A Checkbook Register is a document used to maintain a personal record of financial transactions.

The document will enable you to check, track, and regularly bring your account up-to-date once you make any deposits or withdrawals. In financial accounting, the term used for a checkbook register is a cash disbursement journal. It is used to record and track all the cash/checks/wire transfer inflows and outflows of a personal or a business account.

Maintaining a balanced checkbook is essential as it allows you to determine how much money you have in the checking account at any moment in time. To keep your checkbook balanced, you only need to understand the basics of addition and subtraction. The critical step in maintaining your checkbook is ensuring that all transactions are recorded in the register, irrespective of whether it’s an ATM withdrawal, a check, a debit card payment, or a check.

Keeping a personal register of a checkbook alongside the bank statements is important for comparison purposes. Although banks rarely make mistakes, it is good to take precautions to ensure that any errors are detected as early as possible.

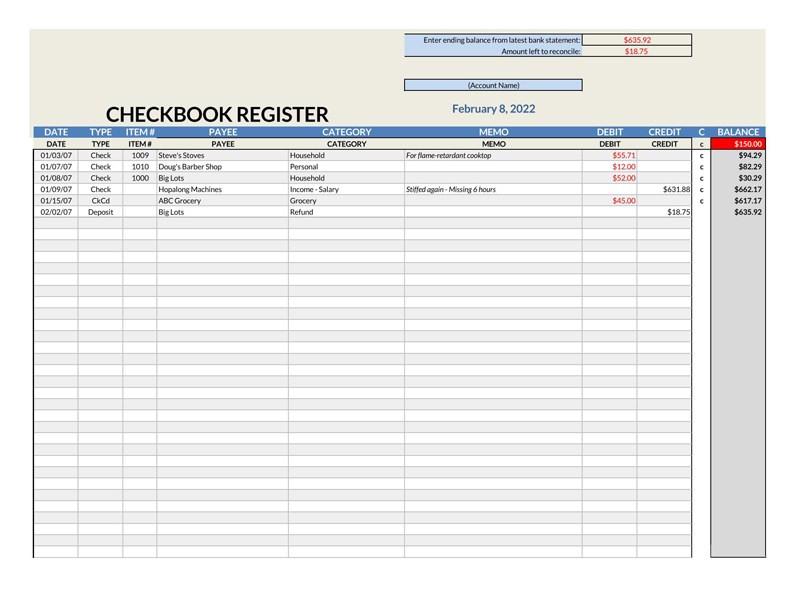

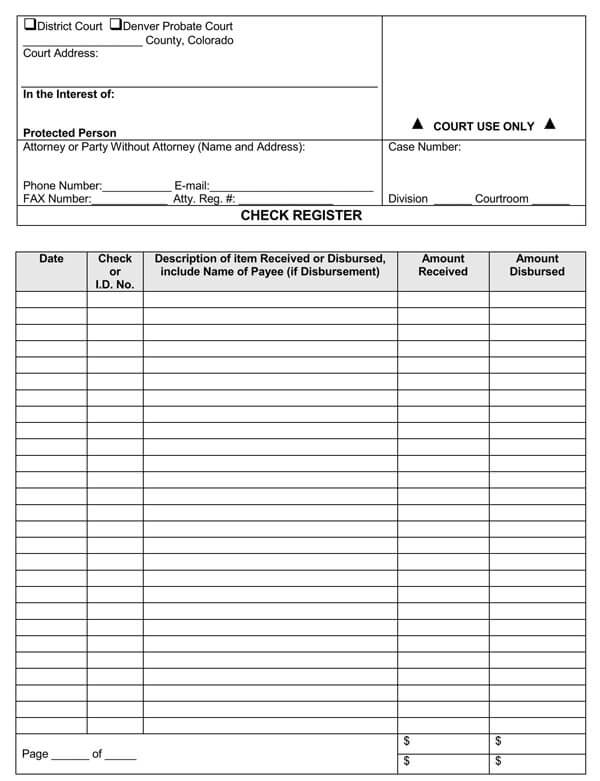

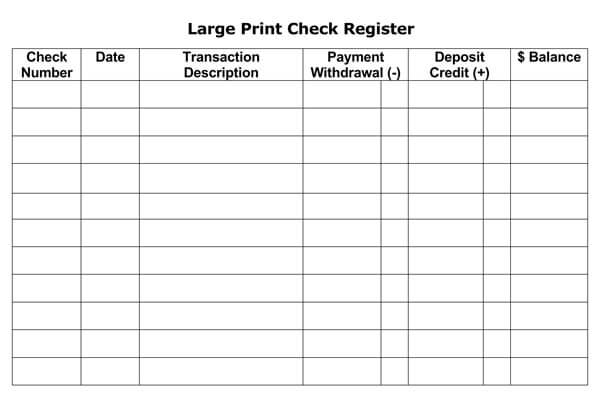

Free Templates

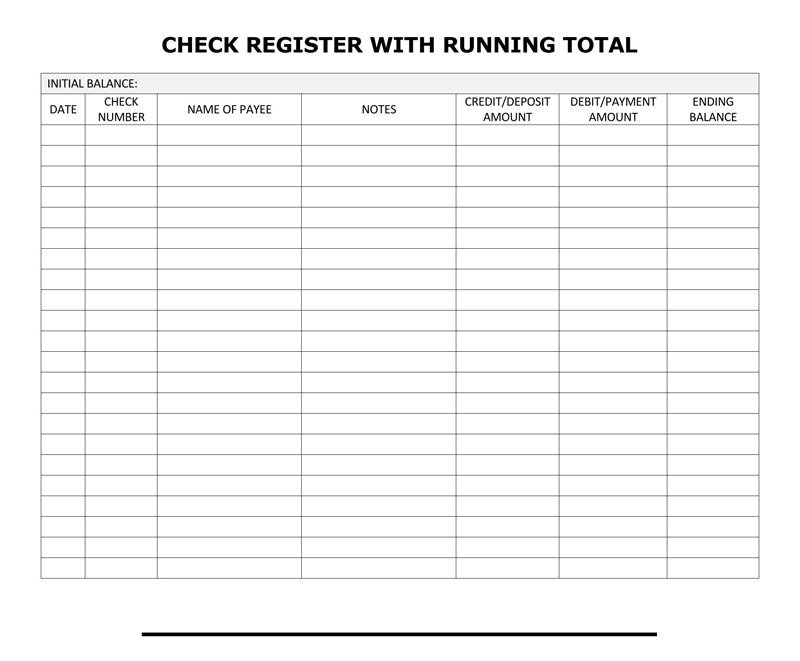

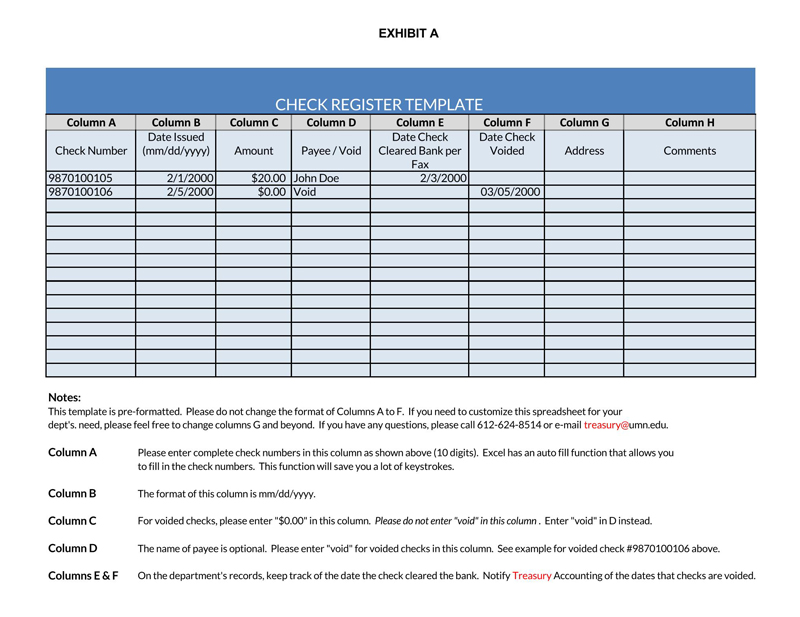

Following are some free downloadable templates for you:

Origin of Checkbook Register

The origin of the term ‘checkbook register’ goes back to many years ago when no online accounts were available to track one’s spending. It was, therefore, essential to maintain personal records of all financial transactions.

For example, an accountant used a quill pen to maintain all the records of the cash inflows and outflows for a business. This marked the origin of this register and its usage to date.

Necessary Information on a Checkbook Register

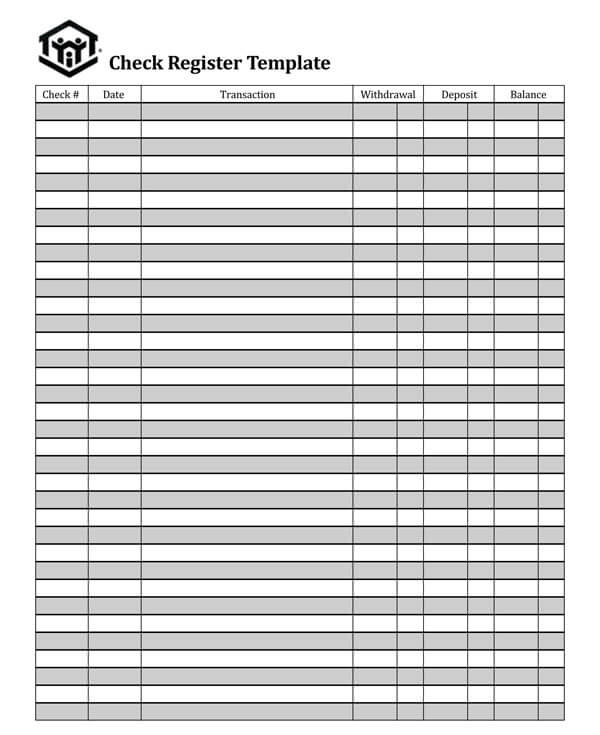

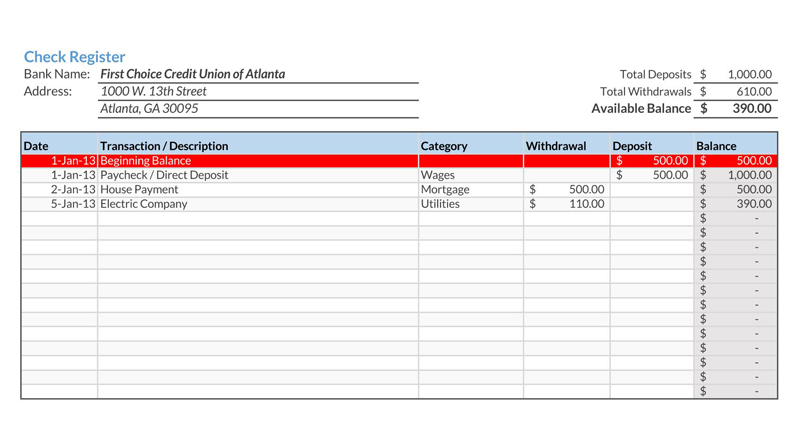

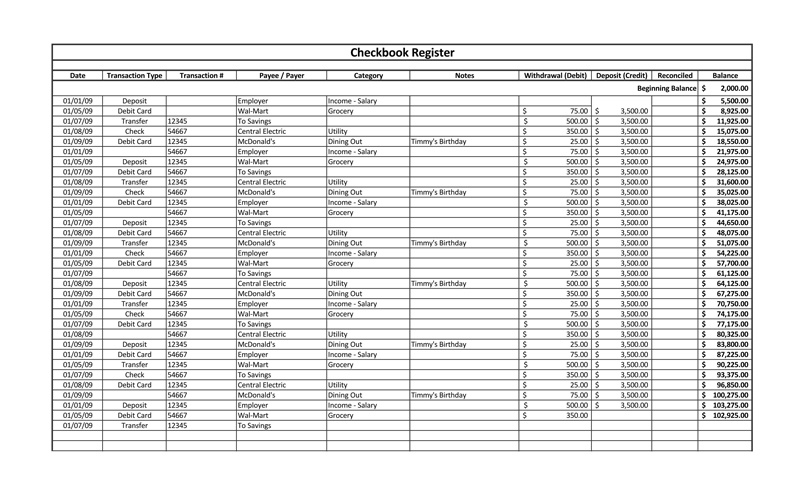

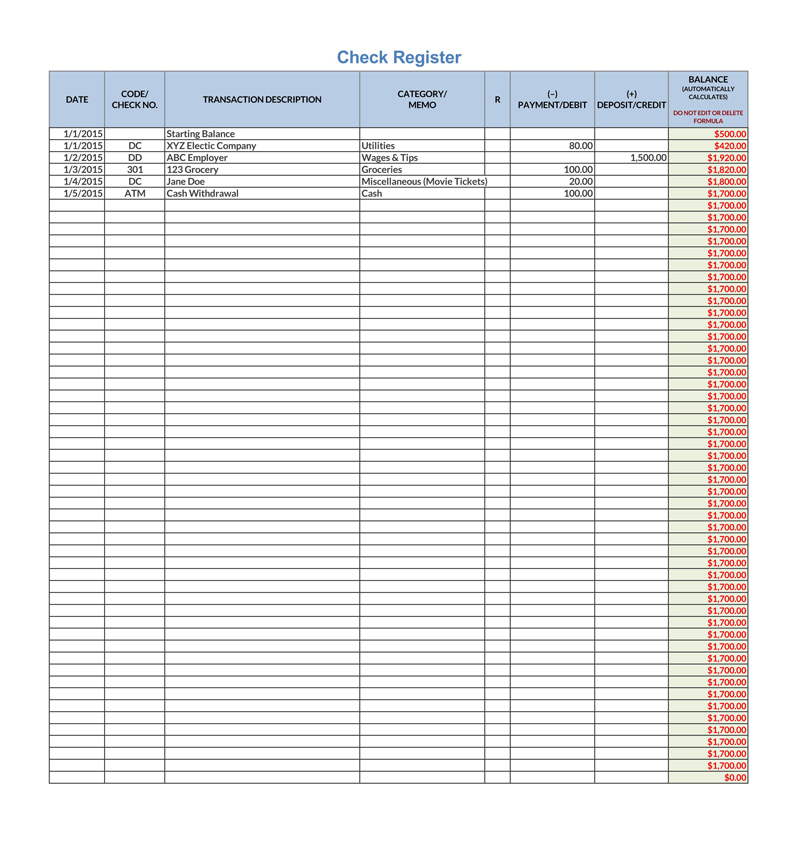

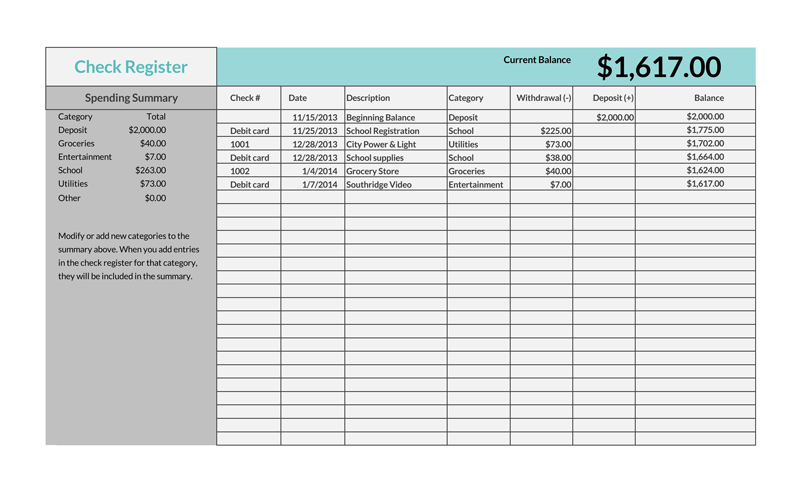

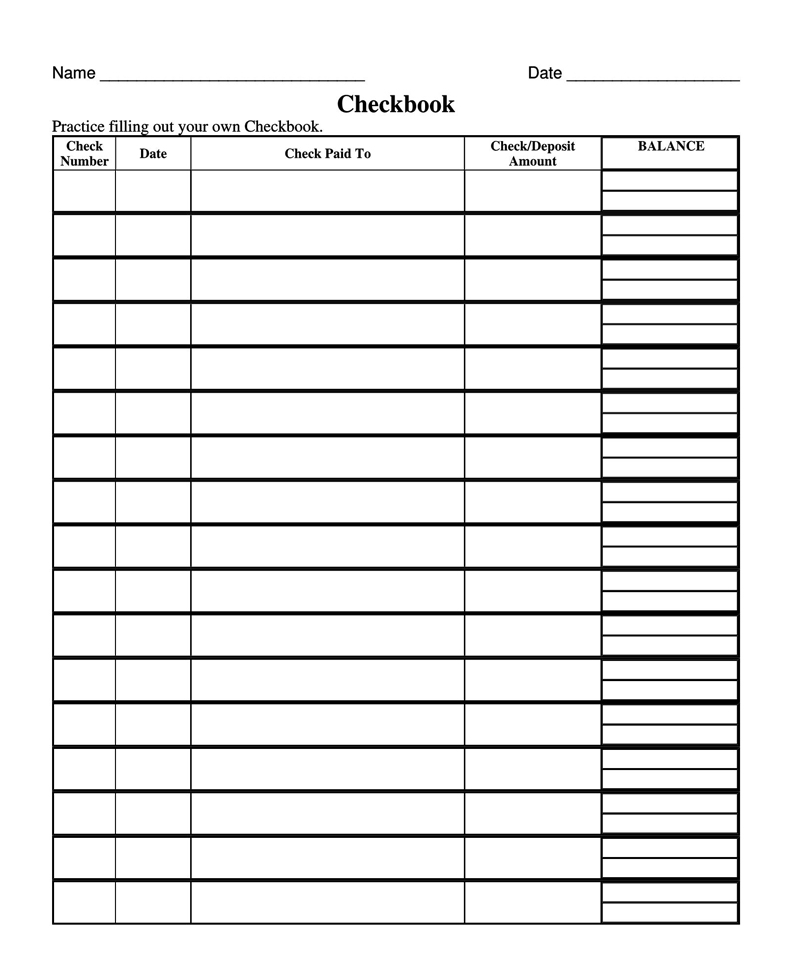

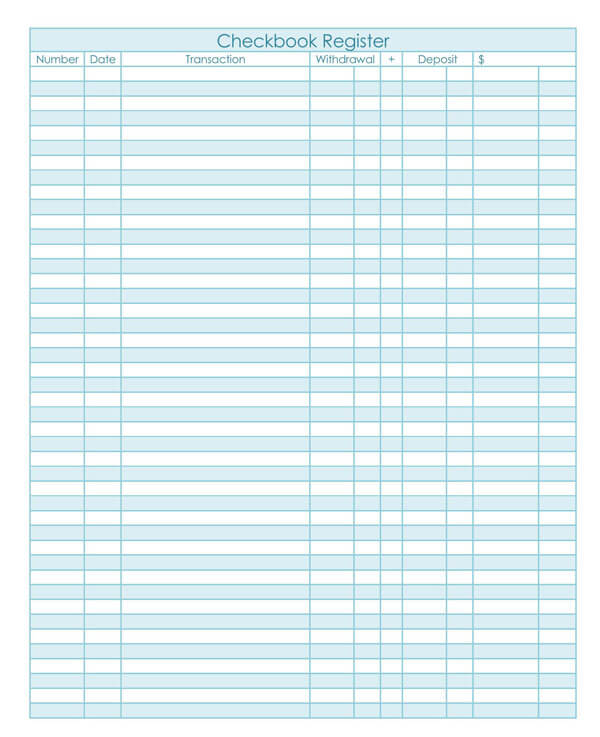

The register comprises columns that allow you to organize and categorize information related to various transactions. The various elements included in the check register are the date of the transaction, name of the payer or payee, category of the transaction, check number, notes to describe the transaction, debits and credits related to the transaction, and account balance.

Functions of a Checkbook Register

This register performs various functions, and you have the freedom to choose its different forms depending on your needs.

Its different forms include:

- The cash register can be obtained from a mobile app such as My Check Register.

- The register can be a soft copy on your computers, such as a spreadsheet or excel document.

- It can be an individual checkbook input with a pen or pencil.

- It can be paper based, containing debits and credits input into a general ledger using pen or pencil.

- The register also comes in the form of various online accounting packages.

Benefits of Using/Keeping a Checkbook Register

The register makes your financial management easy and seamless. The register can enable you to determine the number of funds available for effective budgeting when need be. The key advantage of a cash book register is that it maintains real-time records of your bank account balance.

There are many benefits associated with keeping the register, as presented in this section:

Quick access to financial transaction information

A cash book register lets you know immediately whether a check has hit your account or not. Whether you are the payee or the payer, your transactions are completed and recorded in the register as soon as they happen. It is therefore much faster to access all your information using a cash register.

Includes all types of payment mechanisms

A cash register excludes no transaction or payment. All types of payments, including ATM withdrawals, wire transfers, online payments, checks, and cash, are all included in the cash register.

It helps you budget better

The register provides you with all your financial information at a particular period. It allows you to determine how your business is going and ascertain how your expenditure is. In addition, you can have a breakdown of all your income and expenses. As a result, your budgeting has been made easy as you are aware of the number of funds in your credit and debit accounts.

Record of payment

The cash register acts as a book of original entry where records of all your financial transactions are maintained. It is a valuable accounting tool that provides a detailed record of your transaction history by including the date when payment was made, the person who made the payment, the total amount, and the form in which the payment was made. With a clear understanding of your financial position, it is possible to make better financial decisions.

You can monitor your bank

By maintaining a regularly reconciled register, you can compare your records with those of the bank. As a result, you can identify any mistakes made by the bank, such as wrongful charges and deductions. Furthermore, it is easy for such errors to be rectified if they are detected early.

Overdraft fees add up quickly/avoid bounced checks

Bounced checks are expensive as they cost approximately $25 for each. By reconciling your accounts monthly, the probability of returned checks reduces. As a result, you avoid the unnecessary costs related to overdraft fees and bounced checks.

Problem-solving is easier

Because reconciliation is done regularly, the cash register is always up to date. Therefore, in case of any mistakes at the bank, it is easy to identify the source of the discrepancy by just looking at all the transactions made during a specific period. In other words, the register makes problem-solving easy.

Identify bank mistakes/identity theft

Standard reconciliation of your register ensures that any mistakes made by the merchants, or any fraudulent activities are identified. Even though many merchants are honest, it is vital to ascertain that all the amount charged for products and services matches the invoice.

The opportunity for fraud is multiplied

In the modern world, most transactions have gone paperless. This means that people are spending more money on online purchases, ATM withdrawals, and debit card transactions. Unfortunately, these online transactions increase loopholes for identity theft and account hacking. This makes checkbook balancing more crucial than ever before.

It can support your savings goals

By facilitating effective management of cash, a cash book register also ensures that possible loss of funds through bank errors, overdraft fees, and fraudulent activities are eliminated. The savings made can be channeled to a savings account.

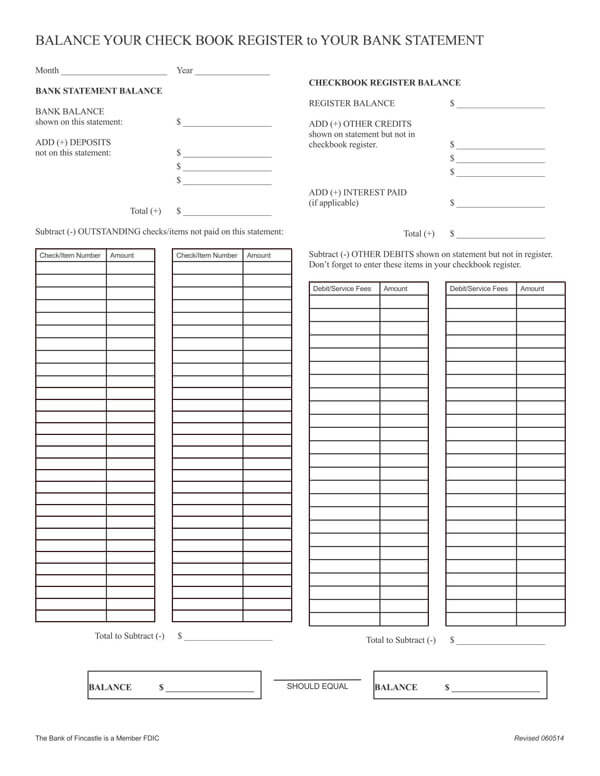

How to Balance a Checkbook Register

Before the digital transformation in financial record keeping came on the board, businesses got their bank statements and reconciled them with their operating accounts. However, even though things have been simplified today, balancing your accounts is still very important. Balancing accounts manually and digitally use the same principles.

For those who do not know how to go about it, here are a few details to help you balance your account manually:

- Go to your bank’s website and check your account’s “current available balance”. You can also get this figure using your mobile app. In your paper register, record the balance in the blank space on top of the sheet before entering any transactions.

- Below the available balance, write any withdrawals or deposits that you had not accounted for, including any checks that have not been taken to the bank. Remember to write all relevant details relating to the transactions, such as dates and check numbers.

- All debit transactions reduce your available balance and should be deducted. Credit transactions increase your available balance and should be added to the total sum. Ensure that each transaction is treated appropriately so that you have correct figures at the end.

- You should also note down any interest that you earned or fees that you were charged.

- Remember that your debits, credits, and total balance should be adjusted in the check register after every transaction.

- To know whether your checkbook is balanced or not, compare your records of deposits and withdrawals with those given by the bank for consistency. You can do this after a week or two.

In some cases, your records may not match with those that you have been given by the bank. The reason for such discrepancy may be a transaction you forgot to record or an error in the figures that were entered. You may have also repeated some transactions unknowingly. At this point, it is advisable to check when your cashbook was last balanced and begin to trace the error by comparing personal and bank records to identify the source of the error.

Many business owners find checkbook balancing very important because of its ability to detect errors and enable you to trace and rectify them. For those who are not conversant with accounting, it is advisable to do the balancing regularly, instead of waiting for transactions to pile up. That way, you will only have a few transactions to consider and have an easy task when analyzing them.

Digital Options for Balancing a Checkbook Register

The following digital checkbook balancing options are available for businesses:

Periodic account confirmations from the bank

Most banks allow their customers to check their account progress from their computers. You can take advantage of such services by checking your transactions from time to time and comparing them with your books of accounts. Some businesses will even prefer to subscribe to text alerts for account updates from the bank.

Although periodic online confirmations are a convenient alternative, they have several disadvantages when balancing your checkbook. First, online check-ins do not consider paper checks, and you may end up forgetting some of them and overdrawing your account. Secondly, since you only rely on the bank’s records, without having personal accounts, it becomes difficult to identify bank errors.

Account aggregation software

Businesses can use account aggregation software that combines all account information in one place. For example, the software will list the available balance, your loans, checking, and savings accounts, among other aspects. You will only have to check it periodically and compare it to your financial data to ensure consistency.

Business owners can easily understand the trends and details of their finances using account aggregation software. A potential disadvantage of such programs is that business owners may be tempted to think that they do not have to do anything because the software is doing all the tasks. It is important to always do some manual balancing to understand the trajectory of your finances and the consistency of your own accounts with those given by the bank.

Open-source spreadsheets

Using your cell phone, you can easily create your register on various applications such as open-source spreadsheets, that are available online and update them regularly. You can use freely available online spreadsheet platforms to record your transactions and access them from anywhere for purposes of tracking or balancing them.

With such applications, you do not have to carry your checks wherever you go because you can note your transactions and balance the register on a computer even from the comfort of your home or office.

Accounting software

You may decide to have more organized and structured data by using accounting software. Such applications will remind you to record transactions and even help you to balance your accounts. Some accounting software may also manipulate some figures, making the work easier for you. However, some effort is still needed, especially when you are keying your data in your phone or computer.

When a Checkbook Register is Used

This register can be used for two purposes.

They are:

Checkbook register for individuals

Individuals need to keep the register to record transactions to understand their financial activity effectively. Some individuals find themselves with bounced checks, insufficient fund alerts, or credit troubles simply because they do not track their account activity. Make sure to record all your ATM card and account receipts, regularly compare them with your bank statements to avoid such issues.

Checkbook registers for small business

If your small business incurs penalties related to late or overdraft fees, it’s time to get this register. Businesses that also want to track and correct their financial recording mistakes, or those from the bank’s side, can use the registers. You will also find a check register very useful if you want to prevent fraud in your business accounts, considering the large number of transactions that may be involved.

Obtaining a Checkbook Register Template

There are various ways in which you can obtain a template. Such as:

- Most importantly, it is good to ask for a check register from your bank, which may come with your checkbook. Your bank can also direct you to online check registers found in the bank’s online personal banking tool.

- There are also helpful online registers that you can download and print.

- You can also create your register using accounting spreadsheet tools that contains the following columns:

- Checkbox– Accounts for all records from the bank.

- Check Number or Category– Keep a list of your checks and their numbers.

- Date– Indicates when transactions took place.

- Description– Provides additional details for a transaction.

- Payment/ Debit (-) – Shows money that has been withdrawn.

- Deposit/Credit (+)– Shows money that has been received

- Balance– Indicates the available money in the account after payments and deposits.

A template offers several benefits to businesses. First, it makes it easier for novice business owners to create their own registers. Secondly, it enables business owners to cross-check that all necessary items have been included in the register. Thirdly, templates also make it easier, faster, and convenient to create checkbook registers. Finally, some templates enable you to make electronic registers in various online and offline accounting packages, which is very convenient for business owners.

Key Takeaways

To this end, the importance of a checkbook register cannot be over-emphasized:

- It is only by keeping a cash book register that you can have a crystal-clear understanding of your financing standing as you continue with your day-to-day business activities.

- In addition, this register is a way to go if you want to realize effective financial management, particularly by detecting banking errors and fraudulent activities.

- Finally, there is no better way to budget than by maintaining the register. With a cash book register, you effectively manage your funds and guide you in the budgeting processes.