A Power of Attorney (POA) in Virginia is a written authorization allowing some individual to act instead of another, representing their interests and making legally binding decisions on the person’s behalf.

The authorizing entity granting a POA is referred to as the principal, and the person to whom authorization is granted is referred to as an attorney-in-fact or agent. POA Virginia is used to empower a chosen representative to manage some aspect of the principal’s personal or professional business in a situation where the principal is unable to do so. This can include scenarios in which the principal is incapacitated, absent, or requires the services of a professional. When such a situation occurs, the attorney-in-fact can step in and make decisions that have the same authority as the principal. A POA can last for a temporary time period or the entire life of the principal.

POA is a legal tool regulated by law, and the state of Virginia is covered under the Virginia Uniform Power of Attorney Act.

Free Forms

10 Types of POA

A POA is used to facilitate several types of arrangements, each of which is supposed to allow the principal to manage some affairs even when they’re not able to do so personally. This can be put in place for several reasons, including as a safeguard against an uncertain future, as a means of regulating some affairs, or as a convenience for facilitating the duties of a professional service provider.

The types of it are:

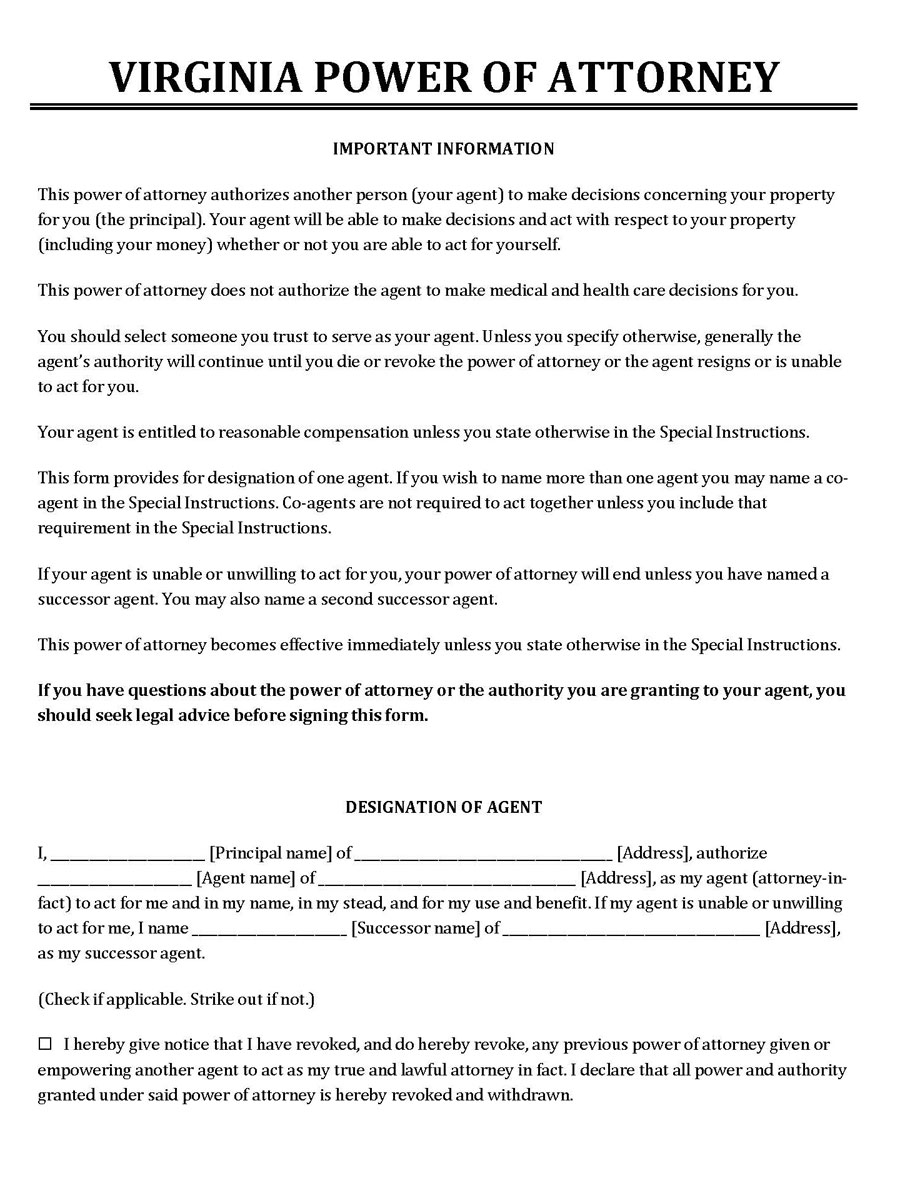

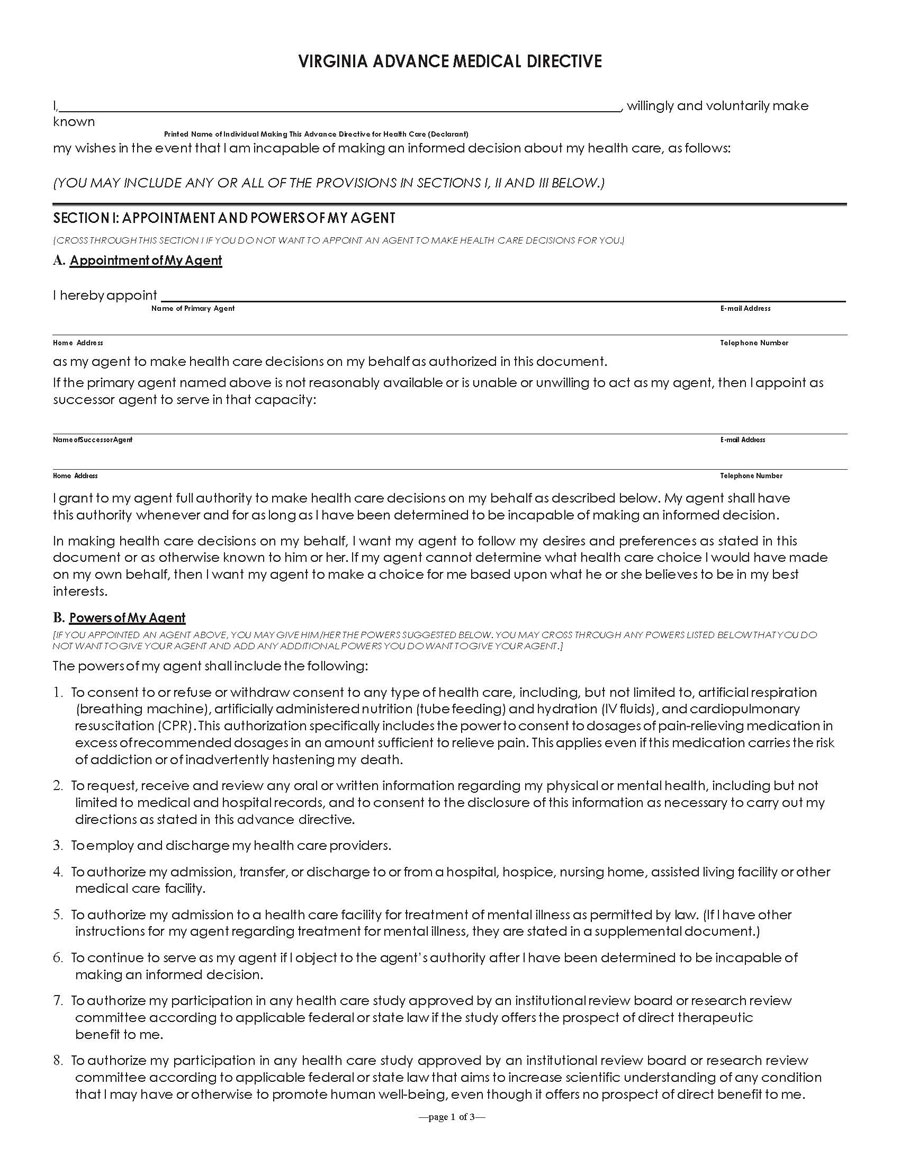

Advance Medical Directive POA Form

Download: Microsoft Word (.docx)

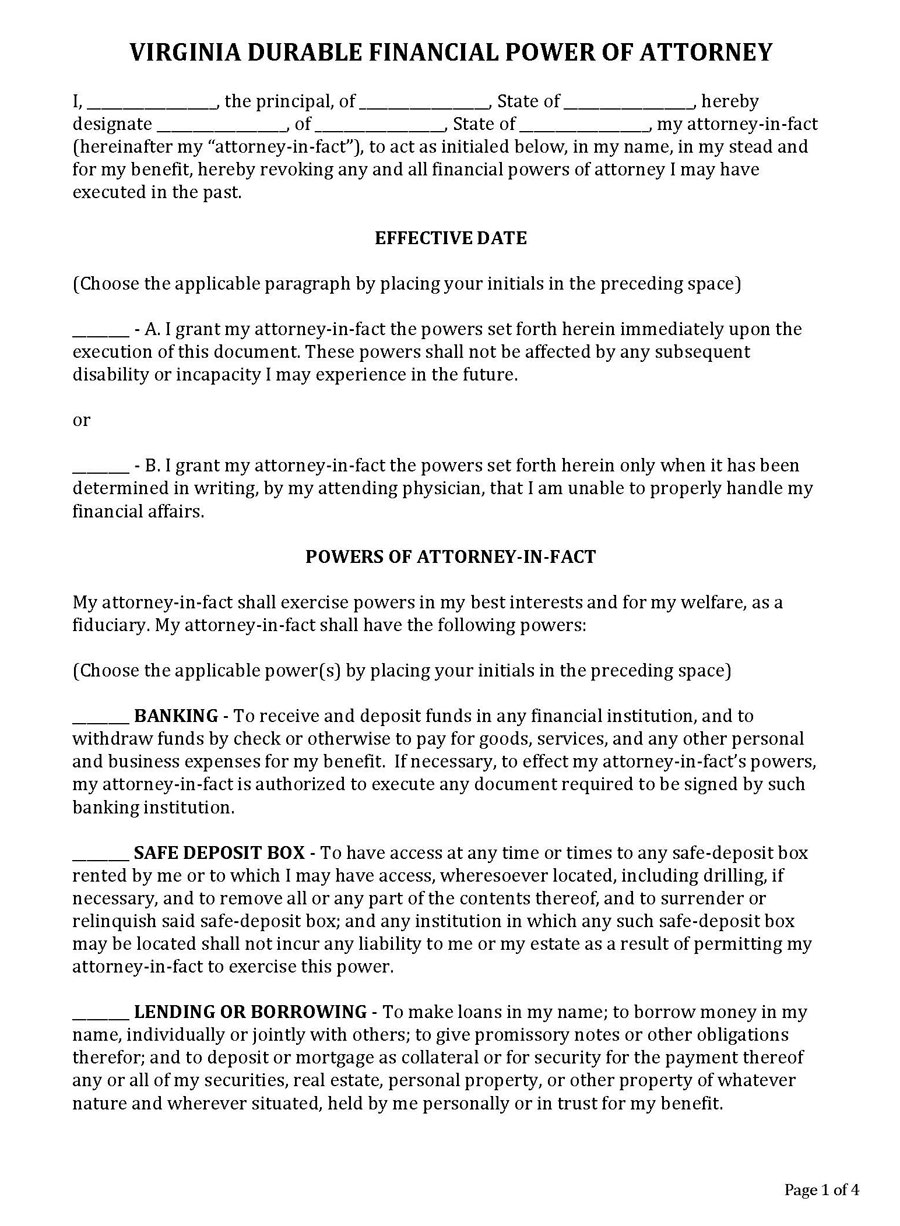

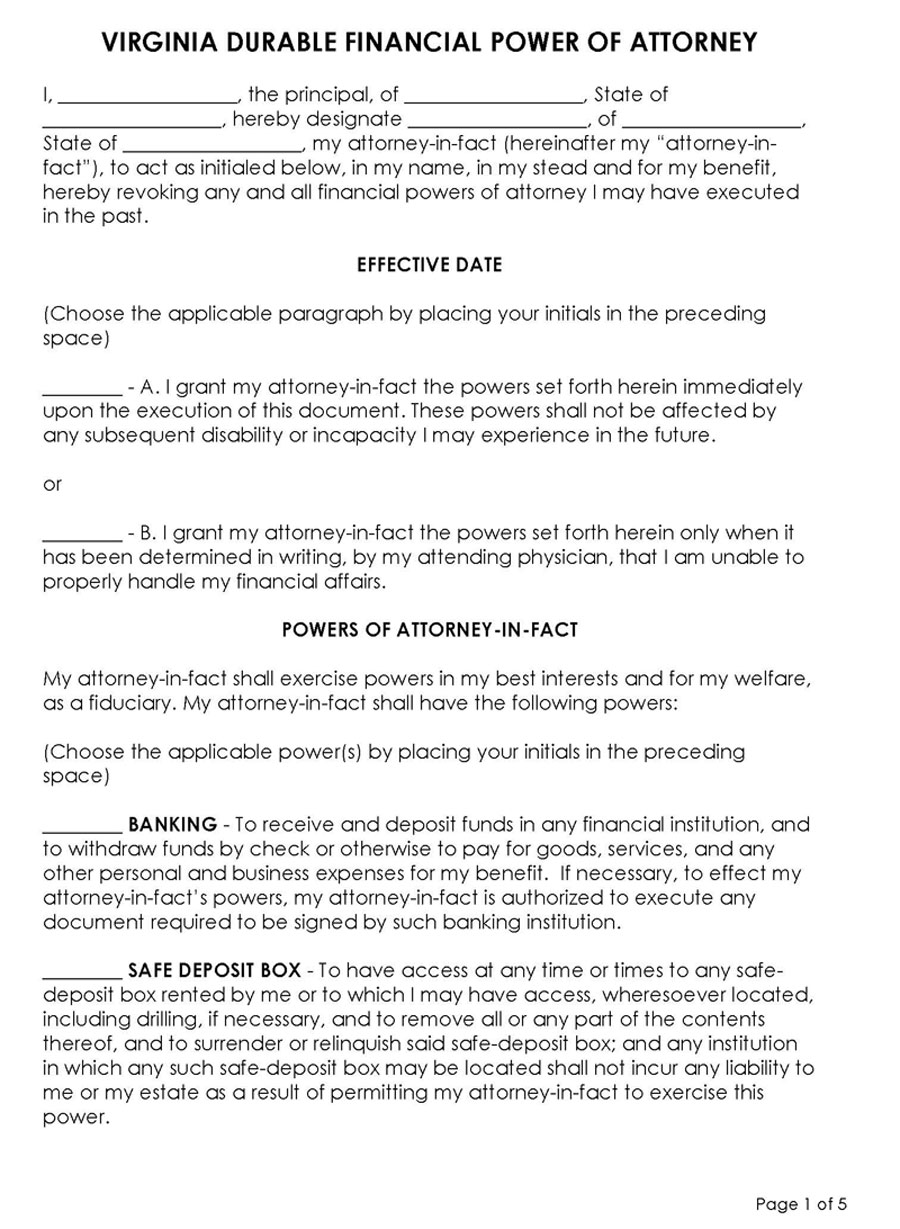

Durable (Financial) Power of Attorney Form

Download: Microsoft Word (.docx)

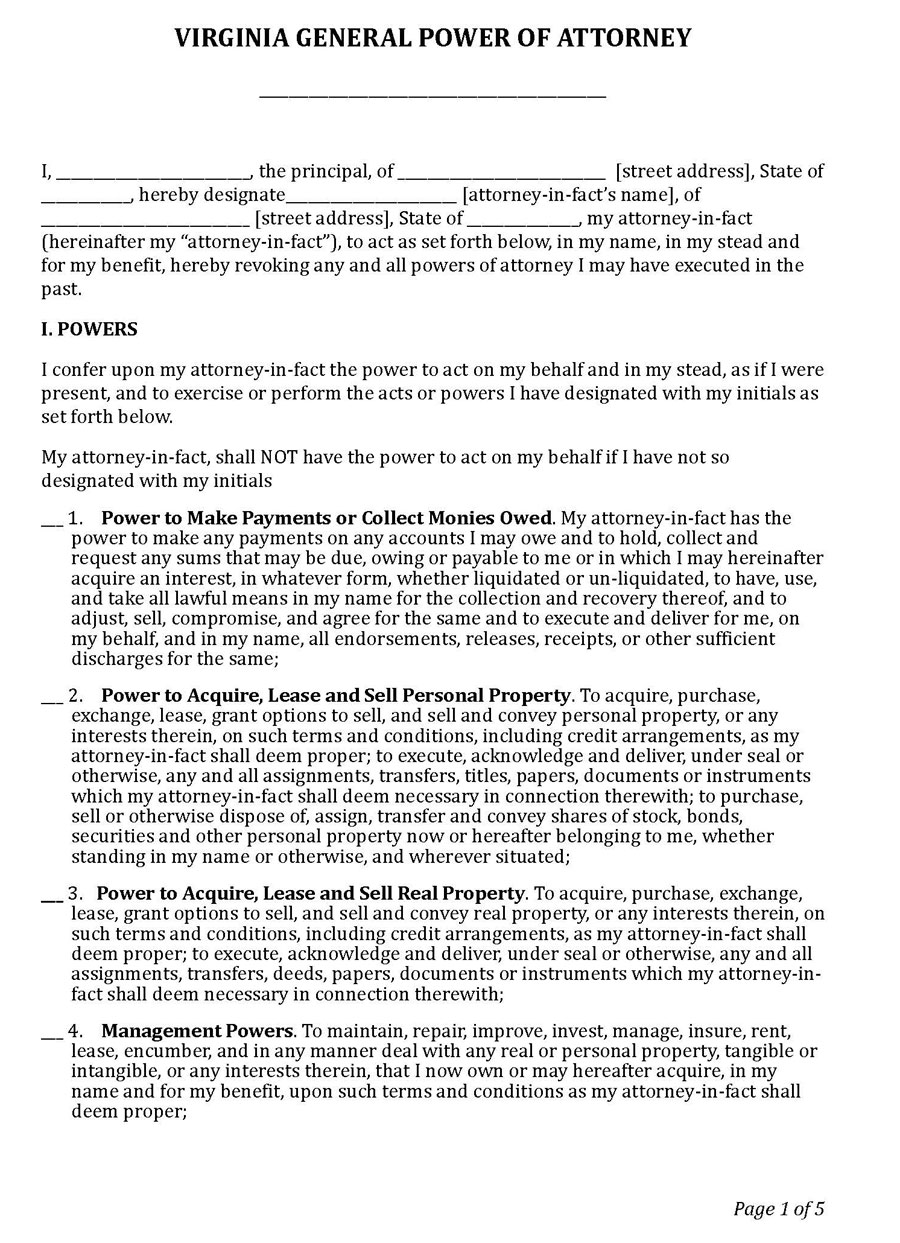

General (Financial) Power of Attorney Form

Download: Microsoft Word (.docx)

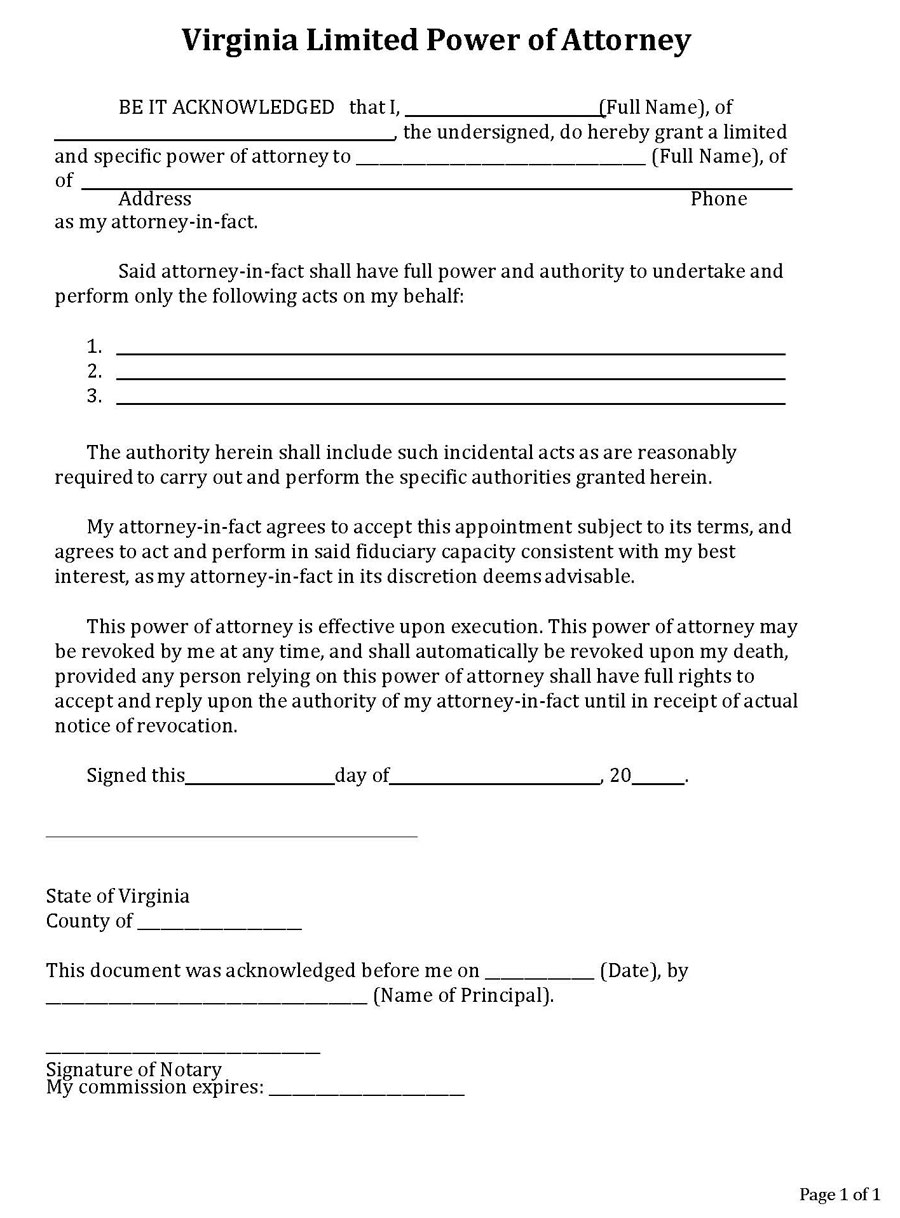

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

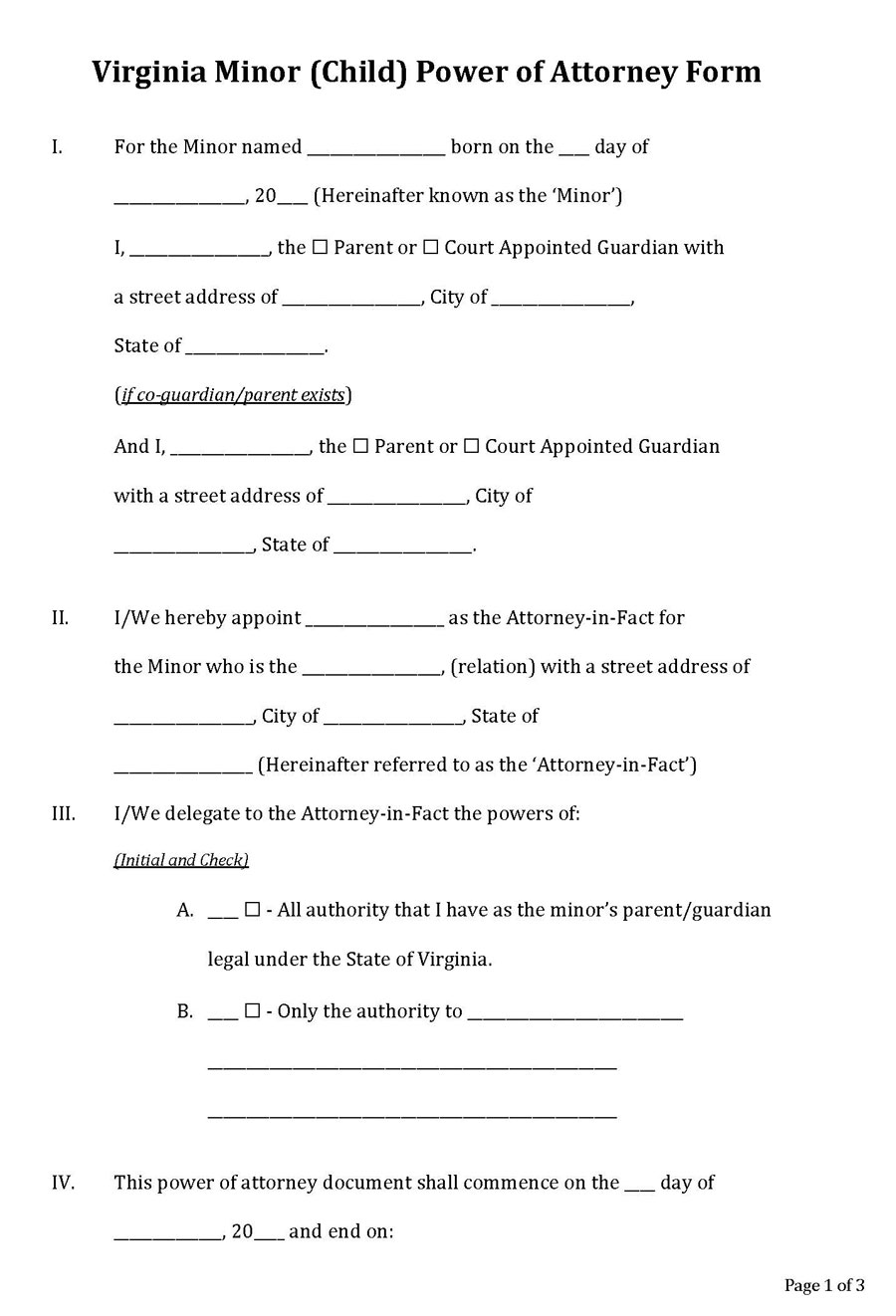

Minor (Child) Power of Attorney Form

Download: Microsoft Word (.docx)

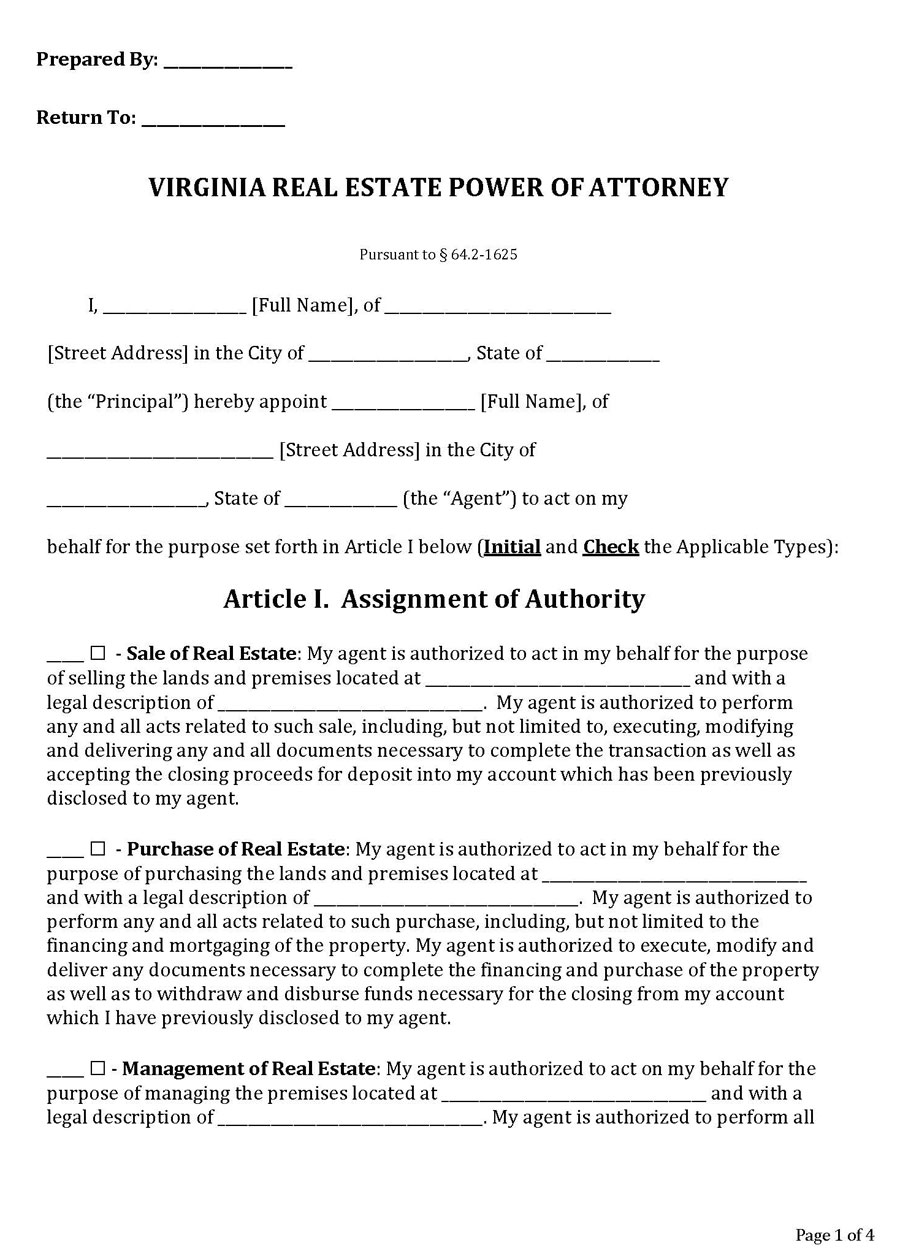

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

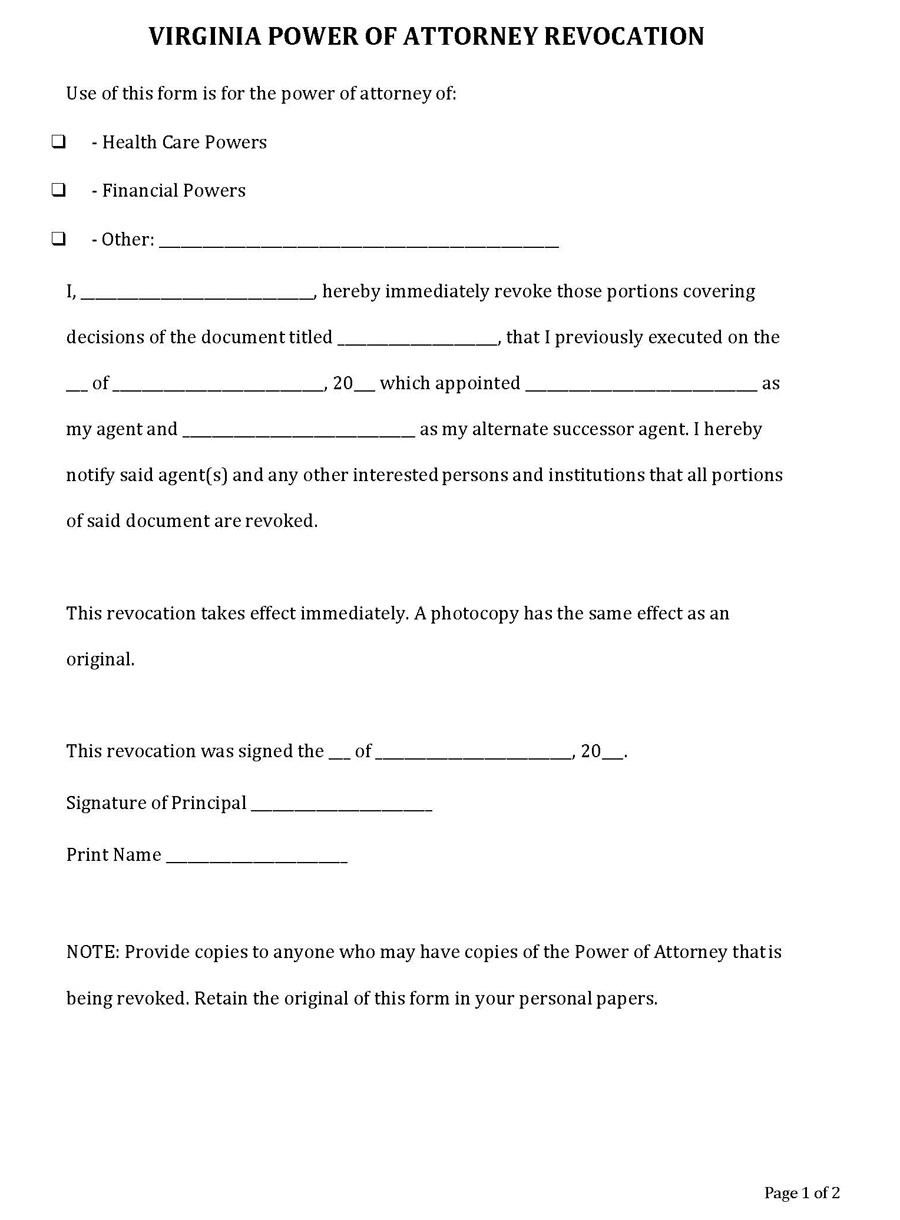

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

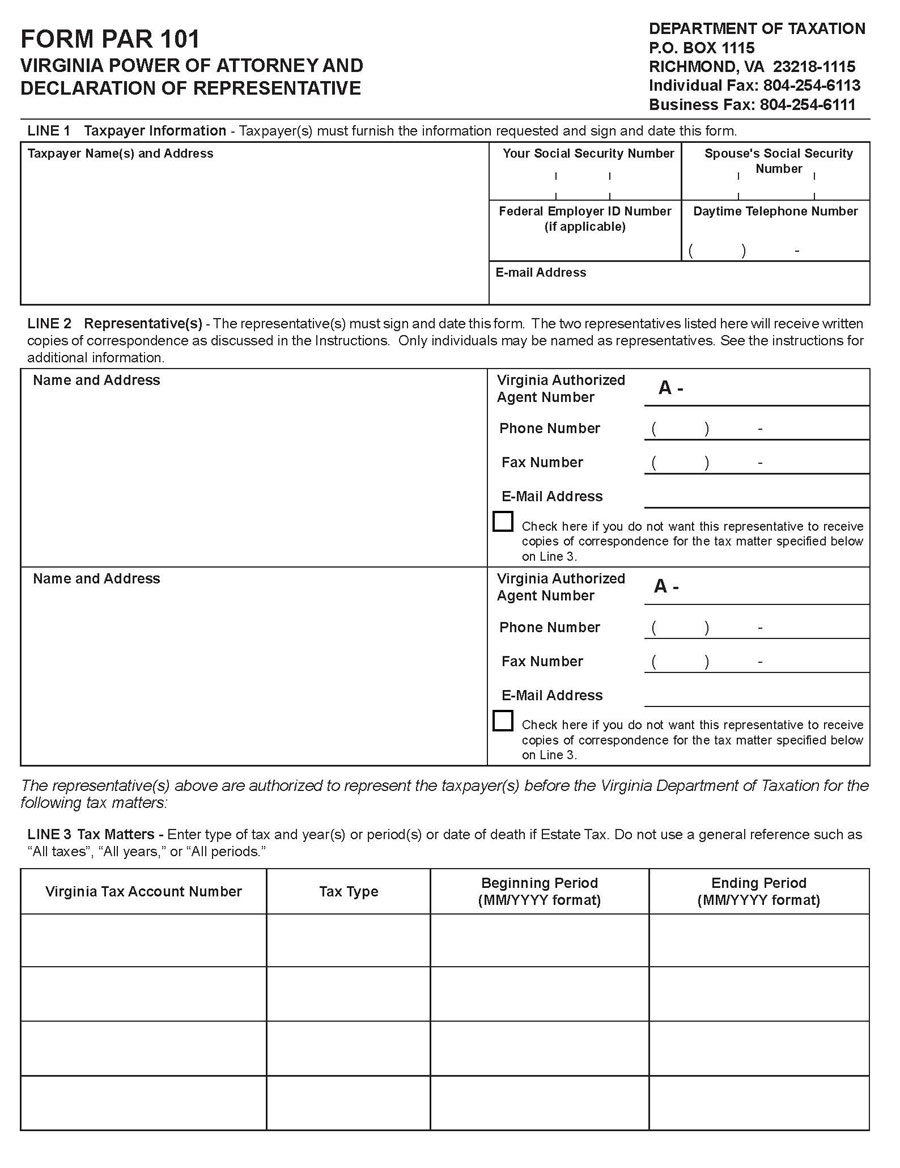

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

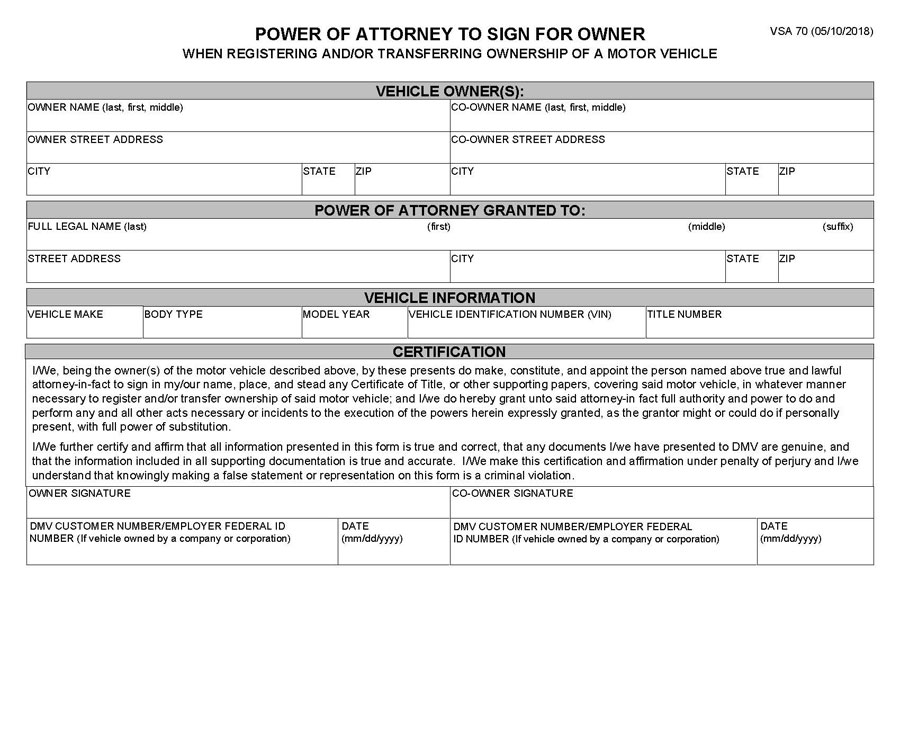

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

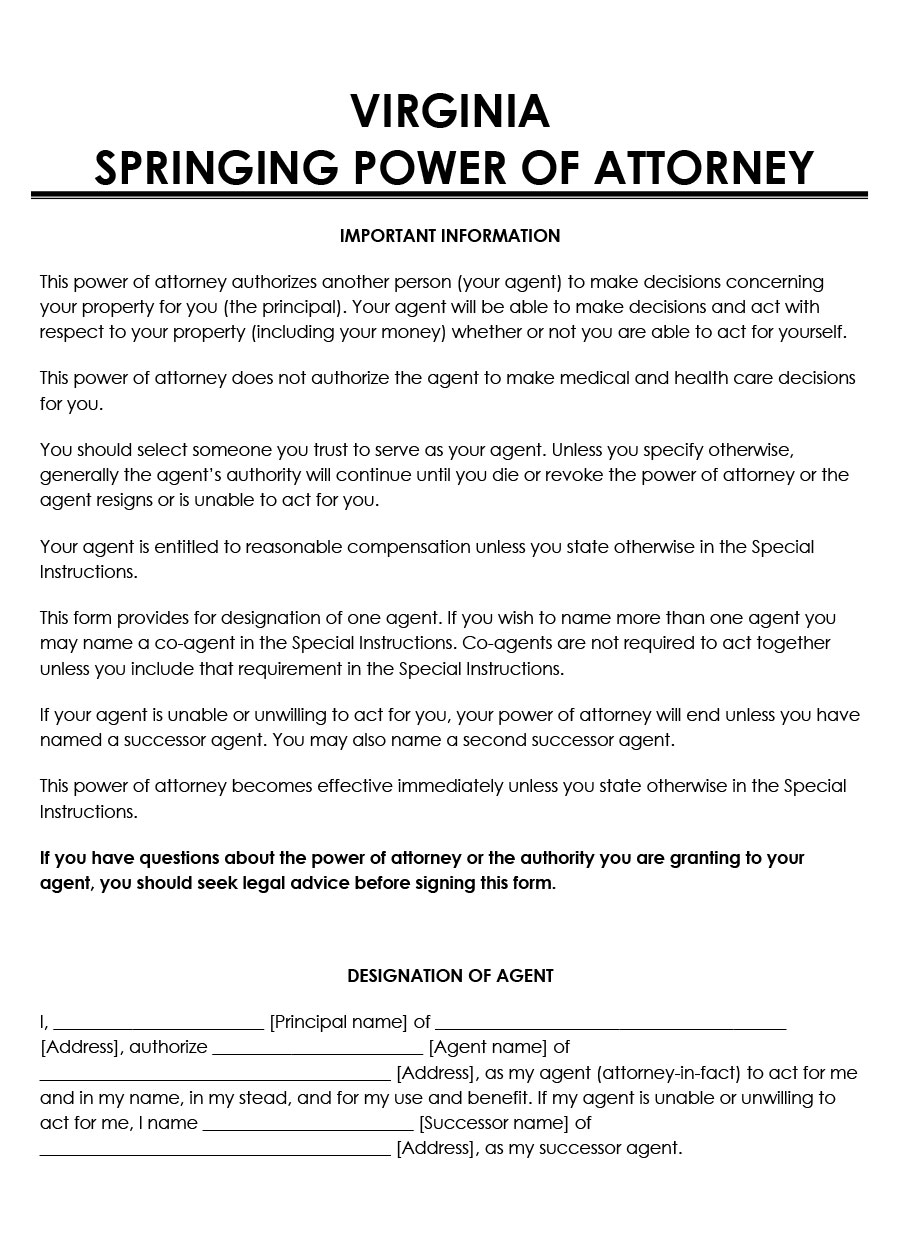

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Virginia Power of Attorney Requirements

POA is a powerful legal tool and, as such, is regulated under the law to discourage exploitative criminal acts. The state of Virginia lists out specific conditions which must be satisfied when creating a POA to ensure the document is complete enough to be backed by the law and prevent the exploitation of anyone.

The requirements to satisfy for creating a POA in Virginia are listed in §55.1-600 and §64.2-1603 of the Code of Virginia:

- the POA must be in writing.

- the POA must be signed by the principal or in the principal’s conscious presence by another individual directed to do so by the principal.

- the principal must sign the POA in the presence of a notary public or other individual authorized by law to take acknowledgments.

- the name and contact information of the agent(s).

- the date of the agreement.

- the powers grant to the attorney-in-fact

- when the powers begin and end.

Default rules of Virginia power of attorney

All powers of attorney created in Virginia possess inherent characteristics that state the extent of applicability of the POA. These inherent characteristics remain valid to a POA unless explicitly stated not to be so by the principal.

These include:

- POA becomes effective immediately after being established. The agent receives immediate authorization to begin acting on behalf of the principal when needed. This exemption is a springing POA that only activates after a specific event. If a POA is set as a springing POA, this rule does not hold.

- If more than one agent is named to act by the principal, each agent can act independently of the other co-agent.

- An agent is entitled to reasonable reimbursement or compensation for any reasonable expenses incurred while acting on behalf of the principal.

- The principal’s estate plan is to be preserved by the agent unless preserving the estate is not consistent with the principal’s best interest.

- The agent is to avoid a conflict of interest with the principal’s wishes.

- The agent must be loyal to the principal in all their actions.

- The agent is to act diligently and, in the principal’s, best interest and keep records of whatever decision is made on behalf of the principal.

How to Get Power of Attorney in Virginia?

Getting this entails an individual declaring their intent to authorize a person to act on their behalf and satisfy the appropriate authority that their representative will act for them. However, every stage of this should be completed with careful consideration of the magnitude of the authority being granted and compliance with the laws of Virginia.

Choose your agent

The person chosen to function as the principal’s representative embodies the same authority as the principal in whatever affair they are authorized to act in. Therefore, agents should be people who are trusted, have a good sense of judgment, and preferably have a record of being able to make the kinds of decisions with which they are being entrusted.

Decide powers to give your agent

An agent can only act within the authorization given by the principal. Therefore, consideration should be given to what the agent should do. Due authorization in all affairs that will allow the agent to complete their duty unimpeded should be granted, but no more.

Find a reliable form

POAs are legal documents expected to comply with some regulations. POA forms are partially-filled documents drafted by either a governmental agency or a third party that a principal can fill to declare their intention of granting authorization. For tax and vehicle POAs, the appropriate government-issued statutory forms must be used. Forms drafted in compliance with the laws of Virginia by third parties can be used for making other POA types.

Sign the form

A POA must bear the principal’s signature to indicate that the agent was authorized legally. The principal must sign the POA (or have the POA signed on their behalf). If the POA is signed on behalf of the principal, this fact must be indicated.

Witness requirements

A POA must be signed in the presence of a notary public or other public agent authorized to acknowledge such signings. This certifies before an officer of the law that the principal is authorizing their chosen representative.

Frequently Asked Questions

It is not essential to involve a lawyer when creating a POA. There is also no restriction on involving a lawyer when creating a POA. A lawyer can be consulted when drafting up a POA to decide on the amount of power to give an agent or avoid loopholes that give an agent unprecedented power. Beyond this, a lawyer is not needed for creating a POA.

Yes, the authorization granted to an attorney-in-fact can be recalled by the principal. This is accomplished by drawing up a revocation of POA document. This document states the principal’s intent of terminating an existing POA. When signed by the principal and after being notarized, this document effectively revokes the agent’s powers. Parties with whom the agent might have contact must be presented a copy of this document to notify them that the agent no longer speaks for the principal.

A POA can only be recalled by a certified principal who is mentally competent to make independent decisions.

This can only be obtained if the principal (elderly parent) is still mentally competent to make independent decisions. If so, the procedure for obtaining a POA is the same as indicated above. If the principal is no longer mentally competent, a POA cannot be obtained. To facilitate the care of such persons, a probate or family court will have to be petitioned to grant guardianship.

The cost for obtaining a POA in Virginia can vary significantly based on the resources used during the process. If an attorney is engaged to create the POA, the cost of hiring the attorney can range from $150 or more. If the POA is personally drafted, obtaining a POA form will be a significant cost. However, some websites can charge as much as $30 for a form. The other significant cost is the fee of the notary public who notarizes the document. In Virginia, this fee will not exceed $5.00.

So, for a POA drawn up from a free online resource without the involvement of an attorney and acknowledged by a notary public, the cost should not exceed $5.00.