When buying, selling, and registering a vehicle in Texas, you will need a bill of sale. It is not only a receipt that proves that the sale took place, it also acts as protection for both the buyer and the seller, should any issues arise with the vehicle being sold. For instance, If the seller got a ticket a few days before selling the vehicle, this can prove that the buyer did not own the vehicle at that time.

Other Documents That You May Need

Normally, the seller is required to list the vehicle’s odometer reading at the time of sale. This is done in the appropriate section of the Certificate of Title under the Odometer Disclosure Statement.

In situations where you have to have someone other than yourself register the vehicle in your name, that individual must complete a Texas Motor Vehicle Power of Attorney (Form VTR-271).

For it to be legal, both parties must sign it. Texas does not require it to be notarized, however, notarization adds more weight to the document when it comes to any liability issues.

Creating a Texas Vehicle Bill of Sale

The Texas Department of Motor Vehicles has its own version of this document (Form VTR-903), also referred to as a Casual Sales Form. You may also create your own form.

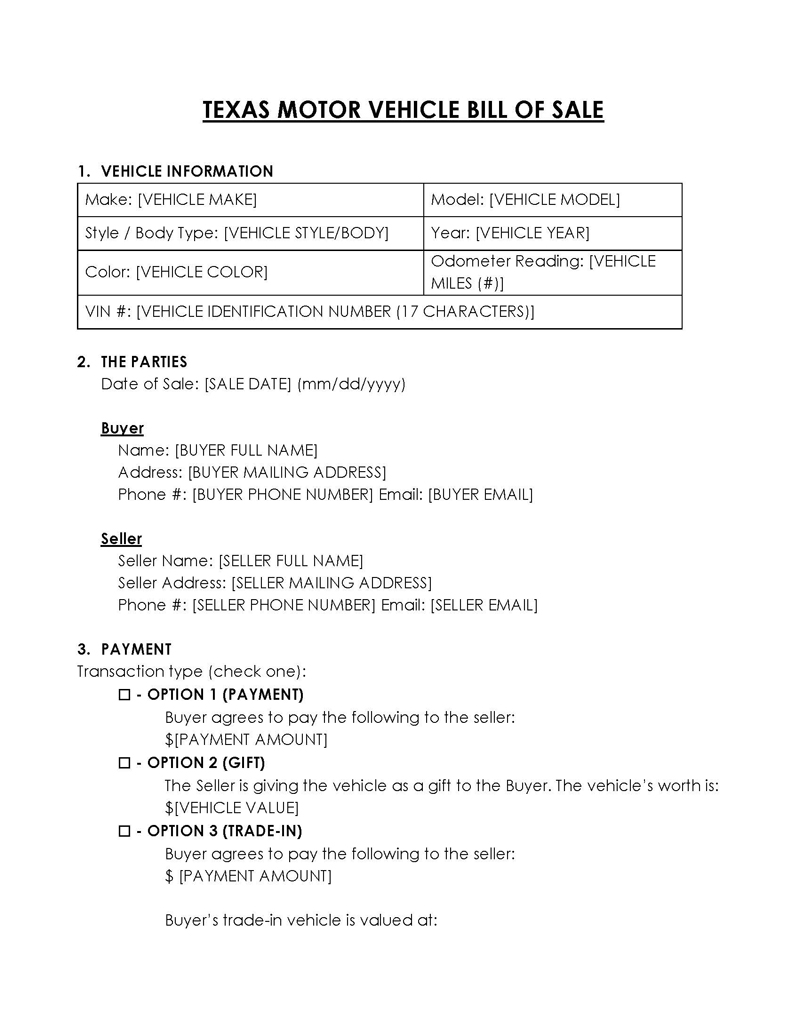

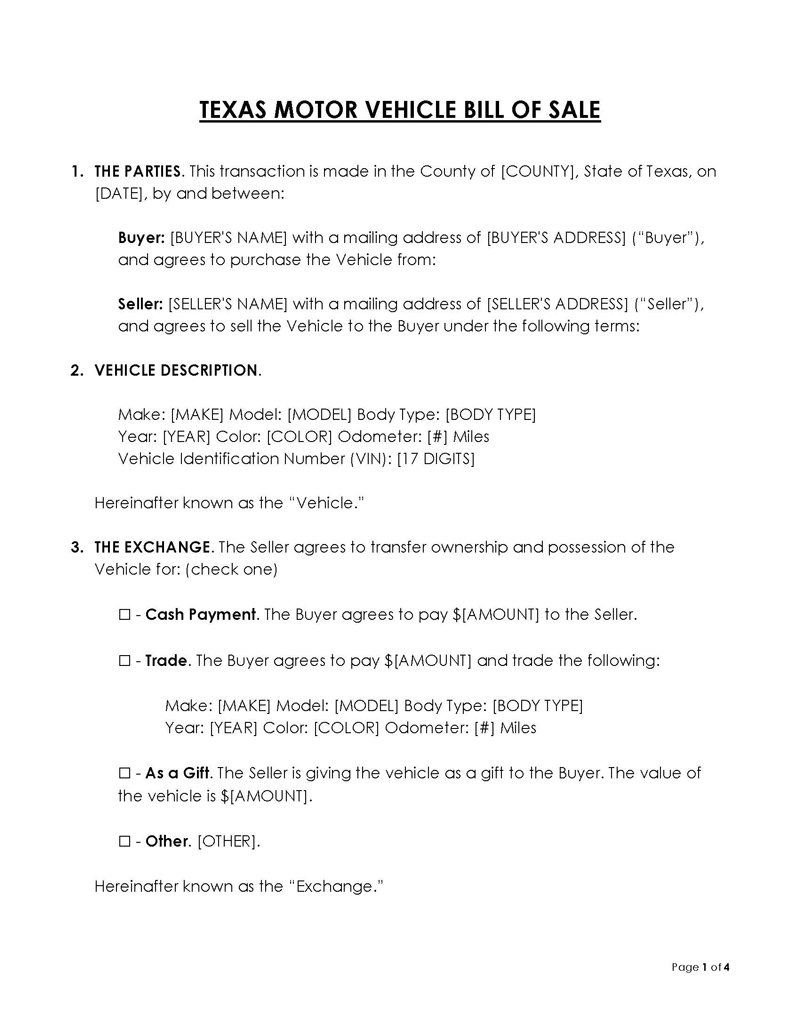

You will need to have the following required information on it:

- The full legal name and address of the seller

- The full legal name and address of the buyer

- Details about the vehicle being sold. This must include the make, model, year, color, and VIN

- The price that the vehicle was sold for

- The date that the sale took place

- The signatures of both the buyer and the seller

Free Templates

Registering a Vehicle in Texas

In Texas, you are required, by law, to register your vehicle within 30 days from the date that the sale took place. The seller is required to fill out a Vehicle Transfer Notification, which can be done online, or in-person at a local County Tax Office. It is advisable that the buyer and seller do this together, to be sure this is filed. Otherwise, the buyer could be held liable for any offenses incurred by the seller. A representative at the county tax office will be able to tell you if the title that is being signed over to you has any problems and is the correct one. Alternatively, you can check this for yourself using DMV’s Title Check.

If you purchased your vehicle at a dealership, they will submit the paperwork necessary for you. Registration must be done annually and renewals can be done online.

Where to Register a Vehicle in Texas

When registering a vehicle for the first time, you will need to do so in person at your local County Tax Office. Some Tax Offices may require you to schedule an appointment.

Registering a vehicle in Texas

Once the sale of the vehicle has been completed, the buyer will need to bring the following documents to their local County Tax Office:

- Vehicle Title, signed over from the seller. If the title is not available or has been lost, you may request s Duplicate Title (Form VTR-34)

- A current and valid Driver’s License

- A completed Application for Title or Registration (Form 130-U)

- A completed and signed Bill of Sale for vehicle in Texas (Form VTR-903).

- Odometer Disclosure Statement, which should be entered in the appropriate area of the Vehicle Title, or on the BOS if there is no room.

- Proof that the vehicle is insured with the Minimum Requirements:

- Coverage of $30,000 for injury, per individual Coverage of $60,000 for injury, per incident

- Coverage of $25,000 for damage to property

- If the vehicle has more than one lien against it, you will need to complete an Additional Liens Statement (Form VTR-267)

- If your situation requires that you have another title the vehicle for you, they must be sure to complete and sign Form VTR-271 (Power of Attorney for a motor vehicle)

- If the vehicle was given to you as a gift, you will need to fill out Form 14-317 (Vehicle Gift Transfer)

- Funds to cover the Required Registration, Title, and Tax Fees

New Residents to Texas

If you are new to Texas and are registering a vehicle, you will have 30 days from the date that you moved to register your vehicle. You will first need to have your vehicle insured. You will then need to have it inspected. To have your vehicle inspected, visit one of the many certified Texas Department of Public Safety (DPS) inspection stations. Make sure that you have your proof of insurance with you.