Event planning is demanding because every event aspect must be perfect and align with the planner’s or client’s wishes. One of the most important aspects of event planning is coming up with a budget for the event. An event budget is a projection of the expenses incurred from the planning stage to the event’s conclusion. The budget determines what the event will look like, how smoothly it will be conducted, and whether there will be enough revenue left over.

A good budget means the event will run within the budget while incorporating the projected event goals. The budget should be prepared based on past practices rather than estimation of costs. Use the costs of items and projected highest and lowest prices for each item to create a comprehensive budget.

Why is an Event Budget Important?

An event budget allows the planner to estimate the expenses and income for the event and determine the best budget that will enable them to turn a profit.

Events can be costly; if they are not well thought out, the planner may barely break even despite having sufficient income. A budget also helps you understand how to allocate money to different aspects of an event to provide balanced quality of goods and services.

Other advantages of having an event budget include:

- An adequate budget keeps the event planner on track with spending and helps them avoid overspending.

- Budgeting allows the planner to foresee issues and quickly resolve them, enabling an event’s smooth running.

- A budget provides a record for stakeholders to assess the investment and event performance results.

- Budgeting allows the planner to assess the most income-generating activity and to maximize increasing profits.

- The budgeting process improves the planner’s experience in event management.

- It enables the planner to project the total income and expenses to calculate the event’s ROI.

- The budget can be used for reference when making budgets for future events.

Step-by-Step Guide on Planning an Event Budget

Creating an event budget can be time-consuming, but in the long run, it helps save on costs. It can even help you increase the profit you earn. The steps below can help you plan your event budget:

Step 1: Identify your event’s needs

The event’s type and goals will determine your event’s needs. Talk to your client about the objectives to determine the type of event that will be held, whether virtual, hybrid, or in-person. Afterward, discuss the event’s goals; what does the client expect to achieve by the end of the event? The objectives help the planner understand how to allocate the budget to critical activities.

Some of these needs include:

- The type and nature of the event

- The expected number of guests

- The theme of the event

- The sources of income

- The entertainment and speakers

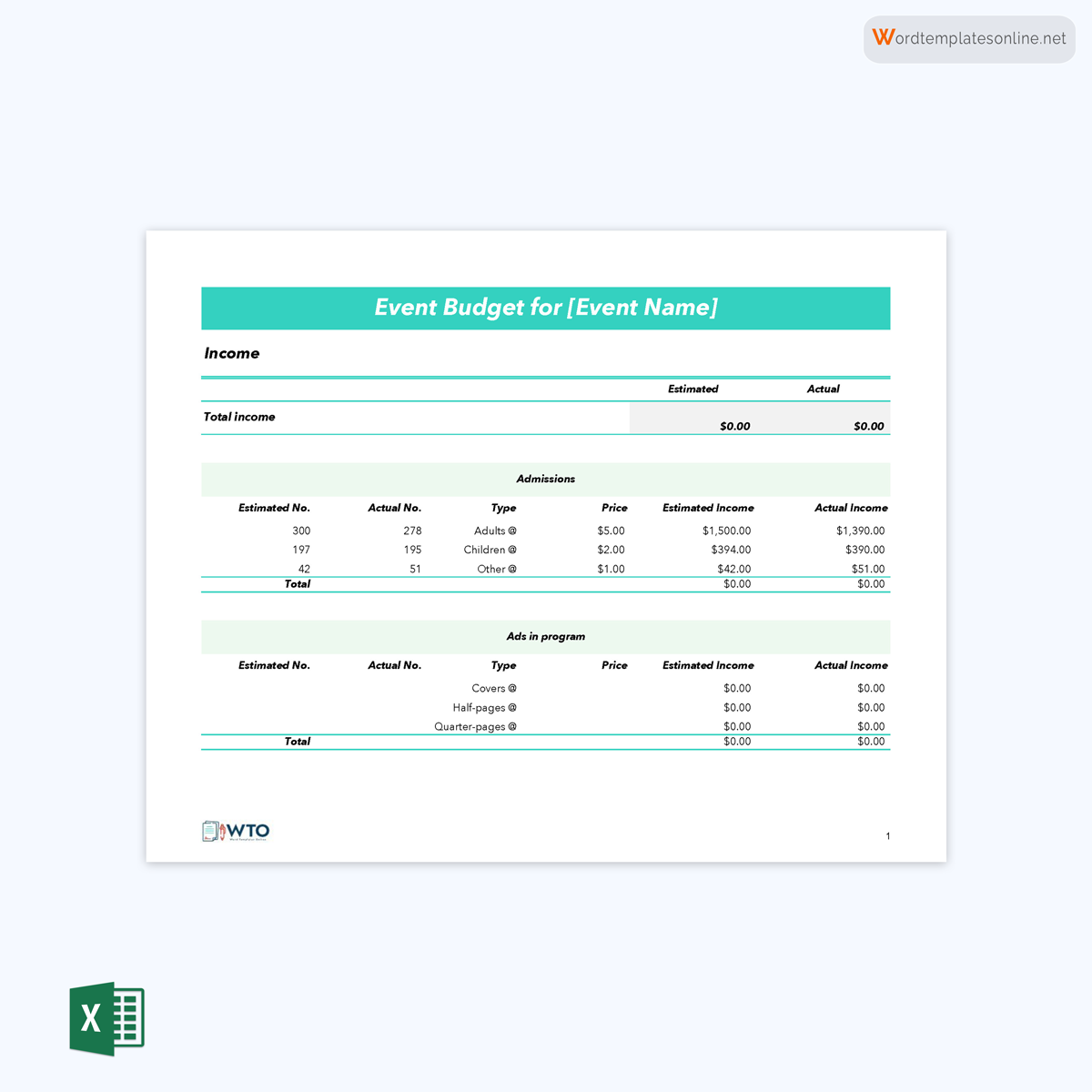

Step 2: Forecasting revenue and expenses for an event

This step requires you to determine which items are expenses and which ones are revenues. A good budget should have an overall of more revenue than expenses while ensuring the event achieves the objectives set by the client.

Calculate expenses

The type of event determines the event’s expenses. A larger event will be more expensive; an in-person event may be more costly than virtual events, and so on. To calculate expenses, you must differentiate between fixed and variable costs.

- Fixed cost: Fixed costs are expenses that remain the same regardless of the number of attendees. They include venue, equipment, event management software, and personnel expenses.

- Variable cost: Variable costs fluctuate depending on the number of attendees. They include costs for gifts, cleaning personnel, event brochures and programs.

tip

Remember, many costs vary depending on the cost of items. For example, the rent for a venue may be cheaper, but it may be slightly farther, causing the cost of transport to be higher. So, consider these aspects before making decisions on the budget.

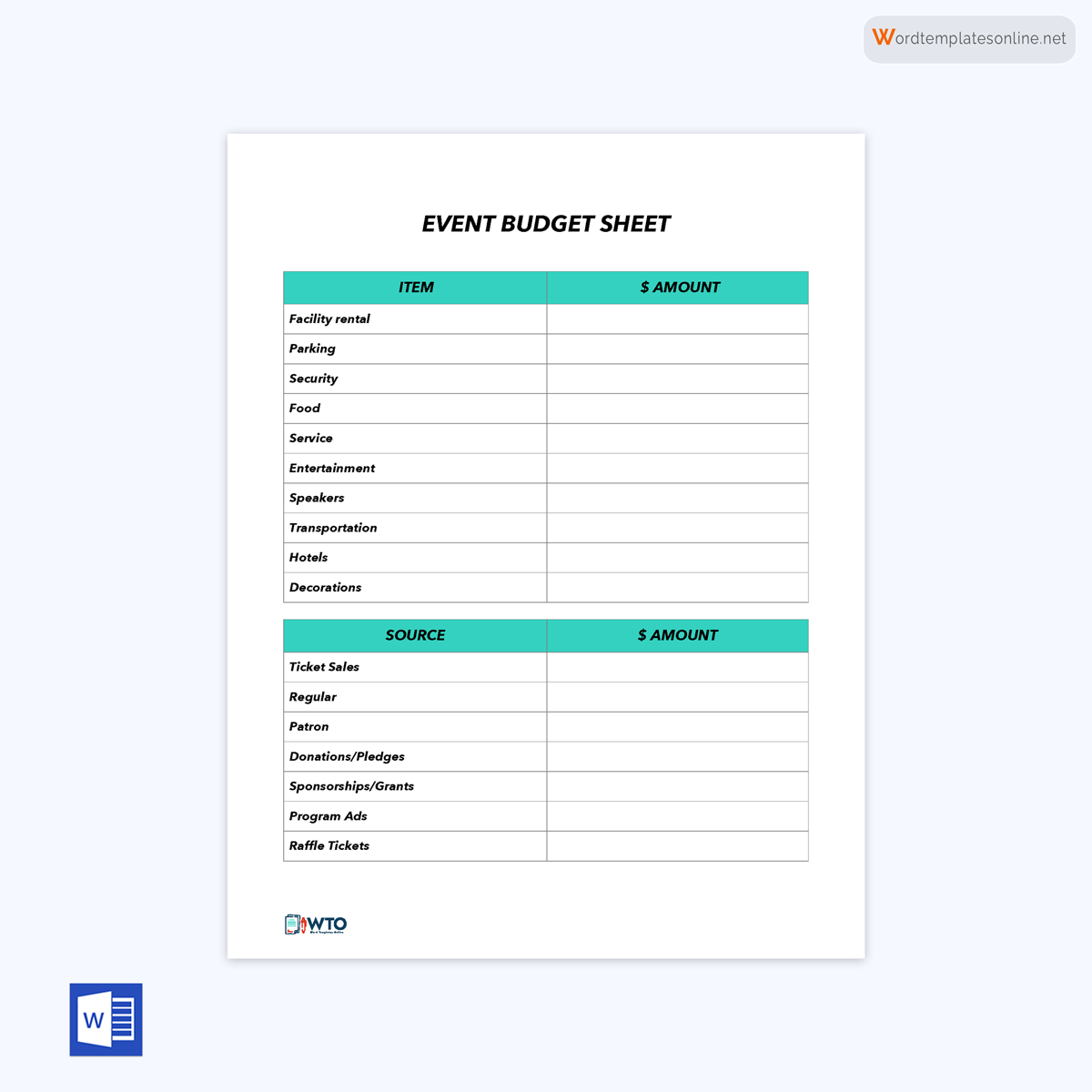

Sources of revenue

Depending on the type of event, there are different sources of revenue. Most public events get their income from sponsorship. Other sources include rental fees, management fees, and exhibition fees. The budget should allow you to determine whether the event is viable depending on whether the revenue is higher than the expenses. When assessing sources of revenue, allocate some income to a contingency fund to be used in an emergency. This fund may be used in case unexpected expenses arise, like the need for additional licensing or permissions.

tip

It is good practice to ensure accuracy and comprehension of a budget. Planners should ensure they keep a proper record of the transaction documents like invoices and receipts to justify their budgets.

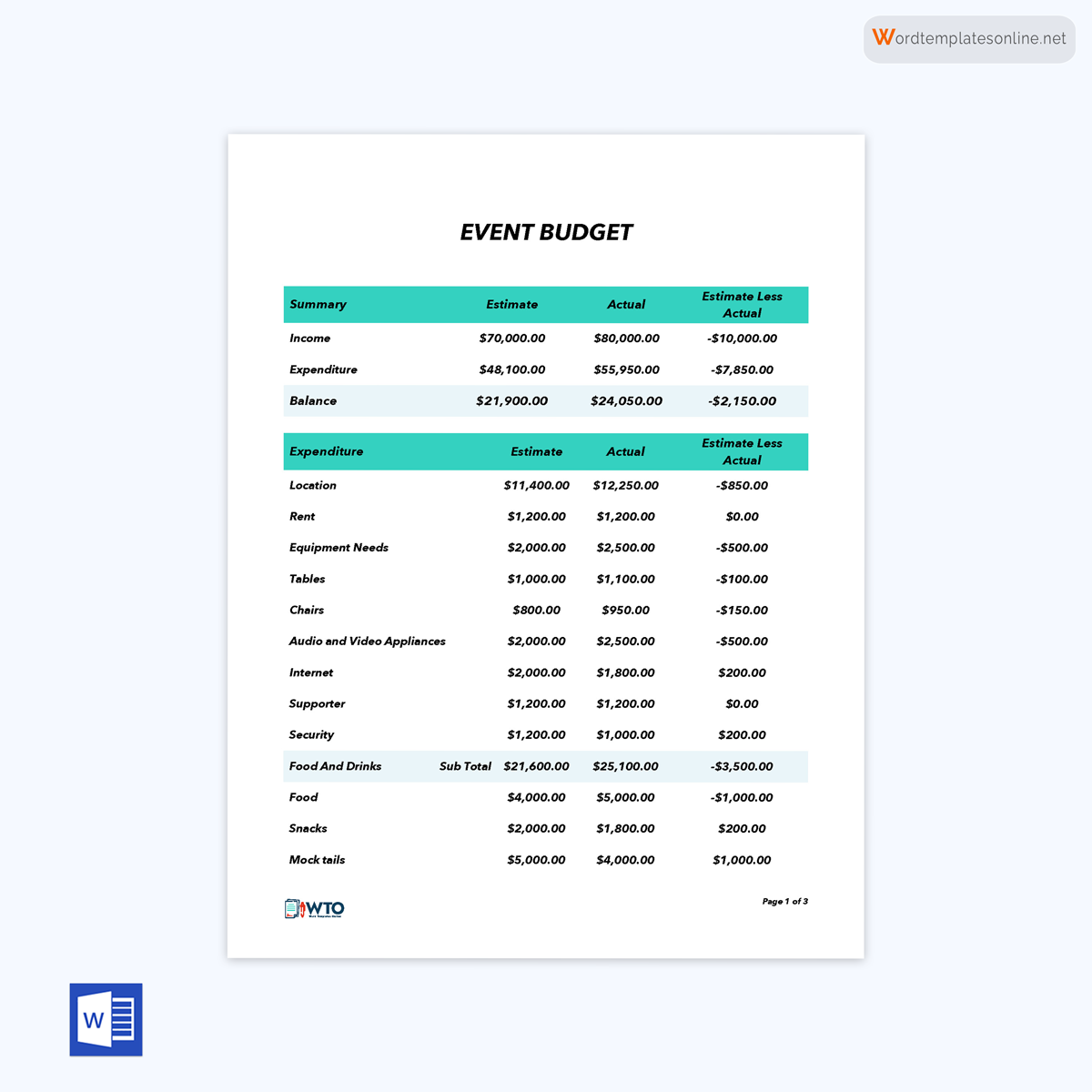

Calculate cash flow and starting cash

You are likely to incur expenses before getting any revenue. To stay on top of the expenses, you need to determine your cash flow and starting cash. Starting cash is the amount of money available before event planning. Your cash flow is determined by the difference between your income and expenses. The balance you get after subtracting your revenue from all the money you are owed is the cash on hand before expenses.

From the cash on hand before expenses, you should subtract all the expenses to determine how much cash on hand you have. Cash on hand is, therefore, the money accessible to the planner after subtracting all expenses. If the balance is positive, the event has resulted in a positive cash flow.

Step 3: Calculate virtual event expenses

Virtual events depend on software, branding, and providing a good virtual experience for attendees. Most of the expenses for virtual events revolve around branding and design of the platform, equipment, streaming service, and expenses for the hosting platform. Most of these costs are fixed. For a virtual event, variable costs include; costs for hiring the speaker and personnel costs.

Some examples of fixed costs for virtual events include:

- Virtual event platform costs

- Technology and studio costs

- Registration costs

- Production and distribution costs

- Streaming service cost

Step 4: Calculate hybrid event expenses

Hybrid events have expenses for in-person and virtual events. The event should be tailored to ensure in-person and virtual attendees have a good shared experience. Technical expenses like audio-visual equipment often cost more for virtual events because they have to cater to both platforms of attendees. A good internet connection is key to enabling continuous event streaming.

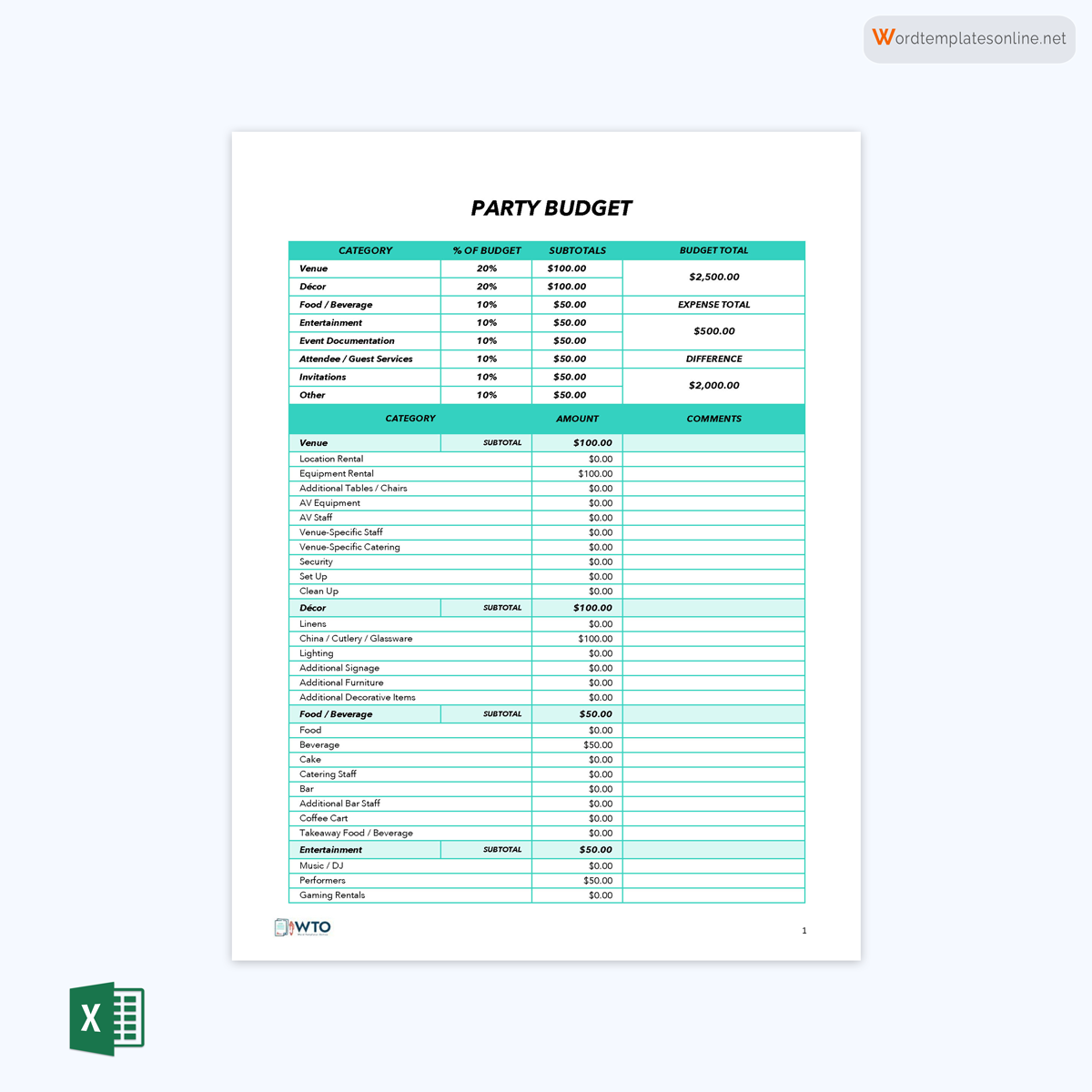

Step 5: Calculate in-person expenses

Most of the budget for in-person events is taken by food and beverage, followed by audio-visual equipment and decoration. Dedicating most of your budget to food and beverages is recommended, but ensure the rest of the items are balanced to achieve the event’s goals.

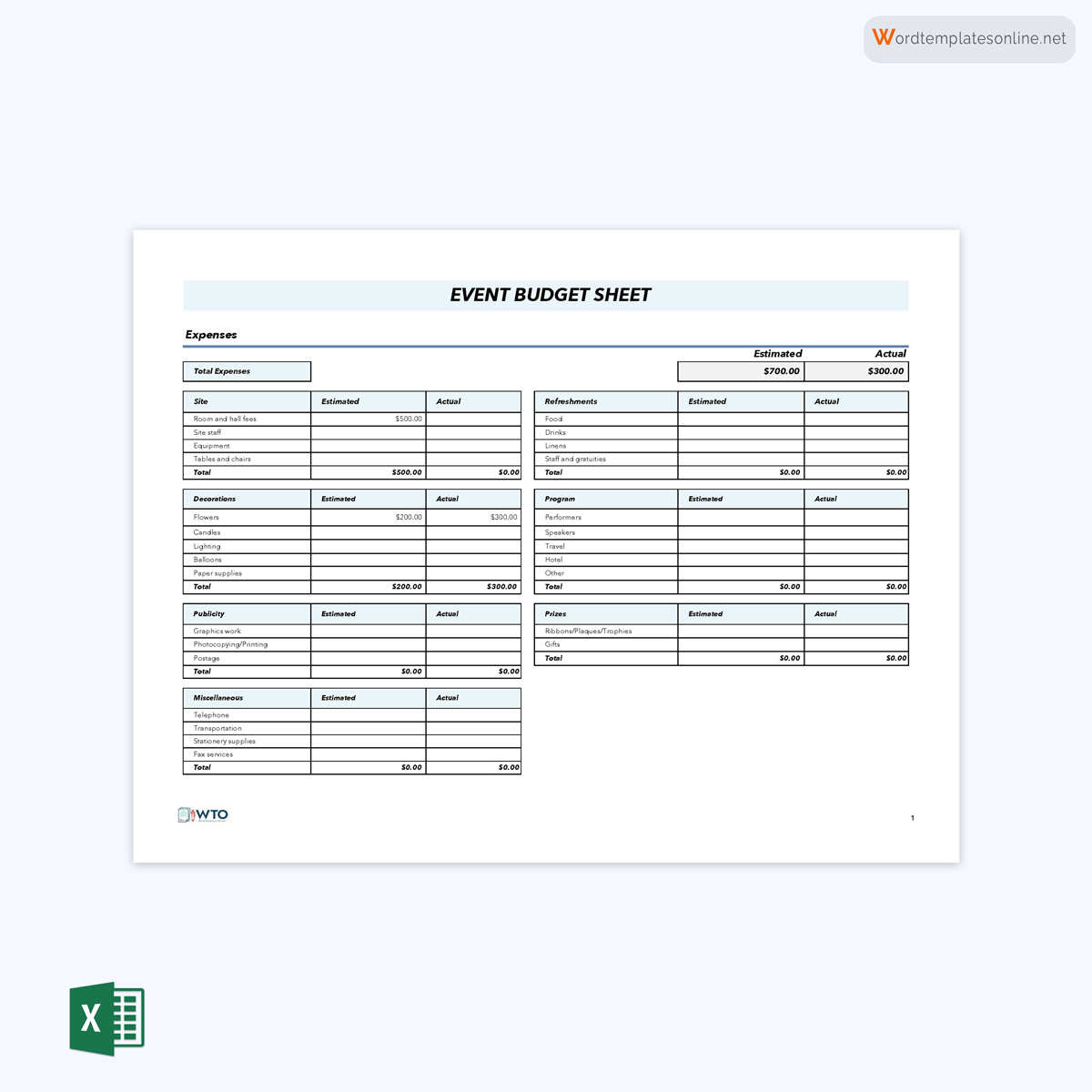

Venue

The venue comes with rental costs and costs for the venue staff. Keep in mind these expenses as they tend to be incurred before revenue starts streaming in.

Food and beverage

Food and beverage fall into catering expenses. Calculating the catering expenses include costs of staff, tips and gratuities, and the number of attendees expected to come.

Lighting, décor, and event design

The lighting, décor, and event design are determined by the type of event you are planning. Themed events may be more expensive than ordinary events. Lighting is also determined by the venue and the event’s time. The expenses may also include hiring a decorator, tents, and flowers.

Travel and transportation

Transportation includes vehicles to be used to charter guests and equipment to the event, toll fees, and fuel. Calculating travel and transportation expenses helps the organizer to keep track of the budget and to avoid overspending. It also helps ensure effective personnel and equipment movement to and from the venue.

Facility expenses

Facility expenses largely depend on the venue. They include toilet provision, water, electricity supply, and parking expenses. Some venues offer packages, but you should be ready to look for separate facilities and factor them into the budget because they contribute to the attendee experience.

Entertainment and equipment expenses

Entertainment is an essential part of the event; music and other forms of entertainment are proven ways to give attendees a good experience. Entertainment expenses can be calculated by adding the cost of booking or hiring entertainers and equipment. Proper allocation for entertainment expenses ensures the event runs smoothly and the guest is engaged throughout.

Logistics

Logistics account for the overall smooth running of an event, from planning the time for decoration, preparing signage, and setting up the venue. It includes items like insurance and permits that may be required for the event. The logistics cost is usually determined by the nature and venue of the event.

Printing charges

Most events have brochures and programs. Printing charges may be determined by the number of attendees and the type of signage for the event. Negotiate a good price for the printing.

tip

According to the PCMA, at least 55% of your budget for an in-person event should include food and beverage, entertainment, and audio-visual equipment because they contribute to the overall attendee experience.

Step 6: Review and evaluate your budget

Once you have classified the costs and determined the type of event you would have, you should evaluate your budget to decide whether or not it is viable.

You should:

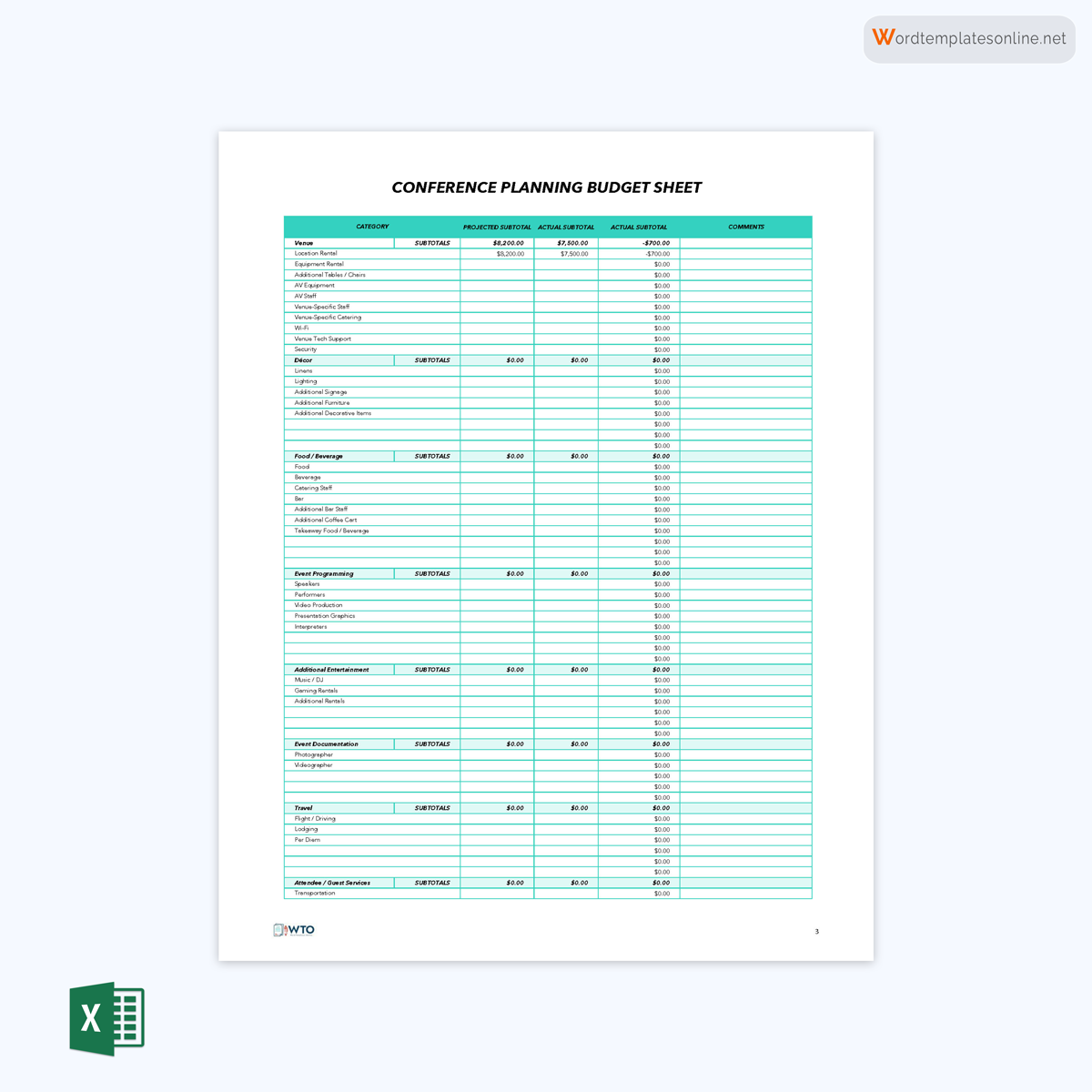

Identify your total spend

After identifying the total cost for each item, get the total for the event by adding up the items. Remember to include items like photography and marketing. Reach out to vendors and negotiate contracts. You can calculate your total spending from these negotiations compared to your projected budget.

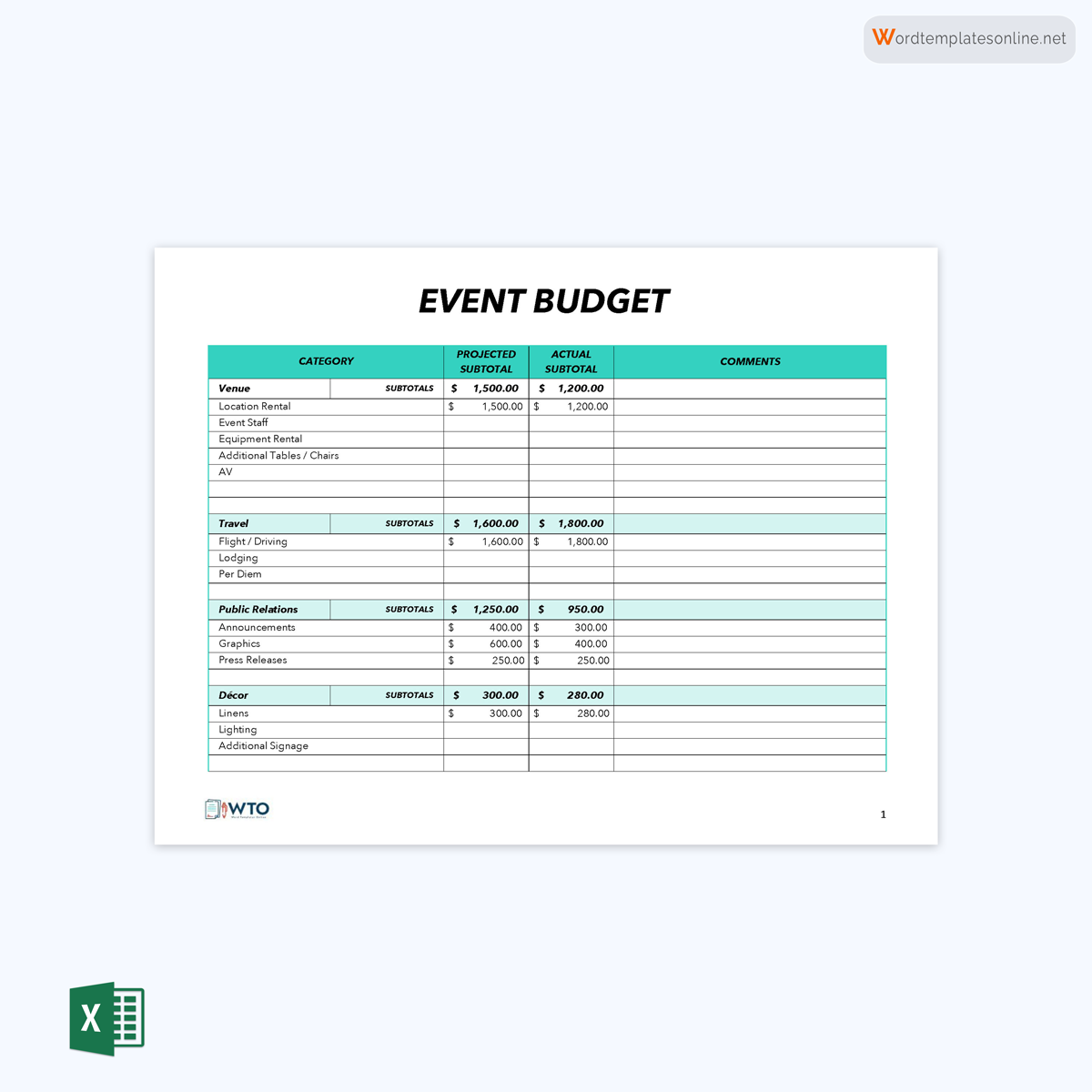

Identify savings

If there are savings from the actual budget, include them and show how you have acquired the figures by comparing the actual and projected budgets side-by-side.

Identify overages

Just like savings, include those overage figures in the budget if you have gone over. You can share the budget with stakeholders; they may offer insight on better ways to cut down on overages.

Step 7: Calculate your event ROI

ROI is the measure of the success of the event. Monetarily it is the percentage profit turned from the event. To get the ROI, subtract the total cost of the event from the total revenue and convert the resulting figure into a percentage by dividing it by 100. In other aspects, the ROI is a measure of the event’s success based on the impact the event has had. In this aspect, ROI can be assessed through issuing surveys and tracking attendances. The data acquired can be shared with the event’s stakeholders.

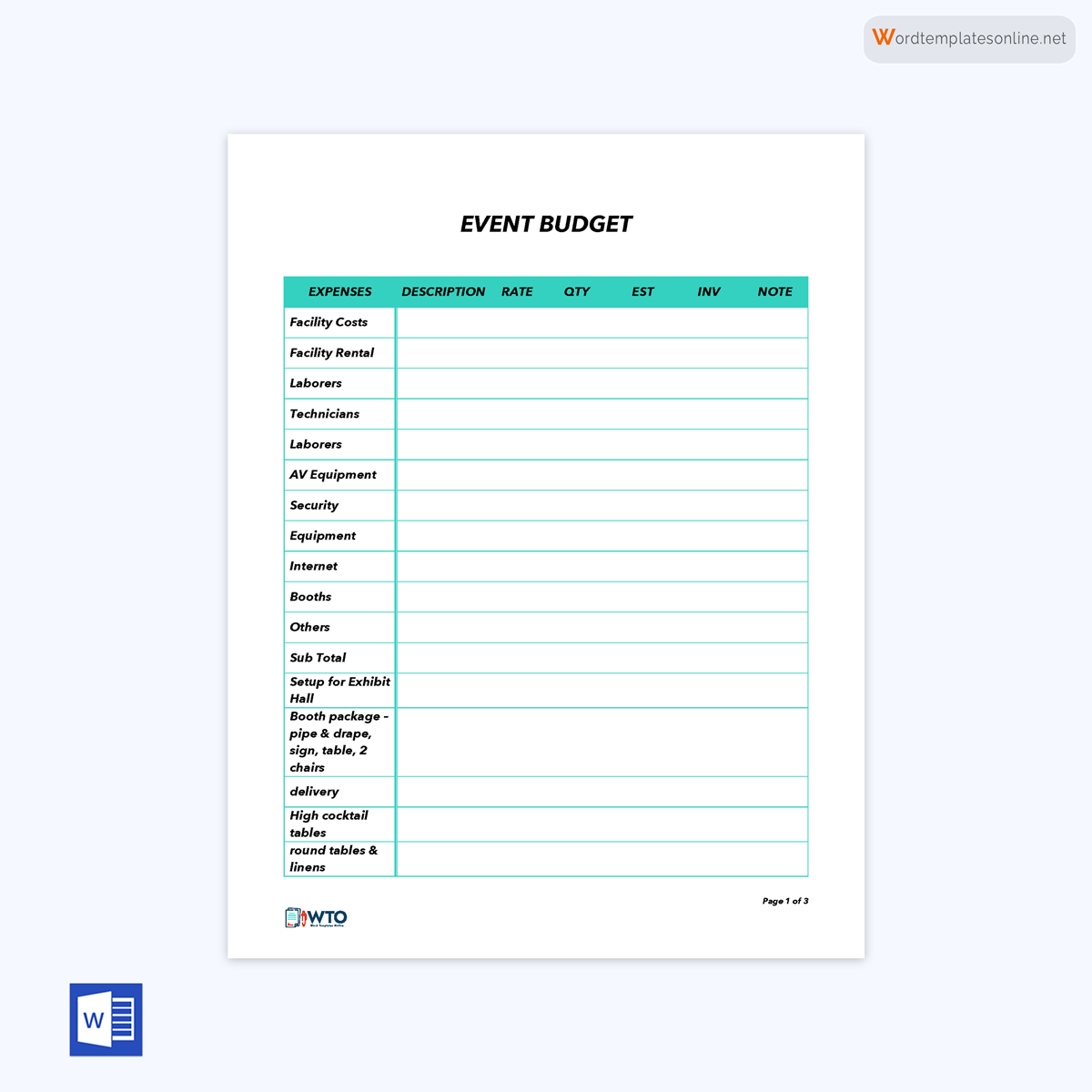

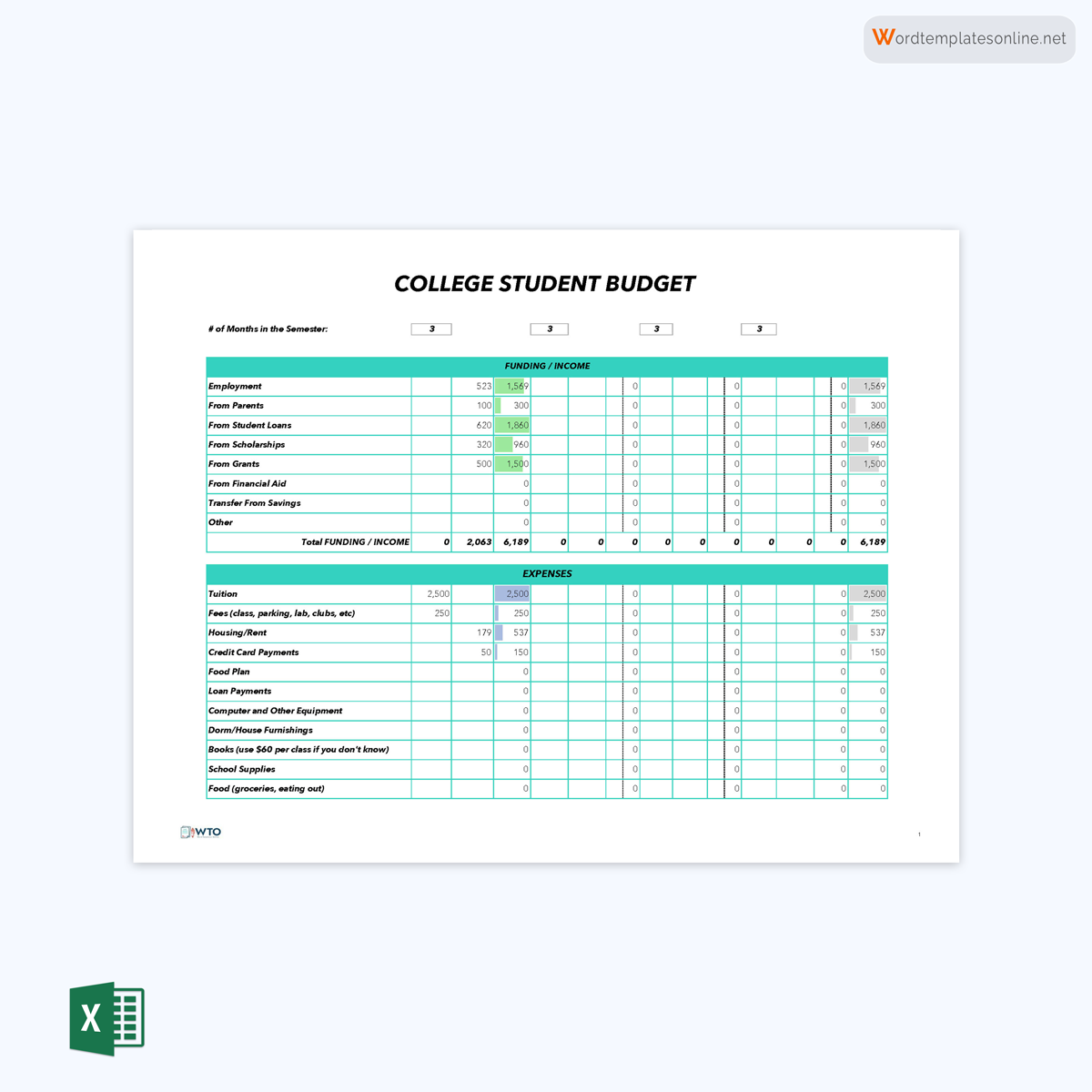

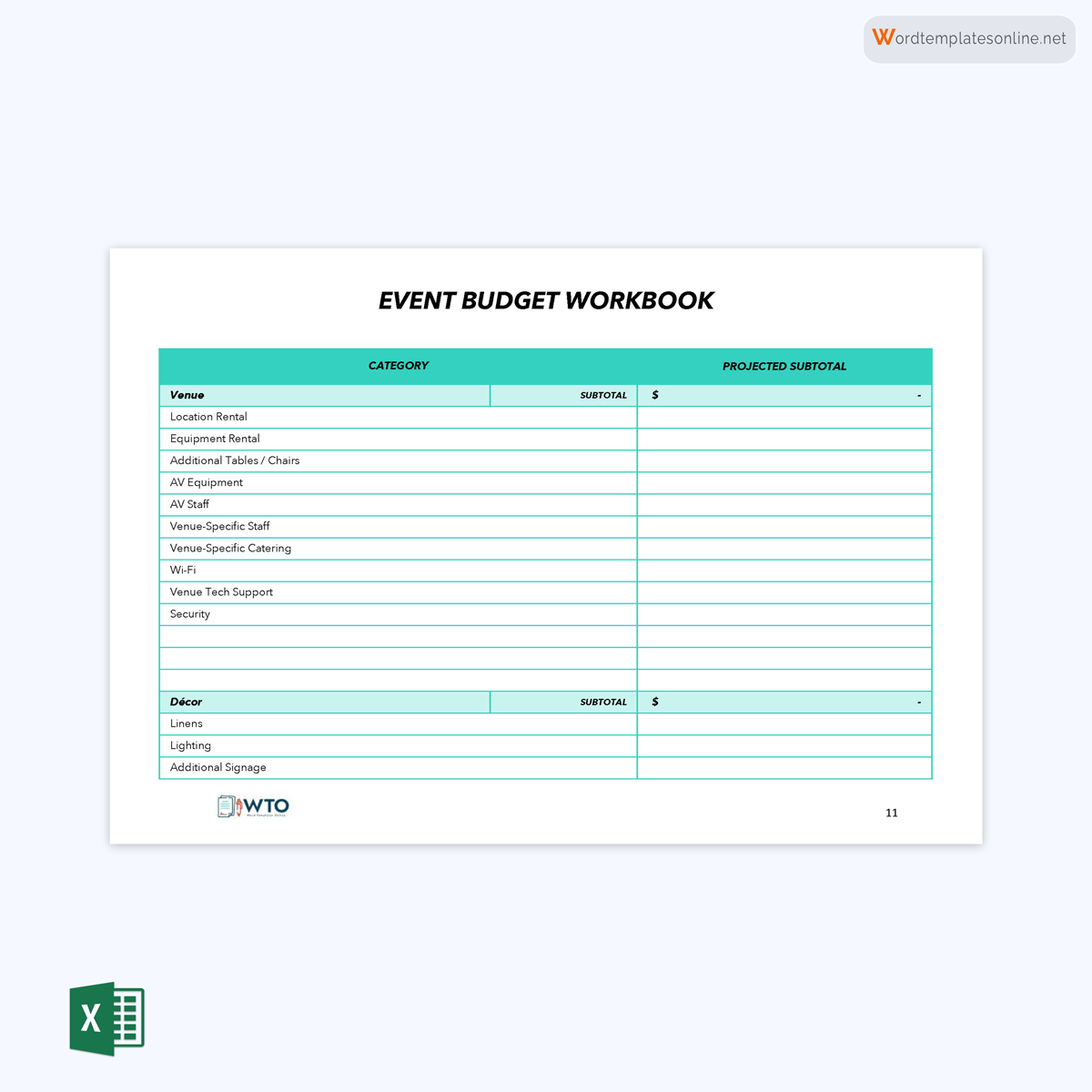

Free Templates

Best Practices

To create a good event budget, you need to understand how good budgeting works, especially concerning event planning. The tips below can help you create a good event budget:

Start as early as possible

You should start preparing your budget as early as possible. Budgeting often comes after stating the objectives of the event. Once you understand the event’s aims, you should start preparing a budget to avoid getting caught up with time. Early preparation allows you to research good vendors and venues and overall preparation for the event.

Use data from past events

Review your past events and evaluate how you budgeted each item. It will help you identify how you dealt with different challenges. You can pick tips on better spending. For example, if you spend more than necessary on entertainment, you can improve by allocating less of the budget to entertainment in your next event.

Do your research and pay attention to detail

Event budgets are detail-oriented; it is advisable to research every detail. Market trends can help you determine what to charge a vendor and update you on new event budgeting software.

Be transparent with the stakeholders

Be honest with stakeholders about the expenses. Even if it might seem counterproductive, let stakeholders know what is and is not viable; this sets expectations and allows them to approve the budget. Their approval allows you to hold them accountable.

Make adjustments to improve

Remember, a good budget is a result of negotiation and balancing, do not be too strict on the budget. Adjustments can help you improve your budget with each event. As you learn more about the industry, you should incorporate the information in creating your budget.

Always include a contingency plan

Events are not set in stone; some items in the budget may go over their allocated funds at some point. Always have a contingency fund that accounts for up to 20% of the budget for sudden changes.

Be detailed

Detailed budgets are better for successful budgeting. Detailing the sources of income, expenses, and revenue is important when calculating total costs. The same figures can be used in calculating your ROI accurately. Detailed budgets also work well for stakeholders as it communicates clearly what the event entails.

Build a relationship with your vendors

Event planning is a continuous process. Good planners have vendors on hand if emergency supplies are needed. Before reaching out to vendors, research reputable vendors to whom you can send requests for quotes. Prepare a list of line items and reach out to vendors for quotes; this is when you begin to form these relationships. Keep an open line of communication and allow the vendors to negotiate for fair prices.

Accuracy is key

Accuracy helps you determine the viability of a project when calculating revenues and expenses. An accurate budget can help you in projecting costs for future events.

Secure buy-in with stakeholders as early as possible

Share a draft budget with the stakeholders for their approval. Stakeholders may have questions or require their views to be reflected in the budget; as such, they should see the budget early enough to decide.

Frequently Asked Questions

You can implement many cost-saving tactics when preparing your budget, including looking for sponsors, looking for cheaper venues, and using digital instead of analog planners.

To effectively execute cost-saving tactics, you need to ensure the mechanisms in place can be used to execute the tactics. For example, if you plan on going digital, provide the correct software to be used when creating the budget.

A good budget is determined by what a successful event means to the stakeholders. Before preparing the budget, stakeholders should determine what profits to expect after calculating the total expenses and revenue.

Financial success depends on the type of event being budgeted for. Exhibitions always aim to turn a profit, while leadership events are aimed at creating mentors and are more result-based than profit-based.