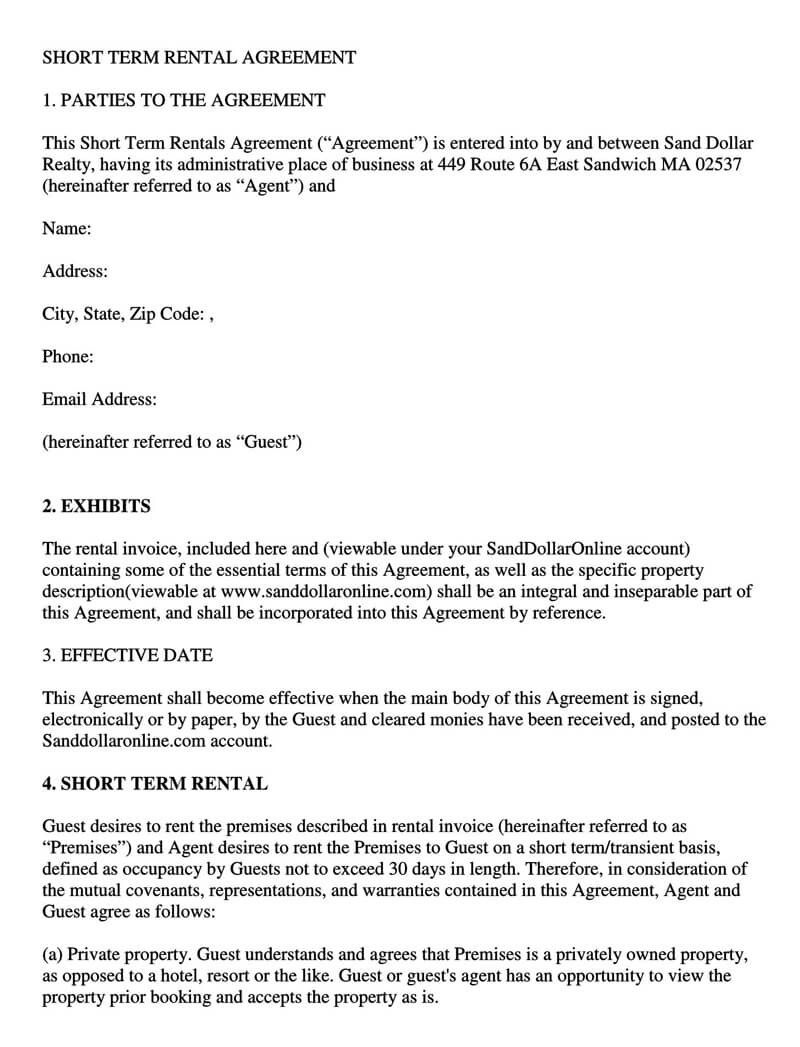

A short-term rental agreement is a contract between a landlord and a tenant that lasts typically between one and thirty days.

The agreement is often used for higher-end properties to set out the specific terms and conditions of the lease period. The contract should comply with all relevant state laws, and if the housing system was constructed before 1978, it should include the Lead-Based Paint Disclosure Form. Owners of holiday homes usually use them to lease their property during the summer season.

The short-term rental agreement is also known by other names. They are:

- Vacation lease

- Guest rental agreement

- Summer rental agreement

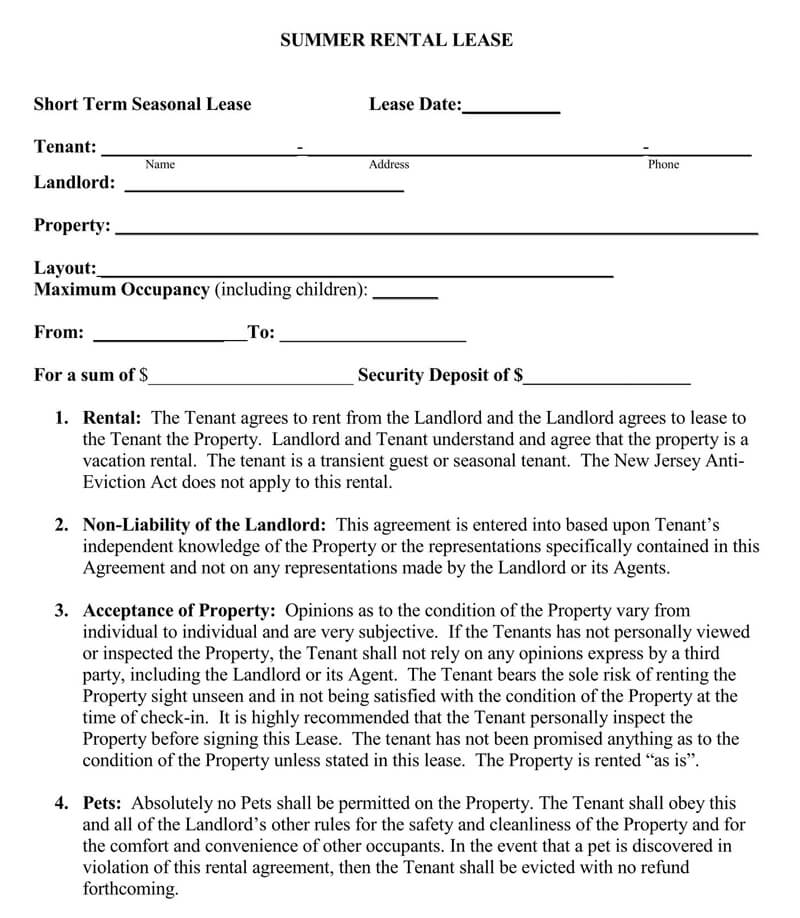

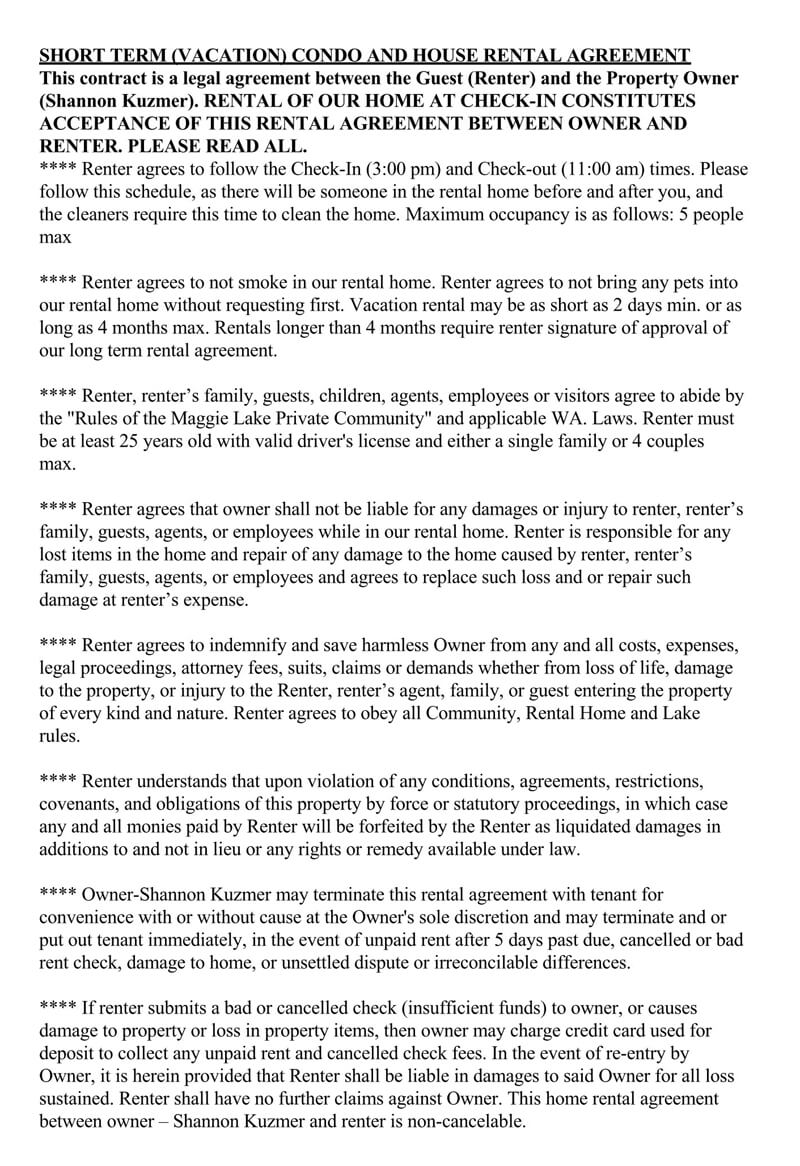

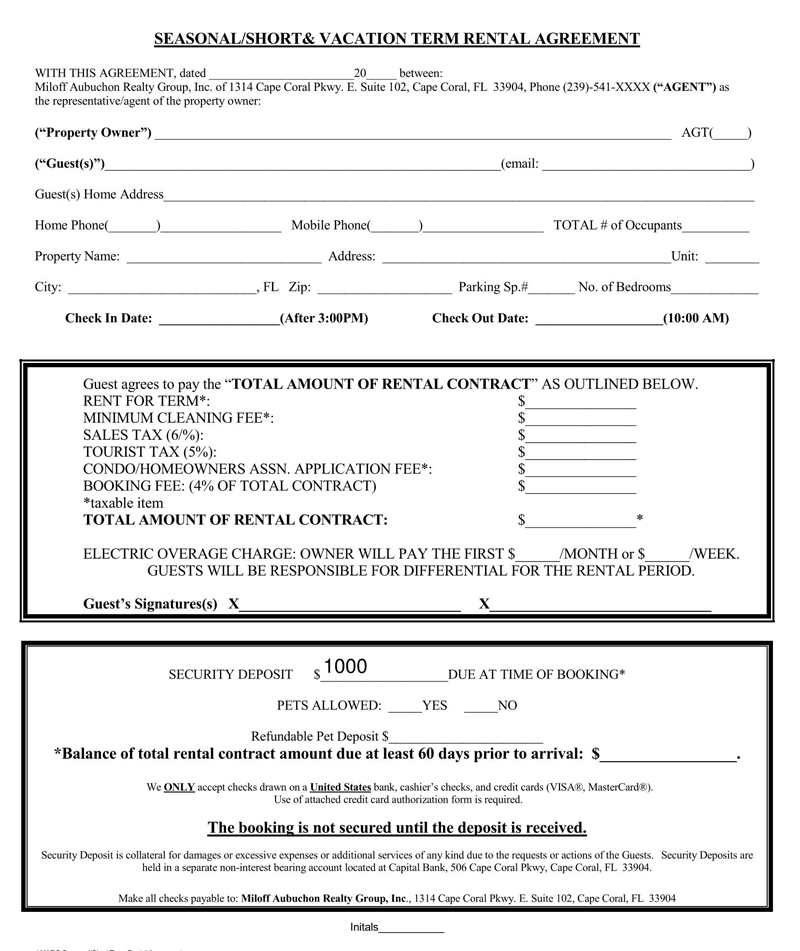

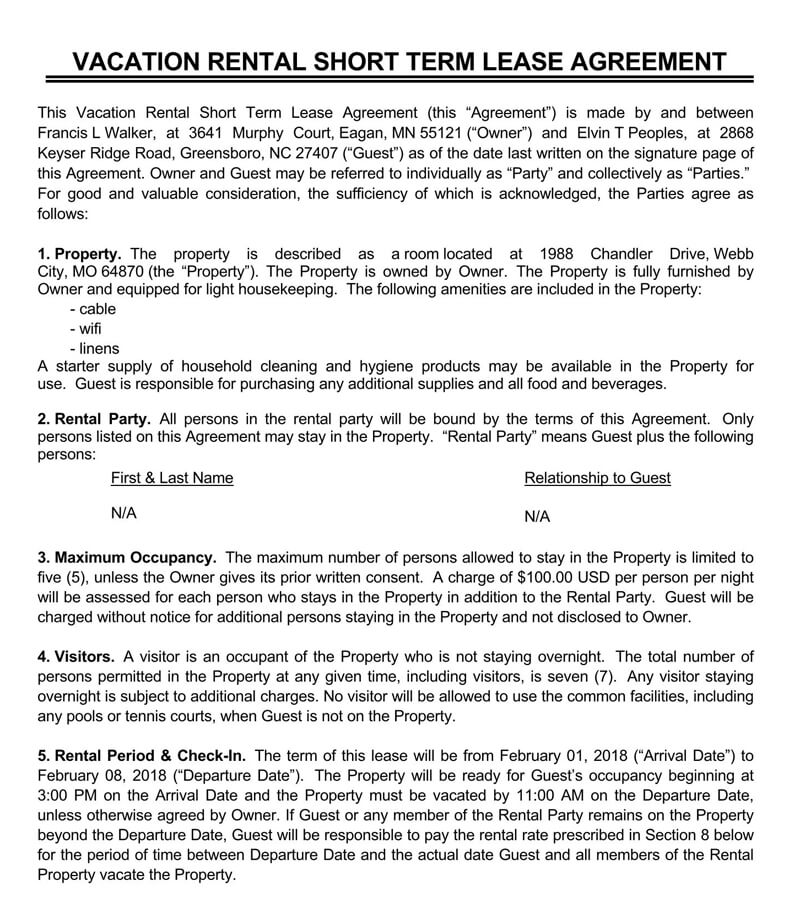

Free Standard Templates

When to Use This Agreement?

Following are the scenarios to use short term lease agreement:

- Hosting Vacationers: When hosting vacationers rather than ordinary tenants or business events, it is necessary to draft and enter into this agreement. This way, it will be possible to draw a clear distinction between the various events and make appropriate arrangements to handle them as the need may be.

- Too Short Occupancy Periods: Similarly, if it happens that some people come to occupy your premises for too short durations of time, it is necessary yet again to draft this agreement. That way, it will be possible to handle this agreement uniquely and ward off any undesirable confusion later on.

- Tax Compliance: We have already explained that different states have different laws that govern the drafting of such forms. Some states, as a matter of fact, do confer tax breaks to those states that host vacationers. To tap into such incentives, it is in your best interest to leverage the agreement altogether.

Short Term Vs Periodic Lease

While both short-term and monthly leases are used to offer non-permanent tenancies, they vary in many ways:

- Lease term: Unlike a periodic lease where there is no specific end date and either party can decide to end it, short-term rental agreements have a specified end date. The lease period is usually one week or a month (or less).

- Rent prices: Periodic leases usually have higher rental rates in exchange for the option of terminating with little notice, but both types have significantly higher rates than regular leases.

- Property types: Such rentals are often used for vacation homes and short-term visits and are focused on the leasing procedure of vacation-suitable property that is more attractive and comfortable for visitors rather than permanent or long-term tenants. On the other hand, Periodic leases are designed for people who will need to live in a particular location for several months or longer. This could be along with their family in case they are a married couple with kids or any other tenants that need to lease the property under more serious life circumstances. The periodic lease is entered after the short-term rental agreement expires and no new contract is signed, but the tenant would like to continue renting the property.

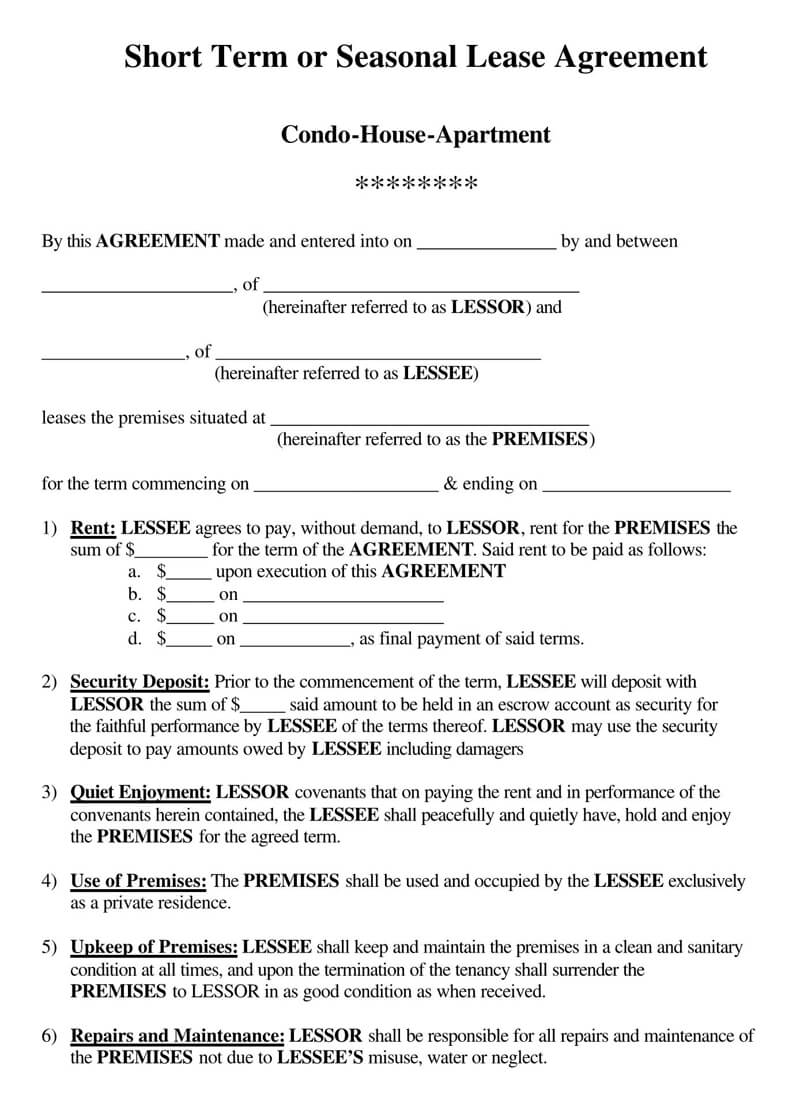

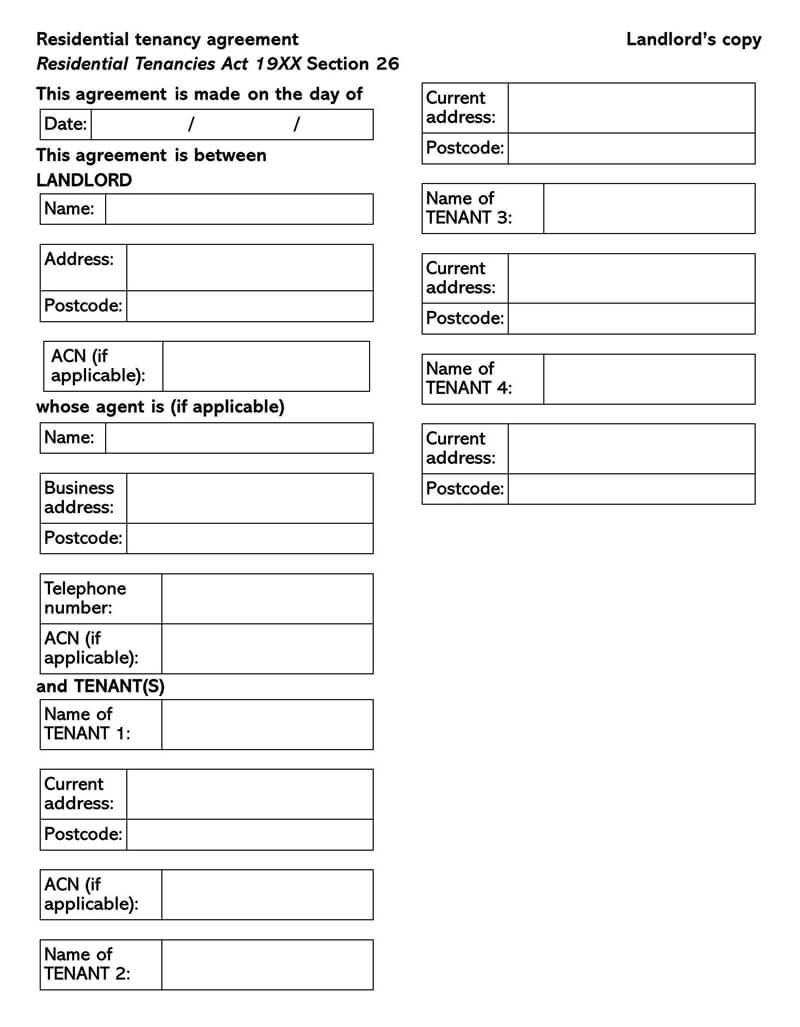

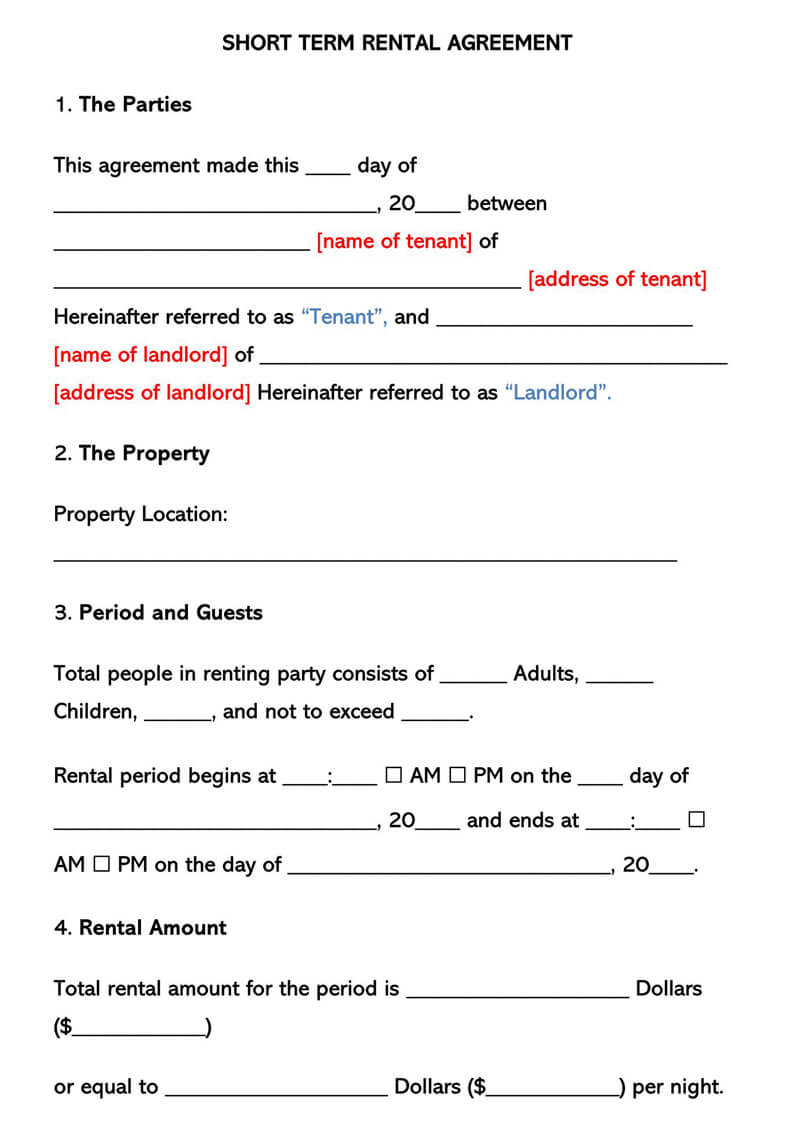

How to Write (Fill) the Rental Agreement

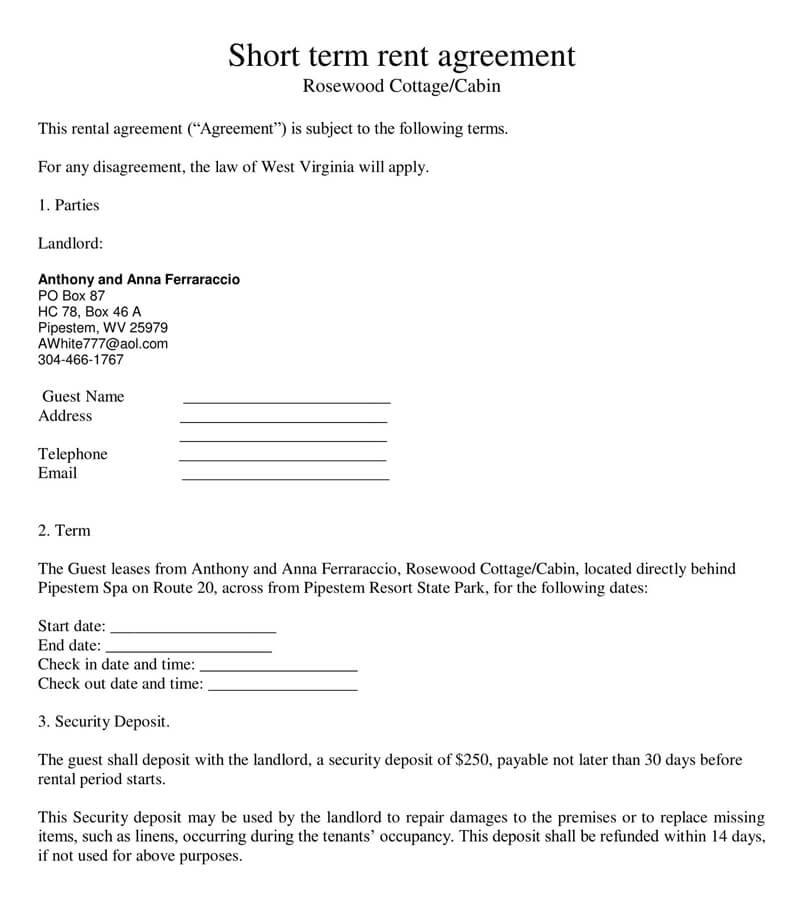

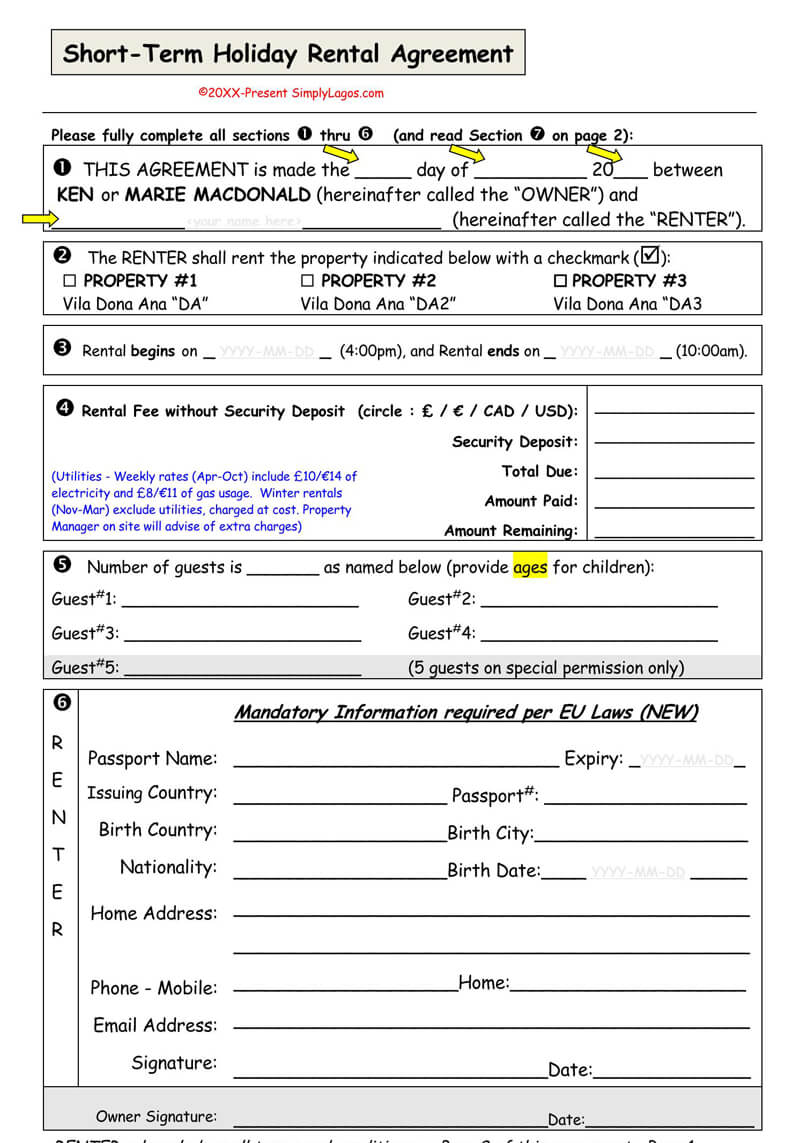

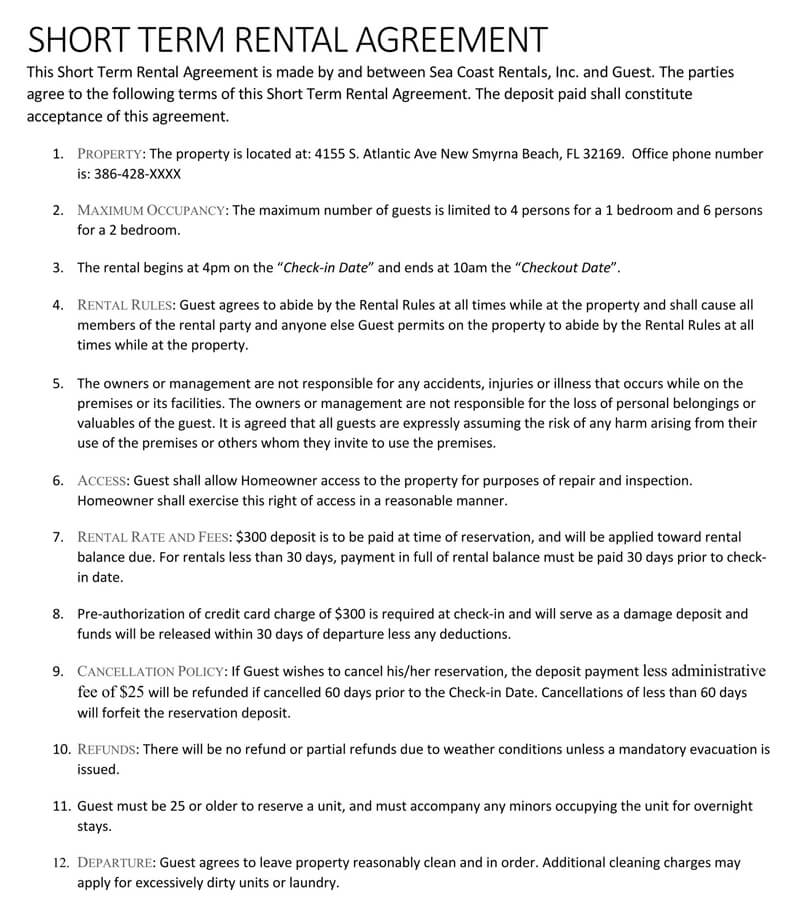

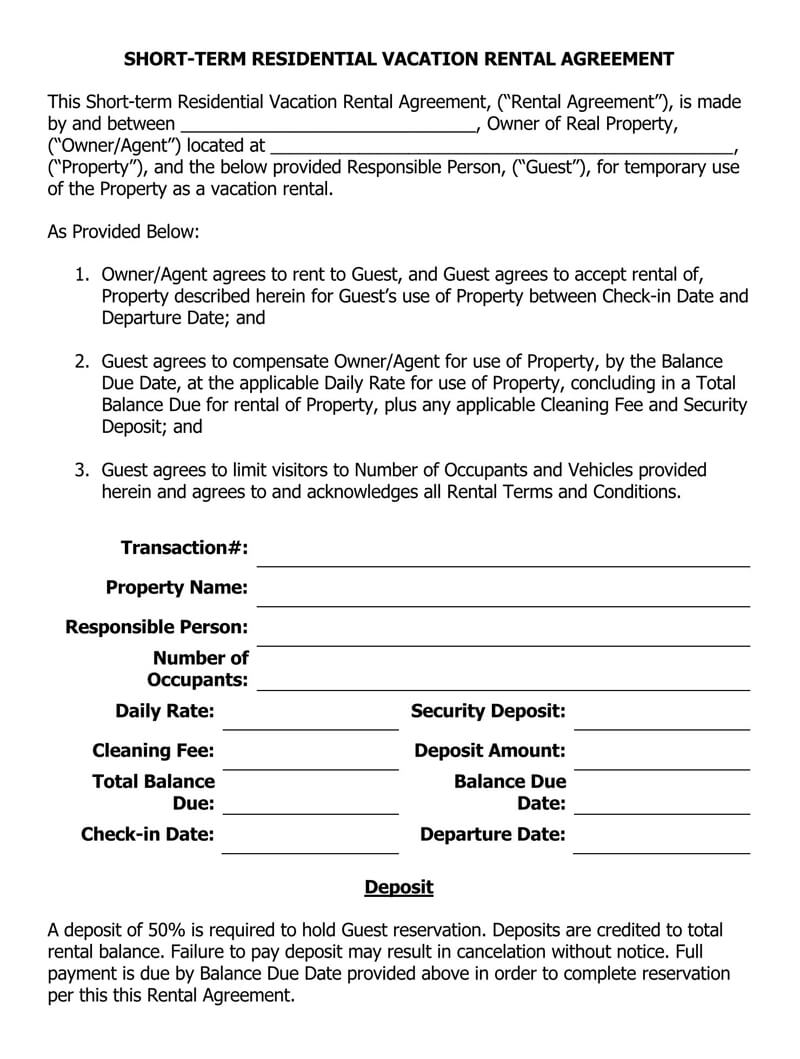

In this section, we have explained the components that make up the short-term rental agreement. This information will guide you when filling this document:

Basic information

The landlord should provide the following information in this section of the agreement:

- The date when the contract is created (day, month, and year);

- the guests’ full names and mailing address

- the landlord’s full name and mailing address

Sample clause

This rental agreement entered on _____day of____ is made between: _____ (tenant name) with a mailing address of_________ and (landlord name) with a mailing address of______________.

The premises

This is where the visitor will stay. Enter the rental’s full address, including the unit number (if applicable).

Sample clause

Premises: The rental property, known as the premises, is located at:

Street: _________________ Unit number_________________

City: _______________State: ______________Zip: ______________

Rental term

This part specifies how long the guest will stay in the rental. Write down the day, month, and year the guest will be checking in and out of the rental, as well as the times they will enter and leave. For both dates, choose either “AM” or “PM.”

Sample clause

Rental term: This term shall begin on the___________ day of_________(date) at : o AM o PM (check-in date) and end on the __day of_, at_____: _ o AM o PM (check-out date).

Payment information

The first section is the sum the guest will pay to rent the property for the rental period. First, enter the rental rate for each night, then the total number of days the guest will be staying in the property. Finally, multiply the rate by the number of days and enter the value in the “equal to $ section.

Sample clause

Rental rate: The rent to be paid by the tenant to the landlord throughout the term of this agreement is equal to________(dollar amount), equal to________ days at________(dollar amount) per day.

The second section is where the owner adds other expenses to the overall rental amount. If any charges are applicable, mark the appropriate box and enter the total cost of the fee. Any one-of-a-kind or unlisted prices should be entered in the “Other” section.

Sample clause

Fees and taxes: The tenant will be responsible for paying the following expenses:

(mark all that apply)

o Cleaning fee________ (dollar amount)

o Taxes_____________ (dollar amount)|

o Other____________ (name of other expense): ___________ (dollar amount)

Security deposit: allows the landlord to decide on a deposit that the client should pay before moving in. Check the correct box to show if the deposit is refundable (it typically is). Afterward, enter the deposit amount and the number of days it is due before the client moves in. If the landlord makes the deposit refundable, enter the number of days after the check-out date they will get their deposit back. State landlord-tenant laws usually require deposits to be returned within a certain number of days, usually less than one month.

Sample clause

Initial deposit: The tenant will be charged a o Non-refundable o Refundable (choose one) deposit of_________(dollar amount) that is due________ days before the check-in date. If refundable, the landlord shall return the deposit (minus damages (excessive cleaning) to the tenant within ___________days after the check-out date.

The fourth section is where all the expenses should be totaled.

Sample clause

Total due: The total amount the tenant is responsible for paying for is:

Rental cost: ____________ (dollar amount)

Cleaning fee: ___________ (dollar amount)

Taxes: ________________ (dollar amount)

Deposit: ______________ (dollar amount)

Total: ________________ (dollar amount)

Payment

Check the payment methods available to the guest for paying the rental.

Sample clause

Payment: The acceptable payment methods are:

o – Credit/debit card

o – Check

o – PayPal/Venmo: (send to_______________) (landlord name)

o – Other_____________________

Parking

Check the first box, enter the number of parking spaces, and explain where the guest can find the places to park if they have a particular parking space they can park in. Check the second box if they must park on the street or have access to a public lot.

Sample clause

Parking: The guest (choose one)

o – Is allotted _________parking space(s). Location of the space(s)_____________.

o – Is not allotted any parking spaces (the guest is limited to street or non-reserved parking).

Pets

Check the lower box if the landlord allows pets on the property. Then, write down the number of pets that are permitted and the types that are authorised (dogs, cats, etc.). If pets are not allowed, check the first box.

Sample clause

Pets: The guest is (choose one):

o – Not allowed to have pets of any kind on the property.

o – Allowed to have _______ pet(s) on the property, ONLY consisting of___________________ (state the pet restrictions)

Amenities

Make a list of all the amenities available in a particular residence in this section of the short-term rental agreement. Discuss everything in depth, from the furniture to the sheets, television, and air conditioning system. Make a note of any outdoor locations that your guests can access as well.

Sample clause

Guests shall pay ________________________ (the amenities offered) except not for stays under three weeks. The amenities remain in the landlord’s name and are paid from the security deposit at the end of tenancy or approximately every ________ (payment times, for example, 2-3 months) for long term occupancies. Any extras or refund will be paid within _____ (number of days, for example, 30) of departure. Guest will be given copies of the bills. The rent will not be reduced if you do not get _____ (the amenities) for reasons beyond the landlord’s control.

House rules

This clause is required in every rental agreement since it defines the house rules. No-smoking is an example of a house rule to consider. Ensure to mention any punishments for breaking rules in this section as well, if any.

Sample clause

Guests up to ________ (number of guests allowed) maximum occupants and _ (number of cars) parked at allocated parking spots will be allowed on the property at any time. _________ (write what is not allowed, for example, smoking) is allowed within the house. The property may not be used as__________________ (write for example, commercial or illegal purposes).

Trash disposal

The trash disposal section describes how the guest can dispose of their garbage (e.g., the black dumpster behind the building).

Sample clause

Trash disposal: The guest shall dispose of all waste during the rental term by the following means: _____________.

Keys

State where the guest can pick up the keys for the rental and where they can drop them off when they are moving out.

Sample clause

Keys: All the keys are to be picked up at the start of the rental term at _____________and will be returned at the end of the rental term at____. It is recommended that the guest test all the keys upon checking in.

Contact information

This section of the agreement provides a means for the guest to contact the landlord if there is an emergency or an important question during their stay. The landlord’s full name, address, phone number, and email address can all be written down.

Sample clause

Contact information: The guest can contact the following person for questions or concerns during the rental period:

Landlord name: __________________

Address: _______________________

Telephone: ____________________

Email: _______________________

Governing laws

Enter the state in which the rental property is located. The written state landlord-tenant laws govern the agreement.

Sample clause

Governing law: This agreement is governed by regulations of the state of_______________________.

Lead paints

This part is required by federal law. Check the 2nd box if the rental property was constructed before 1978. The landlord should then give the client a booklet about lead-based hazards in the house. The first box can be checked if the property was built after 1978.

Sample clause

Lead-based paint: The premises (choose one)

o – Was not built before 1978

o – Was built before 1978. An attachment titled “disclosure of information on lead-based paint hazards” has been included in the agreement and should be signed and initiated by the parties.

Additional information

If the landlord wants to include any additional terms, conditions, or requirements, they can do so on the given lines.

Sample clause

Additional provisions

_________________________________

_________________________________

_________________________________

Signatures

Both parties must sign their names (hand-written or e-Signed), the date they signed, and their full printed names. If there is only one guest, leave the second guest signature field blank.

Sample clause

Landlord’s signature: __________________ Date: ________________

Printed name: ________________________

Guest’s name: _______________________ Date: __________________

Printed name: _________________________

Renting Out a Vacation Home

Getting a tenant to occupy the property on a short-term basis is the easiest way to get the most money per day. Finding the right rental scenario requires marketing the house, evaluating the tenant, collecting payment, and repossessing the home at the end/termination of the lease.

Here is how to go about renting a vacation home:

Find out about the local laws

Short-term rental agreements are not supported in some communities. This lack of support has led to regulations being proposed in many parts of the country to ban or tax this form of leasing. It is advisable, therefore, to seek advice from a local real estate attorney or agent before advertising a property for renting.

Prepare the property

Tenants in today’s rental market expect the same facilities and services as those found in a luxury hotel. This will include providing appliances (microwave, coffee machine, etc.), bed linens and pillows, cleaning service, internet (Wi-Fi), cable, shampoo and soap, and towels. The products mentioned do not have to be costly, and since most tenants are careless, the economic models should be made available.

Set a timeframe

Unless the rental is rented year-round, the owner should plan which months they will lease it. This means that they are not obligated to a period in which they cannot physically lease out the rental. Specific times can be filtered out while using various renting platforms, simplifying the method.

In addition, the rental should be compliant with local and state short-term lease regulations. Regulations might involve:

- Installing smoke detectors in each unit.

- Not renting out the entire property (owners should reside in a section of the rental).

- Registering as a short-term rental and obtaining the appropriate licences.

- Other requirements.

Because of the possibility of serious consequences, this procedure should not be hurried.

Understand tax implications

The IRS 14-day law governs how the vacation property is taxed. Any rental income received if the vacation home is leased for fourteen days or less in a year is tax-free. Therefore, the property is classified as a “personal residence.” This also ensures that rental costs cannot be deducted. If a property is leased for more than fourteen days in a row, the property is known as a “vacation rental property.” If a property is leased for more than fourteen days in a year, the owner should monitor and document all expenses and profits. This will be beneficial when it comes to tax season.

Clean and take pictures

A clean property will always look better on camera. Therefore, it is important to clean the property to make it more appealing when people see the pictures online. A landlord’s images of their property serve a purpose other than simply displaying the rental. They express the landlord’s level of involvement in the entire operation.

High-quality pictures prove to potential tenants that the owner is serious about the rental and has put effort into the overall experience. Those who do not have a professional camera or the skills to take high-quality photographs should seek the assistance of a professional photographer. The cost of getting professional pictures taken is primarily determined by the size of the rental, the photographer’s experience, and the number of photographs taken. Landlords should expect to pay anywhere between $200 and $2500.

List the rental

The owner can begin accepting reservations after thoroughly cleaning and preparing the house, ensuring compliance with local regulations, and obtaining any necessary licences. The landlord can use one of the many available apps for listing vacation rentals to greatly simplify the process.

Research potential tenants

When a client shows interest in renting, the owner can spend some time researching the tenant on social media. Unless the client is signing a lease for more than a month, they are unlikely to complete standard screening procedures (i.e., a rental application).

Since vacation renters usually pay in advance, owners should not be concerned about checking the applicant’s wages, jobs, and so on.

Finalise potential tenants

If the reservation is verified, the landlord should try to collect the rent for the specified period. If the landlord uses a website to receive payment on their behalf, they are in good hands if they are properly processed. However, if the tenant has not paid to secure their reservation, online payment platforms can be used.

If the landlord accepts cash or payment after check-in, they should be aware that it will take up to 90 days to terminate the tenant once they have access to the premises due to eviction laws in several states.

A security deposit is recommended if the landlord has valuables in the property that a security deposit, in addition to the rental payment, is needed. This ensures that the landlord can be partly compensated if any personal belongings in the property are damaged or stolen.

Approve the reservation

If the client is considered trustworthy by the owner, they can proceed with approving their reservation. Once accepted, the owner can begin collecting rent from the tenants. If you use renting apps, payment is obtained when you approve the reservation. Accepting funds in person is not advised because it increases the chance of the tenant moving in and not paying rent. The occupant is considered a tenant under state landlord-tenant law after they have moved in.

Check-in and check-out

The check-in process will differ depending on the owner’s preferences. The owner should be present to personally greet the tenants and provide step-by-step directions for keypad entry, among other things. The most significant check-in aspect is that the owner receives payment before allowing the tenant to access the property. If the tenant moves in, the landlord should be available in case the tenants have an issue, a repair request, or anything else.

Final Thoughts

A short-term rental agreement is a contract between the owner of the property and the tenant. This rental agreement is identical to a lease agreement for an apartment, except that it only covers the brief period guests are renting a house. A rental arrangement specifies both the owner’s and the guests’ obligations. For example, the owner can agree to provide the tenants with a key to the property. The tenants agree not to engage in any criminal activity on the property. A successful rental agreement also lists the consequences for violating any of the laws. It may give a landlord the right to terminate a booking or obligate the renter to cover the costs for fixing any damages caused by their violation of the agreement’s terms.