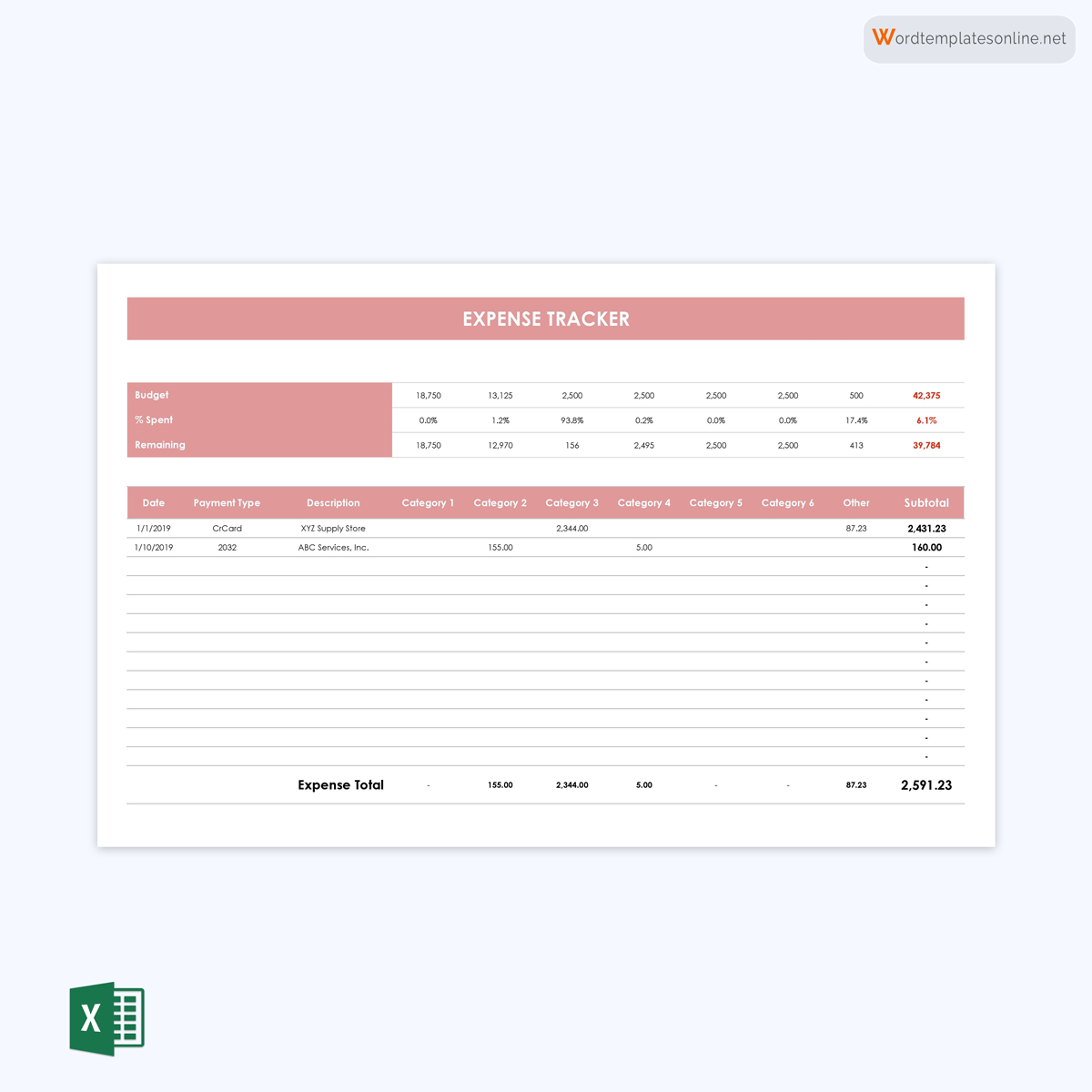

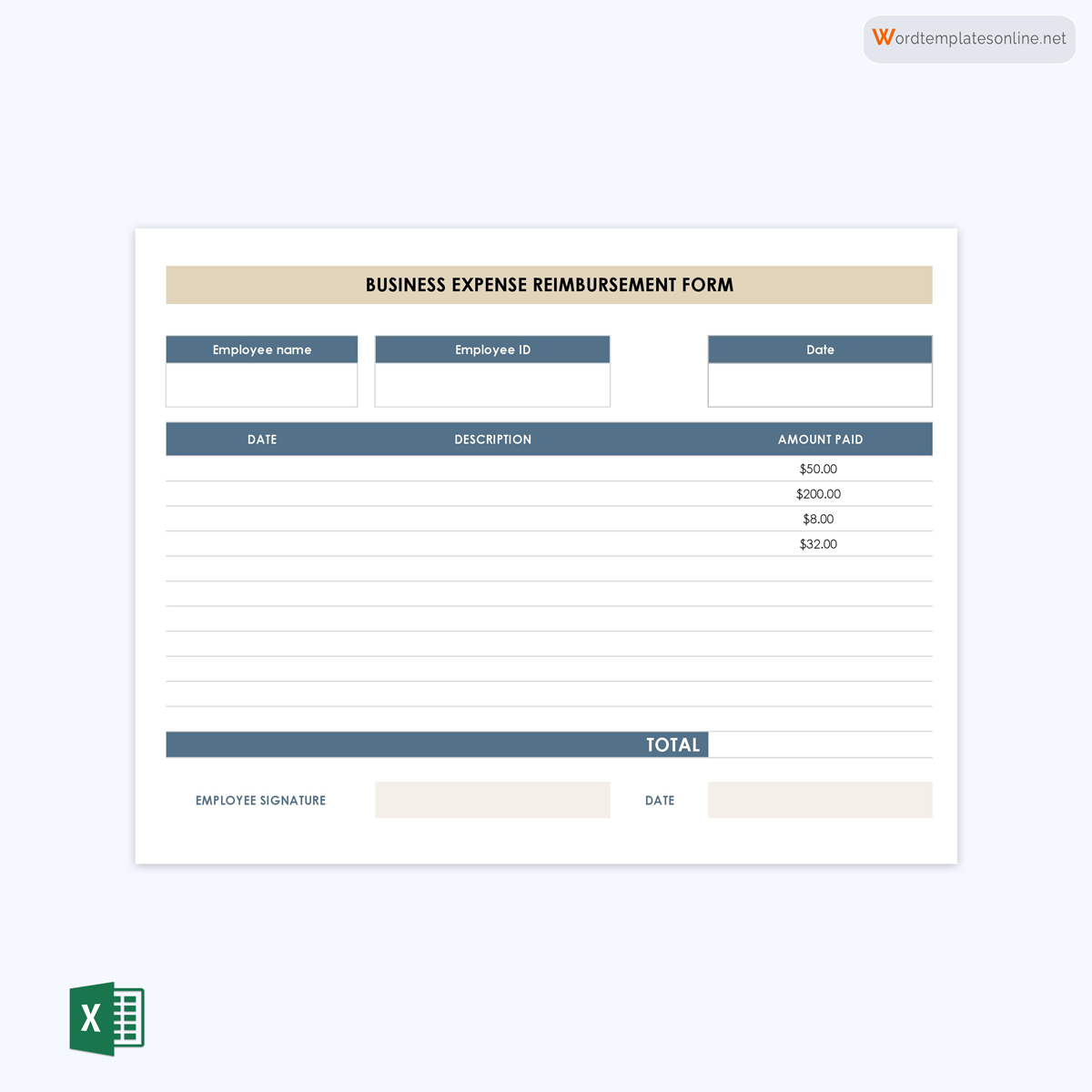

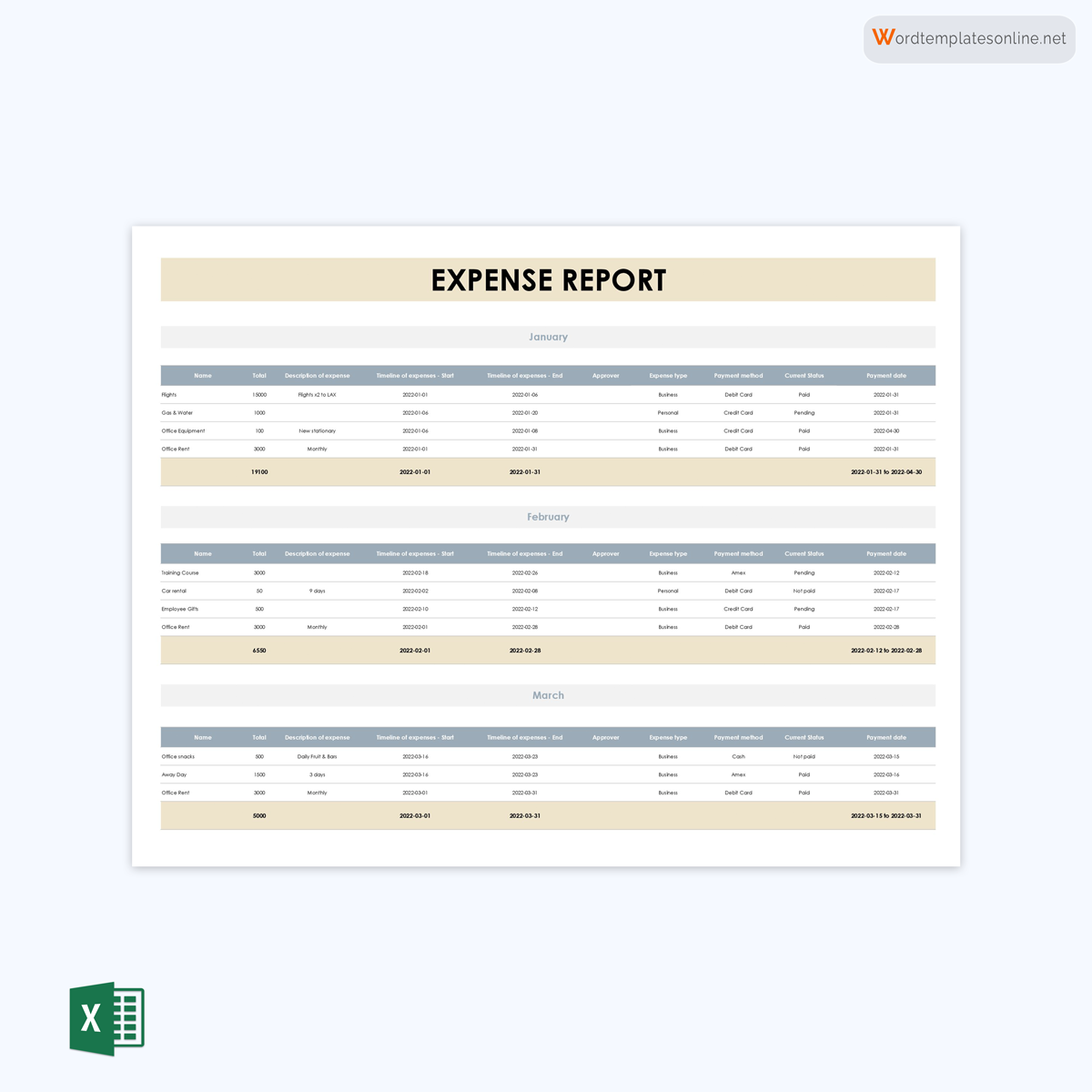

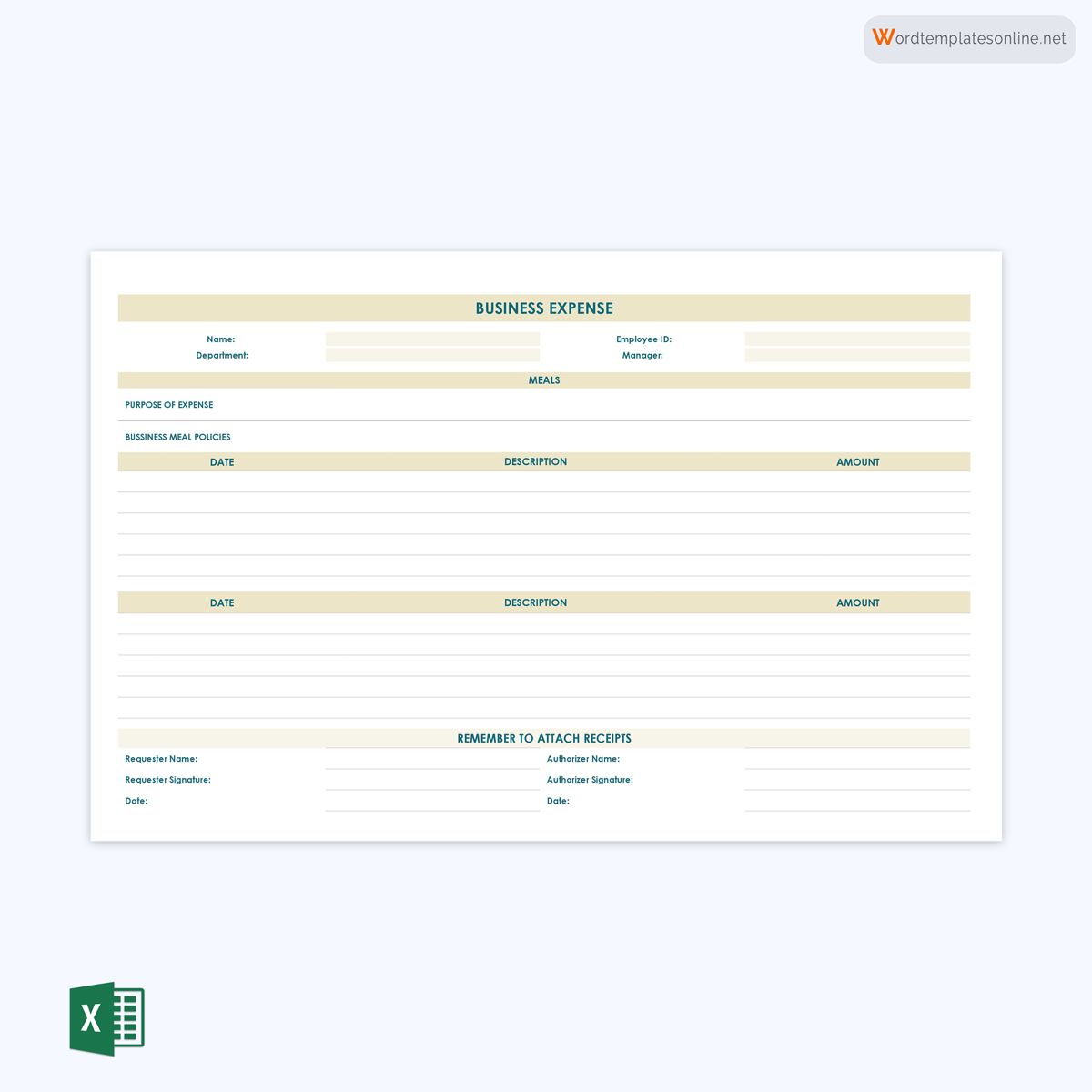

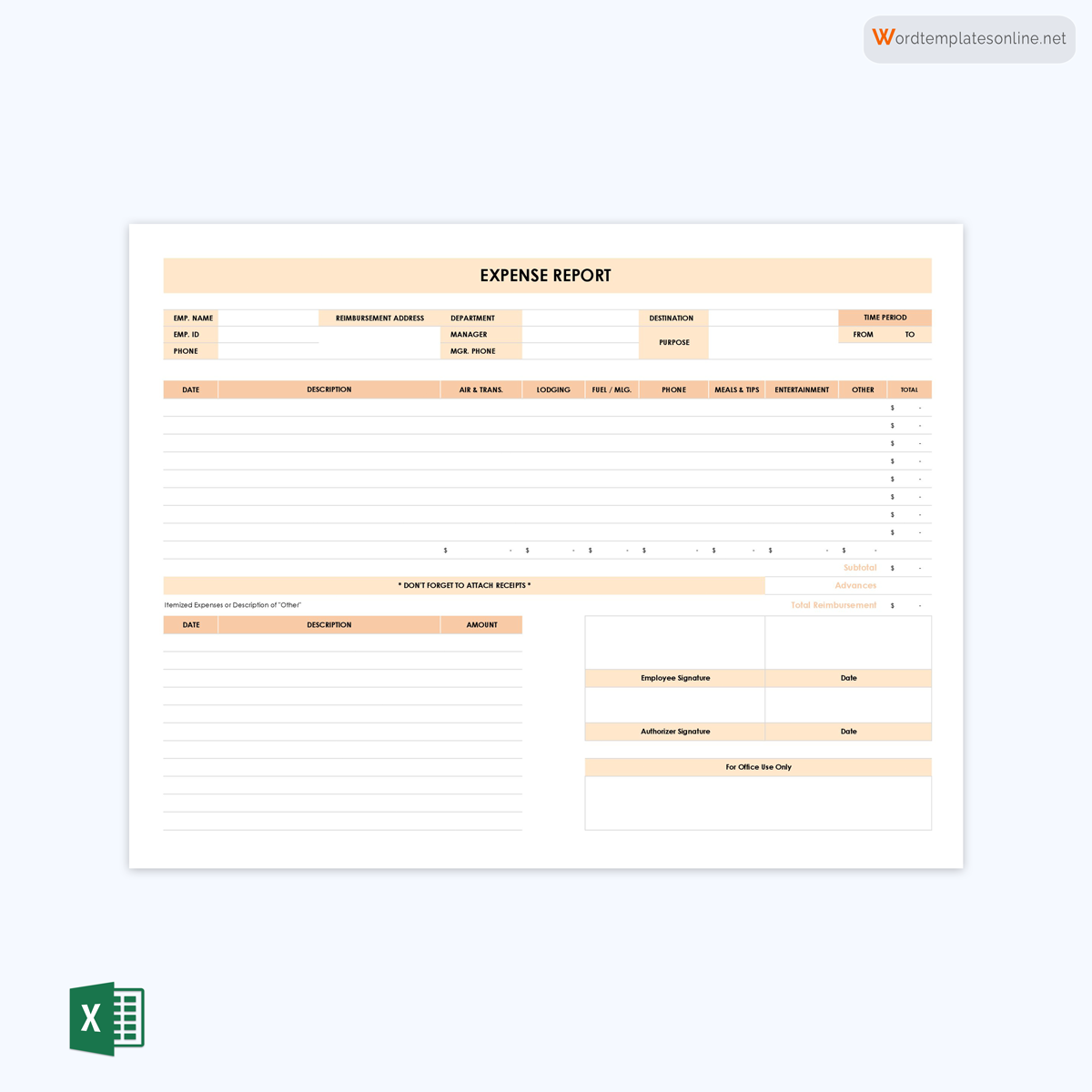

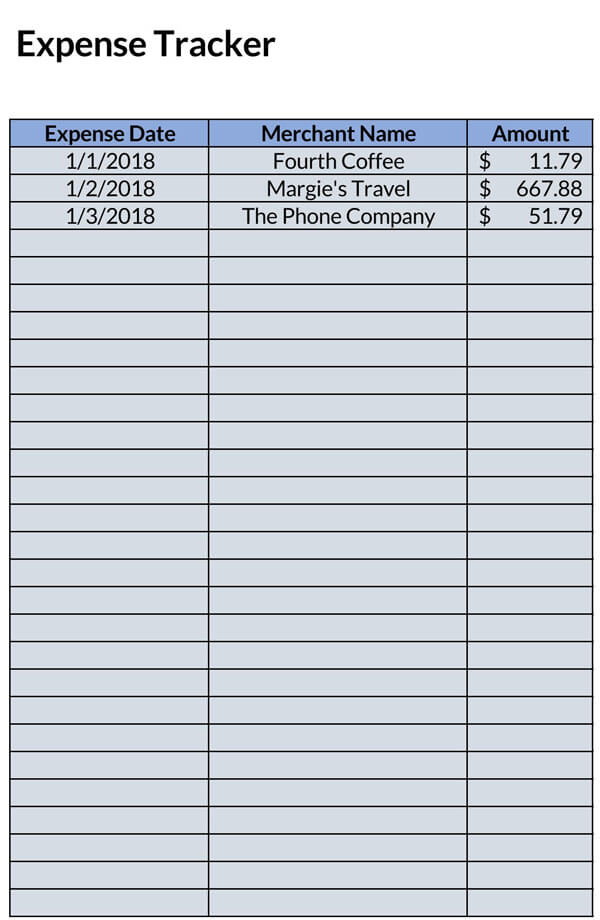

An expense tracking template is a worksheet document used to track and organize a person’s or a business’s finances and help them plan for their monthly or yearly expenses.

For personal expense tracking, the tracking template records monthly income and household expenses such as clothing, recreation, travel, etc. For businesses, an expense tracking template is used to keep track of daily or routine expenses such as transportation, conference fees, food, etc. Employees can also use the template to record mileage, gas usage, meal expenses when on official duty, and other business expenses the employee would need to be reimbursed.

Expenses on the template will typically be in an itemized list accompanied with a description for each item. Templates for personal income management are usually simple, while those for businesses can be lengthy and detailed. They can also be used for one-time events such as birthday parties, weddings, etc.

tip

Avoid budgeting before tracking expenses. A budget might have little or no impact if at all one does not closely track their spending.

Free Templates

Ways to Track the Expenses

Different methods can be used to track expenses depending on convenience and preference. People can use whichever way, and the result would still be sufficient. Some prefer a more hands-on approach which involves noting down what they spend on, while others prefer using spreadsheets and other digital means:

Paper trail method

Also referred to as pencil and paper, is a common method of tracking method that involves physically writing down expenses on a notebook or paper as soon as they are made. Paper trail helps one be attentive when spending and encourages them to think carefully before making a purchase.

It is also beneficial to people less knowledgeable about technology, especially the elderly. Written down expenses can be compared to the credit card statement to verify if the records are in order meaning the person is able to keep his or her own records instead of over-relying on the credit card company. Also, all-cash transactions are captured.

Its drawback is that fewer and fewer people are carrying paper and pens these days, making physical records a bit difficult to keep up with. Also, it requires people to safeguard their receipts so, they can transfer information on paper – it is common for receipts to get lost. A paper trail method of tracking expenses is sometimes reliant on memory, and one can forget to include a purchase leading to inaccurate records.

Credit card statement

One can opt to request credit or debit card statements at the end of the month to see where or what they spent money on. A statement will outline every expense made by the credit or debit card. This method is less stressful and involves than a paper trail. However, using credit and debit card statements to track expenses does not capture any cash purchases made, compromising its accuracy.

Online servers

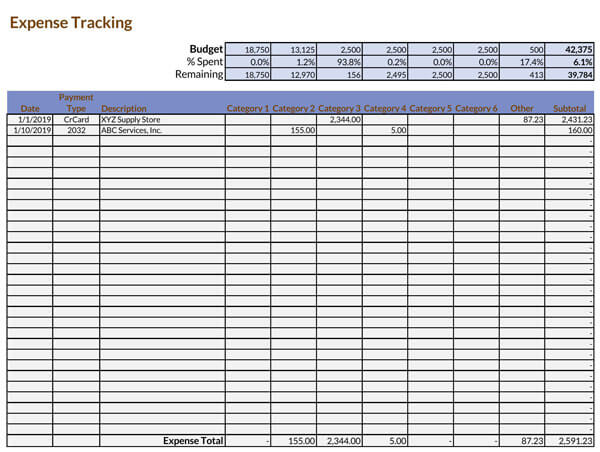

The third option is the use of online resources like downloadable expense tracking templates or programs to track expenses. Budgeting apps are also used to generate templates. Online resources allow the consumer to record expenses as they occur. One chooses their preferred frequency of reporting, and after the period, a detailed expense report is generated by the app. Templates are made such that they can be customized to fit a person’s spending habits and saving needs. Using the software is a one-stop-shop for consumers where tracking and calculations can be done with much ease.

Regardless of the method, tracking expenses should be a habit if one wants to succeed with money. In short, the effectiveness of tracking expenses is not dependent on the method but rather the will and commitment of the consumer to follow it and be aware of when they spend more than they should.

Creating an Expense Tracking Worksheet

The template does not have to be complex. It is recommended that one should use tools at their disposal to create the template. As long as it serves its purpose, which is accurate tracking of expenses, the tracking template will be sufficient.

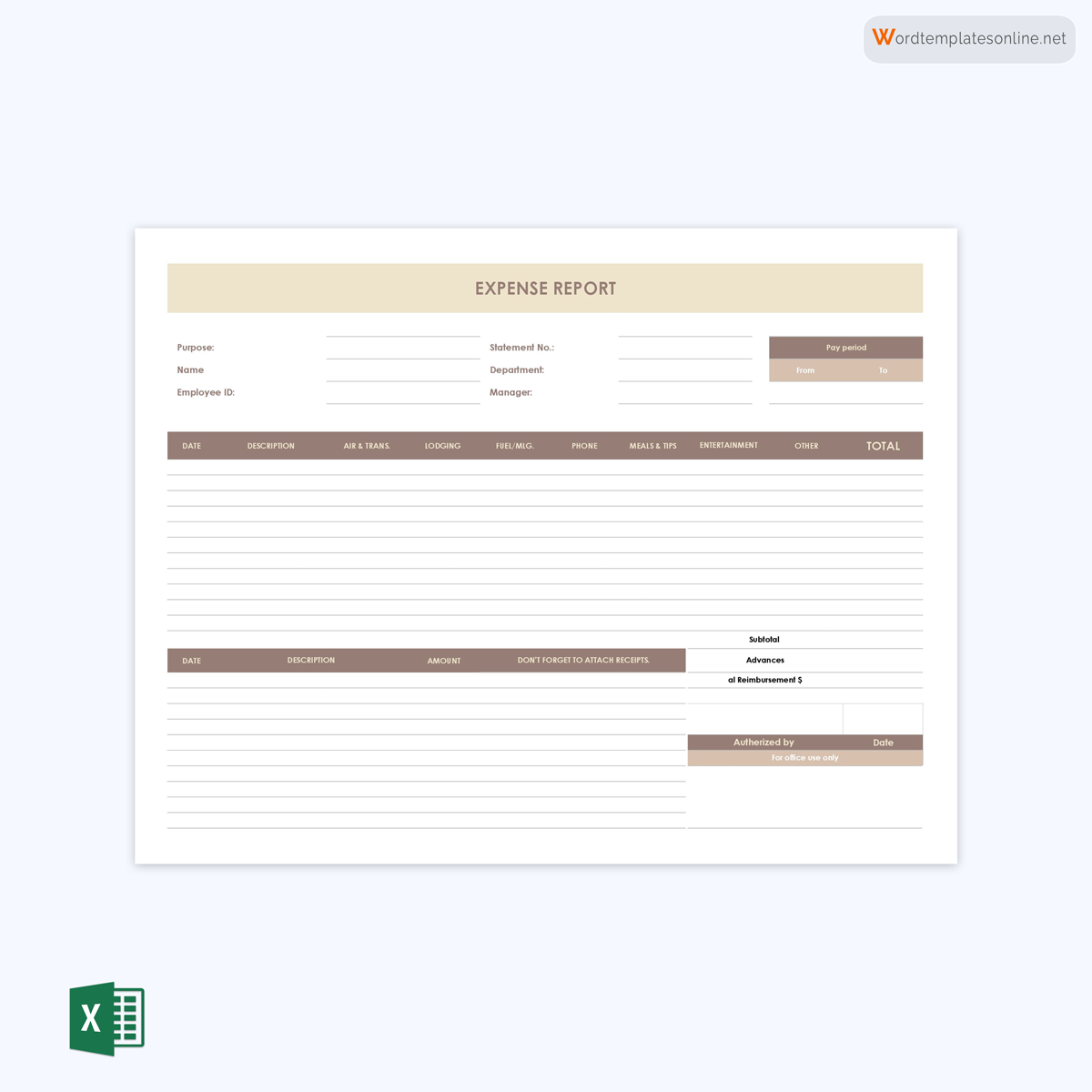

Below are steps to create one of the most common types of expense tracking templates – Excel tracking template:

- Step 1: Ensure that a desktop or laptop computer is within reach. Also, ensure that MS Excel is installed and if it is not installed, consider installing Google sheets that is another capable tool and can be used in the absence of Excel. It is free and readily accessible online.

- Step 2: Run the Excel program and select a pre-installed template for tracking personal expenses or spreadsheet. Pre-installed templates can be obtained by clicking the “File” tab and selecting “New” and then select “Sample templates” and choose “Personal Monthly Budget” and finalize by clicking “Create.”

- Step 3: Indicate the month or period for which the template is meant below the worksheet. Personalize the template title, for example, “Personal Expense Tracking worksheet for June 2021.”

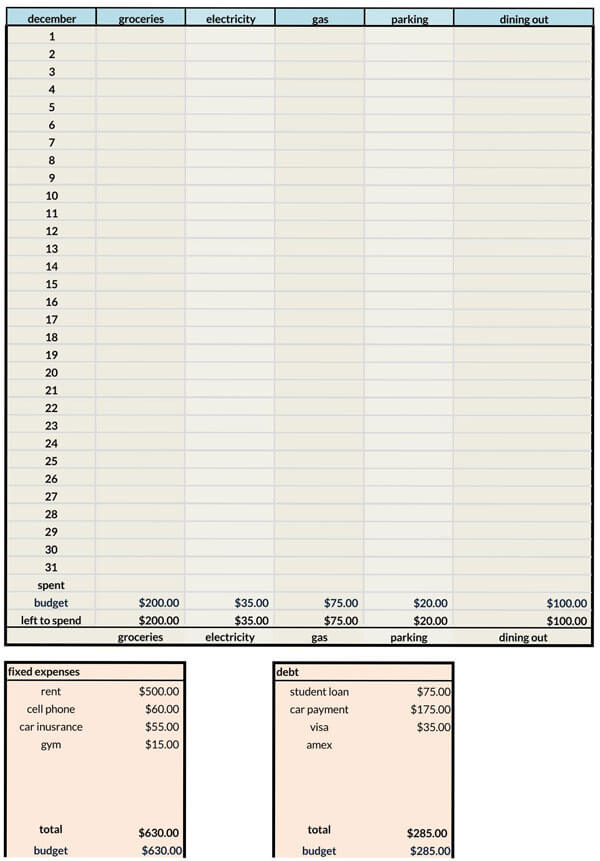

- Step 4: Fill in the information in appropriate rows and columns. A “Personal Expense Tracking Template” will typically have the following categories: Monthly income, End of month balance, and Expenses categorized into housing, food, savings/investments, entertainment, loans, insurance, transportation, personal care, taxes, gifts, and donations, pets, and legal expenses. Complete accordingly.

tip

Numbers should be carefully added to the template to simplify calculations. Excel calculations are dependent on how well the information was input.

A Personal Tracking template will typically have projected and actual figures for income, balance, and total expenses to create a more realistic record of finances. The actual figures are filled in at the end of the month after calculations. This way, the consumer could see if they managed to spend and save within their expectations.

note

Do not be limited to using MS Excel tracking templates alone; numerous other template templates are available.

Using an Expense Tracking Template

Tracking funds using templates, if done correctly, is a significant step towards financial stability. The objective of using the template will often be accurate capturing of personal or household expenditure.

Below are the steps that can be used to ensure the template benefits the user:

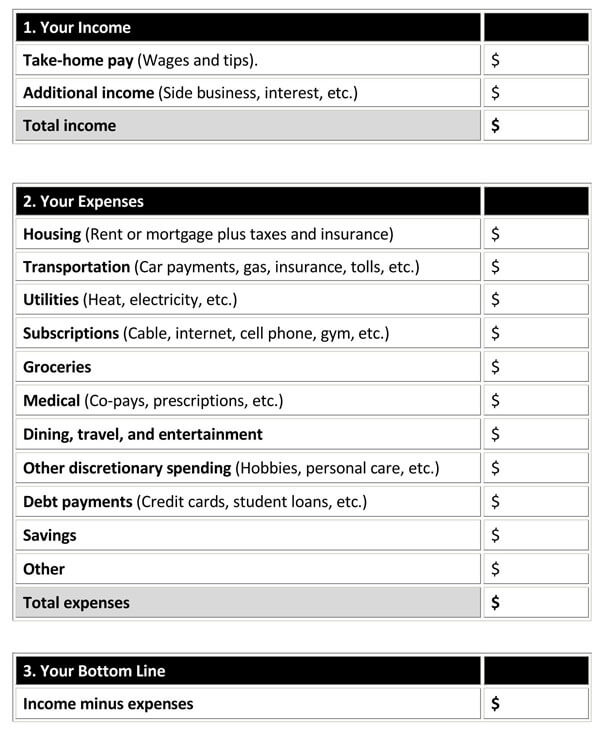

List down all the income sources

First and foremost, users should enlist their source(s) of income. Families or households with more than one person contributing to the household expenses should declare the amount of money they are able and willing to contribute in the template. The collective/total income should be stated to help the user(s) strategize on how the income contribution can be maximally and optimally utilized.

Mention the expenses

Next, expenses should also be indicated. Household expenses will customarily be inclusive of personal and joint expenses. The template is an effective way of keeping track of how much one spends.

Create saving goals

Thirdly, with the total income and expenses declared. It is up to the user(s) to plan ahead and develop cost-cutting solutions for themselves or their households to avoid a situation where they have to depend on debt to stay afloat. Money to be directed towards saving is the remaining amount after the expenditure has been deducted from the total income – this is the money they are able to save without straining their budget.

Fix budgets amounts

Lastly, the worksheet can be used to create the budget for the next month. By determining the expenses, one can appropriately allocate money for other necessities, such as shopping, date night, groceries, etc., in the budget while implementing the saving goals. As a result, couples can include personal financial needs such as expenses for hobbies in the household budget.

Frequently Asked Questions

The primary reason for tracking expenses is to ensure that we stick to the budget that we created. A budget is more of a pre-determined expenditure plan, whereas an expense tracking template is more of a progressive record – track as one spends.

Expenses can be broadly categorized into fixed, variable, and periodic expenses. Fixed expenses occur every month, and the amount paid rarely changes. Examples of fixed expenses include mortgage or rent, insurance payments, car payments, etc. periodic expenses are those that occur occasionally, and sometimes the consumer is aware or not aware of them, examples include property taxes, vehicle maintenance, membership fees, donations, etc. variable expenses fluctuate from month-to-month, and it is hard to be certain how much money they will take up. Examples of variable expenses include food, electricity, gas for a person’s car, electricity, water bills, etc.