When renting a business property from another, a commercial lease agreement is used. To make changes to the existing terms of the lease agreement, a Commercial Lease Addendum needs to be agreed upon and signed by both the person leasing the property and the person renting it.

What is a Commercial Lease Addendum?

A Commercial Lease Addendum allows changes or additions to be made to an original lease agreement without having to write a new agreement document. This is typically used when a landlord wishes to make changes, such as extending the time frame of the lease, making changes to rent amounts, or giving certain rites to renters. Renters may also use the addendum for certain changes.

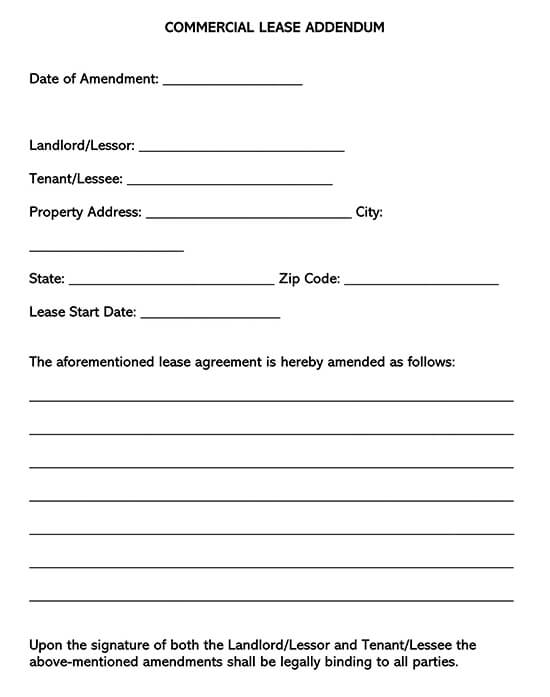

Free Template

How to Create a Commercial Lease Addendum

A Commercial Lease Addendum will differ depending on the reason for creating it. However, some key elements need to be in the addendum:

- The date that the addendum was created

- The legal name of the landlord

- The legal name of the tenant

- The full address of the property

- The date that the original lease began

In the main body of the document, you will need to outline and give details regarding the addition being made. Each addendum should be on its own document. For the addendum to be binding, both the landlord and tenant must agree to the changes and sign and date the addendum.

Basic Addendums and Lease Terms

Addendums can be created to change the term time of a lease, for example, going from a monthly to a yearly term. There are a few different types of lease terms that a commercial property landlord may use:

- Fixed End Date Lease – this term gives an exact date that the tenancy ends. During that time, rent cannot be increased, and changes to the lease cannot be made without an addendum.

- Fixed Term Time – this term option specifies a fixed amount of months, days, weeks, or years. This can be beneficial if a tenant is trying out a new property or a landlord is trying out a new tenant because it doesn’t lock them into a long lease term. A landlord can then use an addendum to increase the term if both parties agree.

- Periodic lease – with this option, the lease term will continue until either the landlord or tenant terminates the contract. With this option, a landlord can make changes to the terms or raise the rent as long as they give notice to the tenant.

- Automatic Renewal – with this option, the lease will renew until either party terminates the contract. The contract will continue with the same terms that were originally agreed upon, regardless of each end/renewal date.

When a Commercial Lease Addendum would be Used

The use of a Commercial Lease Addendum would be needed for:

- Changes to provisions for renewing the lease

- When a landlord is making improvements to the property

- When a tenant is making improvements to the property

- To outline whether a tenant is allowed to sublet the property

- For termination of tenancy

- For insurance provisions

Different Types of Commercial Properties

A Commercial Lease Addendum covers the following commercial properties:

- Office Space

- Retail Business Space

- Restaurants

- Industrial Business Space

- Self-storage Facilities

- Hotels

- Medical Facilities

Responsibilities of Landlords

As a landlord, there are a number of responsibilities that need to be kept in mind when creating an addendum.

This would include:

- Property Specifications and Use: The landlord is responsible for ensuring that commercial property is being used legally and that it is actually permitted to be used as such. This means building codes and bylaws need to be satisfied; for example, a restaurant business cannot be run in a commercial property that is only designated for factory use.

- Exclusive Uses: It is up to the landlord to decide if the tenant will have sole use of the property for their business type. An example would be a business that runs the only bakery in a mall setting.

- Terms of the Lease: The landlord must outline how long a lease term will run for. Different terms may apply to different terms, and this needs to be clearly outlined.

- Costs of Operating Utilities: The landlord also needs to determine who will be responsible for paying the utilities. In some instances, the tenant and landlord may split the costs, or the landlord may charge a monthly fee. The same would go for paying property taxes.

- Improvements: It is the responsibility of the landlord to make any improvements requested by the tenant that will improve the running and safety of their business. The landlord typically pays for this to be done and may pass the cost on to the tenant.

Frequently Asked Questions

A residential lease contract is used for tenants who are renting a home or personal space to live in. A commercial lease is used to rent space to run a business. There is less protection from the government for people renting commercial properties than for those renting residential properties.

This refers to the jurisdiction of the state/locality of where the physical property is located, rather than where the landlord or tenant may reside.

This refers to the minimum amount of rent outlined in the lease agreement, excluding any additional rent percentages or operating costs.