Private Placement Memorandums are part of the private placement process and are defined as:

A private placement memorandum is a legal document that is presented to potential private investors in an effort to sell stock or any other security, e.g., bonds, in a company when raising capital.

A PPM introduces the investment opportunity to the investors and gives additional information that can convince them to invest in the business. Kindly note that private placements are regulated by the SEC even though they do not have to go through the same registration process for public offerings.

A PPM can also be referred to as:

- A private offering memorandum

- Unregistered offering memorandum.

PPMs can be used for diverse offers in a private placement. Such offerings include:

- The sale of common stock in a company

- When issuing notes/debt of a mortgage broker business

- When issuing promissory notes/debts of an LLC(limited liability company)

- The sale of shares in a mutual fund that is held by a trust

- The sale of bonds, for example, by a county financing authority.

When securing funds, you are not required by regulators to provide a PPM, but investors consider that a legitimate private offering is often best described in a private placement memorandum.

Additionally, a PPM is often confused with a business place due to the common purpose to raise funds; they are two different entities. A PPM is principally a more factual statement of the risks of investing in a business. It is more of a disclosure document and not persuasive in nature. Even though a PPM is used to address the internal and external risks facing a particular offering, it can market the business if well-drafted.

On the other hand, a business plan is more forward-looking in terms of market demand, growth opportunities, revenue changes, competitive landscape, etc. It is used to demonstrate the potential of a business (market). So we can summarize it all by saying that a business plan is a marketing tool.

Free Templates

The Information Included in PPM

It is important to note that a private placement is a security transaction, and like all security transactions, it is subject to anti-fraud obligations highlighted by federal securities laws. A PPM should be devoid of false or misleading information regarding the business/company, the securities being offered, or the offering. A PPM should be informative about the business as much as possible.

The following should be evident in the PPM:

- Nature of the business- for example, PPMs are common in restaurant and real estate offerings, yet they are rare in technology start-ups.

- Terms of investments- investors should be aware of all the terms the securities are being offered with; this helps investors in deciding whether the investment is worth it.

- Potential risks of investment- a PPM should highlight the internal and external risks associated with the investment or offering.

- Management team and structure.

Things to Know About PPM

Before writing or asking a lawyer to write a Private Placement Memorandum, there are several things you should consider:

Compliance as well as a marketing tool

A PPM acts as a dual-purpose document that serves as compliance and a marketing tool. Despite the significant distinctive aspects between compliance and marketing, when writing a PPM, the aim is to strike a balance; however, the balance should weigh more towards compliance (mitigating risk). As much as you and your lawyer(s) would like to loop in the investors on potential risks of the investment, it should not be at the expense of the investor’s interest.

Should be drafted in simple English

Even though PPMs are more inclined towards the legal issues associated with private securities, plain English (simpler wording) should be used when writing. Complex legal jargon should be avoided unless absolutely necessary. Remember, the objective is to sell the investment and the issuing company to investors. Investors would find it hard to pour their money into that which they do not understand.

Focus on legal issues

A PPM should primarily focus on the legal issues (terms and obligations) surrounding an offering. After all, it is a compliance document. Any federal, state laws or SEC regulations related to private placements should be observed. When offering private securities, always ensure you are eligible for one of the exemptions of registration by the Securities and Exchange Commission. Being aware of the exemption in question is important as it influences some of the PPM requirements by dictating the type of information disclosure expected.

No one-size-fits-all approach

There is no single format that can be used in every type of PPM. The contents of a PPM will be determined by the following aspects:

- Industry

- Structure of the deal

- Target audience

- Specific exemption observed.

Therefore, always consider and research these factors whenever you wish to prepare a Private Placement Memorandum. The exemption to be heeded is key-it will outline what is legally expected in your PPM.

Warning: Beware of software products and PPM mills.

Software-produced PPMs should be avoided. Why? Well, the answer can simply be put as- every private security offering has its own specific risks that cannot be generalized. Off-the-shelf PPMs are curated on a general perception and can miss key information that would greatly influence the decision of the investor.

If such information is missing and the investor chooses to raise the money only to find out that there were more risks than brought forth, the offering can potentially end up in court and the PPM would be part of the legal process. The judge or jury would rule depending on whether your PPM provided enough information to the investor on the risks associated with the risk of the offering, which would mean legal action if not all the information was given.

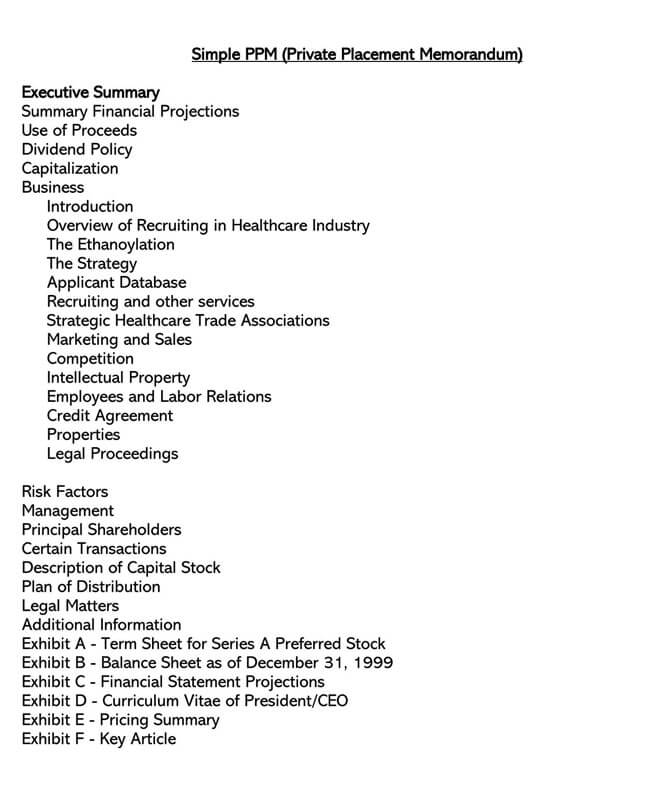

Format of a PPM

Now the question is, typically, what can you find in a PPM? Ordinarily, there are basic elements that can be included in the memorandum. They are used to categorize the contents of a PPM. The amount of information provided in each section will vary depending on what you are raising capital for.

They include:

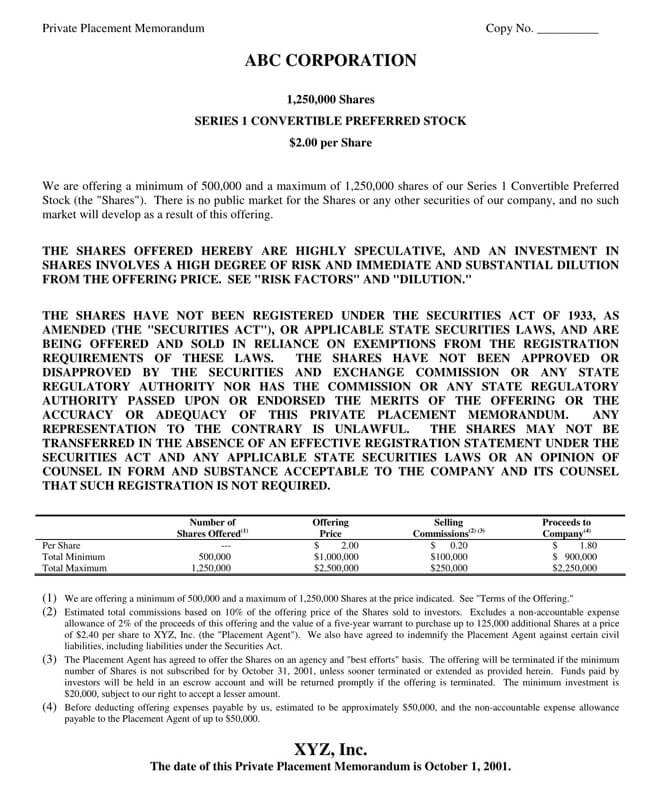

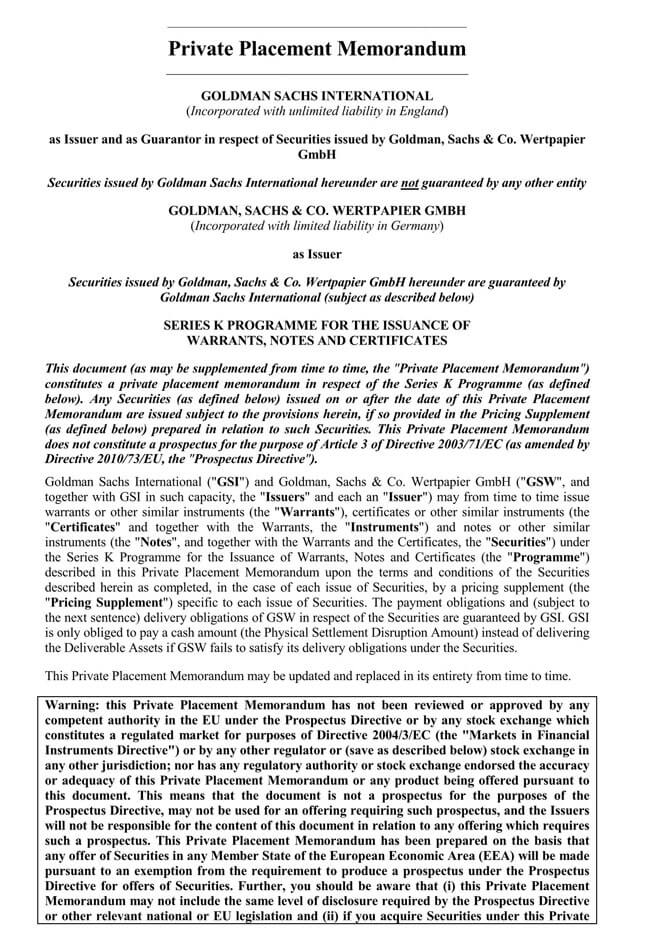

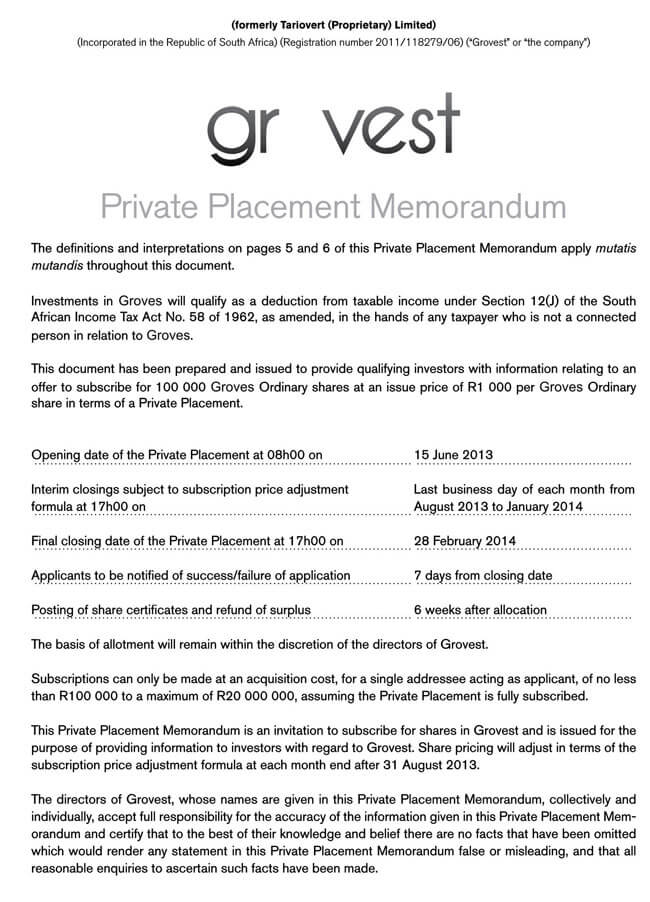

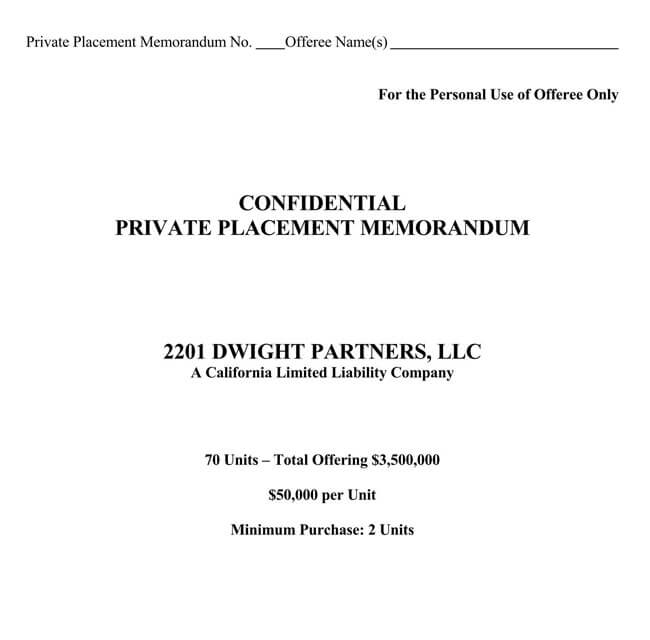

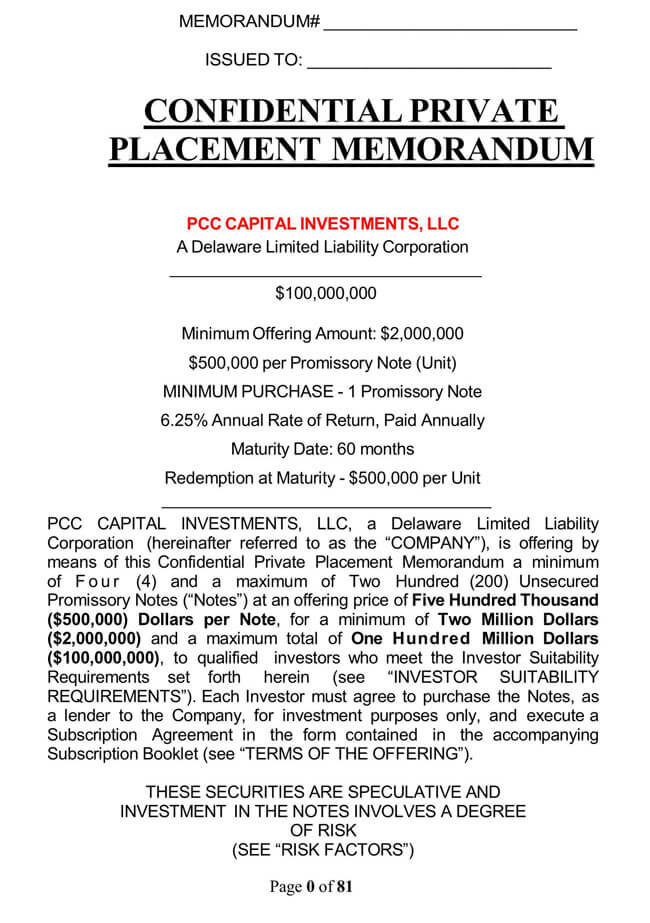

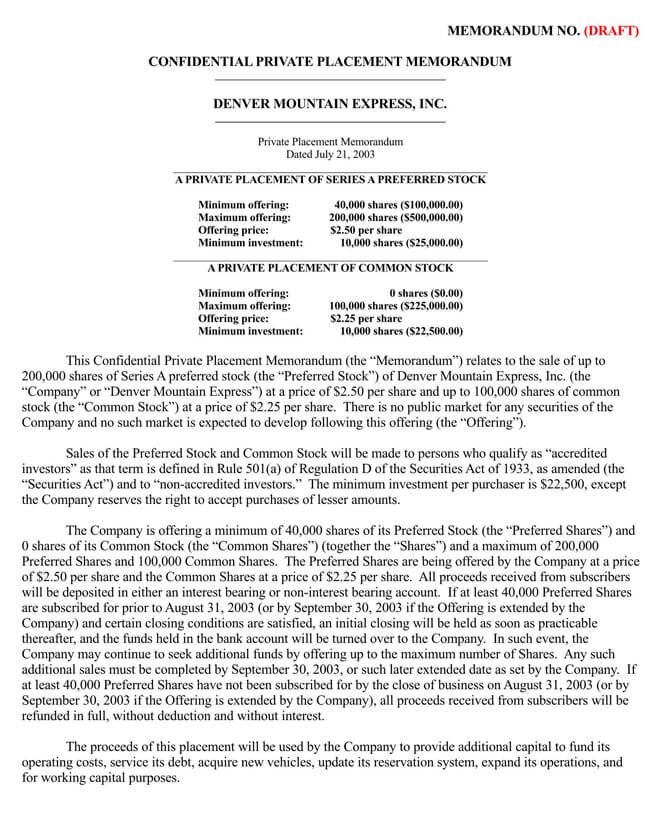

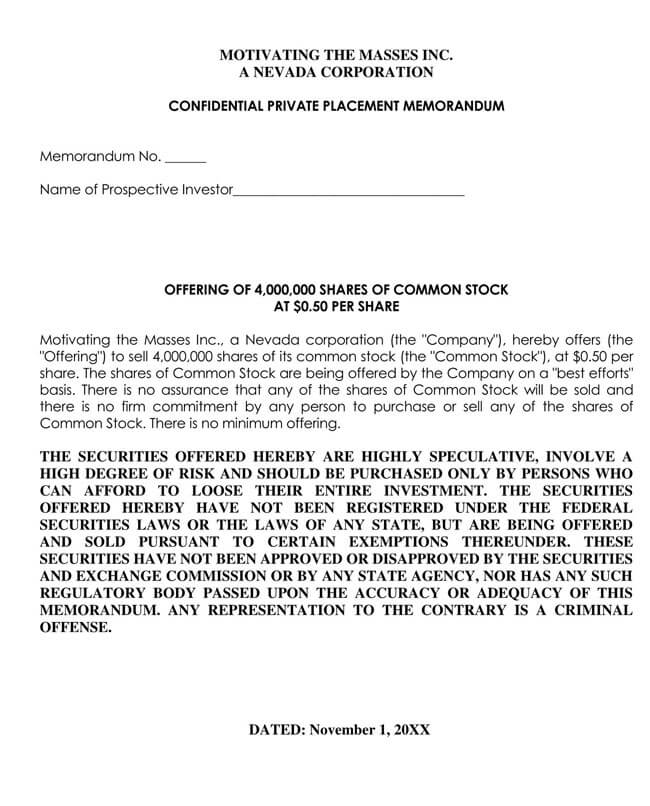

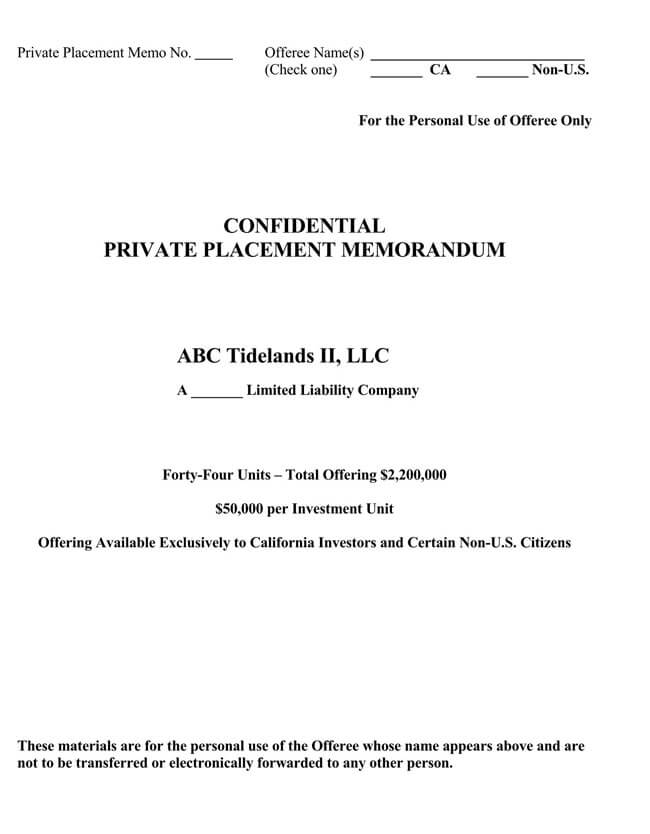

Outline of the PPM

The outline is usually the first page of a PPM. The basic terms of the offering are provided in this section, accompanied with a brief description of the company in terms of a brief description of the issuing company, the core business, and any obligatory “legends” expected under the federal and state laws.

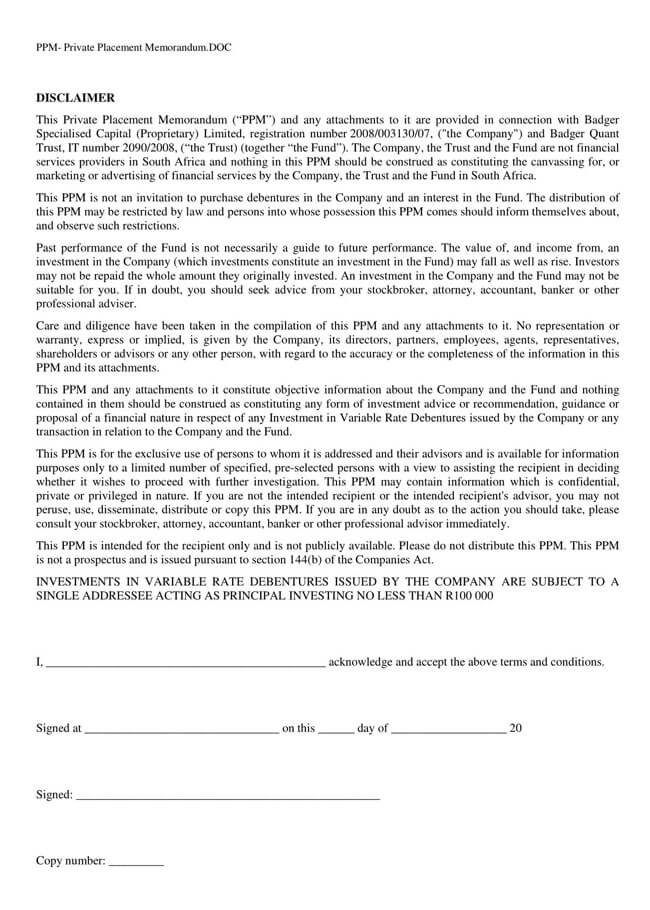

Notices to the investors

A PPM will contain various notices to potential investors that are either required by the investors or just important. They are regarded as disclaimers, and in some instances, they are requirements under securities laws so that an issuer can enjoy the privileges of exemption from registration.

Some of these notices address the following aspects:

- No registration to let the prospective investors know that the securities are unregistered hence are offered under some exemptions, a condition for Private Placements.

- A notice stating that the securities being offered are not being sold in the public securities market should be provided

- Private securities are characterized as high-risk investments; this is an affirmation to this.

- The restrictions associated with the transfer of securities.

- An affirmation that no one is authorized to make representations other than the issuer. Assures the investor(s) that the official and legal authorities are making the offer.

- The validity of the descriptions and summaries in the form of a statement of assurance that they are based on actual documents can be included.

- The issuer will provide no legal, business or tax advice. Investors are required to hire their own or opt not to hire.

- A statement indicating that the issuer would be well within their rights if they choose to modify or withdraw the offering at hand.

- Notice to the investor that they are allowed to ask questions, and information will be provided accordingly.

Executive summary

An executive summary is meant to give the potential investor a brief but thorough overview of the business, management, and available terms of investment. An executive summary helps the investor get a quick understanding of the mentioned aspects of the issuing company.

An executive summary will typically contain:

- An abstract of the business and offer made by the issuer.

- The current capitalization of the issuer

- The material terms associated with the offering and securities.

- The requirements and restrictions of any investors willing to participate, for example, only “accredited investors” as termed in Rule 501 of Regulation D of the Securities Act.

- A reference to the risk factors of the offering.

- A list of the necessary documents’ investors will sign to participate.

Disclaimers and other legalese

The memorandum should also include disclaimer privileges that the investors should expect to enjoy. This includes litigation. Pending or threatened lawsuits should be listed. In matters regarding taxes, the issuer should disclose the tax affairs involved in the business. Tax information can be brief or lengthy depending on the size of the business or type; for example, partnerships and s-corporations have high tax implications.

Company purpose and overview

This is the most marketing inclined section of a PPM. It gives a description of the business by indicating the products and services, the industry, goals, performance history, advertising and marketing strategy, competition, intellectual property, employees, and assets. It gives a clear representation of the company’s structure in terms of management and operations. It should be more factual than if the same aspects were to be addressed in a business plan.

To effectively cover this section, here are the inclusions you should put:

- A description of the company’s main operations- current and planned.

- Information about your target market- who are they

- A description of the industry the business operates in, that is, in terms of competition, size of the issuer, regulations in the industry.

- An outline of milestones and challenges expected for strategic plans, for example, stages of product development.

- A portrayal of the business processes such as methods of manufacturing/production means of selling and distribution of products.

- A summary of the company’s marketing plan.

- A description of the business’s sales cycle, that is, how products and services reach the consumer.

- An acknowledgement of the probable risks in the supply chain and the variations in revenue generation. Helps build trust as a business with a constant increment in revenue is not realistic.

- A provision of the number of employees and the general organizational structure of the company.

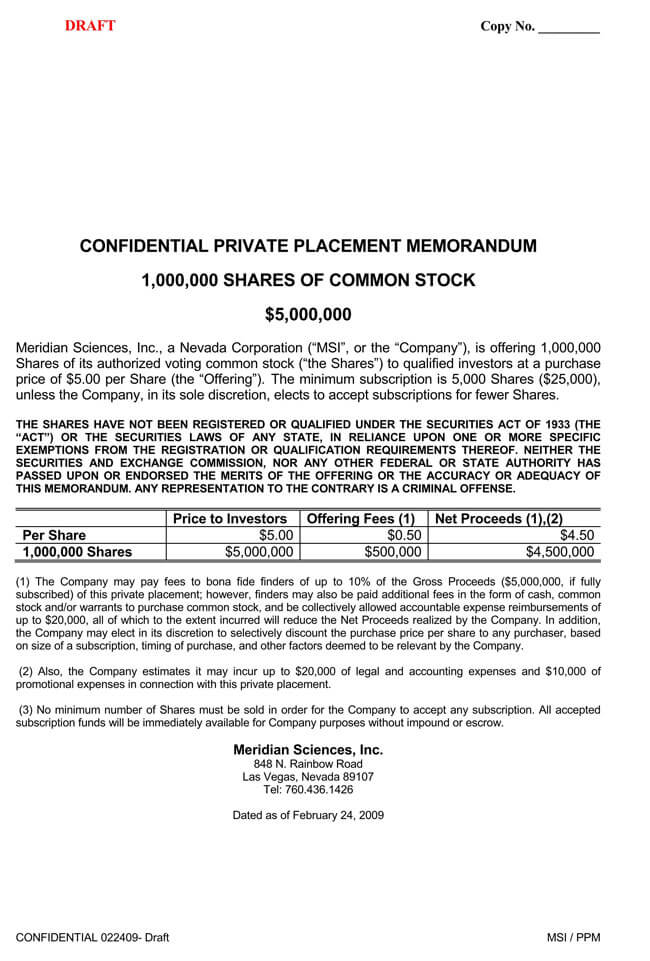

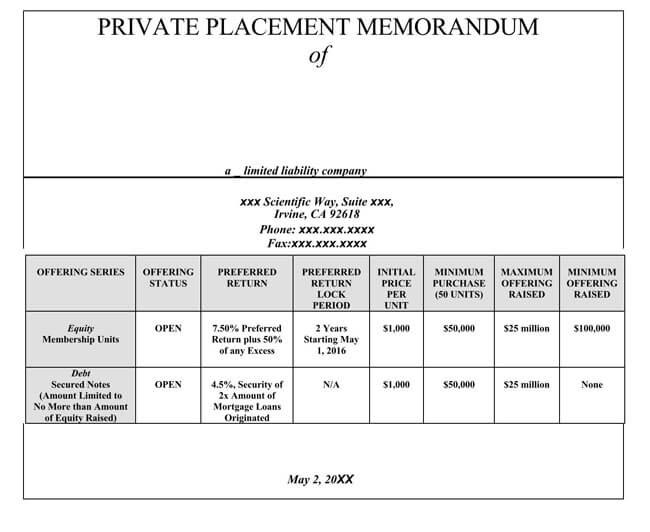

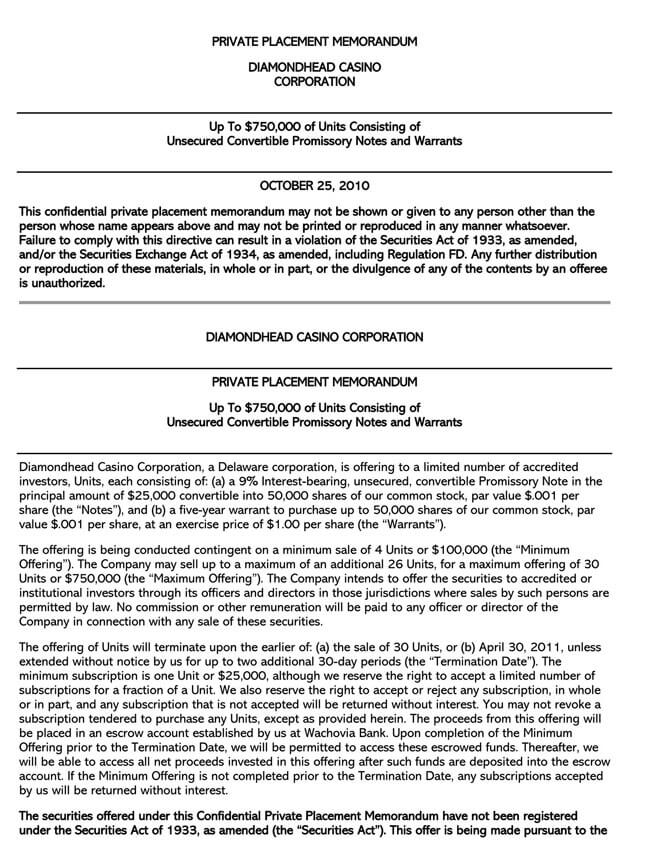

Terms of offering and securities

It is important to provide prospective investors with in-depth information about the securities being offered for purchase. This information includes the type, price, and terms of the offering.

Some of the things to include are:

- Who can invest, that is, accredited or non-credited investors or both?

- Minimum investment amount

- The maximum allowable amount of funds that can be invested in figures- absolute dollars vs. percentage of net worth.

- The appropriate risk tolerance to be expected in this type of investment.

- The laid-out plan for the distribution of the securities.

- Is there a finder’s fee for anyone who helps identify potential investors?

- The documents an investor must sign to invest

- Possibility of dilution should the company issue securities in the future.

Other terms include liquidation preferences, anti-dilution provisions, voting rights, ownership percentages, information rights, and any other terms relevant to the issuer.

Subscription process

This section in the PPM is used to describe how the funds raised through the offering will be used and the approximated amount to be allocated to each category. It also highlights the guidelines to be used for investing in a securities offering. It typically includes four to five categories and a maximum of twelve. Some of these categories include transaction fees (legal, accounting, finder’s fees, etc.), compensations ( for example, salaries, bonuses), pro forma financial statement, etc.

Business and management section

This is a descriptive section of the structure of the management team of the company. It highlights the relevant background information, experience, accomplishments, and setbacks for vital members in the command hierarchy. You can cover this information by providing biographies of the management team (officers, directors included), past professional experience (should be more than five years), successes and failures, compensation and conflicts of interest. Failures and conflicts interested are important; remember, the aim is to be as honest as allowable. Where members of management own some securities, ensure that you declare it in this section of the PPM.

Financial information

This section is used to describe the financial position the company is at the moment, regardless of the stage of the company, e.g., start-up or expansion stage. The information to provide in the financial section includes company capitalization, historical financials, pro forma financials, financial strategies (forward-looking language can e used), financial risks (cross-referenced from the risk factors section), and any other commentary deemed necessary.

Risk factors

This section can be easily regarded as the most important section in the PPM in terms of risk assessment. It is where the balance between compliance and marketing is achieved. The risks should be sorted into general categories and within each category ranked in order of priority, starting with the most significant. Some of the categories include; company-related, industry-related, offering-related, securities-related, etc. each risk should be stated in a simple, bold sentence or two.

Repetition should be avoided, and cross-referencing should be used to avoid the same. Generic, boilerplate risk factors should be avoided. As willing investors know the degree of risk associated with private securities, always aim to be specific and avoid using risk-mitigating language when outlining the risk factors. There is a wide variety of risk factors, always do your research to determine the ones associated with your company before writing a PPM.

Exhibits

Exhibits are formal documents that can be provided as evidence in a court of law. A PPM should have a section for this. Some of the exhibits include; subscription/purchase agreement, governing documents, e.g., Certificate of Formation/incorporation, instructions for investing, material contracts, W-9, and an investor questionnaire.

Professional Tips to Consider

To ensure a PPM serves you and the investor effectively, there are some tips professionals in the offering industry recommend one to consider.

They include:

- Always try and align yourself with a securities lawyer despite the extra cost expected; they ensure that your PPM is well written, and since they are more experienced, it will probably save you time and give you a quality PPM.

- Be wise whenever raising private investment capital. Be attentive to detail, especially in terms of the conditions investors will give so as to invest.

- A PPM is not always a requirement for particular securities exemptions available, but one should not automatically decide not to use one unless their research or situation dictates so.

- Always aim to effectively communicate with the investors on a PPM. Honesty is key and where there are risks, let them know. Should this be off-putting to the investor, it is still okay. It is a better position than acquiring the funds through withholding information or misrepresenting the issuer.

Frequently Asked Questions

The legal fees estimated for writing a PPM range between $10000-$40000. This will be varied/dependent on the size of the company.

No. Private placement is the sale or issuing of private securities. Debt or equity are securities that can be issued through private placement.

Final Words

Raising funds through private securities is a risky process, and doing it by the book to the letter can prove to be very vital in the long run. A PPM is an opportunity for you to explain the dynamics of a private securities offer while stating the risks and terms associated with the offer. While it is taken as a document of compliance, it can also market the investment opportunity when well written. As much as you want to let the prospective investor know of the risks associated with the offering before they invest, it is good to write it in a way that convinces them that it is a worthwhile investment. Always use simple English and be factual. Providing misleading or incorrect information can lead to legal action. Try to use legal counsel when coming p with a Private Placement Memorandum.