A collection letter is a notification informing a customer of a due payment.

It is sent by different people, especially landlords and business owners, to borrowers and debtors for different purposes. This letter informs, inquires, reminds, and warns the debtors of possible legal actions resulting from payment defaults.

It serves three purposes for the business owner and creditor:

- It informs the debtor of outstanding debt: Late payments demand a form of reminder and information from the defaulter. It highlights that the payment date and the expiration period have passed. It is more of a goodwill message to the defaulter to pay up or face the consequences of a default.

- It initiates payment negotiation: A creditor either renegotiates the payment plan or requests for the payment procedure to commence. If there is to be a renegotiation, a defaulter has to comply with the terms of payment unfailingly to continue business relations between them.

- It initiates the legal process: It is the last stage in writing. The letter warns a debtor and defaulter of the legal processes that might arise from the inactivity of the defaulter. It notifies them of the urgency of paying to avoid litigation procedures.

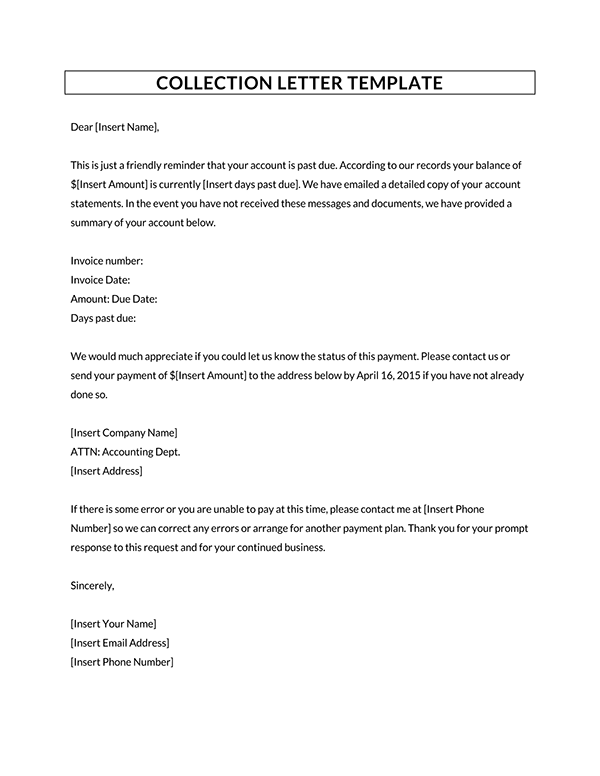

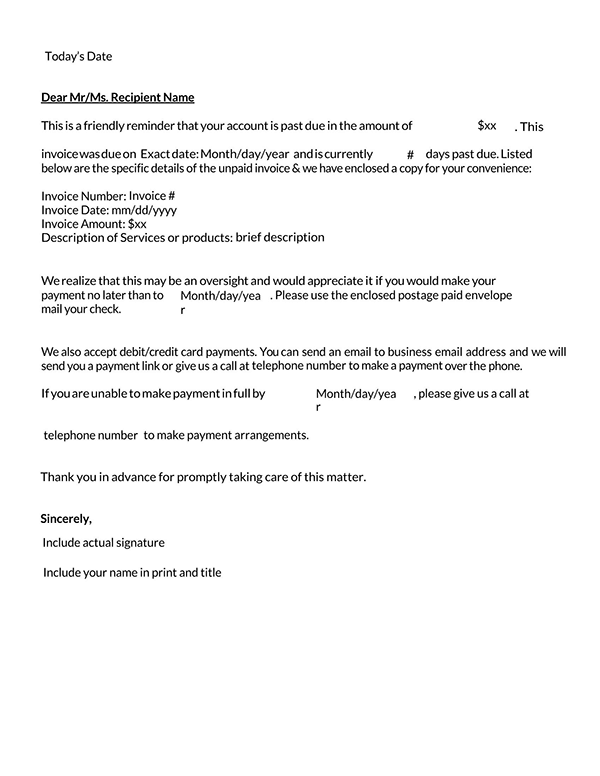

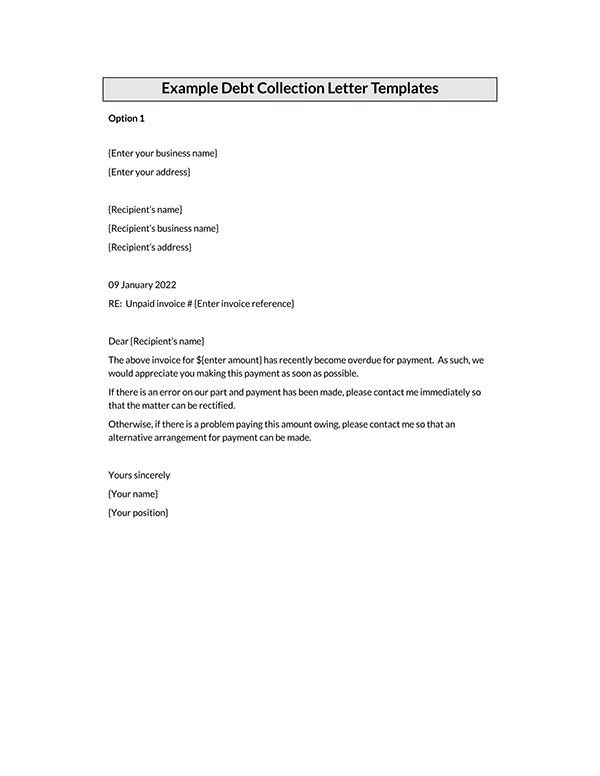

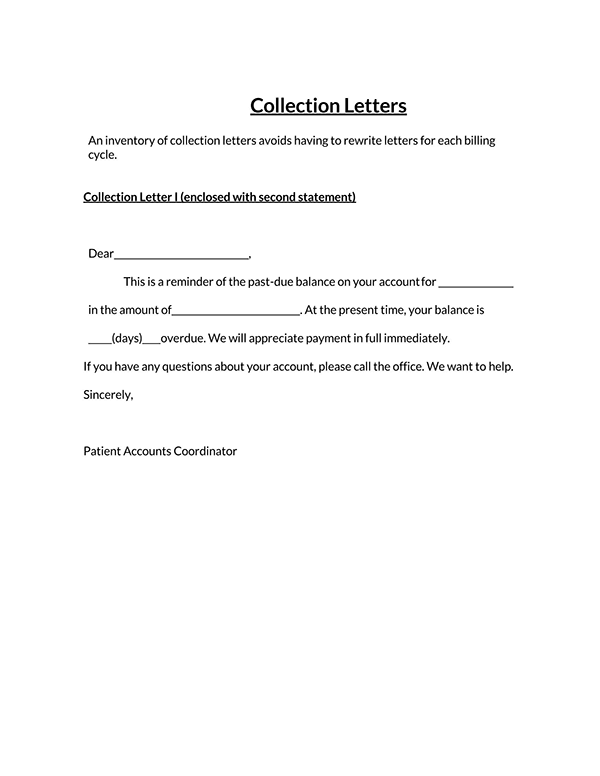

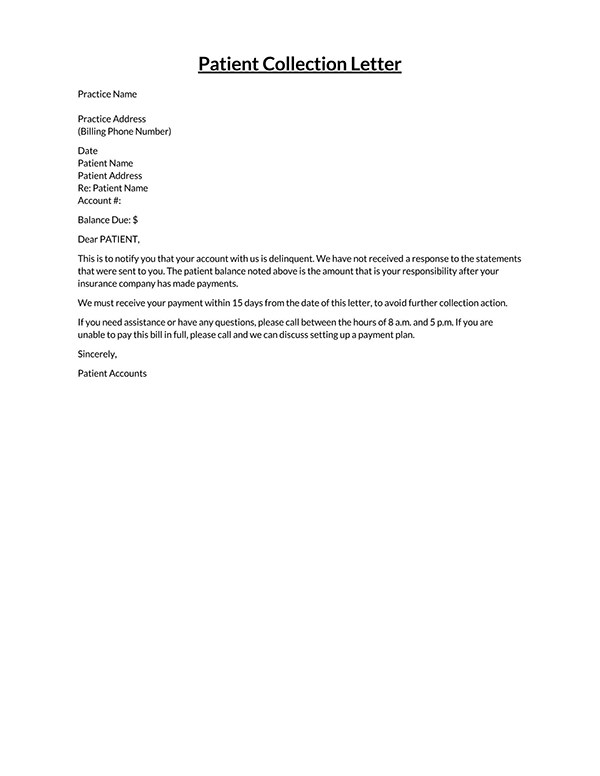

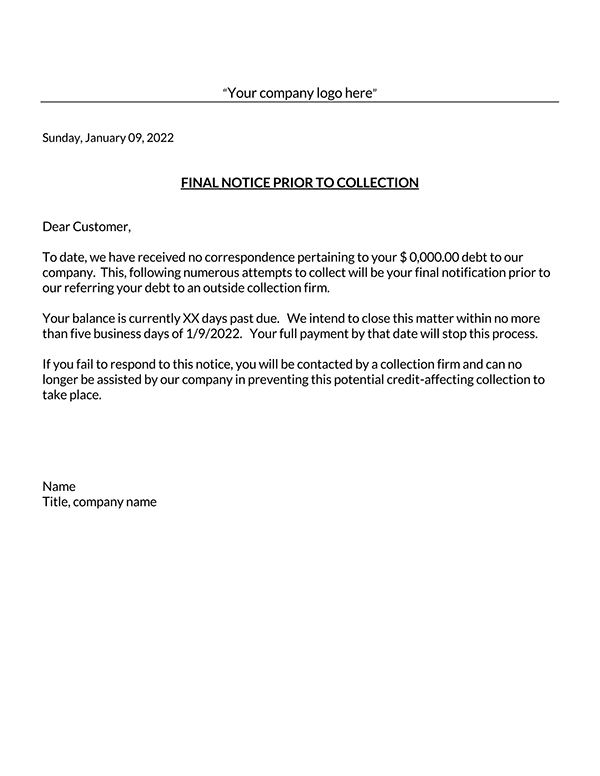

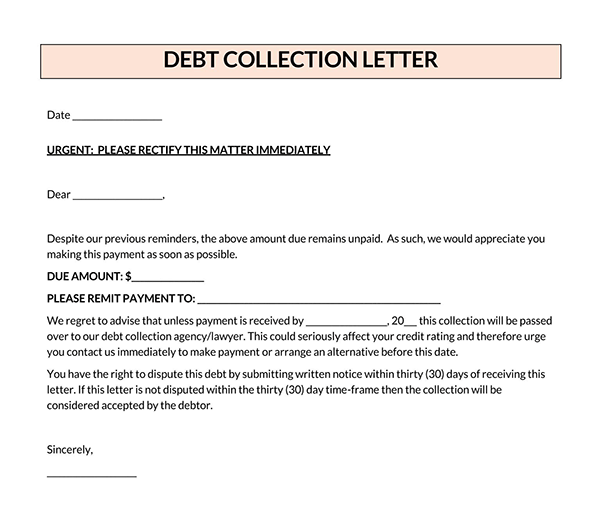

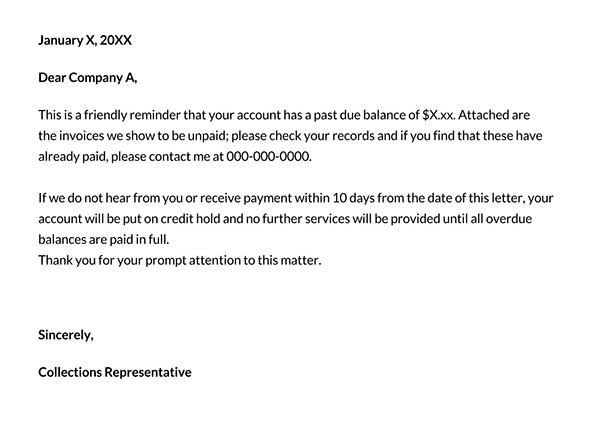

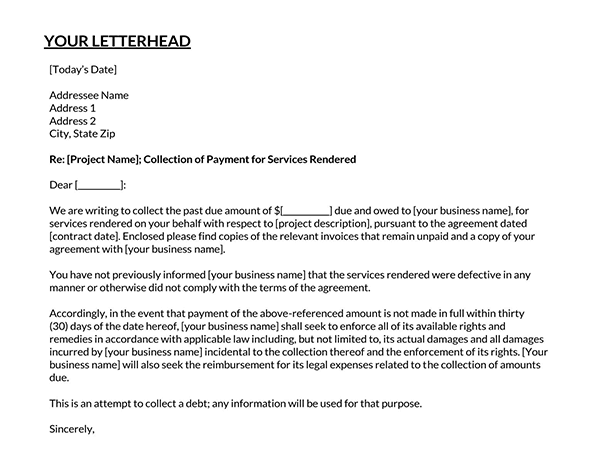

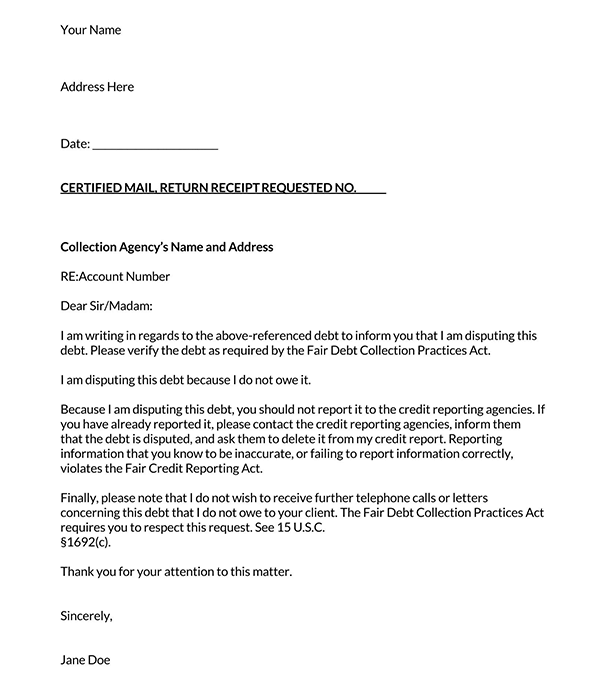

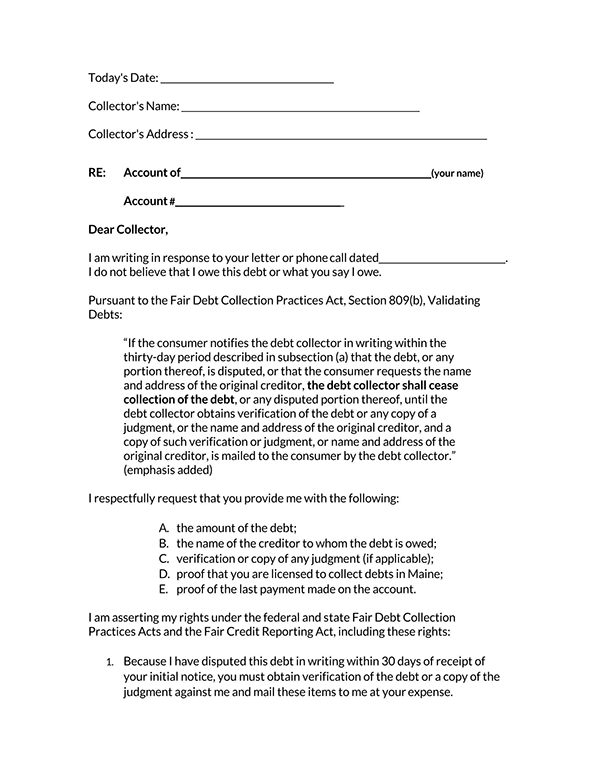

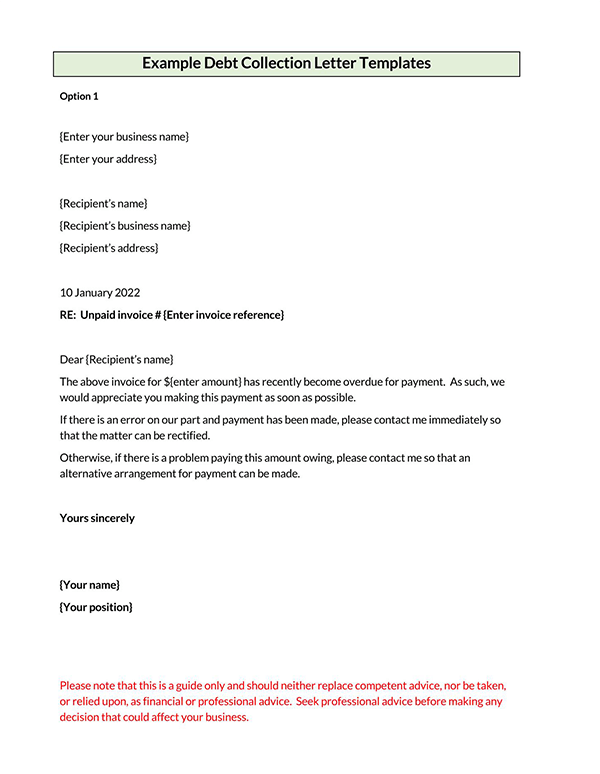

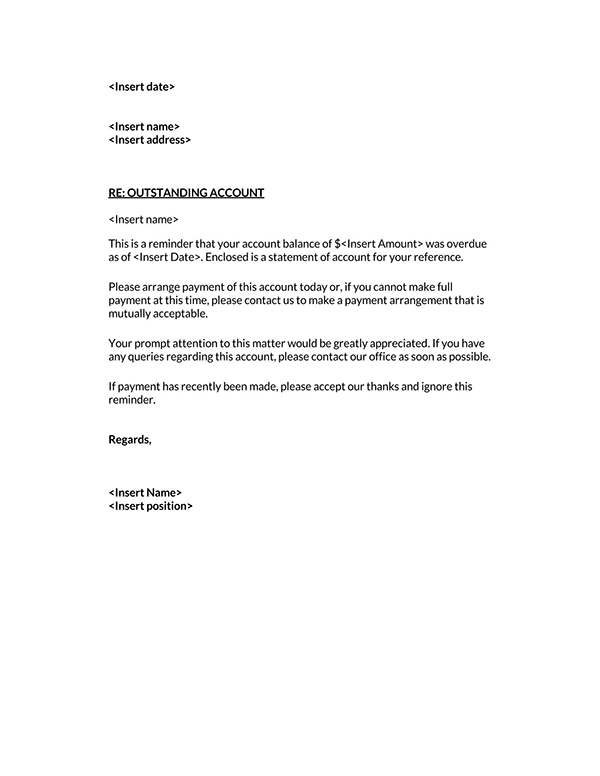

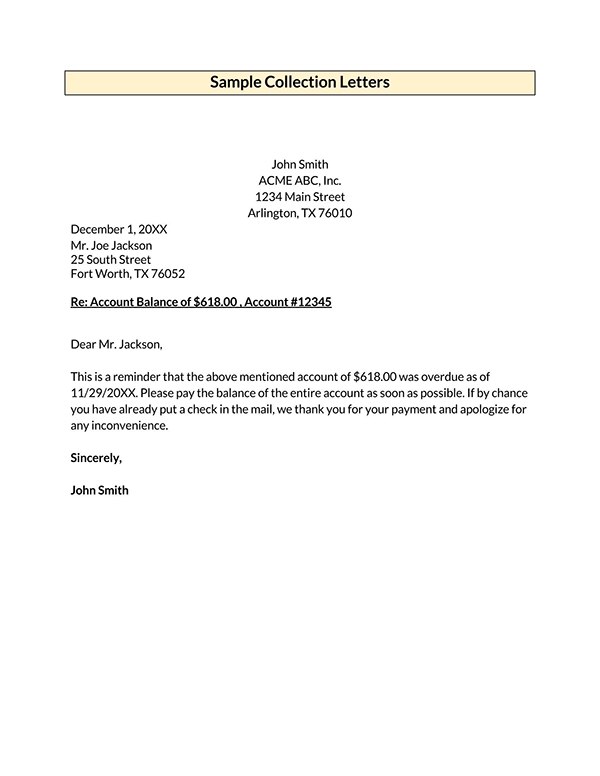

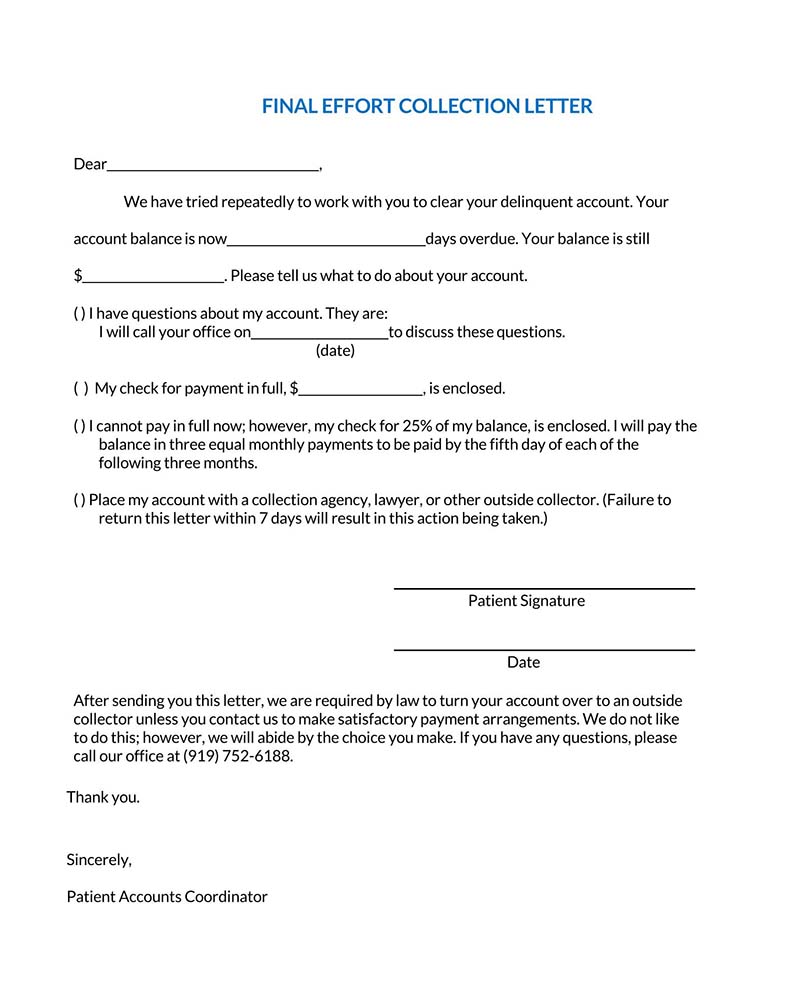

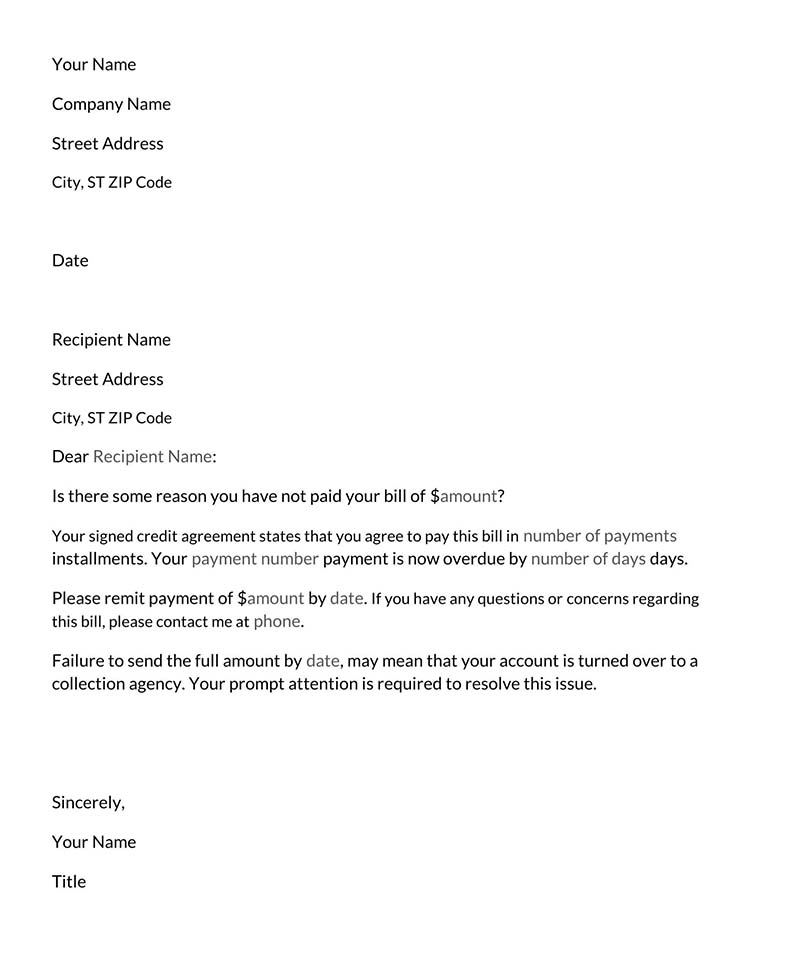

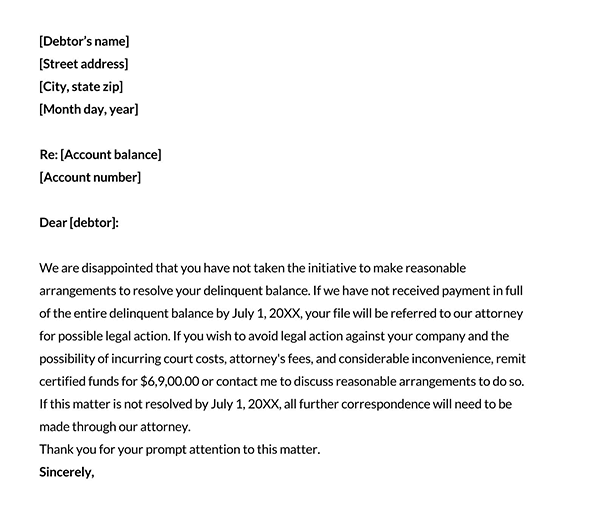

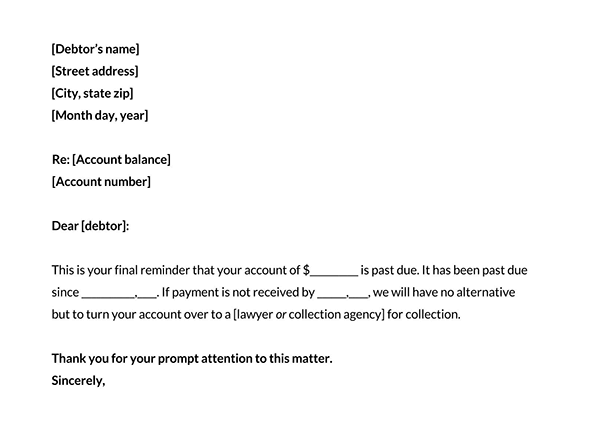

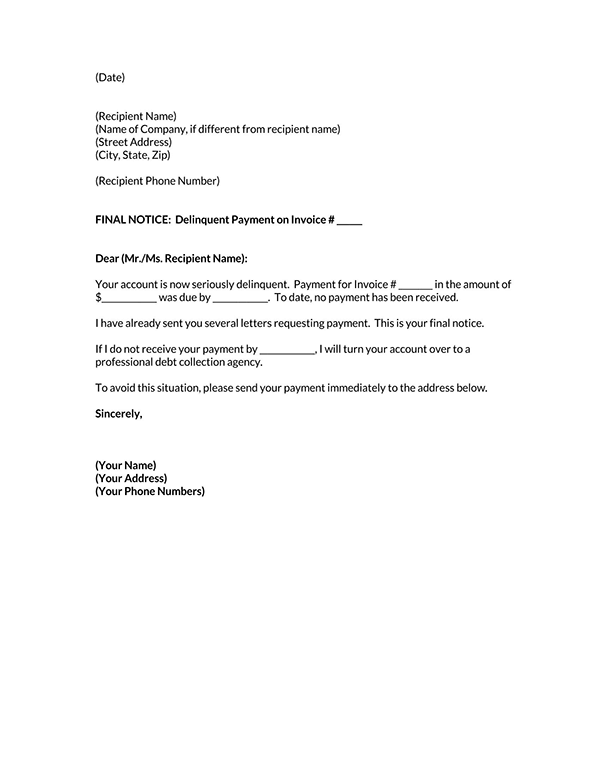

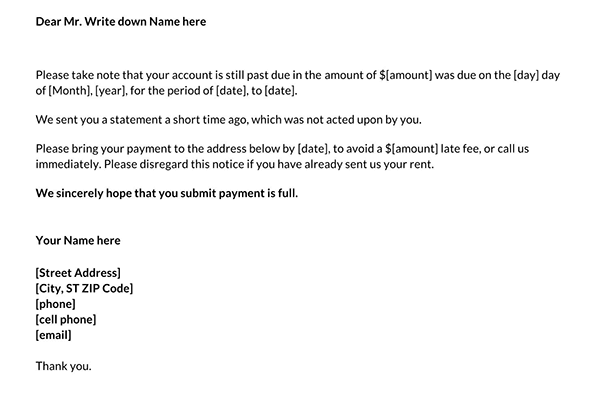

Free Templates

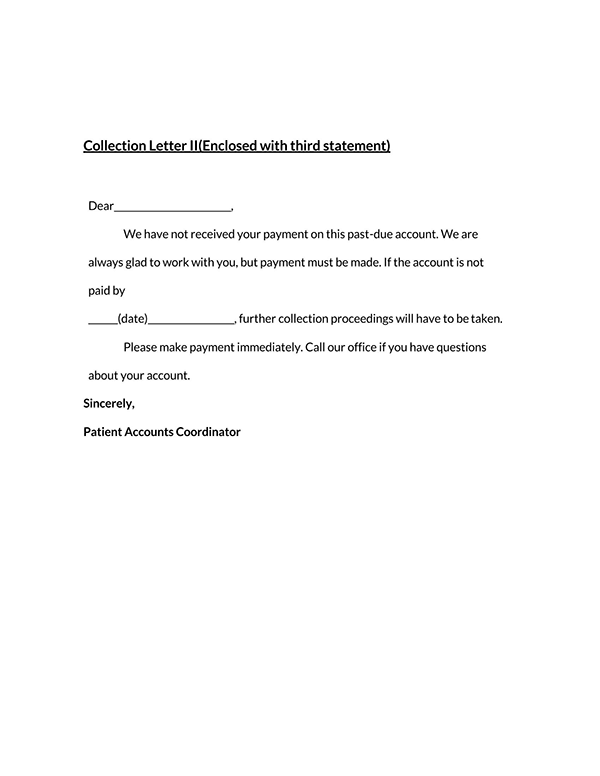

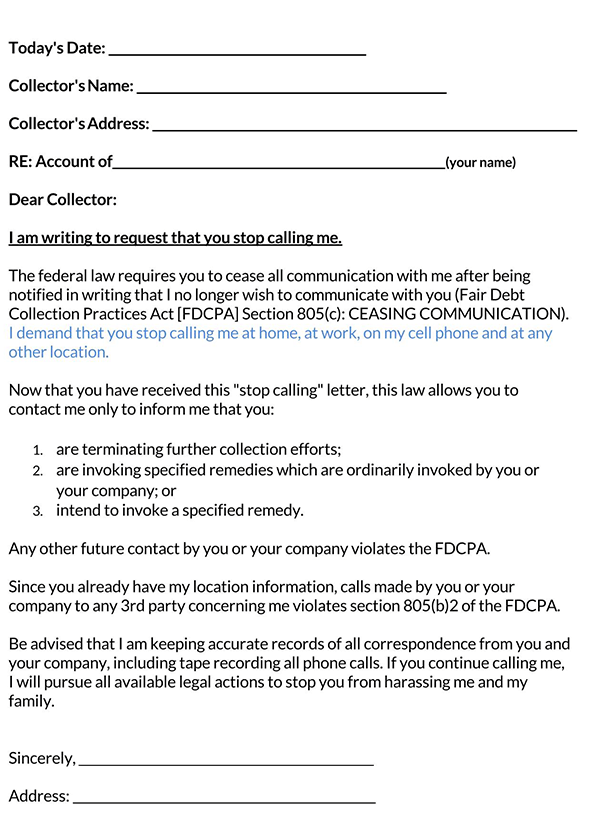

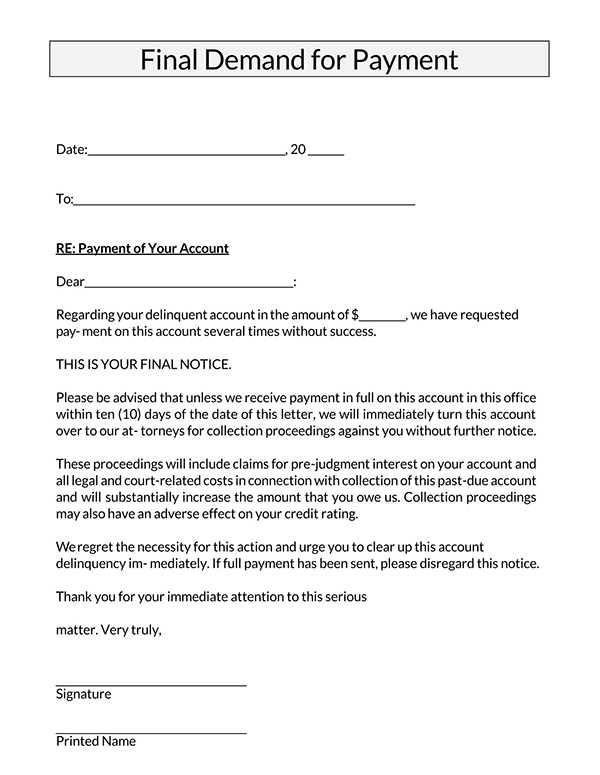

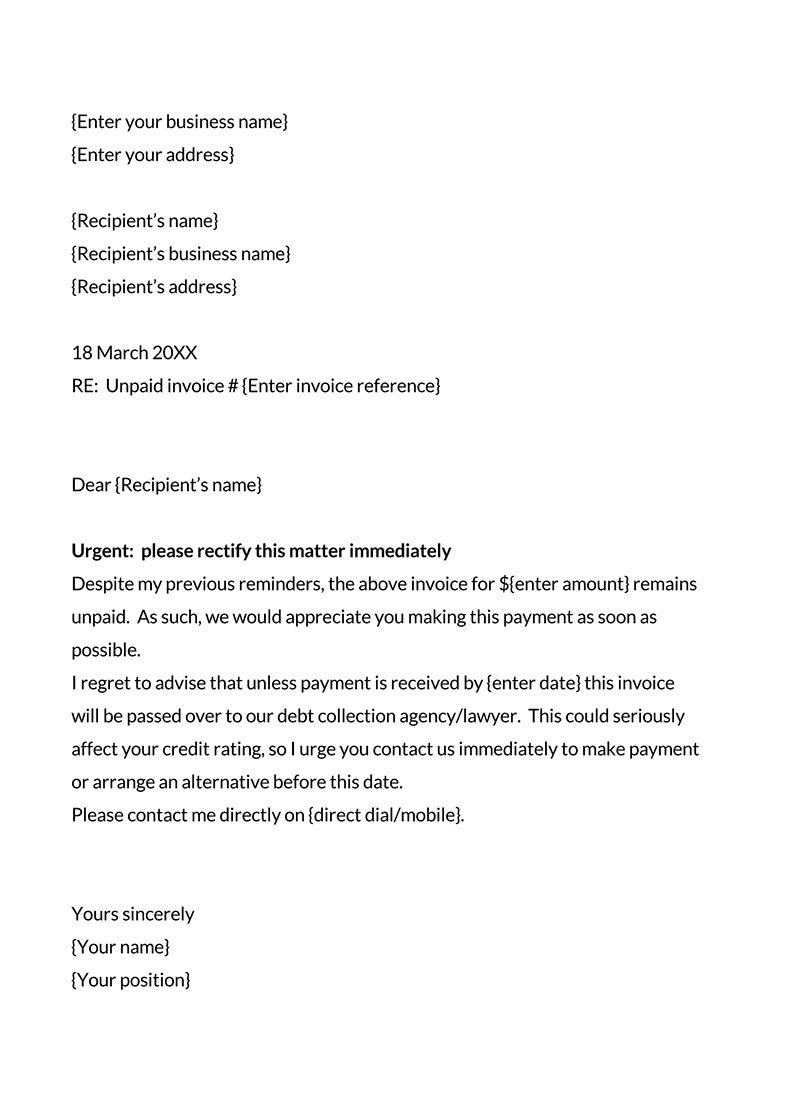

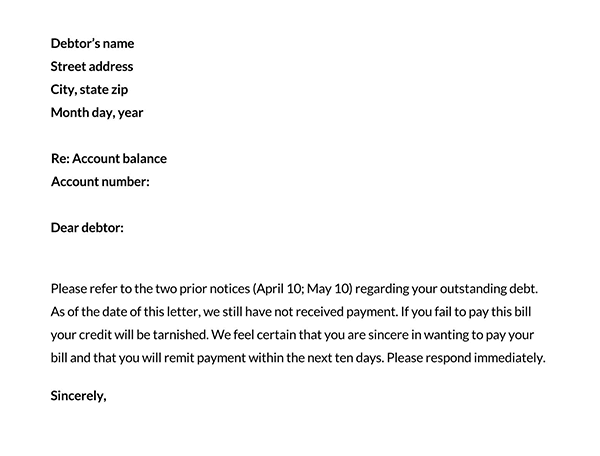

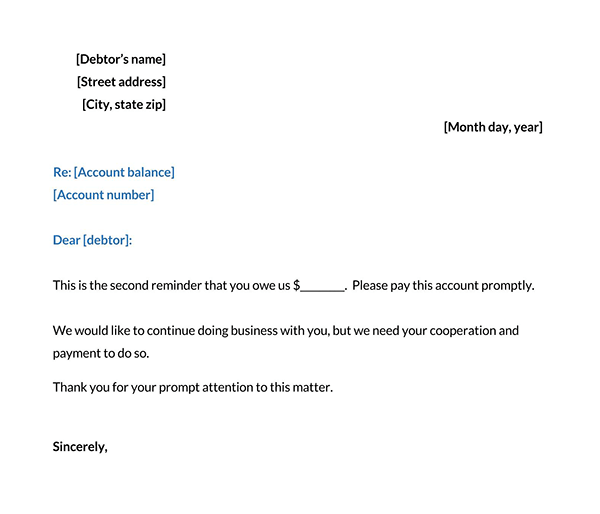

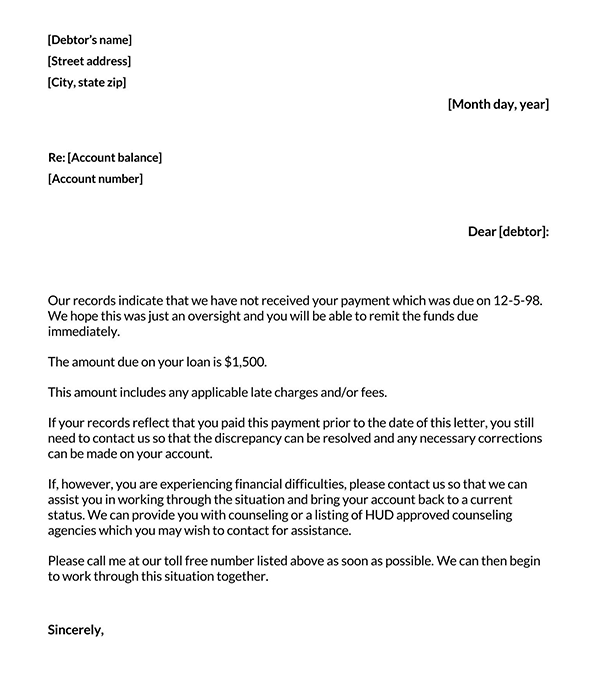

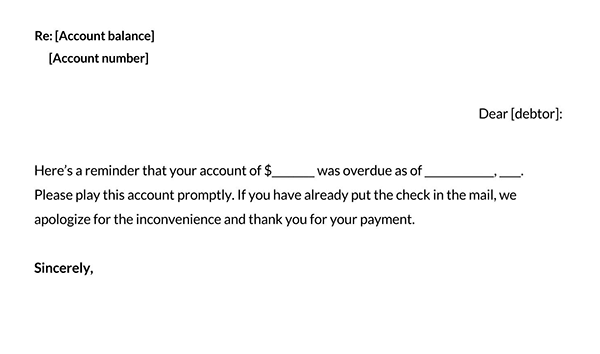

Following are some free templates for you to get a better understanding of the sentence structure and tone of the letter:

Important Features of the Letter

A good letter should have all of these features to achieve the desired effect for a business owner or creditor. These features serve as the guiding principles for writing an efficient letter.

These are:

Series of letter

A collection letter has to inquire, appeal, and notify debtors about the necessary actions concerning a default. It is sent in a series with the sole objective of payment compliance.

Objective

The objective is to spur debtors to pay their debts. They also function as a notification to arrange a new payment procedure.

Governing principle

The sole purpose of a governing principle is to ensure compliance and the recovery of debts. It does not prescribe the interaction between sellers and debtors after payment has been made.

Referring to the previous letter

This letter is also known as a dunning letter, as it is sent as one of the last resorts in debt recovery. Dunning letters refer to previous letters written by a business to the debtors.

The threat of legal action

The stage establishes a statute of limitation to recover debts owed by customers. The threat of legal action legalizes debt collection via the judicial system.

Sent through registered post

These letters should be sent through registered agencies to keep records and avoid susceptibility to loss. In addition, this helps the business owner to keep such agencies as witnesses during a legal procedure for debt recovery.

Language

The language should be straight, formal, and friendly. It helps businesses retain customers’ loyalty before and after debt recovery.

Types of Collection Letters

These should help a business owner or creditor maintain a healthy relationship with the debtor, and they should help them get cleared of an outstanding debt. Payment signifies the effectiveness of the letter. If a creditor or business owner receives no response after initiating a response letter, it is time to rework the template until there is a reasonable response.

Following are the four types of the letter:

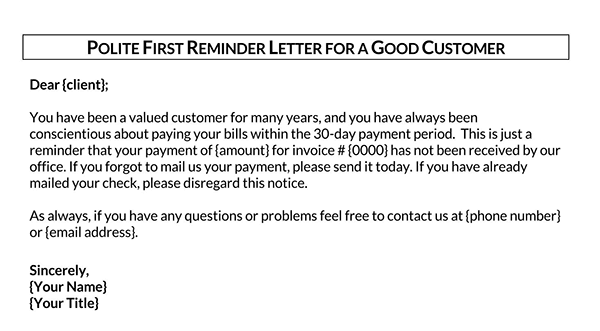

The first letter

Try to contact debtors before sending the first letter as much as possible. You can do this via phone calls or emails. Include your payment method in the email to give them immediate access to a payment channel.

It can be sent 14 days after the invoice is due for payment. It should be written with a courteous tone to remind the debtor of an overdue payment agreement. Please demonstrate that you know that failure may be due to an oversight, but do not intimate that you doubt their ability to pay. Always use your company’s letterhead paper to give your letters a formal approach.

The letter may contain a unique sale paragraph that informs the debtor about their interests. The objective of the particular sale paragraph is to hasten and lure debtors into paying on time. It should be noted that the first contact does not often generate a reaction.

The second letter

After the first one, it is sent to confirm the receipt and establish if the debtor would like to arrange a new payment procedure. The difference between the second letter and the former is that the second shows an initial contact.

Try as much as possible to contact the person to know if they received the first letter before you send the second letter. The call gives them a chance to confirm if there will be a new arrangement.

The third letter

The process is the same as the second stage. Attempt to reach the debtor before you send the third letter.

It can be sent out a few weeks after a second attempt has been made to reach out to the defaulting party. Like the second one, the third letter is needed to confirm the receipt of the first message. It keeps the debtor informed of the expected action. Start sending the letters via courier services to confirm the receipt of the letter.

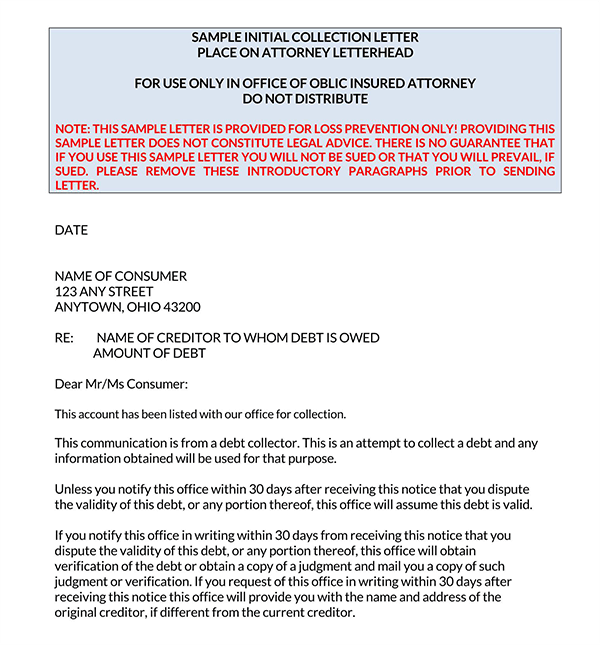

The fourth and final letter

The final letter performs almost a similar role to the rest. It is needed to confirm the silence from the debtor’s end. It is, therefore, necessary to be a bit assertive and professional with the language choice.

It is recommended that a business owner adopt a recognized mail system to analyze the debtor’s reaction to the email.

How to Write a Collection Letter

Writing this letter requires adequate attention, patience, and dedication. A typical letter has to state the objectives and position of a business to the defaulting party to help them understand the consequences of such actions to the business and the consequences to themselves if the creditor takes a legal route. Therefore, it should be written clearly. It should demonstrate a direct request and the expected reaction you want from the debtor.

The following components should be a part of the collection letter:

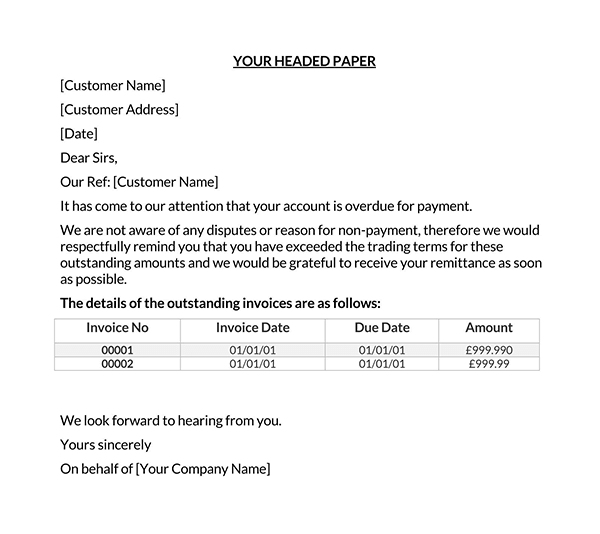

Header

It should be addressed and formatted formally to the debtor. It should carry the creditor or business owner’s address at the top of the page, while the name and address of the defaulting party come directly beneath it.

It should be written on a company’s letterhead paper. The paper contains a formal address and contact details of the creditor. This should be followed immediately by the debtor’s contact details to personalize the letter.

Date

The current date of the correspondence should be clearly stated. Also, include a specific date the payment procedure has to be completed. It allows the defaulting party to understand the importance and urgency of the letter.

Parties details

It should be detailed to generate clarity. The creditor’s and the debtor’s full details, including their names, addresses, and contact details, i.e., their phone numbers and email addresses, should be written in the body of the letter.

Salutation

Businesses often send multiple letters out at the same time. Therefore, each letter should be addressed to the recipients correctly. Salutations carry the names of the addressed parties. i.e., “Dear Chadwick,” “Dear Eric,” and “Dear Jake” differentiate the three recipients.

Introduction

The introduction has to be short, direct, and detailed to explain the importance of the letter. It should have a brief highlight of the case and the reason for the origination of the debt leading to the letter.

A good introductory paragraph captures the recipient’s attention if you want to achieve the desired results.

Body

The body of the letter is the essential aspect of the message. It is where the most attention should be dedicated to generating the result.

The body should detail the history of the debt, goods purchased, dates purchased, payment deadline, and the request for pending payments.

Demand payment

It should be made clear that you want the payments made at a specific time. You may break it down to allow the debtor payment flexibility.

Include a specific date; the amount should be made current. It gives the debtor the sense of urgency required to generate the result.

Include an acceptable payment method to help the debtor make a quick decision. A call to action of this nature ensures that clients pay on time and avoid procrastinating payments.

Closing

The expected action needs to be clearly stated in the closing section of the letter. It should be specific, with a call to action. It should also indicate a final request warning for a quick and easy resolution.

Also, include your contact information within the closing section of the letter to help the debtor reach out to you. It includes a phone number, email address, and mailing address.

note

A demand letter can be used during a lawsuit by either party. Therefore, to avoid unwanted situations, it is advisable to contact your lawyer to draft the letter.

Tips for Writing an Effective Letter

The following tips will help you write an effective letter to defaulters and debtors. The success of a collection process for a business depends on the delivery of each letter. Therefore, it should show concern, detail the need for action on the debtor’s part, and inquire about possible solutions.

The following tips will help you to craft an effective letter:

Write in a professional tone

Every form of familiarization should be halted when writing it. Therefore, the letter representing a business entity must be written professionally to persuade the debtor to pay up, especially those you hope to continue dealing with.

Enclose in an envelope for payment

Enclosing the letter in an envelope for payment helps in the delivery of the letter. It also helps to formalize the appearance and intent of the letter to the debtor. The letter should include postage that helps debtors make payments easily.

Keep it brief

Long letters often capture less attention than short letters. Therefore, consider keeping your letters short, direct, and catchy to generate the desired result.

Free Template

[Your Company Letterhead]

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date: December 19, 20XX]

[Tenant’s Name]

[Tenant’s Address]

[City, State, Zip Code]

Dear [Tenant’s Name],

I hope this letter finds you well. As the owner of [Property Address], I am writing to address an important matter regarding your rental account.

Our records indicate that your rent payment for the month of [Month], due on [Due Date], remains outstanding. This letter serves as a formal request for the payment of this overdue rent.

- Details of the Outstanding Payment

- Property Address: [Property Address]

- Tenant Name: [Tenant’s Name]

- Rent Due for Month: [Month]

- Original Due Date: [Due Date]

- Outstanding Amount: [Amount Due]

The purpose of this letter is not only to inform you of the outstanding payment but also to request its settlement. We value our relationship with you as our tenant and understand that sometimes unforeseen circumstances may lead to payment delays. However, as per our rental agreement, timely payments are essential for the continued use and enjoyment of the property.

To resolve this matter, we kindly request that the outstanding amount of [Amount Due] be paid by [Specific Future Date]. This prompt action will prevent any further complications or potential actions regarding this debt.

For your convenience, payments can be made through [Payment Method, e.g., bank transfer, online portal, check]. If you have any questions or concerns, or if you are facing difficulties making this payment, please contact me directly at [Your Phone Number] or [Your Email Address]. I am more than willing to discuss possible arrangements or solutions.

We appreciate your prompt attention to this matter and hope to resolve it amicably. Please consider this letter a final reminder to settle the outstanding rent to avoid further actions.

Thank you for your cooperation and understanding. I look forward to hearing from you soon.

Sincerely,

[Your Name]

[Your Title/Position]

[Your Contact Information]

Sample Letter

Dear Alex Johnson,

I trust this letter finds you in good health. As the owner of Greenwood Apartments, it has come to my attention that there is a pending matter regarding your rental account at Apartment 5B, 123 Oak Street.

Our records show that your rent payment for November 20XX, which was due on November 1st, 20XX, remains unpaid. This correspondence is a formal notification and request for the settlement of this overdue rent.

Details of the Outstanding Payment

- Property Address: Apartment 5B, 123 Oak Street, Maple City, IN 47891

- Tenant Name: Alex Johnson

- Rent Due for Month: November 20XX

- Original Due Date: November 1st, 20XX

- Outstanding Amount: $1,200

The intent of this letter is not merely informational but to seek a resolution for the pending payment. We value our tenant-landlord relationship and understand that sometimes situations can lead to delayed payments. However, according to our lease agreement, it’s important for rent payments to be made on time.

To amicably resolve this issue, we request that the outstanding rent of $1,200 be settled by January 5th, 20XX. A prompt settlement of this amount will ensure the avoidance of any further steps regarding this matter.

You can make this payment via bank transfer to Account Number 9876543210 at Maple City Bank or by sending a check to the address mentioned above. If you are experiencing any difficulties in making this payment or have any queries, please feel free to reach out to me at (555) 123-4567 or via email at john.smith@greenwoodapts.com. I am available to discuss any possible arrangements or solutions.

We appreciate your immediate attention to this matter and hope for a quick resolution. Please regard this letter as a final reminder to clear the outstanding rent to prevent further actions.

Thank you for your cooperation and understanding in this matter. I look forward to a prompt resolution.

Sincerely,

John H. Smith

Property Manager

Greenwood Apartments

(555) 123-4567

john.smith@greenwoodapts.com

Key takeaways

The sample letter is an example of a formal rent collection notice from a property manager to a tenant. Here are its key aspects:

- Both the sender (property manager) and the recipient (tenant) are clearly identified with full names and addresses, ensuring there’s no ambiguity about the parties involved.

- It precisely details the issue at hand — the overdue rent for November 20XX. This includes the property address, tenant’s name, due date, and the outstanding amount, providing clarity and leaving no room for misunderstandings.

- The letter states its intent to resolve the pending payment and highlights the importance of timely rent payments as per the lease agreement.

- A clear deadline (January 5th, 20XX) for payment is given, along with payment methods. This offers the tenant a clear path to resolve the issue.

- The property manager provides contact information and expresses willingness to discuss any difficulties the tenant might face, demonstrating flexibility and openness to communication.

- The letter serves as a final reminder and subtly hints at possible further actions if the issue remains unresolved, which adds a sense of urgency.

- It ends on a cooperative note, appreciating prompt attention and understanding from the tenant.

This letter serves as an effective guide for writing a formal rent collection notice. It balances professionalism with politeness, provides clear and specific information, and maintains an open line for communication, all while firmly stating the requirements and potential consequences.

Do’s and Don’ts

While writing the letter, it is necessary to observe some attributes to stay in tune with the objectives of your letter. You should do and avoid certain things to deliver an effective letter.

Do’s

- Keep letters professional: Use a company’s letterhead paper and avoid familiarity.

- Create the impression that you know they can and will pay. This helps you retain your customers’ faith and show them that you empathize with them.

- Attempt to reach out to the debtor before proceeding to send the letter. Doing this helps you understand the hindrance and the reason for the payment delay

- Send an email to contact them before initiating it. It helps you to find out what the problem is with the delay.

- Explain the details of the prices and charges to the debtor. It is necessary to help establish clarity about the particular debt you’re trying to reclaim.

- Consider incentives for them to pay on time. It helps the debtors make payment decisions. This can be in the form of cashback, coupons, or discounts if they meet certain conditions.

Don’ts

- Refrain from using harsh words. It is not a good business ethic to retain customers.

- Do not harass customers with the tone of the message. Legal threats and every other form of coercion should be avoided to keep the objective in check.

- Avoid contacting them via social media to maintain professionalism. It is necessary to avoid unnecessary familiarization with the debtors.

- Never send text messages to your customers. Text messages are meant for personal relationships.

Ways to Avoid Payment Collection Issues

As a business, it is almost impossible to prevent debt. At the same time, debt prevention is needed to keep the business running. Therefore, try as much as possible to follow these procedures in your daily practices to keep your business in good shape when it comes to debt recovery principles:

Review AR aging report

A business owner needs to understand the top-level view of the expected business income, outstanding debts, and customer adherence to the company’s collection policies to keep the business in a healthy position.

Therefore, an account receivable report should be used by businesses to review all unpaid debts, check invoices, amount, due dates, and the number of dates that debts have run behind schedule.

Offer early discount payment terms

An invoice reduction system allows a debtor to enjoy a discount on outstanding accounts paid before a particular period. It is also known as a prompt payment or cash discount method.

Such discounts can be between 1 percent and 5 percent and are usually requested between 10 days to the invoice date.

Request deposits upfront

While it provides security against loss to the creditor, it helps them get some working capital. It also improves the business relationship between all the parties involved and keeps your customers leveraged to make payment commitments.

Request deposits on big projects, projects that run for more than 30 days, and new clients.

Be proactive before a debt becomes past due

Send reminders to your customers if you want to increase the chances of getting paid early. It may be about a week or some days until the expiration period.

You can use a service that allows you to send scheduled messages to customers. With this, you can send the email about 2 to 3 days before the due date. Also, note that you can still contact your customers via phone.

Run a business credit check

Confirm every bit of the information about the customer to reduce the risks that come with credit purchases. This should be in the credit report history, revenue, and outstanding obligations.

When we run a business credit check, it helps a creditor know which customer has a history of compliance and which customer has a debt history. These are signs for a business transaction to go on with customers.

Frequently Asked Questions

Hire an agency for any amount of outstanding debt. Consider hiring an agency to boost your collection chances for debts past 90-120 days.

If you cannot contact the debtor, you should consider writing off the account as bad debt. Also, consider a bad debt situation if the defaulting party does not react to your persuasions for more than 90 days.

Late payments affect the cash flow and business productivity of a business. Understanding the reason for late payments will help you make an informed decision about such customers.

· Consider the return on investment in terms of their recovery record

· Consider their operation jurisdiction.

· Consider the cost of hiring them with your business size

· Consider their collection specialization area

Know the number of accounts receivable that are over 120 days old. There are specific requirements for different departments; therefore, understand your industry to know the required action.

· Maintain an accurate customer data

· Establish precise credit management and approval process

· Establish an effective payment process

· Optimize the collection process in a timely and effective manner

· Hone a cash application process

· Consider short payment terms

· Create a billing dispute resolution process

The fee varies in terms of agency. They usually charge a percentage, and it can go as high as 50 percent of the paid amount. The debt tenure determines the calculation of the percentage.