A Hawaii Power of Attorney (POA) is a legal document that permits another person to manage both legal and financial affairs on your behalf under specific conditions and scenarios.

EXAMPLE

Selling your property, accessing your financial accounts, and signing contracts.

In this case, the person appointing another person is the ‘principal.’ In contrast, the one assigned to act in place of the principal is the ‘agent.’ It is suitable for residents in all Hawaiian states. But since some POA can be pretty broad, they are personalized to fit particular situations specifically for an agreed period.

Or, in some cases, they are utilized in various scenarios for a more extended period. As you use these forms, you need to remember that your agent will present this legal document as confirmation that they can act in your interest.

For that reason, one of the critical factors to consider is who your agent will be. Your agent will be making judgments that will affect you and your possessions. Therefore, it’s crucial to have one who is at least accountable, dependable, and accessible.

Download Free Forms

Reasons for Having a Hawaii POA

It’s crucial for everyone above 18 to have it. While it can be difficult to admit, there are times one might be unable to manage their affairs on their own, such times are almost inevitable.

There are several scenarios when a POA might come in handy including when you’re getting older and struggling with mobility issues. Or in other cases, if you intend to leave your house and enter an adult care facility.

Also, a POA is beneficial if you intend to live or travel to another country for a short period or in the long term. If you’re legally incapable or absent, a POA will help you give someone you trust the mandate to make crucial decisions and take legal actions on your behalf.

Therefore, whether you’re creating this in response to an immediate need or as a part of a long-term strategy, witnesses and notarization can help preserve the integrity of the document if called into question by a third party.

Types of Power of Attorney

There are undoubtedly different types depending on the powers they grant. That said, we can put these POAs in nine categories as follows:

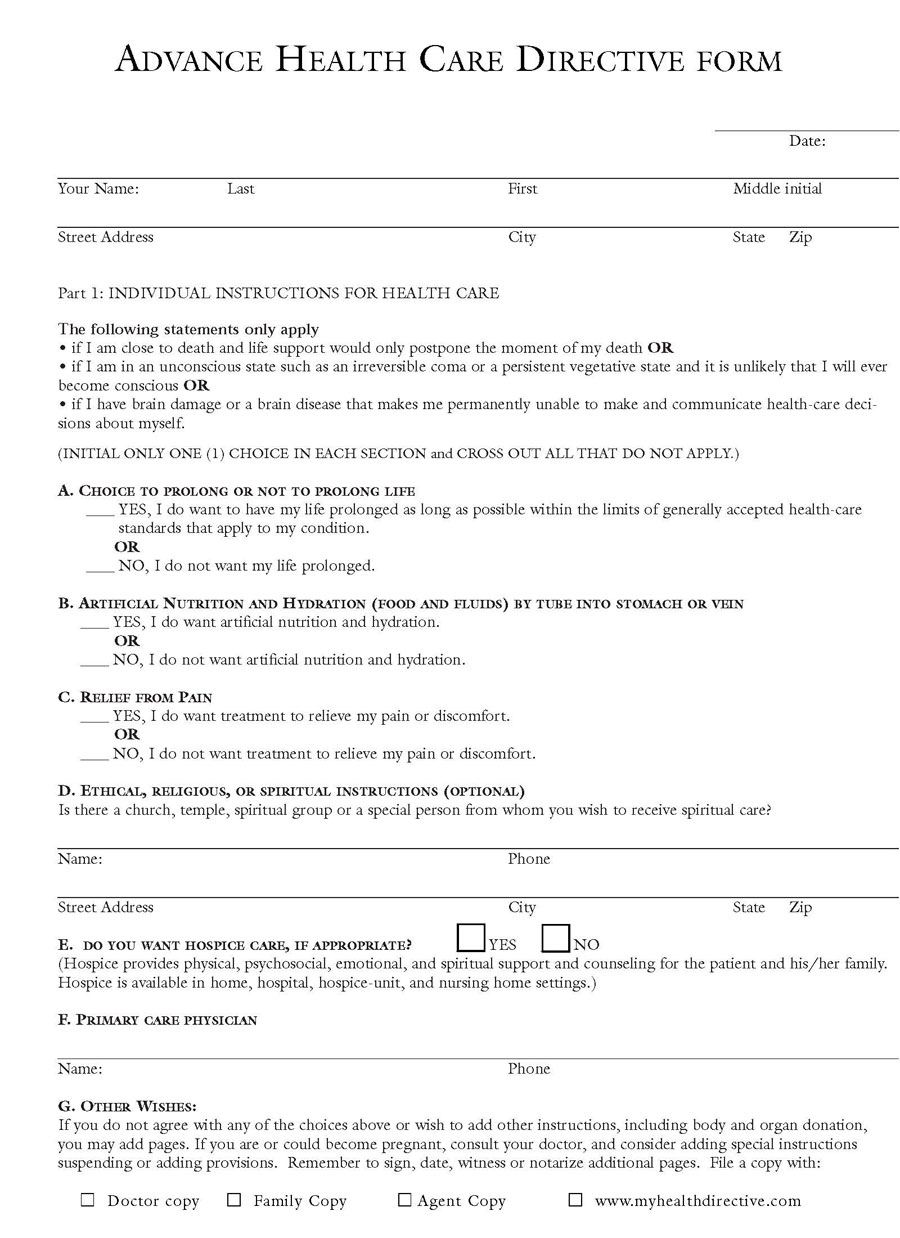

Advance Health Care Directive

The advance health care directive in Hawaii allows the principal to choose an agent who can make healthcare decisions when the principal isn’t in a position to do so through a power of attorney form. In addition, this form gives the medical staff taking care of the principal instructions on how they wish to be treated in cases where they are permanently incapacitated.

The Advance health care directive is governed by Chapter 327E (Uniform Health Care Decisions) Statute law. The signing requirements are well expressed in (§327E-3(b)), requiring a notary public and two witnesses.

The advanced health care directive comes in handy for the elderly and any other person seeking an advanced plan. Other laws related to the Advance Health Care Directive include the Hawaii durable (financial) power of attorney and last will.

Download: Microsoft Word (.docx)

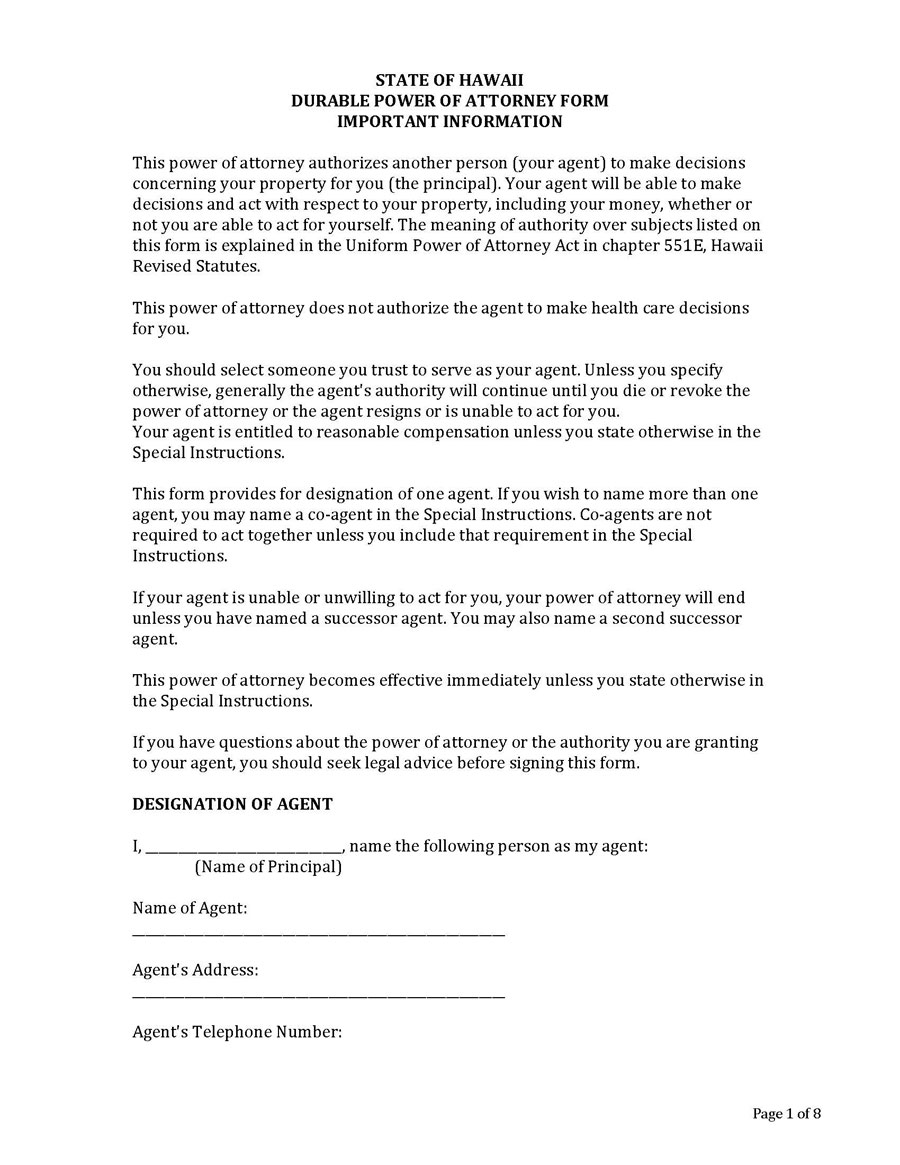

Durable (Statutory) Power of Attorney

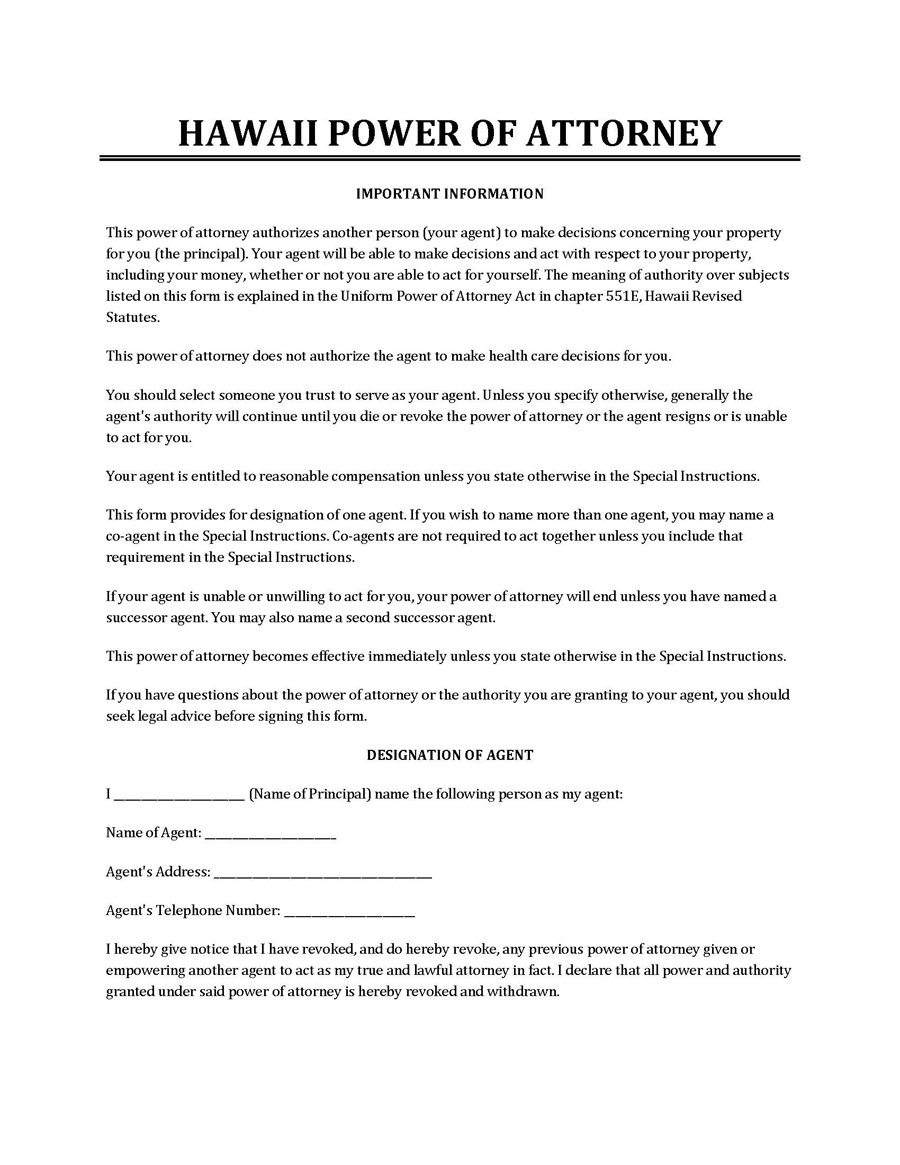

The Hawaii durable power of attorney form delegates responsibility for financial matters, assets, and property to an agent. Therefore, it’s essential to carefully read the document to ensure that the rights granted to the agent are correct.

Also, the principal must appoint an agent they can trust and who will act in the principal’s best interest. Finally, this sort of POA is known as durable since it remains even after the principal becomes incapacitated, unable to make choices on their own.

According to Uniform Power of Attorney ACT 551E-1, durable means that the principal’s incapacity does not terminate the power of attorney. At 551E51 of the Hawaii Revised Statutes, there is a sample statutory form for a durable power of attorney.

As for the signing requirements, the principal authorizes the agent’s signature before a notary public. However, they must also complete an Agent Certification signed before a notary public to give that extra layer of certification.

Download: Microsoft Word (.docx)

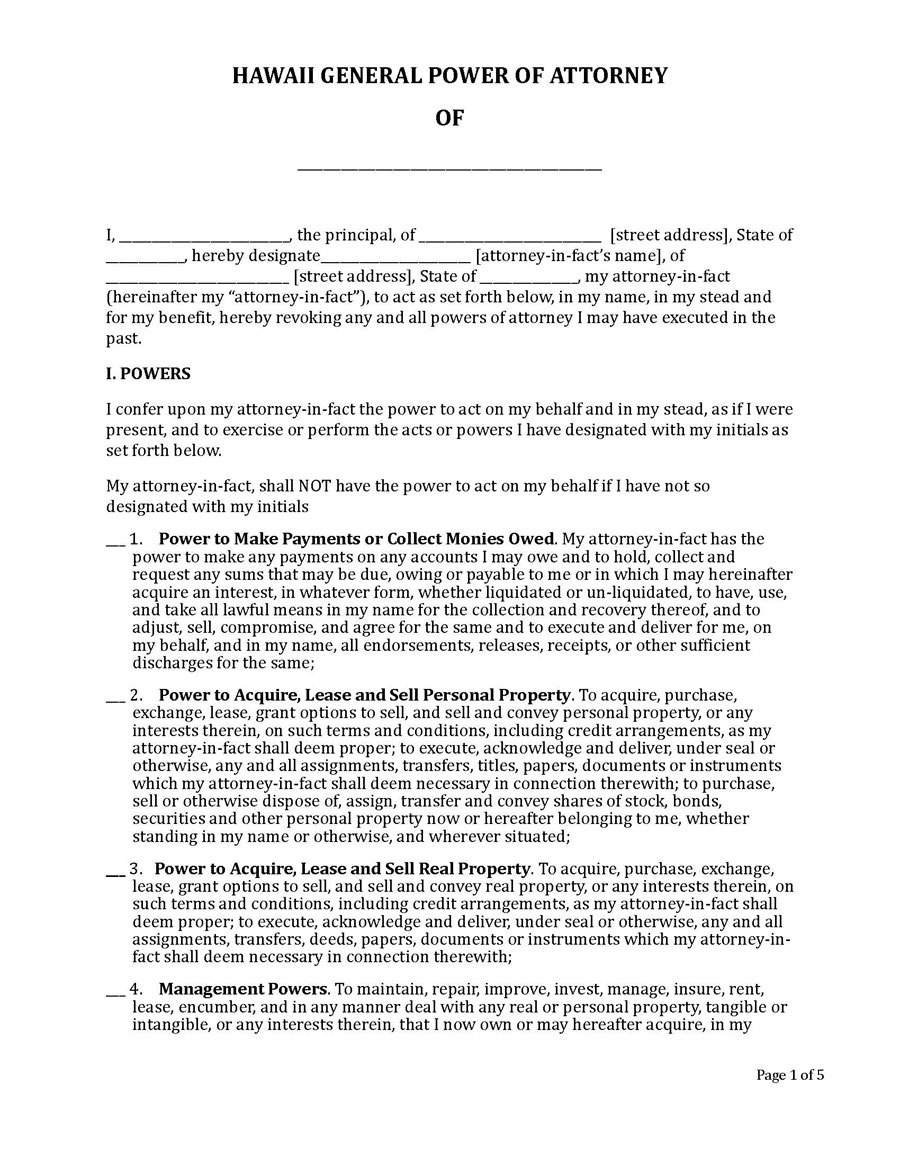

General (Financial) Power of Attorney

The general (financial) power of attorney in Hawaii establishes that the principal intends to appoint an agent to represent them in property and financial matters. This sort of POA form comes in handy for individuals who will probably be abroad or unavailable.

Also, the general (financial) power of attorney suits a person who cannot act on their matters. Or, simply, just anyone who needs a representative agent in charge of safeguarding their assets as they find it more convenient to delegate.

Overall, the general (financial) power of attorney differs significantly from the durable one. The general POA becomes void in situations where the principal is incapacitated. Since the principal is not in a position to cancel the POA after incapacity, then it shouldn’t be allowed to continue unless it was specified in the form.

The statute law governing the general (financial) power of attorney is the Uniform Power of Attorney Act (§§ 551E-1 — 551E-63). Also, according to (HRS § 551E-3) we will require a notary public to fulfill the signing requirements.

Download: Microsoft Word (.docx)

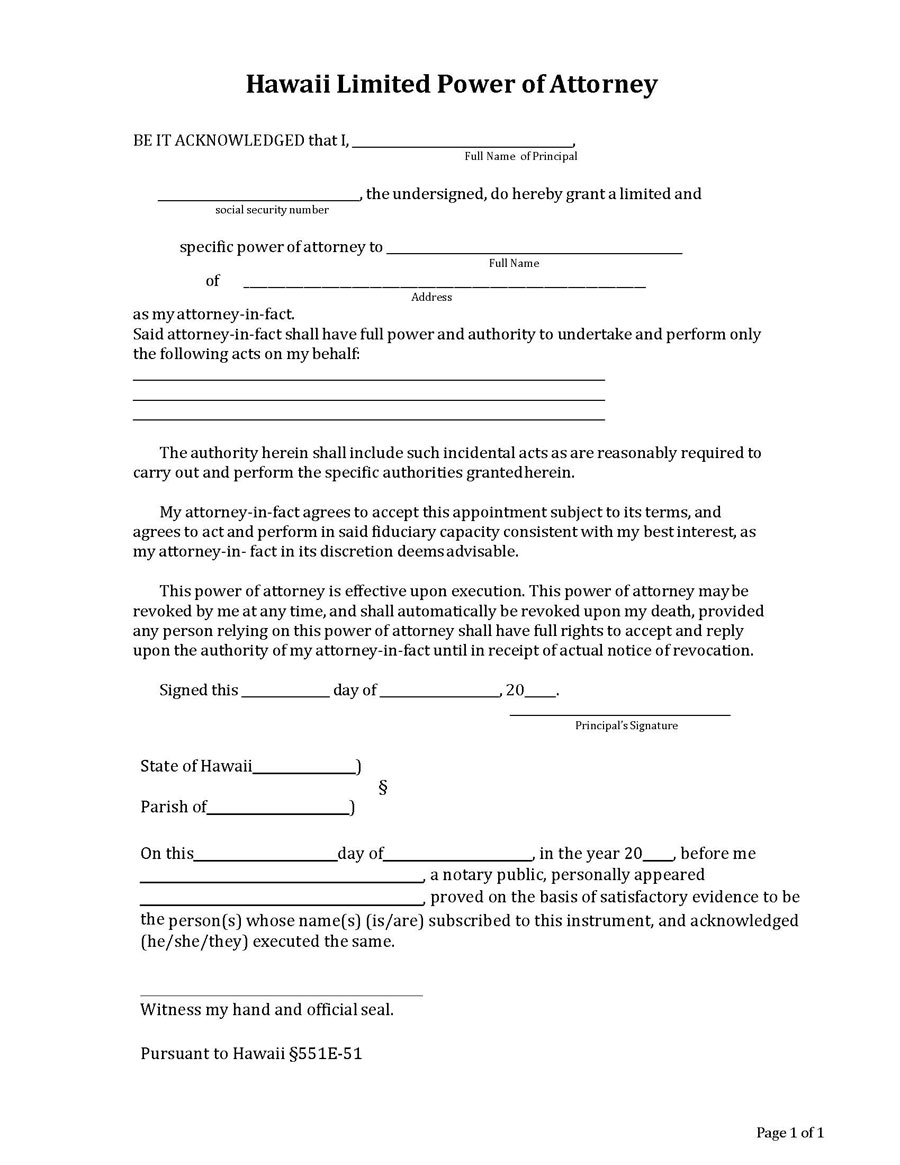

Limited Power of Attorney

The limited power of attorney in Hawaii designates the principal to delegate their authority to an agent. The appointed agent is permitted to act or perform a specific task on behalf of the principal for a set length of time.

Since you don’t want the POA to be interpreted more broadly, you must define the specific task you need the agent to do and the timeframe for which you require the agent to perform on your behalf. Ensure everything is explained accurately.

Any broad interpretation of this document could potentially be unproductive and lead to unintended outcomes if misinterpreted. Therefore, the limited POA is used in particular circumstances.

The statute law governing the limited power of attorney is the Uniform Power of Attorney Act (§§ 551E-1 — 551E-63). Also, to fulfill the signing requirements, a notary public must be present according to (HRS § 551E-3).

Download: Microsoft Word (.docx)

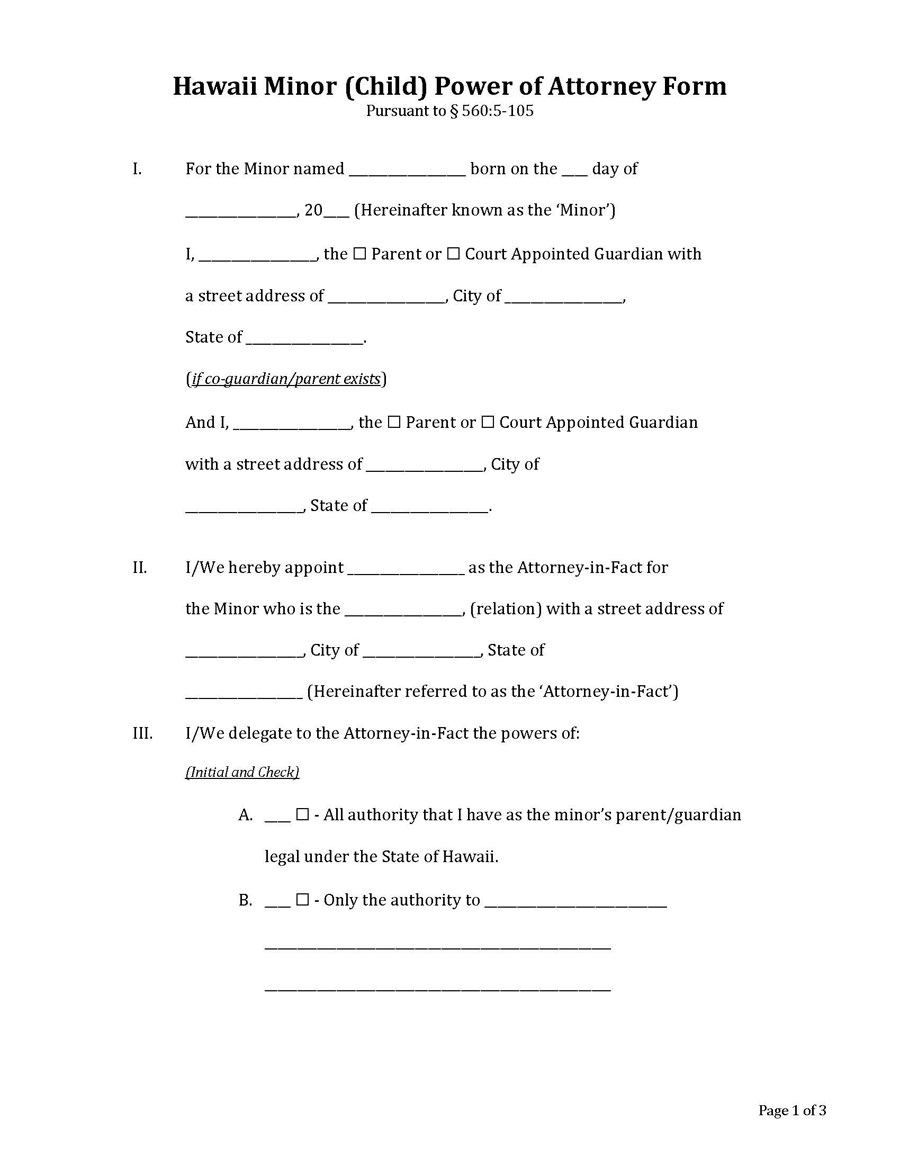

Minor (Child) Power of Attorney

The minor (child) power of attorney in Hawaii empowers the parent to appoint caregivers to make confident decisions on behalf of their children if they aren’t in a position to make these decisions themselves. Parents who decide to use the minor POA should select a friend or relative capable of carrying out the responsibilities and authority of making crucial decisions on behalf of their child.

It comes in handy for parents who need to appoint a guardian for their minors if they anticipate being unavailable or deployed. This POA is valid until the parents can independently make decisions for their children. However, unlike other POA forms, the term of appointment is limited to a year as per § 560:5-105.

But if, for any reason, the period needs to be further extended, another document must be signed before that one-year period expires. Likewise, if more children need to be added to the form, a separate document must be used and then attached to the form. Note that this document could, however, be revoked in writing.

Download: Microsoft Word (.docx)

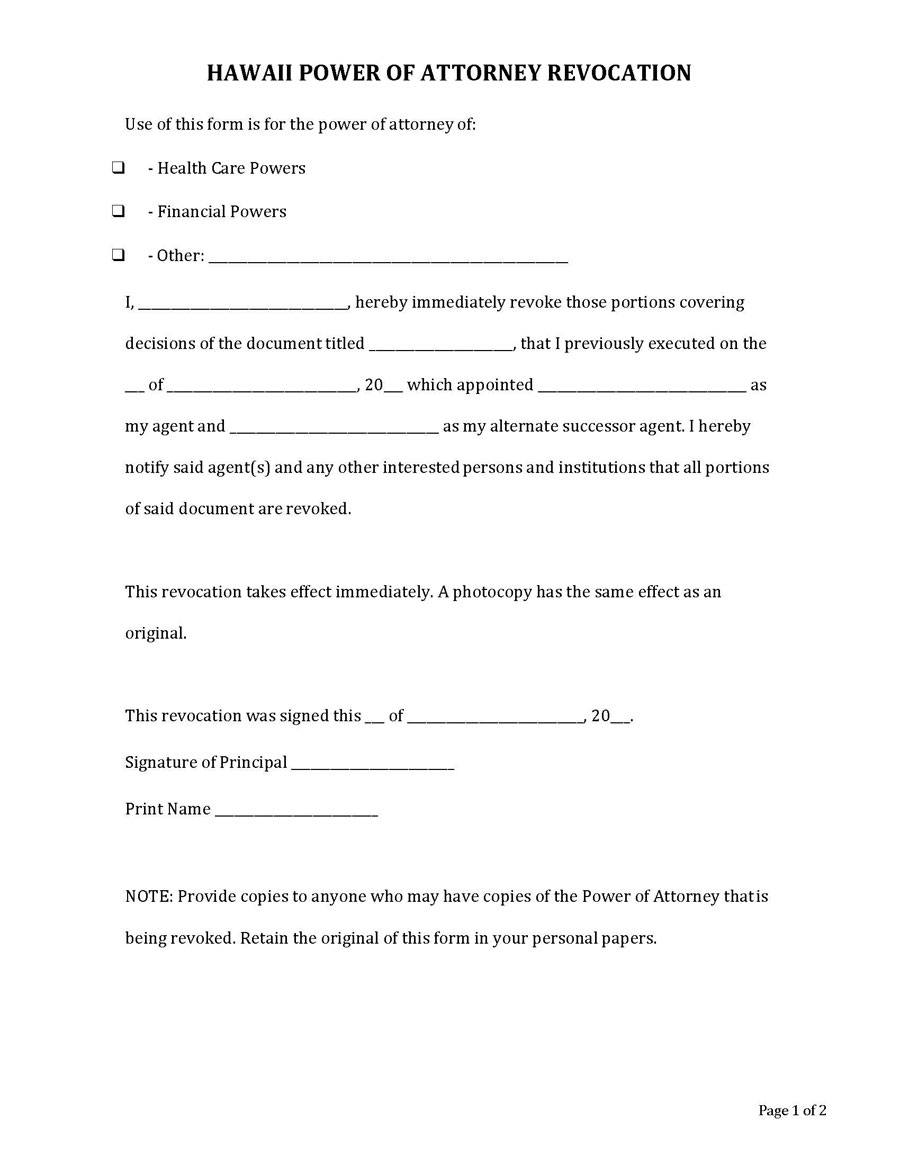

Power of Attorney for Revocation

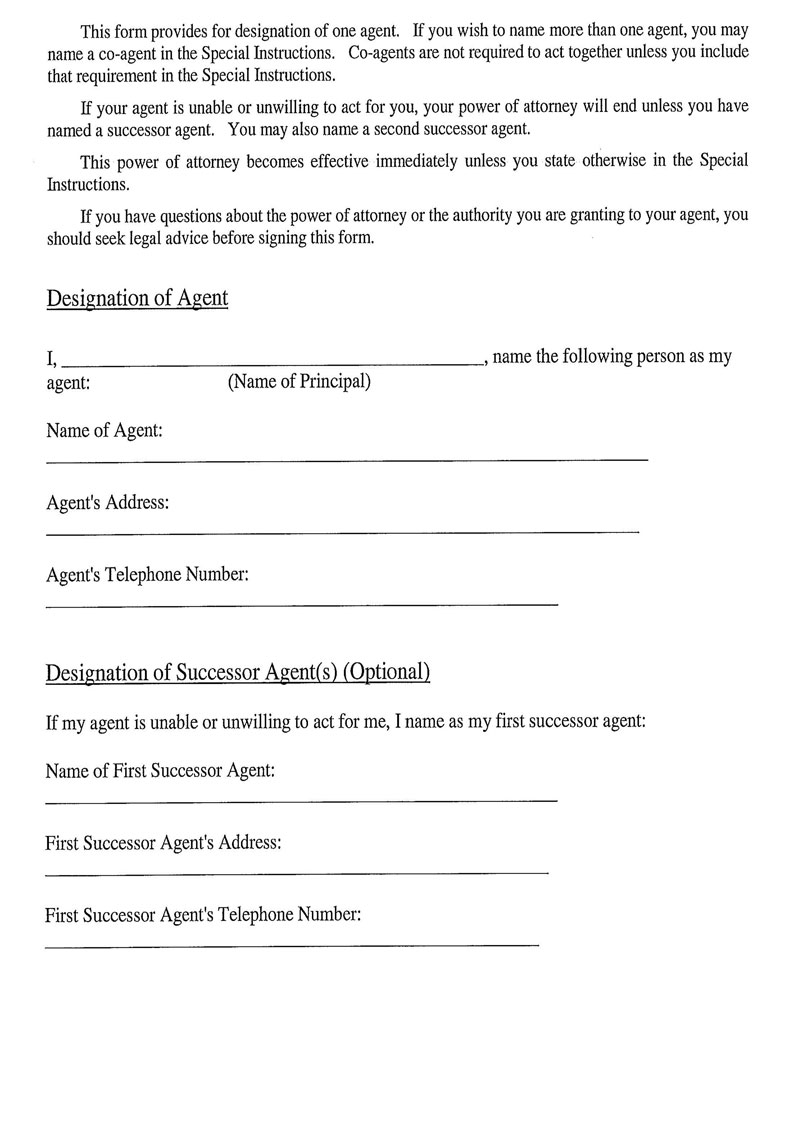

The Hawaii power of attorney for revocation is a document that will revoke any power of attorney that was signed off in the past. However, on top of filling the form out, the principal must be notified in advance that the cancellation process is underway. Also, any institution that relies on the previous document must be notified.

Any party involved in the previous document is notified, so they may act accordingly once the document is filed. It’s important to note that any third party who didn’t receive the revocation document or information will likely follow up in good faith based on the previous paperwork.

That could potentially hurt the revocation process. Therefore, it is essential to inform all parties involved in the documentation beforehand to be aware of what is happening. There are no laws governing this documentation, but it’s always an excellent idea to notarize it.

Download: Microsoft Word (.docx)

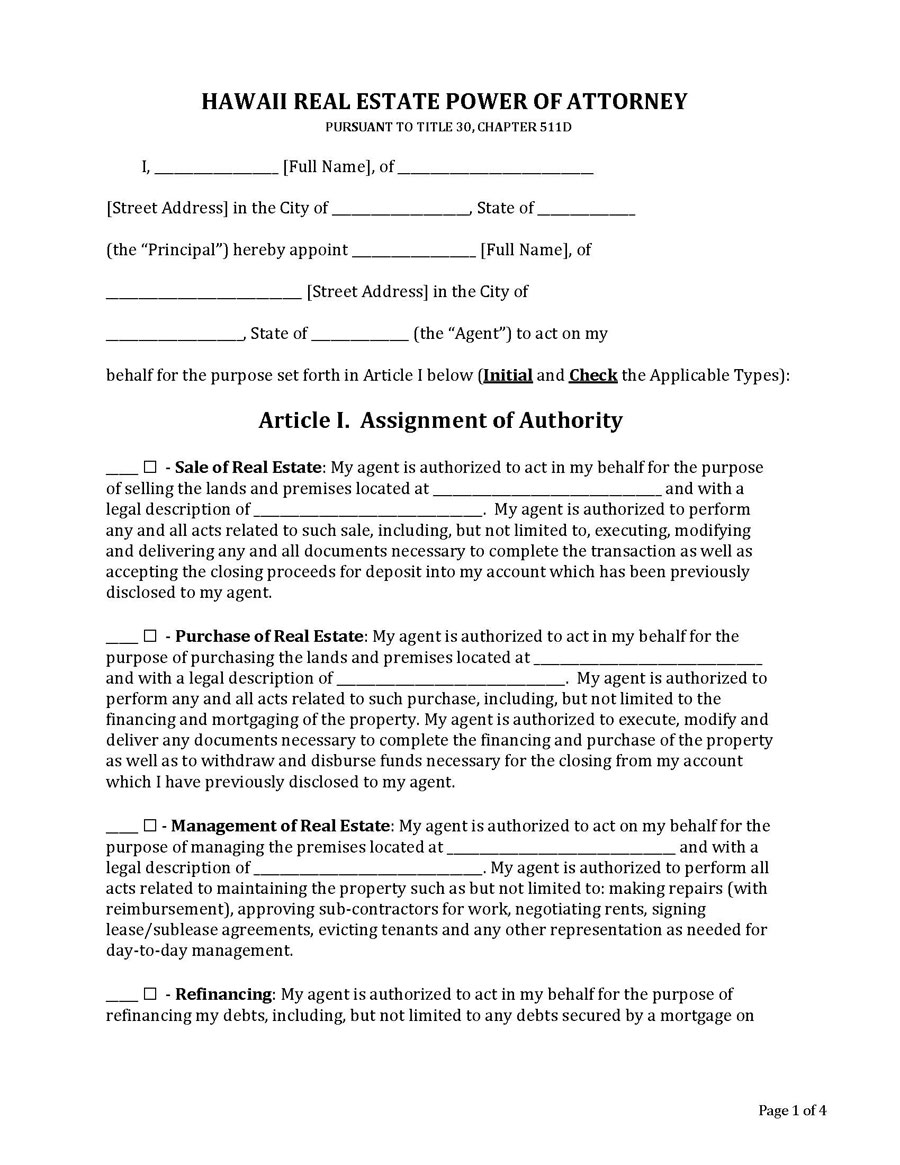

Real Estate Power of Attorney

Hawaii real estate power of attorney is a document that helps the landlord designate a representative who will handle all matters regarding the purchase and the sale of their property. The documentation is primarily used by a property owner (someone with a title deed of real property).

Essentially, it grants power to close and conduct a sale, refinance, or even manage a specific real estate. Also, the document grants permission to the real estate attorney when completing a real estate sale.

Additionally, it may also be used in selecting a real estate attorney to conduct the business of the property on behalf of the property owner. However, several statutory regulations govern the real estate power of attorney, including the Uniform Power of Attorney Act (§§ 551E-1 — 551E-63). Once all signatures have been obtained, the notary must also be notified (HRS § 551E-3)

Download: Microsoft Word (.docx)

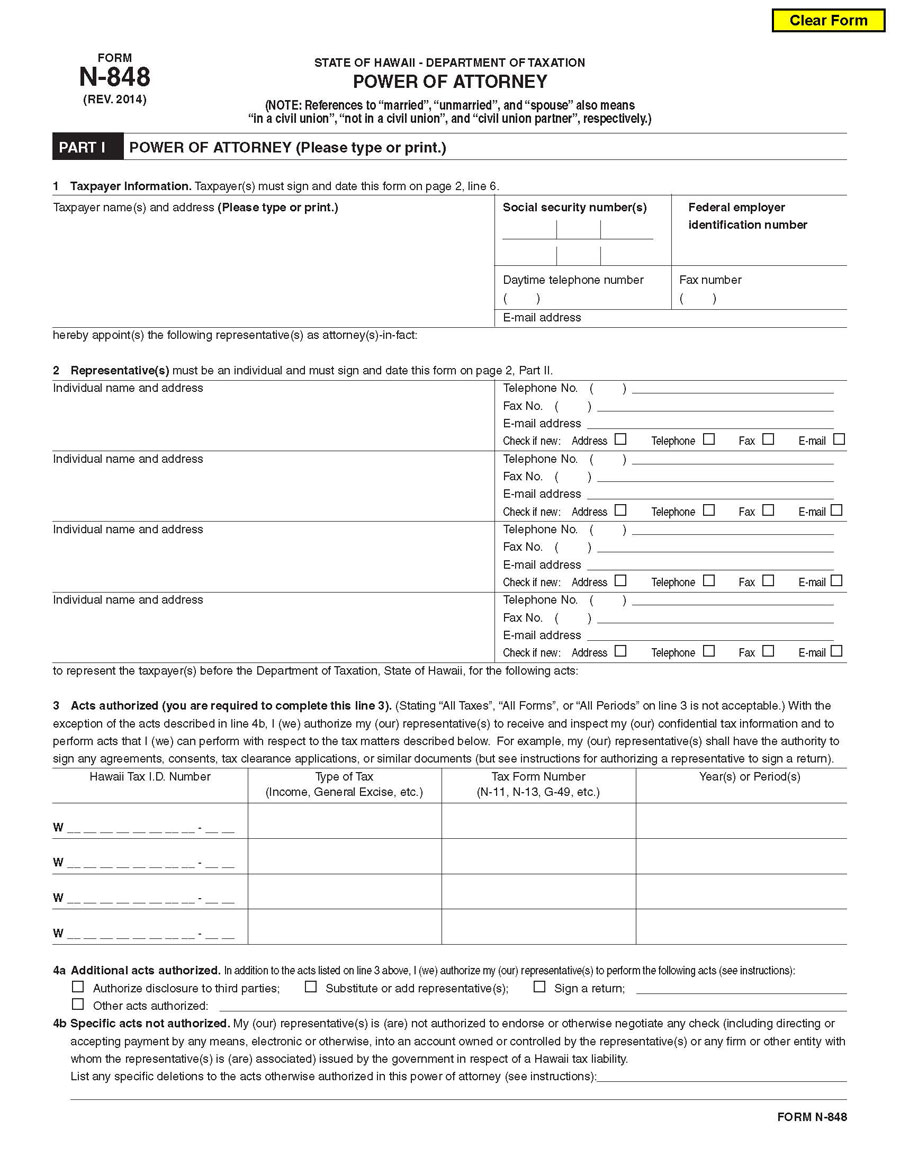

Tax Power of Attorney (Form N-848)

Hawaii tax power of attorney form allows a representative, usually an accountant or any other person with the suitable qualification, to represent you in front of the Taxation Department. The Department of Taxation provides someone you’ve appointed with a representative role to assist in filing taxes for a power of attorney.

Typically, the appointee will help with filing taxes, speak on behalf of their client, and obtain information regarding taxation. However, a notary will be required to sign the document before this takes hold. The signing requirements include the taxpayer and their appointed representative.

Download: Microsoft Word (.docx)

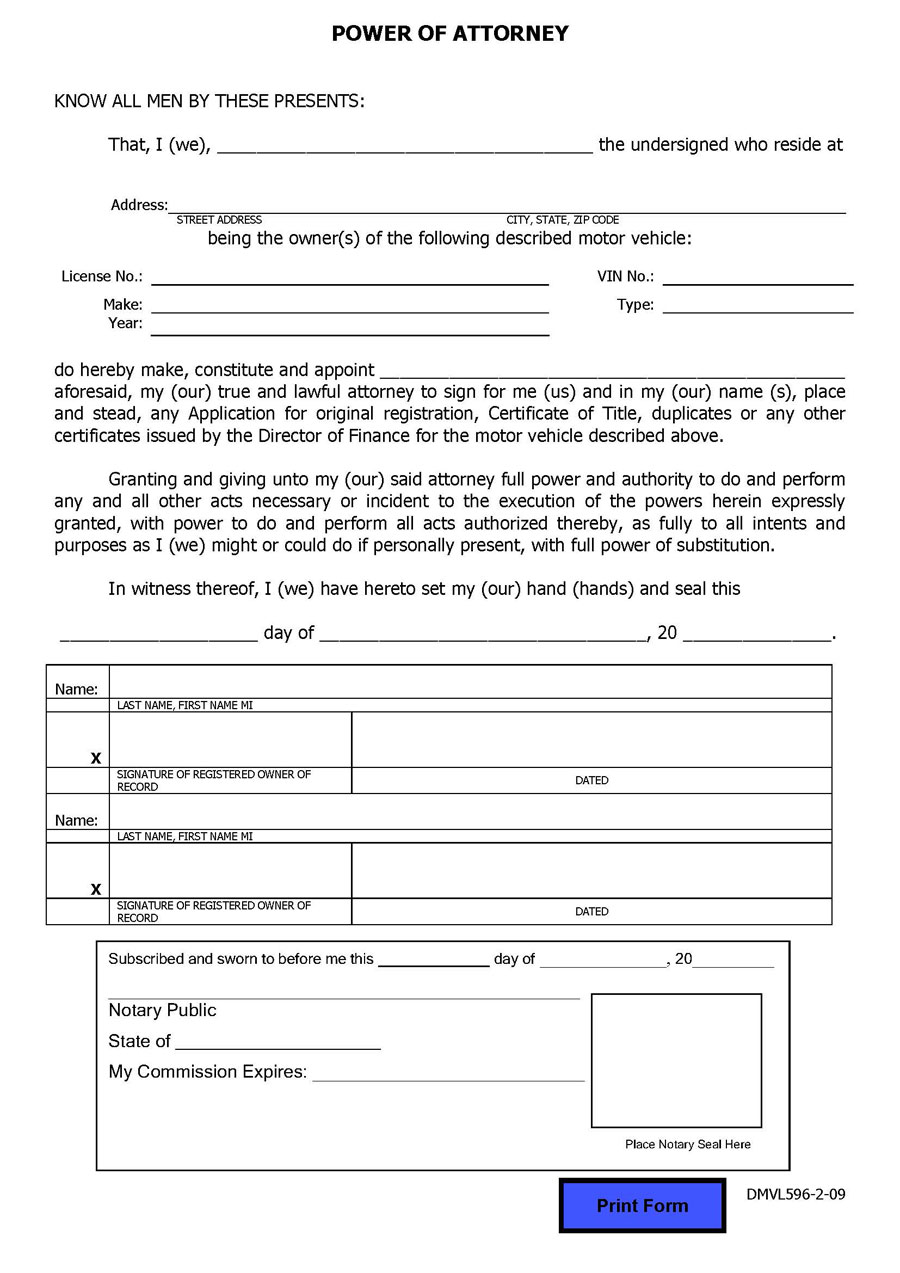

Vehicle Power of Attorney (DMVL596-2-09)

The vehicle owner can use vehicle power of attorney to enable someone else to deal with all matters regarding the vehicle in Hawaii. Unfortunately, Hawaii doesn’t have a county-level motor vehicle department for registrations and titling of vehicles.

Therefore, you should be ready for any regulations imposed in the paperwork before filing it out to be executed. The signing requirements here are a notary public and the vehicle owner.

Download: Microsoft Word (.docx)

How to Get Power of Attorney in Hawaii?

This section will cover how you can get it, which includes:

- The principle: The person giving their powers to an agent to act on their behalf

- An agent: The person receiving the powers. In situations where the first appointed agent cannot act, 2nd or 3rd agent may be involved

- The POA document: Will vary from one state to the other

- Signatures: The principal’s signature or any other individual directed by the principal to sign the document on their behalf in their conscious presence

- Witnesses: Depending on the states and the POA form, the principal and one or two witnesses’ signatures are acknowledged before a notary public. Witnesses, however, need to be individuals with no vested interest in the document. Therefore, they cannot be the agent or other person involved in the principal’s medical decisions.

For an individual to get it, the principal and the agent must discuss the powers to be given. Then, when that is agreed on, both parties need to fill out a form.

But before we proceed, note that for any individual to create and sign a POA form, they must be an adult who can read and comprehend the document’s requirements. Most importantly, the POA document must comply with the outlined rules in the Uniform Power of Attorney Act CHAPTER 551E.

As soon as the form is signed, witnessed, and notarized, it becomes effective unless specific dates or events are added. The POA stays active until a revocation form is filed and completed.

Frequently Asked Questions

While it is pretty straightforward, you or the agent you’re working with might still have a few questions. Working hand in hand with an attorney is a better option for such cases. They will offer expert guidance on how to handle the POA document and will answer any additional legal questions you or your agent might have.

The fees associated with hiring an attorney to get a POA on your behalf could range from $200-$500 in Hawaii, based on your state. The alternative is to the POA form for free online. It’s less time-consuming and cheaper than working with an attorney to get the form.

Hawaii power of attorney forms vary. Therefore, each POA document comes with its guidelines. The primary interaction is editing the POA, downloading it as a PDF or Word document, and signing it. The last step is to provide your signed copy of the POA to your agents and financial institutions.

Each state has its requirements governing the documents. However, Hawaii requires that POA forms should be notarized. Therefore, when the assigned agent participates in real estate transactions, the POA must be signed before a notary public. Alternatively, the POA should be filed or recorded within Hawaii.