The financial POA is explicitly written to let someone else act as one’s legal representative when making money decisions. By definition, it can be stated as:

The Financial Power of Attorney (FPOA) is an official legal document that authorises someone else to act on your behalf in financial decisions and matters.

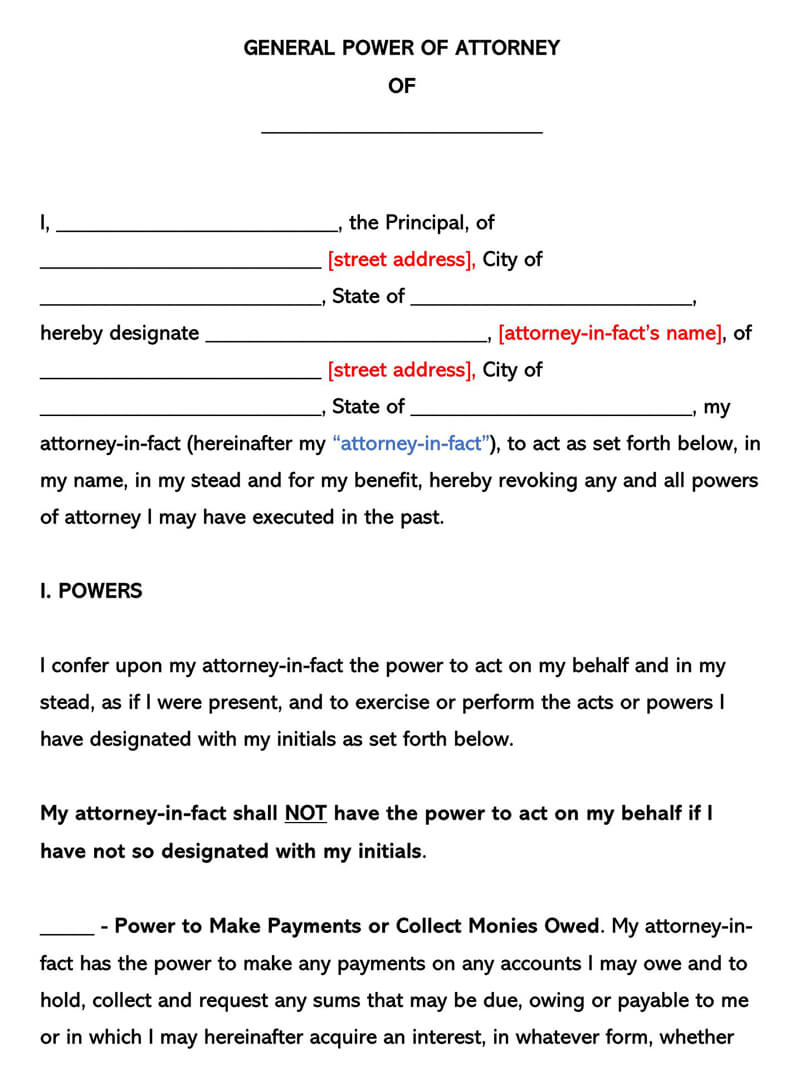

This document is usually created alongside one’s will. Like other forms of power of attorney, an individual who creates the Financial POA is known as the Principal. In simpler terms, the Principal, in this context, is the person whose money is being protected. The person selected to act on behalf of the Principal is known as the Agent or Attorney-in-fact.

The FPOA is sometimes known as a General Power of Attorney or Power of Attorney of Property. This type of POA gives the Agent the power to manage the financial life of the Principal when he/she is unable to do so. In most cases, this document is issued when the principal Agent is ill, incapacitated, or is physically not present to sign the necessary paperwork.

Financial Power of Attorney Forms (by State)

Preparing this form is an essential step in ensuring your financial matters are handled according to your wishes. By using professionally designed and free pre-built templates, you can easily create a customised Financial POA that suits your specific needs and complies with the laws of your state. These templates offer convenience, clarity, and peace of mind, empowering you to proactively plan for the future.

Financial Power of Attorney Vs. Other POA

It is a form of POA. There are several other types of POA that one can utilise depending on their specific purpose:

- Limited Power of Attorney- The Limited POA gives the Agent minimal power and usually provides a given end date for the agreement. For instance, a principal may appoint a family member or a friend as a limited POA agent if he/she is unavailable to sign the necessary paperwork at a given time. In other cases, this type of POA authorises the Agent to withdraw money from the Principal’s bank account. The Limited Power of Attorney is also a type of non-durable POA.

- Medical Power of Attorney- A Medical POA is also known as a Healthcare POA. It allows the Agent the authority to make and execute important medical decisions regarding the Principal’s healthcare when he/she is severely sick or incapacitated to do so themselves.

- Springing Power of Attorney- This kind of POA only becomes effective when the Principal is incapacitated and cannot make decisions independently. To take effect, the Springing Power of Attorney document must outline the exact definition of incapacity such that there is no confusion as to when the Agent can begin acting on behalf of the Principal.

Understanding Financial Power of Attorney

The authority outlined in the Financial POA can be fairly broad or restrictive in some cases, limiting the Agent to only specific duties. The agents named in this form are legally allowed to make decisions about the Principal’s money, property, and medical health.

Following are a few queries that one needs to understand in order to get the idea of the FPOA:

Working of financial POA

Typically, it is used during a medical emergency. When caught up in a medical emergency, your financial needs might not be top of your list. Unfortunately, these needs don’t just disappear because you are lying helpless in a hospital bed. Your regular bills need to be paid, your business accounts need to be managed, and even the hospital bills need to be cleared.

Just as Medical POA only applies to medical choices that someone makes on your behalf, the Financial POA extends no more than the right for an agent to make and execute money decisions for you if you are not available to do so by yourself. Therefore, if something unthinkable happens to you that prevents you from making urgent financial decisions for yourself (perhaps due to an accident, sudden illness, or simply because you are physically unavailable), with a FPOA, your named Agent can keep everything running smoothly with your money.

The main reason for creating this POA is to protect yourself and your family from a preventable legal battle. In this context, the idea is to be confident that someone trustworthy is always available to decide what happens to your money if you are incapacitated or unavailable.

Once a Financial POA is executed, the original document is given to the Agent, who may subsequently present it to a third party as evidence of your Agent’s authority to act on your behalf in financial matters. This means that you are legally obligated to a third party who relies heavily on a POA in dealing with your Agent.

Need of power of attorney

You need this legal instrument in the following three major case scenarios:

- Busy schedules- If you operate a busy schedule, especially one that entails regular travels, you might not have the time to undertake the roles above on your own. Moreover, you may often be penalized if you do not meet the stipulated headlines. That is why you want to delegate the same to a less busy person.

- Limited expertise- Some of the chores above require some expertise to undertake. The chances are that you may not have the necessary expertise to do so. To be able to do a good job and meet the requirements of the letter, you will yet again have to choose someone with the right skill to do them for you.

- Legal compliance- In some states, there are issues that are only performed by persons who are well qualified and appropriately licensed to do the same. In case you are not licensed, the only way forward for you is to choose someone who has those very skills to do that.

Effectiveness of financial POA

Depending on how the document is worded, a this POA can either become effective immediately or upon the occurrence of a future event.

Immediate effectiveness

In this case, the FPOA authorises your Agent to act on your behalf even when you are available and not incapacitated.

EXAMPLE

If you are married, you will undoubtedly want to have your spouse make financial decisions for you whenever faced with a medical emergency. Given this case, making this POA effective immediately is a wise choice.

Generally, the more closely related the Agent is to the Principal, the more likely the Principal would choose to immediately make the FPOA effective. Similarly, making the document effective immediately is also a wise option when the Principal is frequently on the road, yet he/she has lots of financial needs that require official approval to get done.

Below is a list of key reasons why you might consider making your Financial POA effective immediately:

- If you expect to be physically unavailable for a particular business transaction that can’t wait for your return

- When you anticipate an upcoming medical issue that will render financial chores difficult

- In cases where one wants to allow their spouse to complete financial obligations if they are frequently out of town.

Specific effectiveness

Most people want to keep the option of making financial decisions for themselves for as long as it may take. If you would like to name one of your children or someone more distantly related to you as your Agent, creating a springing power of attorney would be a wiser choice. In this case, the event that would trigger a financial POA to take effect is if the Principal is incapacitated. Although this is a tragedy that no one ever wants to deal with, it’s always within the realm of possibility.

Given that this POA is tied to an incapacitating event, the document can only become effective when one or more doctors have certified that you are in a state of being mentally or physically unable to make significant decisions on your own. This is referred to as “springing into effect” in the attorney world.

The following are some of the certifiable conditions that could cause a FPOA to spring into effect:

- If the Principal is in a coma

- The onset of Alzheimer’s disease

- Mental illness

- The Principal’s inability to communicate.

Whether your financial POA takes effect immediately or in the future after the occurrence of an event, your Agent only gets the power to make financial decisions on your behalf when you grant it.

Ending of financial POA

Usually, the authority conferred by a Financial Power of Attorney ends upon:

- The death of the Principal

- The Principal decided to revoke the power at any time

- A court order declaring the POA invalid

- The Principal’s incapacity unless stated otherwise in the POA.This POA can be written to particularly state that the Agent’s power continues even in the event of the Principal’s incapacity. This type of POA is known as a Durable Financial Power of Attorney (DFPOA)

- In some states, when the Principal has both named their spouse as the Agent and later divorced their spouse

- The Principal’s Agent failed to fulfil their obligations as a financial POA. However, this can be avoided by naming a successor agent in such POA.

Who is an agent

For most states, the only legal requirements for becoming an agent are that the individual is of sound mind and of legal age. Because your Agent has the power to make financial decisions for you, ensure that you choose someone who is responsible and has your best interest at heart.

Legally, the named Agent has a responsibility to act in your best interest, keep records of transactions, an obligation not to mix your property with theirs, and not engage in any conflict of interest. However, sometimes the Agent can act unlawfully.

remember

You must select a person that you can fully trust.

Typically, a principal has the power to grant an agent any financial privileges they may see fit. However, it is essential that you first think about the Agent’s actual abilities and know-how before granting them the FPOA.

Acceptance by third parties

Perhaps, you might be wondering whether or not a POA is acceptable by Third parties. Normally, a third party is not required to accept a power of attorney. Nevertheless, it is a legal requirement in some states, and any third party who refuses to accept a power of attorney is penalised using the state’s official form.

How to Get a Financial Power of Attorney(FPOA)

Establishing this involves several steps. It is a great idea to consult with a lawyer even as you go through the process. The following is an outline of the steps you will take while establishing a FPOA:

Select an agent

You have to name one adult in your FPOA as the Agent responsible for making financial decisions on your behalf. Therefore, figure out who will best suit this responsibility. You can consult your attorney, family counselor, or faith leader to help facilitate this process. While selecting the Agent, it is good to pick someone who can comfortably carry out these responsibilities while also considering other people’s viewpoints.

Determine the powers

Under a few specific circumstances, a power of attorney may not be necessary. For example, if a person’s assets and income are also in the name of their spouse- like in the case of a joint bank account or a joint brokerage account, then a power of attorney is not necessary. Most individuals may also have a ling trust that appoints a trusted adult relative or friend to act as a trustee, and in which they have placed all their assets and income. Regardless, having a durable power of attorney is still a good idea in any of these mentioned circumstances. A POA provides an agent who can be the same person as the living trust’s trustee- to handle these matters whenever they arise.

To be certain that your FPOA is acceptable, contact anyone you think your Agent would have to deal with and verify from them if your POA is acceptable:

- Pay bills

- Purchase insurance

- Operate a business

- Sell assets

- Pay taxes

- Invest

- Collect retirement benefits

- Banking and other financial institution transactions

- Claims and litigation

- Safe-deposit box access

- Giving donations to individuals or charities

- Estate or business management

- Acquire, lease out, or dispose of property

- Issue out gifts

- Deal and handle motor vehicles

- Handle general healthcare issues

- Health Insurance Portability and Accountability

- Sue third parties

Pursue legal guardianship

Just in case you are unable to obtain this power yourself, consider pursuing legal guardianship. This guardianship should also be pursued in the event that the principal who happens to be you are incapacitated and is unable to act on your own.

Check the requirements of your state

It is always necessary to act within the law. Remember, these agreements and powers governed by laws that are crafted and vary from state to state. It is hence vital that you check the requirements of your states that govern such powers. Be sure to act strictly within these confines to avoid ruffling feathers with authority.

Execute

Once you have identified an agent, proceed to fill out your state’s standard forms or financial institution’s custom forms. Afterward, execute the FPOA by having the written document notarized and witnessed as required, storing it safely, and providing copies to essential people. The original copy of the document should be provided to your Agent, and your family and loved ones should be informed about the person you select as your Agent.

Proof-read your document

After filing the details, you have to proofread the document to see to it that all the pieces of information you furnish are accurate and to the point. It must specifically spell out the names of the agent, principal, and the kinds of powers that are delegated to a third party.

Gather some witnesses

It is always necessary that you gather some witnesses to vouch for your own agreement and decision, even if none is required by your state. These are persons who are well known to the two of you and therefore have the ability to offer reliable confirmation later on.

Notarize the document

This is also an optional step, but which is highly recommended, though. You should notarize the document to make it acceptable by the state. The procedure also eliminates any ambiguities and doubts that may arise with regards to its validity later on.

Save the document

Lastly, you should save the document. Let each party to the agreement save a copy for himself. These are you, the principal, the witnesses, and the agent himself.

Review the Financial POA periodically

Ideally, it has to be prepared before you actually need it. And since that time may be unforeseeable, a POA could exist for several years or decades. Thus, periodically reviewing the document together with your loved ones is a great idea. While reviewing it, pay close attention to whether your Agent is still willing to serve in that capacity or not, as circumstances and laws may have changed over time.

Drafting a Financial Power of Attorney Form

A FPOA needs to be legally binding to be effective. To achieve this, the document should be signed in Infront of a notary public. In other cases, the FPOA form needs to be witnessed at the time of signing. Still, other states require the Agent to sign the document to indicate that they accept the responsibility.

Generally, when creating this Form, your first and most important step should be filling out your state’s official form. Nonetheless, keep in mind that some banks may require you to use their specific forms for your Agent to conduct business there for you.

Similarly, some title insurance companies, lenders, and closing agents have unique forms that the Principal must fill out before accepting an agent’s actions. It is likely for you to end up with more than one financial POA at the end of the day.

Revoking Financial Power of Attorney

The following are the steps required to revoke a general power of attorney:

- Construct the revocation document- Start off by constructing your own revocation document. While at it, choose a format that is easily noticeable and which displays the information you need in a clearly legible manner. You may seek inspiration from legal websites.

- Fill out the form- Go ahead to fill the form out. Be sure to make it plain that you are revoking a power of attorney. Identify yourself and name the agent too. Lastly, date the form appropriately.

- Gather witnesses and notarize it- To make the form more legally acceptable, you have to display the form to some witnesses and a notary public. These persons, you will find in a law office or a bank. Assign their photo IDs and notarize the form thereafter.

- Write the word ‘REVOKED’- Write the word ‘REVOKED’ in bold, dark, and large letters. Make several copies and your intent to revoke the agreement. Attach a copy of your ‘revoked power of attorney to each copy of the ‘original power of attorney.’

- Notify your existing agent- As a last measure, you have to notify your existing agent of your decision to revoke the initial power of attorney you had delegated to him. Do the same to all institutions which you may have some dealings with. Utilize the certified mail to prove that the persons to whom they are addressed receive them.

Frequently Asked Questions

A ‘durable power of attorney’ comes into effect when the principal is either incapacitated or terminally ill so much so that he cannot make crucial decisions on its own. The ‘general power of attorney,’ however, is in force within the lifetime of the principal, not unless it is revoked.

This requirement varies from state to state. In most states, two witnesses are enough. Others may impose three witnesses, yet others require no witness at all. It is hence necessary that you familiarize yourself with the requirements of your state before proceeding.

You have the leeway to appoint anyone to act as your attorney. These persons must be aged 18 years and above, mentally stable, well-known to you, and trustworthy enough to handle confidential issues on your behalf. Check out your state requirements, too, in order that you do everything in accordance with the law.

You really need no lawyer to draft this agreement. However, a lawyer comes in when reviewing and notarizing the agreement later on. It is also a good thing to hire a lawyer to review the language used and to ensure that every aspect of the document meets the existing legal thresholds.

Given that you and your spouse or another person own property jointly, the property will automatically be transferred to the survivor upon your death. Nevertheless, this will not allow the other person to sell or mortgage the property if you become incapacitated, but a Durable POA will.

Normally, a living trust will allow the trustee to transact business for the trust if you become incapacitated. However, most people do not put all their property in the trust of a trustee. Suppose you own any property that is not in the trust; you should consider a DPOA for that property.

An ideal answer for this question would be; however long you set it up to last. However, if you create a general power of attorney and set no date for which it will lapse, then the POA will last until you die or become incapacitated.

Key Takeaways

Financial POA is a legal document that grants a trusted agent the authority to make financial decisions for a principal-agent. It is automatically considered durable in some states, meaning that it remains in effect upon the Principal’s incapacity. However, in other states, a financial power of attorney automatically becomes in kaput once the Principal becomes incapacitated or dies.