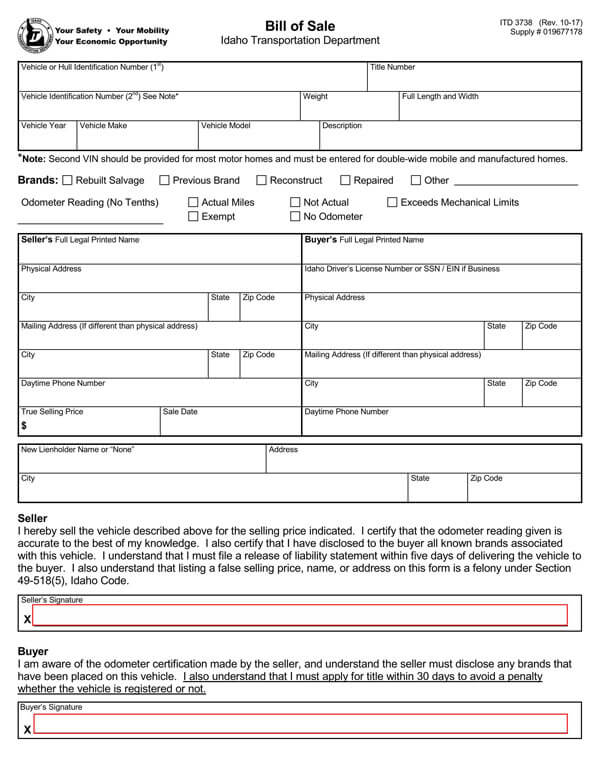

When selling or buying a motor vehicle Idaho, you are required to complete a bill of sale (Form ITD 3738). This form serves as a receipt for both the seller and the buyer, legal proof that a transaction has taken place, should there be any legal disputes after the sale, and is needed when the buyer registers and titles the vehicle.

Free Forms

Other Requirements

The seller is required, according to Idaho code §49-526 to complete a release of liability statement, or Form ITD- 3858, which will need to be sent to Idaho’s Department of Transportation (ITD) with a processing fee of $3.50 within 5 days from the date of sale. This can be done online.

The release of liability document also serves as proof when you need to have your details removed from emissions testing requirements for a vehicle that you no longer own.

If the vehicle being transferred is under 10 years old and weighs under 16,000 pounds, the seller will need to complete an odometer disclosure statement, as per the Idaho admininistration code r. 39.02.05.201. This can be entered in the space provided at the bottom of the title.

If registering a vehicle on behalf of another, you will need to complete an Idaho vehicle power of attorney form.

This bill of sale must be signed by both the seller and the buyer. Notarization is not required.

Key Information Required on a Car Bill of Sale for Idaho

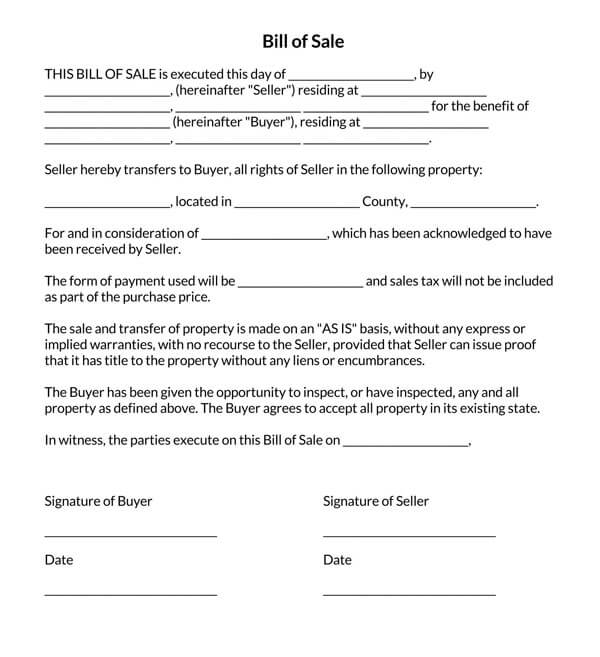

Whether you are using form ITD 3787 provided by IDT or creating your own bill of sale form for Idaho, there are key details that are required to be on it.

These include:

- The legal names and addresses of both the buyer and the seller

- The date of sale

- How much the vehicle was sold for

- Vehicle description, to include make, model, year, body type, color, condition, and VIN

- Signature of both the seller and the buyer

The form must be written in plain English. Both parties should receive its copy.

Motor Vehicle Registration Law in Idaho

By law, you must register a vehicle within 30 days from the date of sale. The amount that is stated on the bill of sale form for Idaho will be used to determine the tax amount due for the vehicle.

The state of Idaho does not list proof of insurance as a requirement for registering a vehicle. However, from February 2018, you will need to show proof of insurance coverage.

Registering a Vehicle in Idaho

When purchasing a vehicle through a private sale in Idaho, the owner will be given 30 days from the date of the purchase to register the vehicle in their name at their local Department of motor vehicles office. If it is an out-of-state transfer, you will be given 90 days from the date of the sale to register the vehicle. Vehicles registrations must be renewed annually and can be done through the DMV’s online services. If the renewal period of 30 or 90 days expires, it becomes illegal to drive your vehicle on roadways in Idaho until the vehicle has been properly registered.

Vehicles that are being registered for the first time will have to be done in person at one of Idaho’s transportation department, motor vehicle division offices. Visit ITD for country-specific details.

Requirements for Registering a Motor Vehicle in Idaho

When registering a vehicle, you are required to have the following:

- A car bill of sale for Idaho

- A completed release of liability (Form ITD 3858)

- Vehicle title that has been signed by the previous owner and transferred to the new owner.

- A completed application for title certificate (Form ITD 3337)

- A completed VIN inspection certificate (Form ITD 3403) for vehicles being transferred from out-of-state

- Odometer disclosure statement if the vehicle is under 10 years old and under 16,000 pounds. This can be filled out in the space provided on the title.

- A valid and current ID or Idaho driver’s license

- If you are registering the vehicle on behalf of another, you will need to complete a motor vehicle power of attorney

- Proof of insurance for the vehicle by an active insurance company

- Funds to pay the appropriate registration fees

- Emissions test certificate, if required

Emissions Testing in Idaho

Emissions testing is required in parts of Idaho where the air quality value exceeds 85%, as stated in Idaho code § 39-116B, when registering your vehicle.

It is in the following counties:

- Ada County

- Canyon County and Kuna City

You can visit one of the many emissions testing stations.

Emissions testing is required every 2 years. For any vehicle that is model 1981 or newer, as well as diesel and gas-powered vehicles that are older than 5 years and have a GVWR (gross vehicle weight rating) that is under 14,001. Vehicle owners will be sent at least two reminder notices when they are due to have an emissions test. Testing costs $14.00 per vehicle.

Notices will give the following details:

- The vehicle that is due for testing

- A list of nearby testing stations

You are given until the end of the month designated on the notice to have the required emissions test and a final notice will be sent out at the end of the 30 day period for testing. If you have not had your test, you will be given a further 35 days, from the date on the final notice, to have an emissions test done. Not having the emissions test will result in ITD revoking your vehicle’s registration.

You may also have your emissions testing done before you have received your reminder notice, but it must be no longer than 90 days prior to the emissions renewal date. You can find out when your testing due date is on the Idaho department of environmental quality website. You will need your vehicle identification number or license plate number.

Emissions Testing Exemptions

The following vehicles are exempt from emissions testing:

- Hybrid and electric vehicles

- Vehicles that are less than 5 model years old

- Vehicles whose model year is older than 1981

- Vehicles categorized as classic by Idaho code

- Motorized farming equipment

- Vehicles whose max gross weight is under 1,500 pounds

- Vehicles whose GVWR is 14,001 or greater

- Vehicles that have been registered as a motor home, as set out by Idaho code

- Vehicles that have been registered for the sole use of business agriculture

Conclusion

A bill of sale is a vital document in the process of vehicle registration in Idaho. However, there are multiple benefits other than the direct benefit of vehicle registration attached with this document therefore it must be prepared and used properly.