A credit report authorization form, also known as a consent form or permission form, is an agreement between you (the consenter) and another company (third party) to allow them to look at your consumer credit file for their own business reasons.

The form permits the third party to view your credit report only, and the request must conform with the Fair Credit Reporting Act regulations. Generally, there are two different types of these forms. The first type gives the company/individual permission to order your consumer credit file from everyone who compiles it, while the other permits them to order only certain information about you from any company that compiles your credit information. Credit report consent forms must be written clearly with no vague or ambiguous language, and credit reporting agencies should not charge individuals for the credit report.

The form is sent by a credit reporting agency to you, the consumer. You then sign the document and return it, allowing the credit reporting agency to release your credit file as needed. For example, a credit card company that extends credit often needs access to your credit file from any of the three main credit reporting agencies and bureaus. It then uses the credit information provided to decide whether you are creditworthy.

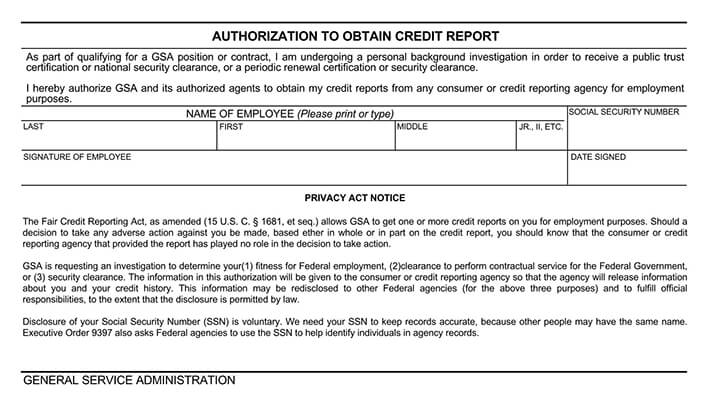

The form is also used by insurance agents, landlords, employers, government agencies, collection agencies, student loan providers, utility companies, and other parties that may need to review your credit file before insuring you or your business, granting credit, supplying you goods on credit terms, granting you an employment offer, allowing you tenancy, etc.

Free Consent Forms

How to Fill a Credit Report Authorization Form

After credit reporting agencies receive a credit report consent form from a customer or third party, credit reporting agencies will verify that all information on the form is accurate and complete before releasing the consumer’s credit report. Credit reporting agencies will then provide credit information to the credit grantor making the credit inquiry on a consumer credit file as needed.

However, if they detect any errors or problems with the credit report consent form, such as an invalid signature, incomplete form, or a signature that does not match with what is on the file with their records, they will not release your consumer credit report. As such, you need to understand how to fill your form accurately and with completeness.

Below is a detailed guide on the essential details to include in your form:

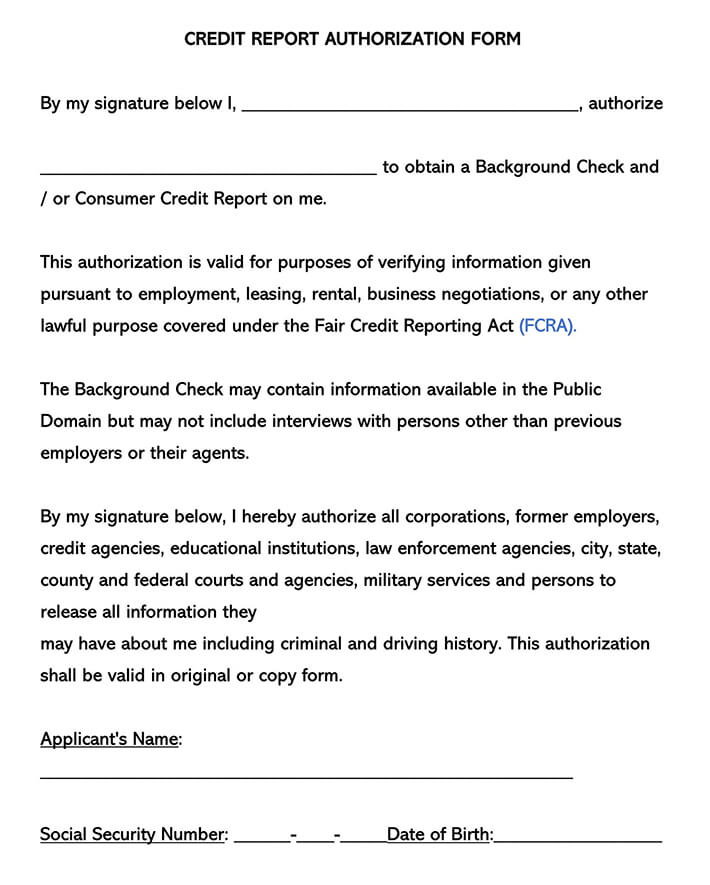

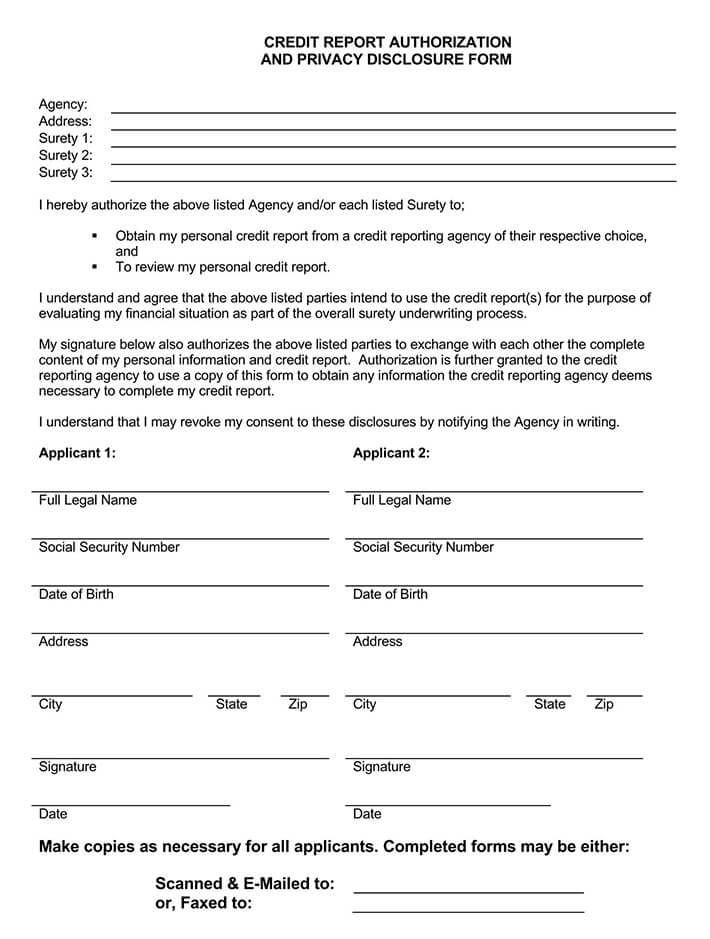

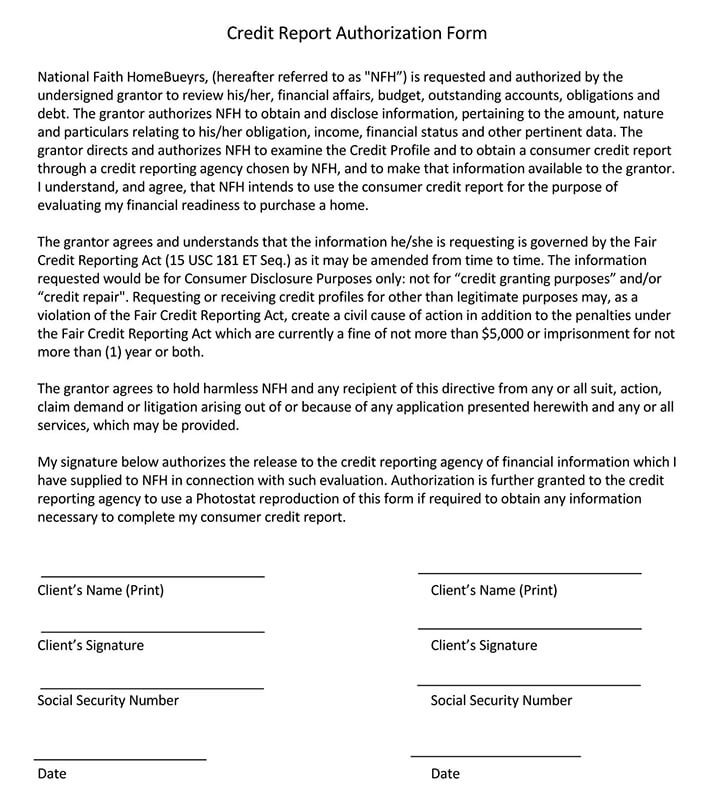

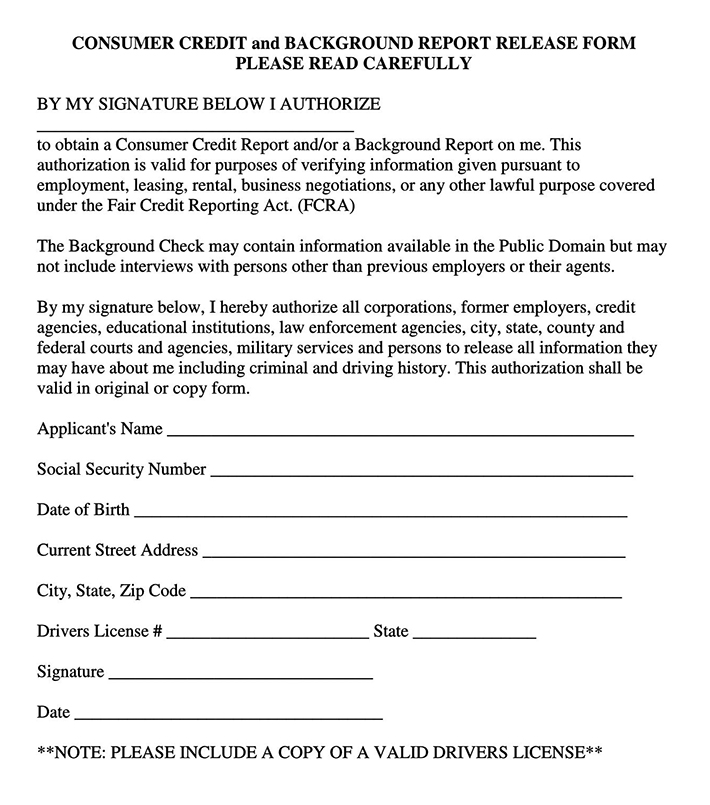

Complete the authorization statement

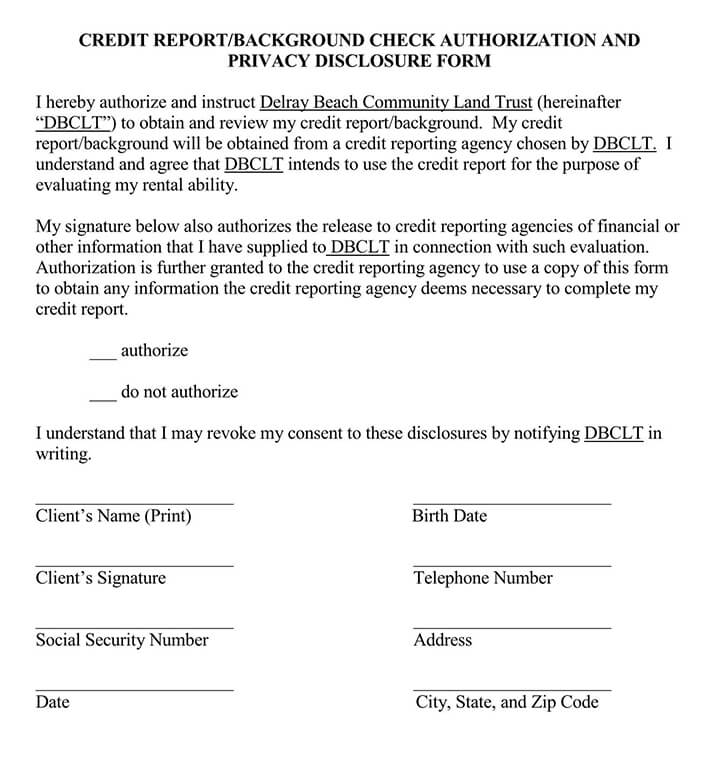

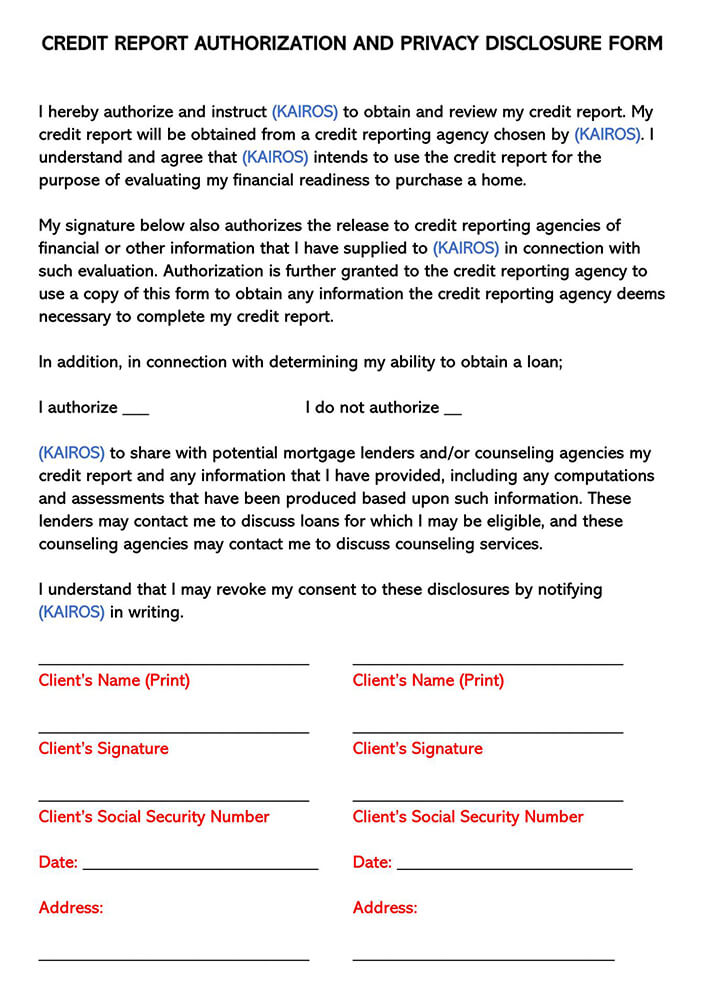

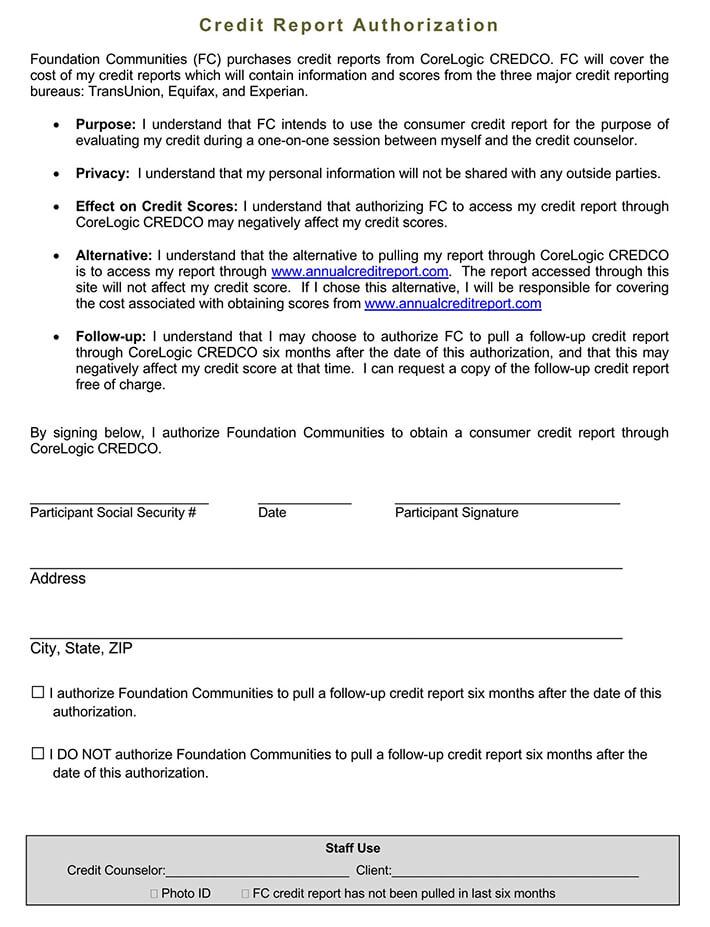

The first section of the form contains an “authorization statement,”- which is basically a statement of permission from the consumer to provide a copy of their credit report for a specific reason. This can include applying for new lines of credit, leasing an apartment, obtaining financing for a car/business, getting life insurance or home insurance coverage, getting an employment offer, etc.

In most cases, the authorization statement will include four main parts, that is:

Date

The date you will provide in this section should be when the document is signed. But, the best practice is to provide a current date and include a language stating that the credit report consent is effective immediately.

Your personal information

In this section, provide your personal information, including your full name, exactly as it appears on your credit report filed with the credit reporting agency for verification purposes.

The statement section

The statement section of the authorization form should specify what type of information will be released, for example, how much information should be disclosed or whether it will be a complete report. Additionally, include information about who will receive the information and state that giving consent for this disclosure is voluntary and revocable at any time.

Disclosing language

The last section of the authorization statement should include language disclosing that you have the right to have copies of all disclosures about you sent to you at no cost under federal law.

Enter details of the party running a credit check

Next, you will need to supply information relating to the third party requesting your consumer credit report. Information to provide in this section include the third party’s full name if it is an individual or the organization’s legal business name. It is essential to note that the credit reporting agency will verify the third party’s personal identifying information; thus, you must be as accurate as possible.

Add addresses for the last 7 years

You will need to provide the credit reporting agency with additional information such as your addresses for the last 5-7 years for identification purposes. The credit reporting agency assumes that the consumer has lived in three different places within the last 7 years, including their current address, and as such, you should report this information in the credit report consent form. If you have lived in more than three addresses within the seven years, consider providing all those addresses.

Essential information such as your current building name/number, street, unit number, city, and state should be accurately listed. Your current residency start date should also be indicated on the form. Follow the same procedure to provide all the residential addresses you have lived in within the past seven years.

Include your driver’s license details

After providing your residential addresses for the last seven years, you will need to record your driver’s license details to solidify your identity. For identification verification purposes, credit reporting agencies often request two forms of government-issued ID. One of these should have your current address, and the other should include your driver’s license number as well as the relevant state where it was issued. Your driver’s license details should also be accurate as the credit reporting agency will verify this information with the relevant state department.

Provide your social security number

To ensure maximum accuracy in processing your consumer credit report, it is essential that you include your accurate social security number on the credit report permission form. A social security number is a unique identifier that is used for all types of credit reporting purposes. It ensures that there is no confusion with any other credit report requests that could be placed under your name.

Enter your date of birth

The next step involves filling in your full date of birth following the Month/Date/Year format, such that the credit reporting agency can further verify your identity. This step is crucial as it helps prevent any potential fraud.

Sign and date the authorization

Once you have completed all relevant information in writing, you should sign and date your statement of consent. The date provided should be current, and by furnishing your valid signature on the document, you are authorizing the release of your consumer credit information for its specific purpose.

It is important to note that the authorization is valid for a year, but you can include an expiration date in the form. You can also revoke your consent at any time to cease future disclosures and checks, but credit reporting agencies have a 30-day waiting period before accepting a revocation. Once the document is signed and dated appropriately, you can return it to the credit reporting agency or the party requesting to obtain your credit reports. Based on the document’s purpose, you may be required to attach additional documentation such as a clear photocopy of your driver’s license, etc.

What is the Fair Credit Reporting Act (FCRA)?

This is legislation that the U.S. Federal Government has enacted to help promote fairness, accuracy, and the privacy of consumer information. It protects people from having information included on their credit report that is inaccurate, either done willfully or through the negligence of the company reporting the information.

Along with the Fair Debt Collection Practises Act, they form the basis of consumer rights. According to FCRA, your credit report can only be requested and obtained if the need is a legitimate one. While certain types of credit requests won’t need consent, to use that information in making a decision about the individual can create legal issues.

For example, running a credit check on someone applying for a rental lease and rejecting their application. By law, landlords need to inform the applicant of why they were rejected. If they based their decision on a credit report that they were not given the authorization to run, it could result in a lawsuit.

Frequently Asked Questions

While anyone can run a few basic credit report requests without consent, to do so is violating certain laws and guidelines that safeguarded the consumer. The information on a credit report is a private matter, and inquiries can have an impact on a person’s credit score.

Yes, you are able to sue anyone who has performed credit checks without your knowledge or consent in civil court. In some situations, you may be able to report a fraud alert and can report unauthorized access to the credit bureau.