This bill of sale is a legal document or form that details in writing the sale of a business entity from one party to another.

It serves as legal evidence that full consideration has been provided in the transaction and that the seller has transferred the rights to the business detailed in the form to the purchaser for a given financial value.

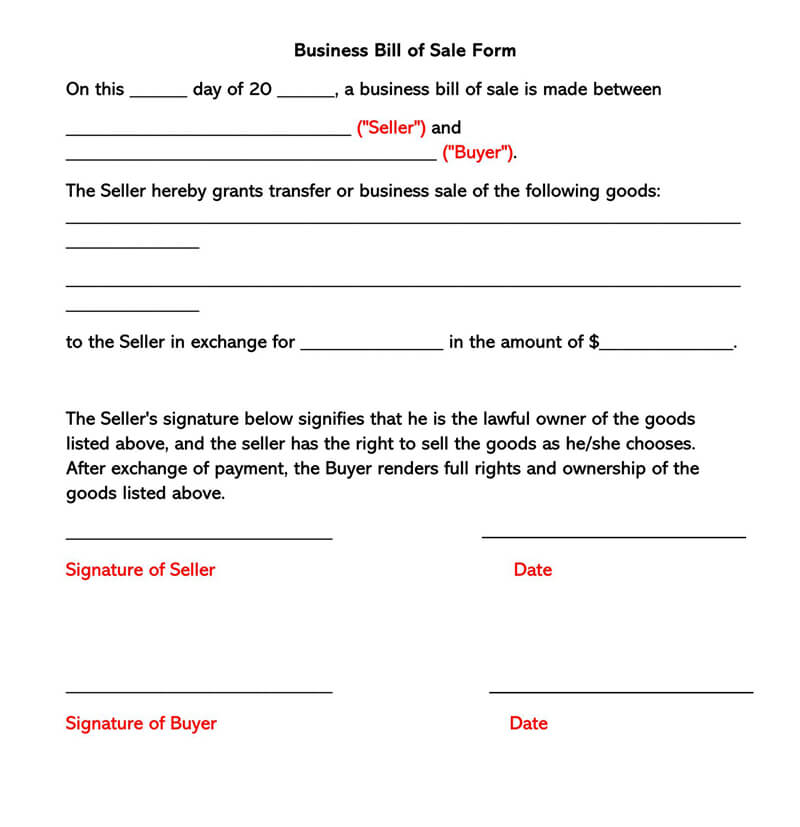

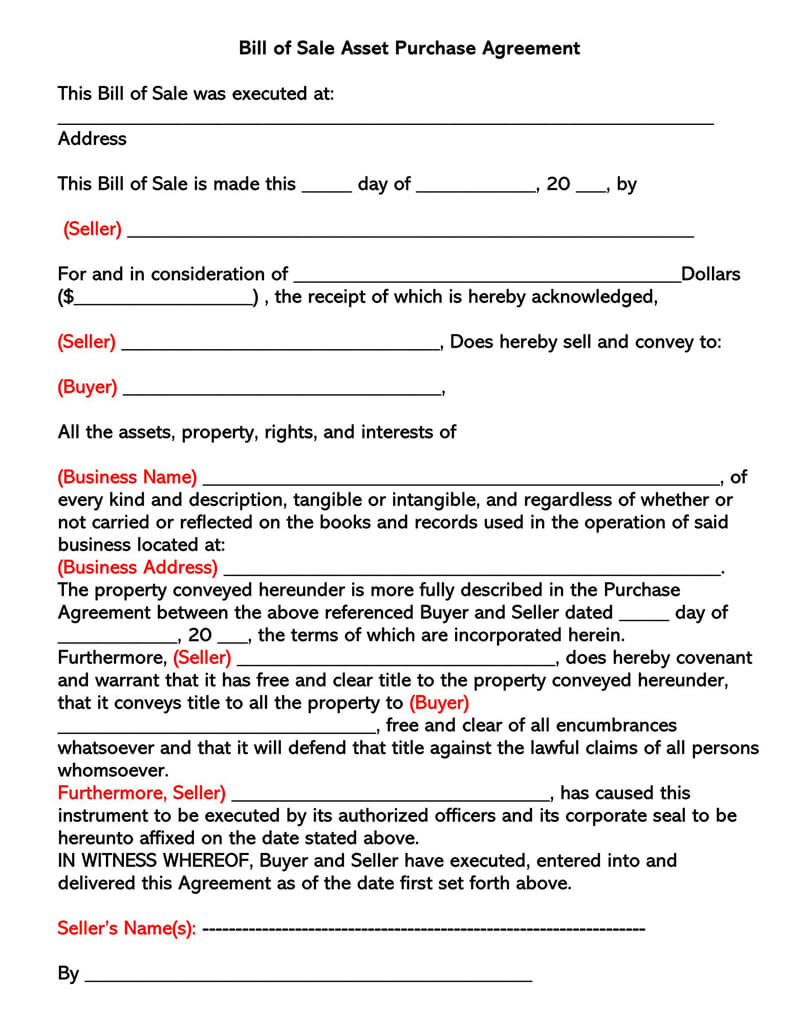

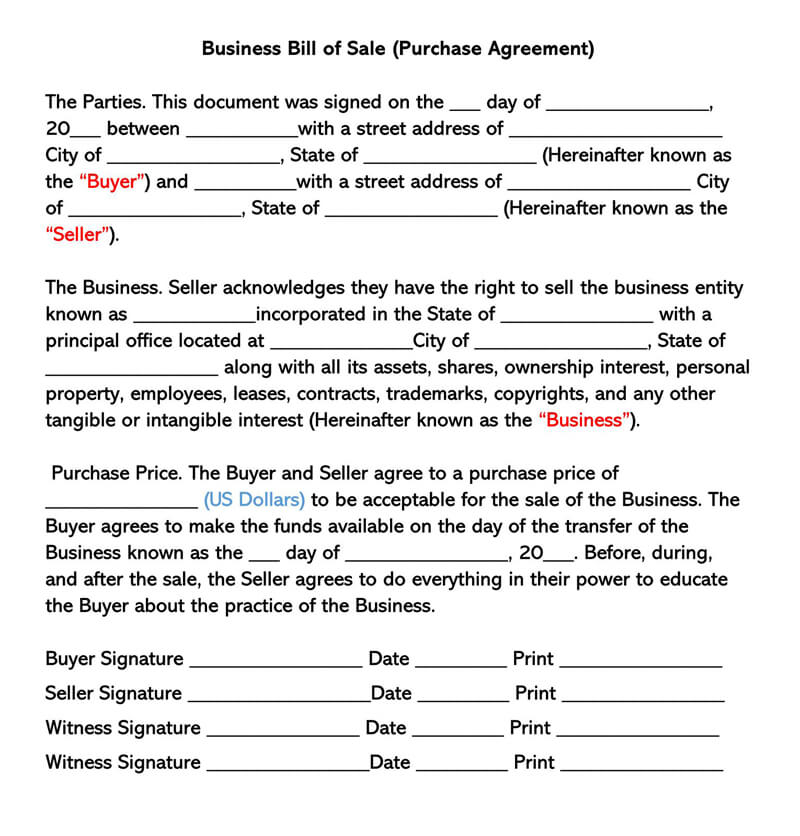

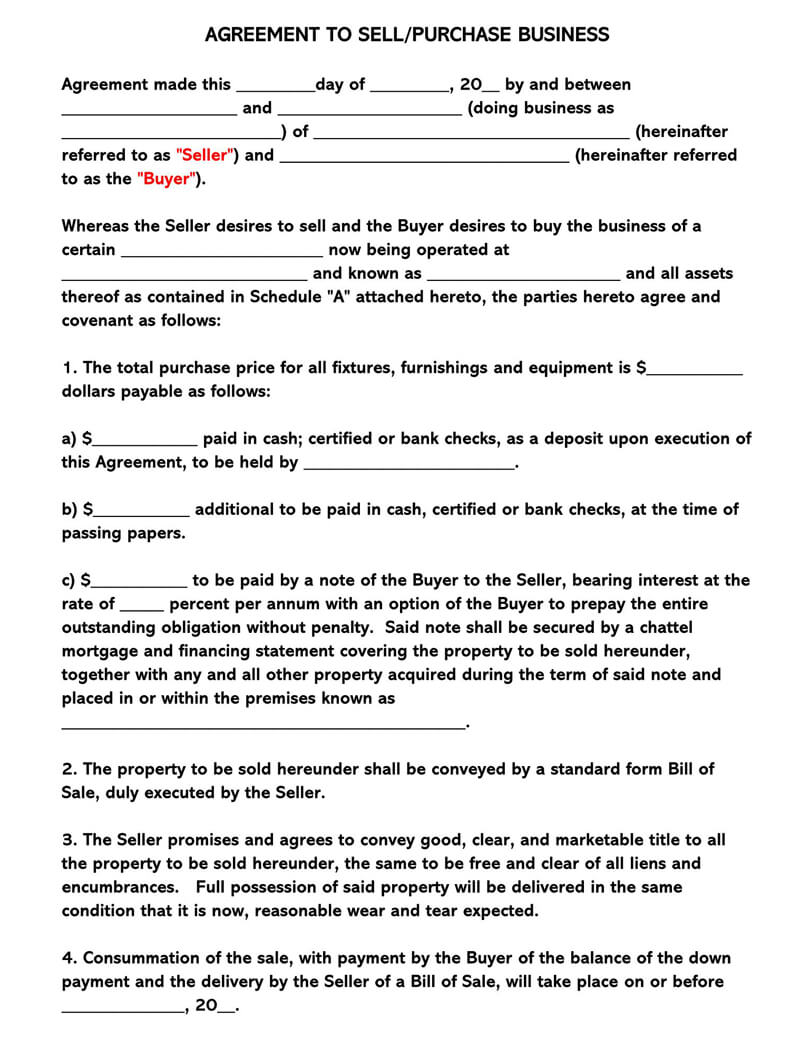

It usually specifies the business being sold and lists the transaction date, the seller’s and buyer’s information, the purchase price and outlines the terms of the sale.

Free Templates

Bill of Sale Vs. Purchase Sale Agreement

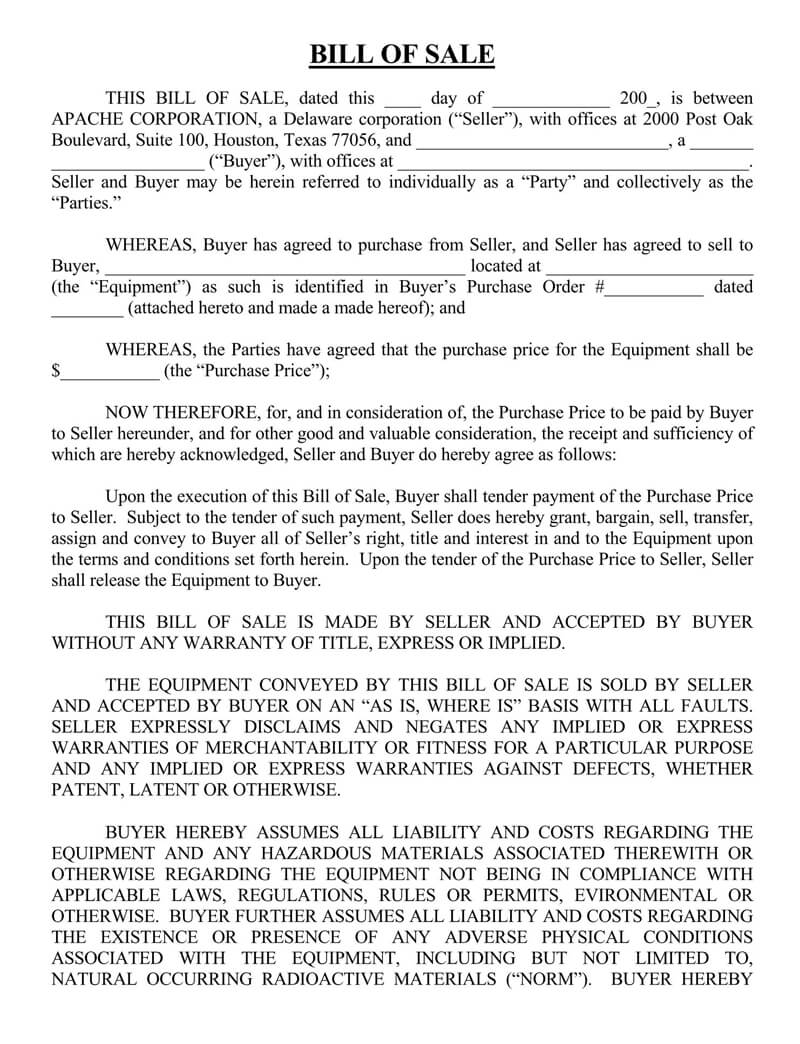

A bill of sale signifies the transfer of ownership of a piece of property from one person to another. A purchase or sale agreement, on the other hand, expresses an intention by one party to acquire some goods from another at a future date.

Though both touch on the transfer of property, they differ markedly beyond that. Here are some of the inherent differences that the two possess:

- Purpose: A BOS spells out the transfer of a commodity from one party to another. The sale or purchase agreement, on the other hand, showcases an intention rather than the actual transfer. In this case, the intention is to buy the stipulated stocks later.

- Applicability: With a bill of sale, you may litigate in court, prove property ownership, fill the tax returns, and even write a will. A purchase or sale agreement will not do you much. It only expresses an intention to purchase the listed stocks but is not legally binding.

- Scope: A BOS touches on physical tangible assets which are private in nature. A purchase or sale agreement, on the other hand, deals with stock rather than private property.

- Legality: Also, the bill of sale has many legal applications. These range from the filing of tax returns, proving ownership of any assets, arguing disputes in a court of law, and even sorting out inheritance matters. It is never really legally binding as it is merely an expression of interest.

- Contents: Lastly, these two documents differ in their contents. The bill of sale generally contains more details than the purchase or sale agreement. A purchase or sale agreement only has information about the stocks of interest, their quantity, and the cost of each item in the inventory.

Why is the business bill of sale important?

Customarily, selling a business and all its assets is a complex procedure that needs the completion and execution of a bill of sale to adequately demonstrate the transfer of ownership. Naturally, no buyer would be willing to pay for or take possession of business assets without a written document provided by the business’s original owner. For this reason, having a documented contract testifying to the transfer of a business is essential as it serves to protect both the buyer and seller from any liabilities, disputes and legal ramifications in the future.

Furnishing it for the sale of a company is also required by most, if not all, local and state governments. In addition, a buyer will be required to present this document to obtain necessary permits and for tax purposes going forward.

Documents Required for Business Bill of Sale

The process of changing ownership of a business from one party to another is usually complex and may require the seller to outsource the services of a professional. The business selling process often takes around 6 months to a year. At the final stage of the business selling process, the seller is advised to prepare and complete a bill of sale to officiate the transaction. They will also require the following legal documents: Tax and revenue records for the past three years; photo gallery of the business; Asset description; Business operational manual; Non-disclosure forms; Financial statements, Insurance forms; Client information and current Distributor contacts.

note

The required documents can depend on the State Laws and the nature of the business on sale.

What Should be Included in the Business Bill of Sale?

Generally, its contents may vary depending on the state laws upon which the business is being sold. Therefore, when drafting the document, an individual should make sure it complies with their state requirements and considerations.

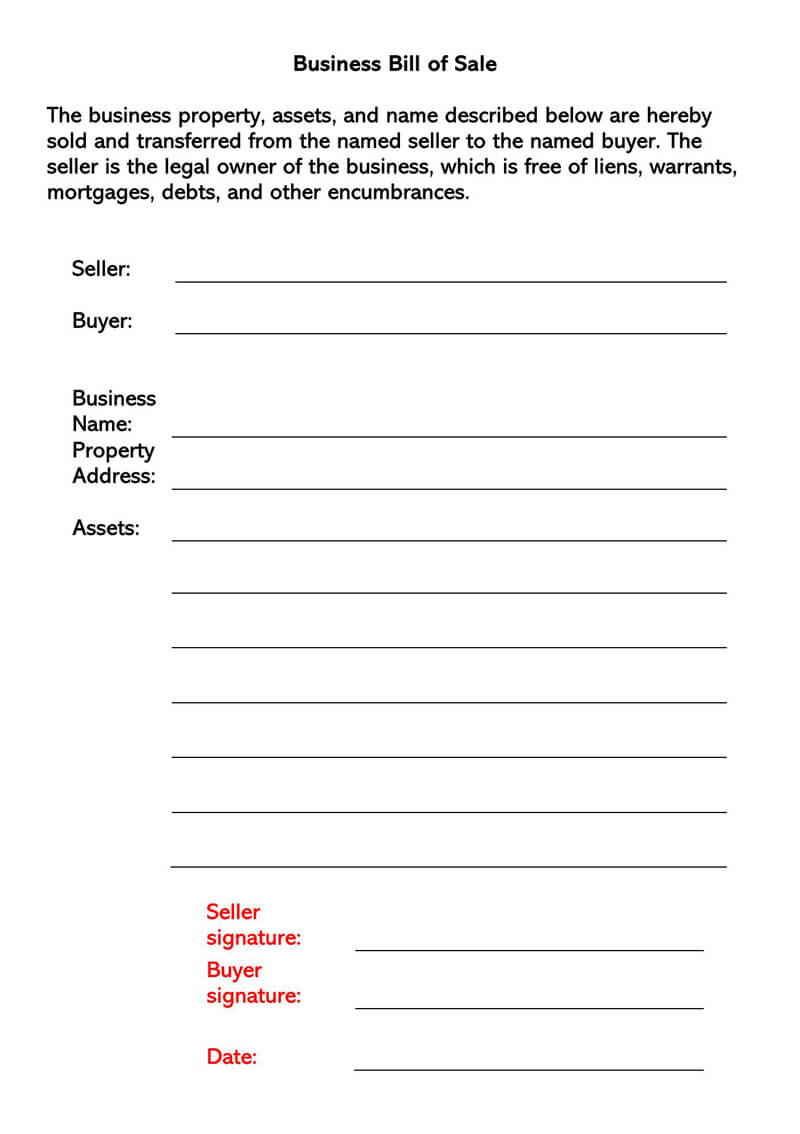

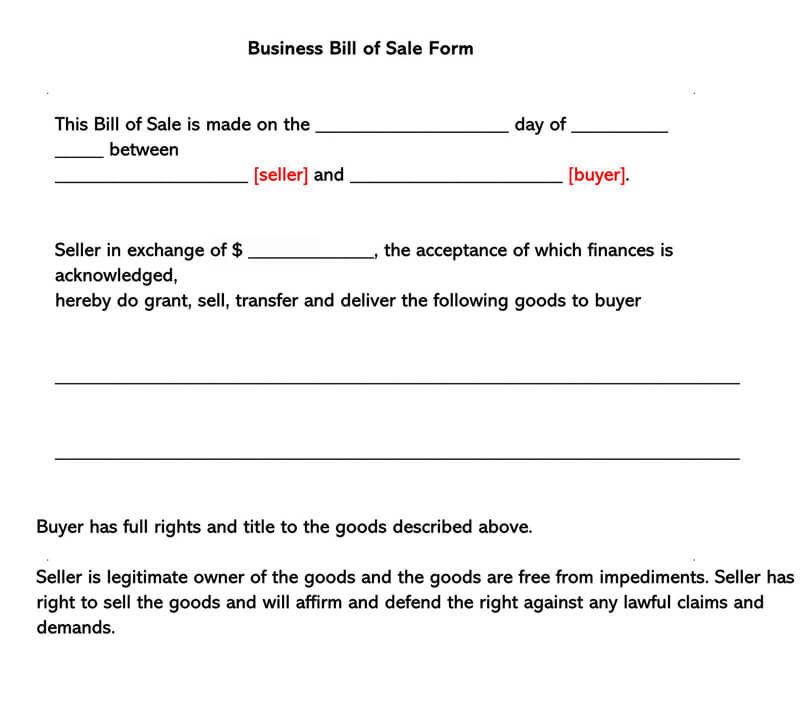

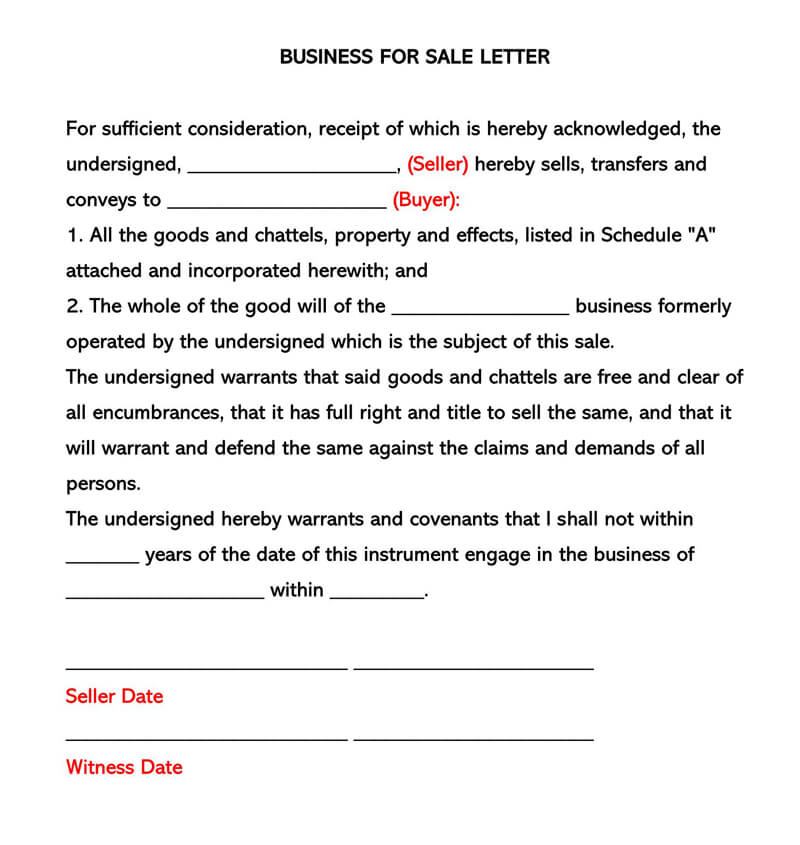

Nonetheless, a generic BOS usually includes information such as the date of purchase, the name, and addresses of both the seller and the buyer, the amount of financial value paid for the business, a description of the business assets being transferred, a representation of warranties, a guarantee that the specific business is free from all claims and offsets, and endorsements from all the involved parties.

How to Sell a Business (the Process)

Whether an individual wants to sell their business to a partner, an internal management group, or an outside third party, through the available two methods of selling a business- asset sales or share sales; they must follow the following guideline to obtain maximum financial value from the sale.

Here is the detailed guideline:

Step 1: Determine the business’ value

Determining the value of a business usually involves individually appraising the businesses’ assets to come up with a selling price for the business. However, listing assets and their actual value and totaling them to arrive at a realistic selling price for the business is not as easy as it may seem. Thus, hiring an evaluation specialist to gauge a feasible estimation of the business is highly recommended.

Business evaluation experts mostly determine the value of a business using several factors. Such factors include; the businesses’ financial performance over a given period, risk, potential for growth, goodwill, trademark, etc. Hiring a third party, for instance, a broker, is also a wise move, as the broker will oversee the transaction and bring in clients and vet prospective buyers. However, hiring the services of a professional may not be essential if a seller owns a small business or if they already have a potential buyer in mind.

pro tip

If a seller chooses to determine the value of their business on their own, based on the business type and size, they might have to sell the business at a much lower financial value as compared to if they hired a specialist. This is because the seller might be forced to prove the value of a given asset, for example, the potential for growth, to a potential buyer who may prefer to attribute this value to a tangible asset instead and negotiate a lower price. To avoid such hitches, it is best to seek professional assistance from brokers, appraisers, or consultants to help assess and sell the business smoothly.

Step 2: Prepare information

Once a seller has gauged the value of the business and established an ideal selling price for the business entity, it is time to gather documentation for everything pertinent to the business before listing it for sale. Ordinarily, one will need to prepare information such as accounting information, company details, as well as legal information.

Each category has been discussed in the section that follows:

Accounting information

When it comes to financials and accounting information, potential buyers would want as much transparency as possible. For this reason, the seller will need at least three years of clean financial statements to present to potential buyers. If the seller is not a certified accountant, then hiring the services of a licensed accountant to organize their business books may be worth the expense. The accountant will help the seller prepare the following documents for prospective buyers and ensure that all income is accounted for:

- The business’s balance sheet

- Income statements

- Cash flow statements

- Tax returns, mainly for the past three years

- Bank statements

- Audited financial ratios including the reported gross profit to net sales, net income to net worth, and net income to total business assets

Mention company details

The seller should prepare a comprehensive company description that carefully strikes a balance between delivering facts about the business while still offering an inspiring description of the company’s future potential. While doing this, be careful not to reveal sensitive company information that buyers wouldn’t want non-buyers-especially competitors to know. On the other hand, remember to be as factual as possible and avoid overlooking weaknesses since one will need to warrant the accuracy of all information they have provided before finalizing the transaction.

To outline the present status of the company and its corresponding field, the seller will need to arrange the following materials:

- The company’s brief information summary

- Business operational manual

- Business bylaws

- Security reports

- Photos of the business

- The list of employees and their payrolls

- Present distributor details, including their contacts

- Competitor research

- Evaluation materials

- Media accolades, if any

Legal paperwork

The seller will also be required to prepare and organize a business disclosure statement for the prospective buyer. This can be done with the help of an Attorney or Broker, who will provide an assessment of the business condition, a list of licenses and regulations that apply, and descriptions of any legal issues that are required to or may hinder the transfer of possession of the business to another party.

The following pertinent documentation and contracts will come in handy at this stage:

- Non-Disclosure Agreement

- Partnership Agreement

- Asset Acquisition Statement

- Letter of Intent

- Business expense reports

- Profit Reports

- Revenue documentation

- Supplier Agreements

- Return On Investment (ROI) Analysis

- Business Article of Incorporation

- Assignment of Leases

- Current stock status

- Assignment of Licenses and necessary permits

- Company’s current contracts.

Step 3: Market the business to prospective buyers

When an individual wants to sell a business, the most difficult task may be knowing where and how to advertise. Depending on the size of the business, the seller will want to offer the business for sale in a manner that does not tip off customers, suppliers, creditors, or even the employees. Most importantly, the seller wouldn’t want to let their competitors know their sale plans- unless otherwise, they are considering a specific competitor as a likely buyer.

The most common tactics of advertising and promoting an item for sale, such as getting the word out via networking, putting up flyers, or signs in windows, don’t usually work well in the business sale process- however small it is. This will most likely attract buyers who are willing to buy the business at a meagre price, and the seller cannot obtain value for their time and effort in building the business over time. Besides, this does not allow for discretion and confidentiality. For this reason, a seller should employ the following business marketing tactics:

Suppose the seller knows of a specific person or business that is interested in buying the business. Then, they can proceed with a confidential inquiry. However, if they don’t know of anyone, they can cast more widely for potential buyers.

The most secure approach for marketing a business widely is offering the business discreetly or without identification using an intermediary or putting up blind advertisements to get the word out. The primary purpose of selling the business discreetly is to maintain confidentiality. If word gets outs to creditors, customers, competitors or employees that the business is being sold, it could trigger a negative reaction, thus weakening the business drive and selling value.

If the seller decides to hire the services of a middleman to sell his/her business, its marketing becomes the middleman’s responsibility; however, if they choose to market it independently, it’s best to first understand where prospective buyers might be looking to evaluate better marketing plans.

EXAMPLE

The seller can reach their target audience by listing their business in local classifieds ads and newspapers, listing the ad in online sites that are dedicated to selling businesses, trade publications, and sites, or seek networking leads from people such as industry executives, attorneys, accountants, bankers, etc.

pro tip

Whichever method the seller uses to market their business to potential buyers, they will want to include a description of the business type, location, and the asking price. Including photos of the business is also a great way of attracting buyers.

Step 4: Meet with potential buyers

Before releasing any confidential information to any buyer interested in buying the business, it is wise to meet them in person first, examine them, and screen them to remain with only potential qualifying buyers. At this stage, the presence of an attorney is highly recommended to look over offers, contracts, and agreements between the seller and the buyer to ensure that they are in order and to protect the interests of the seller. If the buyer agrees to buy the business, the seller can request them to sign confidentiality or non-disclosure agreements before handing them the business information. Having the buyer sign an NDA agreement helps protect the businesses’ proprietary information.

Once all the involved parties reach a mutual accord, they can make arrangements to determine a realistic closing date, discuss the contract terms, and reassign associated leases and assets.

Step 5: Close the sale

The final step of the business selling process involves completing and signing a busines bill of sale. All the parties to the contract (i.e., the seller, buyer, witnesses) must supply all the required information in it and provide their signatures.

The following is a guide on how to fill it out:

- Provide the location and date on which the form is endorsed. The format of the date should be Day/Month/ last two digits of the year.

- Write the full name of the business’ seller and provide their address

- Input the agreed-upon purchase price of the business in both words and numerals

- Write the information pertinent to the purchase. That is, the buyer’s full name and address, the business name and address, and the transfer date. The business details that should also be provided in this section include:

- The businesses’ state of incorporation

- Assets, personal property, shares, and other interests included with the company

- The address of the business’s main headquarters.

- Once an agreement has been reached from all parties, under the supervision of a notary public, both parties can finalize the form with the seller’s signature and printed name, the buyer’s signature and printed name, witnesses’ signature, and printed name (if applicable), and finally the exact date in which this document is executed.

- The notary citizen can then acknowledge the text by providing the following information and endorsements on the certificate of acknowledgment:

- County

- Date of notarization

- Notary’s name

- Notary’s signature and printed name underneath

- Notary commission’s expiration date and official Notary seal.

Final Words

Selling a business may seem like such a daunting task, and buying an already established business from someone may be very risky. But with proper documentation and utilizing legal forms such as a bill of sale, the whole process can be smooth while minimizing the risks associated with such complex transactions. With that in mind, this document is as valuable for the buyer as it is to the seller. The buyer can use it as proof of their purchase from the seller. Likewise, the seller can use it to protect themselves from any legal liabilities associated with the business once the sale is finalized. Therefore, anytime an individual is looking to sell or buy a business, this form is very crucial.