Inheritance distribution after the death of property owners is a source of disputes, especially among fortunate families when there is no will. Lack of a will worsens the situation. To avoid this, most people opt to leave a written will that will guide the wealth distribution process. Such a document is known as a Last Will and Testament. Legally, without a will upon the demise of an individual, their property should go to their spouse and children, then the next of kin if the first two options are not applicable. However, beneficiaries of a will do not have to be family members; they can be organizations or other entities.

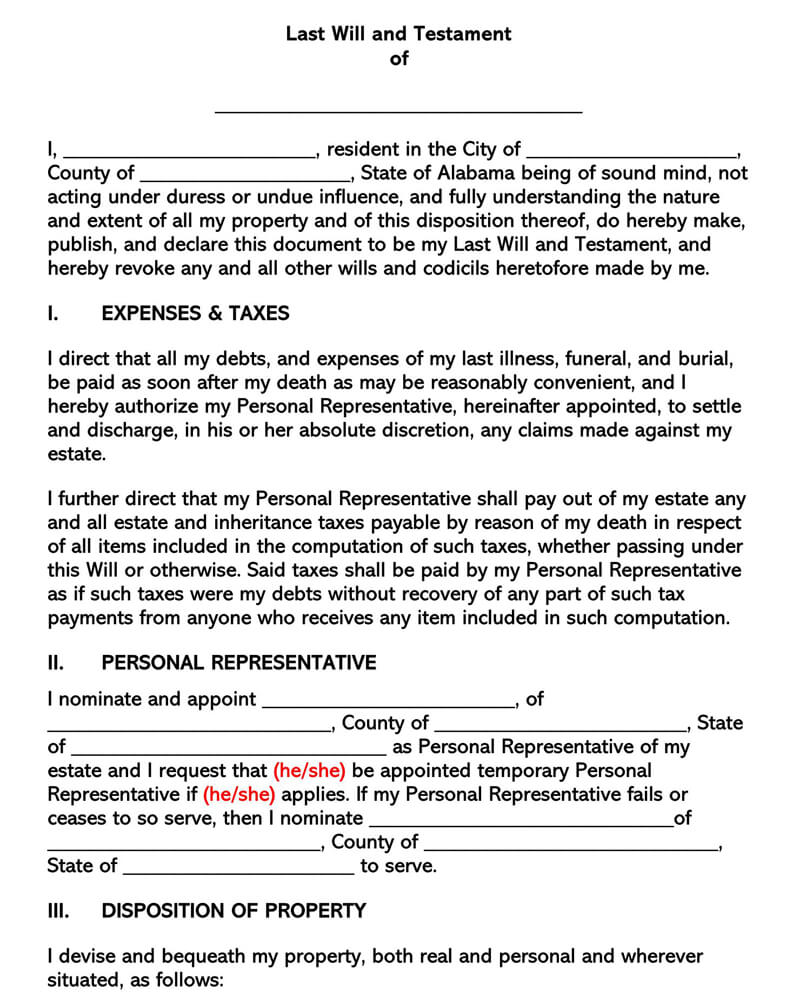

A Last Will or Last Will and Testament is a document prepared by a person (referred to as the testator or grantor) to outline how their personal and real estate property should be distributed to all the beneficiaries after his or her death.

Once the document is signed, a copy should be sent to each beneficiary and the testator’s attorney. Property can be a house, car, money, land, company ownership, etc., having a last will and testament ensures that a person’s property does not go under the state’s care.

A will does not have to be registered, but in some instances, it is optionally filed with the county clerk’s office, probate courts, or any appropriate state secretary’s office.

The last Will and testament must be signed and witnessed by at least two (2) disinterested witnesses to be legally valid in all USA States. However, the states of Colorado and Louisiana directs that the Last Will be notarized for it to be valid.

Following are the standard as well as states templates that can be downloaded for free:

By State

Free Last Will and Testament Templates

Standard template

Understanding Last Will

In order to craft a last will, one must know in which situations it is used and which parties are involved in it.

The following section contains a comprehensive explanation on such topics:

Situations for using last Will

It is generally used to plan ahead of an individual’s death. It is a communication of a departed property owner’s wishes.

Therefore, one should consider using a will if:

- A person has predetermined directives of how their estate should be handled after their death and wishes to have them implemented even after they are gone.

- An individual has a child or children under eighteen and would like them to be cared for by someone (guardian) of their choosing after their demise.

- An individual wishes their estate to be handed over to their preferred beneficiaries and not the government or state after passing on.

People Involved in a “Last Will and Testament”

Following are the parties involved in the Last Will:

- Grantor- Grantor refers to you, or the person who actually drafts the ‘last will and testament.’ It is this party who owns the pieces of property which are to be disposed of upon death.

- Beneficiaries- These are the persons who stand to inherit the said pieces of the property upon the death of the grantor.

- The Executor- The executor is the one who implements the provisions of the will. He carries out the wishes of the grantor that are expressed in the will. In many cases, he is charged with the responsibility of transferring the will for probate.

- Witnesses- It is the witnesses who verify that the will was not only drafted by the grantor but also contains contents that are accurate, free, fair, and devoid of any errors.

Making a Last Will and Testament

Making a will involves the identification and allocation of property. A Last Will should be able to communicate the grantor’s wishes effectively.

To ensure that this is realized, below are several steps a person can follow when making one.

Identify the properties

The first step should be to establish all the real and personal property under a person’s ownership. This information should be in the form of an itemized list of all the valuable assets owned by the grantor. The assets should total up to 100%. Once listed, one should decide what property should go to whom, and each beneficiary is then assigned a percentage of the total. Beneficiaries should then be notified of the allocation to financially and psychologically prepare themselves for the liabilities that come with their share should the grantor pass away. A detailed description of each asset should also be included.

Hire an executor

An executor is a person who will be in charge of carrying out the grantor’s directives and ensuring every beneficiary gets their fair share of the property. Grantors should select someone trustworthy and well-informed of the property at hand – this can be a lawyer, a close friend, or an associate. The primary obligation of the executor is to act in the best interests of the estate and the grantor, which could include settling debts and ensuring funeral expenses are covered, respectively. A secondary executor can be selected to assume the responsibilities if the primary executor cannot fulfill the tasks.

In situations where minor kids might be left behind without a guardian upon the property owner’s death, a responsible adult can be assigned to assume the parental responsibilities of the property owner. The appointed guardian is also tasked to manage the estate and the children’s assets (finances) to ensure they can provide for the children financially. Care must be taken during selecting a guardian to ensure that someone with the kids’ best interests at heart is chosen.

Decide the heirs

Beneficiaries do not necessarily have to be people; they can be entities such as charities, etc. The grantor should decide if they intend to leave their entire estate to one or multiple beneficiaries. In most cases, beneficiaries are family members, but that is solely up to the grantor. One should also decide when a beneficiary of the Will passes on, how their share will be dealt with. The options would be to transfer the interest to their heirs or distribute the interest amongst the other beneficiaries of the last will.

Witnesses and a notary

As a last will must be witnessed and notarized in some States, as mentioned earlier, one should check the signing requirements within their state of residency. Once the guidelines have been established, at least two witnesses who should be present when the grantor signs the document should be determined. The witnesses are meant to establish that the grantor signed the document at Will and with a sound mind, not under duress. They should then be notified of when the signing will be taking place so they can also sign the document. Signing will often be at the notary public’s office as applicable.

Deliver and store the Will

Once signed, the Last Will should be stored at a safe and accessible place, and the executor and legal counsel should be made aware. The beneficiaries should each be handed an original signed last will. At the discretion of the testator, the Last Will can be registered with the probate court of the grantor’s county of residence.

Signing a Will

As already mentioned, most States recommend a last will be witnessed by at least two witnesses. The grantor’s responsibility is to ensure their last Will is signed according to the state’s guidelines. Remember, if the last Will fails to meet the applicable signing requirements, it might not hold in court and can be a source of disputes which a Last Will is meant to mitigate. Below are the different state laws that govern the signing of last wills.

| State | State Laws | Execution Requirements |

| Alabama | Title 43, Chapter 8 | § 43-8-131Two Witnesses |

| Alaska | Title 13, Chapter 12 | AS 13.12.502Two Witnesses |

| Arizona | Title 14 | § 14-2502Two Witnesses |

| Arkansas | Title 28 | § 28-25-102Two Witnesses |

| California | Sections 6100 to 6139 | 6110Two Witnesses |

| Colorado | CRS Title 15 | § 15-11-502Two Witnesses or Notary Public |

| Connecticut | Chapter 802a | Section 45a-251Two Witnesses |

| Delaware | Title 12 | DE Title 12, Chapter 2 § 201 & 202Two Witnesses |

| Florida | Chapter 732 | FL Section 732.502Two Witnesses |

| Georgia | Title 53 | GA Section 53-4-20Two Witnesses |

| Hawaii | Chapter 560 | HI Section 560:2-502Two Witnesses |

| Idaho | Title 15 | ID Section 15-2-502Two Witnesses |

| Illinois | 755 ILCS 5 | Section 755 ILCS 5/4-3Two Witnesses |

| Indiana | Title 29 | IC 29-1-5-3Two Witnesses |

| Iowa | Chapter 633 | Section 633.279Two Witnesses |

| Kansas | Chapter 59 | Section 59-606Two Witnesses |

| Kentucky | Chapter 394 | Section 394.040Two Witnesses |

| Louisiana | CC 1570 | Art. 1577Two Witnesses and a Notary Public |

| Maine | Title 18-A, Article 2 | Section 2-502Two Witnesses |

| Maryland | Title 4 | Section 4-102Two Witnesses |

| Massachusetts | Chapter 190B | Section 2-502Two Witnesses |

| Michigan | Act 386 of 1998 | Section 700-2502Two Witnesses |

| Minnesota | Chapter 524 | Section 524.2-502Two Witnesses |

| Mississippi | Title 91, Chapter 5 | Section 91-5-1Two Witnesses |

| Missouri | Chapter 474 | Section 474.320Two Witnesses |

| Montana | Title 72 | Section 72-2-522Two Witnesses |

| Nebraska | Chapter 30 | Section 30-2327Two Witnesses |

| Nevada | Title 12 | NRS 133.040Two Witnesses |

| New Hampshire | Chapter 551 | Section 3B:3-2Two Witnesses |

| New Jersey | Title 3B | Section 3B:3-2Two Witnesses |

| New Mexico | Chapter 45 | Section 45-2-502Two Witnesses |

| New York | Estates, Powers, and Trusts | Section 3-1.1Two Witnesses |

| North Carolina | Chapter 31 | GS 31-3.3Two Witnesses |

| North Dakota | Chapter 30.1-08 | 30.1-08-02. (2-502)Two Witnesses |

| Ohio | Chapter 2107 | ORC 2107.03Two Witnesses |

| Oklahoma | Title 84 | 84 OK Stat § 84-55Two Witnesses |

| Oregon | Chapter 112 | ORS 112.235Two Witnesses |

| Pennsylvania | Title 20 | Title 20 § 2502Two Witnesses |

| Rhode Island | Title 33 | Section 33-5-5Two Witnesses |

| South Carolina | Title 62 | Section 62-2-502Two Witnesses |

| South Dakota | Chapter 29A-1 | Section 29A-2-502Two Witnesses |

| Tennessee | Title 32 | Section 32-1-104Two Witnesses |

| Texas | Probate Code | Sec. 251.051Two Witnesses |

| Utah | Title 75 | 75-2-502Two Witnesses |

| Vermont | Title 14 | 14 VSA § 5Two Witnesses |

| Virginia | Title 64.2 | § 64.2-403Two Witnesses |

| Washington | Title 11 RCW | CW 11.12.020Two Witnesses |

| West Virginia | Chapter 41 | Section 41-1-3Two Witnesses |

| Wisconsin | Chapter 853 | Section 853.03Two Witnesses |

| Wyoming | Title 2 (Wills, Decedents’ Estates and Probate Code) | Section 2-6-112Two Witness |

Other Considerations

A last will and testament is among the different types of wills that a person can use to issue directives of property distribution after their death. There are various aspects of the last will that a person should be familiar with.

We shall look into some of these aspects below.

Amending a will

Just because one has already written a last will does not imply that the issued directives are final. A grantor can opt to amend all or sections of the Will. Amendment can be to change the executor, personal representative, legal counsel, to include acquisition or sale of property, change the beneficiaries, or any other justified reason. Amendment of a Last Will is done through a Codicil of a Will or simply a Codicil. The Codicil is attached to the Last Will and signed as provided by State laws.

A Self-Proving Affidavit shows that the two witnesses swear under oath to having witnessed the grantor sign should be used when amending the Last Will using a Codicil.

Last will vs. Living trust

A last will is seen to be similar to a Living Trust in that they both are used in distributing a grantor’s ownership of assets to his or her beneficiaries after his demise. However, there are notable dissimilarities between the two, which can influence people with higher wealth to opt to use a Living Trust rather than a Last Will.

The differences are as follows;

| Last Will and Testament | Living Trust |

| After the death of a grantor, the probate oversees the implementation of a Last Will | It does not fall under the jurisdiction of a probate court. |

| Permits/allows the appointment of a guardian for a minor(s) (children below 18 years of age) | It does not allow a grantor to appoint a guardian for minors left behind. |

| It becomes public knowledge once recorded | It is not public knowledge |

| It allows conservatorship when a court of law appoints a representative to handle one’s finances after one’s demise. However, a Durable Power of Attorney can appoint a guardian/agent/manager of preference to handle the finances. | Avoids conservatorship by allowing the appointed trustee/representative to be responsible for handling the property. |

A living will deal with a person’s health care preferences should they become incapacitated and communicate or make decisions regarding their health. A Health care Proxy is appointed through a Living Will to direct medical personnel on the principal’s medical preferences. A last will and testament is implemented once the guarantor passes on, and its objective is to transfer their assets to the rightful beneficiaries.

No will after death

Suppose a person dies without leaving a will (known as Die Intestate or intestacy), division and sharing of the estate left behind can be complex and dispute-prone – a situation no one wants to expose their beneficiaries to. To remedy this, the distribution of assets in such a case can be done through a Small Estate Affidavit. This is, however, dependent on if the estate falls under the state-specific threshold (value limits) for it to be subjected to probate proceedings.

Estate planning checklist

An Estate Planning Checklist can be used to ensure that a person’s estate has been determined to the maximum degree permitted by law. Other authorizations such as end-of-life directives, power of attorney forms can be identified and utilized to keep check of maximum clarity of an individual’s estate so that it may be specified in a will, if available. These documents supplement the last will by determining the departed individual’s wishes regarding funeral wishes and the making of medical and financial decisions, respectively.

Frequently Asked Questions

Having a will is very important for anyone with valuable assets and property. Death is primarily unprecedented, and leaving no will behind leaves the distribution of property in the hands of a court, which means the property might end up benefiting people or entities you would not have wanted. Having a will, especially for senior citizens, can be vital in determining how family members relate after passing on. Disputes have been seen to arise if a family member dies without leaving a will.

The state laws of the testator’s state of residency are used to govern their Will. Typically, this will be the same state to which one pays their income taxes.

Property to be included in a will is any valuable item in one’s possession. Personal property includes vehicles, furniture, jewellery, collectibles, etc. However, this does not include cash.

Should a guarantor’s primary beneficiary die before the guarantor, the Will can be amended to remove the beneficiary from the Will, and a secondary beneficiary can then be included. If there were multiple beneficiaries, the guarantor could decide to allocate a new beneficiary or distribute the departed beneficiary’s share among the remaining beneficiaries. Some states use the Uniform Probate Code, which states a beneficiary must survive at least five days after the death of the guarantor to inherit the property. If there is no alternative beneficiary, the property is subjected to the state’s Anti-Lapse laws.

Yes. Pets can be assigned a caretaker who should take them in should the primary caregiver passes on.