A bank reconciliation statement is a document that compares or reconciles the company’s bank account with its financial records and provides a summary of all banking information and business activities.

You, as the company accountant, must include information in this document about all transactions that happened over a given period and had an effect on the company’s bank account, such as deposits and withdrawals.

When it comes to a bank reconciliation statement, it is all about preparing a financial document to help prevent fraud and cash manipulations within the company. As a company accountant, you are responsible for checking that the cash balance on the balance sheets matches the amount on the company’s bank statement. To make sure that financial reports are accurate, you will be required to prepare a statement for the business for a specific period, typically after one month.

The statement also enables the company to confirm that all required payments, cash collection deposits, and fee charges related to the company’s bank account have been made and are properly recorded. Make sure to record any discrepancies as you work to balance the balance at the end of the balance sheet with the amount on your statement. As the company’s accountant, this will assist in correcting your accounting records and resolving any discrepancies.

To perform the bank reconciliation process, you will need to check the financial records you have of bank and cash transactions and compare the bank statement sent over by the bank that contains details of deposits and withdrawals. This allows you to compare balances and prepare the statement to facilitate any necessary financial changes.

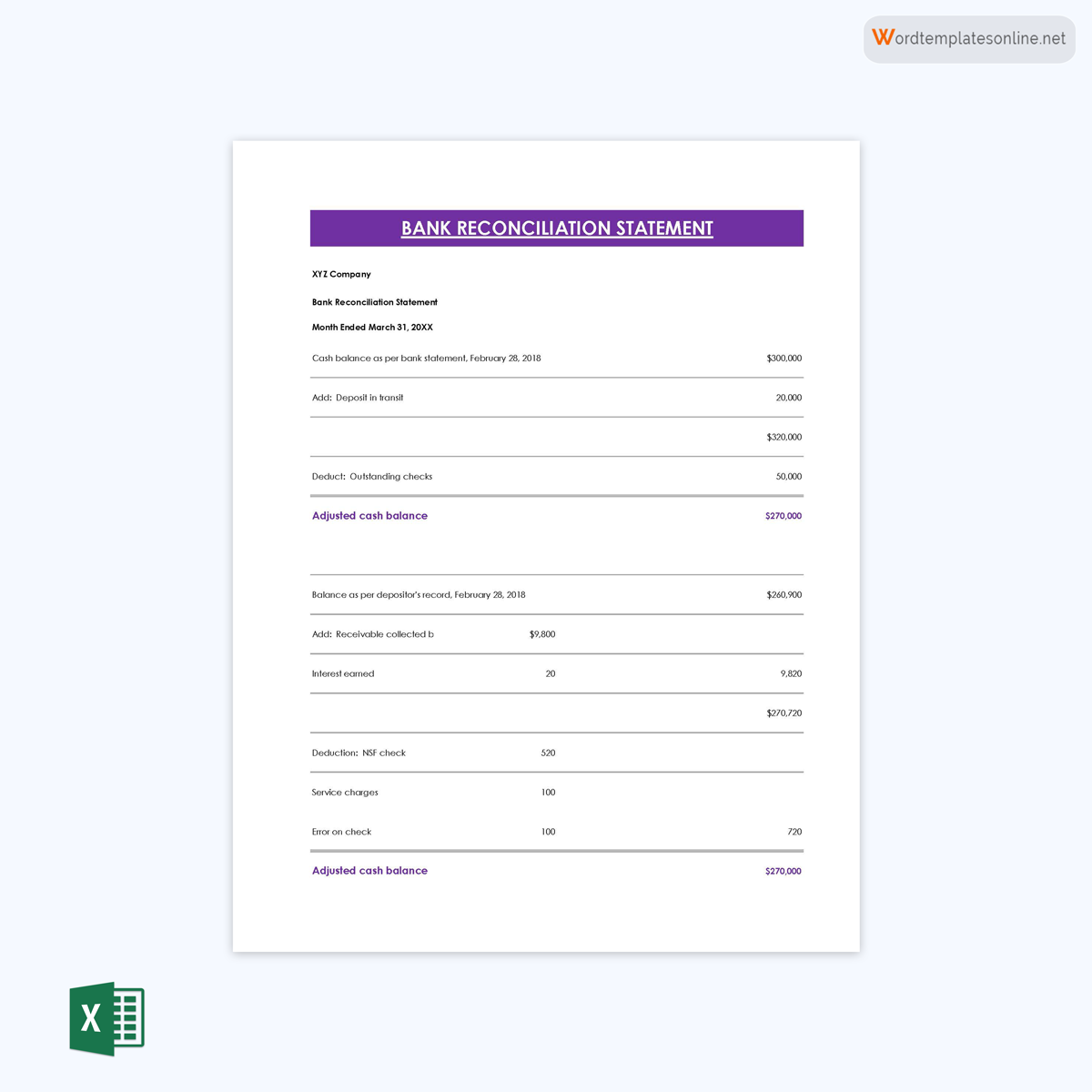

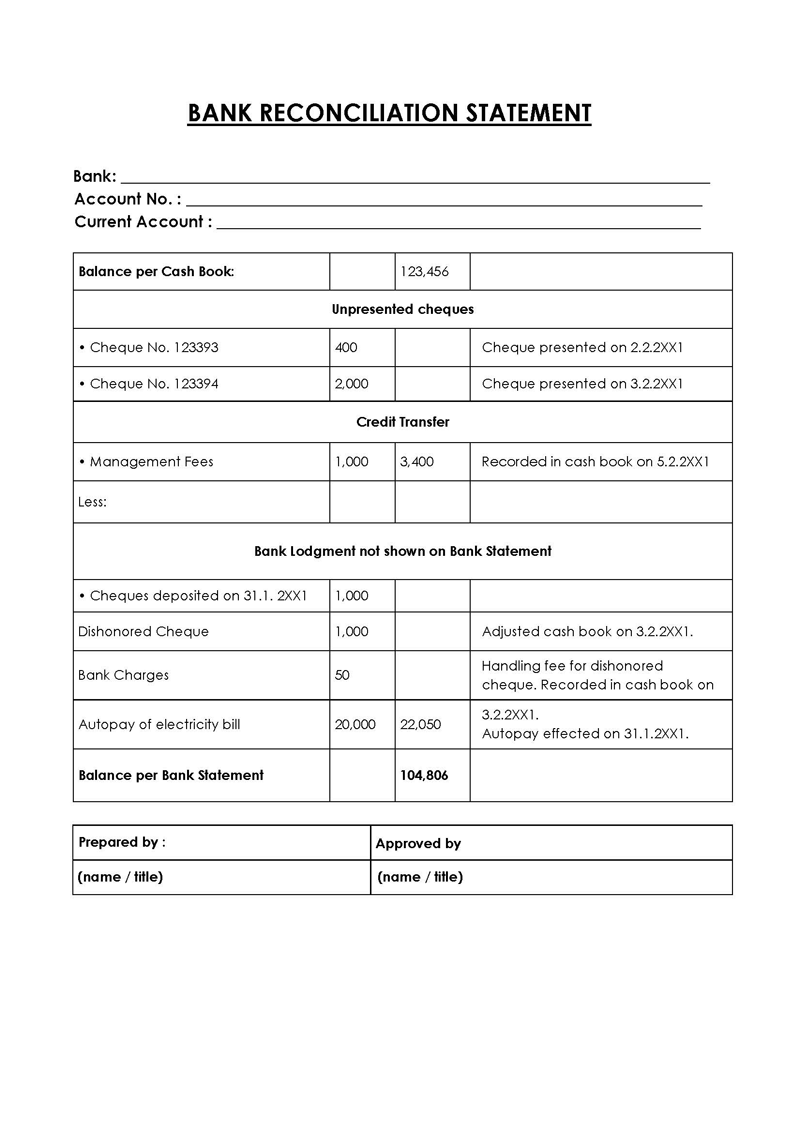

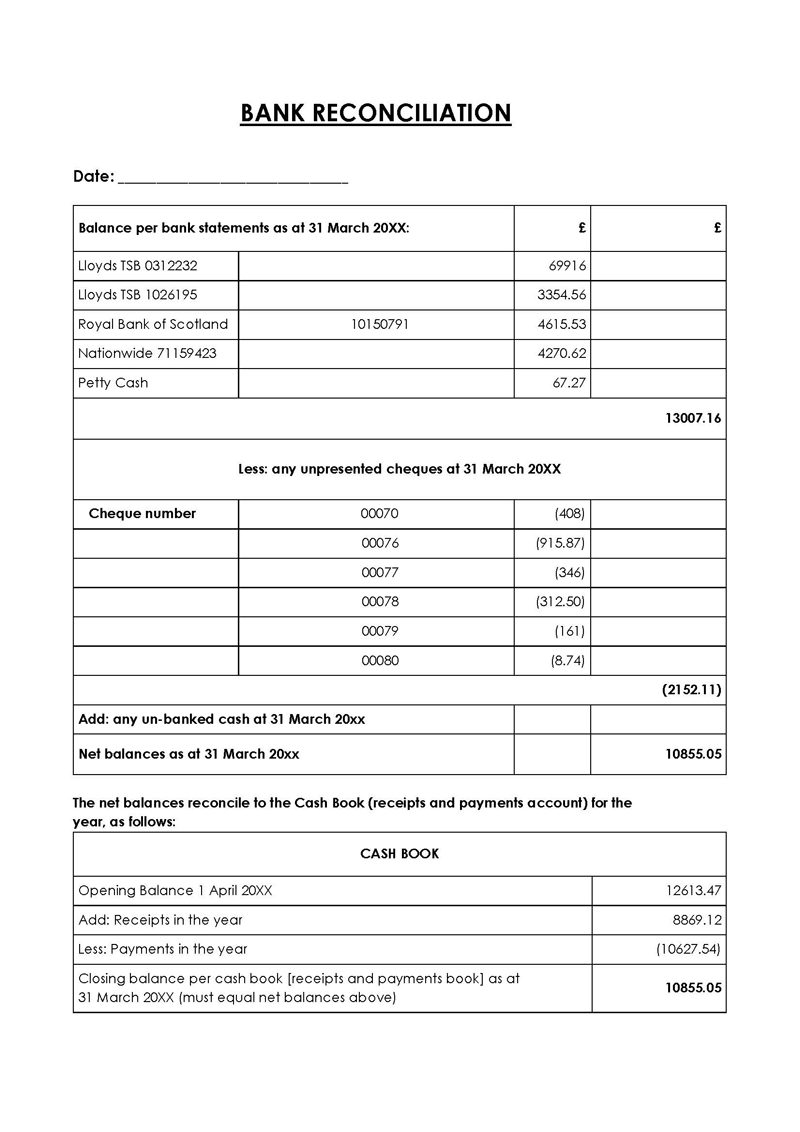

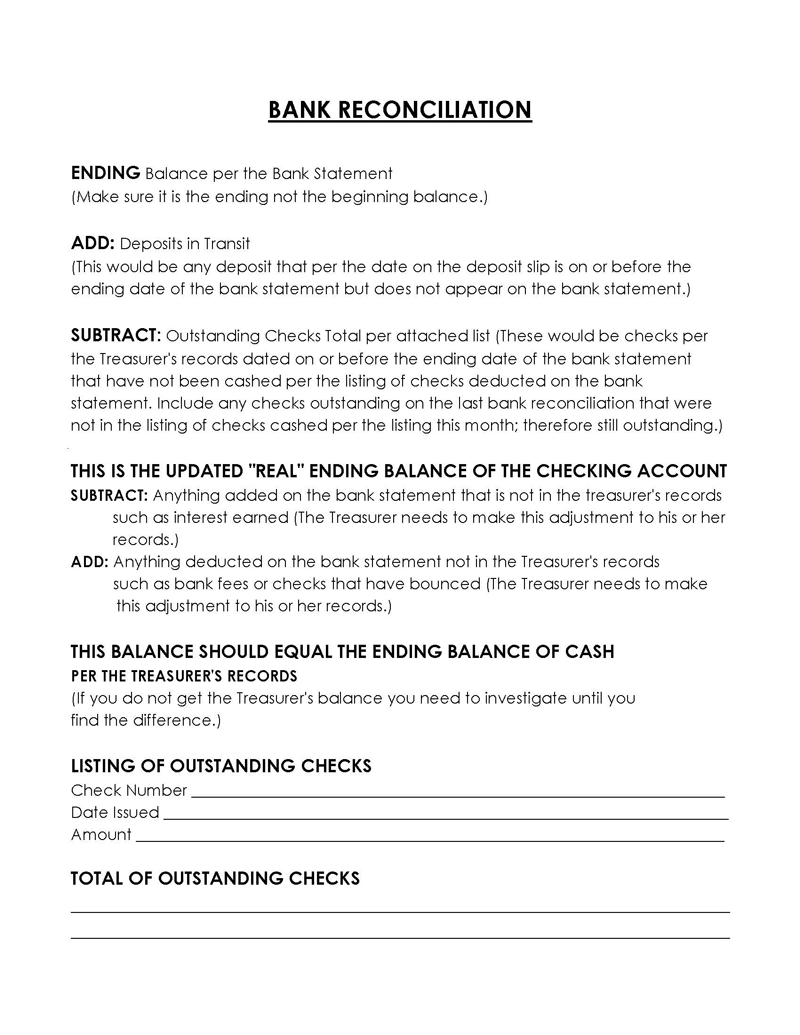

Statement Templates (Excel)

Bank Statement Vs. Company Balance Sheet

As a company accountant, you must remember that when preparing a statement, the balance in the bank statement may differ from the balance in the company’s balance sheet. There are reasons for this situation. First, there might be deposits, cash, and checks that the company may have received, but the information is yet to be recorded by the bank on the bank statement.

Also, there might be some outstanding checks, which means the company might have given checks to its creditors, but the bank has yet to process those payments. Banks typically charge their customers for services rendered, which can contribute to balance discrepancies. In addition, the balance may be different since the bank may have paid interest to the company’s bank account. Finally, the difference may occur due to Non-Sufficient Funds (NSF) checks.

Bank Reconciliation Procedure: A Step-by-Step Guide

As a company accountant, you must follow certain steps to complete the bank reconciliation process.

The step-by-step process for performing a bank reconciliation procedure is as follows:

Step 1: Choose an appropriate template

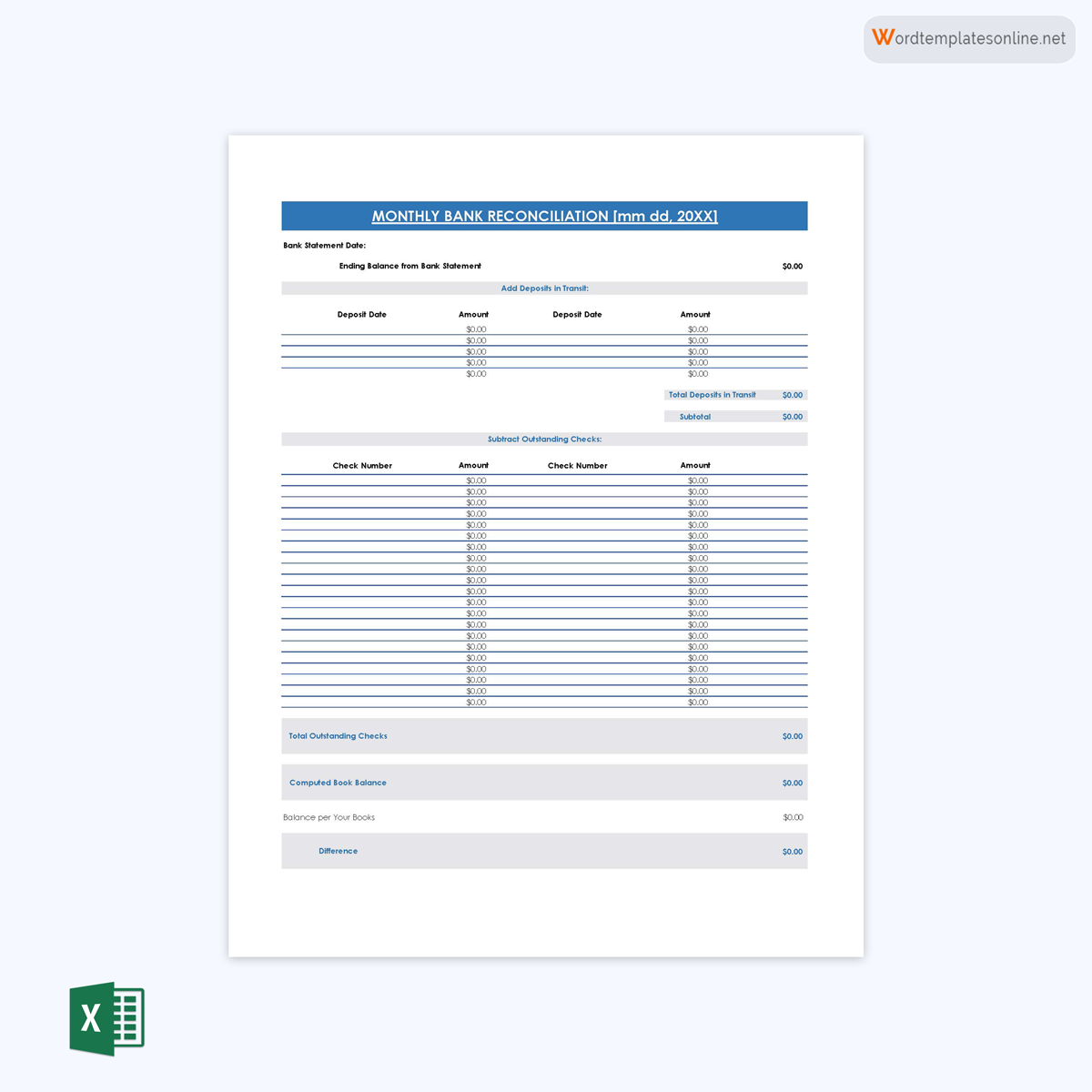

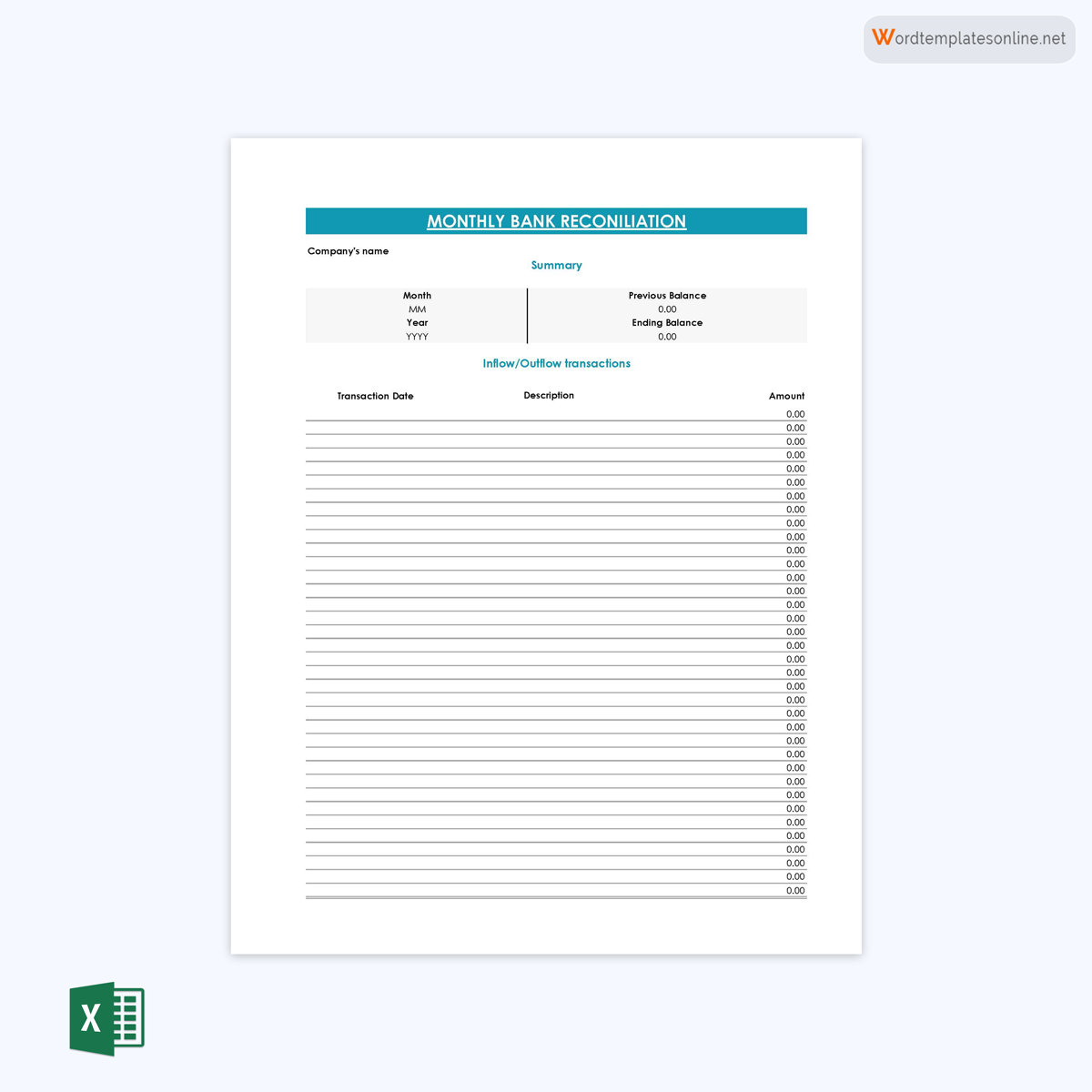

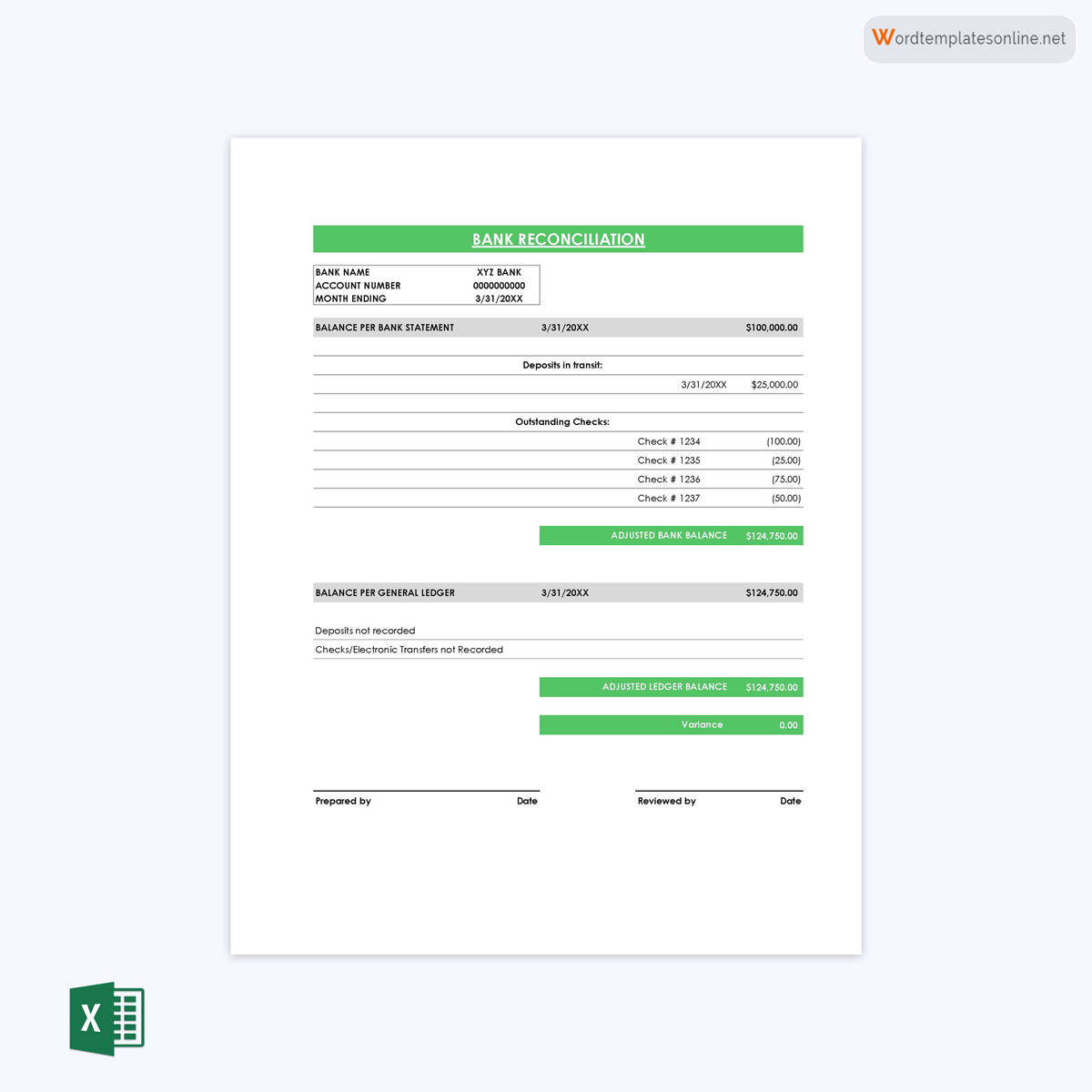

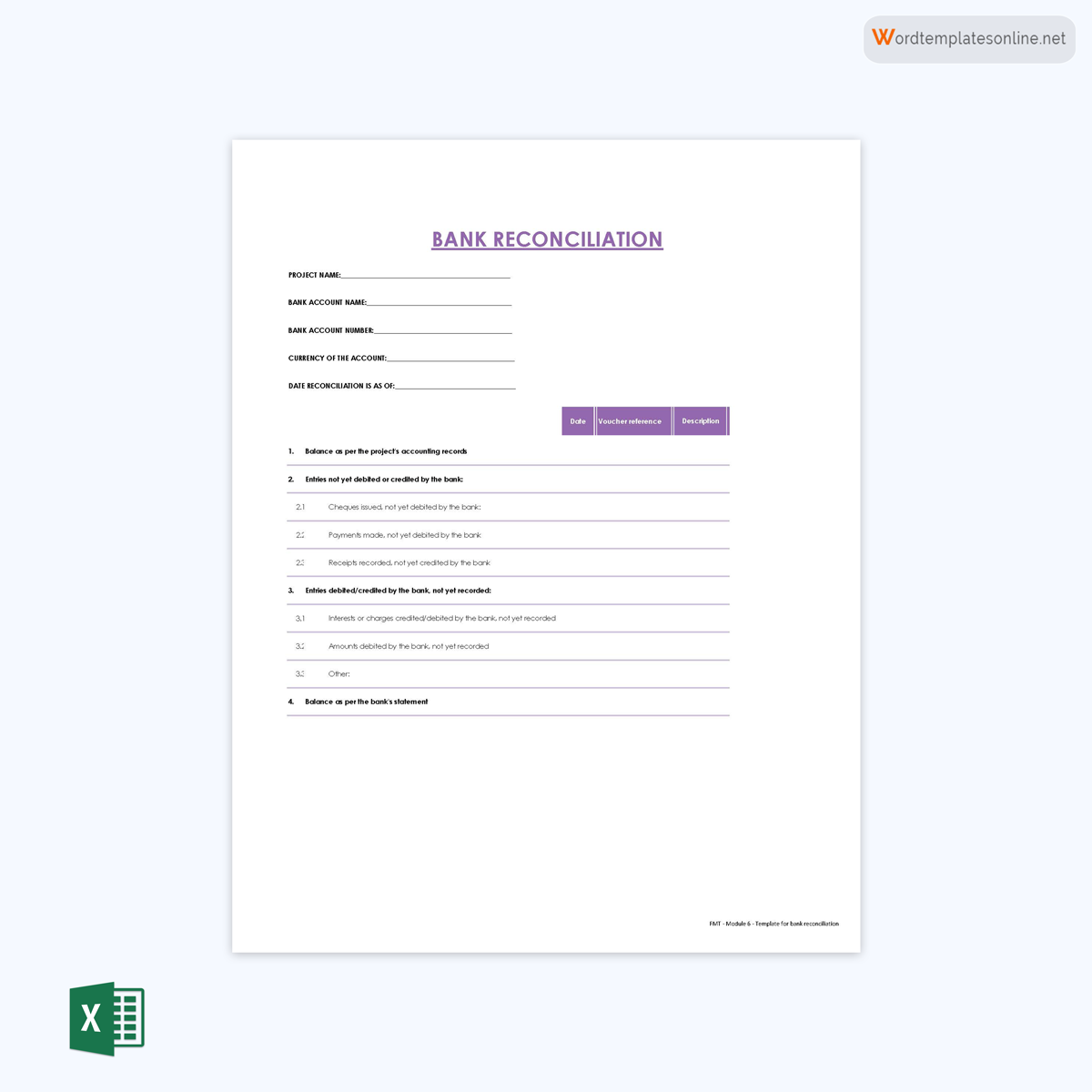

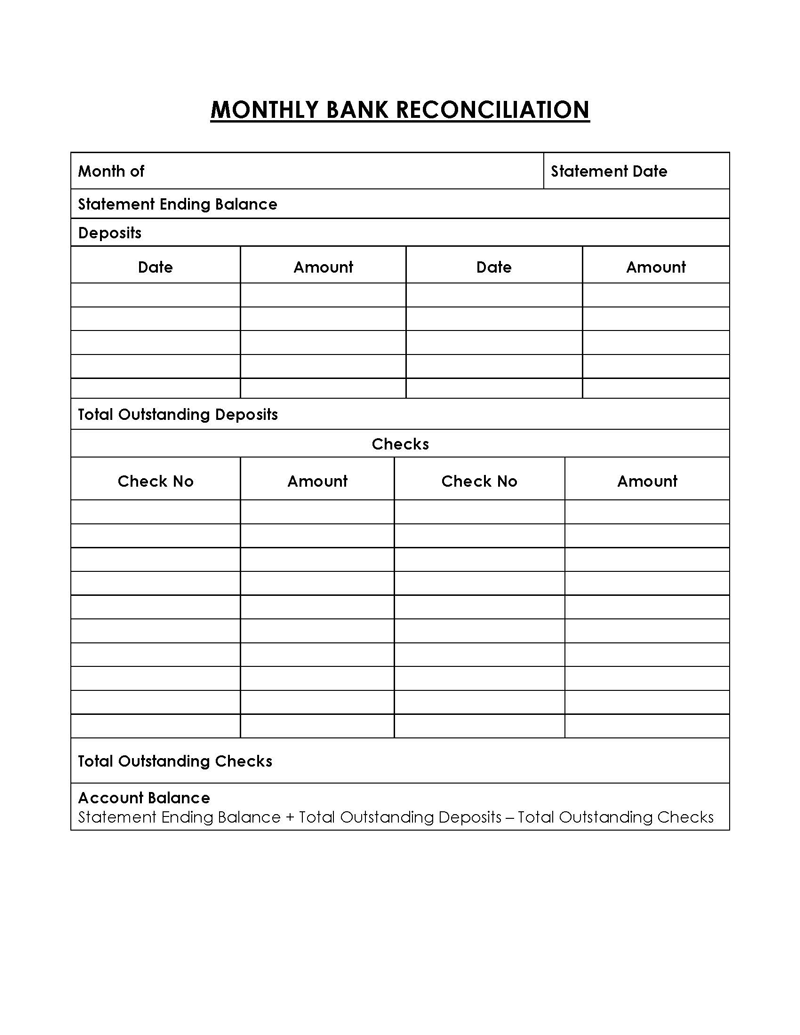

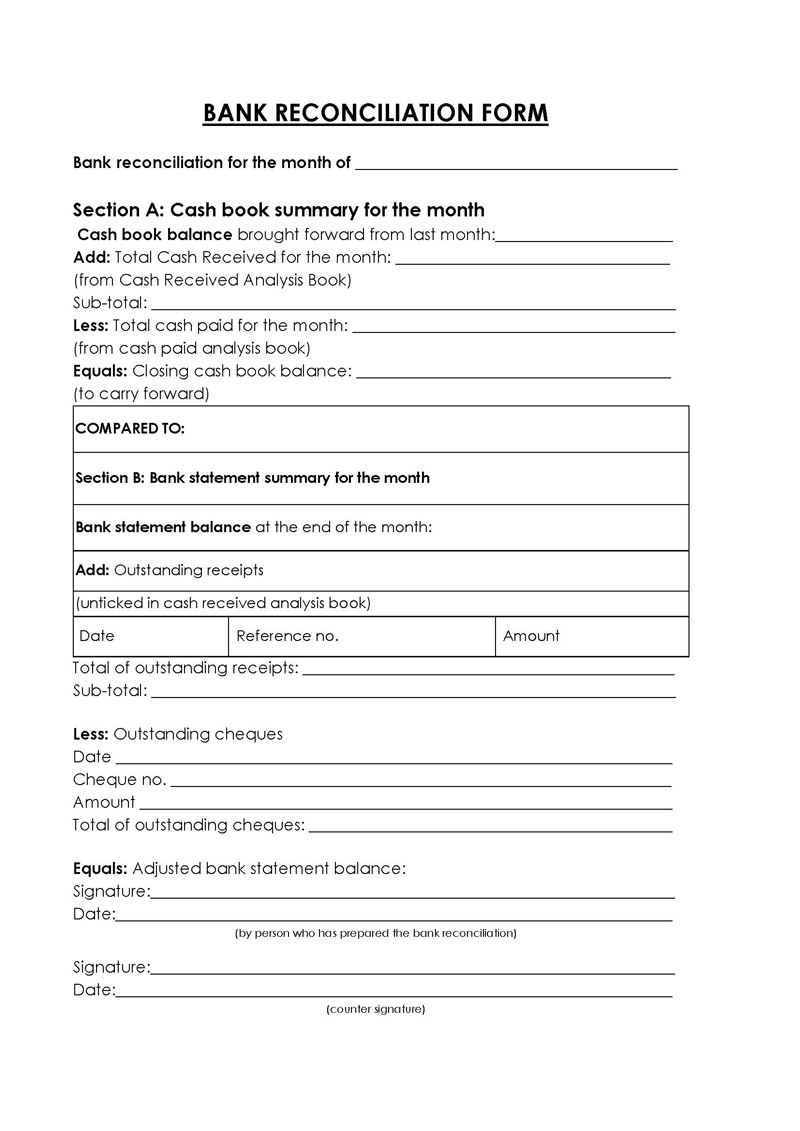

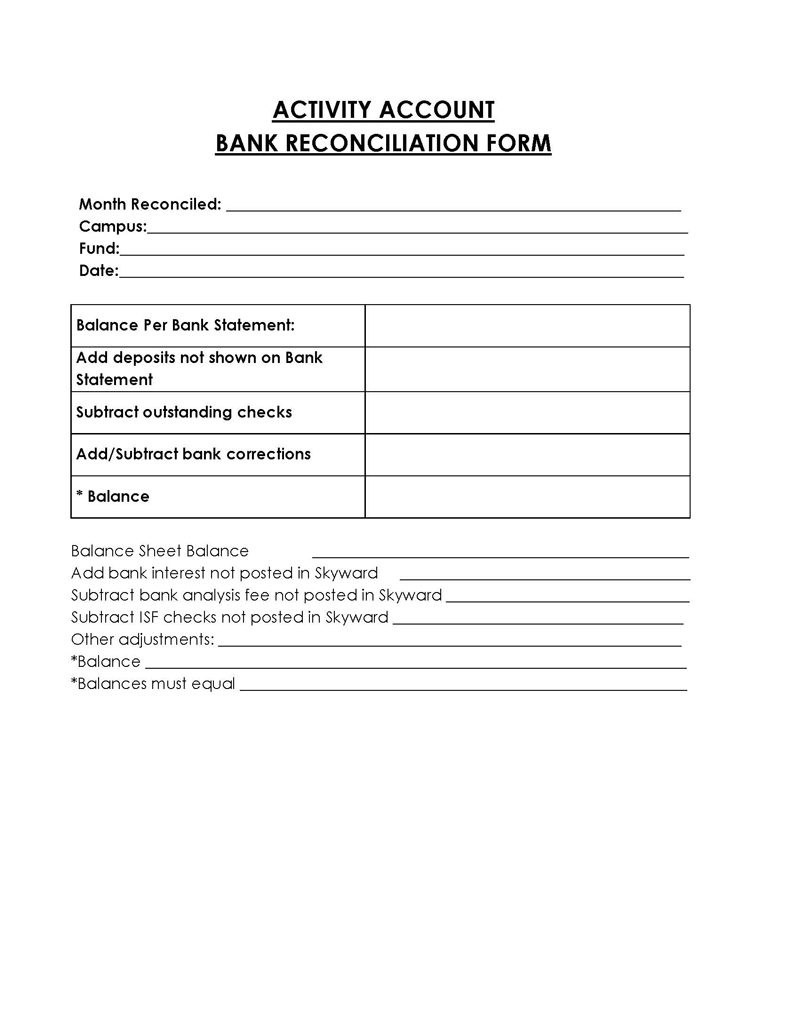

The first step is to choose a pre-made template for a statement. You will only need to fill in the necessary details and information with this template. A bank reconciliation template can easily be downloaded and will make the process easier for you.

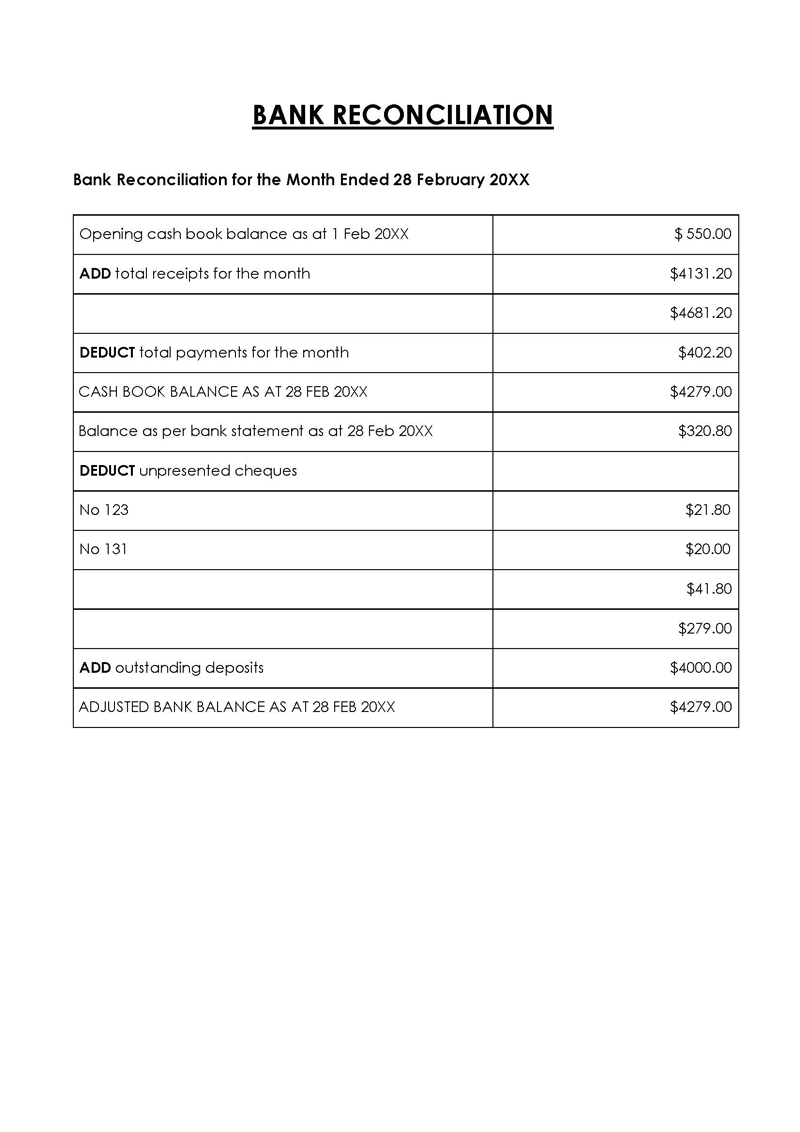

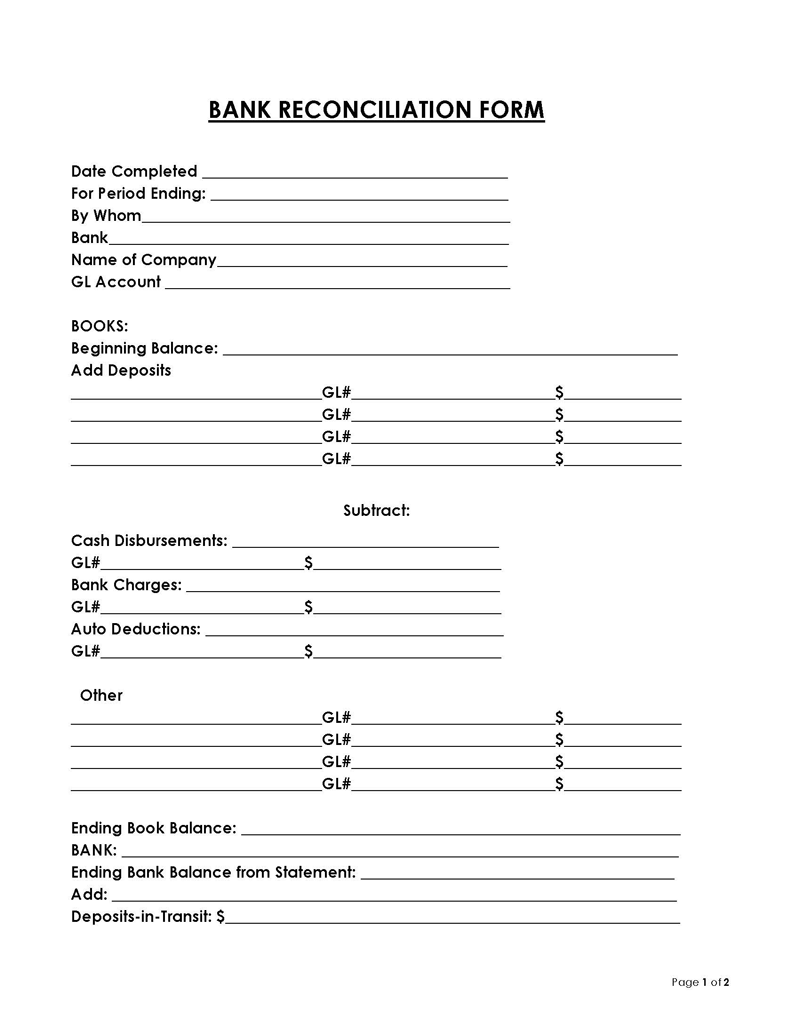

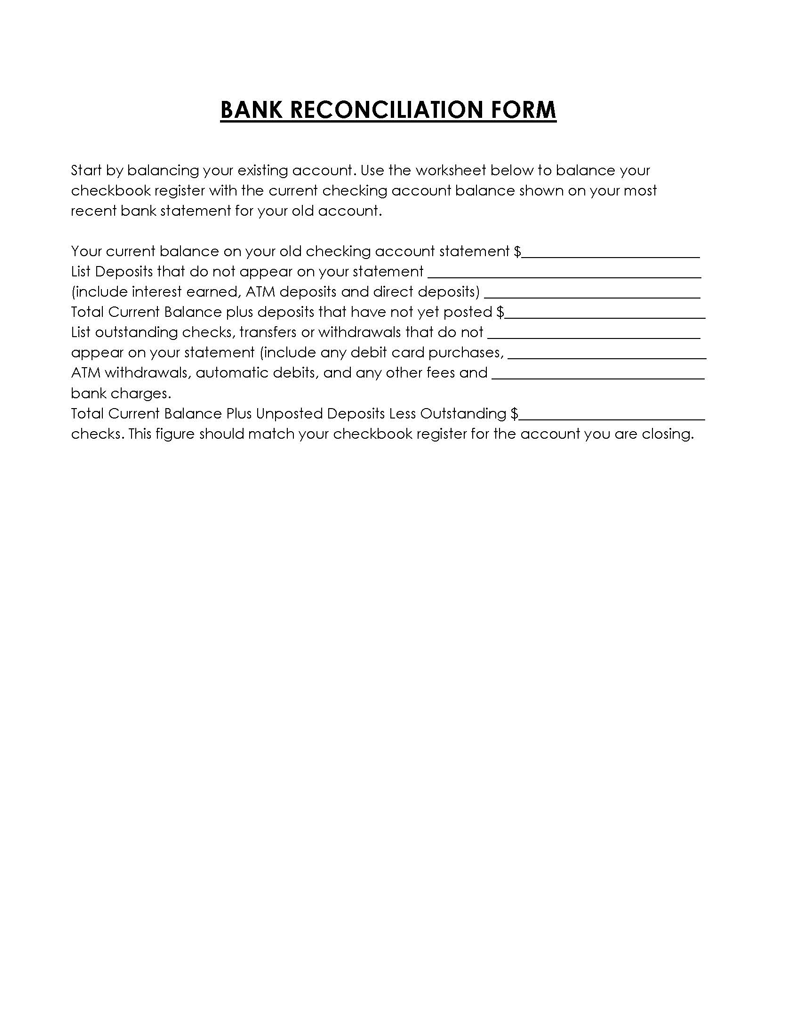

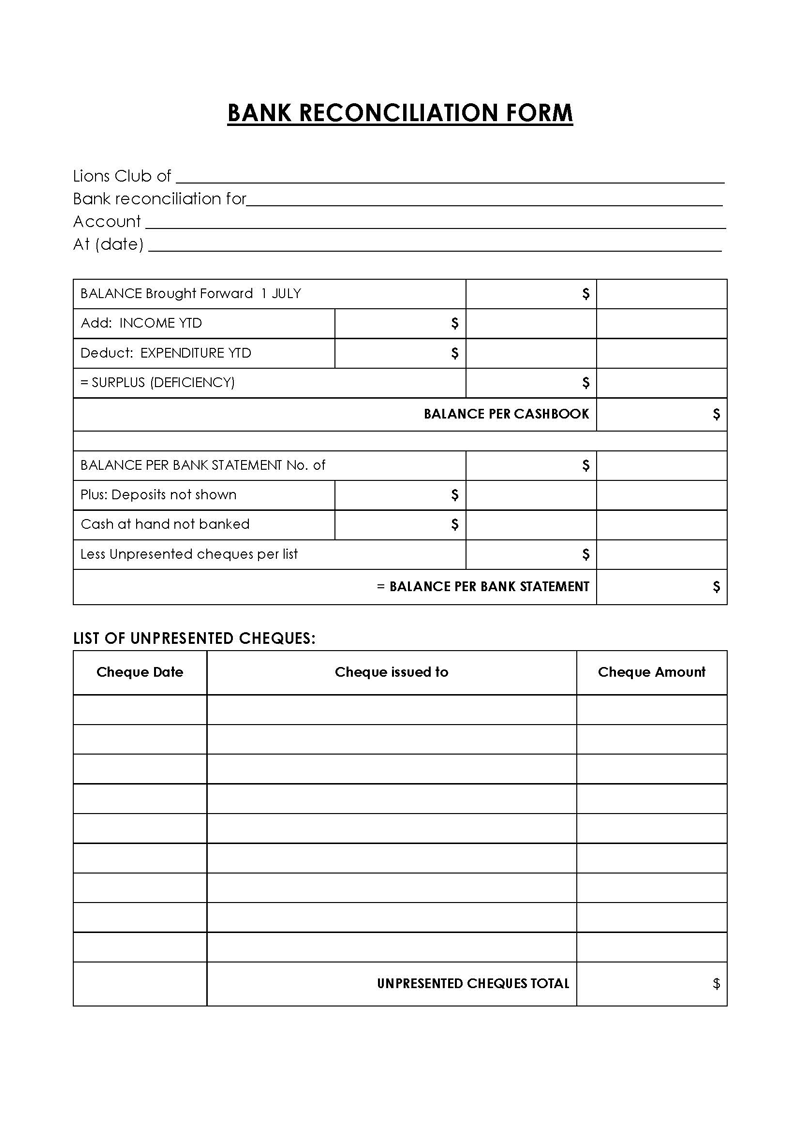

Following are a few templates for you:

Step 2: Obtain the bank records

The next step is to access the bank records to get a list of bank transactions. Then, you can use the bank statement provided to you by the bank to access all the bank records. Ascertain that if the company has a credit card account, you have access to the statement for that account as well.

Step 3: Obtain the company records

You should also access the company’s business records, including all the inflows and outflows of money. The best way to store and easily access business records is by using a spreadsheet, a logbook, or software. Other business records you need to access are the bills and receipts for the required period.

Step 4: Compare bank deposits with company income

The next step is to make sure the information matches by comparing the bank deposits and the company’s income. Ensure that all the deposits listed in the bank statement are present in the company’s financial books. To ensure proper recording, the deposits must also be divided into categories. These categories may include sales, interests, or funds. Each deposit on the bank statement should match the company’s income records.

Step 5: Compare bank withdrawals with expenses on company books

Aside from the deposits and income, you must also review the withdrawals on the bank statement and compare them to the outgoing amount in the company books to ensure they match.

Ensure that all withdrawal transactions, like bank fees and payments, are included in the company books and also in the statement. If the withdrawals do not match, the problem could be that the payment has not yet cleared or that the money was used in cash or from a different bank account.

Step 6: Adjust the cash account

If the bank statement and the company’s books do not match, you will need to make some adjustments. You can handle this process by adding the deposits in transit, adding interest, deducting bank fees, deducting any outstanding checks, and correcting any errors you made as you prepared the statement. The bank fees that must be deducted include charges for bank processing and overdraft fees.

In the case of errors, such as omitting certain records or indicating the incorrect amount, you will either have to deduct from or increase the cash account. You also need to take any NSF checks into account; this is a check that has yet to be deposited by the bank into the company’s account due to a lack of sufficient funds from that particular entity. To identify any errors that need to be corrected, compare the company’s cash account ledger to the bank statement.

After all the adjustments have been made, do not forget to match or reconcile the balances once more. If the balances do not match, a company accountant should repeat the reconciliation procedure.

Step 7: Match the end balance

The final step of the bank reconciliation process is to match the end balance. The balance on the company’s balance sheet and the amount in the bank should be identical. With the balances being equal, your statement can be filed.

Advantages of It

Preparing a statement as a company accountant benefits the company in a variety of ways. First, the statement ensures that all required payments are made and cash collections are deposited. It also helps to identify any discrepancies between the bank balance and the company’s balance so that any required adjustments can be made.

This way, the financial security of the company is improved, and issues like fraud and cash manipulation are detected. Also, the statement helps to correct any errors in the company’s financial reports, such as double payments, missed payments, and calculation mistakes in the company’s tax reports, such as paying too much or too little tax.

Also, preparing the statement helps you keep track of any bank fees and penalties you will include in the company’s financial books for proper reconciliation.

Frequently Asked Questions

The common problems concerning bank reconciliations include infrequent reconciliations, which lead to failure to resolve the identified issues, poorly recorded transactions, and the inclusion or exclusion of bank fees and other charges that lead to a mismatch.

NSF checks are typically included in the statement as an adjusted line item from the company’s financial records during a bank reconciliation. Additionally, the balance in the statement is always reduced by the amount of the NSF checks.

As a company accountant, you should do a bank reconciliation every time you receive the company’s bank statement, which can be monthly, weekly, or even daily (at the end of the business day).

A bank reconciliation software is useful because it goes through each transaction received and matches it with a specific entry in the company’s bank account or records the information in the bank accounts.

In case the business books show something that is not on the bank statement, ensure that you confirm if there are any pending incomes yet to be recorded or if there were payments made but from a different company bank account.

If the bank statement shows something that is not in the business book, you should check your business book to confirm if it is a keystroke error that happened when entering the transaction details or a particular transaction you failed to enter.

Fixing a bank reconciliation problem is all about identifying mismatched information. You can resolve this issue by reviewing invoices, receipts, and other financial records for errors or missing information. To lessen the workload, make sure you handle this process frequently, typically once a week or every day.