A household budget worksheet is a document used by an individual to track their spending for better financial management.

This worksheet helps an individual save their money, adopt better spending habits, avoid debt, and easily repay the debts they already have.

Budgeting and planning are crucial for effective financial planning. However, many people find it challenging to manage personal finances and do not know how to use a financial planning tool. This article will help you create a budget plan for your household.

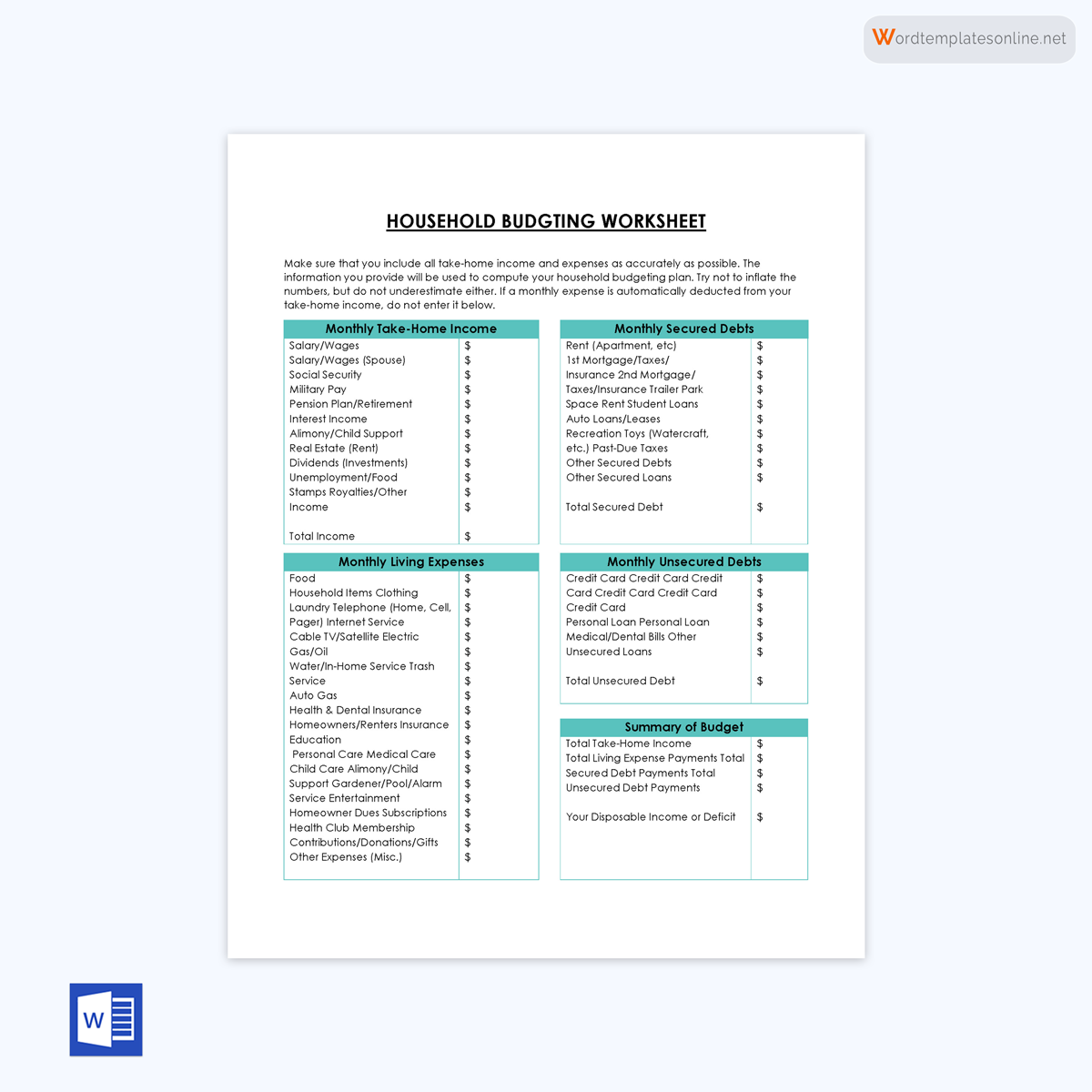

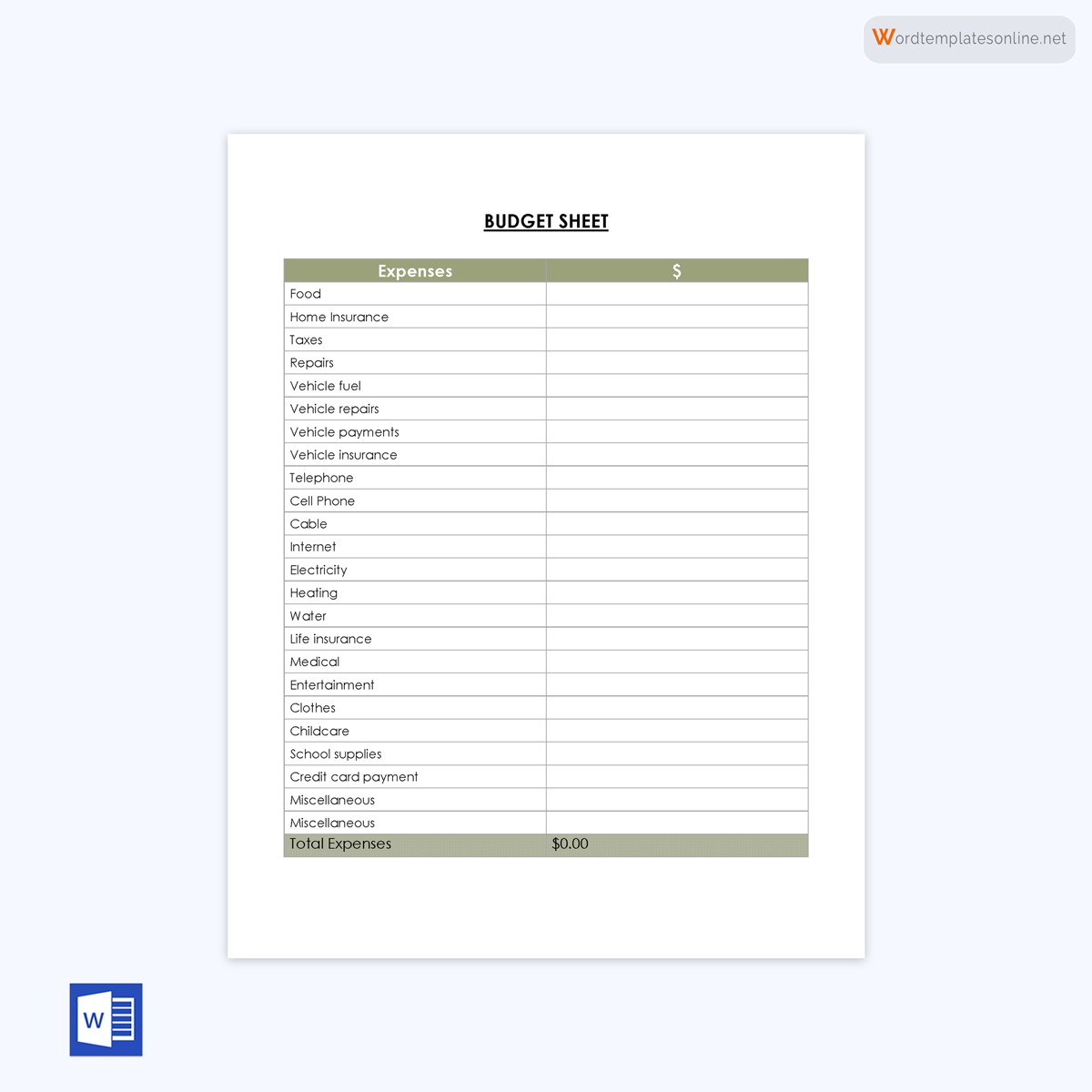

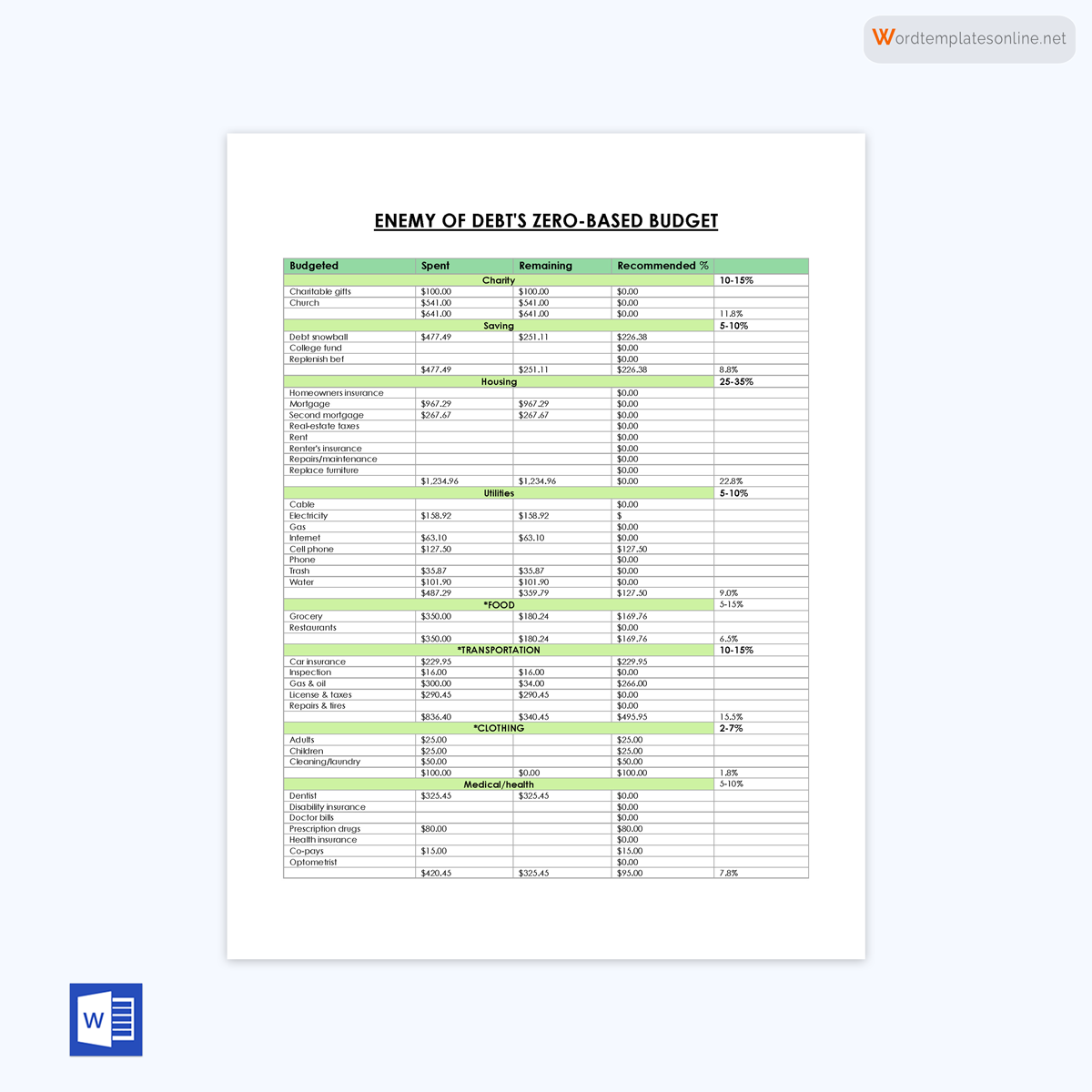

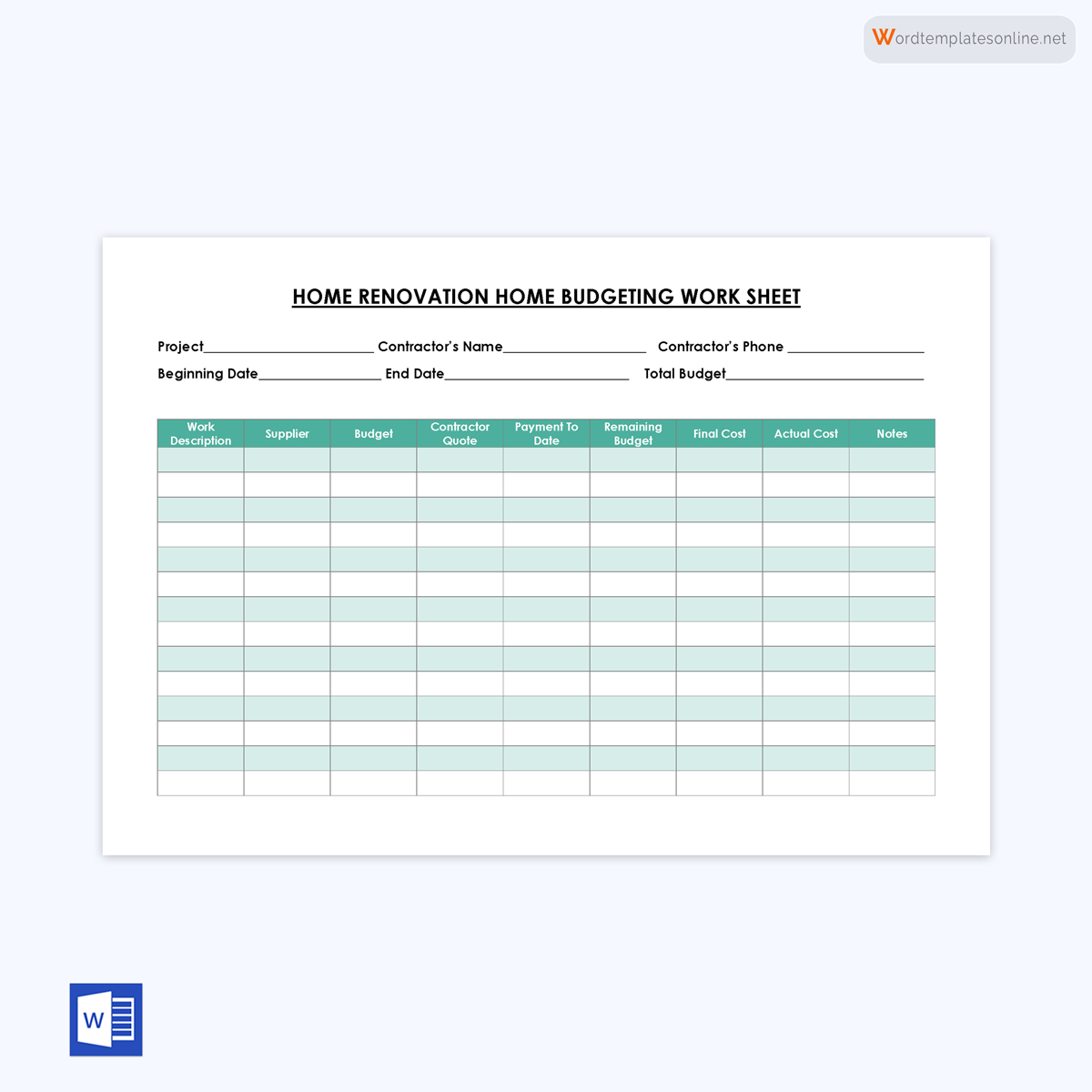

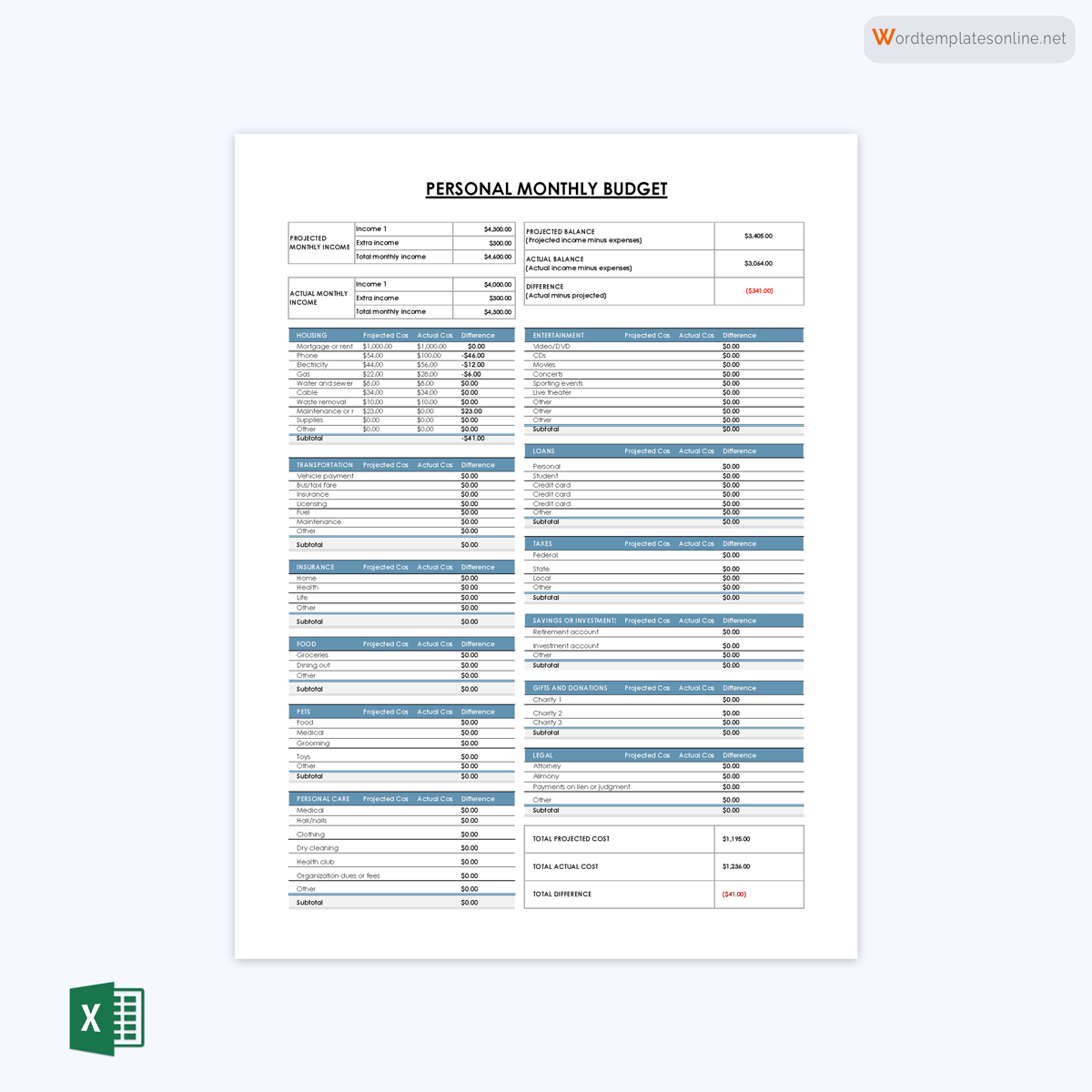

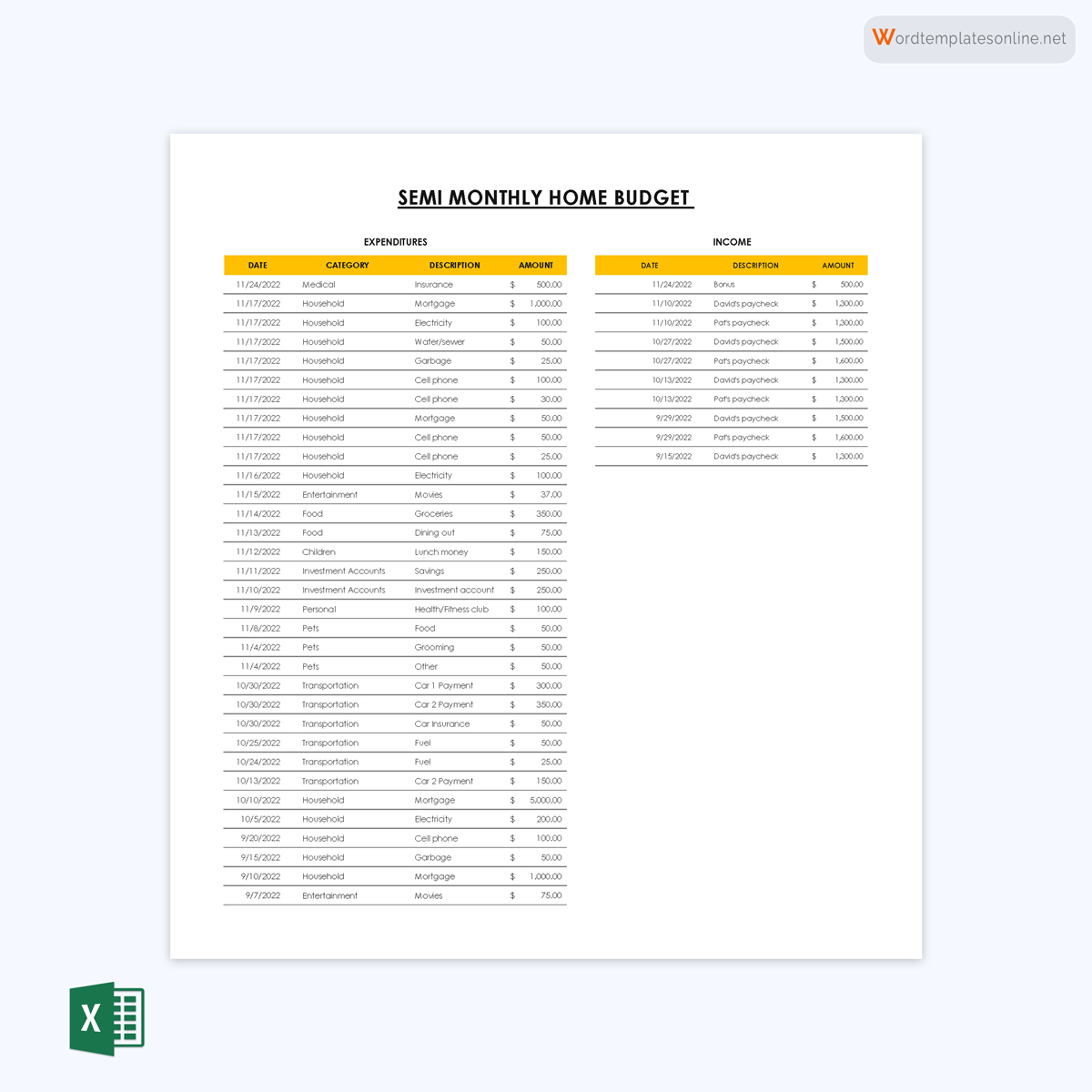

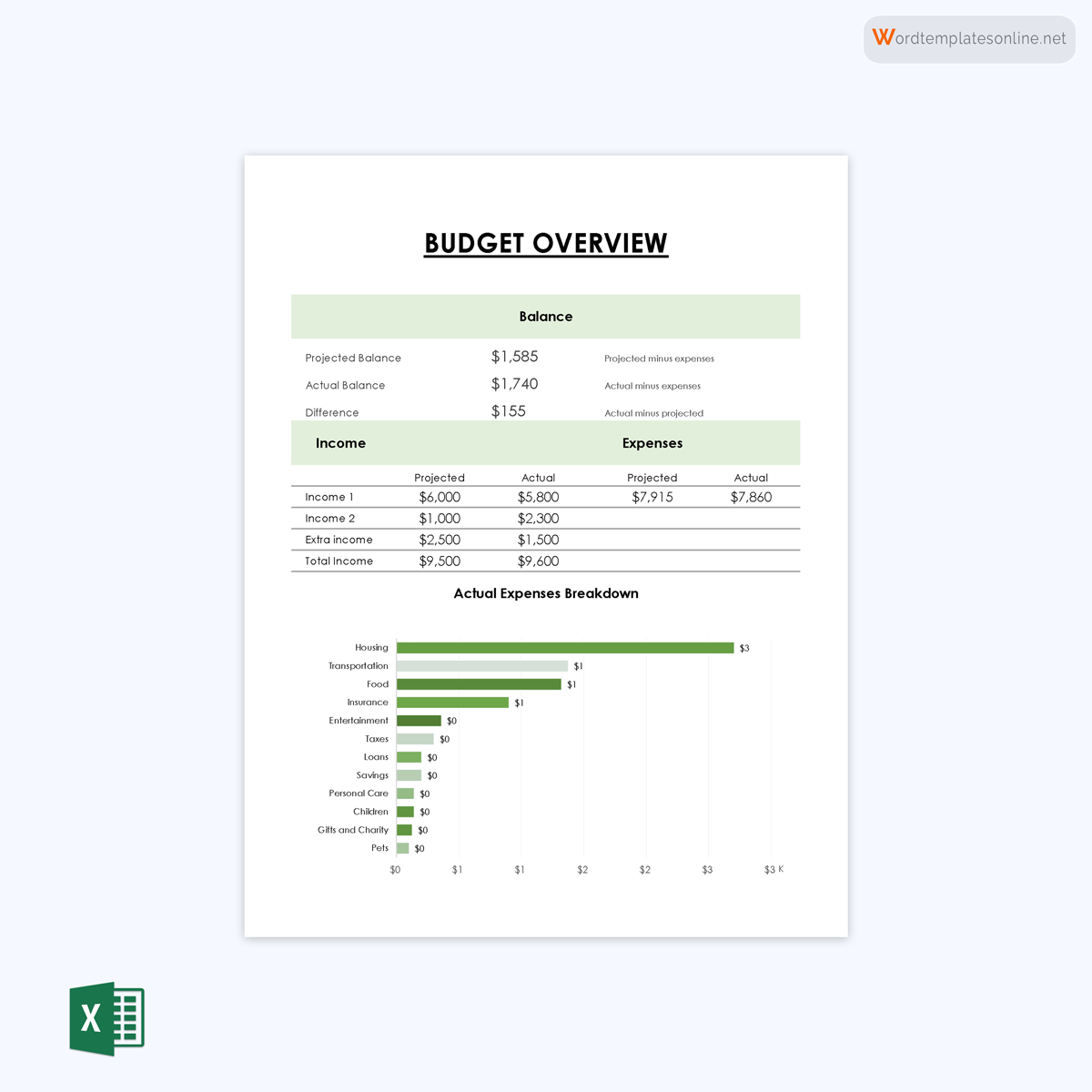

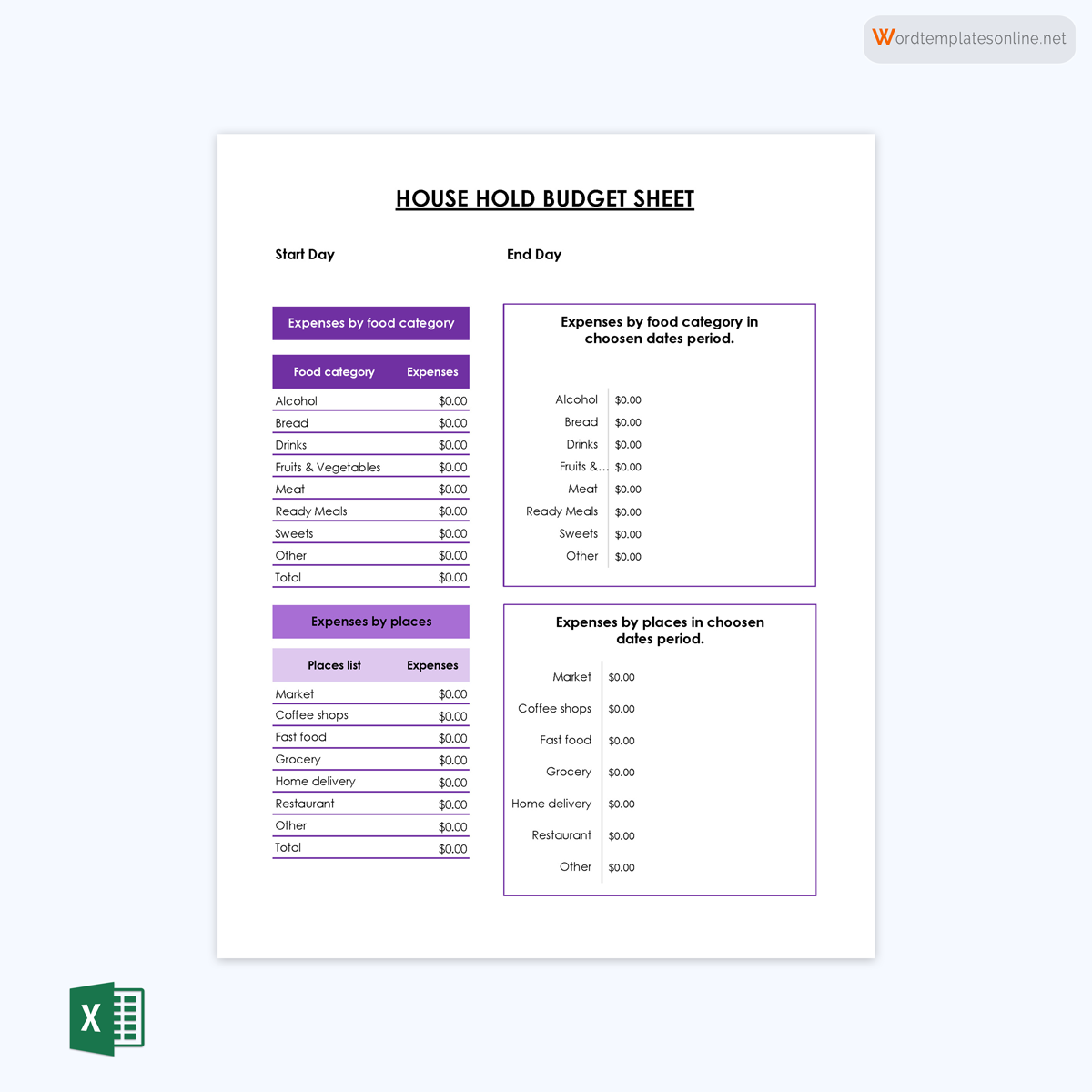

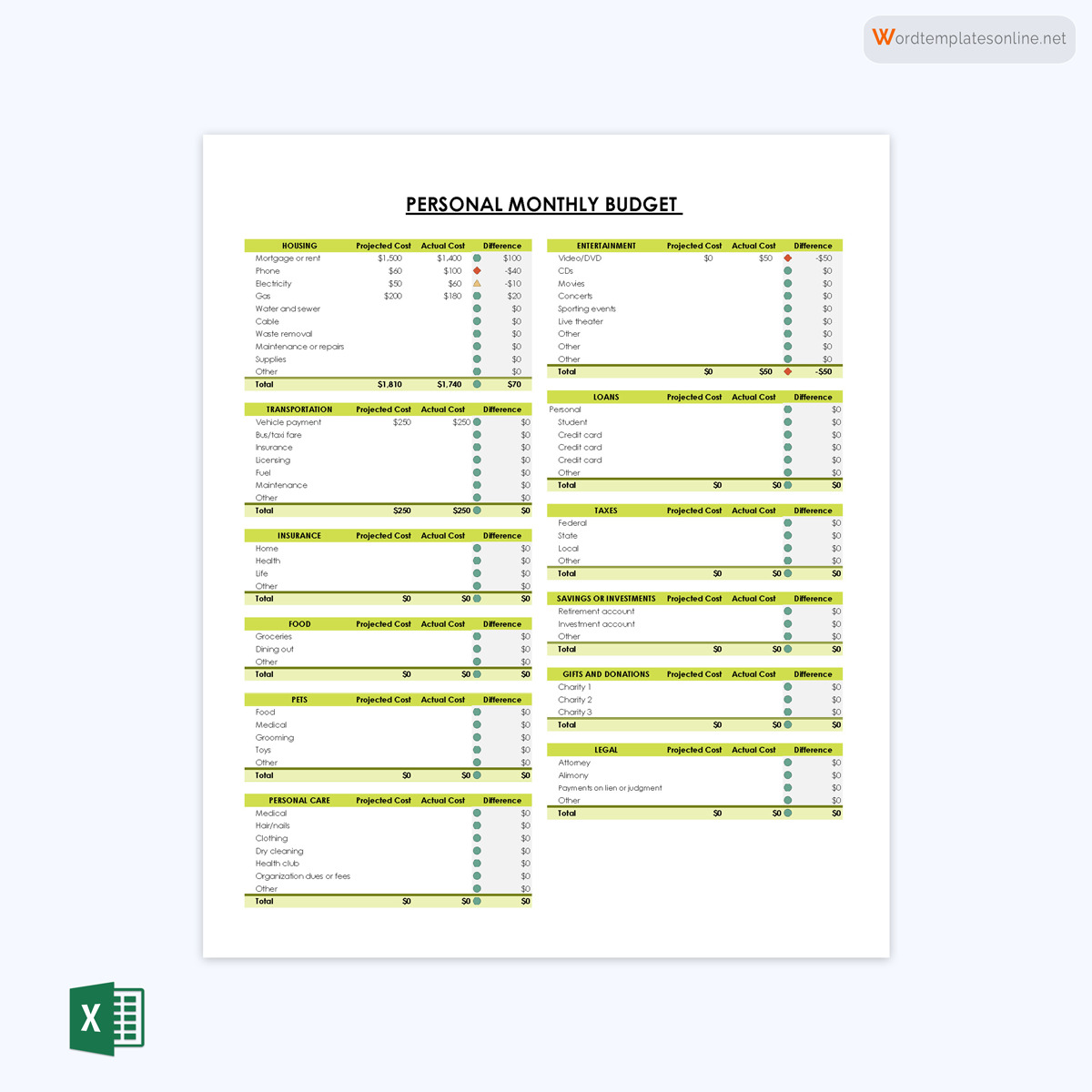

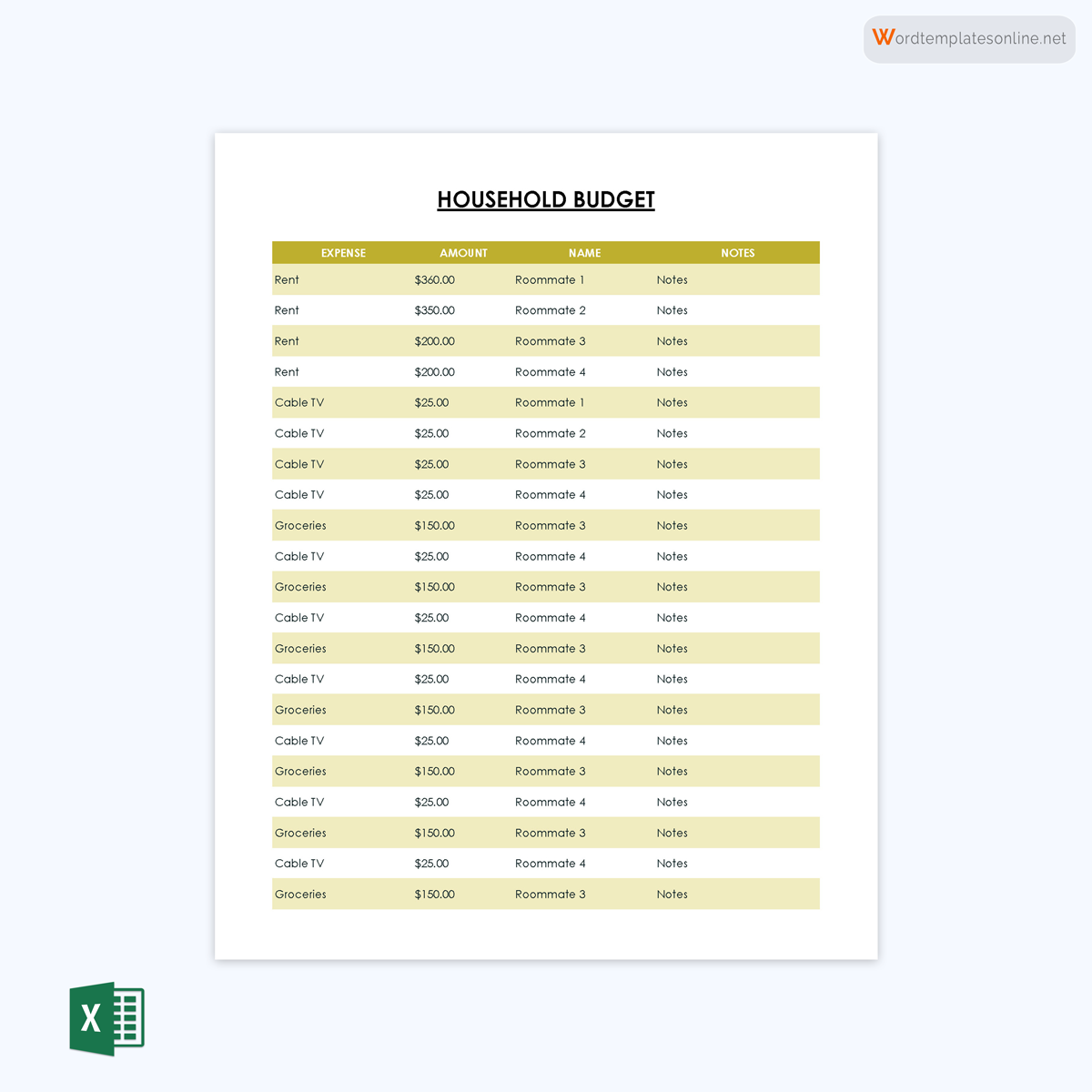

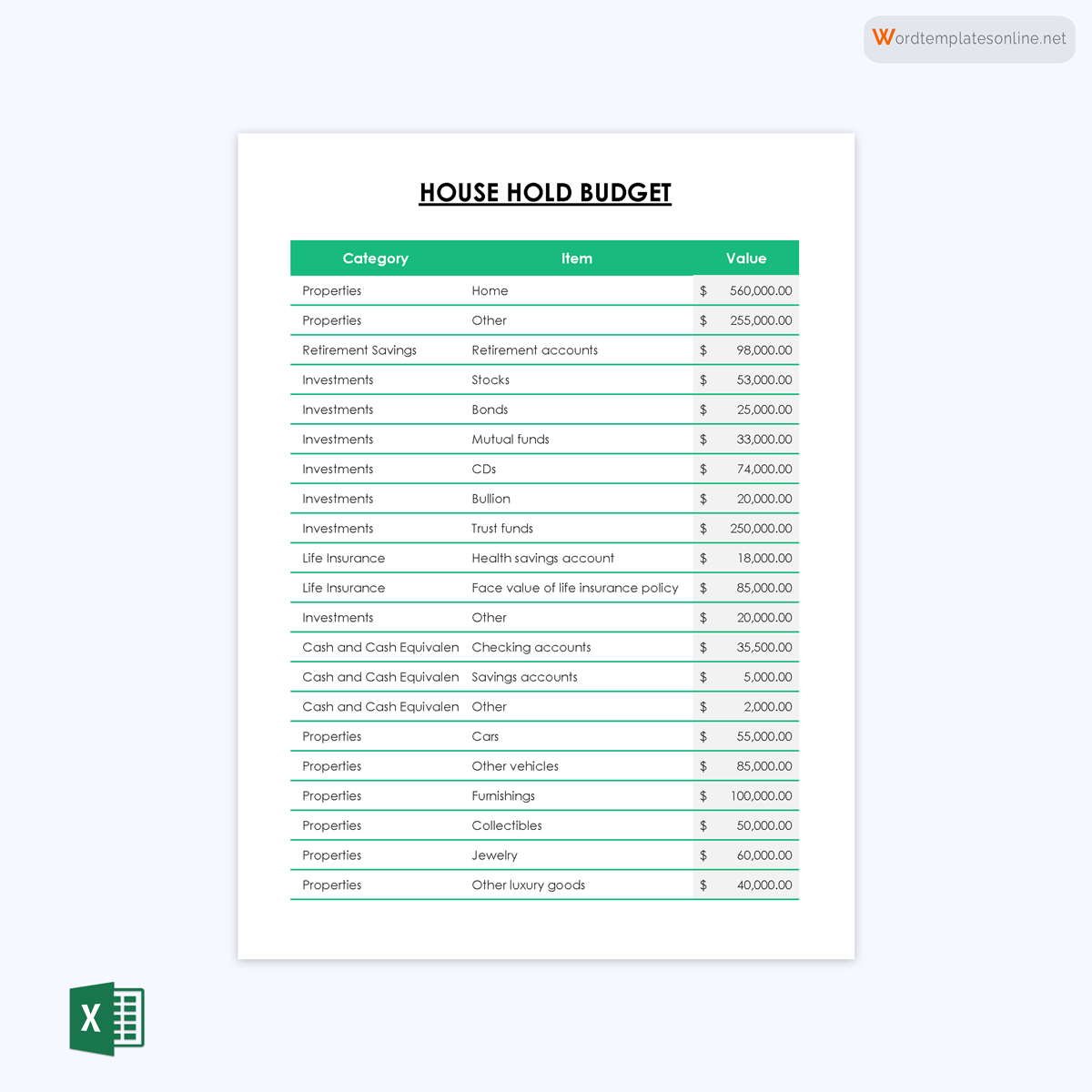

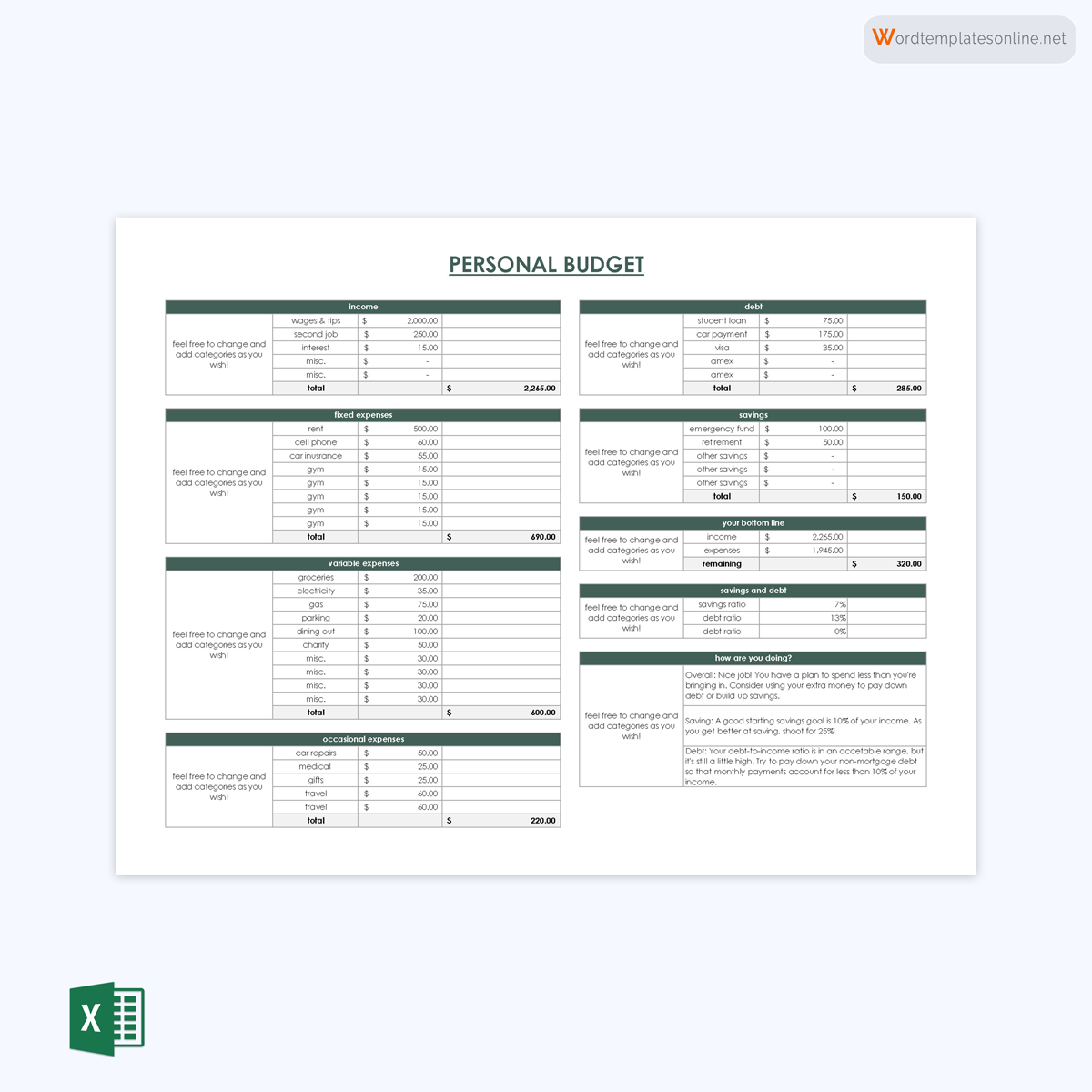

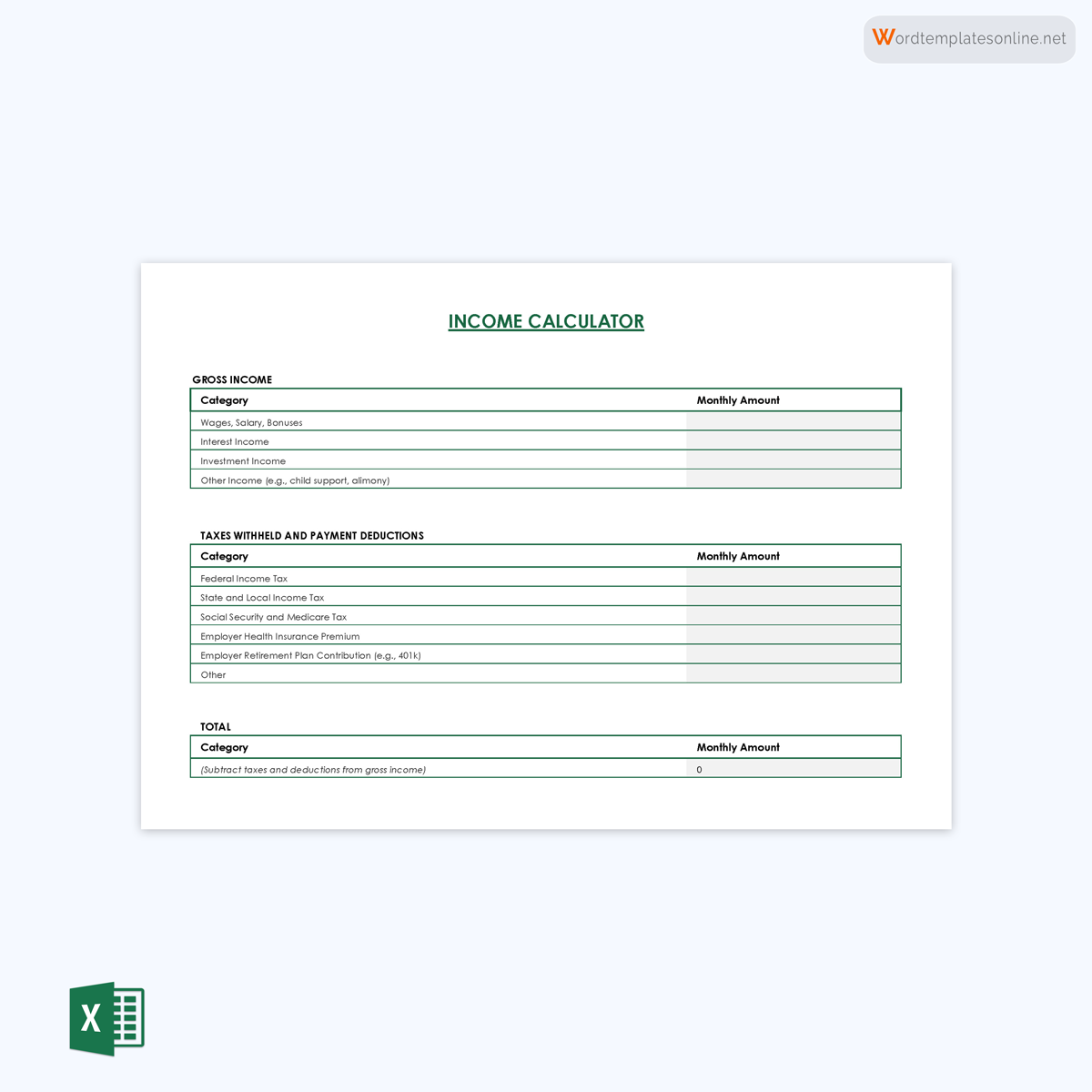

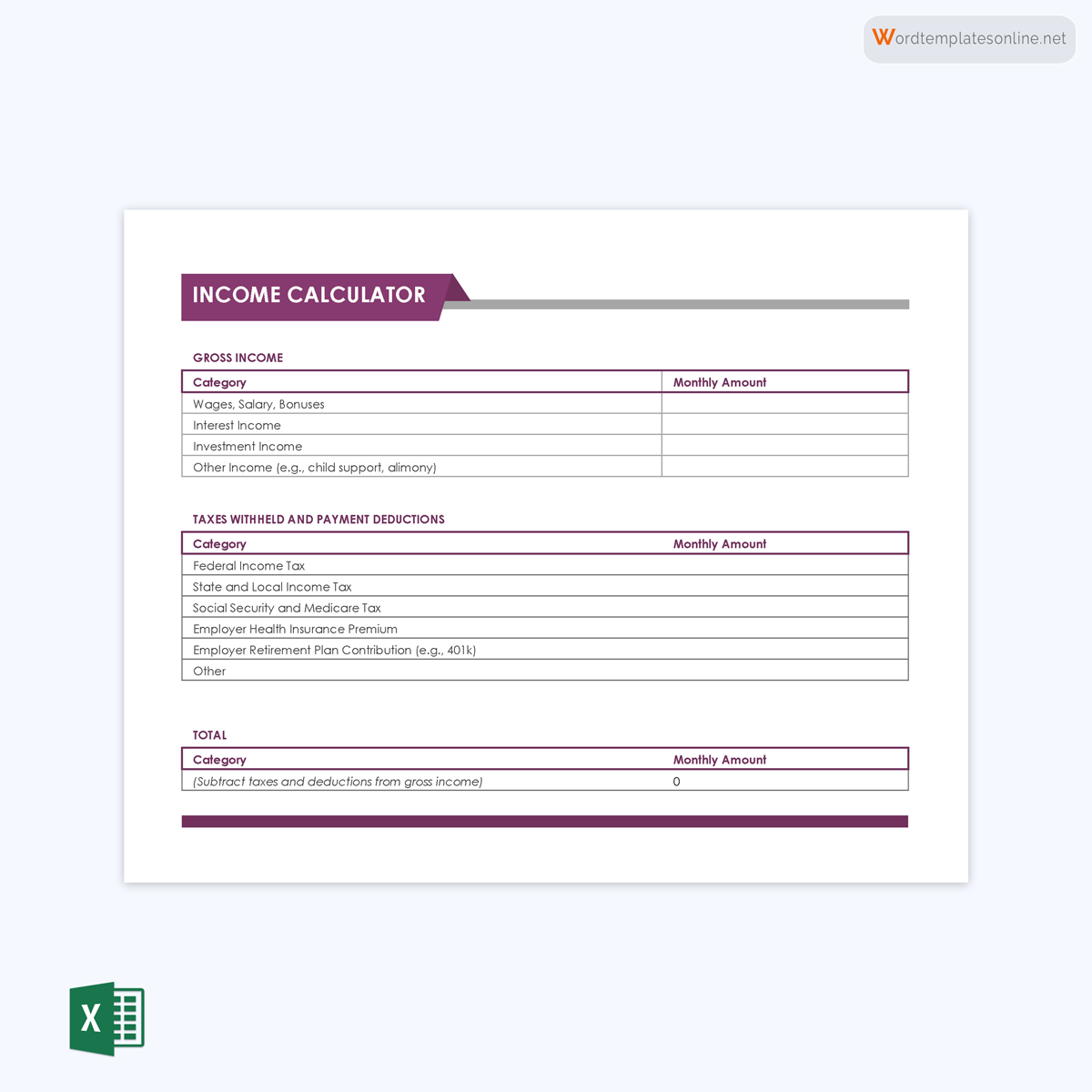

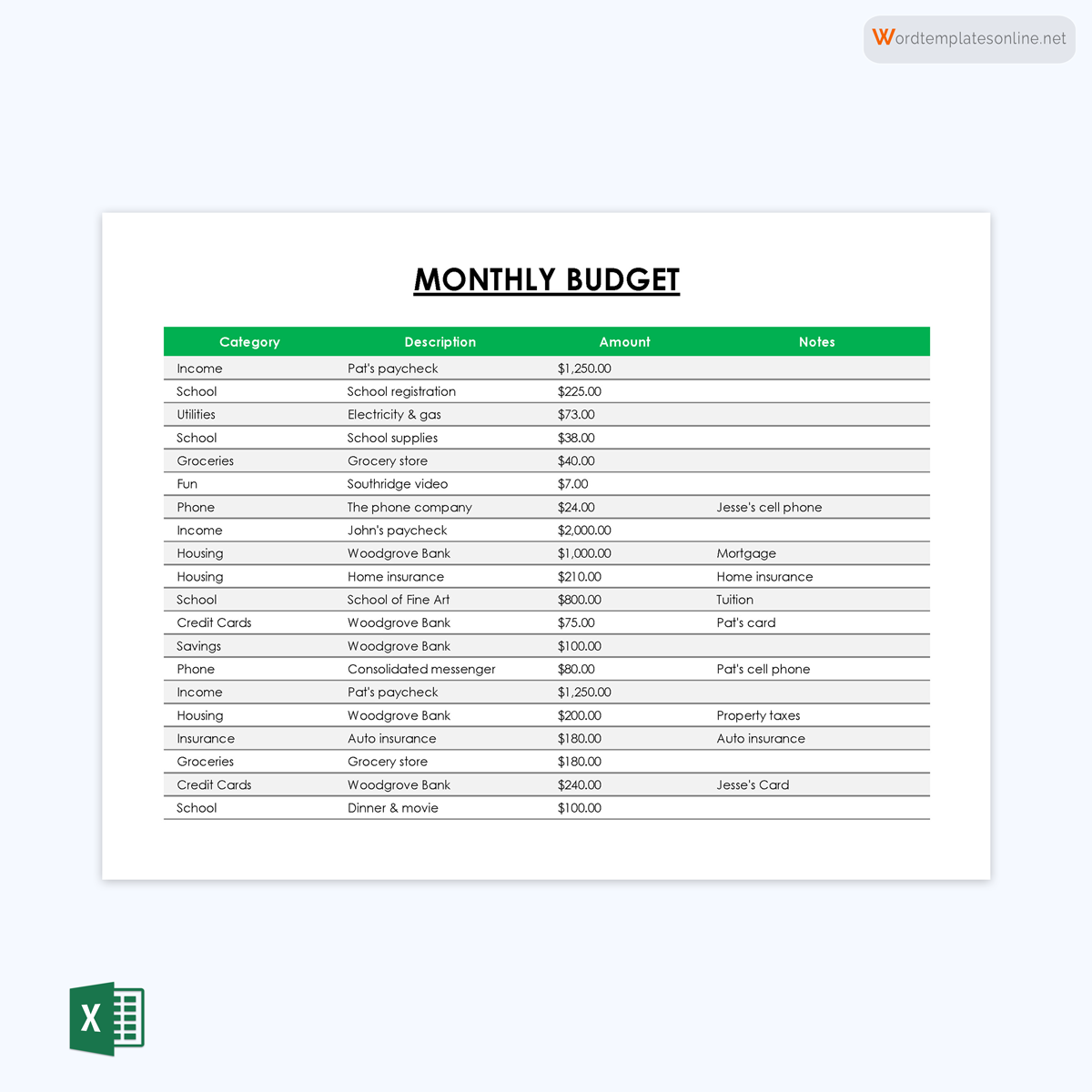

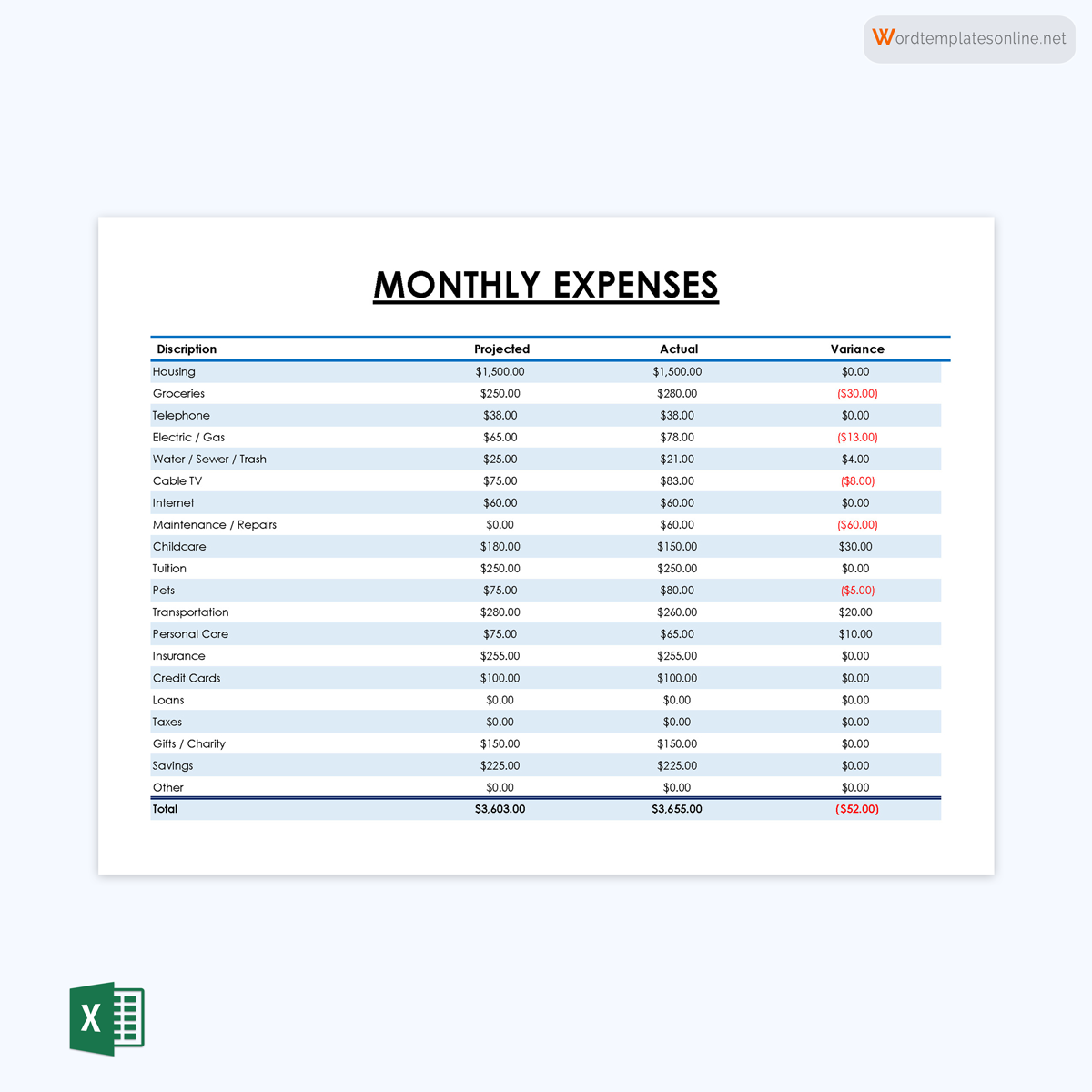

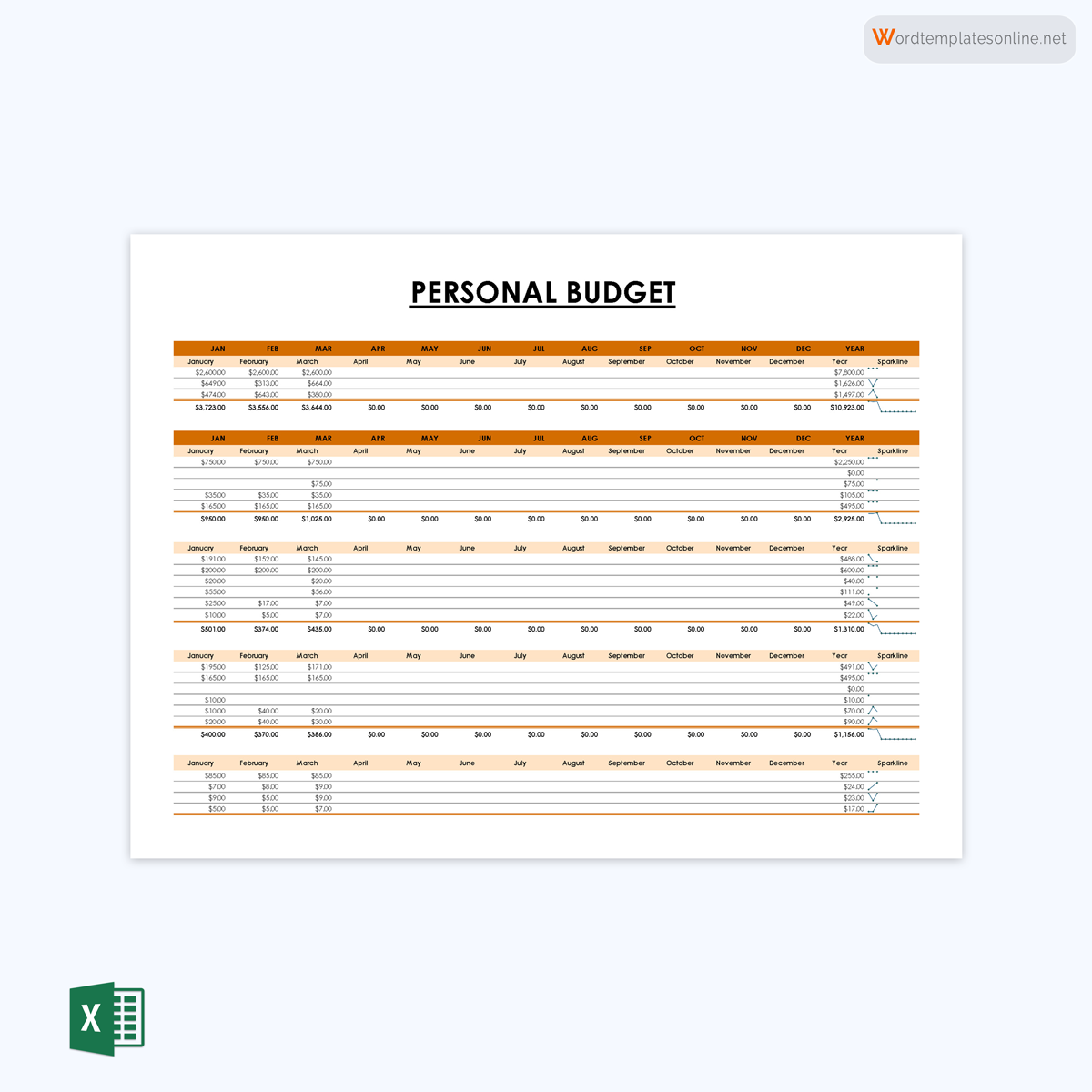

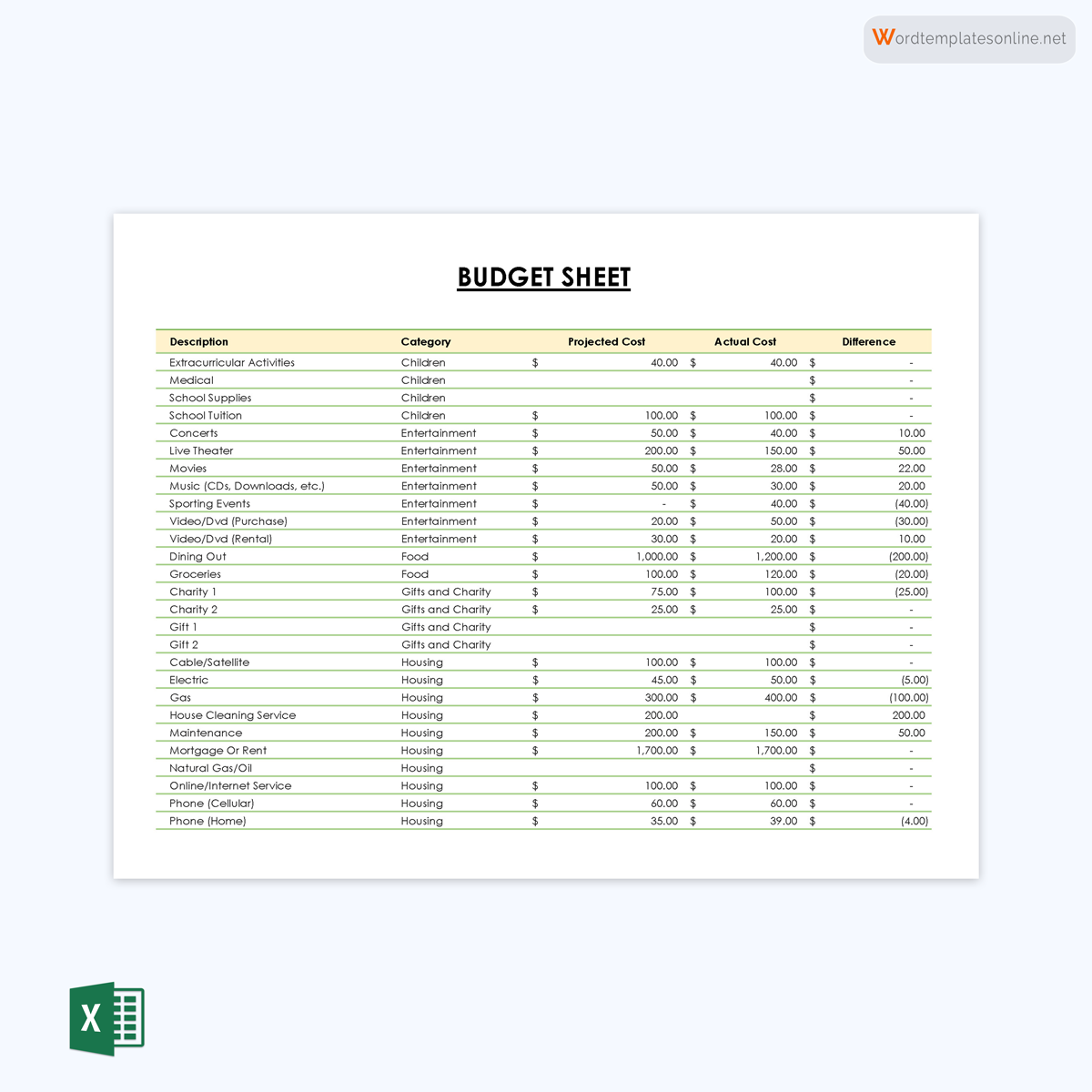

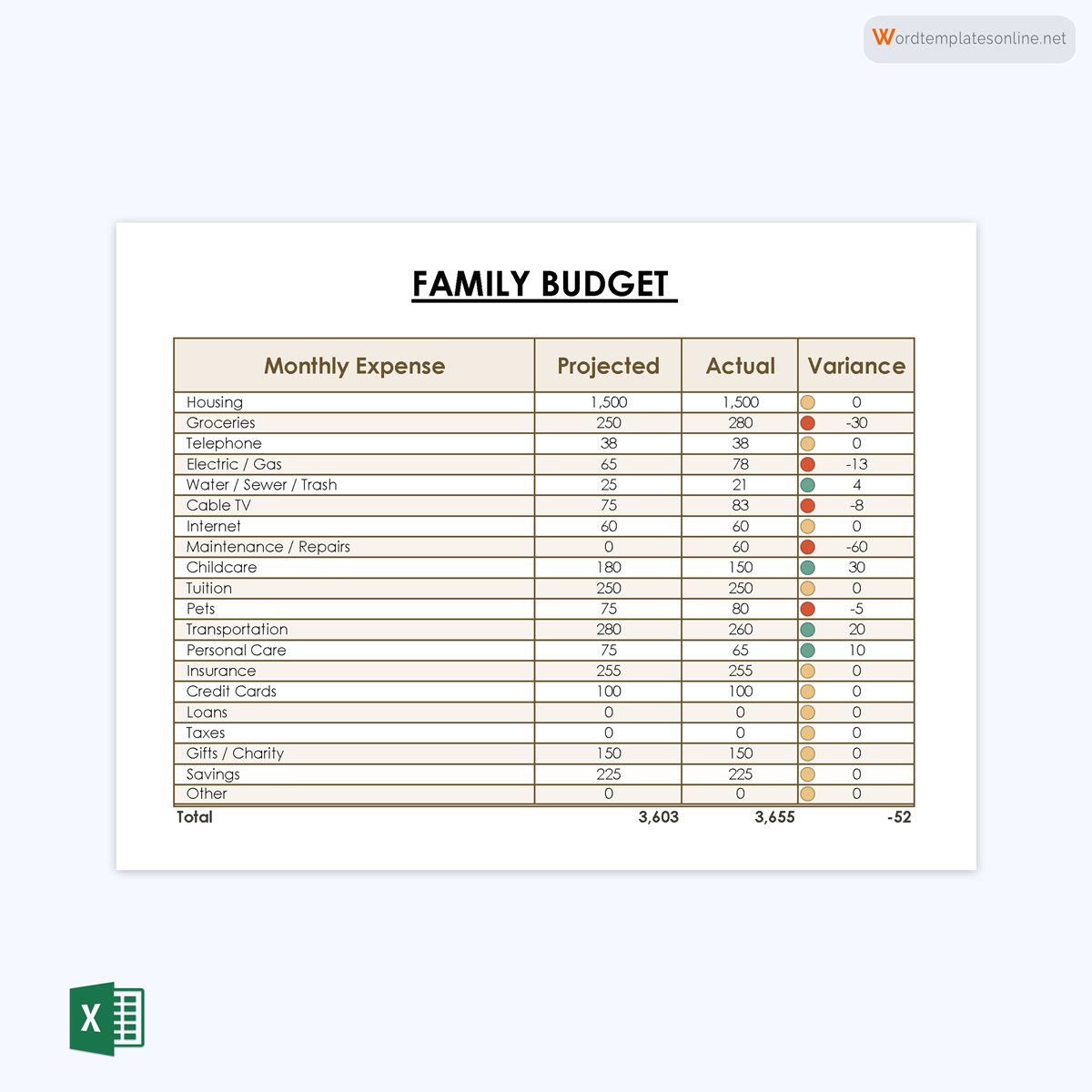

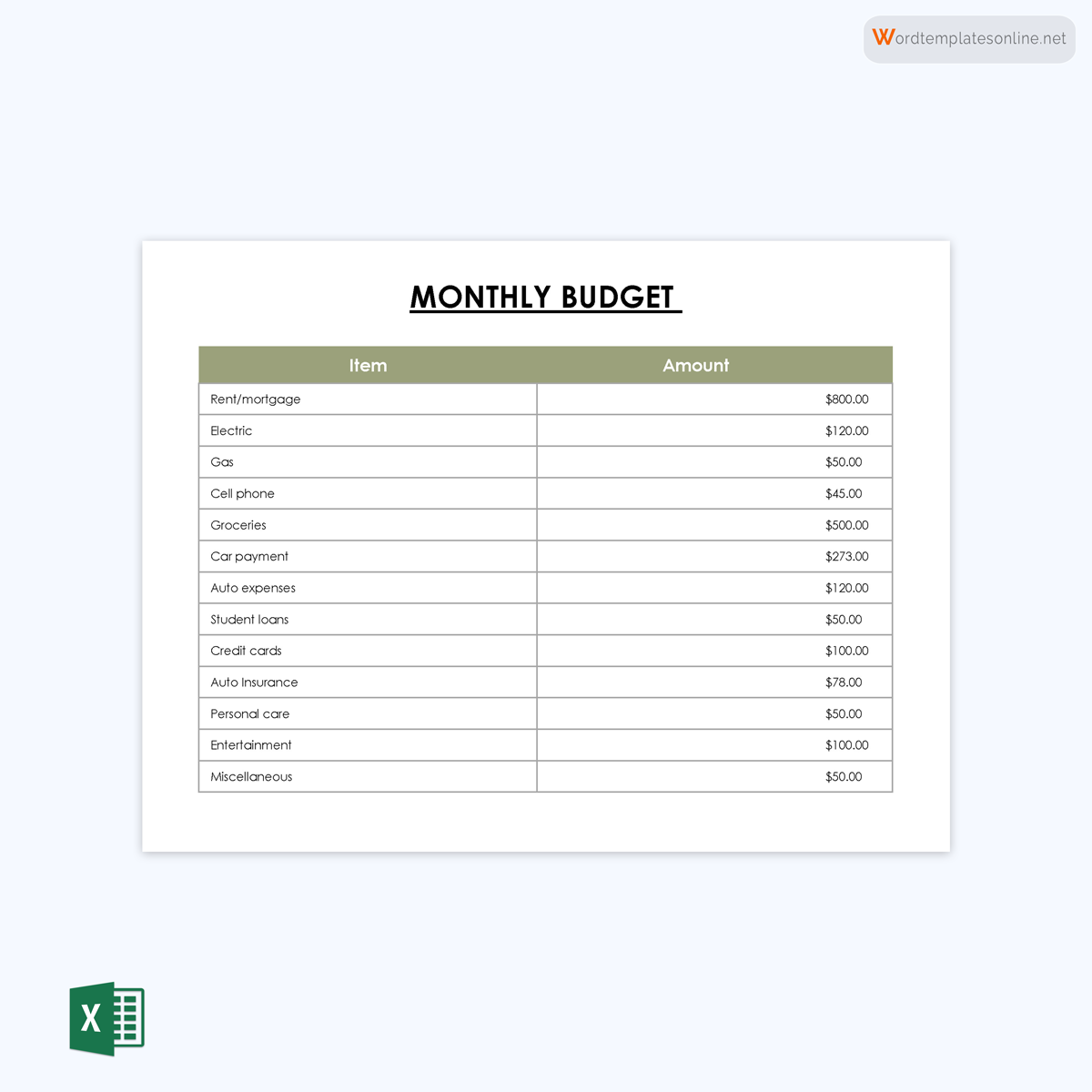

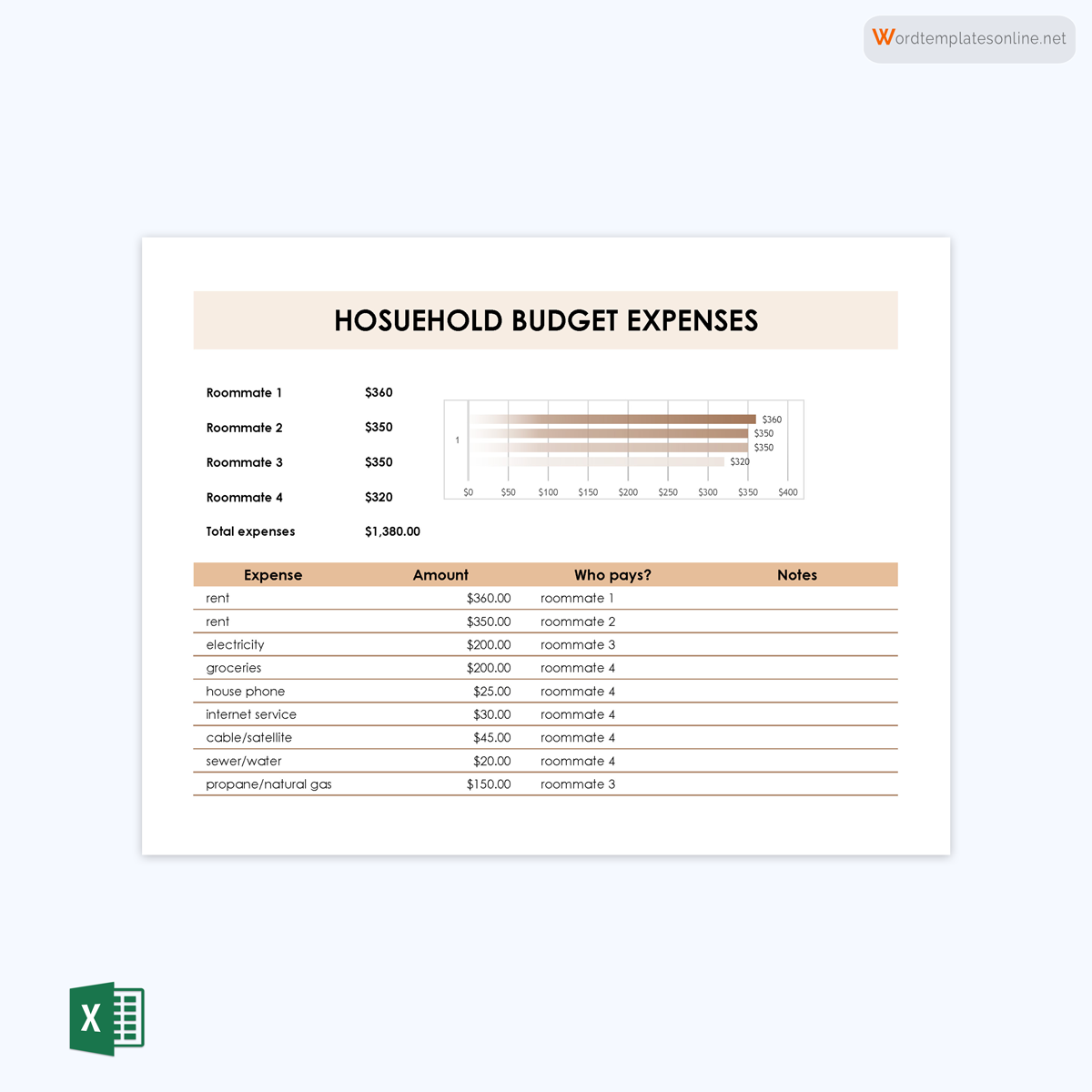

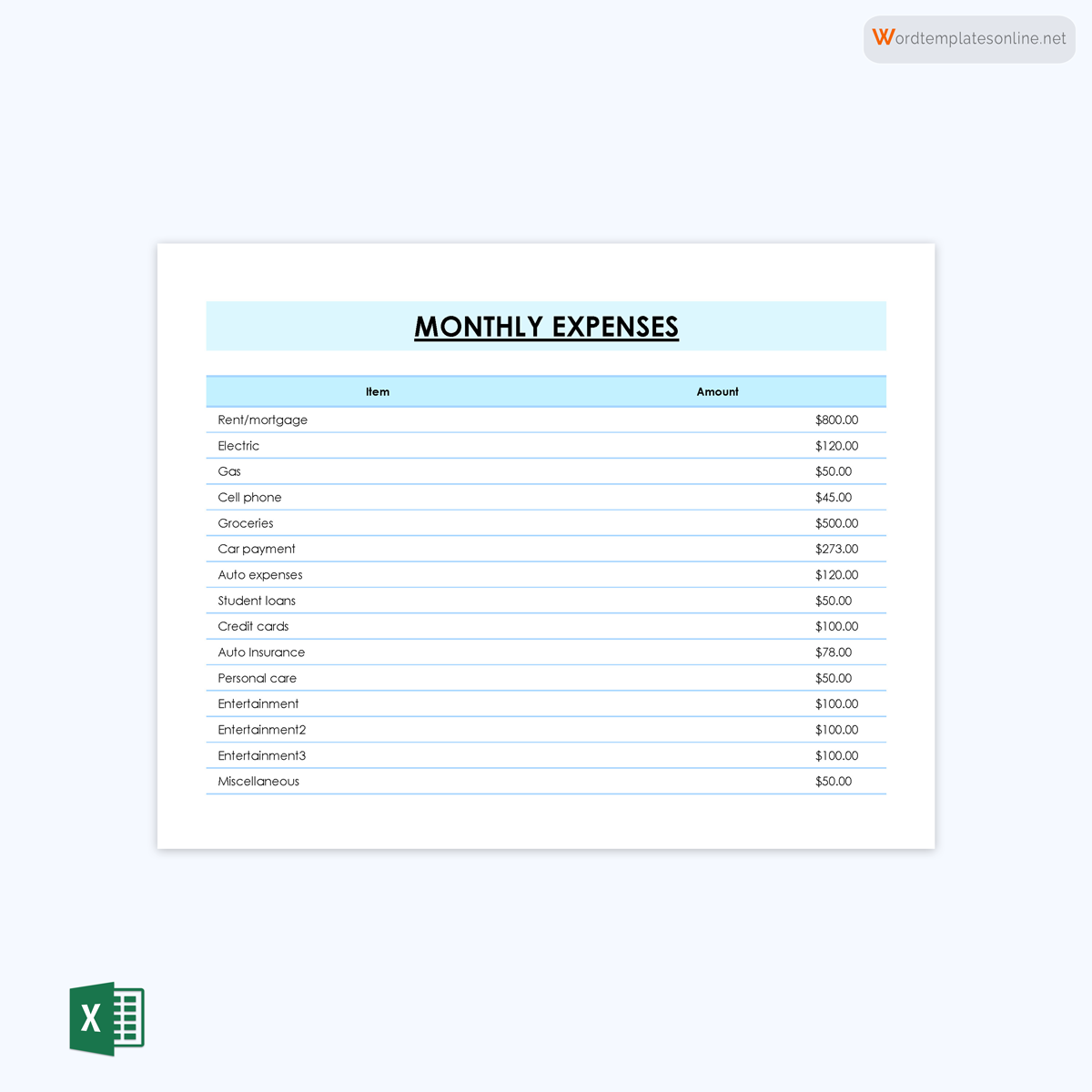

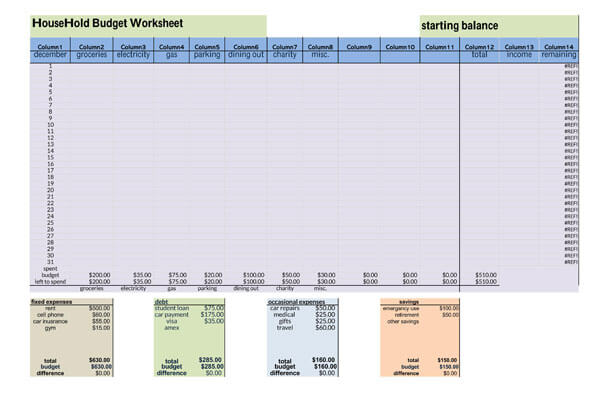

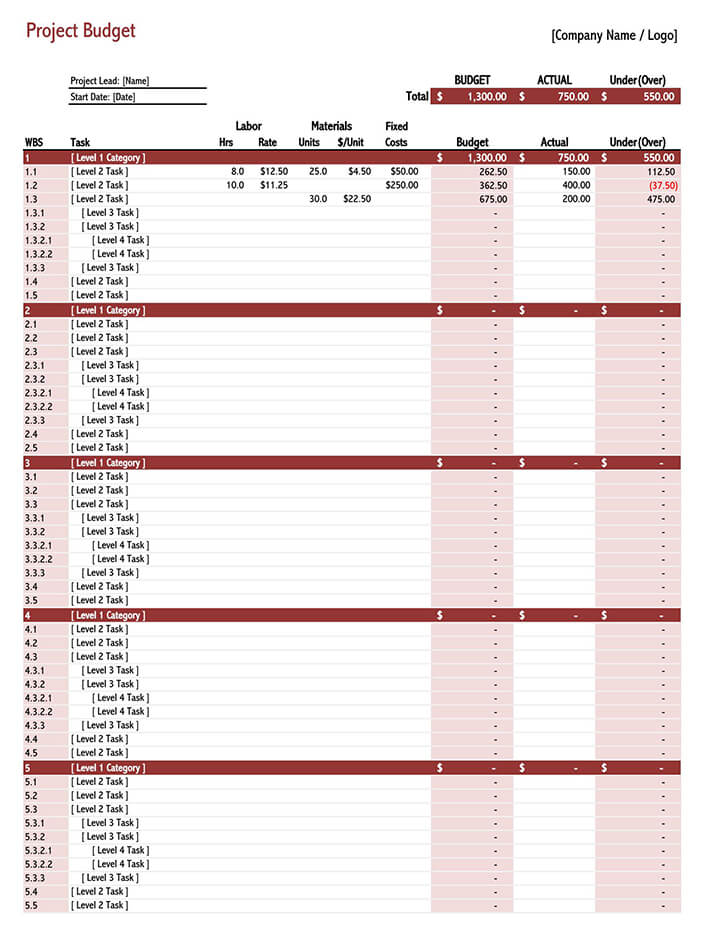

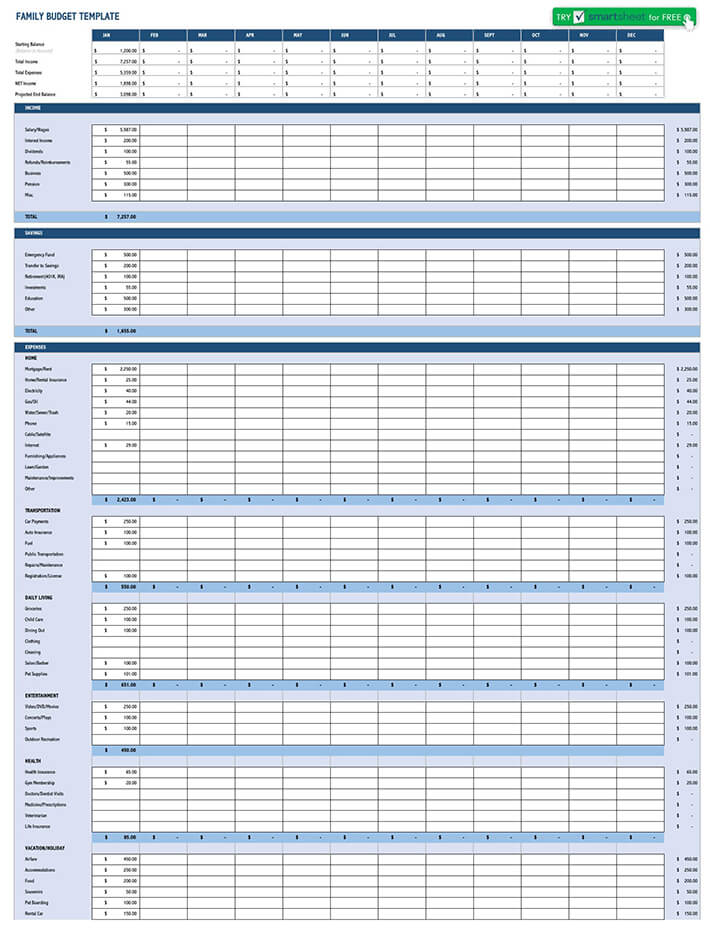

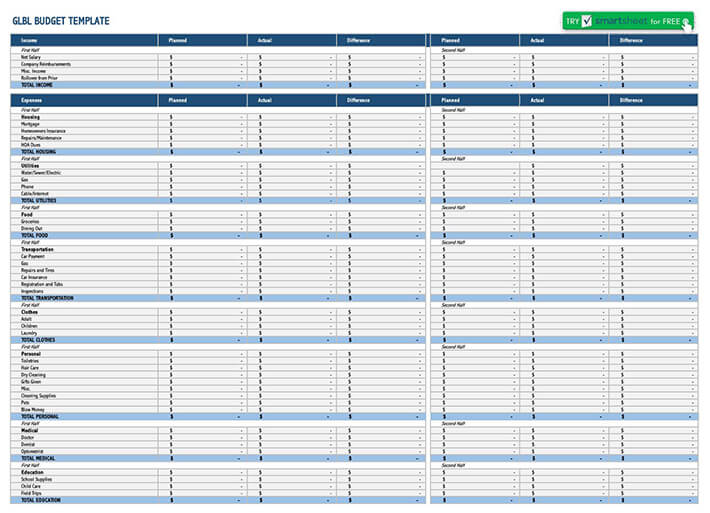

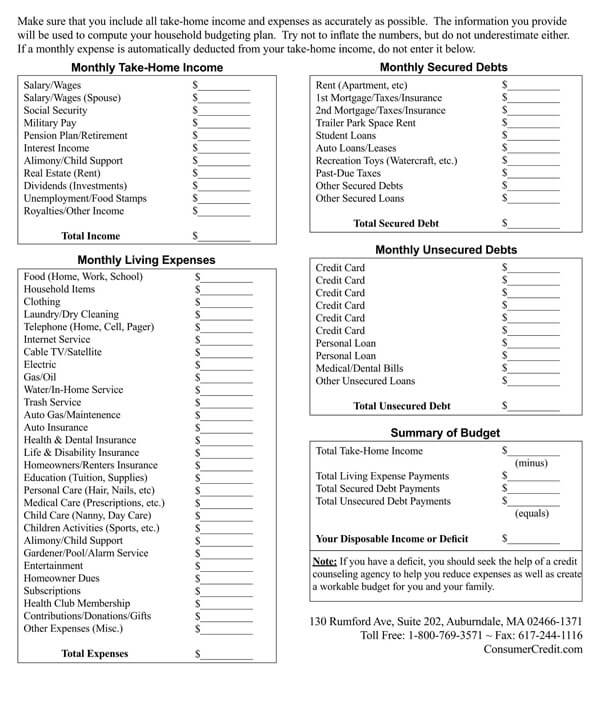

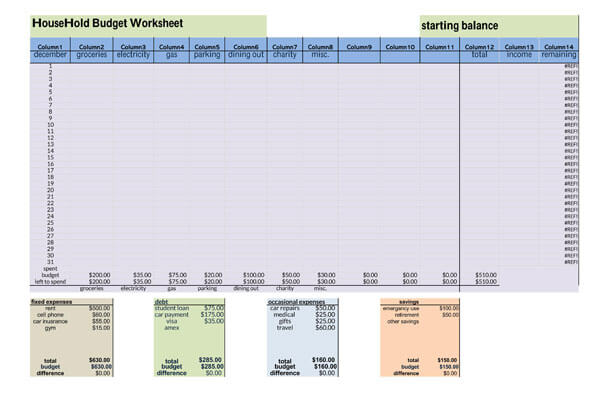

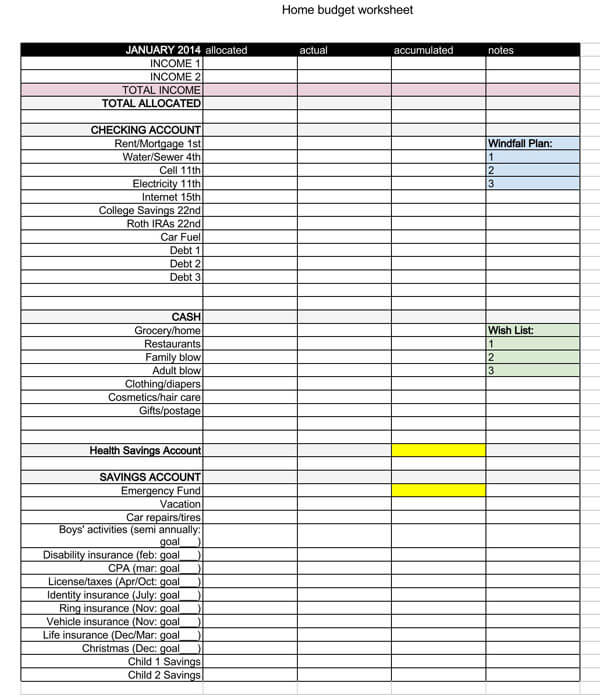

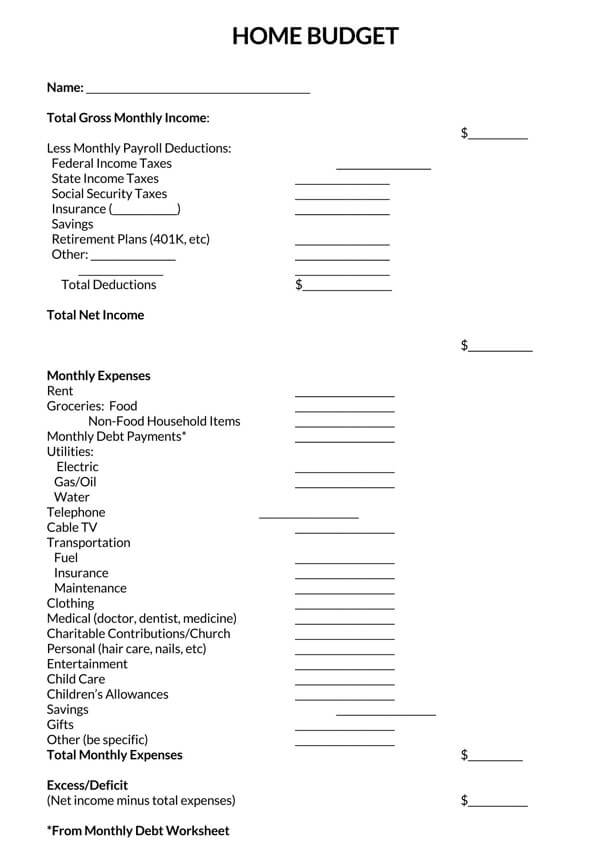

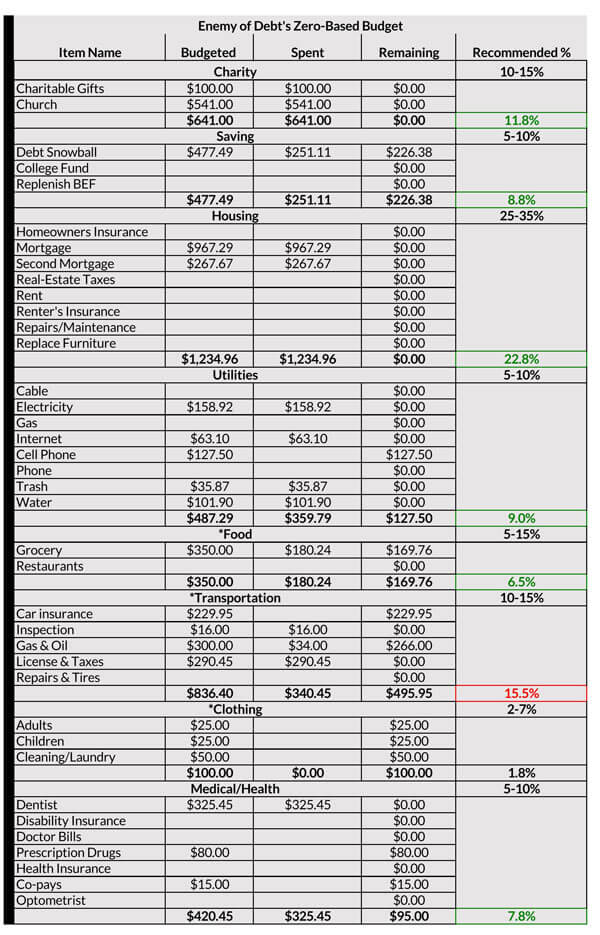

Free Household Budget Worksheets

Different Ways of Documenting Your Spending

Before you prepare a budget plan, the first and most important thing to do is to document your earnings, your spending, and the outline of your budget.

This can be adequately done in any of the following ways:

Use a notebook

An individual can note their spending by writing it in a notebook. This process might be tiresome, but it is simple and affordable. In addition, it does not require that they have special financial expertise when they document their spending.

Spreadsheet program

Another way of documenting finances is by using a spreadsheet program. An individual can set up such a program on their computer and use it to make the documenting process easier.

Some spreadsheet programs usually have templates that can calculate an individual’s budget. Using a template, which is selected according to an individual’s circumstances, is time-saving compared to writing it in a notebook.

Worksheet template

Since having a budget helps individuals develop excellent financial habits, it is necessary to have a worksheet that enables them to pay their bills on time without depending on loans or credit cards.

A template is a document that is already formatted and that you can use to create your household budget as per your needs. It is time-saving, practical, and simple, and includes all the information required in preparing a budget. You can either download the template for free from this website and use it based on your needs or prepare your own.

Personal finance software

Personal finance software and apps can help you learn the basics and become more efficient at managing your money. Choosing the best software depends on your needs. Some personal finance software can assist with managing your investment portfolio, while others can assist with budgeting and expense tracking.

Creating Monthly Household Budget Worksheet

To create an effective monthly budget worksheet, they will need to follow the instructions listed in the four sections below. This will help them prepare a document that will guide them in managing their finances. That way, they will achieve the financial discipline to learn how to save money and control their expenses.

The instructions are mentioned in the following sections:

Section 1: Set up your spreadsheet

The first step in creating a budget plan is to set up your spreadsheet.

This can be done by following the steps mentioned below:

Format the columns

The first section requires an individual to set up their spreadsheet. Format the columns to fit all the required information.

For the columns, you can use the following titles:

- Date of expense: This column will help you keep track of expenses and maintain discipline.

- Amount of expense: The amount you spend on each expense is also essential information, as it helps when making calculations at the end of the month.

- Payment method: Having a column for the method of payment also helps maintain a record of an individual’s expenses.

- Expenses: This column records all the expenses. It includes fixed and unexpected expenses.

Section 2: Categorize your expenses

It is important to categorize your expenses clearly to have a proper understanding of how you have spent your money. You can easily input your expenses and access any expenditure you want if you categorize them.

Categories

You can classify your expenses into the following categories:

- Rent or mortgage: this category should also include mortgage and any insurance.

- Utilities: for utilities, you should include gas, water, and electricity bill

- Household operations: It includes money needed for lawn service, pool cleaning, maid service, window washing services, etc.

- Transport expenses: This category will include money needed for car service, car insurance, gas for the car, public transport costs, etc.

- Groceries: This includes money needed for buying food, groceries, and even eating out.

Ways to categorize

You may use software that can help you categorize your expenses into the above-listed categories. These programs can also help you calculate your total expenses and categorize all the transactions. Another benefit of using software is dividing your expenses based on urgency and time.

You can also choose to categorize your expenses using a paper ledger. This means that each page on the ledger can be used for a particular category of expenses every month. However, a paper ledger might be challenging since you cannot add any rows in case of extra expenses, unlike the software.

Section 3: Document your spending

You must document all spending and expenses for the worksheet to be effective.

This can be achieved using the following steps:

List your expenses

An individual must list all the types of expenses to have a clear picture of how their budget will look at the end and how they will manage their money wisely. With a clear list of all expenses per month, you can easily manage your money and save more.

The following are some types of expenses that you should include:

- Fixed and variable expenses: Fixed expenses usually remain the same every month, while variable expenses tend to change based on how you spend. First, list all the fixed expenses, like rent and insurance, then all the variable ones, like utility bills.

- Put the biggest expenses first: You need to list all the primary and most significant expenses you may have, including rent or mortgage, utilities, insurance, etc. Each expense should be on a separate line. Then, you can use estimated amounts for these expenses as you await the actual bill. Ensure you write the actual amount of the expenses at the end.

- Calculate your regular essentials: All the expenses you usually incur and must spend some money on must also be listed separately. This may include gas, groceries, and many others. You will either have to note the amount of money you usually spend on such essentials or use receipts to keep a record.

- Input your discretionary expenses: Such expenses must also be noted to prevent you from tampering with your budget. These items are meant for recreation and enjoyment, like nights out, coffee dates, and even take-away lunches.

- Insert an expense row for savings: After listing all the expenses, ensure you add a row to include savings on your worksheet. It may be challenging to save money constantly, but it is necessary to manage your finances better. The best way to start is to save 10% of the money you earn to avoid having no money by the end of the month.

You can adjust how you spend your money to increase your savings with time, and such financial discipline will help you make better financial decisions like investments. In addition, you can join savings programs at banks and have a way to quickly and efficiently manage your savings.

The sum of your monthly spending

You can then add each section of expenses that you have created separately and write the total. With this, you can get a picture of your monthly expenditure, i.e., you can identify the percentage of your income that you spend on each expense.

Although not all of your expenses are monthly, accounting for them in your budget will make it easier for you to deal with them when needed. You can also divide your annual expenses by 12 and all your semi-annual ones by 6 to develop monthly details that will fit your worksheet.

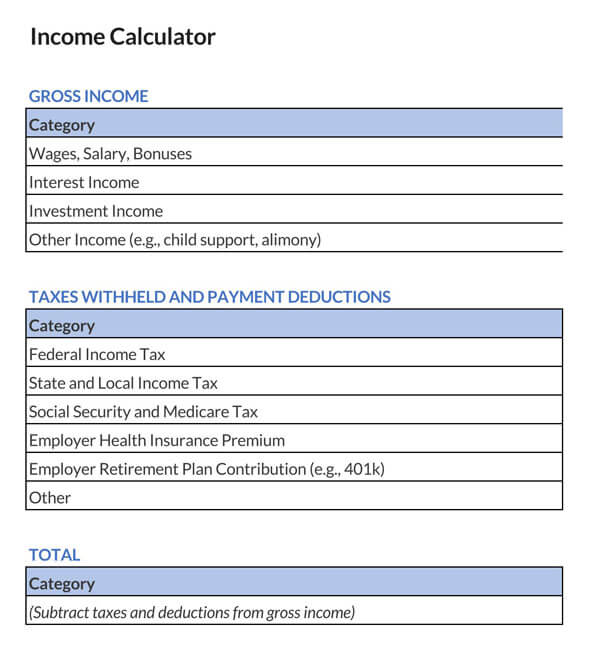

List your income

The next thing you will need to do is list your income, which includes your investment earnings, rent payments, tips, extra jobs, and the salary you get (whether weekly or monthly), etc. This should be all the money that you will receive before paying taxes. Your income details should be well-detailed for easier budgeting.

Calculate net income

With your total income listed, you should then calculate your net income. This means subtracting your taxes and other deductions from your income to determine your net income.

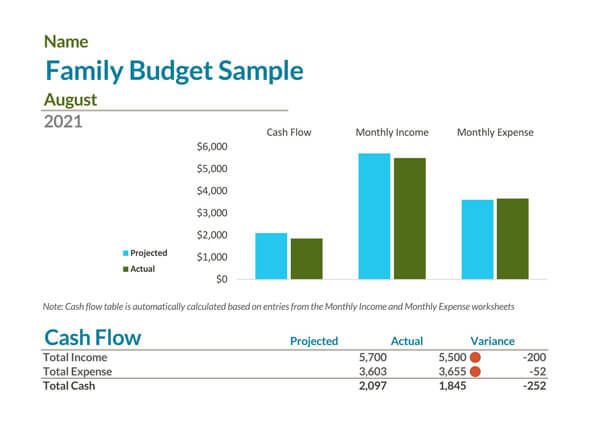

Compare your monthly income and total expenses

The next step is to make a comparison between your net income and your total expenses. This will help you determine if there is a need to change or maintain your habits regarding your finances. For example, if your expenses are higher than your income, you need to change your spending habits.

Adjust your expenses

You may have to adjust your expenses based on your information after comparing your monthly income and total expenses. After that, you can reduce your spending or even change how you spend your money. If you have a monthly income higher than your total expenses, you can save more and invest your money.

Section 4: Create a new budget

You have been able to list your income and expenses, and the next step is to create a new budget. Based on your findings, you will know what you need to do to ensure your expenses are less than your monthly income. This way, you can have more savings and a better financial position.

For you to create a new budget, you should observe the following steps:

Track your spending

You should keep track of your spending by targeting specific areas where you may need to decrease your spending. Then, you can set limits on the amount of money for your discretionary spending and discipline yourself not to spend more than that amount.

Your regular expenses should not consume a significant portion of your income beyond what is necessary. So try and reduce this expense as well if you are overspending on your regular essentials. Even though the amount spent may vary from item to item, avoid spending too much where it is not needed. For instance, you can look for discounts at supermarkets and stock items if possible. Or you can look for cheaper alternatives, such as consuming margarine instead of butter.

Keep tracking what you spend monthly against what you have set aside for that particular need in your budget. This way, you can identify where you overspent and either change your spending habits or compensate for your additional spending in your budget.

Remember that you must always try to balance your budget by reducing expenses in one area whenever you increase them in another.

Estimate contingency expenses

You will also need to have an estimate of your contingency expenses and include them in your financial plan. These expenses may include medical bills, car maintenance, and house repair costs. Allocating money for contingencies will protect your budget.

Allocate a small amount for this category every month. You will not have to take a loan or rely on your credit card for emergencies with these expenses. If you get to the end of the year and have not spent your contingency money, then that means that the extra money can be saved or used for investment or retirement plans.

Determine your objectives

As you plan to create your new budget, try calculating what your short, medium, and long-term goals will cost you. For instance, you may have a target for buying a new fridge or saving for a vacation. This is different from a contingency budget, as it is not an unexpected expense but rather one that is planned. Plan and follow your plan strictly to avoid disrupting the budget.

You should also record the expenses on your budget once you have fulfilled your goal and delete the provisional expense created to avoid confusion.

When saving, do not put all your money into one bank account; instead, divide your savings into the following categories:

- Checking account for your spending money

- Saving account for short-term savings

- Investment account for mid-term savings

- A retirement account for long-term savings

This way, you will always have money to spend and save, whether for your current needs or the future.

Download Templates

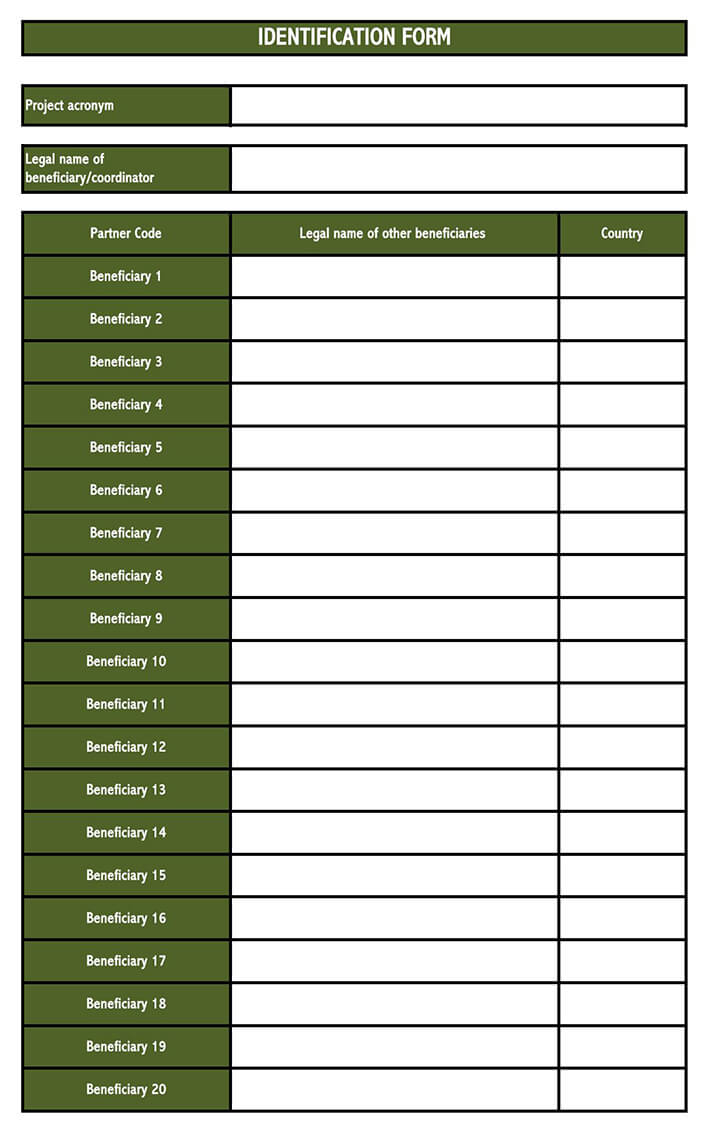

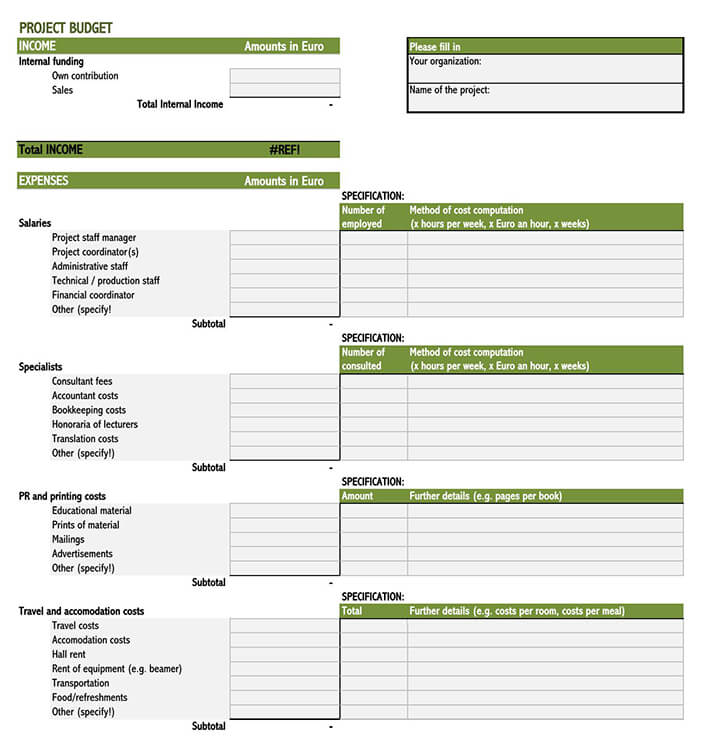

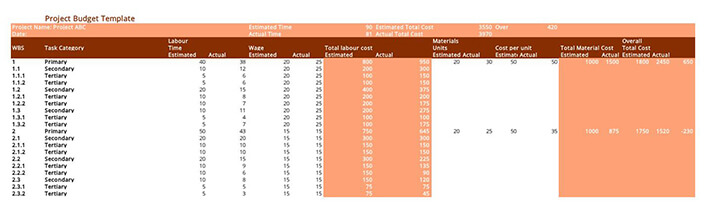

Following are some free downloadable worksheet templates for your household budget:

Tips for Effective Household Budgeting

Financial management can be challenging, and not everyone is an expert. Effective household budgeting requires assistance in the form of guidance and facilitation.

Following are some tips for guidance:

Self-control

Having self-control is essential when learning how to prepare budgets for your household. There are moments when you might fail to manage your finances. The most effective way to get back on track is by successfully managing your emotions.

These emotions are listed below:

- Frustration: Although it may be inevitable to feel annoyed when you fail to maintain your budget, frustration will hinder you from having a clear mind and following your spending plan.

- Guilt: This emotion might lead you to stop the budgeting process since you might believe that you will not be able to do it once you start again. Instead of focusing on what you did that affected the budget, try and find ways to prevent a similar occurrence in the future.

- Envy: Focusing on what others are achieving by having good financial plans can lead you to become envious, making you dismiss your pattern and routine, ultimately affecting your budget.

- Anger: Almost similar to being frustrated, anger clouds an individual’s mind and might lead to worse financial decisions.

- Shame: There is no need to feel shame if you have to turn down situations that might upset your budget. Feeling ashamed might propel you into making a wrong financial decision, which will affect your financial plan.

- Disappointment: Disappointment is a feeling that one might experience once they fail at their budgeting plan. However, dwelling on this will cause a delay in creating a new plan.

An individual can control their spending and maintain an effective household budget by better managing their emotions.

Be composed and relaxed when preparing a financial plan

Another useful tip that you should always uphold is to have a relaxed mind when creating a plan for household expenses. With a peaceful mind, an individual can focus better, have clarity about the financial situation, and avoid anxiety about money.

Final Thoughts

Money management is a skill that every individual must learn for their own benefit. The best way to do this is by having a proper plan for household expenses. This document will help an individual save money, avoid debt, pay debts, and manage their finances.

our specific needs. There are free, downloadable templates available on this website that can help you create an effective worksheet. This will help you manage your finances well and avoid the negative emotions that come with overspending.