A New Hampshire Power of Attorney Form is a legal document that gives the agent or attorney-in-fact the powers to act on the principal’s behalf.

The agent may handle the principal’s medical, financial, personal, or business affairs. The decisions made by the agent must be in the principal’s best interest to ensure that the powers granted are not misused. The power of attorney form in New Hampshire is often used for financial, medical, or real estate matters; however, various other types can be utilized.

Free Forms

Types of POA in New Hampshire

There are different forms in New Hampshire that can be used. Understanding them will help ensure that the correct information is incorporated into the document. It will also help ensure that the form aligns with the state laws.

These types include the following:

Durable (Statutory) Power of Attorney Form

Download: Microsoft Word (.docx)

General (Financial) Power of Attorney Form

Download: Microsoft Word (.docx)

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

Medical Power of Attorney Form

Download: Microsoft Word (.docx)

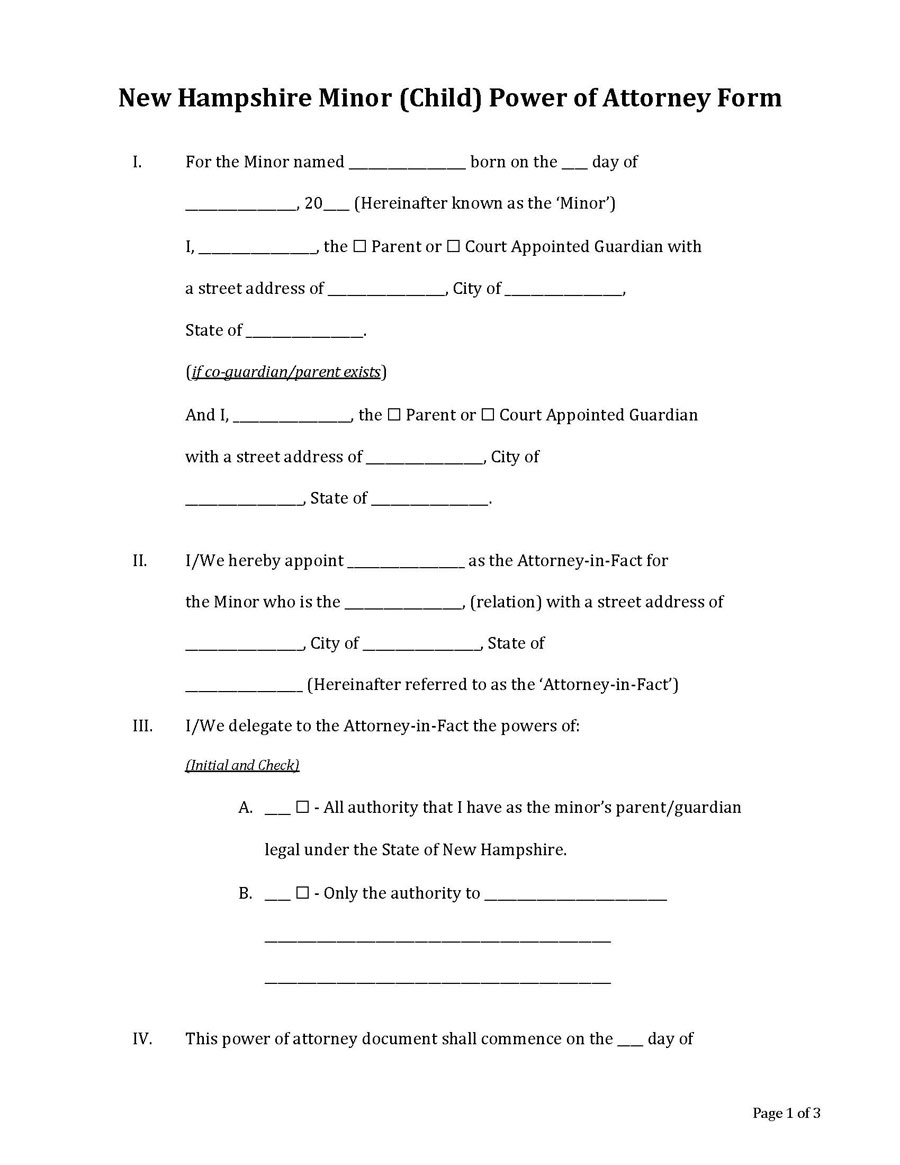

Minor (Child) Power of Attorney Form

Download: Microsoft Word (.docx)

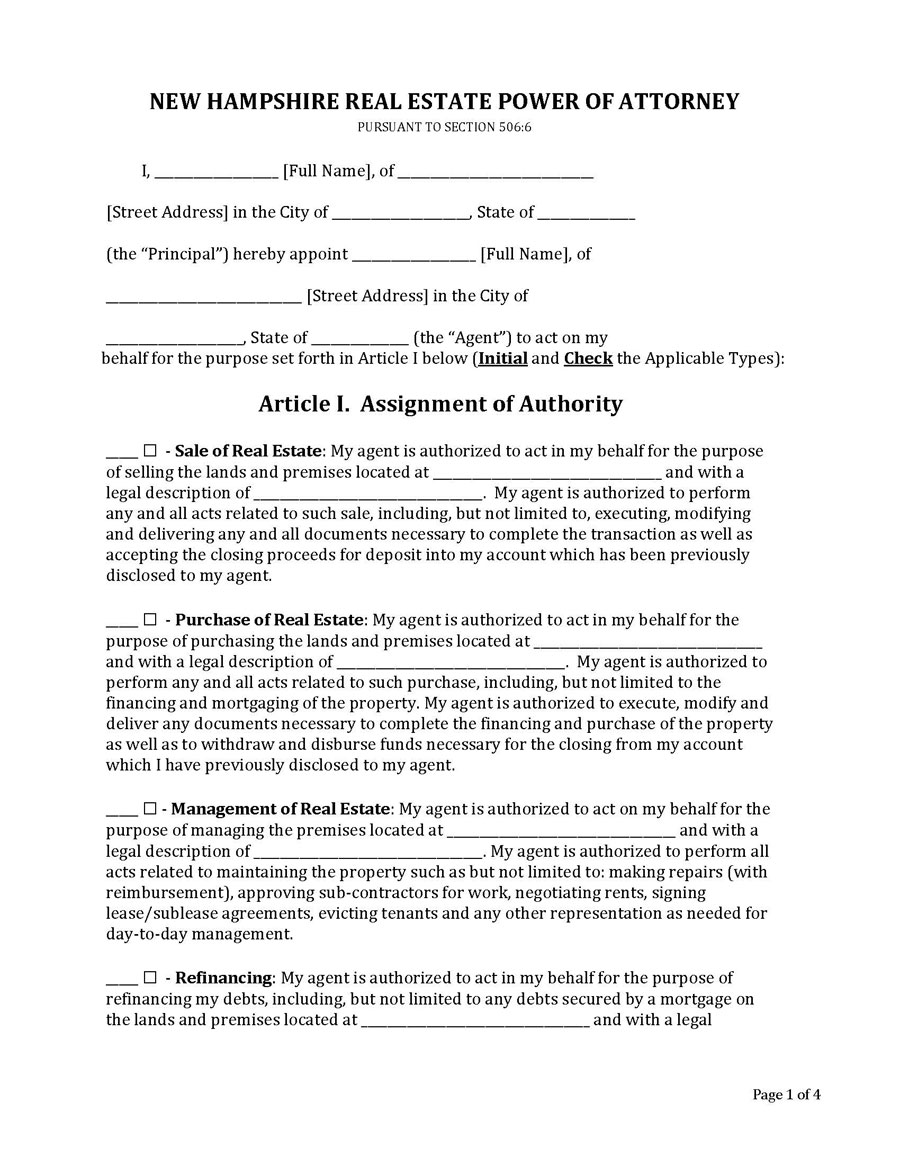

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

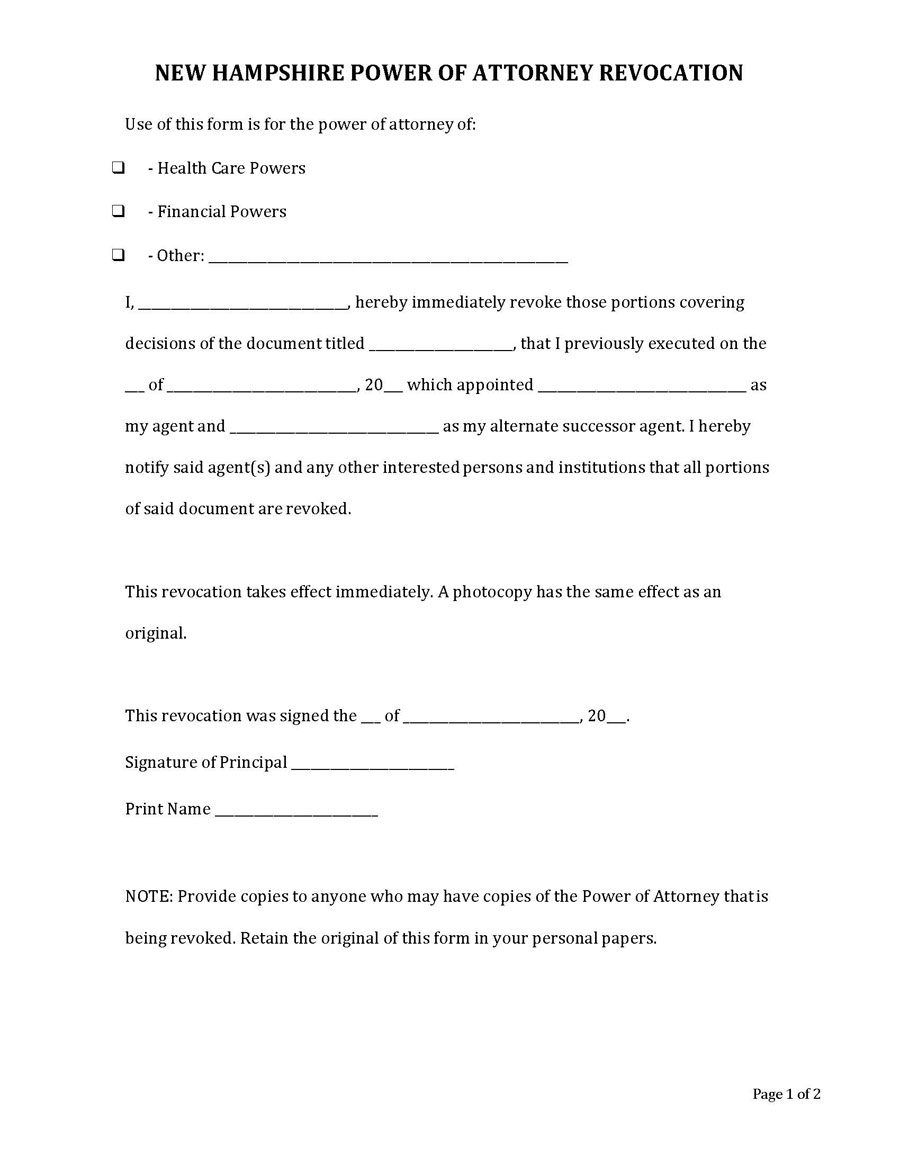

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

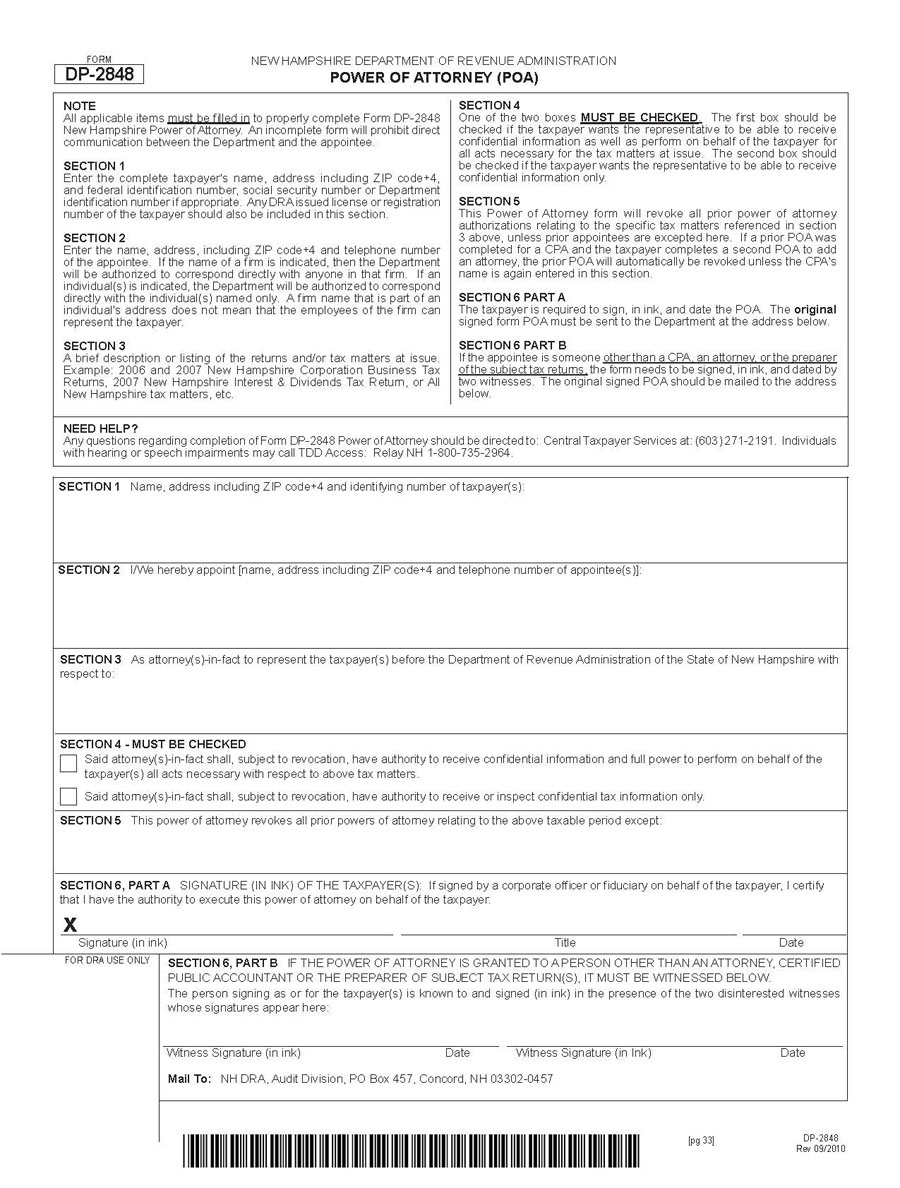

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

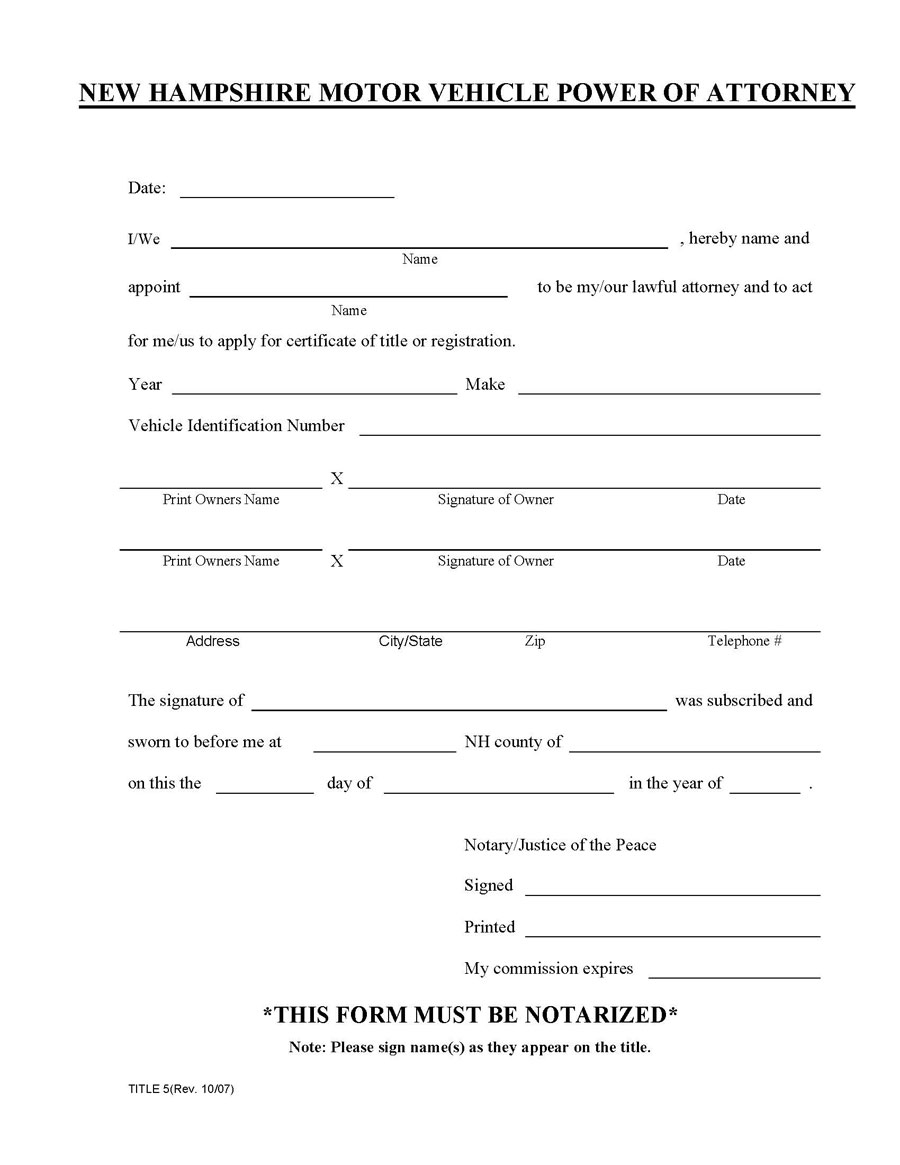

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

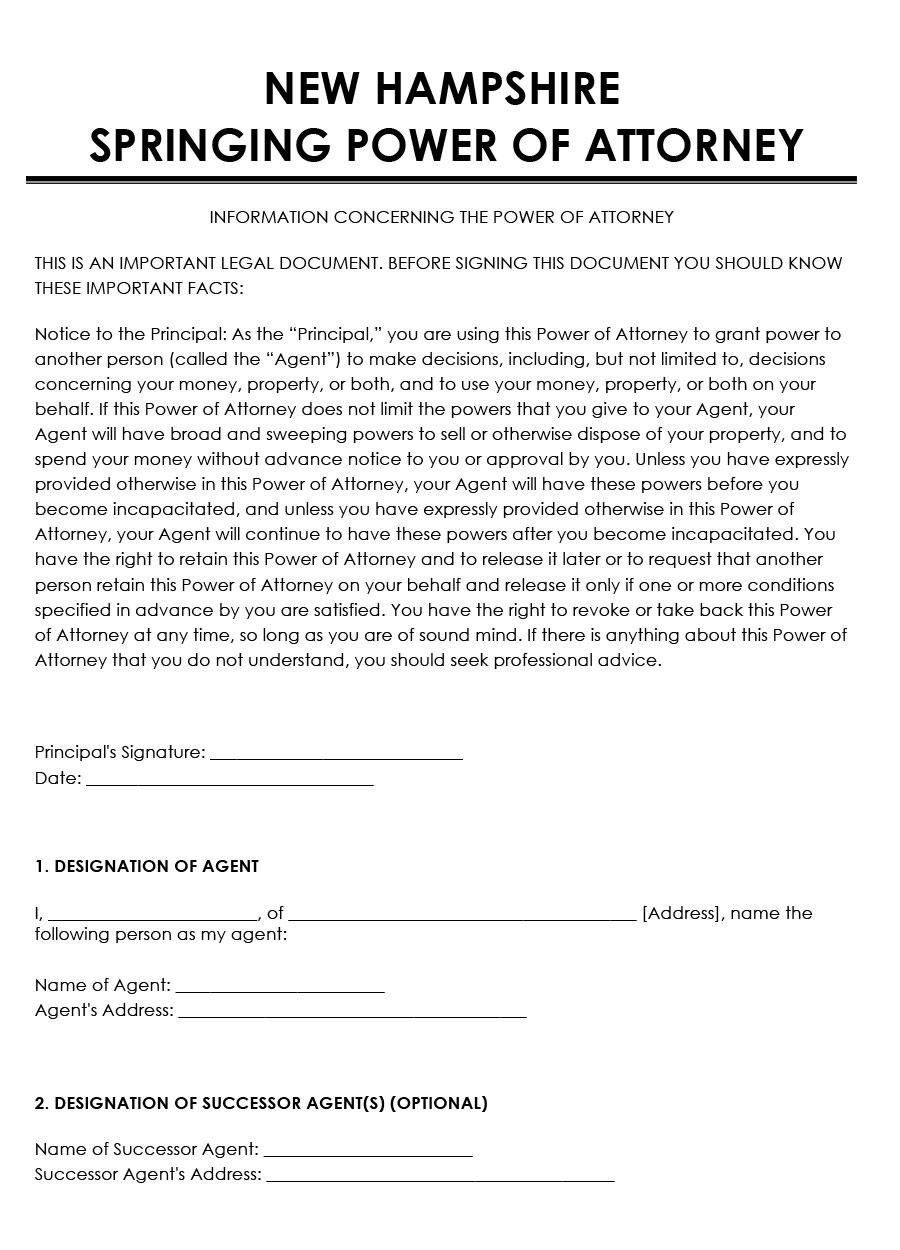

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

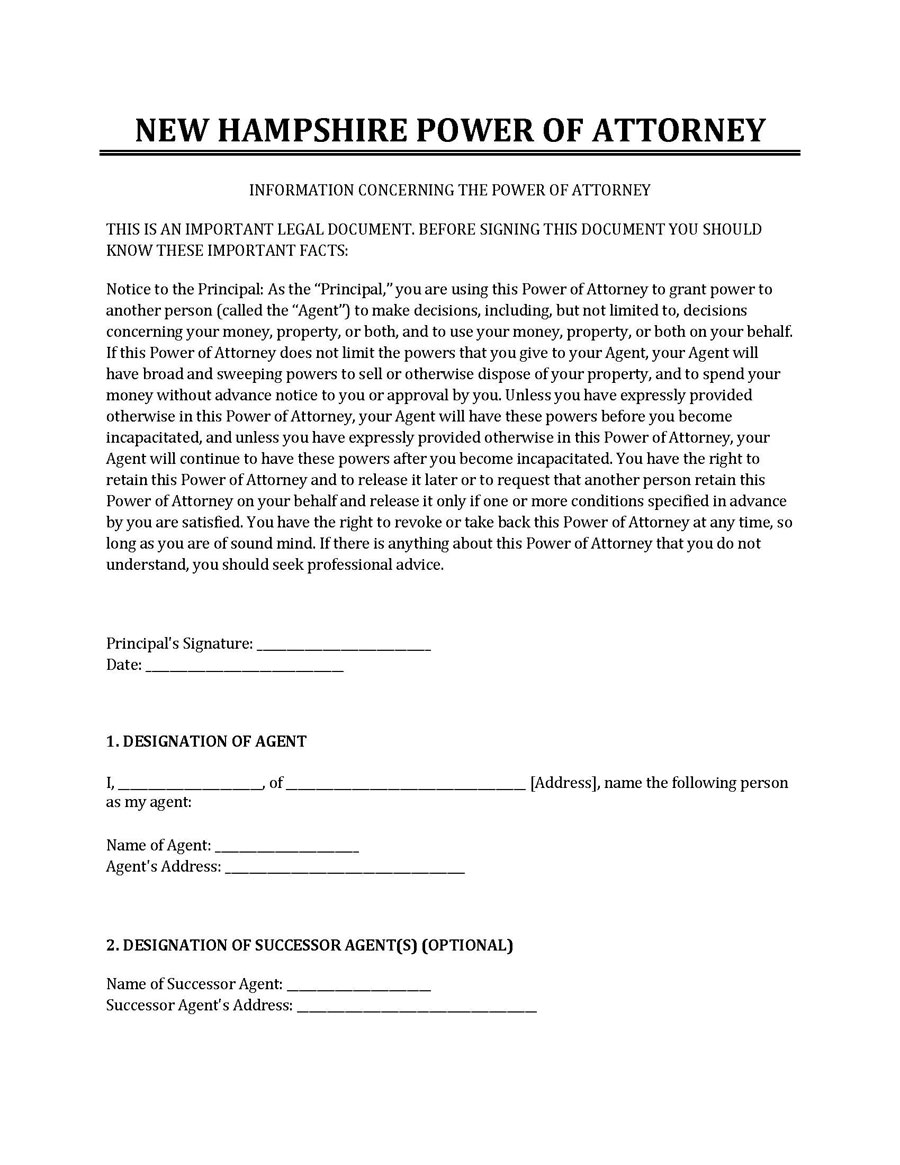

New Hampshire POA Form Requirements

A New Hampshire power of attorney form must contain the principal’s name, address, and signature. The date of execution and the agent’s details should also be indicated. A clear description of the powers that have been granted to the agent should be outlined and described. Information on when the powers begin and end should also be provided. Lastly, the principal’s signature must be indicated in the presence of a notary public.

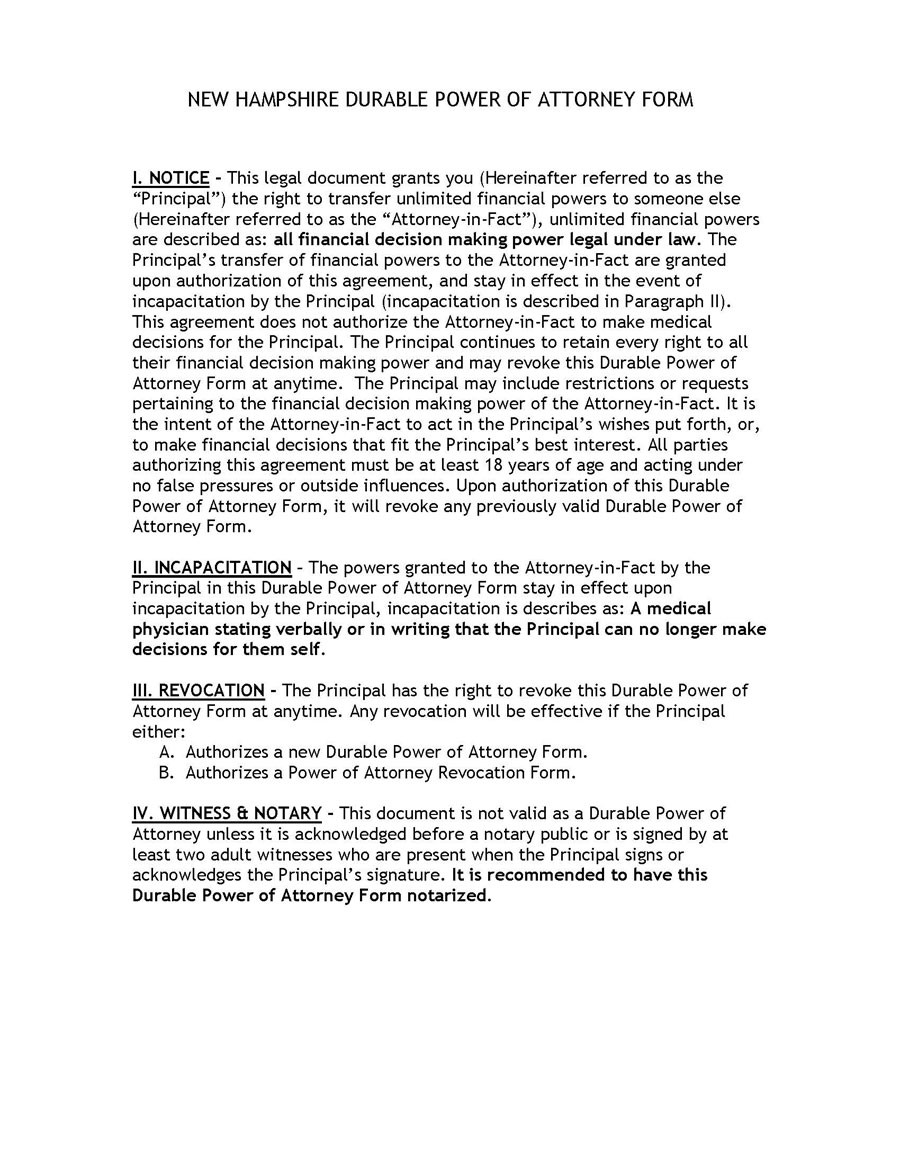

DPOA requirements

A New Hampshire durable power of attorney form must adhere to the laws outlined in Chapter 564-E (Uniform Power of Attorney Act). The form is presumed to be durable by default in the state of New Hampshire if it meets the criteria outlined in §564-E:104. The principal’s signature must be indicated in all forms for it to be legally binding; however, it does not need to be notarized, as indicated in §564-E:105. A statutory form can be obtained from §564-E:301. The form must contain the required language outlined by the state’s laws and regulations.

How do I fill out a DPOA in New Hampshire?

A durable power of attorney form in New Hampshire should be filled out appropriately to ensure that information is conveyed adequately. It also helps ensure that the principal’s intention to transfer powers to the agent is communicated effectively.

The following process should be followed when filing the form:

Designate an agent

The principal should begin by selecting an agent who will act on behalf of the principal in their best interest. Next, the principal should consider the specific decisions the agent will be authorized to make. They should also consider state laws regarding who can be selected as an agent. Once an agent is selected, their name and address, along with the principal’s, should be indicated at the top of the document.

Grant authority

Secondly, the principal should outline the types of powers transferred and the kinds of tasks the agent will be expected to perform. The powers may be general or specific. The principal should look into the language required by the state to ensure an adequate description of the powers.

Ensure form durability

Next, the principal should ensure that a power of attorney is durable so that the agent can exercise the powers in the event of their incapacitation. Again, a review of the New Hampshire state laws will help the principal note that a power of attorney within the state is presumed durable unless indicated otherwise.

Sign and date the form

Finally, the principal and agent should sign and date the form. The signatures must also be notarized as outlined by state law.

How do I Get a Power of Attorney Form in New Hampshire?

To get a power of attorney in New Hampshire, there must be a principal and an agent receiving the powers. There can be two or three agents if the first agent cannot carry out their duties. The document specific to the state of New Hampshire should be filled out and signed by the principal and the agent. The document should be signed in the presence of a witness or notary public.

Storage and Usage of DPOA in New Hampshire

Once the New Hampshire durable power of attorney form has been signed and notarized, it should be stored in the principal’s safe deposit box at home. Copies of the document should be provided to the agent, family members, trusted friends, and third parties involved, like banks, state agencies, and landlords.

Signing on behalf of the principal

First, the principal should contact the third party, place, or agency. This third party must be informed that the principal’s representative/agent will use a durable power of attorney. The principal should provide their ID and that of the agent to help identify who they are. Once the third party confirms these details, the agent can sign on the principal’s behalf.

Revoking a DPOA

To revoke the powers granted to the agent, the principal must fill out and complete a New Hampshire revocation of power of attorney form. If the principal is incapacitated and the agent is suspected of neglect and abuse of the powers granted, a third party can revoke the agent’s authority. Therefore, a principal must ensure that the individual selected to act as an agent is trustworthy and has their best interests at heart.

Conclusion

The form can be used in New Hampshire by a state resident to legally appoint an agent to carry out tasks on their behalf. A state resident can use numerous forms, including the durable power of attorney form. Individuals who use this must understand the types of powers they can transfer and state laws and requirements. For instance, it must adhere to the statutory laws laid out in Chapter 564-E of the Uniform Power of Attorney Act.

For a power of attorney to be obtained, statutory requirements must be met. The form must be filled out appropriately with the agent’s details, the grated powers, assurance of durability, and signatures from both parties. Once filled out, the document must be stored safely by the principal, and copies must be provided to relevant individuals. The principal must also have a clear understanding of how to revoke the powers granted to the agent.