A Shareholder Agreement; also known as a Stockholder Agreement, is a legal document that outlines how a company will operate in order to make sure all shareholders are fairly treated and protected.

The goal of this document is to protect current and future shareholders. It outlines how the business will operate, what rights and obligations are afforded to shareholders, and their relationship with the company. As a result, it leaves less room for confusion or dispute, especially when third-party investors come into play.

When creating a shareholder agreement or using its template which is a fillable form of the same document that can be used by multiple people/shareholders; it is important to correctly set the rules for how decisions will be made in your corporation because changing them can only happen when all shareholders agree.

This means that you may consider keeping control within a small circle of shareholders or eventually offering shares on the public market.

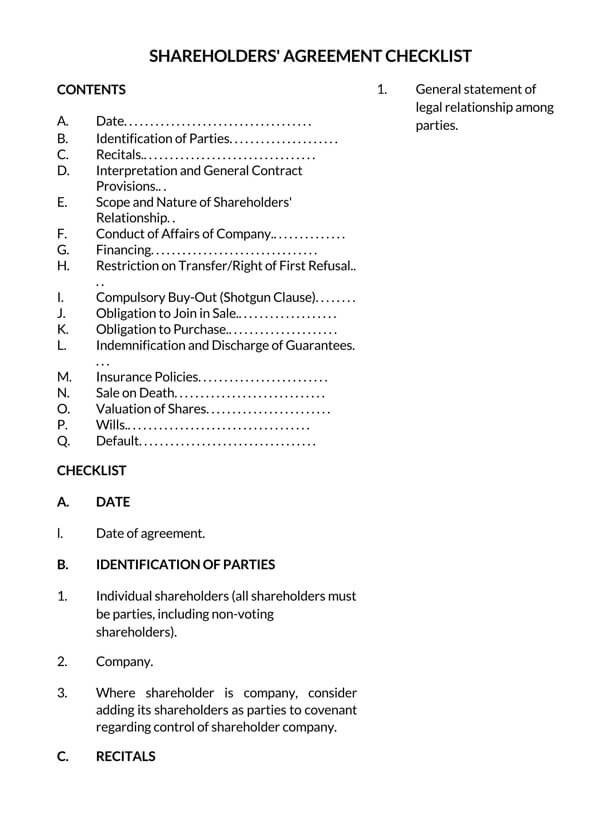

While it is the company shareholders who determine the content to be included in a shareholder agreement or its template, here are some key issues it addresses:

- Methods of resolving disputes

- Rules about conflict of interest

- Actions that should follow in case a shareholder passes on or becomes incapacitated

- Rules governing how news shares are issued as well as restrictions on the transfer of shares

- Management of shares, business, capital, finances, and assess

- Rights and responsibilities of shareholders

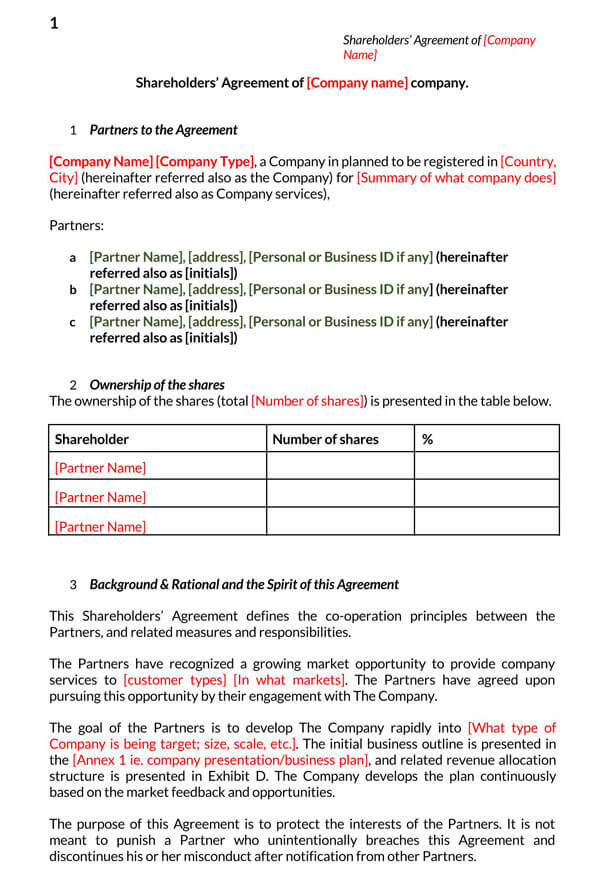

- Ownership and valuation of shares

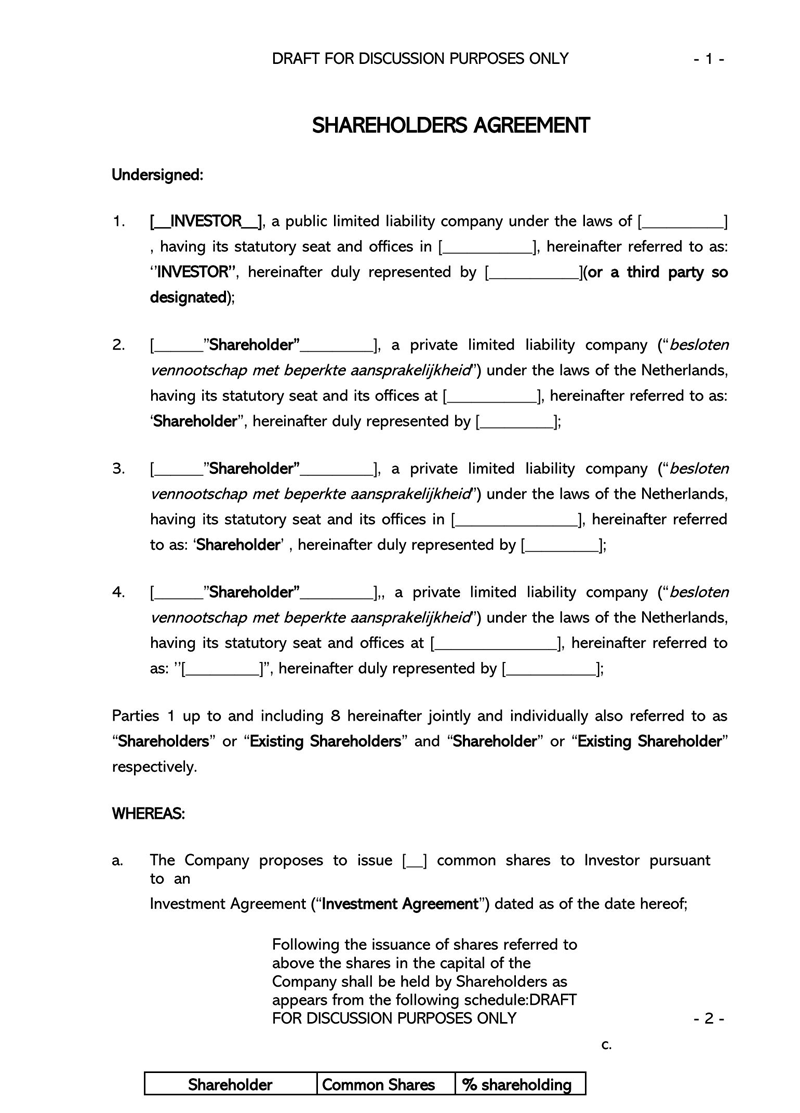

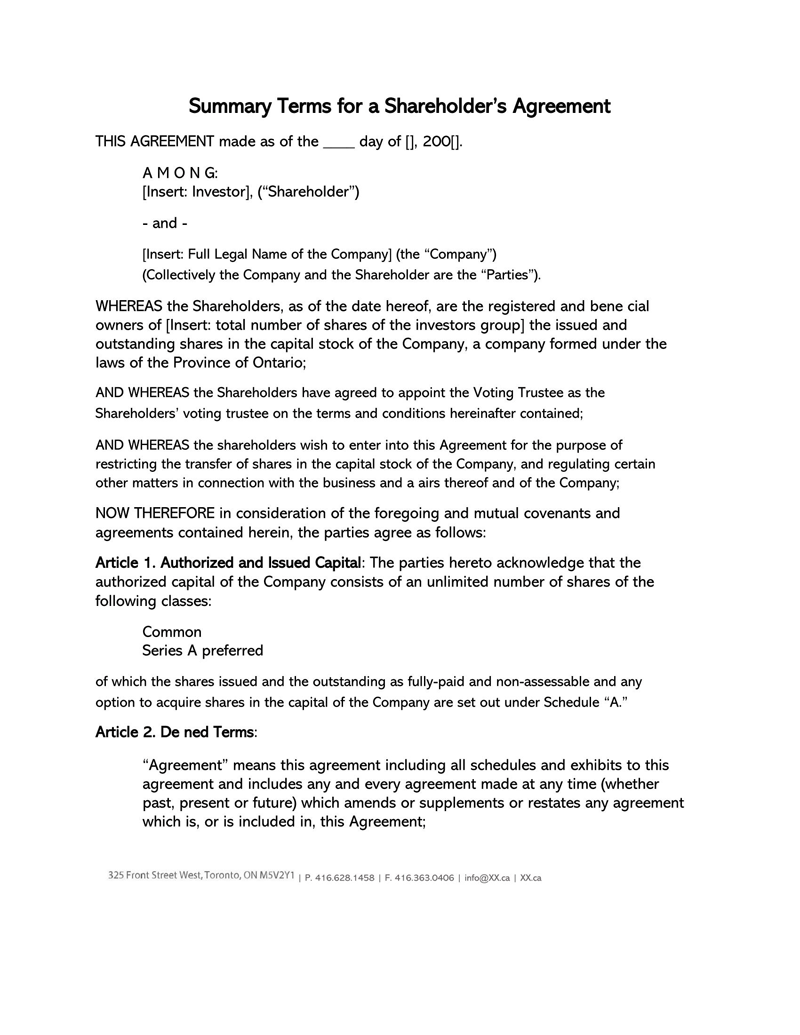

Free Templates

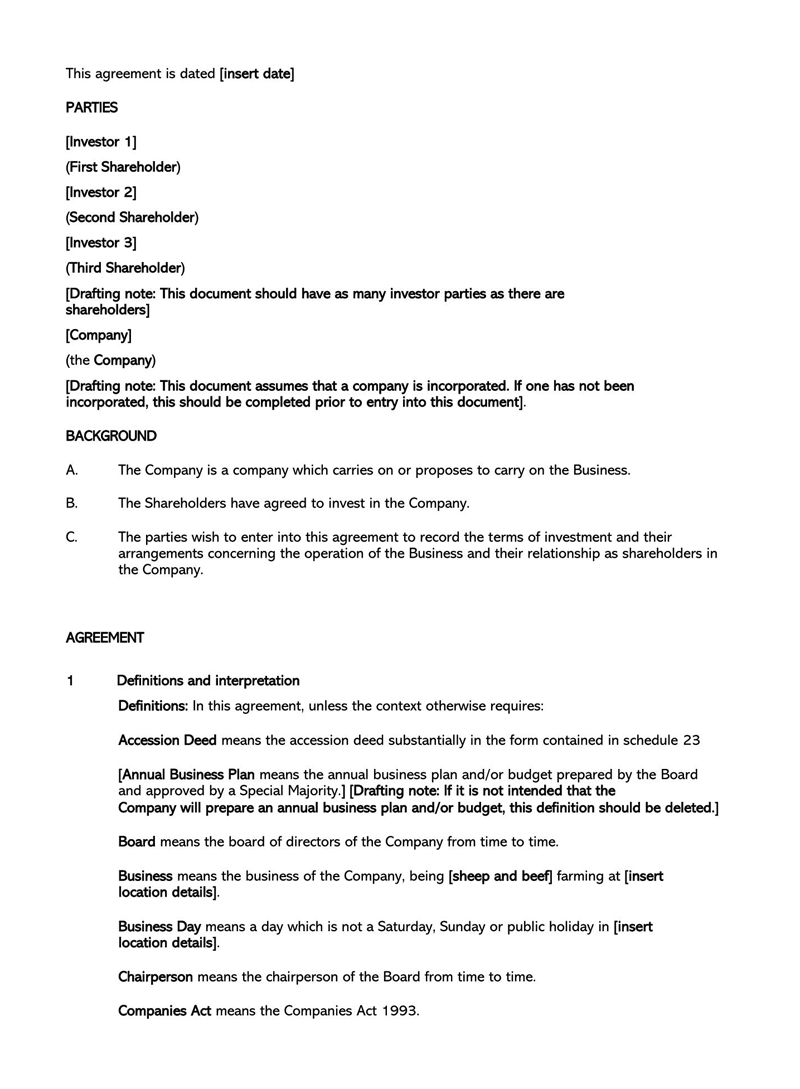

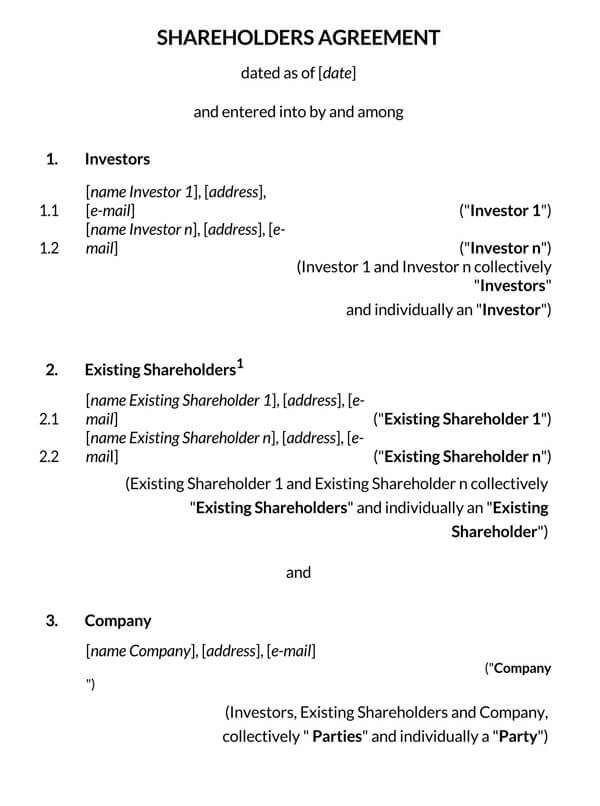

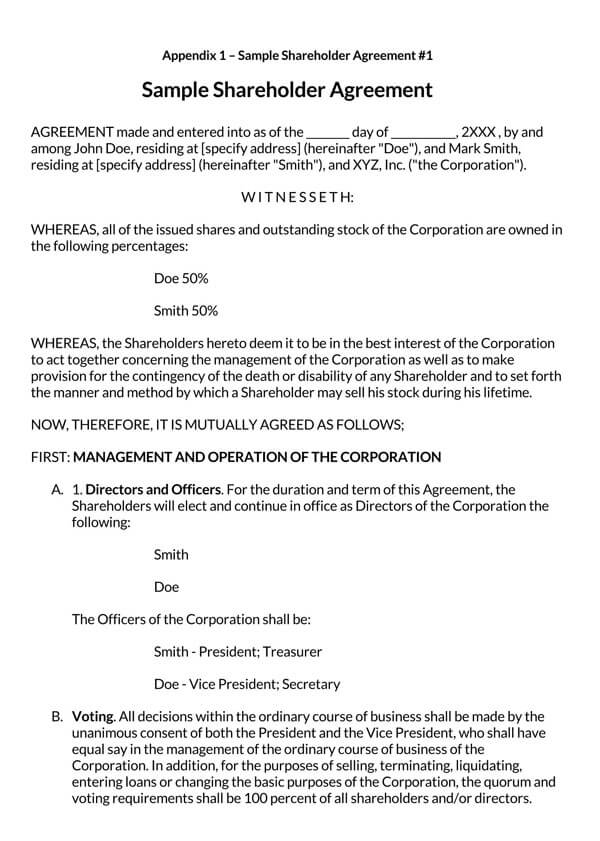

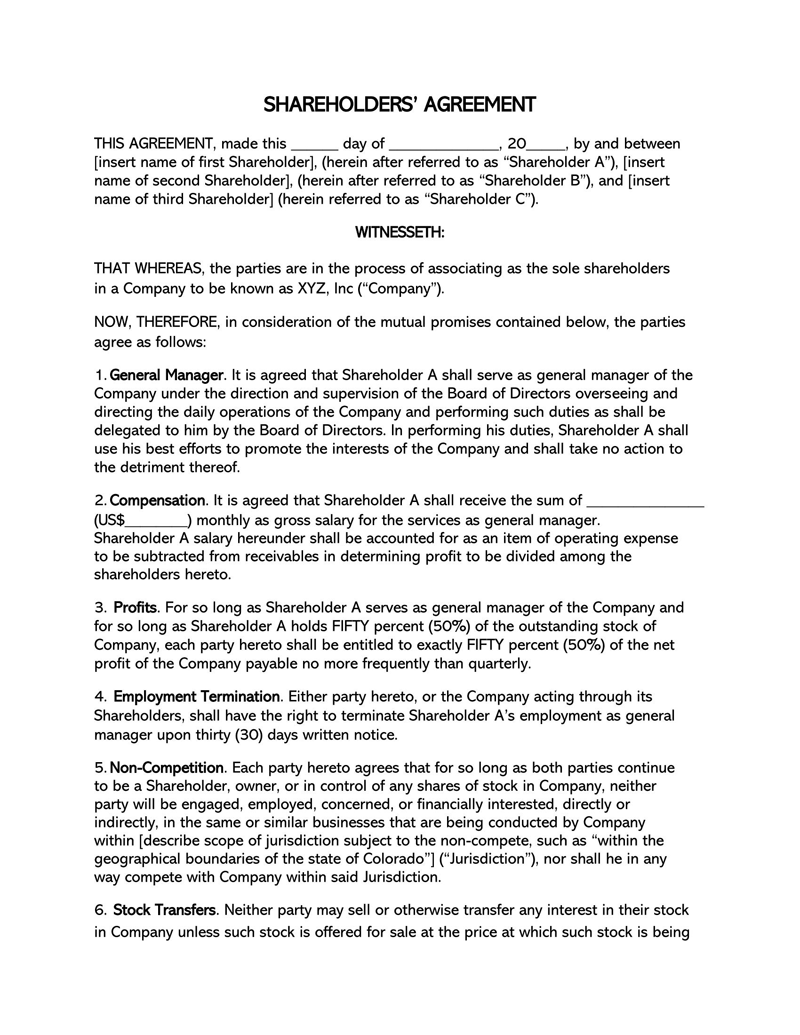

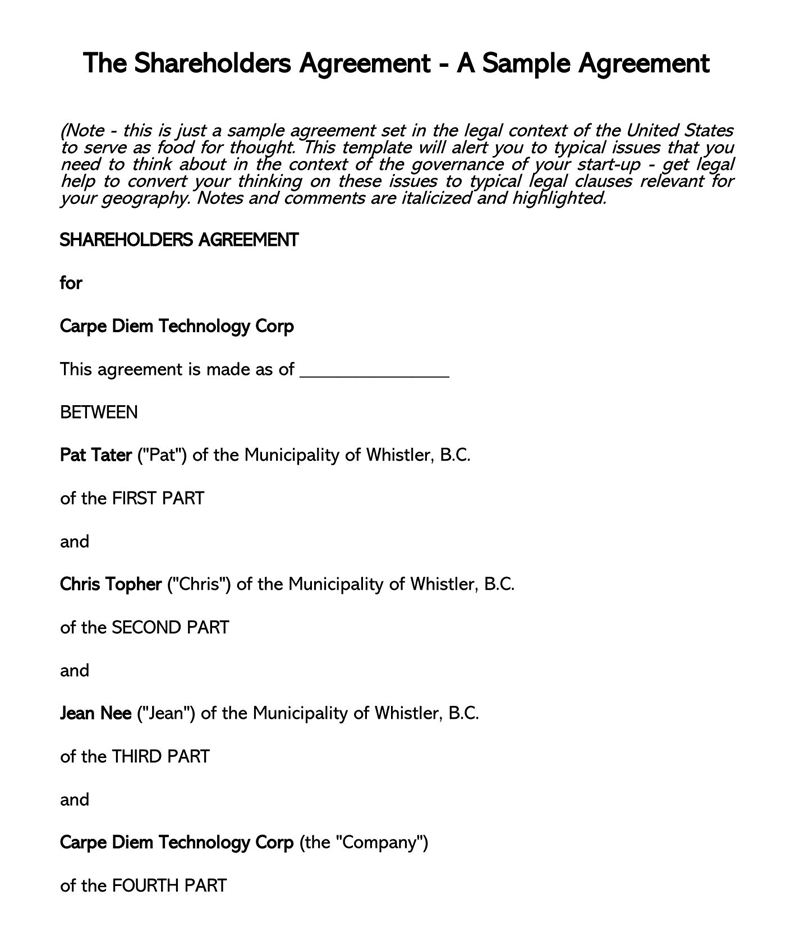

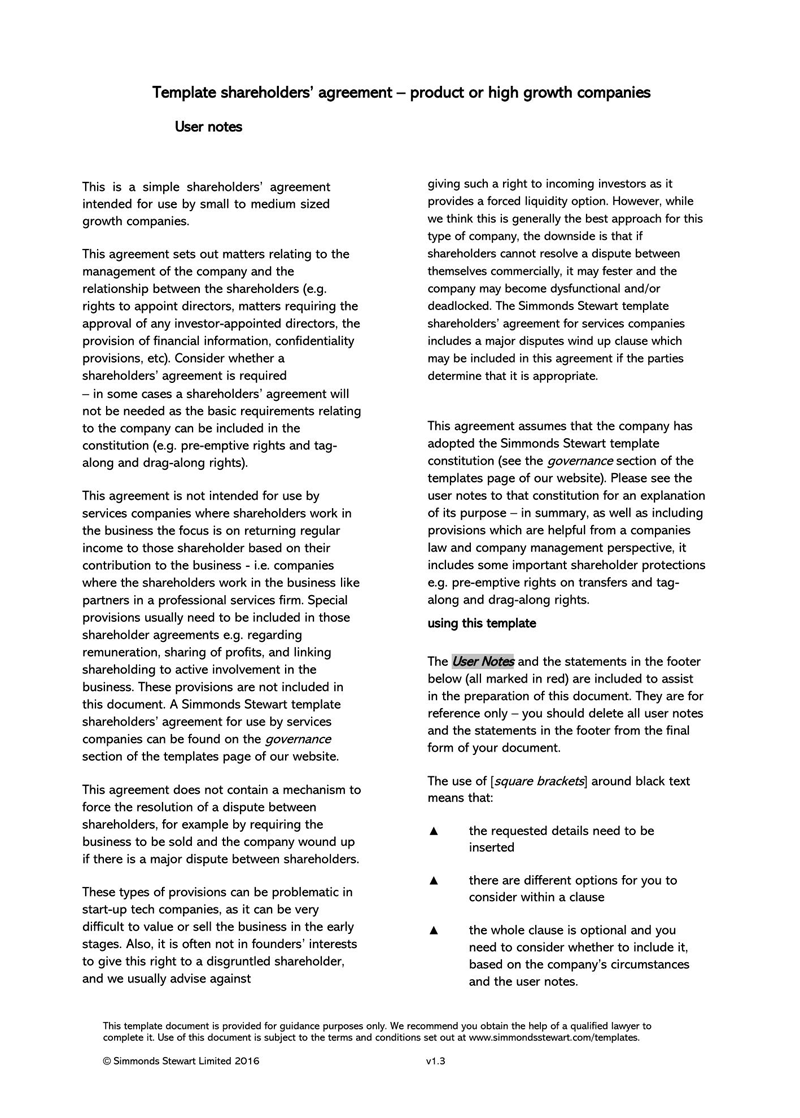

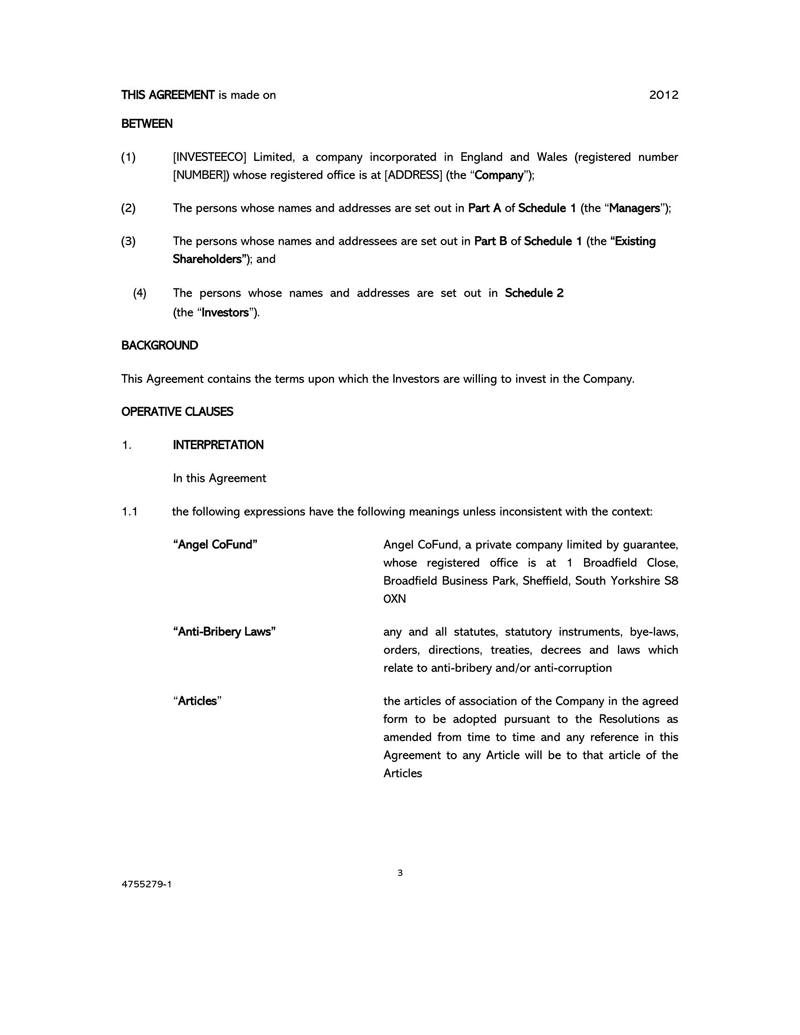

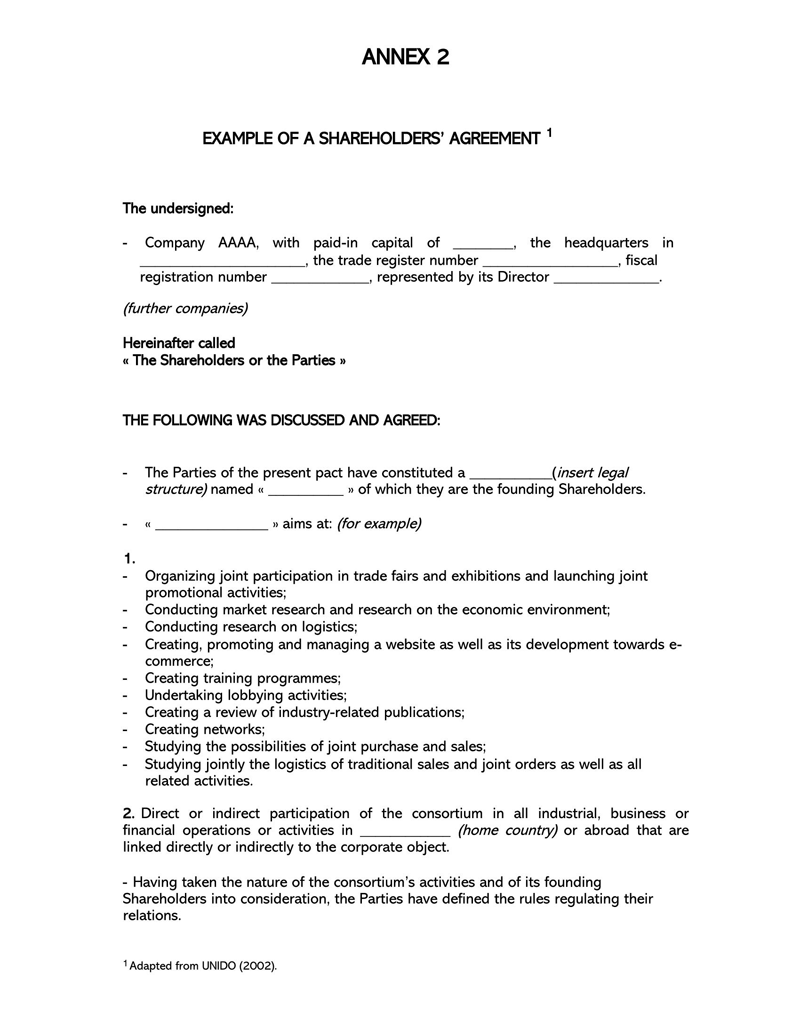

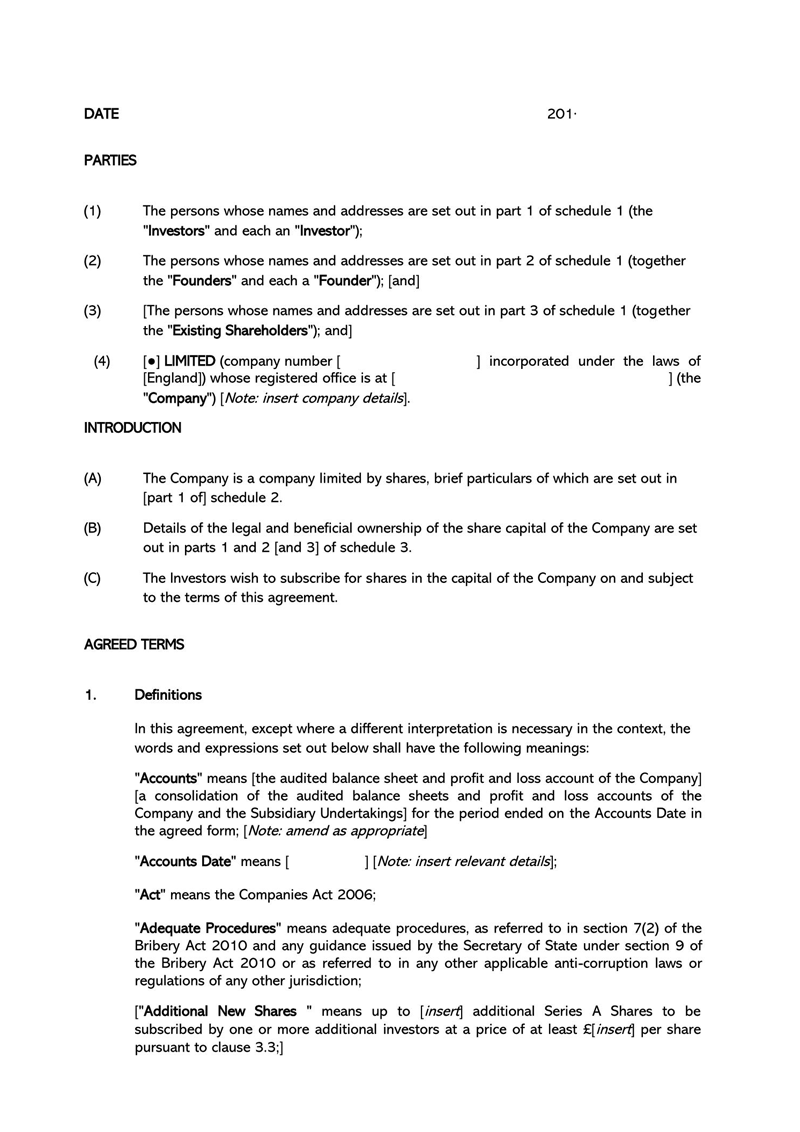

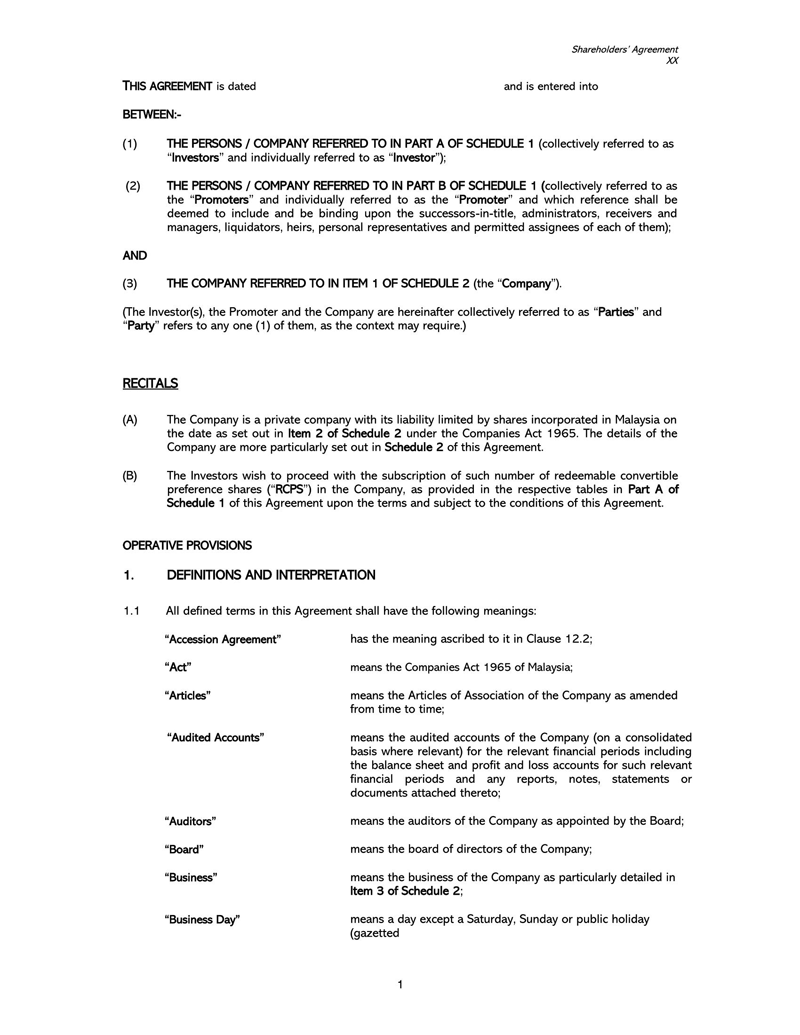

Following are some free downloadable templates for you:

Partnership Agreement Vs. Shareholder Agreement

A partnership agreement is a document that outlines the partnership between two parties. The agreement covers what the partners have agreed to share as well as how they will divide any profits from their business venture. It also details how responsibilities are allocated and who will be responsible for certain decisions.

A partnership agreement includes:

- What each partner brings to the table in terms of money, assets, experience

- How much each partner has invested

- What percentage of ownership each partner has in the company

- Who is responsible for what tasks or duties (e.g., marketing)

- When either party can end the agreement with notice (i.e., at least six months)

A shareholder agreement, on the other hand, is a contract between shareholders in an organisation. It covers the rights and responsibilities of the shareholders while they are owners of the company and how to handle any disputes that might arise among them.

In addition, this agreement defines issues such as voting procedures, dividends, information rights, transfer restrictions, and buy-sell agreements. To be effective, a shareholder agreement or its completed template must be signed by all parties before or at the time shares are issued or transferred.

Shareholder Agreement Vs. Company By-Laws

The difference between a shareholder agreement and company by-laws is that the former outlines how shareholders are to act regarding their investment. In contrast, the latter gives more information on what must be done when running day-to-day activities.

Shareholder agreements outline how people who have invested money into companies should relate. For example, they identify key players within an organization (e.g., executives, directors), set guidelines for voting rights of those parties involved with decisions made about said entity’s plans or investments; as well as establish duties owed to one another throughout these processes: e.g., transparency requirements during all stages of decision making regardless if it pertains directly to them or not).

Company by-laws instead give instructions pertaining specifically toward managing operations. They are the rules, regulations, and guidelines that govern a company. They are necessary for conducting business in an orderly fashion. For example, by-laws usually include information about conducting board meetings, who can vote on behalf of shareholders or directors at meetings, what types of votes require a quorum, and ensuring accountability in several aspects of running the company. Moreover, these documents help keep all stakeholders informed about their rights, so they know where they stand within the organisation’s hierarchy.

Who a Shareholder is?

Shareholders are individuals who own stocks of a company. It is common to hear the terms “stockholder” and “shareowner”. However, the number of shareholders within a specific corporation does not necessarily reflect how many people use its services or products, nor their annual income/wealth.

Shareholders are owners of stock in companies, so they have an ownership interest in those corporations’ assets. Still, they do not manage them day-to-day like managers would (and thus don’t control any decisions about what activities take place with these resources). However, they may be involved on an advisory board that occasionally meets or attends shareholder meetings where important business issues will be discussed.

What Shareholder Agreement Template is (Detailed)

Such agreement templates are fillable documents that specify the rights and duties of shareholders in a company. It provides guidelines for dividing shares, voting, transferability of shares, profit distribution, and the relationship between shareholders. There are different agreements, such as buy-sell agreements for co-ownership or partnership deeds for joint venture companies.

This template also provides all the necessary information for shareholders to come together and divide up shares in their company. It includes information on how decisions are made, what happens if someone wants to quit as a shareholder, and what happens if there is a disagreement between shareholders. Every shareholder should sign an agreement before any money changes hands or any work begins. The template will help you get started with your own agreement so you can protect yourself from future disagreements among partners or legal ramifications down the road.

Essentials of Shareholder Agreement Template

Following are the essential elements of templates:

Names of shareholders

This passage is a contract between the business and its shareholders. The first thing to do in this agreement would be to name all of your initial shareholders correctly, along with their addresses and phone numbers. Additionally, you will need to identify any officers for the company and decide who will be responsible for managing these shares (a “managing shareholder”).

Responsibilities of shareholders

Shareholders are expected to have a strong understanding of the business and how their individual contribution impacts it. They should be willing to commit long-term hours, best efforts, and unlimited resources for them to obtain financial gains from an investment they made with the company.

Shareholder responsibilities to be specified also include following through on tasks assigned by management which may or may not directly benefit shareholders.

EXAMPLE

They can identify rules that establish how officers are appointed and terminated.

Furthermore, shareholders must understand when there might be conflicts between personal beliefs/values as well as those they hold more closely related with memberships within organizations such as boards & committees where these values could influence decisions regarding specific topics impacting all stakeholders involved.

The voting rights

In the shareholder agreement or agreement template, there must be a section that covers voting rights. In this section of the document, owners are given certain powers related to voting on important decisions for their company and who has or does not have power in these situations. The first thing covered here is what constitutes an eligible voter. Generally speaking, those individuals with more than 50 percent ownership interest would be considered ‘eligible voters’.

Secondarily, it outlines some basic rules.

EXAMPLE

If votes go through unanimously, one person’s no-vote will effectively cancel out another individual’s active yes vote; however, when all other factors remain equal, any majority over 50 percent shall control unless otherwise stated by law.

Decisions regarding the corporation

Shareholder agreements are often tedious, but they can be accommodating when the corporation faces dilemmas. Without one in place, a few company members may make decisions that you disagree with or do not support as an owner.

There may also be the need to make decisions regarding acquiring new space, purchasing property, or how to pay back a loan borrowed on behalf of the business. Understanding what your agreement entails is crucial to making smart business decisions later on and protecting yourself from disagreements between other shareholders.

Stock-selling or transferring

A template of shareholder agreement outlines the rights and responsibilities a shareholder has concerning shares of stock. This includes whether or not they can sell, transfer, or buy their share of ownership in the company.

Stock in a corporation can be sold or transferred upon the passage of specific time requirements. If an agreement does not explicitly state how the stock will be dealt with, it will default to being sold on current terms. This would mean that if one person transfers their shares and is immediately bought by another party, both parties have made deals without requiring anyone else’s consent. This means no shareholder vote was required; either could sell at any price but only as long as they were held for at least two business days before selling them again afterward.

Sections outlining legitimate pricing of shares

This agreement template outlines the fair and legitimate pricing of shares in a company. The price for these shares is determined by the shareholders themselves, considering their assets, liabilities, age, and other factors that may impact their ability to continue working at some point in the future. Thus, a well-written shareholder agreement can help prevent disputes among shareholders who disagree on what constitutes a fair price for an investment.

Shareholder rights

Shareholder rights are the bedrock of its agreement as it elucidates various forms of entitlement a shareholder can claim.

Right of first refusal

The right of first refusal is a clause in a shareholder agreement or its template that allows one party, usually an investor or board member, to purchase shares before they are put on the market. This gives them power over who has access. It can be used as leverage when negotiating control because it grants this party exclusive rights before any other stockholder acquiring those same shares. It also has other advantages, such as preserving relationships between shareholders and reducing uncertainty in ownership decisions.

The right of first refusal is often used by companies who want to avoid selling their business on open markets where it may be subject to hostile takeover bids or become vulnerable to other undesirable strategic buyers.

Shotgun provision

A shotgun provision is an agreement that gives one party in a shareholder agreement template the right to buy out the other at their discretion. This type of clause is popular because it provides flexibility and increased control for shareholders, but some can also be seen as too aggressive and unfair. Therefore, it’s important to make sure you include this type of provision in your company’s shareholder agreements if you want them to have more protection against lawsuits or hostile takeovers.

Piggy-back provision

A piggyback provision is an agreement to carry over the terms of an old agreement of shareholders into a new one. The term “piggyback” refers to the ability for one person or group of persons to take another person’s or group’s shares and vote them as they wish.

There are two different types of piggyback provisions: automatic and negotiated. Negotiated clauses may allow shareholders to continue with their current arrangement or agree on something new. In contrast, automatic clauses do not require any input from the shareholders as they will automatically inherit the previous agreement terms.

The most common reason for including this clause is that all parties are aware of how much they owe when buying shares from other members who have left or died without providing written consent.

Legal obligations of each party

Such agreement is a legally binding contract that governs the relationship between shareholders in a company. It establishes the rights and responsibilities of each party.

Shareholders can have a wide variety of legal obligations, but the most common is for shareholders to agree on handling disputes. Thus, the agreement should include what type of dispute resolution process will be used and who has the right to enforce it. It should also cover what types of disputes are covered by the shareholder agreement, including when there’s disagreement about decisions made by one or more shareholders.

Other issues that may need to be addressed in a shareholder agreement template include ownership rights and responsibilities, transferability rights (such as selling shares), and voting procedures.

Financial responsibilities of the shareholders

The financial responsibilities of your shareholders need to be outlined in the company’s bylaws. These responsibilities include voting, reviewing, and approving corporate actions such as mergers, stock splits, or other changes to a corporation’s capital structure. Shareholders also must monitor management and have a say in matters that affect them.

EXAMPLE

They can bring proposals for shareholder votes on potential ways to improve their investment opportunities or create better value for all investors.

Shareholder rights are typically defined in a company’s charter documents, which is the document that governs how it operates and defines its goals and objectives.

The distribution of dividends

The distribution of dividends in an agreement template of shareholders is an important topic. It can be as simple or complex as the parties want it to be, but some common elements should always exist. As with any contract, it’s best to start this section by defining what type of company you have and how many shareholders will be involved. This helps determine who gets paid what and when. The next thing to discuss is the types of dividends that may need to be distributed (profit-sharing or other). Once these items are outlined, the specifics about payment dates and calculation can then follow.

It is also essential for shareholders to understand what they are entitled to and how they see it as a priority before investing. For example, some companies will pay out dividends quarterly or annually, while others may not have any plans for distributing dividends at all. Therefore, the board of directors should decide whether or not to distribute dividends when they believe that the company’s earnings can sustain its dividend distribution policy and provide future growth opportunities to shareholders.

An exit strategy

When one or more shareholders decide to exit their company, they must have an exit strategy in place. Unfortunately, for many business owners, the idea of selling the company can be overwhelming. The process is not only a complicated and time-consuming undertaking but also requires a significant amount of money. In order to avoid these issues, it’s important to set up shareholder agreements that outline when each shareholder can sell their shares and how much they will get for them.

Key Takeaways

- A shareholder agreement is a contract between shareholders of a company that governs the relationship between them and their company.

- The content of this agreement varies depending on each business entity’s size, nature, and purpose. Still, it typically includes rights to subscribe for shares in the company, rights of first refusal or preemption in case of sale and purchase of shares, transferability of shares, allocation of a capital gain on the sale of shares between shareholders, board structure, and composition, management provisions and protection for minority shareholders.

- When creating a shareholder agreement, it is important to ensure that all terms are clear before becoming legally bound. This includes any clauses affecting your assets should the company fail. It is therefore advisable to seek legal advice when entering into these agreements.

- An agreement should consider issues such as what will happen if one party dies or becomes disabled – do their children become entitled to a share of the company?

- You should also consider how disputes will be resolved – will it be through mediation or arbitration, or perhaps even court proceedings? Will one party have more influence than the other to resolve disputes, and who will foot the bill for this type of action?

Frequently Asked Questions

A shareholder is any person who owns shares of stock in a company. A shareholder can be an individual, family, or institution. They invest their money with the company and are entitled to vote on issues that affect its future. For example, shareholders have rights to dividends from profits that they receive by owning stocks in a publicly traded company.

A shareholder agreement is a document that defines the relationship between shareholders in a company. Shareholder agreements are created and signed when there is more than one owner of a company. They can be handy for defining the rights, duties, and responsibilities of all owners. In addition to creating an agreement that will protect each individual’s interest in the business, they also provide guidance on dealing with common issues such as voting power, dividends, or distributions of assets upon dissolution of the company.

Shareholder agreements are important to protect the ownership of a company, especially when there are multiple stakeholders. These agreements should be created in order to establish who is responsible for what and how decisions will be made. Without these agreements, it can lead to conflict or confusion about who has the final say on some issues like hiring employees, creating budgets, and deciding on expenditures.

Shareholder rights are the privileges that shareholders have in a company. These include voting for directors and significant policy changes, receiving dividends from profits, and selling shares of stock when offered to the public.

The original agreement of shareholders is a document that dictates the rules of how your company operates. Whether you are considering changing any of these regulations or not, it’s important to know what they are before making any decisions. Here’s everything you need to know about changing the original shareholder agreement:

• First, you have to pass an amendment through a vote by shareholders.

• The vote has to be unanimous, and there has to be no opposition from shareholders for the change to occur.

• All shareholders must approve changes in writing and then sign their names on documents stating their approval.