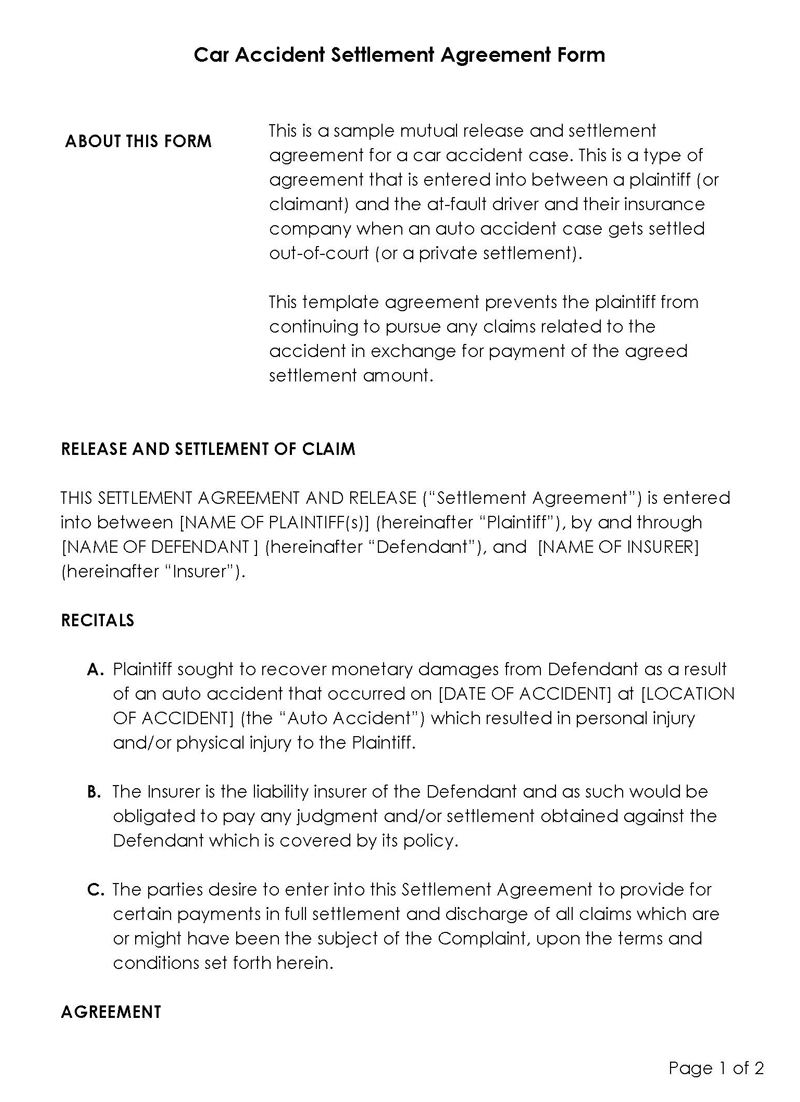

A car settlement agreement also referred to as an accident settlement agreement or a car accident waiver, is a legally binding contract that parties involved in a car accident can sign, which addresses their personal and financial responsibilities for the accident to be finalized out of court.

A car accident settlement agreement is most often used when a party, the insurance carrier, or the party involved, has been injured in a car accident.It aims to end a dispute formally and legally between two parties who have agreed on all necessary details for a successful settlement, including details on who is at fault, how fault is determined, and how the settlement will be paid.

Free Templates

Although knowing what to do after an accident is essential, knowing how to do it effectively is just as important. Having a pre-made template for an agreement is ideal to ensure that the situation is handled correctly and that all affected parties get the compensation they deserve.

When and Why is it Needed?

After a car accident has occurred, it is important to know how to move forward. It is not uncommon for those involved in an accident, especially one with injuries, to wonder what comes next. The first thing that you should do when you have been involved in an accident is to assess the level of damage that has been inflicted on you. If you are not sure what the damage is, you should go to the emergency room to be examined by a medical doctor. After being evaluated and treated for your injuries, you must seek legal counsel. It is important that you do not sign the agreement before evaluating the damages and consulting with your legal counsel, who will advise you of your rights and responsibilities.

If the accident involves more than two cars, more than two drivers and/or bodily injuries, it is more than likely that you need the agreement. If your damages are minor, then the insurance company will most likely be quick to offer you a settlement, if at all. It is important to assess your situation before accepting any settlement agreement to determine whether or not you stand to benefit from signing it.

How it Works

After a car accident has occurred, the insurance companies representing the drivers involved will investigate and decide who is at fault for the accident. They will also determine who will have to pay for any damages or injuries associated with the accident. If you are at fault, it is important that you obtain an attorney as quickly as possible to protect your rights and avoid any unnecessary complications. Once you have successfully secured legal counsel, they can begin negotiating a county settlement agreement with your insurance company or the other driver’s insurance company.

Here are the steps you can follow for preparing your agreement after a car accident:

Step 1: Gather details of the accident

Before drafting the agreement, the first thing you should do is gather as much information about the accident as possible, including details about the driver and the vehicle. You can obtain such information by accessing the police report, if available, or by gathering any other documents and images that will prove how the accident transpired. This information is important as it helps determine who was at fault and ensures that your rights and responsibilities have been understood.

If the victim suffered personal injuries, you should compile a list of their damages. You should talk to their healthcare provider to find out about their medical bills and who will be responsible for them. This should include their medical costs and any future medical treatment they may need. You should also include lost wages, physical pain and suffering, and mental trauma.

In the event that the victim dies in the accident, you will have to include funeral expenses as well. The victim may choose to write you a car accident demand letter-a legal letter that requests compensation as a result of a personal injury. You should contact the victim to find out how they want you to provide compensation.

Step 2: Claim for the damages and injuries

Before you can sign the agreement, you should have the medical treatment that you have had done to assess the level of injuries and damages. You should also look over all the documents that were gathered from the police and insurance companies to obtain as much information about the extent of your injuries and financial losses as possible. It is important to note that the agreements, once signed, are usually final and cannot be rescinded.

Step 3: Negotiate the settlement

Once you understand your losses, you can then negotiate for a better settlement agreement to obtain a fair amount for any financial damages and compensation for any personal injuries that have been sustained. It is important that you negotiate from a position of strength. This can be done by ensuring that you have all the information and documentation needed to support your case in the event that your insurance carrier does not accept your claims or offer an acceptable settlement for them.

Step 4: Get a legal claim evaluation

It is important to get your claim evaluated by a legal professional to ensure that the information you have provided will give you the best possible chance of getting a favorable settlement. Your legal counsel can help make sure that any insurance claims for damages and injuries are filled out accurately and timely.

They will also ensure that the settlement is evaluated accordingly by evaluating your medical bills from healthcare providers, your income statements and calculating your lost hours and wages, your pain journals and testimonies from those around you, and estimating the cost of your future treatments. Additionally, they will also help you with any negotiating process and guide you through it. This will save you the time and stress that may have come from assembling the information alone.

note

Once you sign the agreement, you waive your right to sue for any losses resulting from the accident. This means that you will have to forfeit your chance of suing for any financial damages or personal injuries that occurred in the accident. This is why it is absolutely important that you get your claim evaluated by a legal professional before signing the agreement.

Step 5: Create and sign the agreement

After you have agreed on a settlement amount with your insurance company or the driver’s insurance company, the agreement can be created and signed. It is important that you look over the document carefully to ensure that it includes all of your rights and responsibilities and any financial losses. Both parties should sign the agreement. It must contain details on how the payment will be made to resolve damages, injuries, or any other financial loss associated with the accident.

Contents of Settlement Agreement

There are various things that can be included in the agreement to help you protect your rights and ensure that you receive the compensation that you deserve. The information included in the agreement usually depends on which party was at fault.

Here are some of the items that should be included in any car accident settlement agreement:

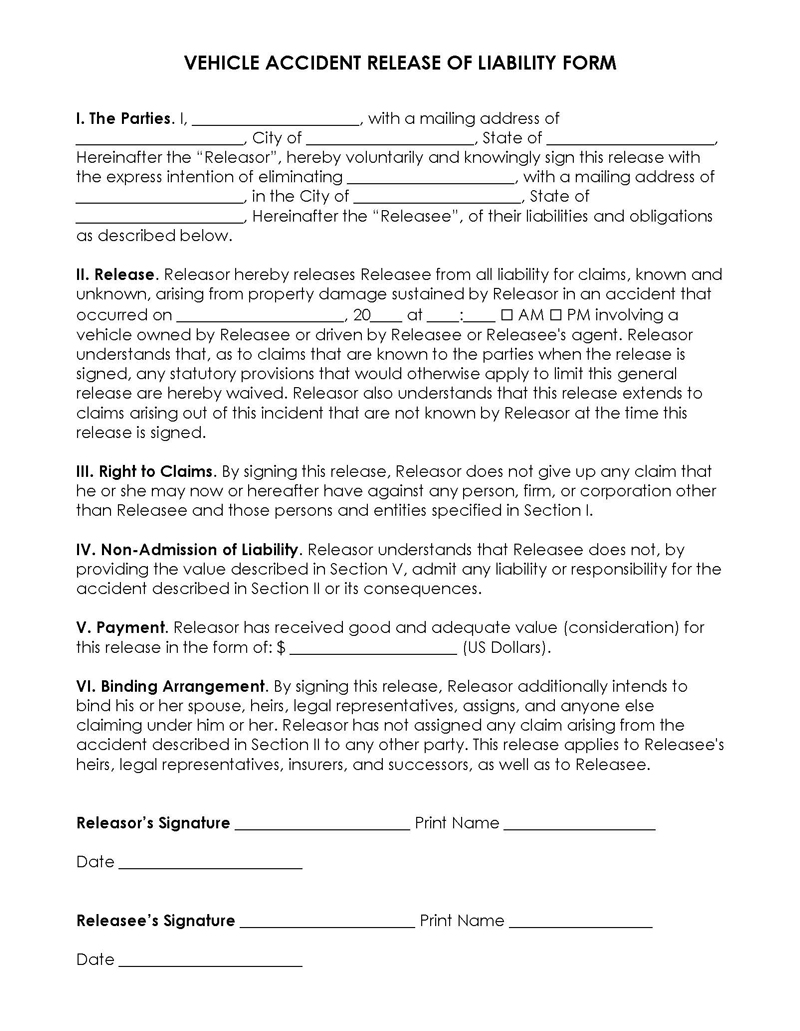

Releasor’s information

The releasor is the person that the liability of an accident rests upon. This can be a driver or a passenger, depending on who was in control of the vehicle at the time of the accident. You must include the releasor’s information in the agreement, including their name, address, and phone number, as well as their license number and insurance provider contact details. All of this information is important as it will help determine how to proceed with any legal action taken against them.

Releasee’s information

The releasee is the person who was actually injured or affected by the car accident. This should be included in the agreement to ensure that they get compensated for any injuries they may have suffered due to the accident. It is important that their personal information, including their name, address, phone number, and insurance provider details, are well captured in the agreement.

Details of the accident

Include all the details you can obtain regarding the accident, such as what happened, where it happened, who was involved, and any other information that may be useful in your case. This is important information because your claim might not be valid if it has not been included.

Claims

Include any documents about your claims such as police reports, legal notices for the settlement agreement, medical records, eyewitness statements, and accident pictures that you may have. These documents can help prove that you have suffered damages and injuries as a result of the accident. They will also help with your claim in the event that your insurance company or other party involved in the accident goes to court and tries to deny any liability.

Settlement terms

Include any financial or other terms you may have with the person who caused the accident. These could include money or property they may have to give you or offer in exchange for compensation. They are also sometimes known as claims of undue payments and are usually offered as part of a settlement.

Amount to be paid

Include the payment amount that you plan to settle for as well as the date when the payment should be received by. This is important for several reasons. First, it will make sure that both parties stick to this agreement and do not try to renegotiate it in the future. Also, it will help determine if there are any additional fees that need to be paid out of the settlement in case the claim has been rejected due to any inconsistency with the facts or evidence.

Signatures

Both parties involved in the claim should sign the agreement to ensure that they both agree with the terms and conditions. This is the most vital feature of the agreement because it signifies acceptance of the terms and conditions between both parties and that they will not try to sue each other again for any losses or damages that occurred due to the accident.

Some Special Considerations

The agreement can help resolve financial losses, damages, and/or injuries that may have been caused as a result of an accident. Nevertheless, there are considerations that should be made when creating and drafting such an agreement.

Some of these include:

Knowing the value of your claim

It is important for you to know the value of your claim before you actually create an agreement. This way, both parties will have a clear idea of how much money (if any) will be exchanged in compensation for any losses or injuries suffered as a result of the accident. Also, it will help you establish if your settlement offer is enough to cover all damages and injuries and if some additional funds should be added in order to make up for any shortfall.

Maintain a record of your injuries

One of the most important things that should be included in your agreement is the records of the accidents i.e. any medical records, photographs, and statements confirming that you have been affected by any injuries or damages resulting from the accident. These will help prove the validity of your case in case it is rejected by any insurance providers involved in the claim. Also, they will help determine whether it is necessary to file a formal complaint against whoever might have caused the accident.

Insurance companies are not on your side

All insurance providers are aware that if they pay out an excessive amount of money to a claimant, then they will be sued by the other party that caused the accident. So, be sure to include all documents and evidence that will prove how much insurance companies might have paid out in order for you to get compensated for any injuries or damages suffered as a result of the accident. This is specifically significant when dealing with any type of policy with underwriting and claims handling policies because these can complicate the claim process.

Understand your options and know what you can do

It is crucial that you choose the option that best suits your needs and covers all losses or damages suffered as a result of the accident. This way, both parties will be assured that they will be compensated for these losses and minimize any disputes in the future.

Know the law

You should also have an understanding of the law dealing with car accidents and how it can affect your claim. This will help you determine whether you should file a formal complaint, who will be held liable for any losses or damages suffered in the accident, and what types of compensation are available to you. This way, you will know what compensations are available to you and which ones are not covered. Also, it will help both parties determine who will be held liable for any losses or damages and what the best solution is that benefits both parties.

Store the agreement

It is also important that you make sure to keep the agreement stored in a safe place. This way, you will have a copy of it whenever you need to refer back to it. Also, it will help avoid any misunderstandings or errors that could occur if copies are not stored correctly.

Final Thoughts

A car accident settlement agreement can help resolve financial losses, damages, and injuries that may have been caused as a result of an accident. This is mostly true if you are dealing with any type of insurance policy with underwriting and claims handling policies because these policies make the claim process more complicated.

However, it is important to remember that this agreement will also help determine how much compensation is available to you as well as eliminate any misunderstandings out of court or when facing a claim for damages or losses. Also, it will help determine whether or not the other party is liable for the accident and what they are liable for. When preparing this agreement, make sure to follow the legal requirements and make every effort to be completely honest, precise, and accurate in all details of the agreement.