Cash flow is a stream of monetary values resulting from running a business. So, technically speaking,

A statement for cash flow is documentation of the estimated revenue gained and costs incurred by a business over a given period.

They include cash in hand, bank deposits and other investments that can be converted into money. A cash flow shows the cash a company sends and receives from operating, investing and other financial activities. It is also referred to as a statement of cash flows.

The purpose of it is to determine the financial health status of a business by indicating the amount of money gained or spent within a certain period of time. It also assists you to make better financial decisions like where to make changes so as to bring in more money and if your company is making enough to invest in inventory or other types of investments.

Banks and investors use it, accompanied by the balance sheet and an income statement, to give an estimated valuation of your company when one is seeking financing.

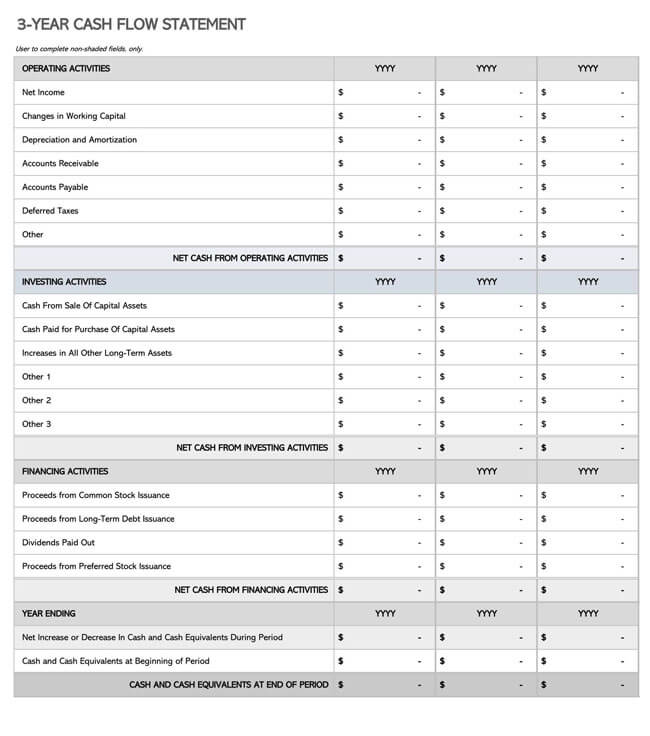

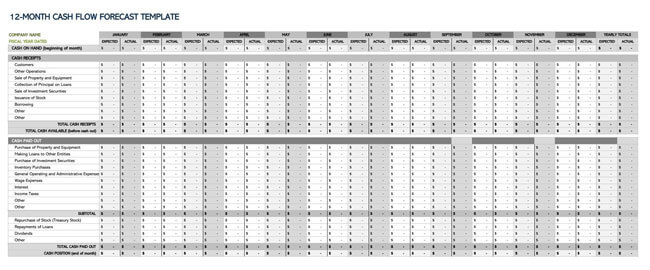

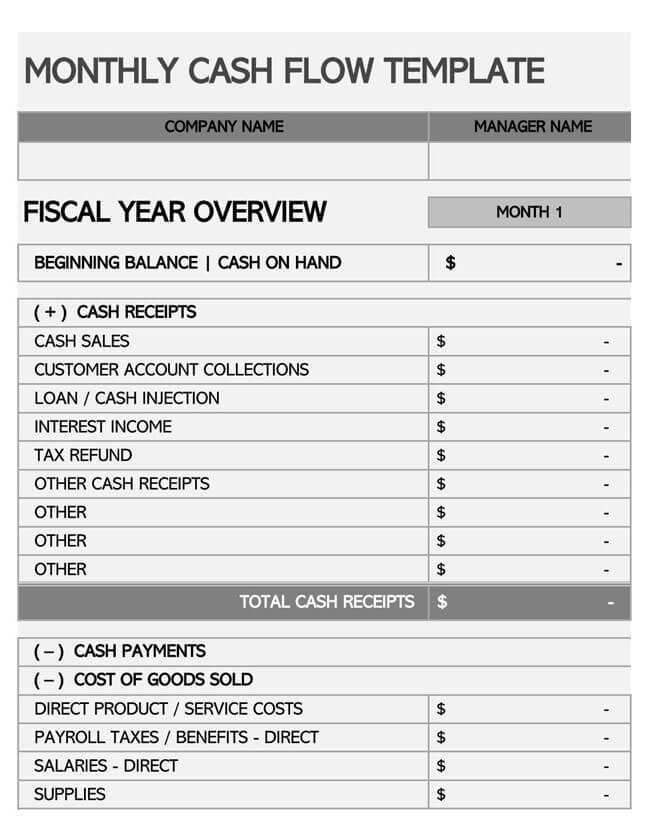

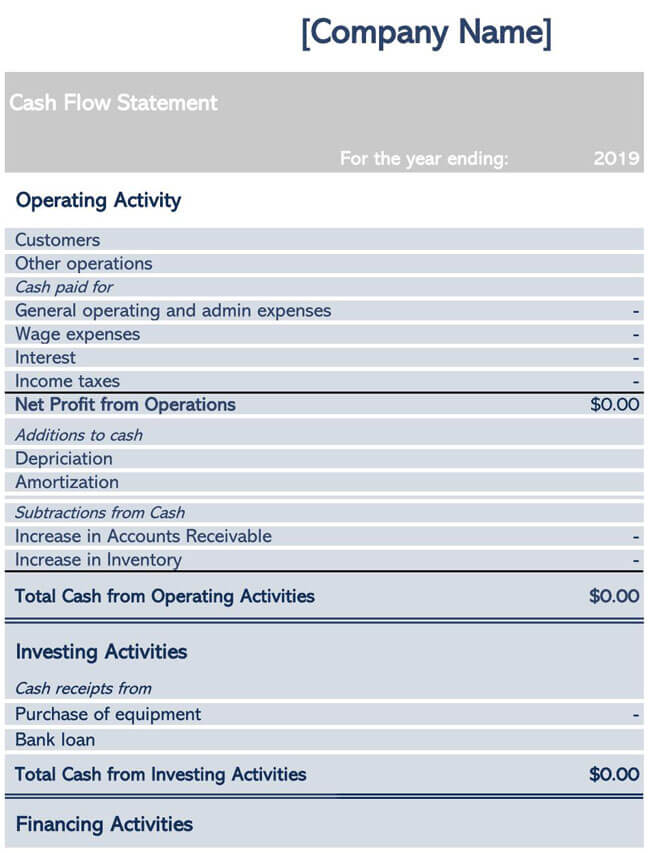

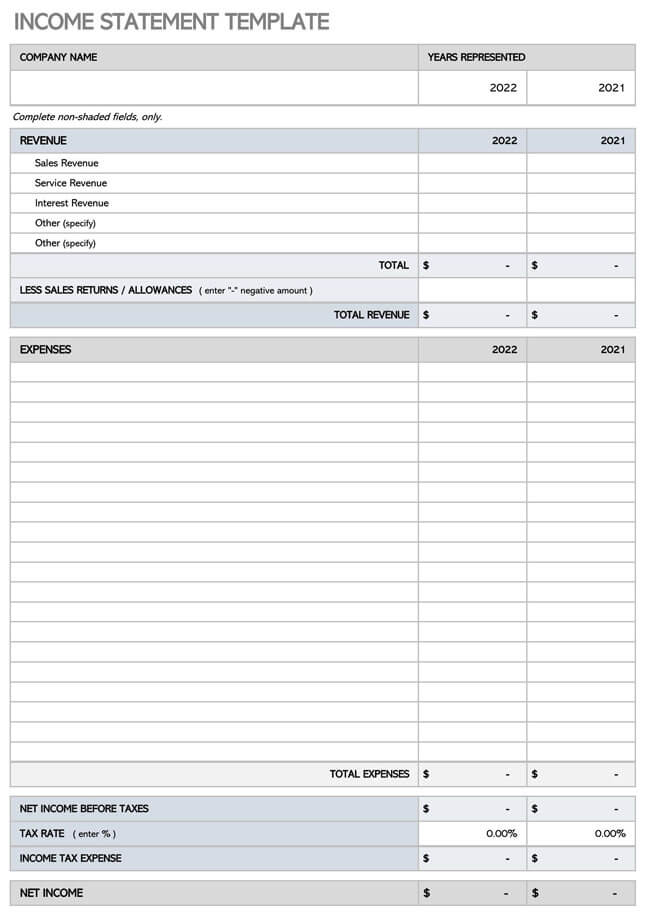

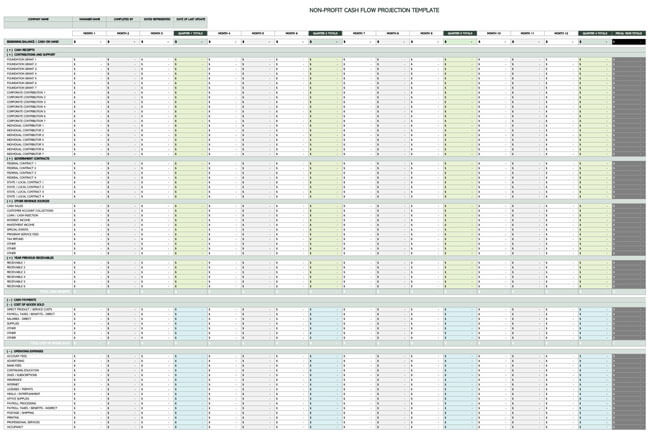

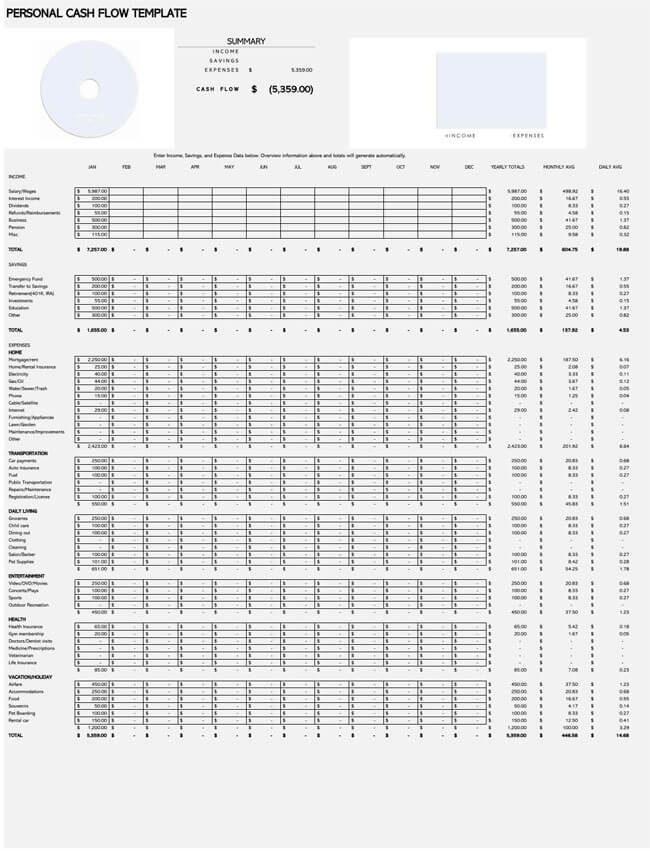

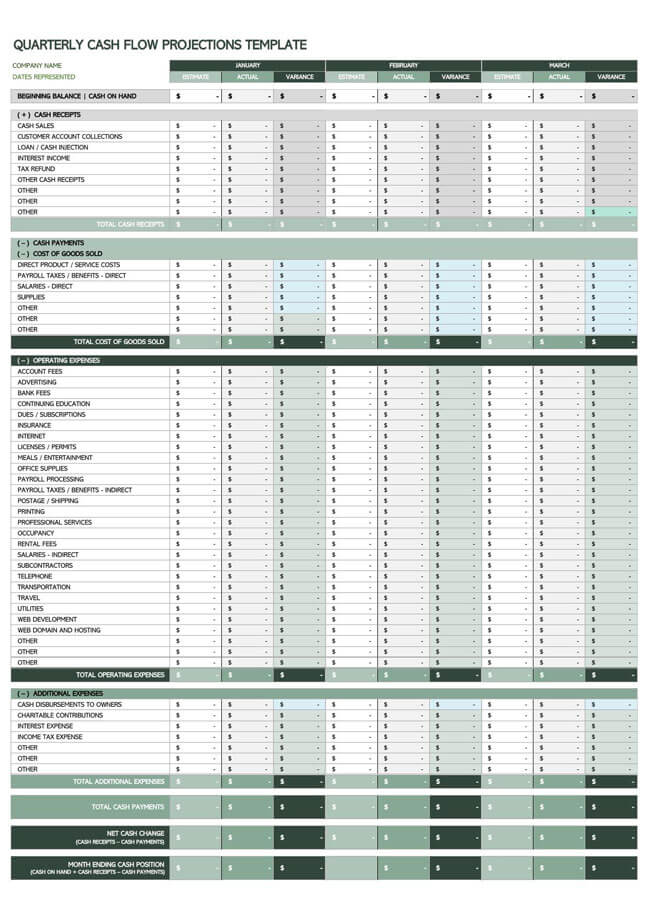

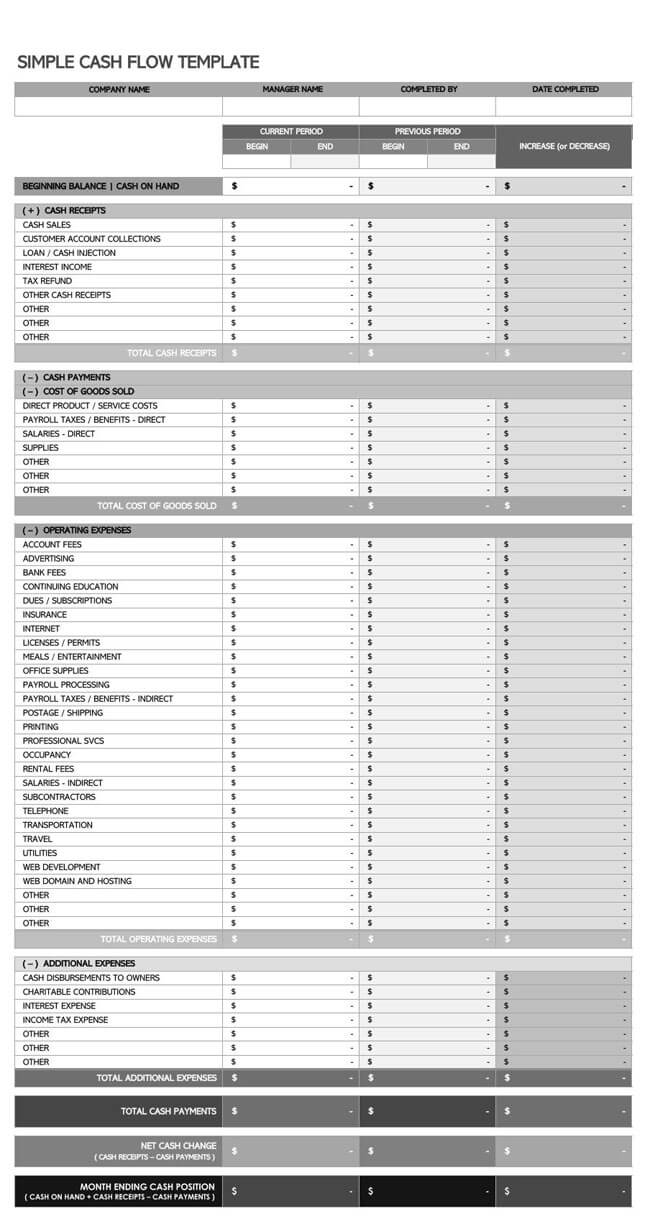

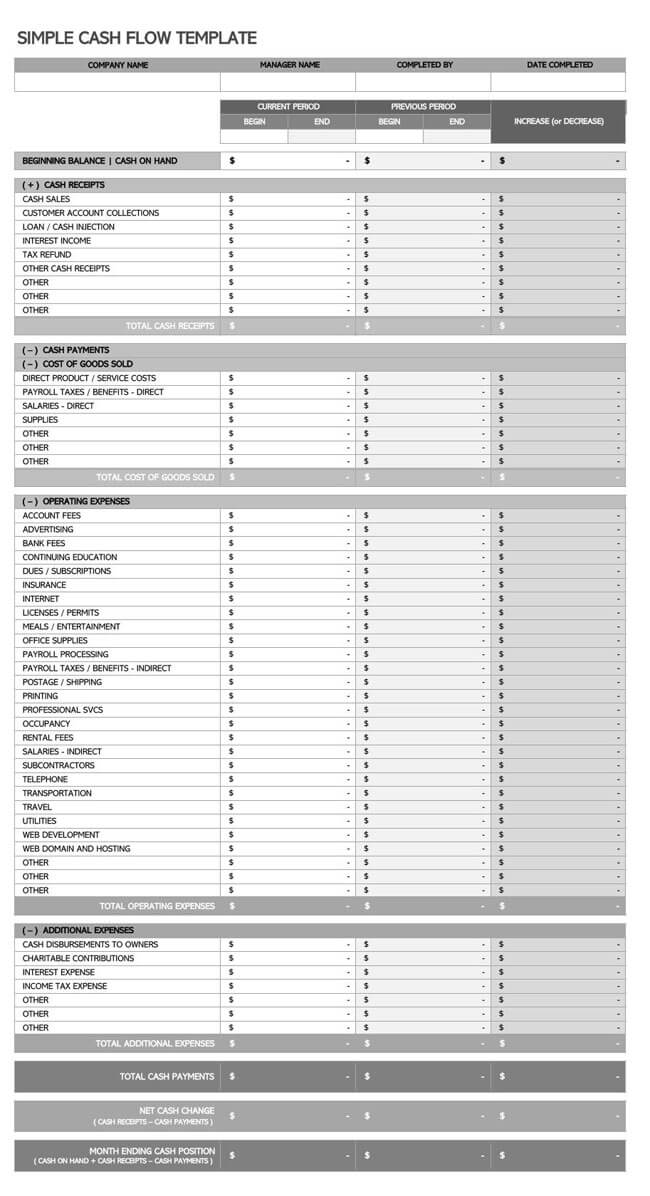

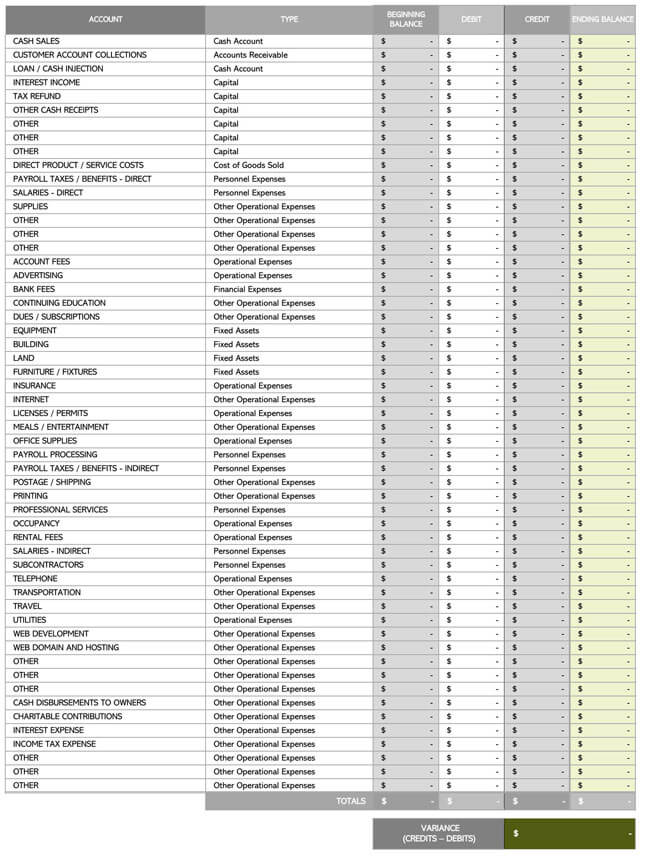

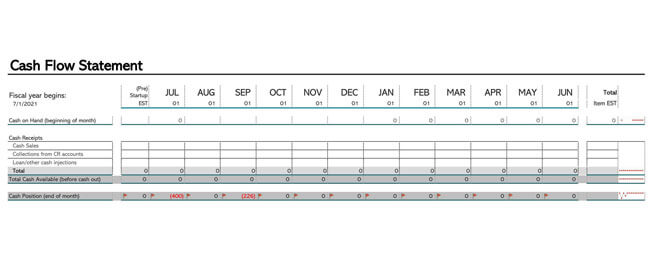

Free Templates Available

The Cash Flow Format

To demonstrate the financial health of a business mentioned above, how do you arrange all the costs and revenues to make logical sense? There are two ways you can format it to ensure you get a clear-cut picture of where your company is financially at.

These are explained as:

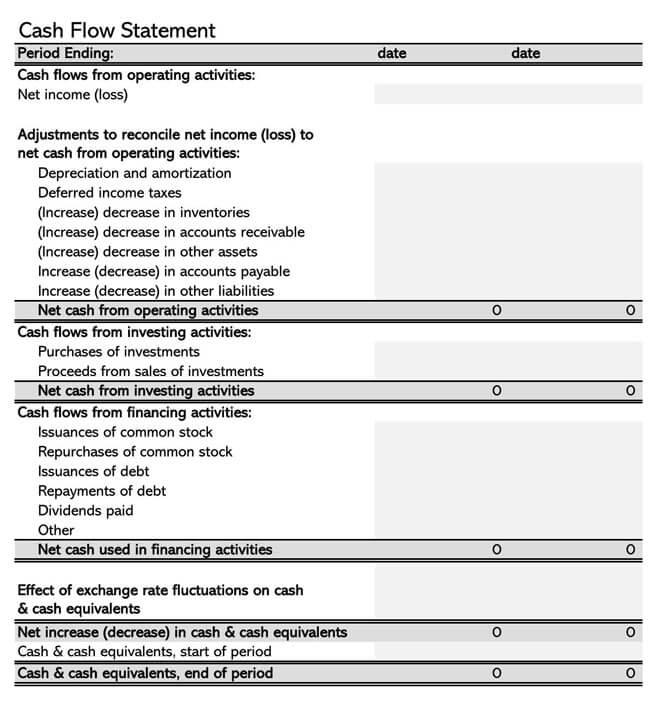

Indirect flow

This format is characterized by starting with a company’s net income derived from the net income statement. However, since the net income statement is prepared on an accrual basis, you should adjust for inventory, depreciation, accounts receivable and payable and accrued expenses emanating from operational activities in your statement for cash flow.

Direct flow

In a direct flow format, any amount received, e.g., from customers and paid, say to employees, is listed. It is essential to note that regardless of the format used, the results should be the same. The indirect format is the most commonly used, so it is up to you to choose a format that is best convenient for you.

Elements of a Cash Flow Statement

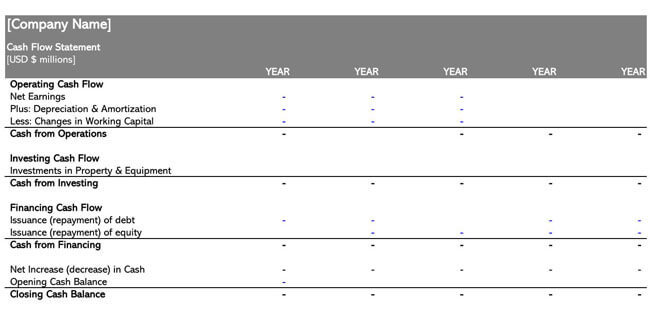

After you have identified the different items money was spent on and ways in which cash was received, you want to group these payables and receivables into logical categories. These categories can be based on the different activities involved in running a business. A CF statement includes operating, investing, and financing activities.

Since both formats, direct and indirect, serve the same purpose, they should address the financial status of a business around all the mentioned categories.

Let us look into the different activities under these categories.

Operating activities

They are the day-to-day revenues and costs registered in a business. Cash received from sales, and paid receivables are examples of everyday income. Expenses such as payments made to suppliers, wages, insurance and business taxes fall under operating activities.

Investing activities

These are long-term and involve a lot of money. Examples of investment outflow include the purchase of inventory/equipment meant to be in use for a long period of time. Renting out or sale of real estate assets is categorized as investment inflow.

Financing activities

This includes money received from business loans, equity or investors. When it is injected into the business, it is regarded as inflow. Other expenses, such as loan interest and dividends paid to shareholders, are considered financial outflows. Financial activities indicate how a business raises capital and pays its debts.

Additionally, it is necessary to mention that a CF deals with cash and cash equivalents and not necessarily cash that has already been paid or received. Consequently, receivables are taken as outflows and deducted from the net income, while payables are treated as inflows in this statement as you have not paid for the mentioned goods and services yet.

Account Payable and Account Receivable

A company’s sales and purchase finances can be broadly categorized into two, that is, accounts payable and accounts receivable which can be explained as :

Accounts payable is the money which your business owes to its suppliers or any third party as banks. For example, when you order goods from a vendor/supplier with a promise to pay.

And,

Accounts receivable, on the other, is any amount owed to you by customers for goods or services delivered.

An illustration of these two terms can be derived from a situation where a photocopier manufacturing company delivers ten photocopiers to a printing company for a given amount. In this case, the value of the photocopiers is accounts receivable to the manufacturing company but accounts payable in the printing company’s statement for cash flow.

Relation with cash flow statement

The account payable and receivable determine the amount of cash flow in a business. To determine how they have influenced the cash flow between two periods, here are two ways to achieve this:

- In regards to accounts payable, subtract your current amount payable from the previous period. If the difference is a positive figure, this indicates there has been an increase in your cash flow within that period. A negative number means a reduction in cash flow by the calculated amount.

- In the case of account receivable, the same applies, you subtract the current amount receivable from your previous, and the difference shows the type of change in cash flow that has taken place and by how much in that period. However, in this case, a positive number shows an increase in expenditure and indicates a reduction in cash flow. A negative number shows the contrary.

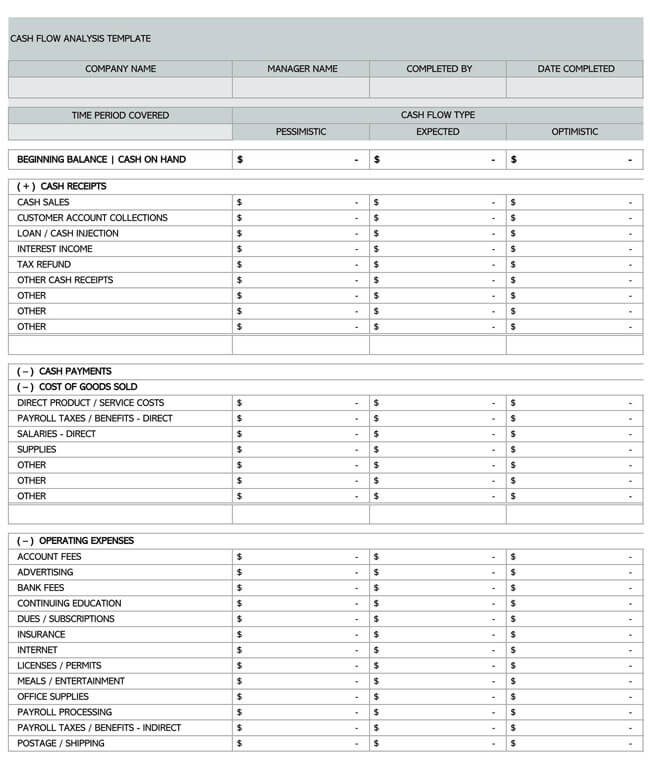

Preparing a Cash Flow Statement

Now that you are familiar with the essential parts of it, you are required to combine them in a way that serves the intended purpose of this statement. To ensure you capture all the costs and revenues, collecting the relevant information such as receipts, invoices and bank balance statements is recommended. These are the documents to help you draw comparisons and such. You can then proceed to prepare the cash flow as follows.

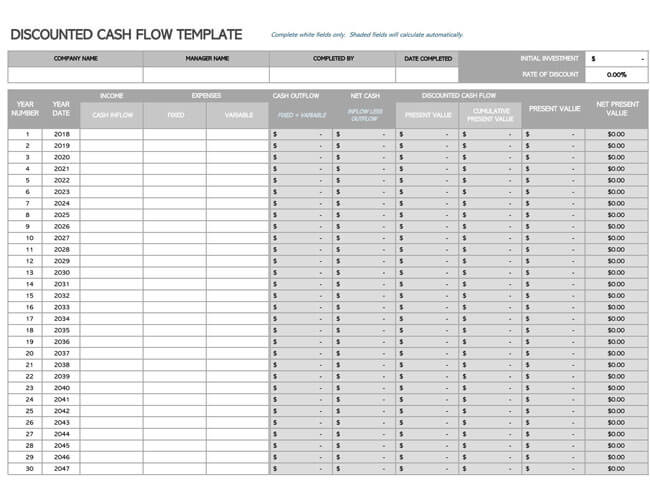

Cash flow statement formula

The first thing to undertake should be to familiarize yourself with the formula(s) necessary during cash flow calculations. The end cash balance can be calculated using the formula;

Ending cash balance = Cash from operating activities + (-) cash from investing activities + (-) cash from financing activities + beginning cash balance

However, there is accounting software that can be used to generate a CF statement. They are easier to use as they do all the calculations for you and provide all the information entailed in it; therefore, you will not have to go researching on this.

Enter the income

This is the beginning of drafting the actual CF statement. The amount generated as net income and that a business has at the moment are determined and entered in it. Net income is the company’s gross profit minus the operating expenses and taxes. The cash balance should include any bank account balances and petty cash where available.

Expenses and income come from different operations, include all the categories from which money was generated or used.

Mark the flows

Follow this up by marking the inflows and outflows from each category. Outflows are marked as negative, where else inflows are marked as positive.

Next, you should ensure that you double-check if you have marked each expense and income appropriately, this is because it affects the value you get as the ending cash flow balance.

Calculate the cash flow

This is the final step in determining your company’s financial health. There are standard ways which you can employ to do your calculations. In cases where software is used, it automatically does this for you, but the same formulas are used within the software execution.

- Operating cash flow: Identify the daily activities that generate income or cost the company money. To determine the operating cash flow, you can use the following formula:

- Operating cash flow = Net profit/loss + change in current assets, excluding cash + change in current liabilities, minus bank and shareholder debt + change in net fixed assets + change in noncurrent assets

- Financial cash flow: To determine your financial cash flow, determine the changes in your bank, shareholder and other long-term debts between periods. The financial cash flow is given by adding the changes in the bank, shareholder, and noncurrent debts to the equity adjustment.

- Net cash flow: The net cash flow is the desired end result of a CF statement. To obtain this, add the operating cash flow to the financing cash flow. The value of the net cash flow shows the financial status of the business. The desired net cash flow is a positive one, for a negative value indicates an increase in debt.

note

Even if you choose to use accounting software, it is important to be certain of the format you are using, whether direct or indirect.

Cash Flow Statement Example

An example of it has been provided for illustration purposes.

Wendy’s Creamery cash flow statement for the year ending July 31st, 2020

All figures in USD:

| Cash flow operation | Value |

| Net income | 100, 000 |

| Depreciation | 4000 |

| Decrease in accounts receivable | (5000) |

| Increase in accounts payable | 12000 |

| Increase in inventory | (8000) |

| Net cash flow from operating activities | 103000 |

| Equipment | (25000) |

| Net cash flow from investing operations | (25000) |

| Dividends paid | (30000) |

| loan received | 15000 |

| Net cash flow from financing operations | (15000) |

| Net cash balance | 63000 |

In the above example, items have been categorized accordingly, i.e. operating activities, investing and financial activities. In this business, it is evident that a lot of the money is generated from the operating activities. Depreciation is added to the income; however, it is good to keep in mind that it is not a source of revenue. The net balance for this business is positive, showing that it is not operating on debt, and there is enough money to make investments with.

Using a Cash Flow Statement

A cash flow is as good as its interpretation. To ensure it helpful to you and your business as much as possible, there are several characteristics you should look forward to:

Pattern identification

As you analyze your cash flow, you can determine the changes in your company’s expenditure. From this, you can identify patterns and relations that exist between your costs and revenues. Through this information, you can make decisions based on your better judgement. Therefore, you can plan on where to allocate more money in the next year or where to withdraw to increase your profits.

Economic health awareness

A cash flow lets you know how well or bad your business is performing in terms of expenses and profit generation. This can be determined by the value and nature of the net ending balance. A positive balance shows your business is financially sustainable; this shows the importance of being keen when carrying out your calculations.

Financial proof for shareholders

It can be used as evidence of a business’s financial status to shareholders. From time to time, current shareholders ask for a progress report on their investments; a cash flow is one of the documents that can be presented to showcase this. Potential investors also require proof of the worthiness of a business before investing. If you can show that if money is pumped into the business, how this would influence an increase in revenue, the more likely you are to secure capital and loans. A cash flow can be used in such an instance.

Limitations of a Cash Flow Statement

As useful as a CF statement is, it does not come without limitations in running a business. Some of these limitations include:

- Business future: A cash flow cannot be used to illustrate how money coming and out of business will be in the future; it be a week, month or a year from the present. It shows the amount of money already earned or spent in a business. This is a limitation because most business owners are interested in where the company will be six months or a year from now.

- Hard for non-accountants: Individuals without accounting skills find it difficult to understand and interpret such statements. This can be a challenge, especially in small and medium-sized business where owners are expected to take on accounting responsibilities. If a person cannot interpret it, then ultimately, it would not be helpful to them or the business.

Final Thoughts

As a business person, you should aim to familiarize yourself with preparing and using a statement for cash flow. Additionally, a statement of cash flows is one of the three vital financial statements within a business. Its importance goes beyond summarizing your income and costs; it gives an overview of the suitability of investing in your business. This is an essential requirement when taking loans or raising capital for your business. Knowing what it entails is important even in cases where you are use software. With the information given in this article, you are well equipped to develop your own statement for cash flow. It is demanding but doable.