When buying, selling, or registering a vehicle in Michigan, you are required to have a Michigan bill of sale for a car. Such Bill of Sale not only outlines the details of the purchase but also protects both the seller and buyer from liability should an issue arise relating to the vehicle.

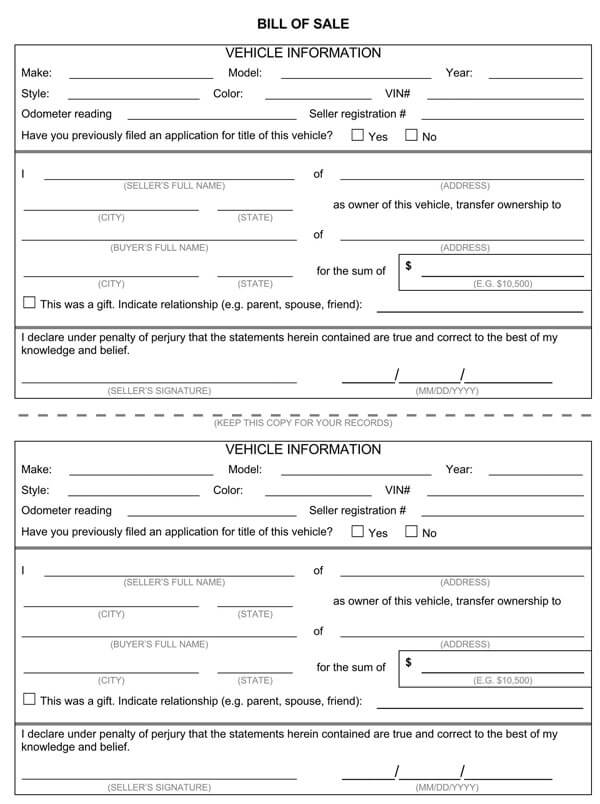

EXAMPLE

If the seller was issued a ticket just before selling the vehicle, the buyer can prove that they did not own the vehicle if questioned.

The Michigan bill of sale must be signed by both the seller and the buyer to make it legal. It is not a requirement to have it notarized, however, doing so can give more protection.

All documents provided by Michigan’s Secretary of State are in English only, however, there are interpreter services available if needed to get through the titling and registration process. If you are creating your own Michigan Bill of Sale, it will need to be translated into English if being used to register a vehicle.

Free Template

Other Requirements

Along with the Michigan bill of sale, the seller needs to either record the odometer reading on the title or, if there is no room to do so, complete a Form BVDR-108 (Odometer Statement).

If you are having someone else take care of the buying, registering, and titling of the vehicle for you, they will need to complete a Motor Vehicle Power of Attorney (Form M-2848)

Key Detail Required on a Michigan Bill of Sale

You can either use the bill of sale (Form TR-207) provided by Michigan’s government website, or you can create your own.

If creating your Michigan bill of sale for a car, you need to include the following:

- The full legal names of both the seller and buyer

- Contact details of both buyer and seller, which should include full addresses, contact numbers, and e-mails (optional)

- Details about the vehicle, which should include the VIN, make, model, year, color, body type, and condition

- The amount that the vehicle was purchased for

- The date of sale

- Optional warranty or lien details if applicable

- The county where the sale took place

- Signatures of both the seller and the buyer

Registering a Vehicle in Michigan

First-time registrations are required to be done within 15 days of the purchase of the vehicle. Out-of-state vehicles are required to be registered within the state of Michigan immediately upon the owner establishing their residency.

Where to Register a Vehicle in Michigan

Vehicle registration renewals are done annually and renewals can be done online using the Secretary of State’s ExpressSOS portal, or in person at a local SOS branch. It is recommended that, in private sales, both the seller and buyer come to the SOS branch together to take care of the transferring of the title.

Documents Required When Registering a Vehicle in Michigan

When registering and titling a new vehicle, you will need the following documentation:

- A Michigan Bill of Sale (Form TR-207)

- A current and valid Michigan Driver’s License

- If there was no room on the title to enter the odometer reading, or you do not have the original title, you will need to complete Form BVDR-108 (odometer disclosure)

- Certificate of Title. If the original title has been damaged or lost, you can request a copy using the Replacement Title Application

- If the vehicle being registered is an out-of-state vehicle, you will need to complete the Application for Michigan Title (Form TR-11L)

- Have the appropriate funds to cover Registration Fees.

- Have proof of insurance from a registered Michigan vehicle insurance provider. Insurance policies must cover the minimum requirements of personal injury protection, property protection, property damage, and residual bodily injury liability.

- If you are registering the vehicle on behalf of the owner, you will need to complete a Motor Vehicle Power of Attorney (Form M-2848)

State taxes

In the state of Michigan, when registering your vehicle, you are required to pay a 6% state-wide tax based on the purchase price or blue book value of the vehicle at the time it was purchased.

Dealership sales

When buying a vehicle from a dealership, the dealer generally completes the titling and registration process on behalf of the buyer. However, if you need to prove ownership of the vehicle before your plates, title, and registration documents come through the mail, you can use the copies of the purchase.

Private sales

In a private vehicle sale, it is the seller’s responsibility to record the correct odometer reading on the title, or complete an Odometer Disclosure Statement.