Receipts are a necessary component in any business. They provide businesses with an accurate record of their transactions, which is helpful for accounting purposes, budgeting, taxes, or record keeping. It is a document containing copies of receipts to be completed when items are sold to a customer.

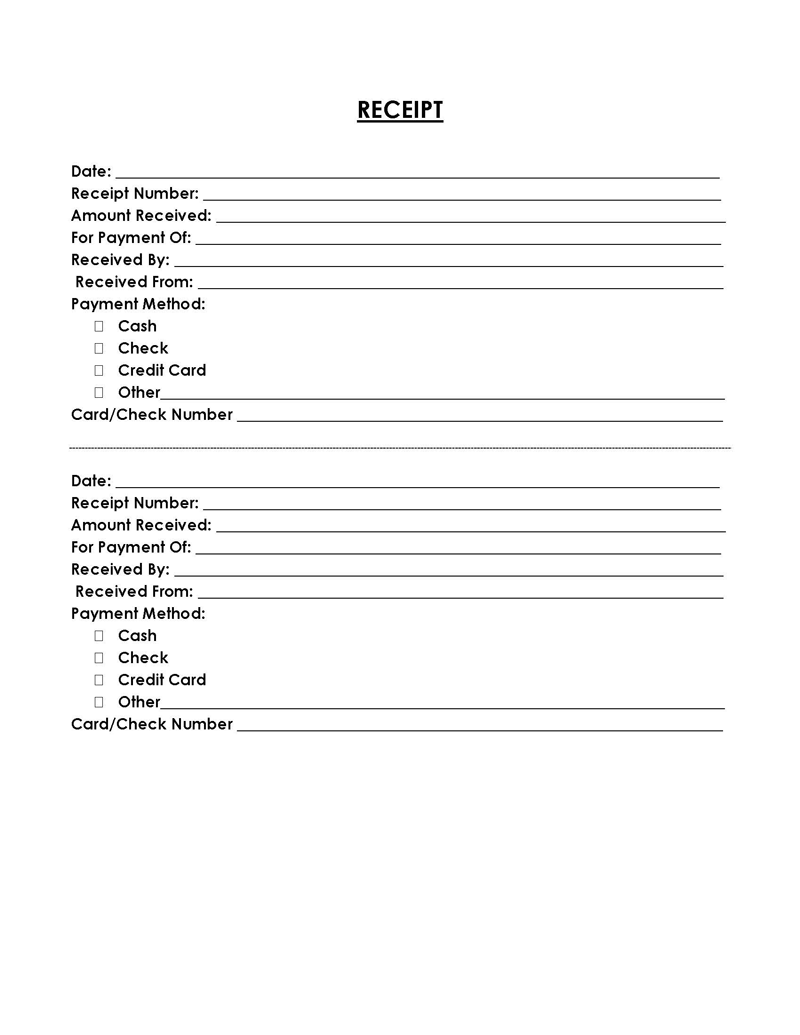

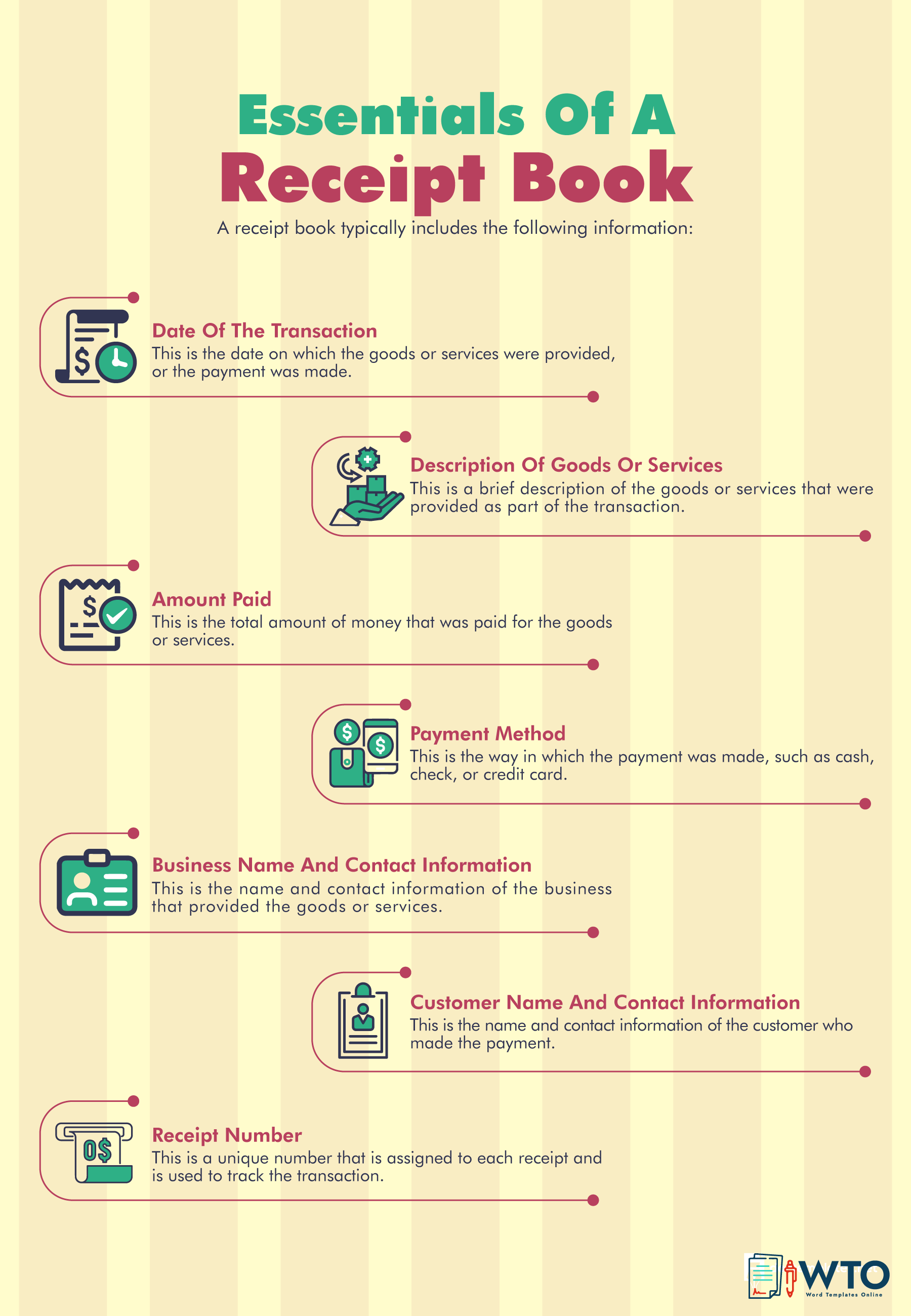

A standard receipt will record the transaction date, receipt number, the amount received, the item purchased, and the payment method (cash, check, credit card, etc.). To appropriately fill out this book, you need to know what it is, why it is needed, and its benefits. This article will provide this information and guide you on how to fill it appropriately.

What is a Receipt Book?

A receipt book is a booklet that contains sets of 3 receipts for each transaction.

These are laid out horizontally to record sales transactions made at a business. They are issued to customers when they make purchases. It can be covered with a binder. If this is the case, the booklet should be “hole punched” using a standard hole puncher (3 or 5 rings).

The booklet is often filled using carbon copy receipts; typically, the customer will be given a copy, while the other two remain with the merchant for different purposes. A properly filled-out one provides information that can be later referenced by the issuer (seller), recipient (customer), or third parties such as tax authorities and accountants.

What is a Template?

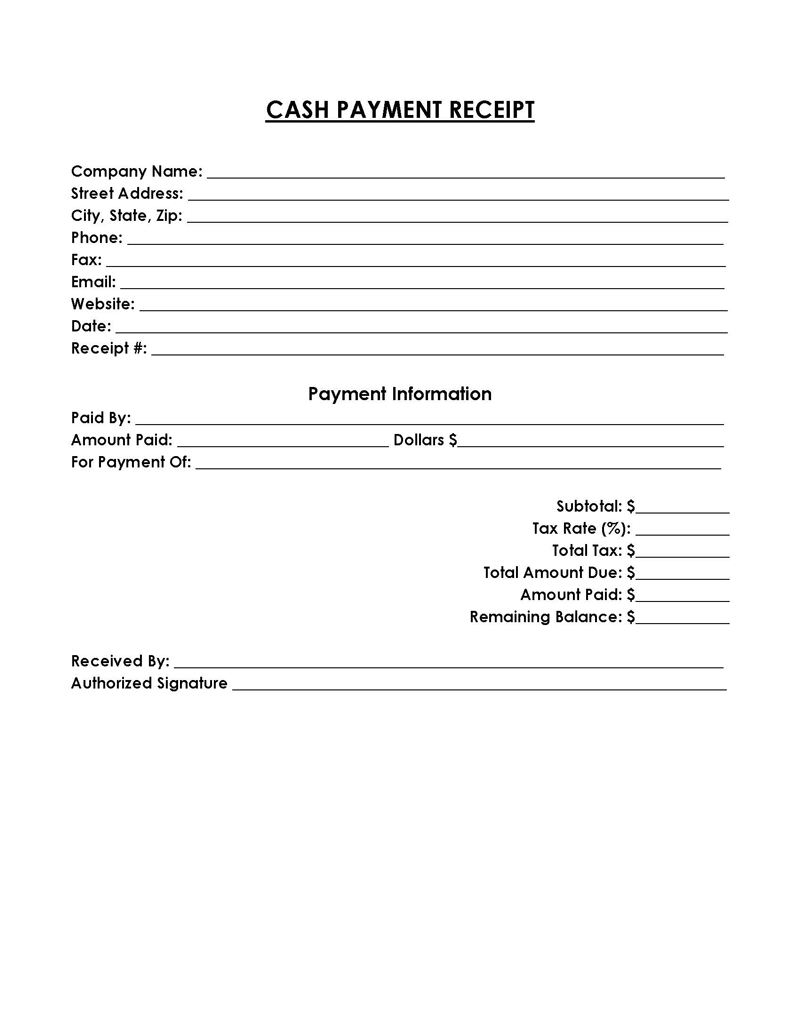

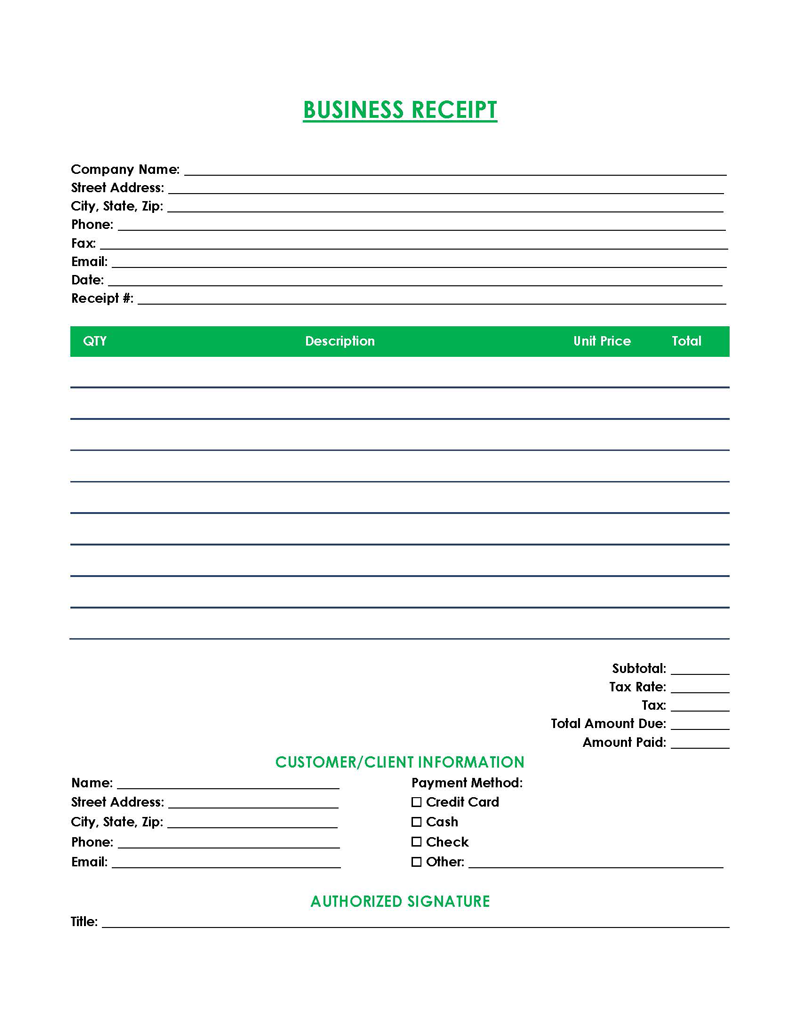

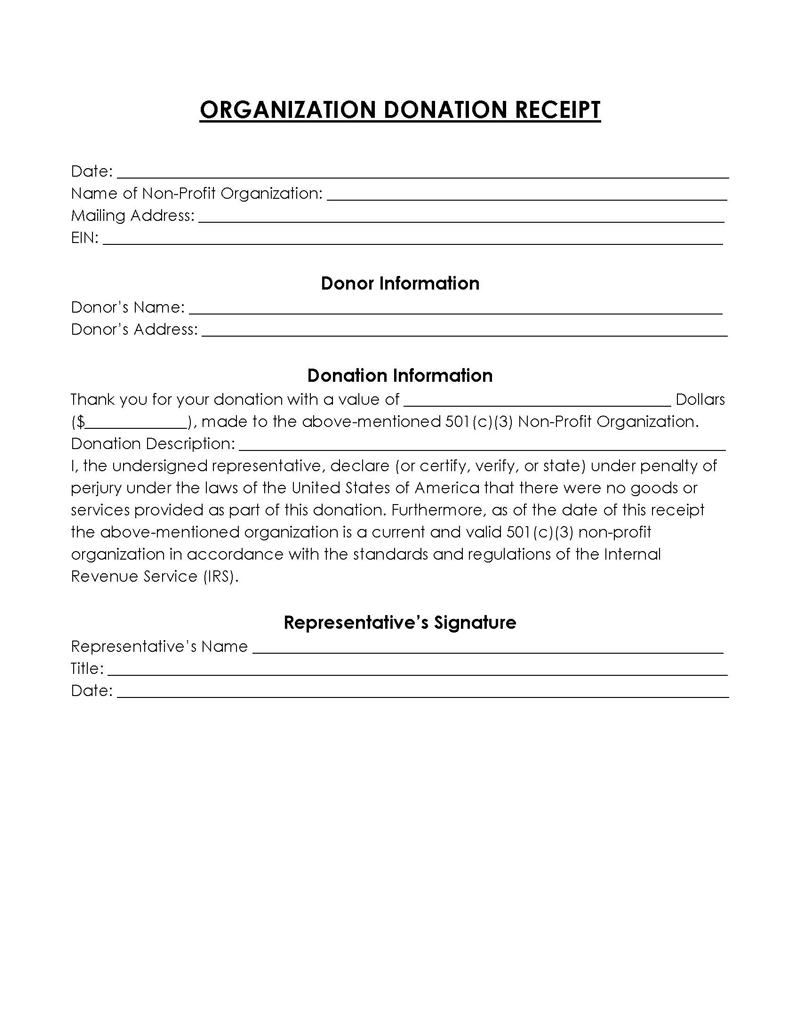

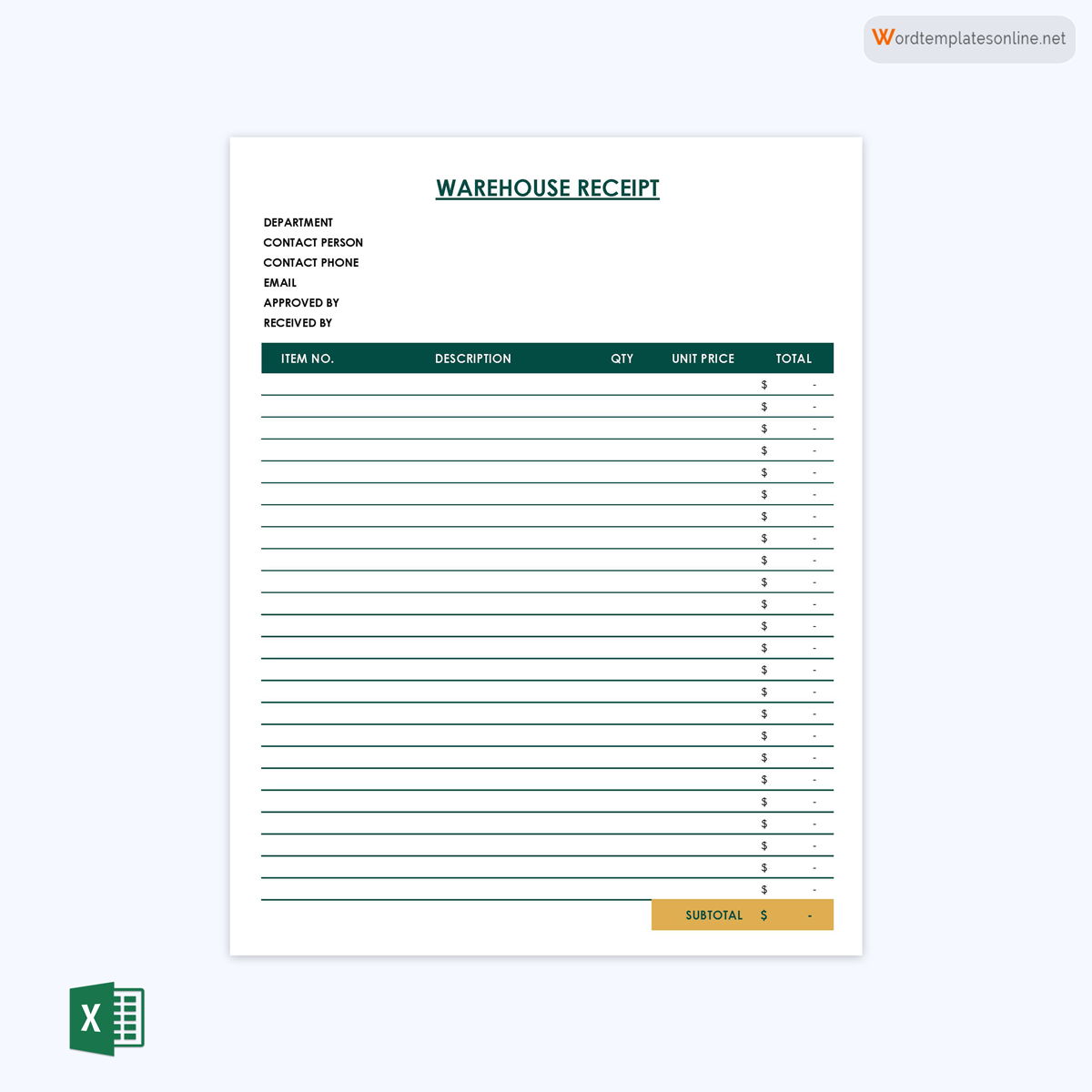

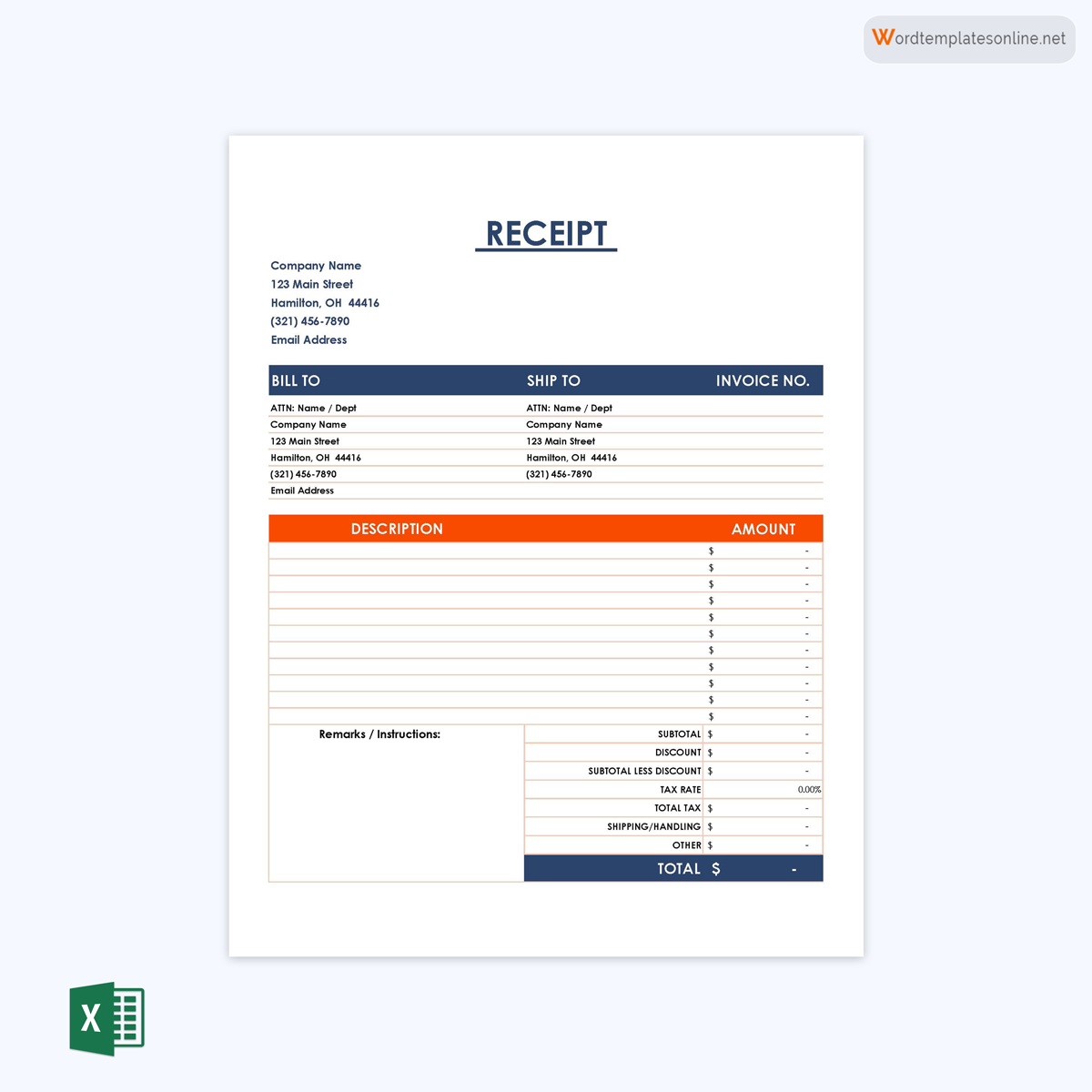

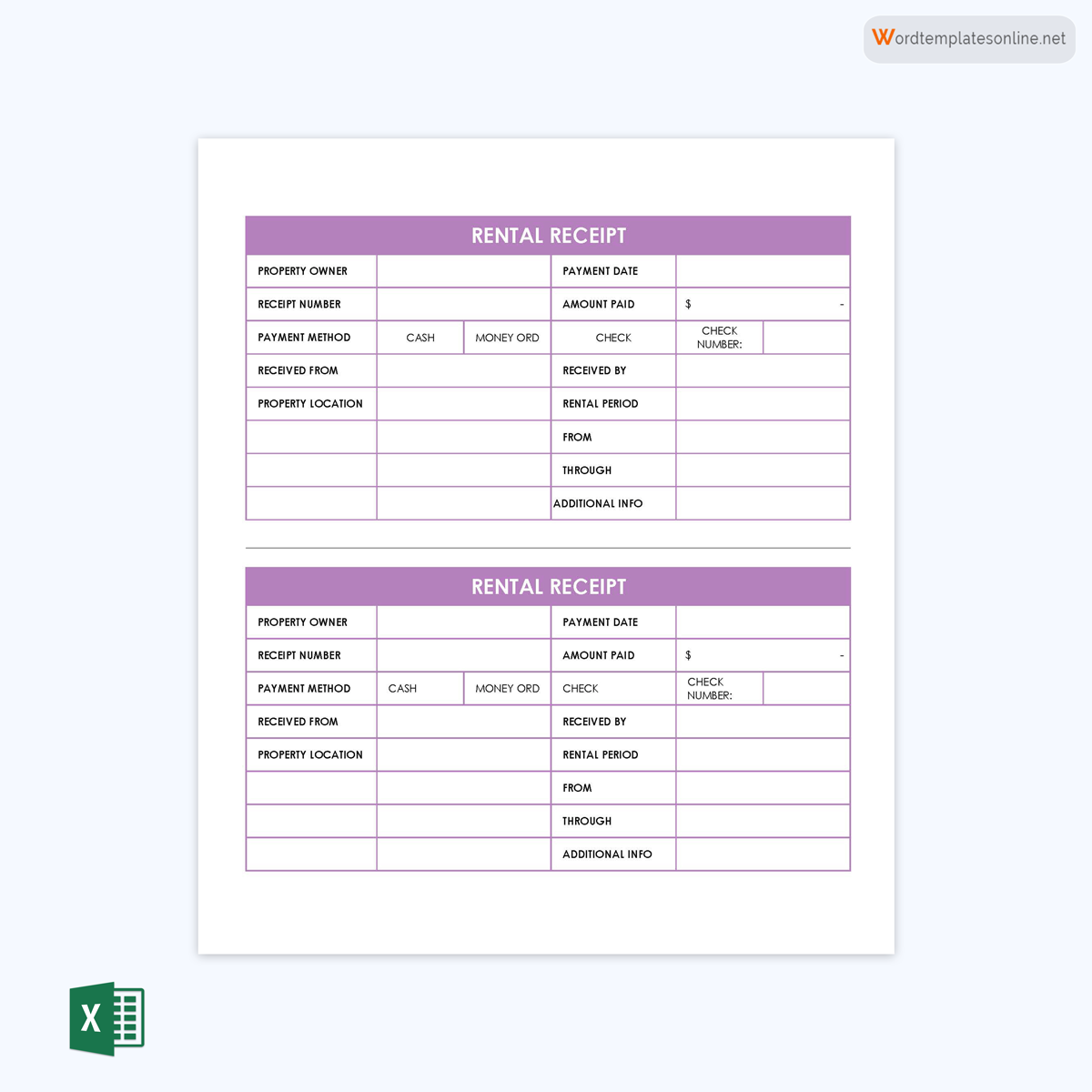

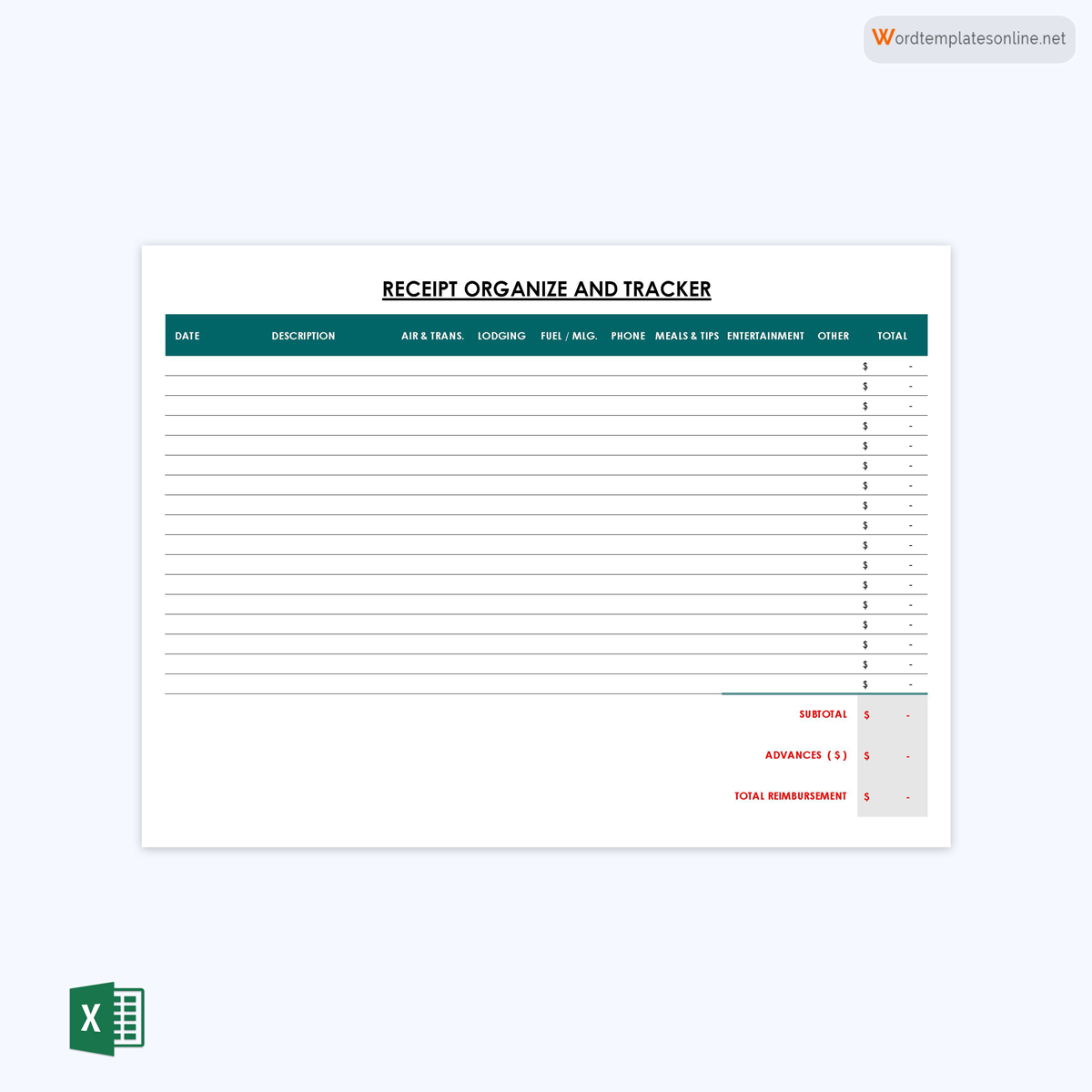

Such a template is a pre-designed format that offers a standard layout for creating receipts in a receipt book. It typically includes fields for essential information such as the transaction date, amount, items purchased, payment method, and applicable taxes.

The template can be customized by adding the name and logo of the business to make it professional-looking. By using a template, consistency in the recorded information is ensured, making it easier to manage and organize financial records.

The template also saves time and effort as it is pre-formatted and requires only minor adjustments. Additionally, a template can help to create a professional image for the business and reduce errors while recording financial transactions. Overall, using a template can improve efficiency, organization, and professionalism in a business’s financial operations.

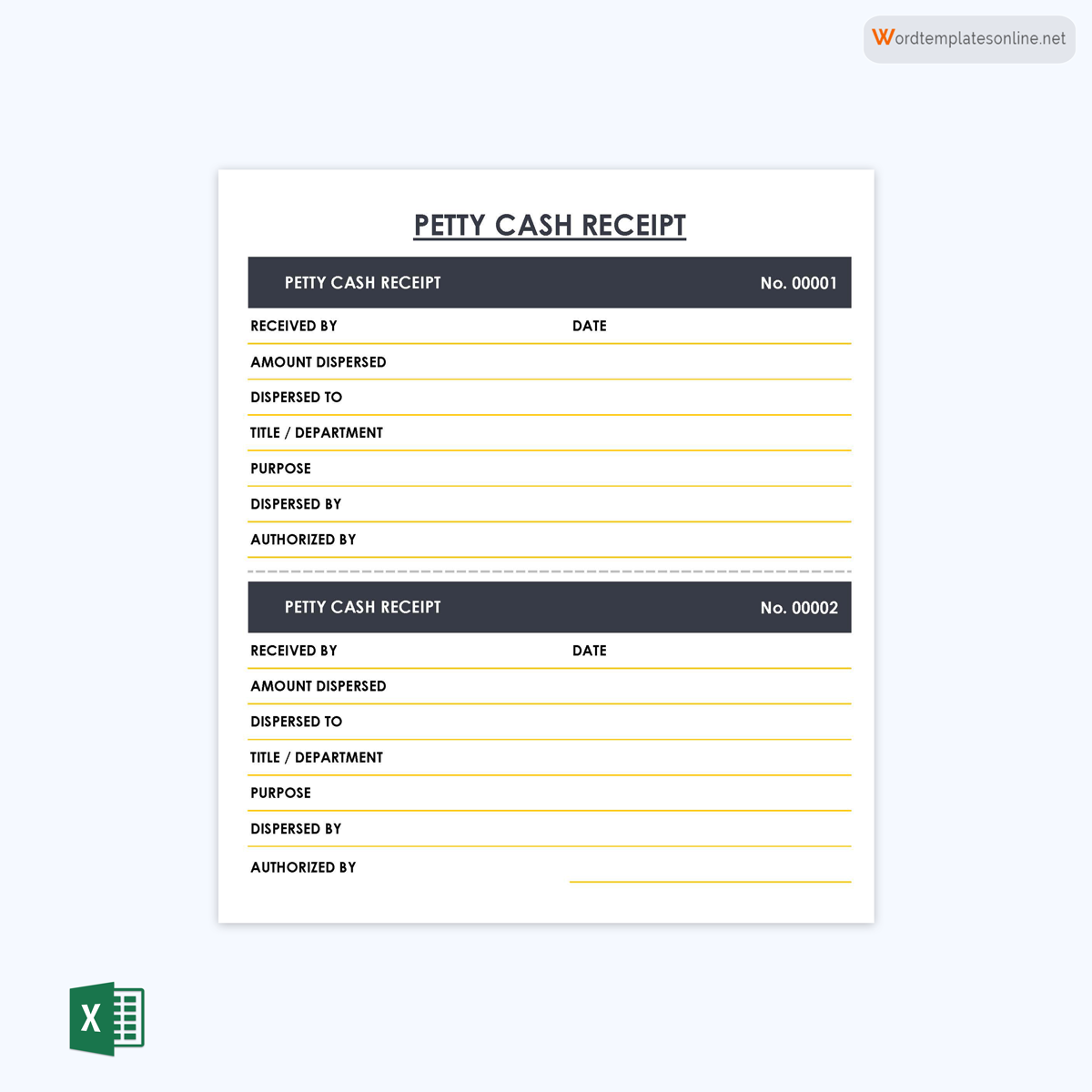

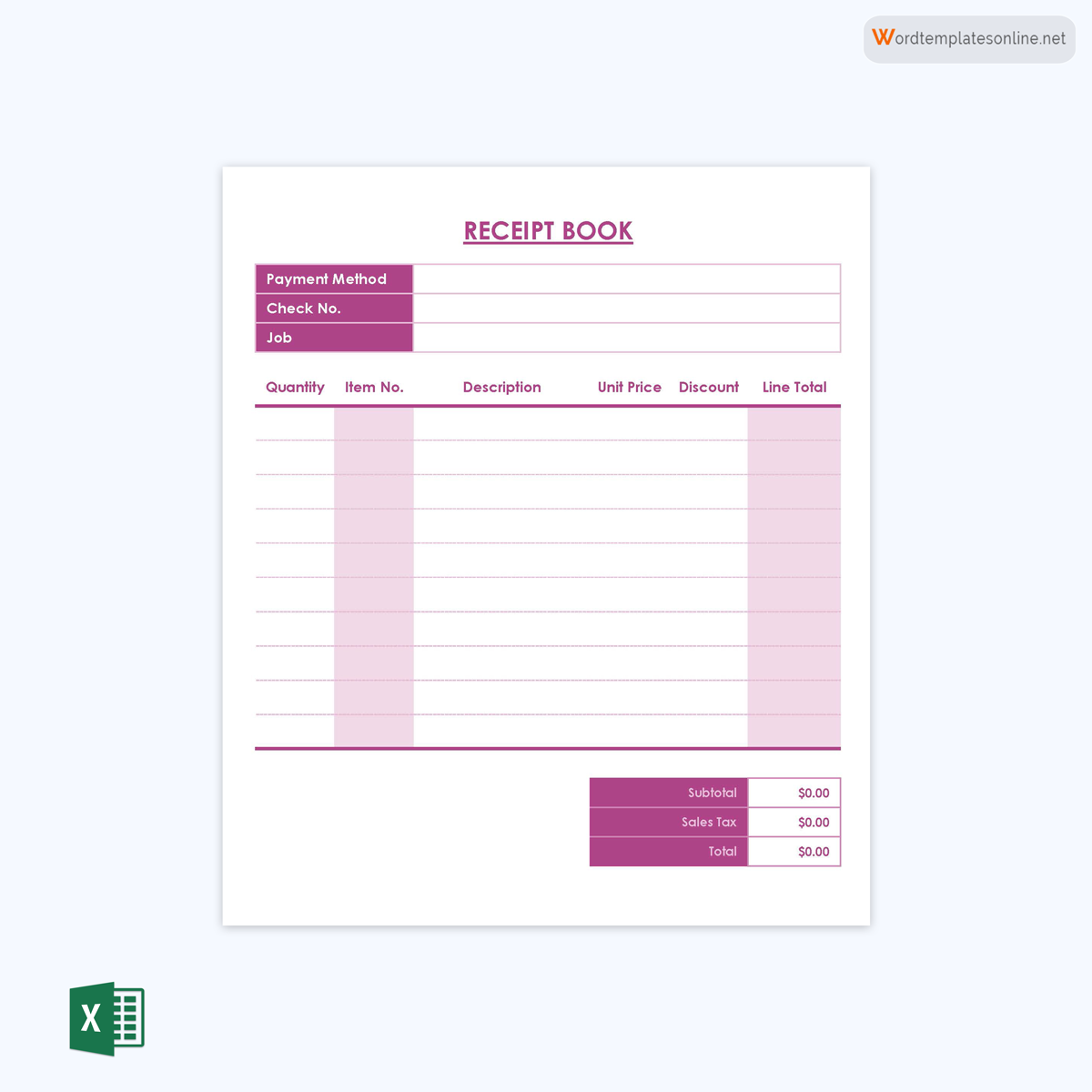

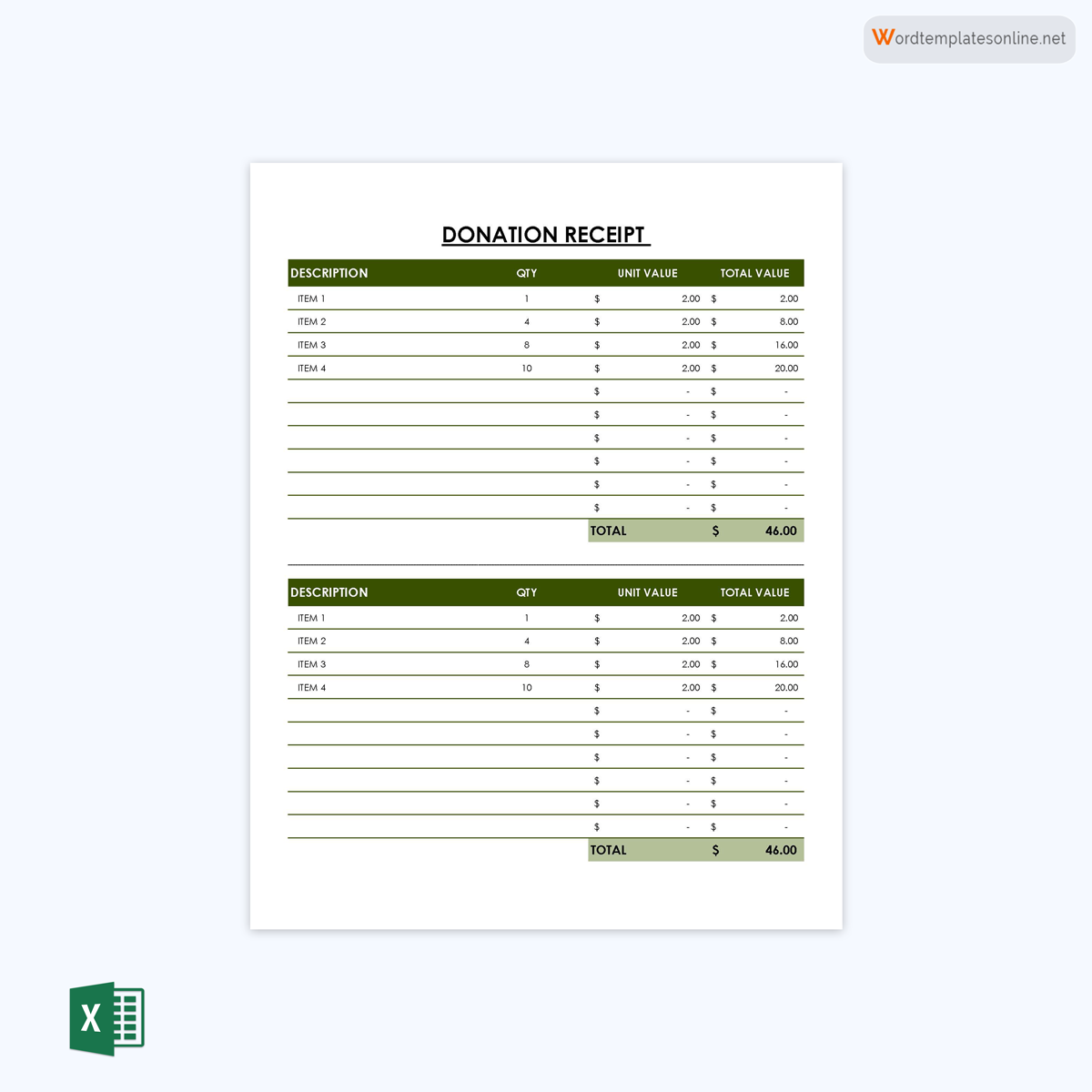

Following are some customizable templates for you:

Why Need a Receipt Book?

All types of businesses require receipt books. Businesses use this booklet for a variety of reasons, as discussed below:

Custom fields

The booklet contains a series of custom fields you may want to use for different purposes. Some of these could be the transaction date, item description, date of purchase, the amount paid, and the purchaser. You can edit these to suit your own needs. This allows businesses to have unique formats that serve their business model and filing requirements. Customization also allows you to create the ones that meet the customer’s needs. The design can thus incorporate any information that the business or customer needs.

Record keeping

The primary purpose is to provide a means for recording transactions. If you are a business owner, the booklet can be used to keep track of your customers and their purchases. The information contained in them will be recorded for future reference. In addition, you can use them to organize your records, such as sales invoices and expenses. For example, a real estate agent selling houses must record the money received for each transaction in the booklet. If a customer purchases a house, the agent must provide proof that payment has been received.

Branding

Having branded receipts will help you to market your business. These can be made to include the business’s name, contact details, website, slogan, etc. This ensures that each one given to customers is a marketing tool to encourage them to return after the initial purchase and anyone who interacts with the receipt.

Cash write-ups

With the booklet, businesses can record any cash sales or transactions. This is beneficial to businesses that operate on a cash basis. However, note that the booklet is not limited to cash sales; it can be used to record debit and credit card payments.

Portability

The booklet is portable, so you can carry it around when you are out of the office. This is beneficial when conducting business activities away from the office, such as service calls, mobile sales, random drop-in sales, etc. In addition, these can be issued to customers on the spot, thus eliminating the frustration of mailing it later.

Types of Book Receipt

There are different types. The type used depends on the type of business you are running and the type of transaction. Below are some of the most popular types used by companies:

Business book

Business receipts are used to acknowledge customer payments for goods or services companies provide. In addition, these are used for record-keeping for quarterly or annual tax returns. They can be electronic or paper-based (if customers don’t provide an electronic option like email). The IRS requires businesses to preserve their receipts for up to 3 years or seven years if a loss was recorded in a year.

Cashbook

A cash receipt is used to record cash (physical currency) transactions in a business such as retail, hospitality, and any other businesses that regularly hold the cash from customers. It is the only proof of payment as no electronic evidence exists. A physical copy should be given to the customer to use for tax filing purposes. The IRS requires taxpayers to provide proof of payment for any tax-deductible purchase. These are issued to customers at the time of purchase.

Donation book

A donation receipt, also a 501(c)(3) donation receipt, is issued to recognize any in-kind donations made to an organization. These are issued once an organization has received the donated items or services. In the United States, for example, the IRS requires charitable organizations to issue these upon receiving in-kind donations of goods, cash, or property valued at $250 or more. It should outline all the donations made throughout the year.

In addition, it should outline the charity organization’s name, date of the contribution, amount of donation, and an acknowledgment that no goods or services were offered. The donor uses them to claim tax deductions for donations made.

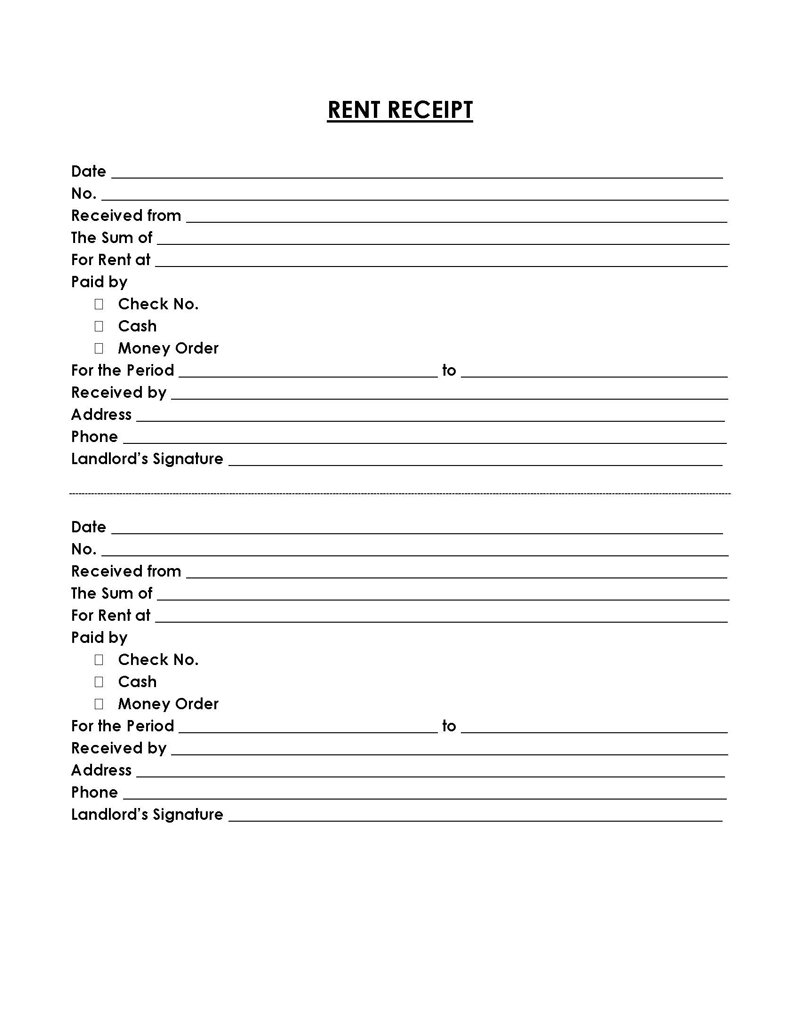

Rent book

A rent receipt records payment in cash, check, or electronic funds transfer from a tenant to a landlord for accommodation. It would show the date, rent amount, property description, list of payments made, name and address of landlord and tenant, and the landlord’s signature.

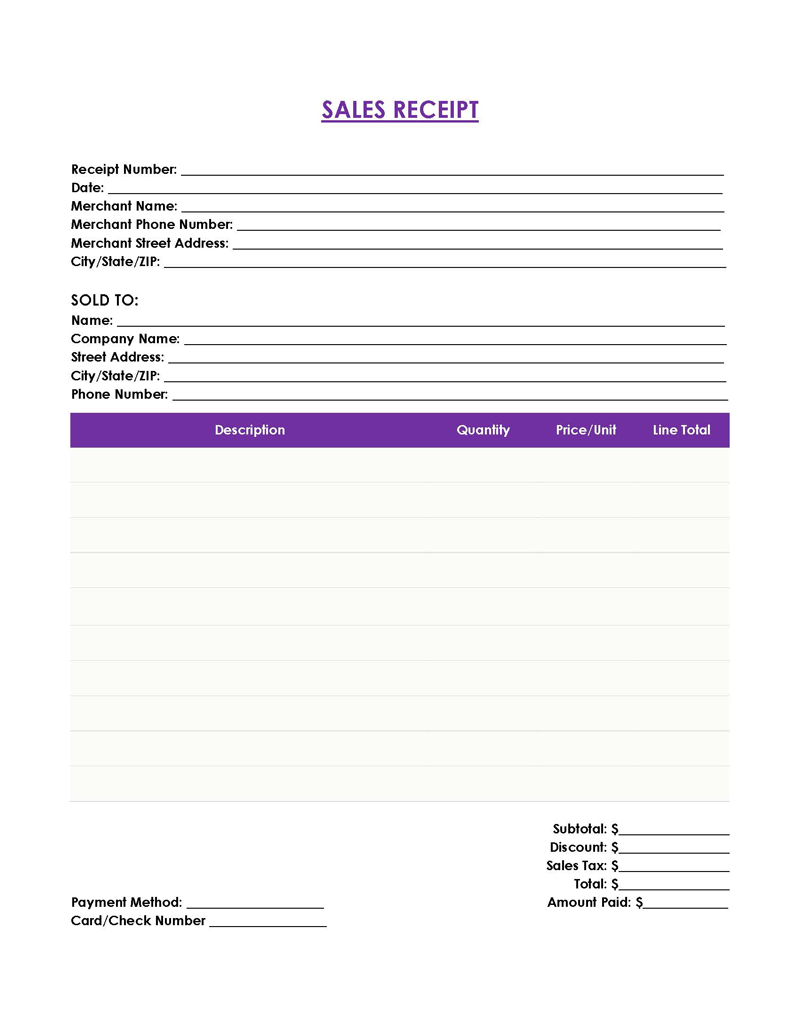

Sales book

Sales receipts are used in transactions between a vendor and a customer. It indicates the number of items and unit prices. The quantity is multiplied by the unit price to determine the price of the products. The applicable sales tax, which is dependent on the type of product and location of the transaction, is also recorded. Most states and counties will have their respective sales taxes.

Benefits

This book is a precious tool to help business owners. Below are some of how the booklet can be beneficial:

Build business’ professional image

They can be made personalized by including content that promotes the business, like the company logo. Also, these are part of excellent customer service. The booklet should contain all the information a customer needs to ensure satisfaction and smooth transactions at different stages of purchase or sale. For example, when paying for an item using cash, customers need to know how much change they will get back from their payment. This helps grow the business’s professional image.

Summarizes financial transactions easily

A receipt book can also record multiple interactions between a business and its customers. Therefore, the booklet helps you and your accountant easily track a business’s transactions, including daily sales, cash, electronic payments, sales taxes, etc. This way, accountants can quickly identify the business’s expenses and income.

Broad variety to choose

The booklet is a highly versatile tool. It can be customized with a business’ preferences in mind. This way, businesses can adopt the ones that match their type of business.

Maintain good business relationships

Having received it, customers are more likely to shop again at the same store or service provider. This is because customers can have an accurate record of their purchase that can be referenced in case of issues such as faulty products and refunds. Therefore, a booklet is beneficial since it strengthens customer relations and builds customer trust.

Make your business much more attractive

The design can be customized to make the company’s brand more visible and appealing to the target audience. The design can also make the business stand out from its competitors. This can, in turn, boost sales and increase brand loyalty.

How to Make It

Creating your receipt can be achieved in several ways. Here are the two methods on how to create your personalized one:

Making it by hand

It can be created by hand. This is typically a paper-based method. This process can be completed through the following steps:

- Step 1: You should get it from office supply stores or online. You can get a two-part carbonless booklet or one with reusable carbon paper. One copy is meant for the seller, while the other is meant for the customer. The booklet will typically be numbered for tracking purposes. When using the carbonless booklet, place the carbon paper between the two sheets – the original goes to the customer, and the seller retains the copy. Next, use a pen to write it up. Finally, exert enough pressure on the paper when writing so that information is transferred to the copy.

- Step 2: Record the number and date. The receipt number should be a sequential number that follows a chronological order for example, 001, 002, 003. This information should go at the top right. Its number is used to track sales, no two transactions should have the same number. Most books have this number pre-written. However, if you’re writing it manually, you can reset it, provided the appropriate date is recorded.

- Step 3: Add the name of the company and contact details. You can include contact details such as telephone number, mailing address, and additional details such as website, social media account, operating hours, etc. For private sales, indicate the name of the seller.

- Step 4: Add the goods or services purchased. List the purchased goods or services, including unit price and quantity. Each item should be identified by name. The items are on the left side, while unit prices are on the right side.

- Step 5: Supply the subtotal of all items declared in it. This figure should cover the price of goods before sales taxes and other additional fees. Ensure each item’s price is outlined before recording the total.

- Step 6: If sales taxes and additional fees are to be paid, they should be recorded. Indicate the type of fee and the associated amount. Next, determine the total of these fees and add the amount to the subtotal of the product’s value to determine how much the customer should pay. Record the final sum.

- Step 7: Lastly, it should indicate the payment method either cash, credit card, bank deposit, or checks, etc. The customer’s name should also be recorded. The customer should then sign the receipt.

Digital receipt

These books can also be electronic or digital. Creating digital receipts is much faster than manual ones. This method can be completed through either of the following:

- Option 1: Begin by choosing a template that suits your needs. Look for various template options. Customizable templates offer more flexibility. Download the template, personalize, and fill out the necessary information. If appropriately filled, it can be shared with the customer online.

- Option 2: Select software to create digital receipts. You can use software to create them. There are free and paid software you can choose from. After setting up the program, you are prompted to fill in specific information about the company. Most programs will allow you to upload your company logo to incorporate in it. The version is saved in the platform’s database for future reference.

- Option 3: Use a POS (Point of Sale) system. POS systems manage business sales, track receipts, expenses, and process payments. Upon processing, it will be generated at the point of sale and registered in the company’s database. Select a system that meets your needs, download it, and install it. POS systems are typically compatible with smartphones, tablets, and computers.

Filling the Book?

A compelling book will outline the main components of a standard receipt. Each section should be completed accurately. Below are the steps to follow when completing the document:

Date

The date should be displayed prominently in the top part. The date must be filled in to indicate when the transaction was carried out. It is pre-written in most receipts, whether manual or digital.

Include receipt number

A number should be supplied to the receipt. This is used to ensure that each customer gets a unique number. It can be found at the top. To avoid ambiguity and confusion, the customer is expected to use this number as an identifier whenever they make queries about the transaction. In addition, the seller uses this number to track sales, identify transactions, and ensure that no two transactions have the same number.

The amount received in words and dollars

The total amount of money received for the transaction should be indicated. The sum must use standard formats, dollars, and words should be displayed to indicate the sum.

Paid for

It should show which specific product or service was purchased. This section should show the product/service description, quantity, unit price, and total amount. It should also record the total value of purchased products or services.

Payment method

Afterward, record the payment method used by the customer. Various methods include cash, credit card, check, or other means of payment. If a check or card is used, indicate the check or card number.

Signatures (received by and received from)

Include signatures from the person who paid and received the amount. Signatures show that both parties have approved it to be true and accurate. The customer’s signature also indicates that they received their goods or services and are satisfied with the quality and value of their purchase.

Final Thoughts

A receipt book is a precious tool to business owners. The booklet helps to keep track of a business’s financial records. The booklet is not only an excellent way to keep track of transactions but also comes in handy as a reference document during tax season. When taxes are due, business owners can consult them and copy-pasted sale entries contained in their book to confirm that their accounts are accurate for tax purposes.

Receipts have become important documents for both business and personal transactions. They are used in an array of financial information daily. For example, they act as proof of customer payment and can be used to claim specific tax deductibles. It is thus vital to ensure it is professionally designed. This can be achieved through the use of a template