A Multi-member LLC Operating Agreement is a regulatory document used by LLC companies with more than one owner to outline the ownership shared between the owners, the management structure, conflict resolution practices, and the company’s policies and procedures.

The agreement helps the members in setting out a clear direction for the LLC. The document must be signed by all members (owners) to be valid. Once signed, it legally binds all the signatories to its stipulations. In its absence, the company is subjected to default LLC laws of its jurisdiction.

These laws may not be in line with the LLC members’ interests, and thus an operating agreement ensures that the members have control over how their LLC is run and their expectations are met.

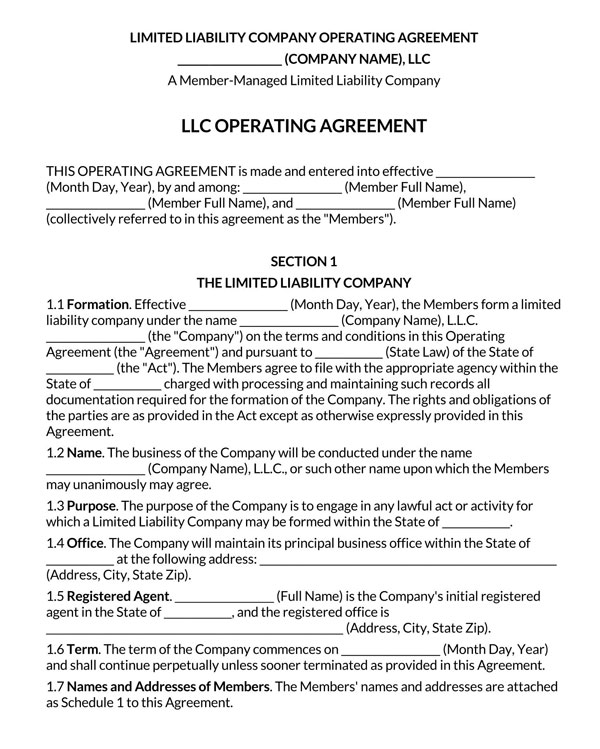

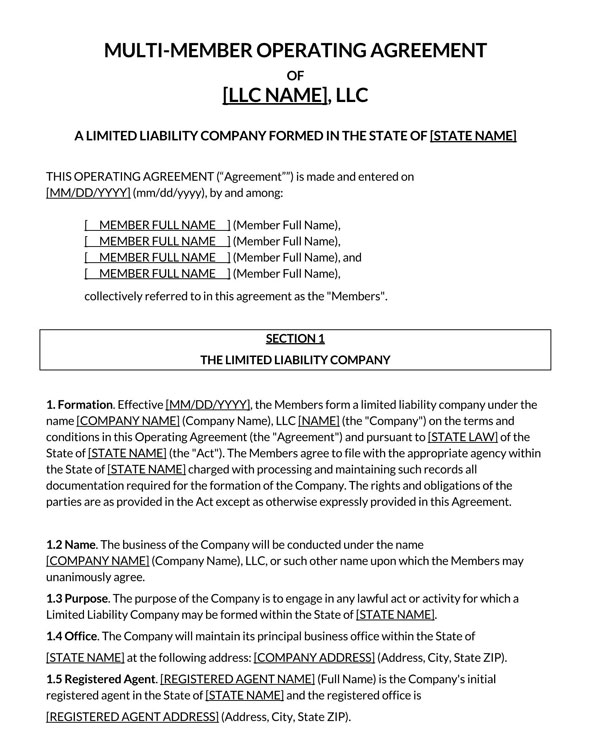

Operating Agreement Template

Reasons to Form Agreement

An LLC gives the owners personal asset protection as they have limited liability protection which extends the owners’ liability as far as their investment into the company. This provision does not apply to standard partnerships or corporations. Multi-member LLCs are therefore suitable for family-owned businesses.

Additionally, there are no constraints to the number of members who can own a multi-member LLC. The members can be individuals, businesses, other LLCs, corporations, friends, family members, etc.

Forming a multi-member LLC gives the company more legitimacy to creditors, investors, customers, and competitors. In addition, Multi-member LLCs can be formed by either US citizens or non-US citizen members, and thus they can help non-US citizens conduct legitimate business in the US.

Multi-member LLCs are not taxed as corporations meaning they are subjected to fewer tax regulations than corporations. Also, multi-member LLCs give the owners the flexibility to have their companies taxed as C Corp through Form 8832 or S Corp through Form 2553.

Multi-member LLCs are treated as pass-through entities, which implies that the LLC does not pay taxes as an entity because the taxes are “passed through” to the owners.

Multi-member vs. Single-member

Both multi-member and single-member LLCs separate the entities from the owners, and therefore the owners of both business structures are protected from the LLC’s financial and legal liabilities. Both business structures are registered using Articles of Organization and are treated as pass-through entities for tax purposes. In a multi-member LLC, the company’s taxes are distributed among the owners based on their LLC interests.

The principal distinction between the two LLCs is that multi-member LLCs have more than one founding member while single-member entities have a sole owner who runs the LLC. It is worth noting that a sole business owner can form a multi-member LLC entity, and multiple business owners can choose to form a single-member LLC business.

EXAMPLE

For example, when individuals decide to start a business, they can start it as a single owner but add their spouse or children as members, forming a multi-member LLC.

Important Sections to be Covered

A multi-member LLC operating agreement highlights different information that is necessary for the smooth operation of the company. As a result, each LLC will have a distinguishable multi-member LLC operating.

However, there are vital details that need to be presented in LLC operating agreement as discussed below:

Company basics

The agreement should provide details surrounding the formation of the LLC.

This will include information such as:

- The company name should have an LLC or Limited Liability Company designator.

- The formation date

- Business purpose

- The principal place of business

Member information

The members or owners of the LLC should be indicated in the multi-member LLC operating agreement.

The following details should be included:

- The name and place of residence (address) of the members.

- The initial contributions of each member

- The percentage ownership of each named LLC member

- The agreement must state how and when (quarterly, annually, etc.) the profits and losses will be allocated.

- The profit/losses distribution procedures and methods should be specified in the document.

Management structure

The LLC operating agreement must indicate the management structure adopted by the LLC members.

EXAMPLE

A multi-member LLC can be member-managed or manager-managed. The members/managers appointed for management duties should be identified and their roles specified. The powers allocated to the members/managers must also be defined.

Accounting procedures

The accounting procedures and regulations of the LLC should be specified. This section should outline the bookkeeping policies and how members’ accounts shall be credited or billed. Accounting and tax reporting procedures should also be defined.

Other processes

Other policies and procedures within the multi-member LLC should be defined. For example, ownership/interest transfer procedures when members want to sell or assign their ownership/interest to other parties. The valuation of exiting members’ interest procedures can also be defined in the operating agreement.

Certification of the members

A multi-member LLC operating agreement should have all the names of the LLC members, their signatures, and dates of signing indicated.

How to Form a Multi-member LLC?

LLCs are a preferred business structure due to their flexibility and liability protection. Their formation is straightforward and requires minimal formalities compared to corporations and partnerships. So, how is a multi-member LLC formed?

The process of setting up a multi-member can be summarized in a few steps that will be discussed below regardless of whether the LLC members are a married couple, friends, family members, different companies, or distinct investors.

These steps are:

Business name

First and foremost, an LLC ought to have an identity. Obtaining a business name gives the LLC a distinguishable identity. This will often involve conducting a name search within the state’s database and selecting available one for use. The name must have the term LLC or Limited Liability Company attached to it and must comply with the state’s business name regulations.

If the name has to be reserved, this can be done by paying a reservation fee which varies depending on the state. Once the business name has been chosen, the registration can commence.

Article of organization

The LLC should then complete the Articles of Organization and submit them to the state department. The Articles of Organization must show the official name of the LLC and other registration information. Filing the LLC’s Articles of Organization can be done physically or online.

Pay the fee

The next step in forming a multi-member LLC is to pay the applicable filing fees. These application fees will vary from one state to another. Also, they will vary for domestic and foreign LLCs. Different payment methods will usually be given; credit card (usually for online applications), check, money order, etc.

Submit the application

Lastly, the LLC members should submit the application to the appropriate state department once all the documents have been completed and paid the filing fee. This process can be done online or by mail. Again, ensure the correct submission process is followed. The state department then approves the application and sends a Certificate of Formation, and the LLC is thus formed.

Other procedural steps to form a multi-member LLC are applying for a tax identification number or any other licenses and business permits. Additional documents such as licenses and permits will depend on the state requirements and the type of business. Before the LLC becomes operational, ensure that the rights and responsibilities of each member are clearly defined.

Frequently Asked Questions

There are no state or federal limitations as to how many members a multi-member LLC entity can have. However, if the LLC applies to be taxed as an S-Corporation, they are restricted to a maximum of 100 LLC members.

By default, multi-member LLCs are taxed as a partnership, meaning that all LLC income and taxes are “passed-through” to its members. Therefore, each member is responsible for paying their portion of taxes based on the percentage ownership in the LLC.

The specifications regarding the appointment of a registered agent for an LLC will differ within states. However, the basic specifications are the registered agent can be an individual or an entity as long as they have a physical address of either residence or operation within the state.

In addition, the registered agent must be 18 years or older, have a residence in the state, and be available to receive correspondence.

An LLC business name must be unique to the LLC and not be used by another business. In addition, the name must have an LLC or Limited Liability Company designator. States also prohibit LLCs from using names that can be confused with state and government agencies.