Bank statements are vital financial documents that may be requested or utilized in different scenarios, including mortgage applications, tax returns filing, investment endeavors, etc. Therefore, what happens when circumstances prevent a bank account holder from personally accessing these crucial financial documents from their bank? In such cases, an authorization letter can be used to permit a trusted party to collect the bank statements on the account holder’s behalf.

This article will provide you with a comprehensive understanding of how to draft, execute, and apply authorization letters to your financial transactions. Moreover, it will unveil the scenarios where these letters prove indispensable. Lastly, it discusses how legal considerations influence the awarded consent to safeguard sensitive personal and financial information.

What is an Authorization Letter to Collect Bank Statement

An authorization letter empowers a designated individual (referred to as an agent) to access or collect your confidential financial records, such as bank statements. We’ll, from overseas transactions to time-sensitive applications. This letter typically outlines the purpose for which the statements are being collected. It also specifies your account details and the range of statements to be accessed (e.g., monthly statements for the past six months).

Additionally, it documents relevant personal details of both you, the account holder, and the authorized representative. This letter is commonly used when you cannot personally visit the bank or access your statements due to diverse reasons such as distance, time constraints, or health issues. It is a legal document and therefore binds the agent to safeguard your information.

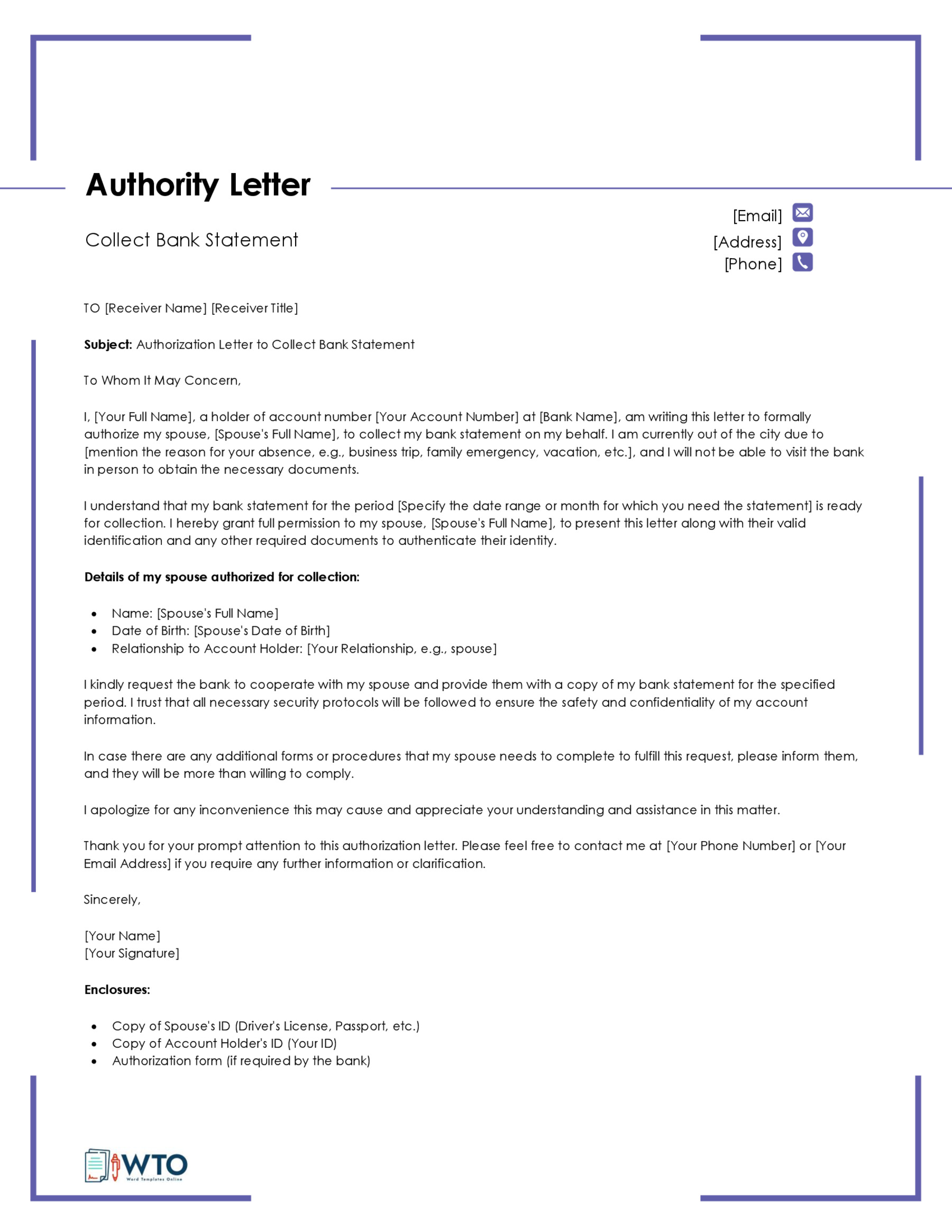

Free Samples & Templates

Given below are bank authorization samples:

Given below are bank statement authorization templates:

Real-Life Scenarios Requiring Authorization Letters for Bank Statements

Authorization letters for bank statements are versatile tools that can be employed in various real-life scenarios. Some common scenarios where authorization letters become invaluable include the following:

Travel commitments

When you are traveling abroad or temporarily residing in a different country, you might require someone back home to manage your financial affairs. An authorization letter empowers a trusted friend or family member to collect bank statements, ensuring that important financial matters are handled in your absence.

Health-related constraints

You can issue a letter of authority to appoint someone to collect your bank statements in cases where you can access the documents due to health issues. Such issues may include severe illness or ongoing medical treatment procedures. Using the letter ensures that your financial matters are in order.

Time constraints

With the demands of work, family, and personal commitments, finding a spare moment can feel like an elusive feat. However, you can use an authorization letter to appoint a trusted agent to access crucial financial information, such as bank statements required for time-sensitive transactions.

Geographical distance

Geographical distance can be a challenge, for example, when you are away on business or studying abroad and cannot access your main bank in person. A letter of authority allows you to appoint a local representative to collect bank statements should you need them.

Emergency situations

Emergencies are bound to occur at any time. Whether natural disasters, medical emergencies, or unforeseen crises such as incapacitation, it can be difficult to tend to your financial matter during such times. Therefore, you can use a letter of authority to permit a trustworthy individual to handle and manage your finances which would require access to your bank statements.

In all these scenarios, an authorization letter serves as a legal document. It signifies your planning capabilities to ensure your financial affairs are handled effectively in your absence.

Writing the Authorization Letter: Step-by-Step Guide

It is important to draft the letter accurately, specifying the scope and purpose of access, and in compliance with the bank’s guidelines for submitting and processing authorization letters. Therefore, the content of the authorization letter may vary depending on the bank’s requirements and the specific purpose for which the statements are being collected.

However, some common elements usually included in the letter are described in the step-by-step guide below:

Step 1: Provide your information with the date

Begin by introducing yourself as the account holder. You can do so by stating your name, address, current phone number and email address. Also, include the date on which the letter is being written. This information sets the foundation for the rest of the letter, provides the necessary context for the recipient, and facilitates communication.

Step 2: Add the recipient’s information

After providing your own information and the date, you should include the recipient’s details. This includes the name, title (if applicable), address, and any other relevant contact information of the person or department at the bank who will be handling the authorization. This information guarantees that the letter reaches the intended recipient.

Step 3: Add salutation

After providing the recipient’s information, you should add a formal salutation. This is the polite and respectful way to address the recipient. Use the recipient’s name or title (if you know it) in the salutation to add a personal touch to your letter and demonstrate your professionalism. A general salutation like “To Whom It May Concern” is also acceptable if you do not have a specific name or title. By including a proper salutation, you set a professional tone for the rest of the letter and show courtesy to the recipient.

Step 4: Write the body of the authorization letter

The body of the letter is where you provide detailed information about the authorization, including the scope and purpose. Here is how you can structure this part of the letter:

- Explain the purpose of the letter – Explain why the authorized person needs access to the bank statements. This could be for a loan application, financial analysis, legal proceedings, or any other specific purpose. Specify the exact bank statements or financial records the authorized person can collect, if applicable. Make sure the information is accurate and comprehensive, leaving no room for ambiguity.

- Provide your account details – Next, indicate your account details for clarity. These details include the account holder’s (your) name, account number and bank branch.

- Mention the agent’s details – Also, include the details of the person you are authorizing to collect your bank statements. Make sure to provide accurate and complete information to avoid any issues. Adding the authorized person’s information helps the bank identify and verify the individual who will be collecting the bank statements.

- Specify the timeframe – You should specify the duration of the authorization’s validity. You can issue the authority for a limited period or until it is revoked.

Step 5: Mention supporting documents, if any

In this step, mention any enclosed or additional documents the authorized person might need to present to the bank for verification purposes. These documents could include identification documents, copies of your driver’s license, passport, signature, or any other requirements the bank might have.

Step 6: Provide your contact information

Next, reiterate your contact details. Provide your active phone number and valid email address. This information facilitates effective communication between you and the financial institution should issues or queries arise. Also, towards the end of the letter, express your appreciation for the bank’s cooperation and request their assistance in ensuring a smooth process for the authorized person.

Step 7: Conclude the letter

Finally, formally close the letter by adding a complimentary close and sign the letter by hand (physical copy) below your name. A signature is needed to validate the letter’s authenticity by signifying your agreement to the content of the authorization letter.

Legal Considerations and Local Regulations

While drafting an authorization letter for collecting bank statements, it is crucial to be aware of legal considerations and local regulations that govern such transactions. Ensuring compliance with these guidelines not only protects your rights but also prevents any potential issues or misunderstandings.

Here is a guide on how to achieve the right balance between convenience and legal compliance when crafting such documents:

Highlighting the importance of complying with legal requirements

A legally compliant letter of authority to collect bank statements protects your interests and sensitive financial data. This is because it binds the agent to the scope and limitations of the authorization stipulated in the letter. Consequently, this prevents unauthorized access to your financial information and fraud and protects your privacy rights. The agent is thus obligated to undertake their functions transparently as they can be held accountable for any misuse of the authorization. Compliance thus reduces disputes and misunderstandings.

Notarization and witnessing: When and why it is necessary

Notarization and witnessing enhance the credibility and legal enforceability of the authorization letter. Notarization involves having the authorization letter certified by a notary public, who is a legally authorized officer with the power to witness signatures and verify documents. Witnessing involves having a neutral third party witness the signing of the authorization letter. This could be a trusted friend, colleague, or family member who is not directly involved in the transaction.

While not always mandatory, notarization may be required if the bank or the jurisdiction’s laws mandate it or if you want to provide an extra level of assurance and credibility to the authorization. It is always advisable to do so where the authorization carries significant legal or financial implications. This enhances the letter’s legal validation, prevents fraud and permits cross-jurisdiction recognition.

How local regulations may impact the authorization process

Local regulations can vary widely from one jurisdiction to another, influencing the legal requirements, documentation, and procedures involved. Local regulations might specify the required format, content, and language of authorization letters. In some places, specific phrases or legal terminology could be included for the letter to be valid. Local regulations may also impact whether electronic signatures are accepted, the duration for which an authorization is valid, and the verification documents agents must present.

Being well-informed about these regulations helps you draft a legally compliant authorization letter, ensure a smooth process, and avoid potential hindrances and legal complications.

Conclusion

In conclusion, an authorization letter empowers individuals to delegate the task of accessing confidential financial information to trusted agents. Mastering how to craft an effective authorization letter for collecting bank statements involves a balance of convenience and legal compliance. By following a step-by-step guide for drafting the letter in this article, you can ensure that your authorization is clear, concise, and legally sound. Moreover, while inputting the fundamental information is vital, so is adhering to applicable bank-specific and local legal regulations. Whether through notarization, witnessing, or adhering to specific formats, these measures enhance the credibility of the authorization and the protection of your financial data and interests.