Managing personal finances is an essential aspect of financial wellness. Whether you are planning for your future, tracking your progress toward financial goals, or applying for a loan or mortgage, having a clear understanding of your financial standing is crucial. One powerful tool that can help you gain insight into your financial health is a personal financial statement.

It is a snapshot of your financial situation, providing an overview of your assets, liabilities, and net worth. It is a valuable document that can help you assess your current financial status, plan for the future, and make informed financial decisions.

In this comprehensive guide, we will explain the process of creating a personal financial statement, providing practical tips and insights along the way. Whether you are a beginner or have some experience with personal finance, this guide will equip you with the knowledge and tools to create an accurate and comprehensive statement that can serve as a foundation for your financial success.

Free Templates

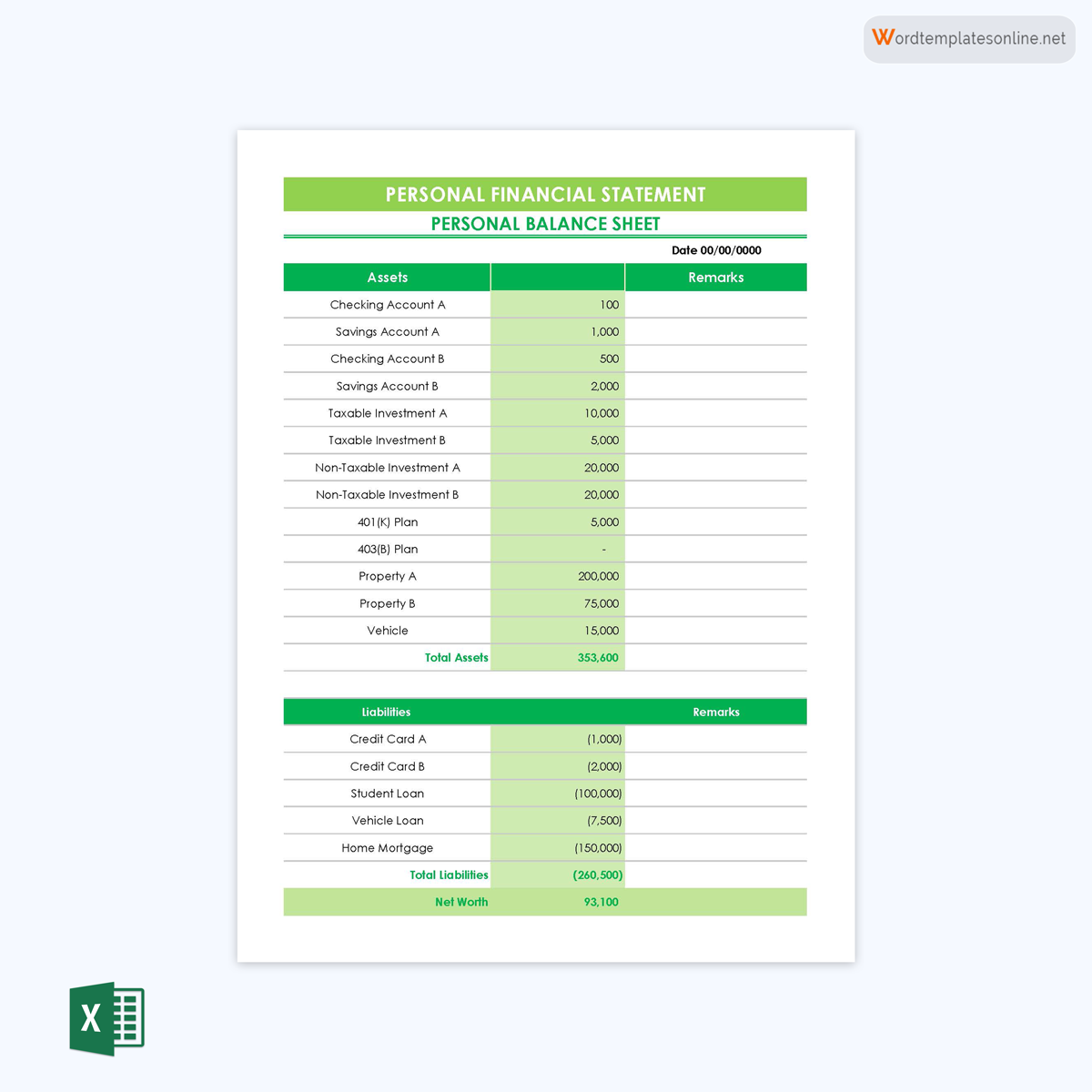

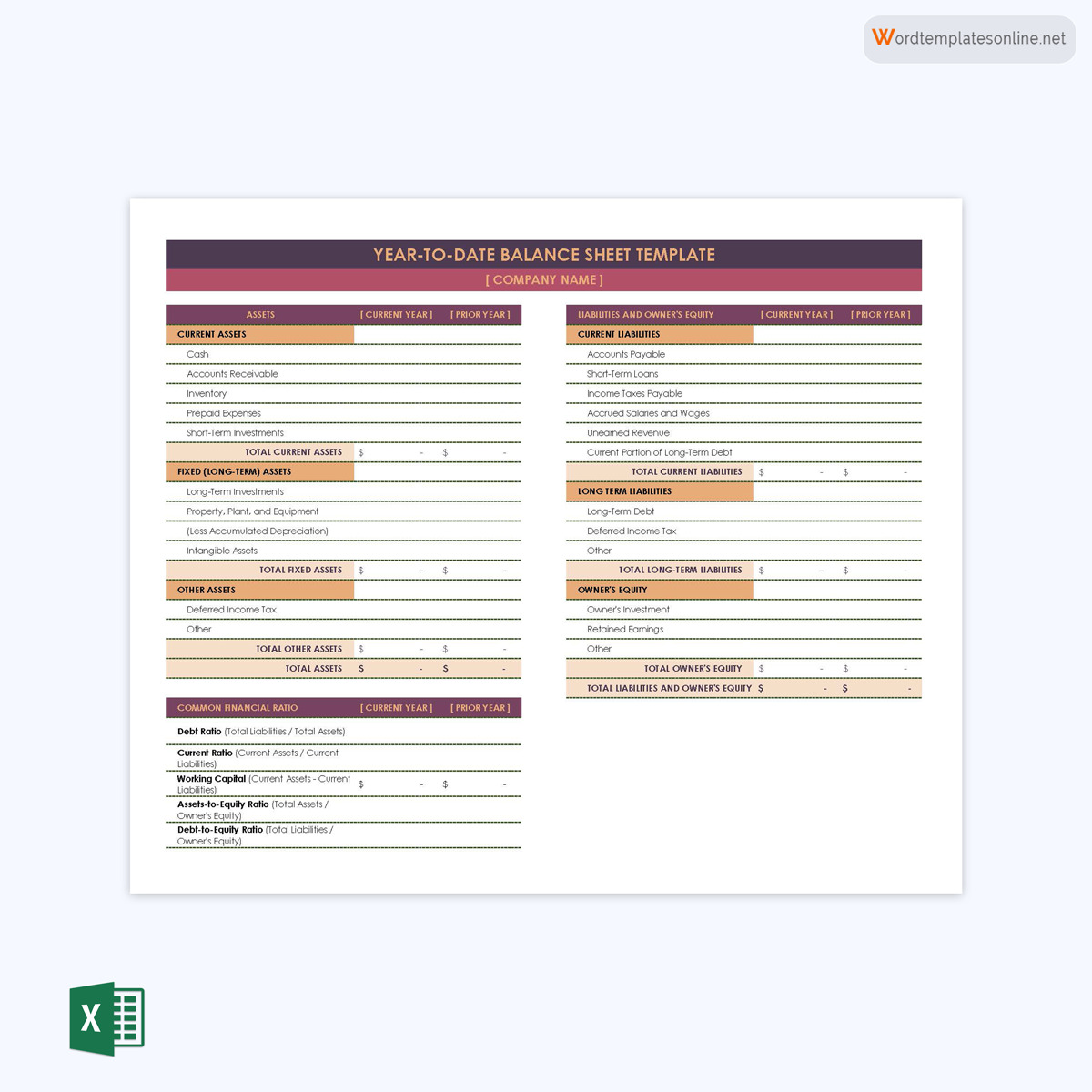

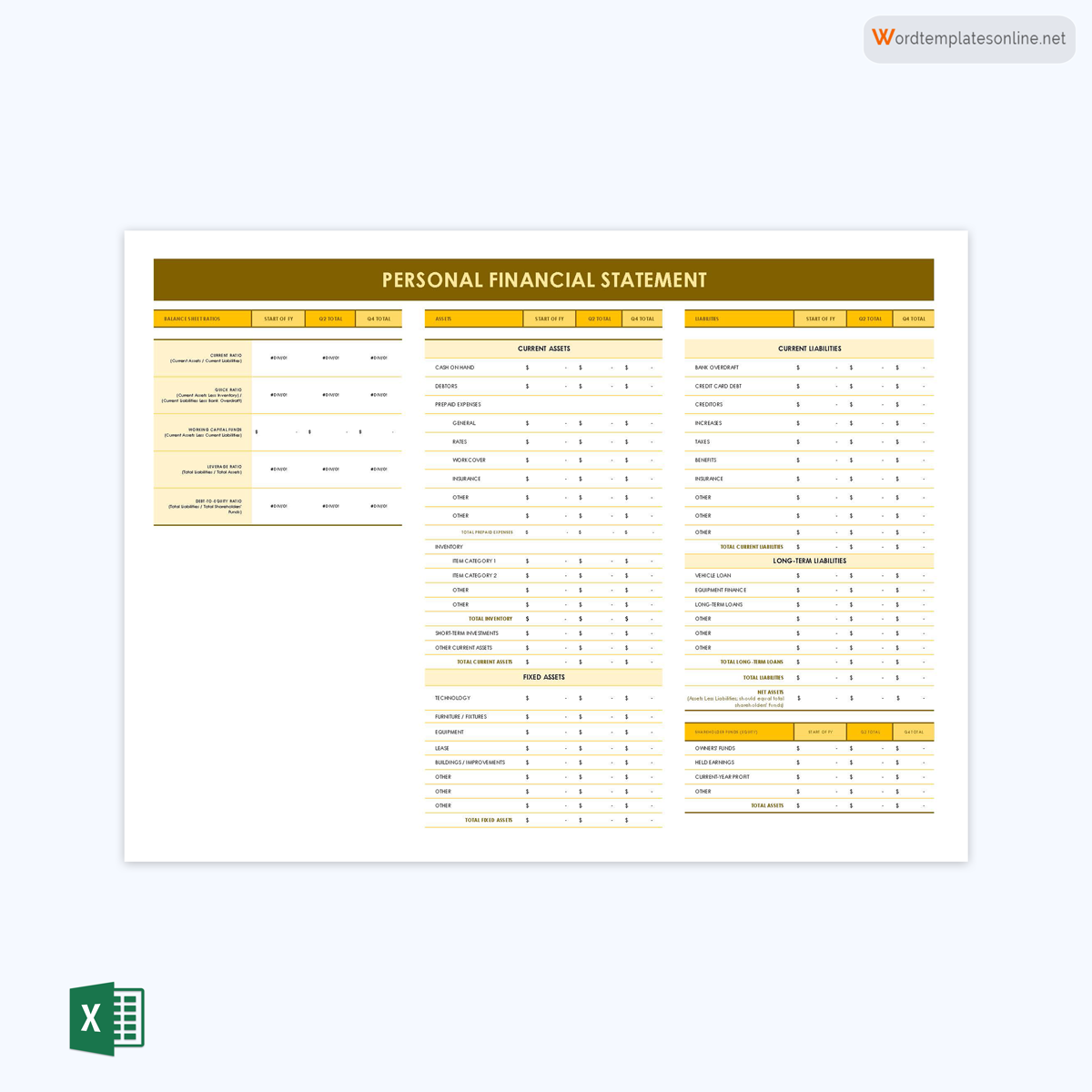

Personal Financial Statement

A personal financial statement is a document that provides a snapshot of an individual’s financial position at a given point in time.

It typically includes information on an individual’s assets, liabilities, and net worth. Assets are items or properties owned by the individual, such as cash, investments, real estate, and personal property. Liabilities are debts or obligations owed by the individual, such as loans, mortgages, credit card debt, and other outstanding debts.

Net worth is the difference between an individual’s total assets and total liabilities, representing their overall financial position.

It can be used for various purposes, such as financial planning, loan applications, mortgage applications, evaluating investment opportunities, and tracking progress toward financial goals. It provides a comprehensive overview of an individual’s financial situation, helping them assess their financial health, make informed financial decisions, and plan for their financial future.

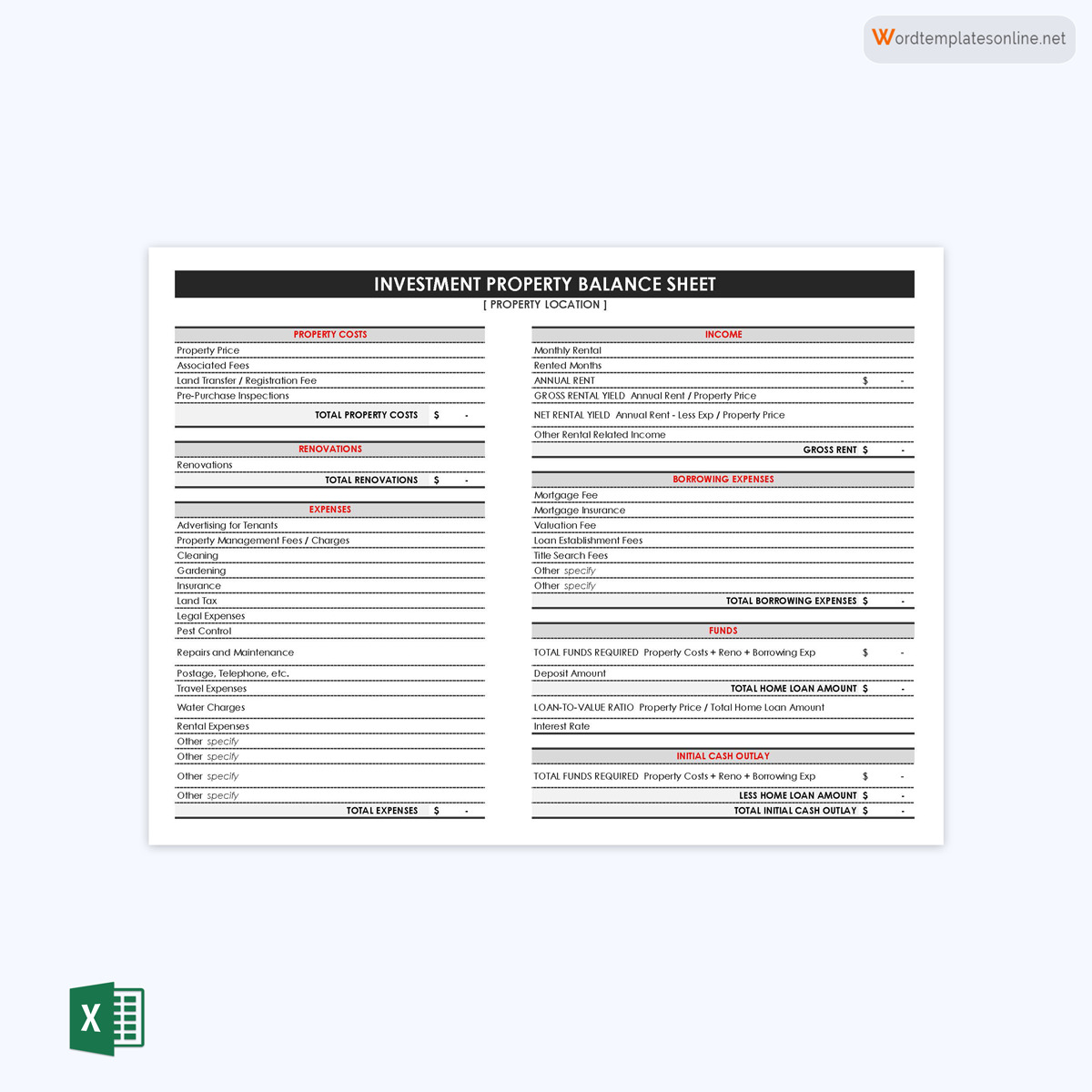

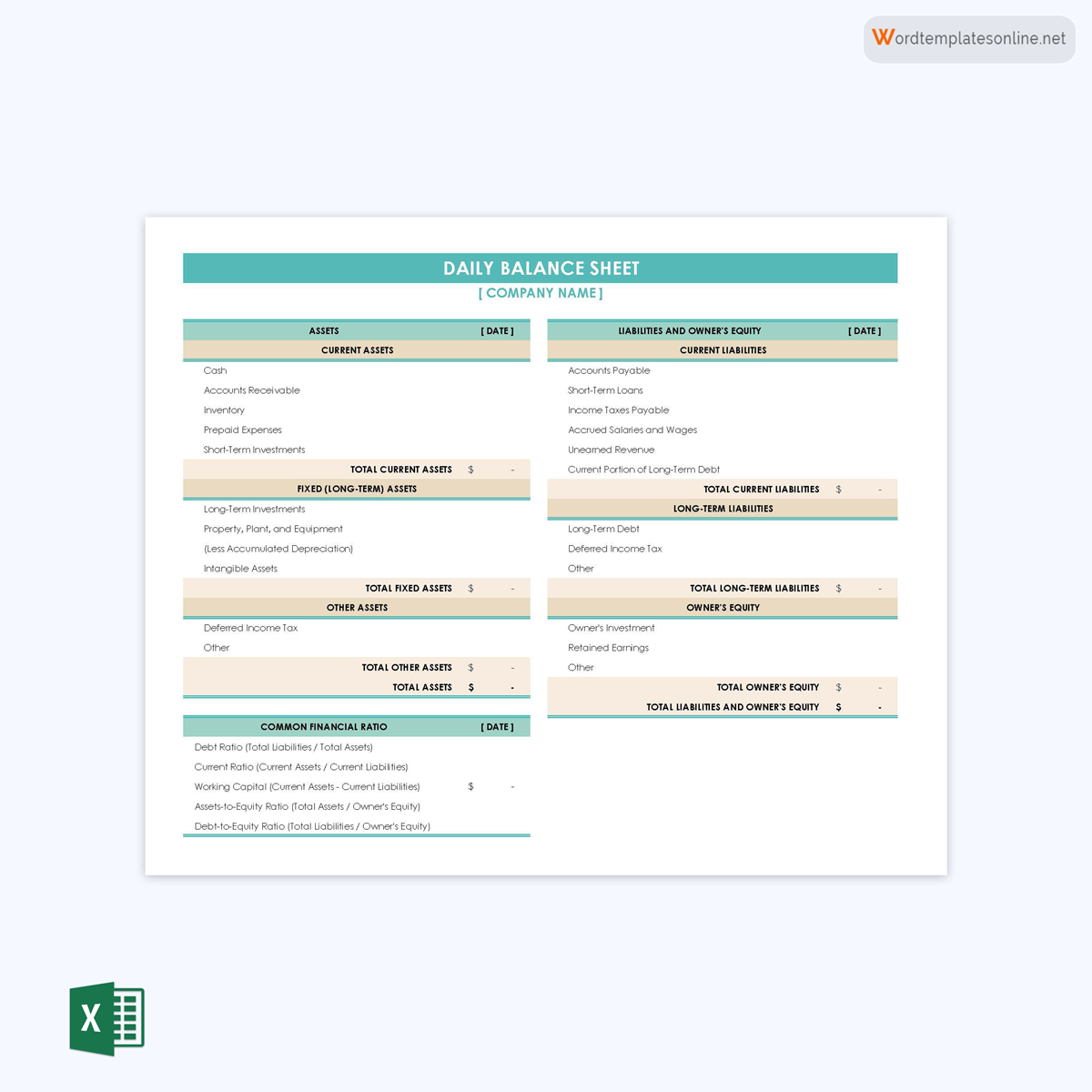

They are typically prepared using a standard template or spreadsheet, and they may also include information on an individual’s income, expenses, and financial goals, depending on the purpose and scope of the statement.

Accuracy and honesty are essential when preparing the statement, as it serves as a key tool for assessing one’s financial situation and making financial decisions based on reliable information.

Corporate VS Personal Financial Statement

A personal financial statement is a document that provides an overview of an individual’s financial situation, including their assets, liabilities, and net worth. It is different from a corporate statement in terms of scope, reporting standards, size, complexity, legal requirements, and purpose.

While corporate financial statements are regulated by accounting standards and required for legal compliance, personal financial statements are typically simpler and used for personal financial planning and loan applications.

When is this Document Required?

A personal financial statement may be needed in various situations, including:

- Loan applications: Lenders may require this statement as part of the loan application process to assess an individual’s creditworthiness and ability to repay the loan.

- Financial planning: They are useful tools for individuals to assess their current financial situation, set financial goals, and create a budget and financial plan.

- Investment or retirement planning: They can help individuals determine their current net worth and make informed decisions about investments, retirement savings, and other long-term financial goals.

- Tax planning: They may be used for tax planning purposes, such as estimating tax liabilities, evaluating tax deductions, and planning for potential tax liabilities.

- Divorce proceedings: In divorce cases, the statements may be required to determine the division of assets and liabilities, alimony, and child support.

- Estate planning: Financial information can be useful in estate planning to determine an individual’s net worth, assess potential estate taxes, and plan for the distribution of assets to beneficiaries.

- Financial management: Information about finances can be used for day-to-day money management, including tracking income, expenses, and net worth, and making informed financial decisions.

Components of Personal Financial Statement

There are three components of this statement. It is essential to include these details when creating an accurate document.

The three essential components are mentioned below:

Personal information

You should include your legal name in full, your address, and your contact information, such as your phone number and email address. The personal information section is important for verification purposes.

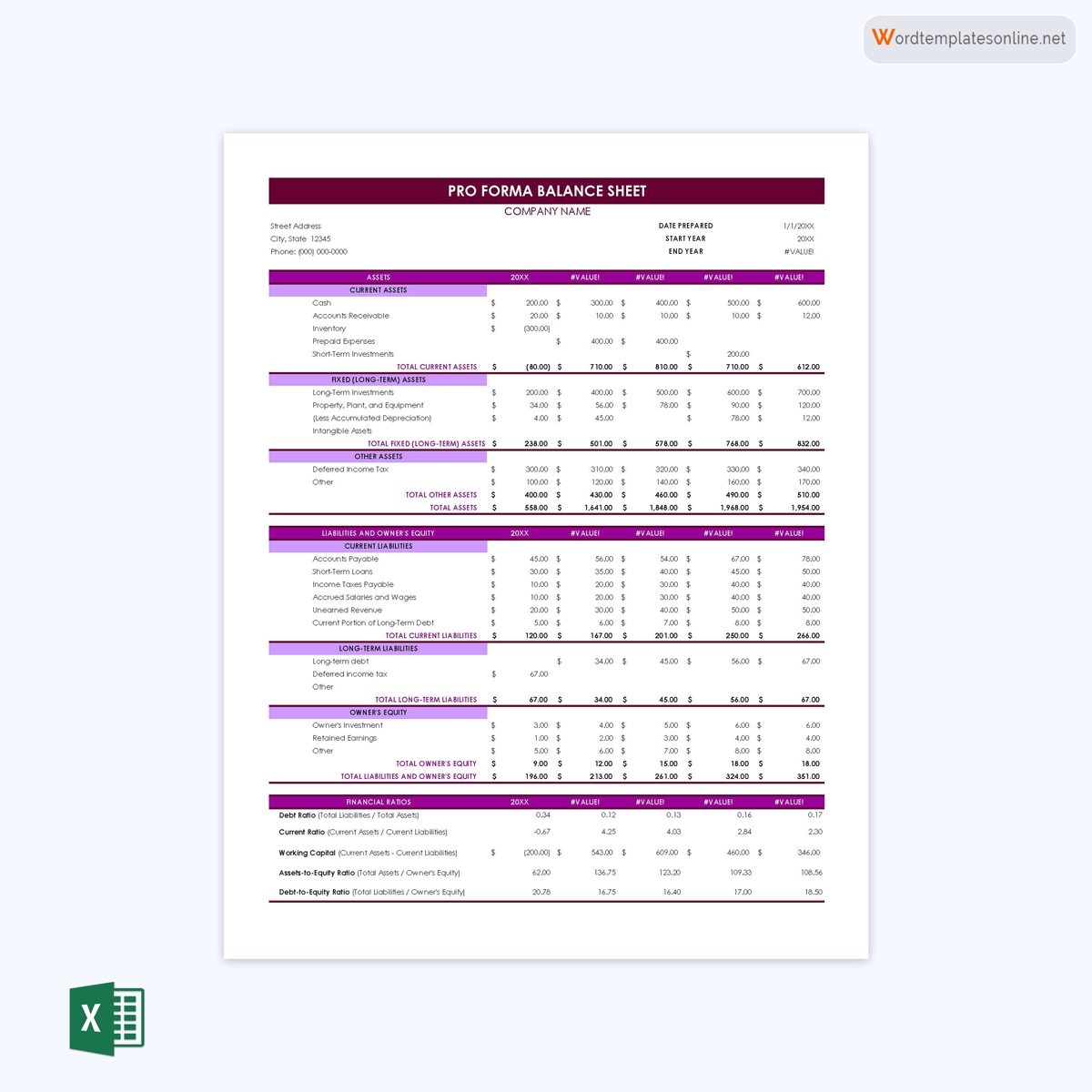

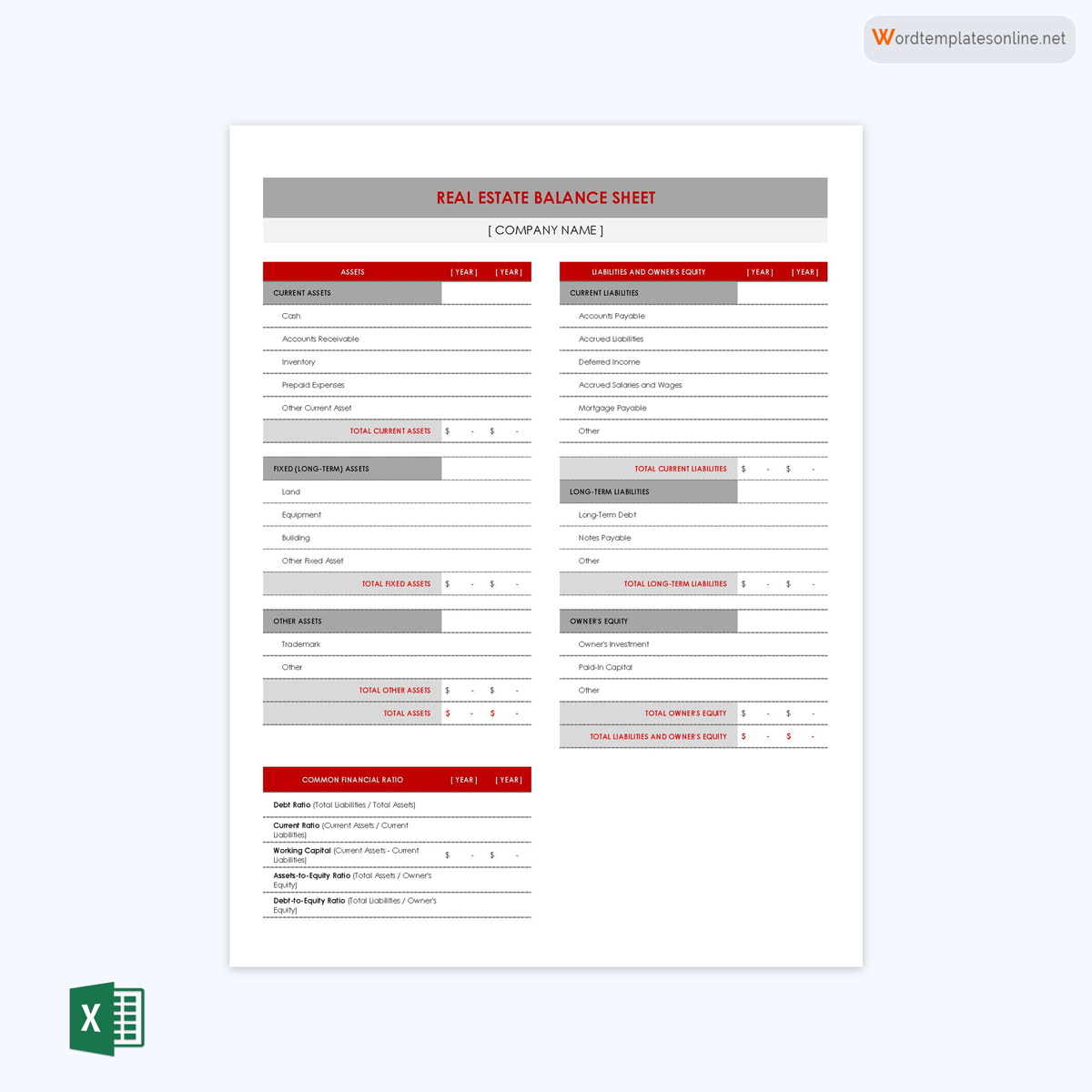

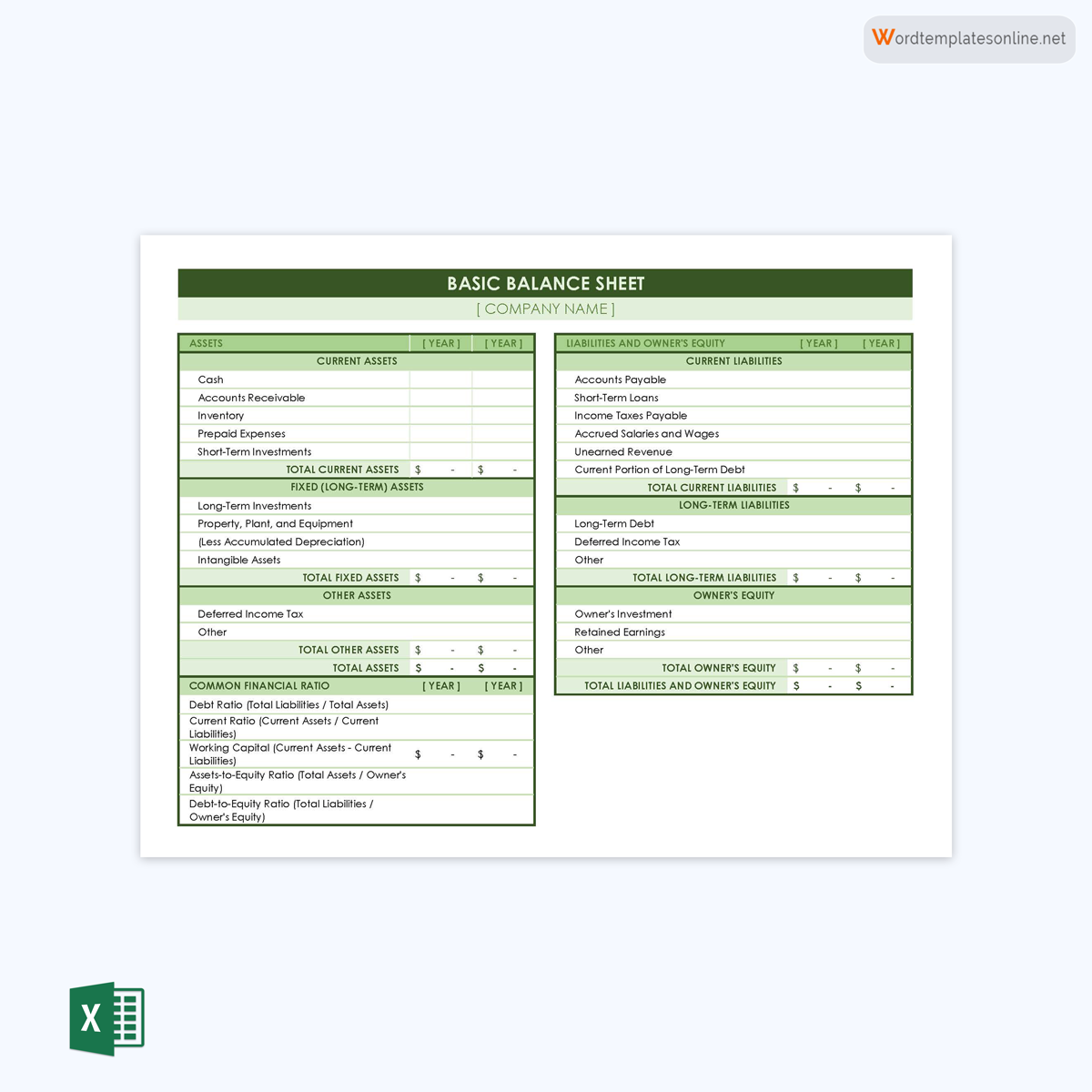

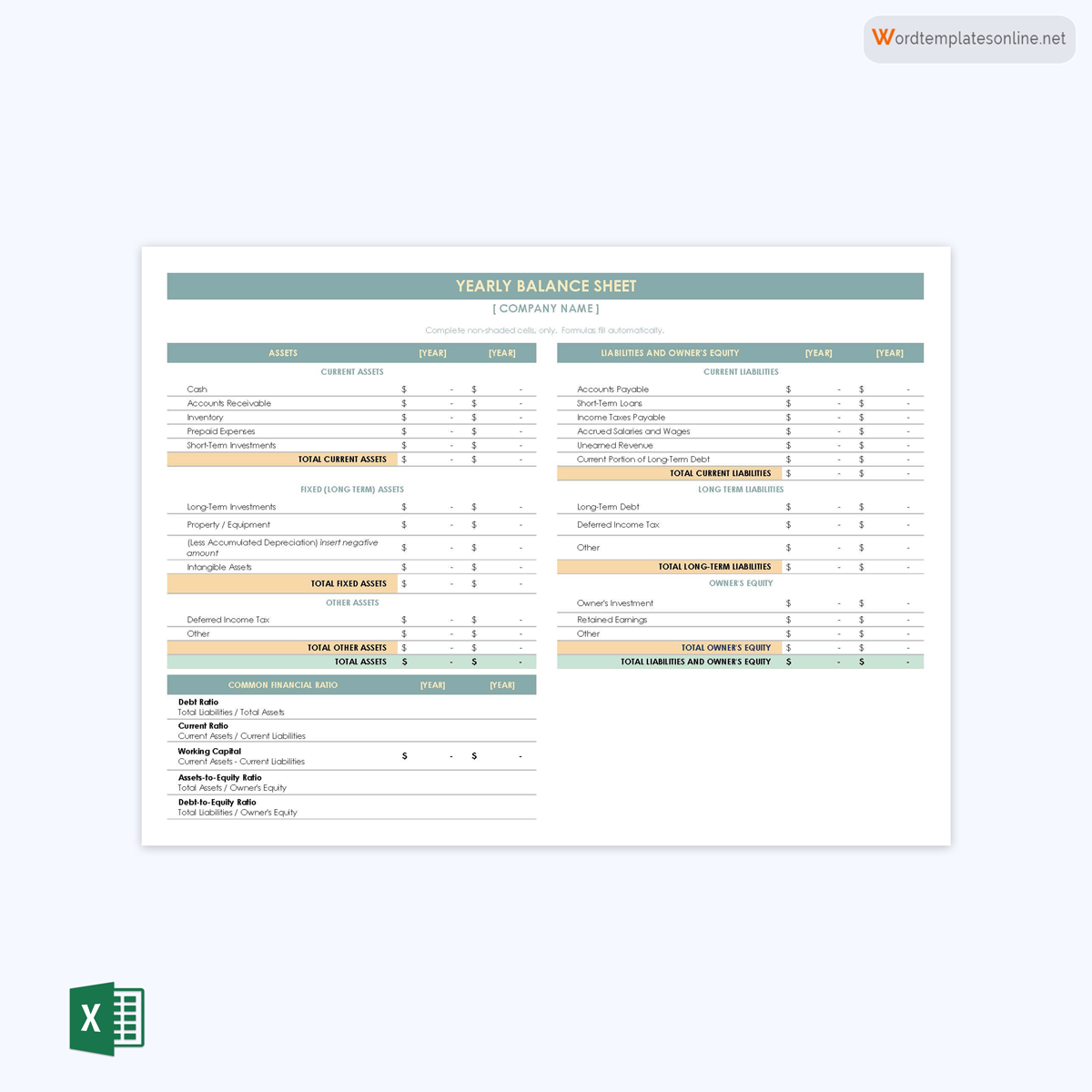

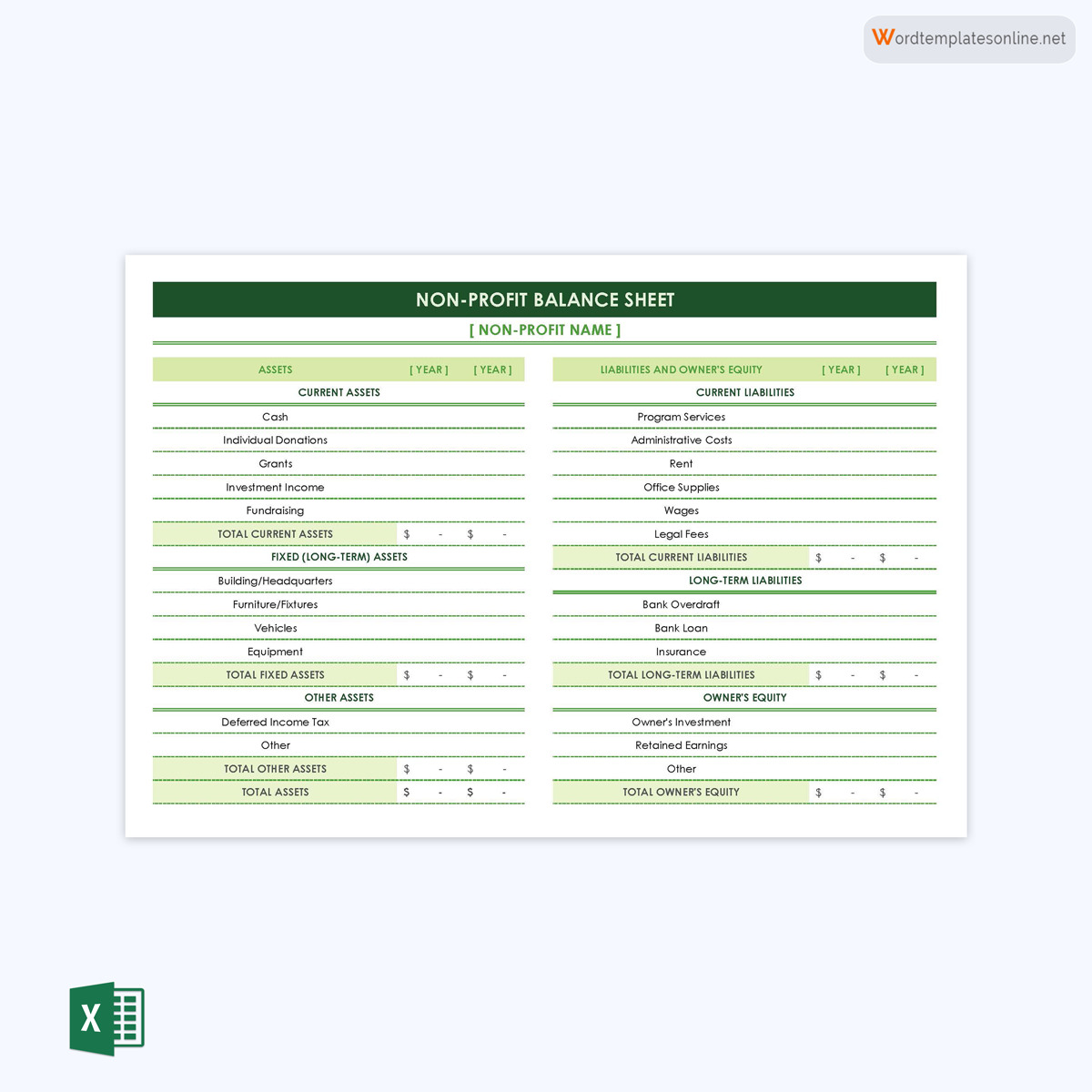

Balance sheet

The other element of the statement is the balance sheet, also known as the statement of financial position. The balance sheet focuses on your assets and liabilities to determine your net worth.

This section lists all of an individual’s assets, including cash, savings and checking accounts, investments (such as stocks, bonds, and real estate), retirement accounts, vehicles, valuable personal property (such as jewelry, artwork, and collectibles), and other assets.

Assets are typically listed at their current value or estimated value. An individual’s liabilities or debts include mortgages, car loans, student loans, credit card debts, personal loans, and other debts. Liabilities are typically listed with the outstanding balance or amount owed for each liability.

Income statement

In the context of the statement, an income statement (also known as a statement of income or statement of operations) typically provides an overview of an individual’s income and expenses over a specified period. It typically summarizes the individual’s sources of income, such as salary, investments, rental income, and other earnings, and deducts expenses, such as living expenses, taxes, debt payments, and other expenses, to arrive at the individual’s net income or loss for the period.

note

It is important to note that the specific components of a personal financial statement may vary depending on the individual’s financial situation, the purpose of the financial statement, and any applicable legal or regulatory requirements.

Guide to Preparing a Personal Financial Statement: Steps and Considerations

Apart from using a template, you can also choose to prepare the statement yourself if you don’t want to use a personal financial statement template.

With the following steps, you will be able to prepare a proper and practical statement:

Choose a format

Decide on the format for the statement. You can use spreadsheet software like Microsoft Excel or Google Sheets, or you can create a document using word processing software like Microsoft Word or Google Docs.

State your assets and their worth

The next step is to list all your assets. You should also include their monetary value next to each asset. You cannot include a rental house or a leased car in the assets section. List all of your assets, including cash, savings accounts, investments, real estate, vehicles, and any other valuable possessions that you own. Be sure to include the estimated worth or market value of each asset.

State your liabilities and their worth

Create a section for your liabilities. List all of your debts and obligations, including mortgages, loans, credit card balances, and any other outstanding debts or liabilities that you owe. Include the current balance or amount owed for each liability.

Calculate total assets and liabilities

Calculate the total of your assets by adding the estimated worth or market value of all your assets listed in the assets section. Similarly, calculate the total of your liabilities by adding the current balances or amounts owed for all your liabilities listed in the liabilities section.

Calculate your net worth

You can now calculate your net worth by subtracting the total of your liabilities from your total assets. Again, ensure this information is included in a separate cell for easier readability.

Review and update

Review your statement periodically and update it as needed. It is important to keep your financial records current to reflect any changes in your financial situation, such as changes in assets, liabilities, or net worth.

Accuracy and honesty

Ensure that your statement contains accurate and honest information. It may be used by financial institutions, tax authorities, or other legal entities to assess your financial standing, so it is crucial to provide truthful and reliable financial details.

note

Including an income statement in your financial statement is optional and may not be necessary for everyone. It depends on your financial situation and goals. Seeking professional advice may be beneficial.

The steps to follow are mentioned below to make it easy for you:

Step 1: Include an income statement

- Create a section for your income statement in your chosen format.

- List your sources of income and expenses for a specific period.

- Include your total income and expenses.

Step 2: Calculate net income

- Subtract your total expenses from your total income to calculate your net income.

- Net income represents the amount of money left over after deducting expenses from income.

Step 3: Include net income in financial statement

- If you choose to include an income statement, you can list your net income under the income section of your statement.

- You can also include it in the total assets or net worth calculation, depending on your desired presentation.

Frequently Asked Questions

It is a legal document and should contain accurate and honest information. However, it may not carry the same legal weight as corporate financial statements. It is important to understand that providing false or misleading information on a personal financial statement can have legal consequences..

It is a good practice to review and update your financial documents at least once a year or whenever there are significant changes in your financial situation, such as changes in income, expenses, assets, or liabilities. Regular updates can help you track your financial progress, set new financial goals, and make informed financial decisions.

If you have more liabilities than assets, i.e., a negative net worth, you will need to revisit your goals and manage your finances better. Avoid attempting to manipulate the data to create a positive net worth on paper to obtain the desired financing. This is a crime that can lead to huge fines and even imprisonment. Instead, find ways to actually improve your net worth.