A General Ledger is a bookkeeping document used by businessmen to maintain and record financial information and transactions made by the business.

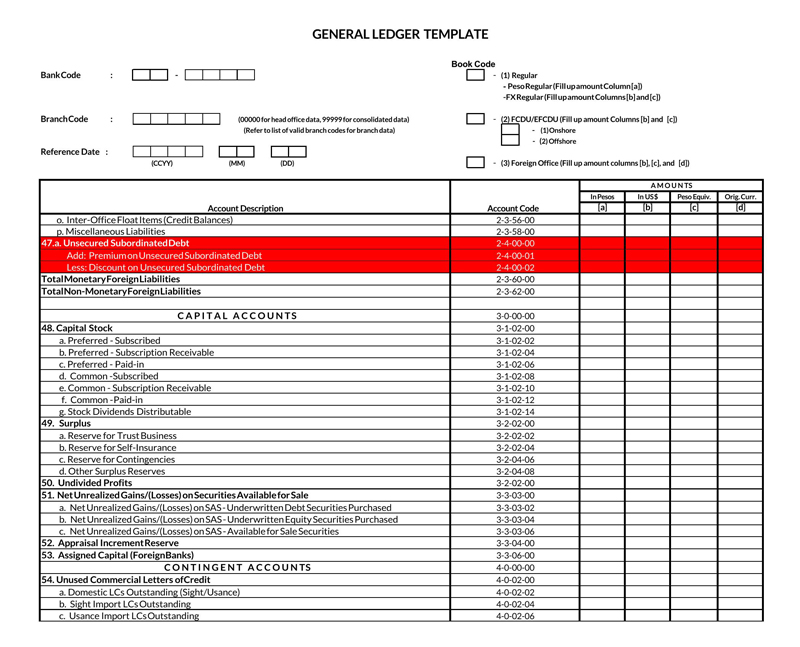

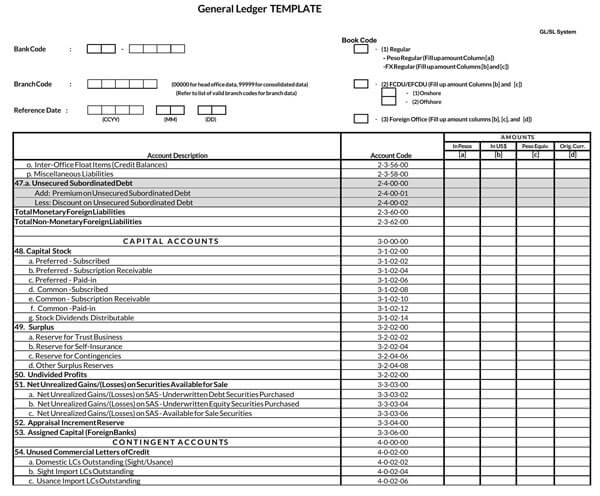

A General Ledger Template provides a business with a pre-determined page layout and style. The template also contains specific ledger elements which can be used to record financial transaction.

The ledger accounts are also known as T-accounts. A general ledger and a journal help ease the accounting process and ensure that businessmen monitor their financial transactions. The ledger also helps speed up business workflow by ensuring that a business person can locate all financial transactions in a singular document.

Free Templates

Importance of a General Ledger

A general ledger provides an accountant with the necessary information to create a financial statement. Thus, the ledger plays an essential role in informing the businessman of the business’s financial well-being.

A general ledger also helps benefit several aspects related to the business, which include:

Research

A general ledger benefits people in business by enabling them to research and find out any financial recording discrepancies. It also enables business people to identify the source of the discrepancy and mitigate its effects on the business. Businessmen can also find out what the long-term impact of a change in business practice has had on the business’ finances. This helps businessmen identify areas of the business that require further investment or financial cuts.

Audit

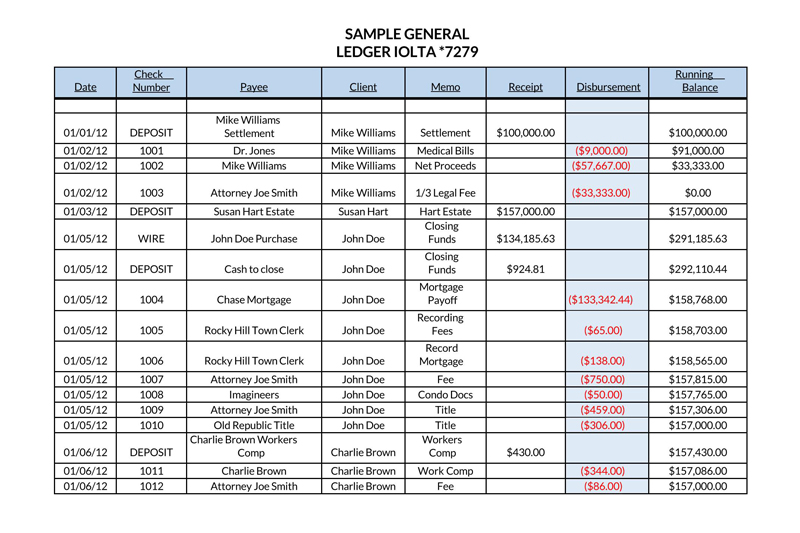

During the auditing process, people in business can use the general ledger to help them verify their financial records to the auditor. The general ledger also allows businessmen to verify that the operations are legitimate, and they work within their legal limits by enabling auditors to have access to the detailed financial transactions recorded in the ledger account. The auditor is, therefore, able to verify the types of transactions conducted in the business and has a general overview of the movement of money into and out of the business.

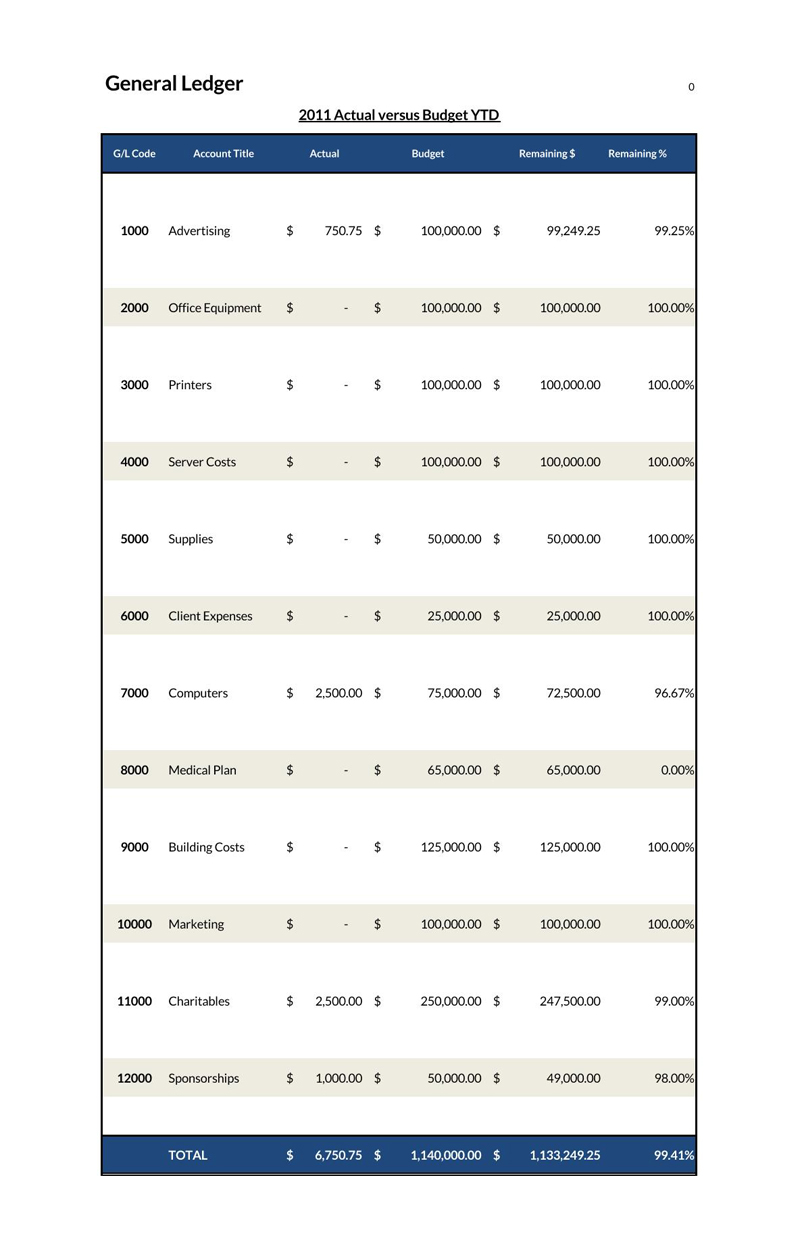

Budget preparation

You can also use the general ledger in the budget preparation process. The ledger contains the business’s income and expenses, which can be used in the budget formulation process. In addition, you can use the previous entries of the ledger to predict possible future income and expenses. This makes the process effective as it considers recurrent and one-time expenses that the business may incur.

Examples of General Ledger Accounts

A general ledger should be divided into different categories referred to as ‘accounts.’ This ensures that you have independent control over the accuracy of the ledger.

The following are examples of general ledger accounts:

- Inventory account

- Sales account

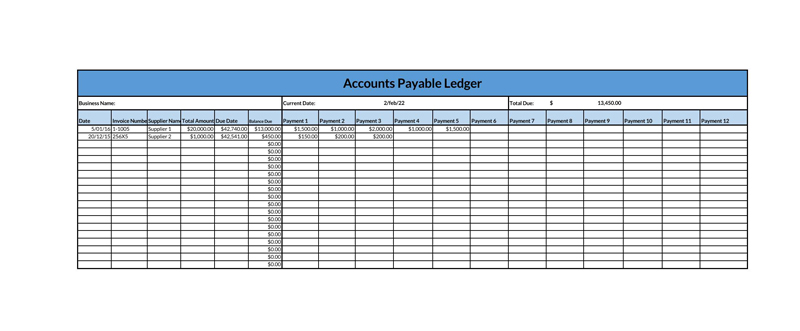

- Amount payable

- Creditor account

- Labor

- General expenses

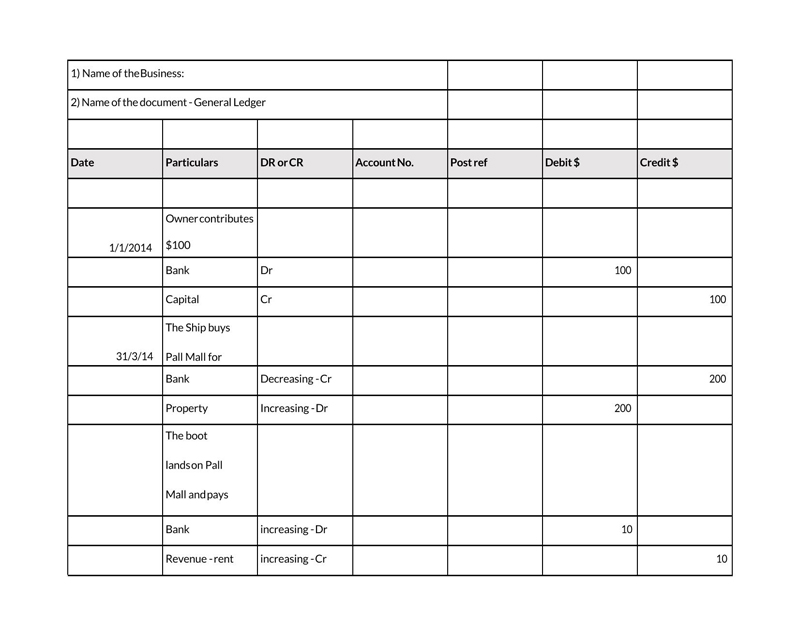

General Journal v/s General Ledger

A general journal is a document that holds the initial transaction records of a business. The general journal is, therefore, the original book of entry. First, the records are posted in respective accounts in the general ledger. Then, the accounts are calculated, balanced, and transferred to a trial balance. The trial balance holds all the general ledger accounts and ensures that the debit and credit sides match each other. Therefore, the main difference between a general journal and a general ledger is that the journal is the first data entry record before information can be recorded to a general ledger.

Note: The entries in the debit account either increase the assets or expenses account and decrease a business’s equity, liability, or revenue account while a credit account entry increases liabilities, revenue, or equity accounts and decreases assets or expenses accounts.

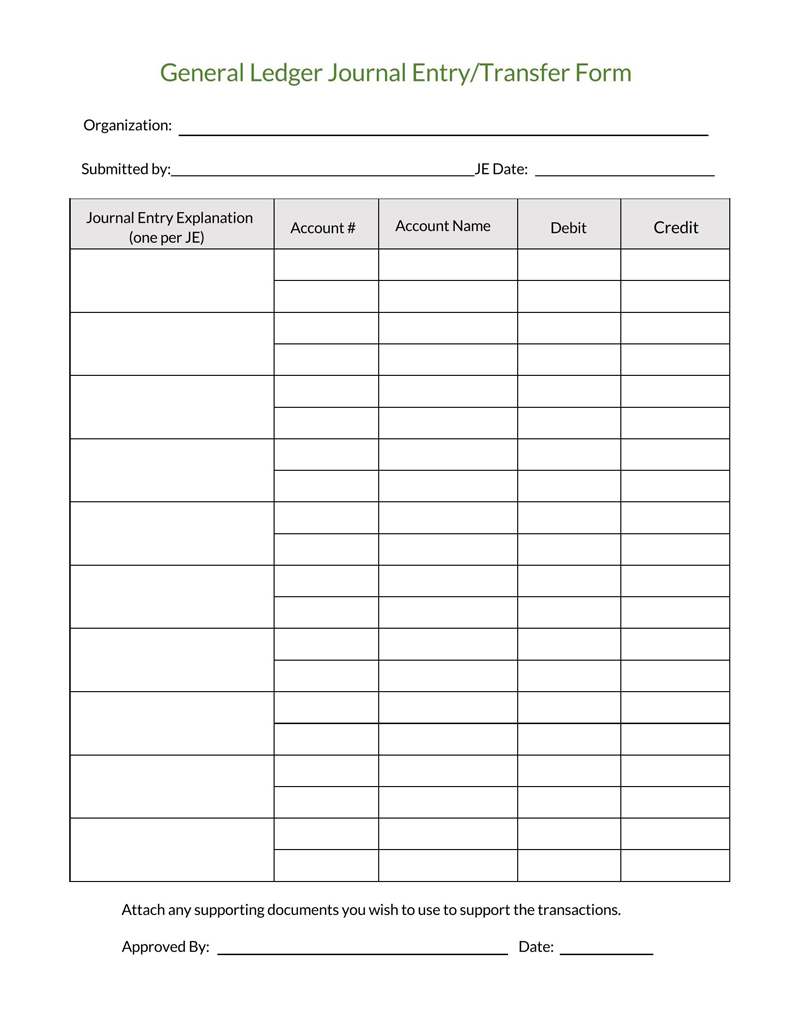

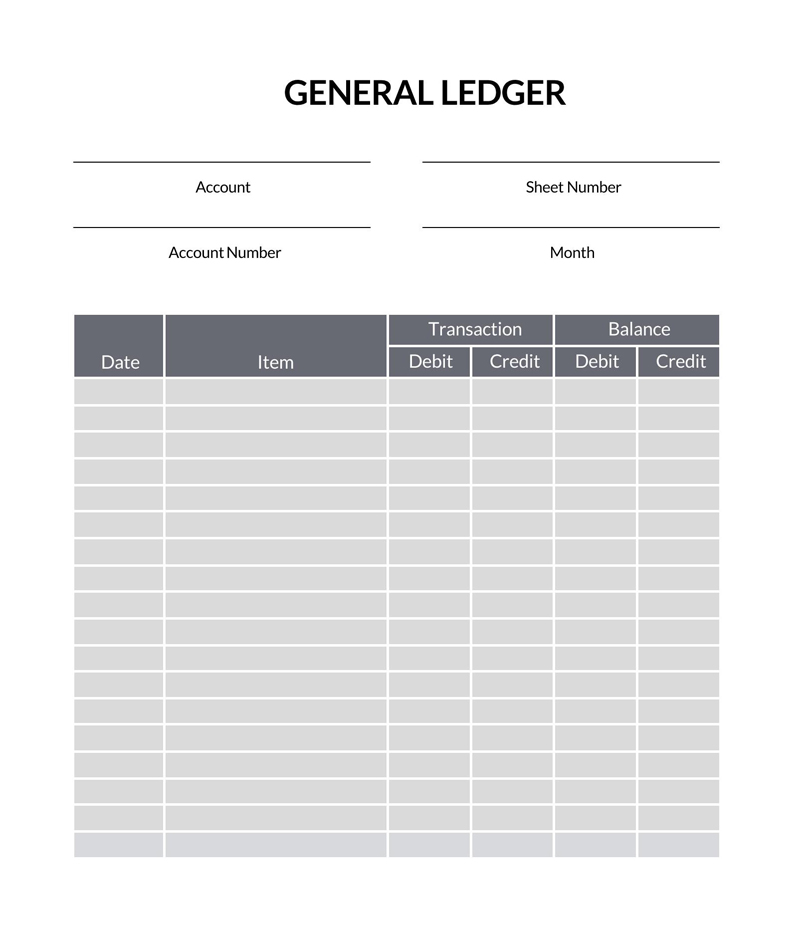

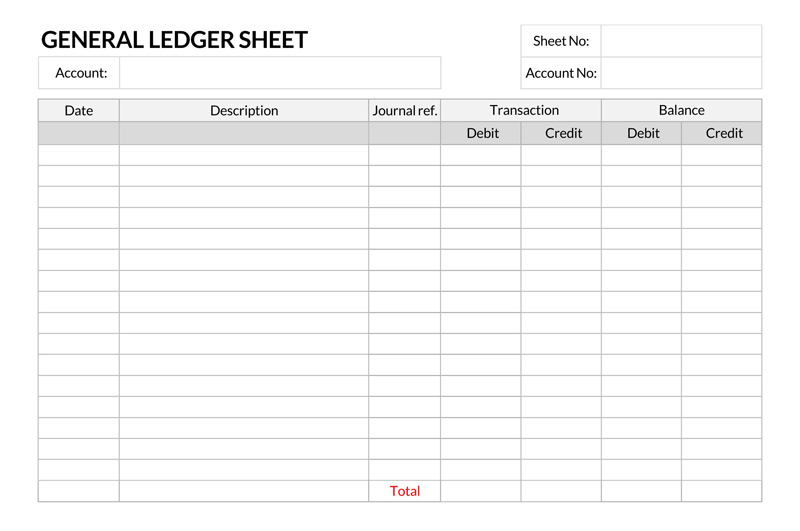

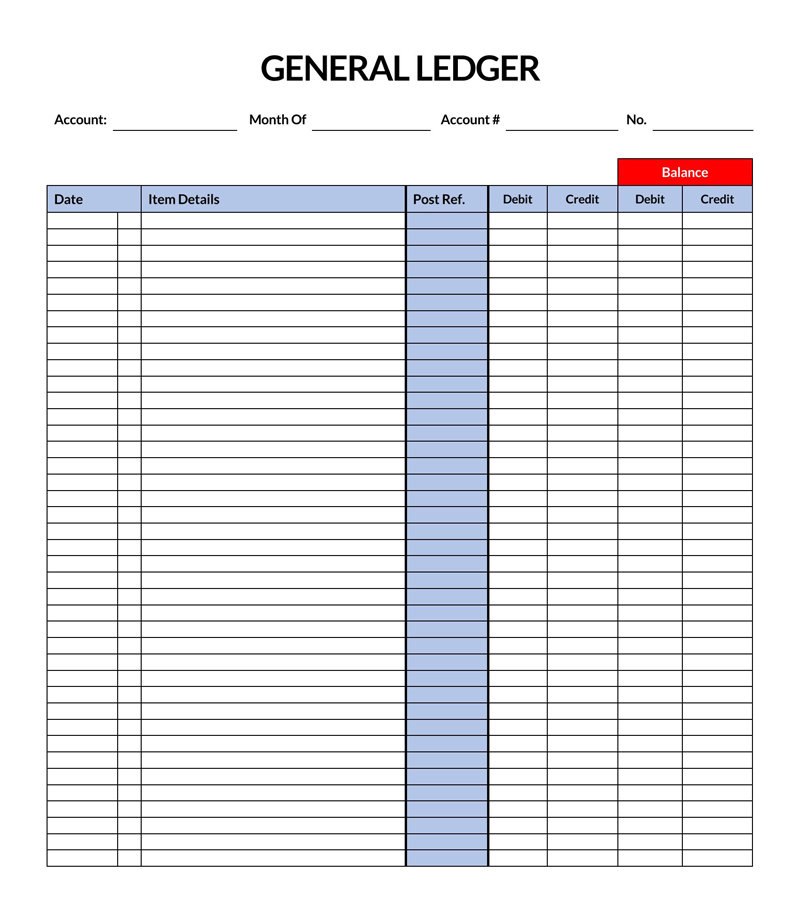

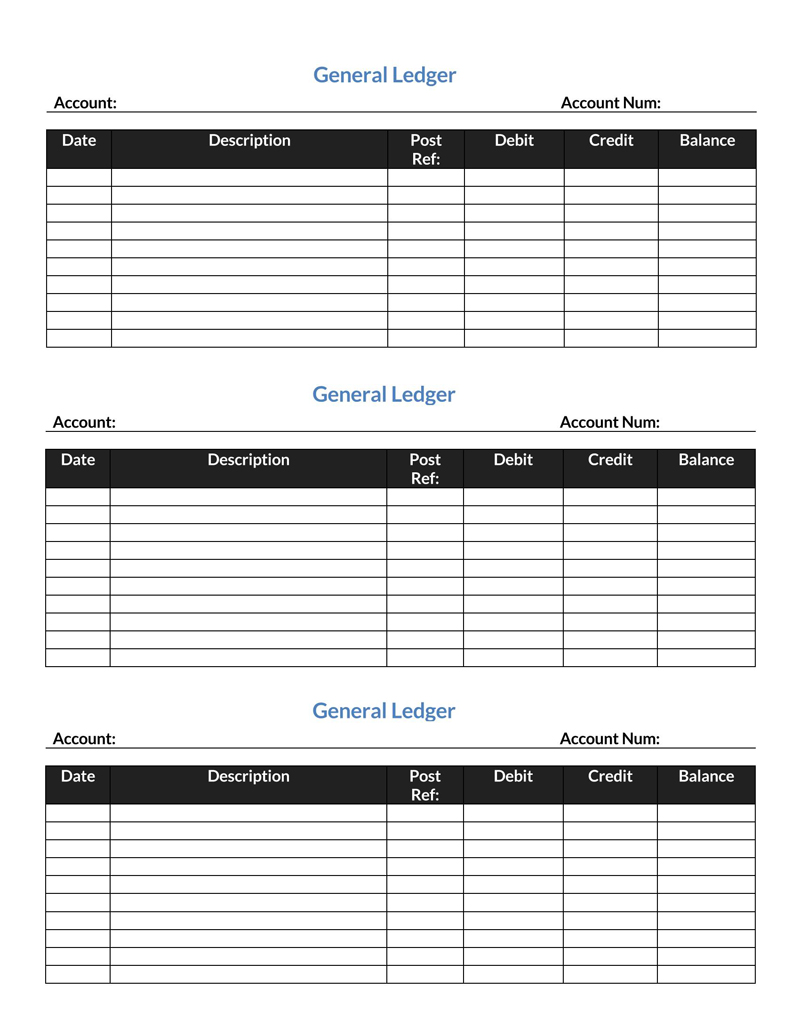

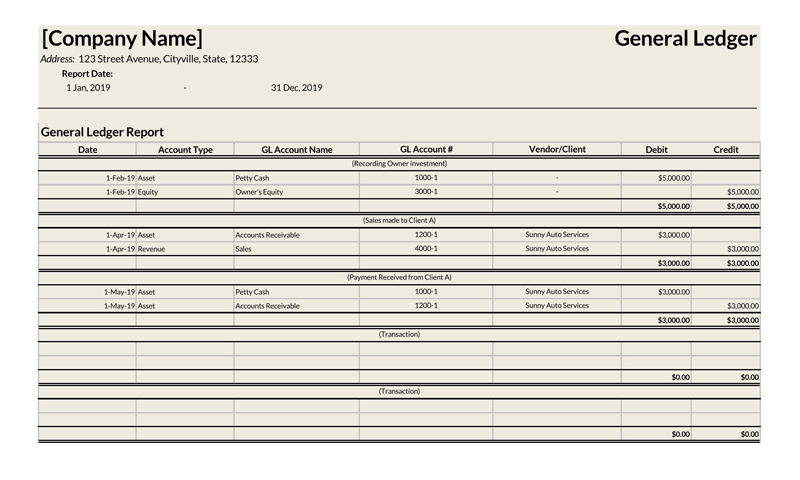

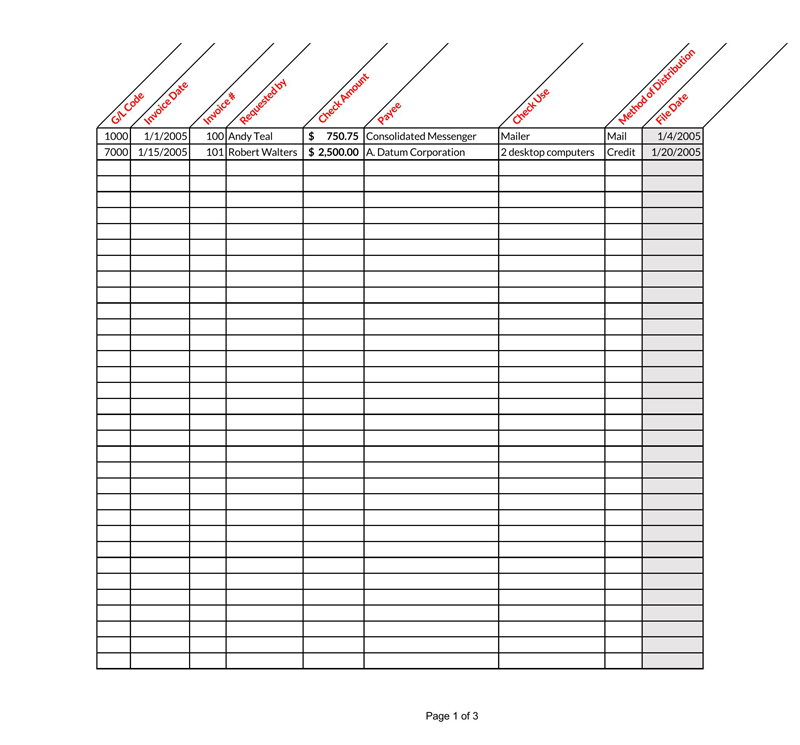

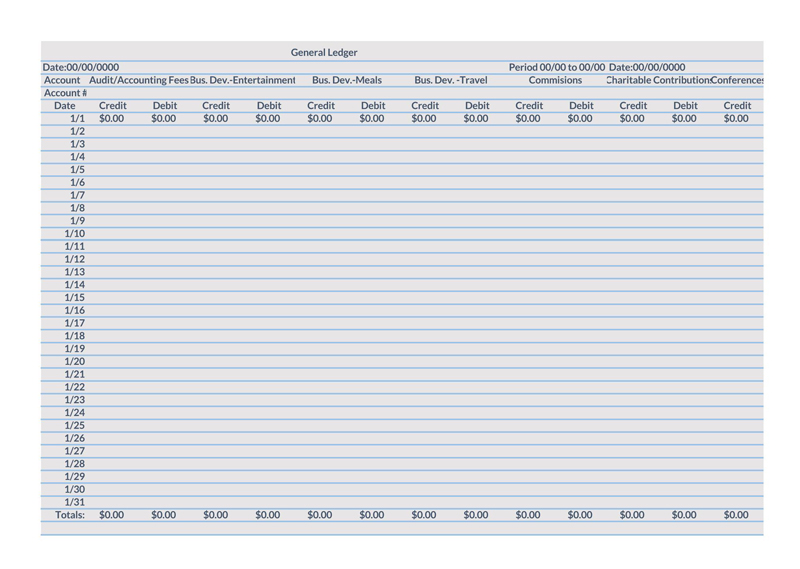

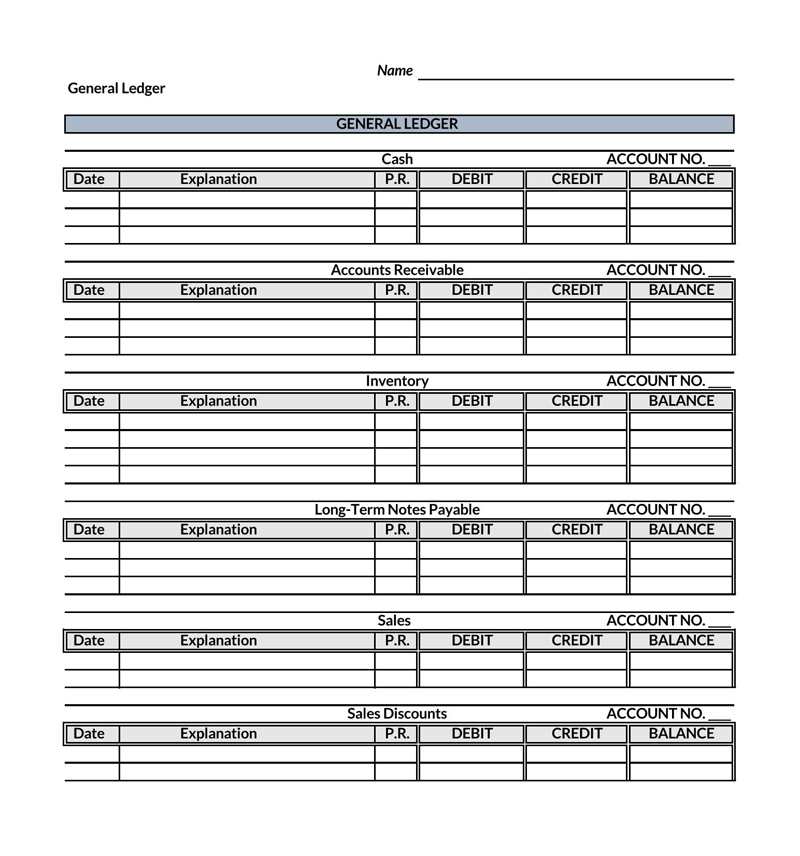

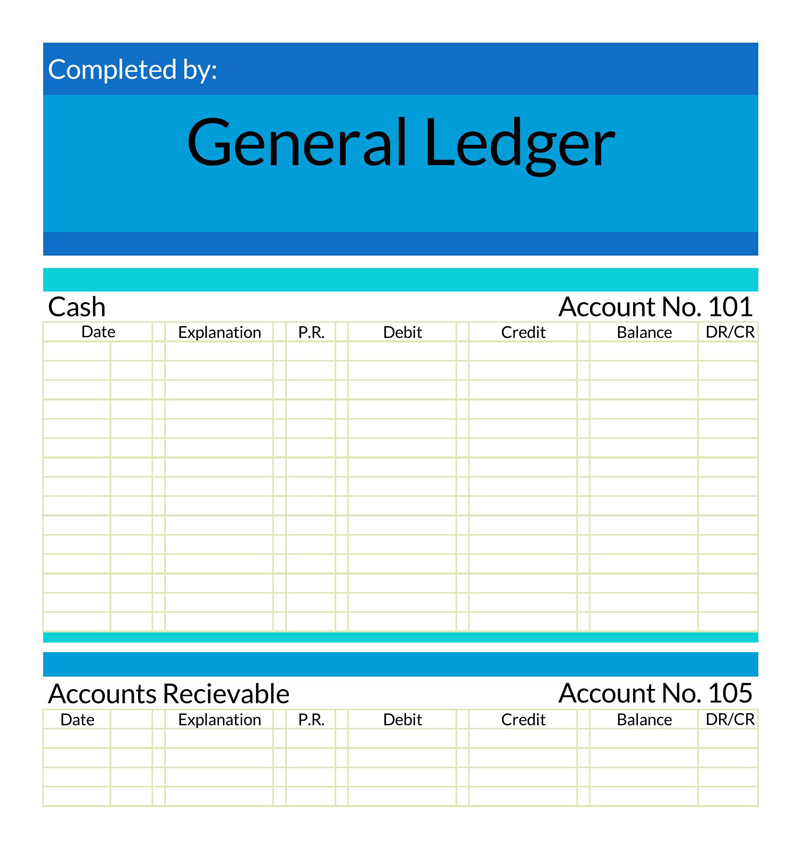

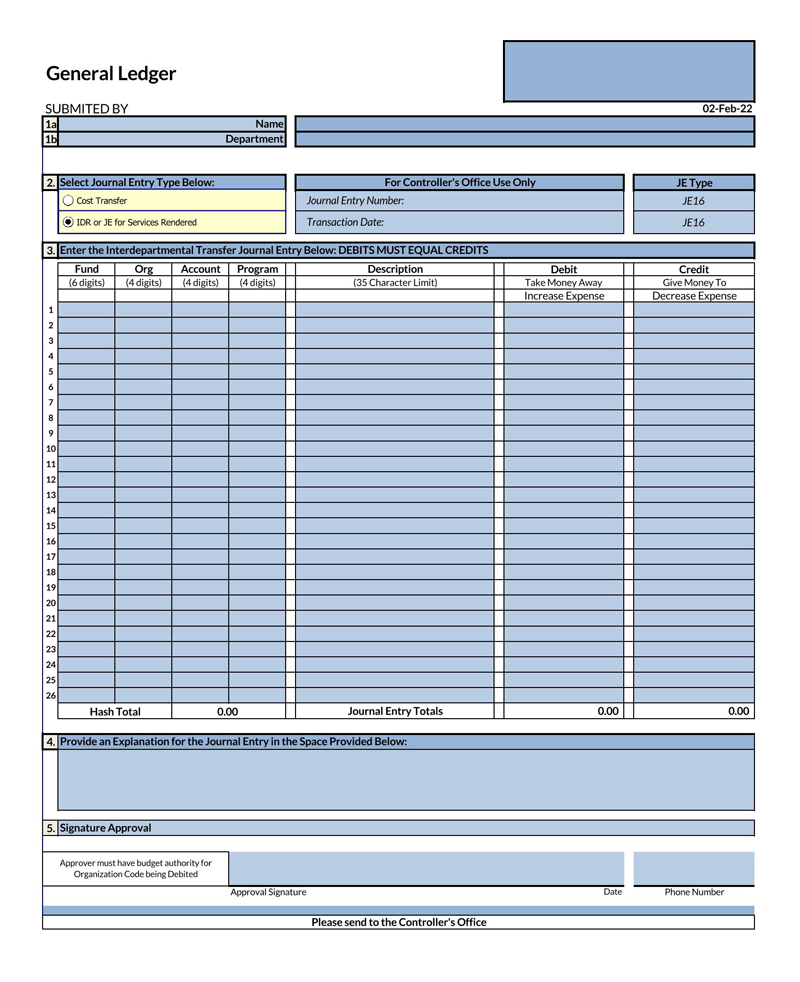

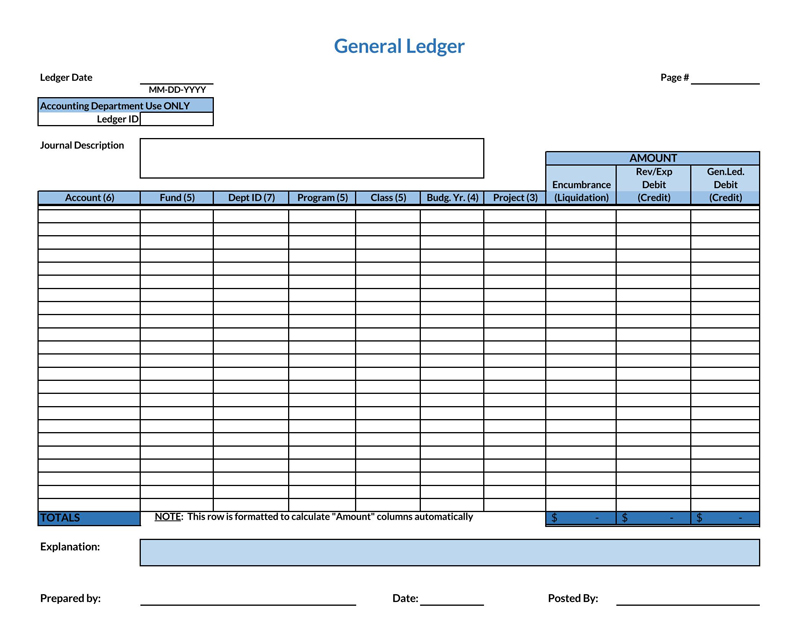

Format of a General Ledger

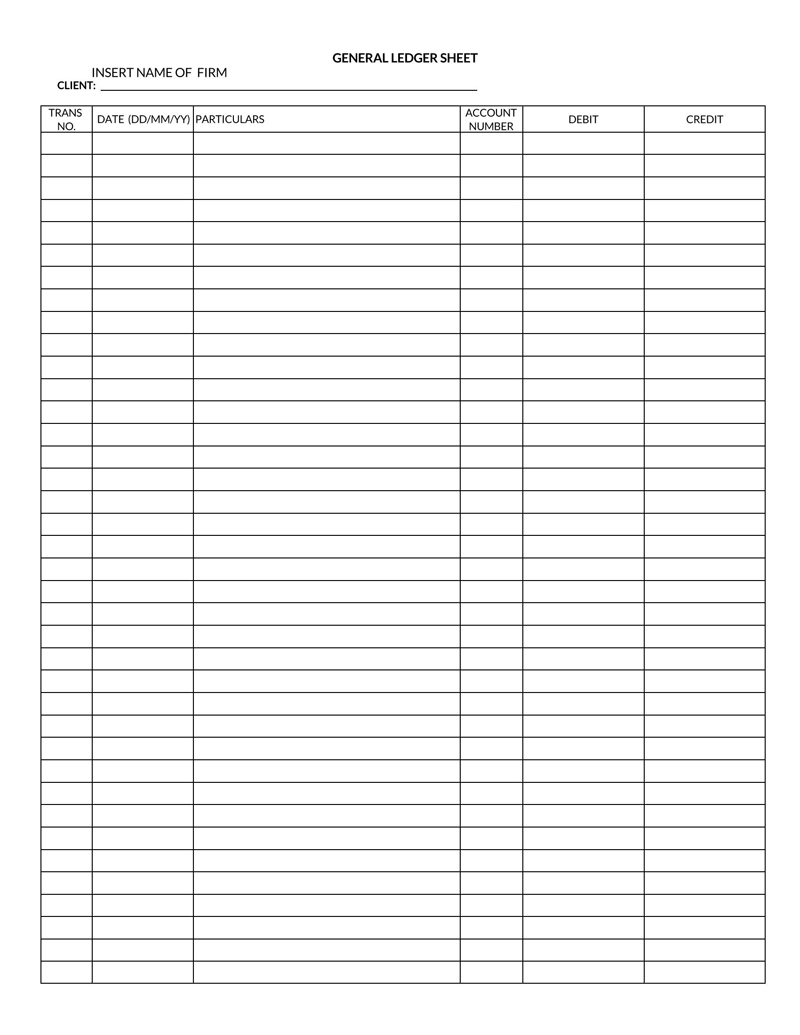

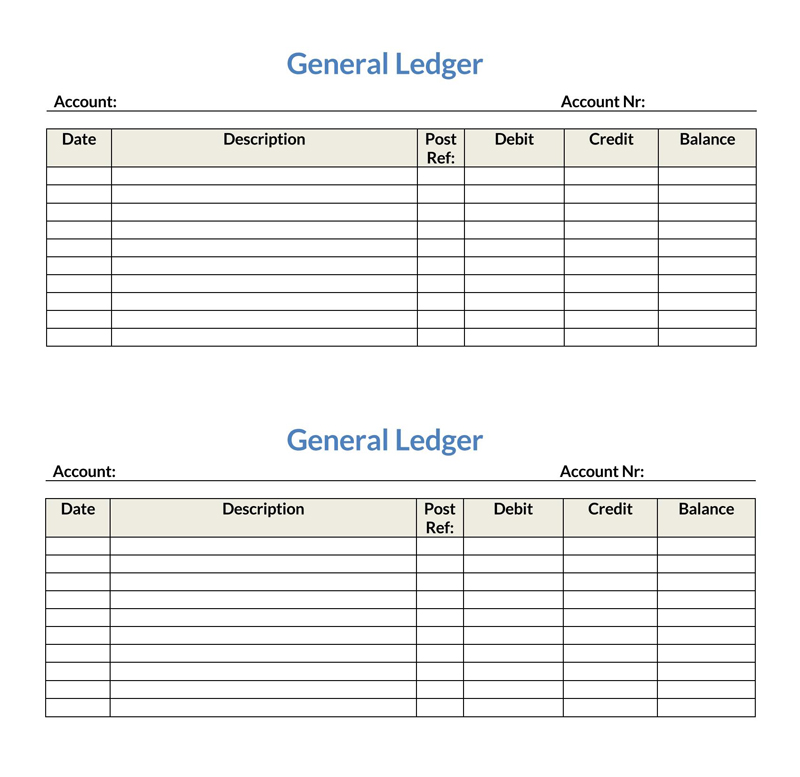

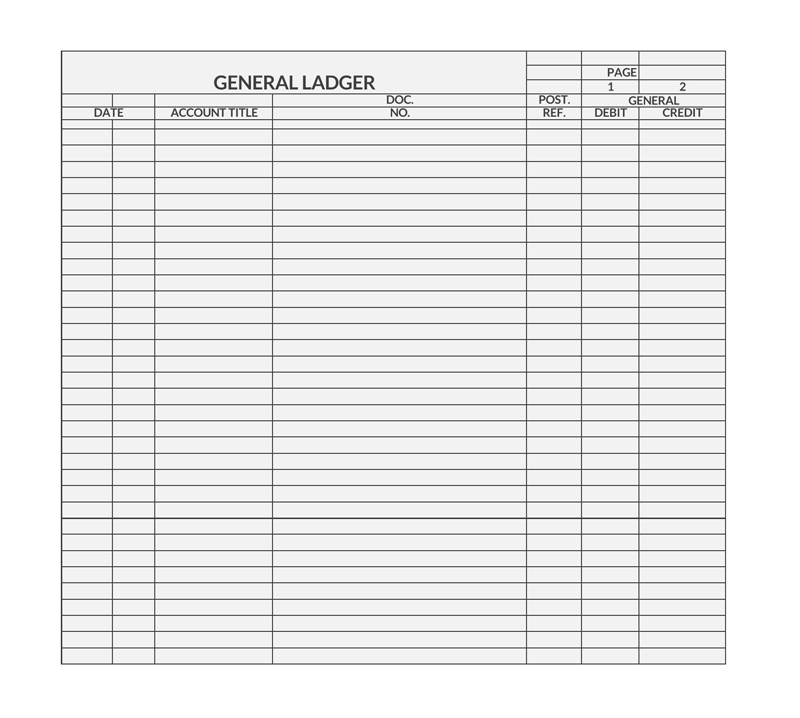

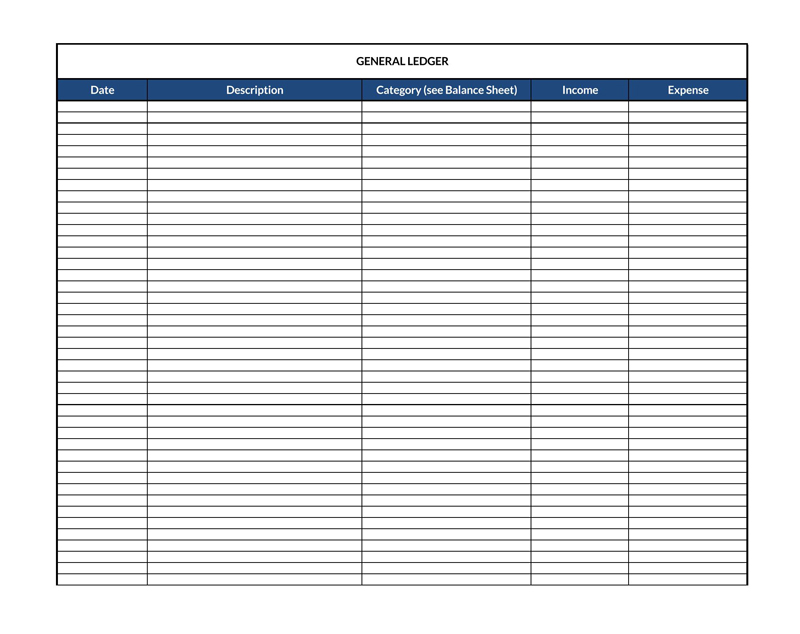

When drafting a general ledger, you should ensure an account name and account number at the top of the ledger table. The account name and number enable you to track specific ledger account, for example, the cash account. A general ledger should also have three columns on the left of the page containing the date, description, and journal number. The data identify the period in which the entry was made, while the description helps make the contents of each entry clear. The journal number is used to index the entry to ensure the information can be easily stored and retrieved from the ledger.

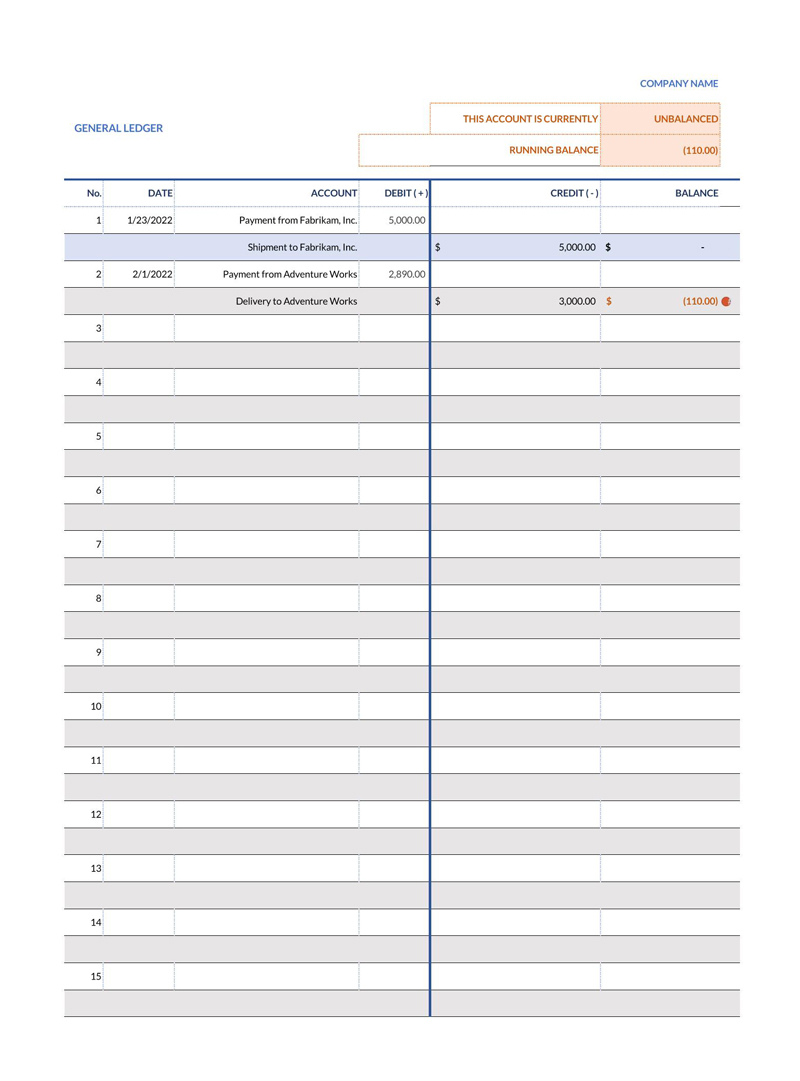

The right page of the general ledger should contain the debit, credit transactions, and balance. The debit transactions represent the money paid out of an account, while the credit transaction represents money paid/owed into an account. The entry of debit and credit amounts in a general ledger enables business people to record changes in value brought about by financial transactions. Likewise, the balance stated enables businessmen to track the amount owed by calculating the difference between the debit and credit amounts.

General Ledger Template

Given below is a free template of a general ledger:

Account name:

Account number:

| Date | Description | Journal no. | Debit | Credit | Balance |

Using an Accounting General Ledger Template

There is a particular manner in which the user of a general ledger template must go about the process of using it in order to attain proper results.

To use the ledger template, you must understand the following information:

Use a general ledger template

A business person should use a general ledger template to ensure that the information logged into the ledger is consistent and can be easily updated. In addition, a general ledger template also helps you save time by enabling him to fill in the information on an already made document.

It is therefore important that a person in a business can obtain a general ledger template using the following means:

Print a blank template and make entries

You can obtain a blank general ledger template from an online website and fill it. However, you must first ensure that the design of the template is suitable for your business. You must ensure that the general ledger template is functional in Excel or MS word, depending on preference. This ensures that you can access the template to make entries of your transactions. Once the template is printed, you can start filling in the financial transactions of your business.

Buy general ledger book from a bookstore

A general ledger book can be bought from a local bookshop. The book enables you to have a manual financial transaction record. The information contained in a general ledger book can easily be retrieved from its pages. Furthermore, the general ledger book can be customized to a preferred design by you.

Filling account ledgers in a template

The information written in the general ledger template enables a business to have and maintain an accurate financial statement. Therefore, you must understand the information you need to fill in the ledger template and its significance.

The following information should be recorded in the general ledger template:

A specific transaction

You should use the general ledger template to dissect specific account transactions like Receivables, Cash, Sales, etc. Breaking down ledger accounts helps you maintain a detailed ledger for future reference. It also ensures that you can easily trace errors or discrepancies made during the accounting process because the information is not initially generalized.

Combined info in one template

You should combine the information obtained in the specific ledger accounts into one general ledger template. This provides him with an overview of financial transactions carried out in a period. A business with complex or irregular transactions can also be able to use a general ledger template to capture all its account transactions. The unusual pattern of transactions can be difficult to record in a specific ledger account as such a general ledger ensures that all transaction information is captured.

Amount(s) in relevant credit or debit section

You should place amounts in the credit and debit section of a general ledger template to ensure that you balance your books. This also helps him ensure that you do not over-extend your financial reach by keeping your credit and debit amounts in check. You can also assess if you keep up with your creditors to ensure you do not default payments.

Balance section of the template

The balance section of the general ledger template enables you to calculate the amount spent or earned during transactions. This helps in calculating if the business is transacting at a loss or profit. It also ensures that you can quickly identify money owed and what you currently have.

Recorded transactions

The transaction records of the general ledger template should be written in relevant accounts as they occur. This ensures that you can keep your accounts updated with each transaction that takes place. In addition, the regular updates made in the general ledger accounts ease the accounting process by ensuring that you do not have to recall each transaction at a later period or sift through several documents to retrieve the transaction information.

Notes section to track new information

You should also add notes in the general ledger template to help him keep track of new information. The note added will help him identify when significant financial changes occurred.

For example:

If you have paid off a creditor, adding such a note will affect the entries made in a new ledger as it will have one less creditor.

Summed up debits and credits at the bottom

The debits and credits should be added up at the bottom of the general ledger template. This helps to identify if the account is losing money. A high credit balance is often expected due to money owed to creditors. The results of adding up the debit and credit account provide you with an overview of generally how much money is flowing into and out of the business.

Matching debits and credits

You should make sure that the debits and credits add up and match with each other on the general ledger template. Every financial transaction should affect two accounts, causing them to gain or lose something equally.

For example:

Items purchased are debited as assets while the money used in the purchase is credited. Therefore, the sum debited will match the sum credited.

Additional steps

There are a few general and basic steps that you must take after completely filling out the general ledger template in order to attain maximum benefit.

These steps include:

Make balance sheets

Once you fill a general ledger template, you should make a balance sheet for yourself to have an overview of the business’s financial health at a specific time. The balance sheet will also help to keep a record of assets and liabilities at a given period which can then be used to assess the accuracy of the information contained in the general ledger.

Make yourself familiar with the accounting cycle

You should ensure that you are familiar with your accounting cycle to update and maintain business finances. The accounting cycle also enables you to store historical transaction data from your journal and organize your account entries. This ensures that you have an accurate accounting system throughout a given period.

Example of a General Ledger Table

Account name: Electric expenses

Account number: 640

| Date | Description | Journal no. | Debit | Credit | Balance |

| 2019 | |||||

| March 12 | Account payable | 4000 | 4000 | ||

| June 10 | Accounts payable | 3800 | 7800 | ||

| July 9 | Accounts payable | 550 | 7,250 |

Frequently Asked Questions

A general ledger format is a layout that the businessman can use to record his financial transactions. It includes the number of columns a general ledger should have on either side of the page.

To create a general ledger in excel, the businessman must first set up a worksheet. The worksheet contains various formulas that he can use, to sum up, transactions into the appropriate accounts. He can also use the excel pivot table features to summarize his journal data and build a general ledger.

A businessman must ensure his general ledger contains the four major sections: the chart of accounts, the financial transactions, the account balances, and the accounting period. This enables the businessman to capture transactions accurately.

The standard paper size of a general ledger range from letter legal (8.5″ x 11″), ledger (8.5″ x 14″) and tabloid (17″ x 11″). These dimensions have their layout to ensure that the general ledger has a professional look.