint: Renters may file an administrative complaint with California’s Department of Fair Employment and Housing within one year of the discriminatory act.

- Investigation process: The Department of Fair Employment and Housing will investigate the discriminatory claim within 60 days after filing the complaint to gather more evidence. The investigation process must be complete within 100 days of filing the claim with the DFEH.

Fair and Accurate Credit Transactions Act (FACTA)

The FACTA is a federal law enacted by the United States Congress in 2003 to enhance consumer protections, particularly those related to identity theft. FACTA also contained measures designed to bolster consumer protection mechanisms. For example, the act allows consumers to obtain a free credit report once every year and allows consumers to place alerts on their credit histories if they suspect any identity theft activity. Moreover, the act requires the secure disposal of consumer information. The following are how FACTA protects housing applicants:

Credit history

The FACTA- Fair and Accurate Credit Transactions Act protects housing applicants by installing checks and balances on landlord credit inquiries and reporting. This law requires the landlord to:

- Notice: A property owner can only obtain an applicant’s consumer reports if they have a permissible purpose. The written permission must be obtained from the applicant or prospective tenant. The property owner must also certify to the company from which they are getting the consumer report to use the obtained report for housing purposes only.

Suppose the landlord takes adverse action against the applicant or tenant. In that case, the landlord must give the applicant or tenant a notice of that fact in writing, orally, or electronically.

- Consumer report details: The landlord must disclose information about the consumer reporting agency in the notice. The notice shall provide the name, address, and contact information of the consumer reporting company that supplied the report. The landlord shall also provide the applicant with specific credit information, such as the credit score or other numerical statistics.

- Copy and opportunity to dispute: The landlord should also issue the applicant a copy of the credit report if they ask for it within 60 days. Include a statement in the notice informing the applicant of their right to dispute the accuracy or completeness of any information the consumer reporting company furnished.

Ways to Send out the California Rental Application Form

Property owners in California can send rental application forms to prospective tenants using either of the following ways:

Manually

California landlords may use downloadable templates available freely on the internet, including this site, or create their form from scratch and send the rental application form to the prospective tenants via a physical copy or through the traditional mail.

Using a software

Typical property management software services include an online rental application form that property owners may use to automate collecting and screening rental applications.

Processing a rental application form

After obtaining rental applications from various applicants, screening the applications to find a few most qualified applicants, it is time to use the information on their rental application form to conduct background checks to identify the most responsible tenants to offer lease agreements. The following are the appropriate ways to process an applicant’s rental application form:

Credit check

Subject to the applicant’s written consent, a credit check will provide a simplified pass or fail report or a full credit report including the applicant’s credit score and information about their income, employment, past addresses, credit inquiries, among other important information. The property owner can then use this information to decide about renting the property to the said tenant or disqualifying them.

Eviction check

Conducting an eviction check on a potential tenant aims at showing the tenant’s history of eviction filings or judgments against them at any given point in the past seven years. This is essential as it helps reveal problems and reduce the possibility of evicting the tenant in the future, which is usually a costly process.

Criminal history check

A criminal history check on prospective renters aims to show any tenant records in state court criminal records or databases such as the national sex offender public registry. Whereas most states, including California, prohibit landlords from refusing to rent property to a tenant based on their criminal background, conducting criminal checks on potential renters helps check and evaluate the risks to enable landlords to take the necessary measures to avoid future problems with the tenant.

Note: California landlords may deny an applicant based on their previous criminal records if they can clearly and thoroughly prove that the stated previous crimes will threaten the health and safety of the other tenants or if the crimes affect the applicant’s ability to fulfill the renter’s obligations, such as not misusing the rental premises and maintaining a clean and safe space for everyone within the residential property.

Conclusion

A California rental application form is used to screen potential renters by collecting information about their rental history, employment and income, and other information that helps landlords decide about renting or not renting their property to the applicant. The maximum dollar amount that a California landlord can charge as a rental application fee varies depending on the consumer price index. Still, as of 2020, the fee was $52,46 per applicant.

California federal and state laws prohibit landlords from discriminating against tenants based on their color, race, religion, sexual orientation, familial status, disability, ancestry, immigration status, medical conditions, source of income, nationality, among others. However, there are some exemptions to these laws.

Before screening a prospective renter’s credit history, California property owners must obtain written consent for a credit check from the tenant. This is to conform to the Federal Accurate Credit Reporting Act. If an applicant’s rental application is approved, the landlord may collect a security deposit from the tenant, refundable upon termination of the tenancy agreement subject to lawful deductions.