The Maryland Lease Agreement is a contract between a property owner and a tenant. In exchange for payment of rent, the landlord guarantees to give the tenant possession of the property.

The lease defines the duration of the bargain, specifies rent payments, and specifies the obligations and responsibilities of each party towards the agreement.

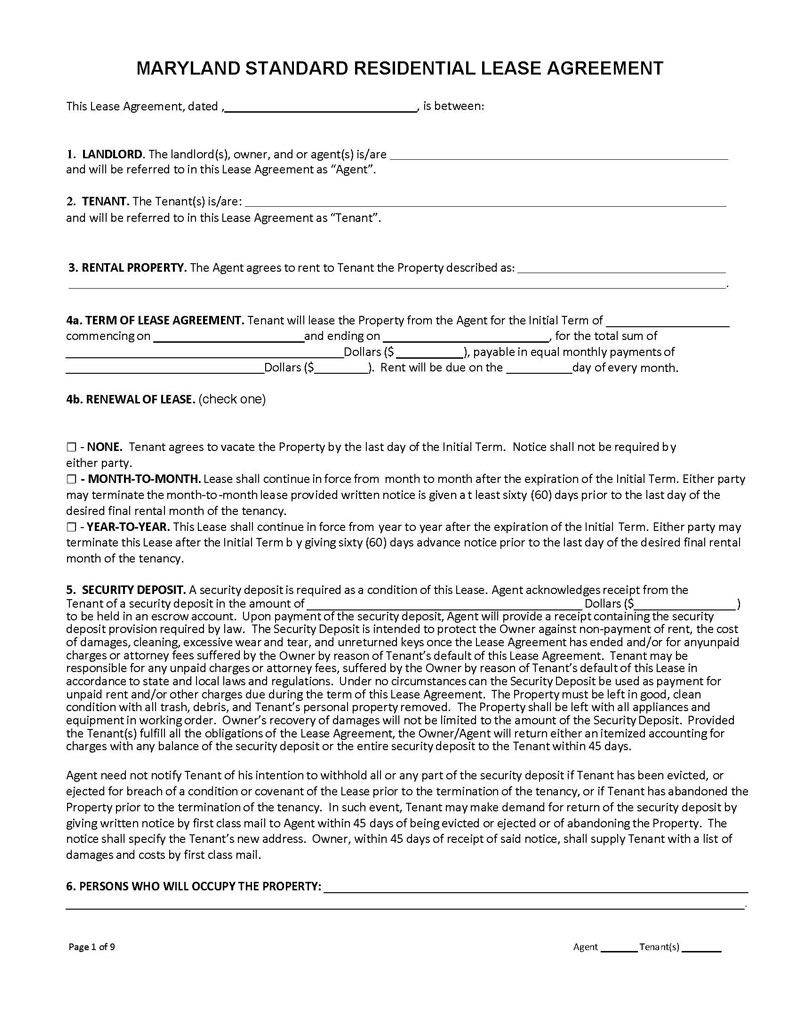

The terms of a lease agreement are binding on both the landlord and tenant once both parties have signed the document. The landlord cannot change any of its terms without telling the tenant, and the tenant cannot change its terms without also telling the landlord. A security deposit, typically equal to one month’s rent, may be requested from the tenant by the landlord.

It is important that both parties read and understand the agreement. The terms and conditions of the agreement are considered acceptable behavior, as are the ways in which any damages done to an apartment space will be dealt with and how violations of the agreement terms will be dealt with. Lease agreements are used for both commercial and residential purposes. The landlord is responsible for writing their agreement, which must adhere to Maryland State Law. This article provides information on what a lease agreement entails and the different types of leases in Maryland.

Free Templates

Landlord-Tenant Laws in Maryland

The landlord-tenant laws in Maryland are found in the Annotated Code of Maryland. There are two primary parts to land-tenant law: the rights and duties of tenants and the rights and duties of landlords. These two sections create a legal relationship between the landlord and tenant that serves as the foundation for both parties’ expectations of specific rights from one another.

The landlord-tenant laws govern the following aspects of the lease, as discussed below:

Rent

Under § 8-401, the law does not require landlords to provide a grace period. Landlords can demand rent on the exact due date stipulated in the lease agreement. According to § 8-208(d)(3), landlords should not charge a late fee greater than 5% of the monthly due amount. In addition, there are no statutes on the rent increase notices.

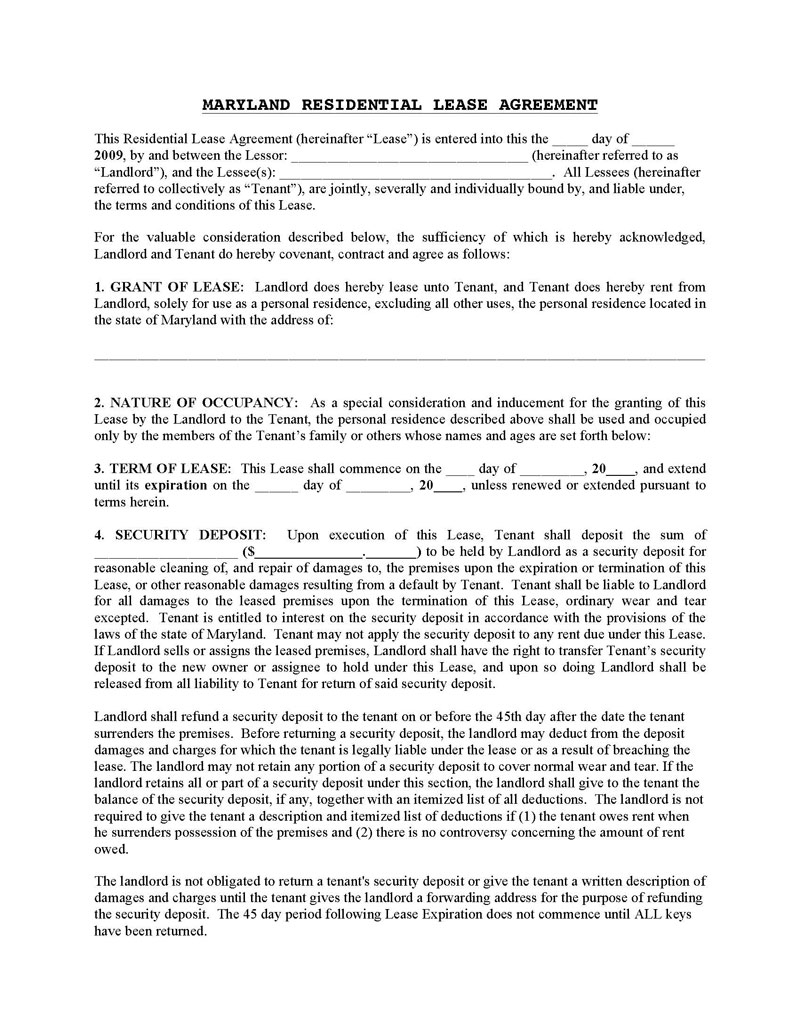

Security deposits

Landlords can ask for a security deposit for a rental unit. They can, however, not charge a deposit amount exceeding two months’ rent, according to § 8–203(b)(1). In addition, the landlord (lessor) must refund the security deposit 45 days after the termination of the contract – (§ 8–203(e)(1)). Also, according to § 8–203(e)(1), the security deposit must be returned with any and all interest accrued. Lastly, the security deposit ought to be deposited in a separate account in a federally insured bank that is exclusively dedicated to security deposits –§ 8–203(d)(1)(i)).

Required Disclosures in Maryland

Lease agreements in Maryland will have a wide range of terms attached to them. Some of these include the rent agreement, the services the landlord offers the tenant, and the responsibilities of the tenant.

Here are some required disclosures and addenda, according to Maryland law:

Agent/landlord identification

All leases in Maryland must identify the landlord/agent as well as provide contact information for both parties. This disclosure is necessary to ensure that tenants have a way to contact their landlord in the event of an emergency or a question.

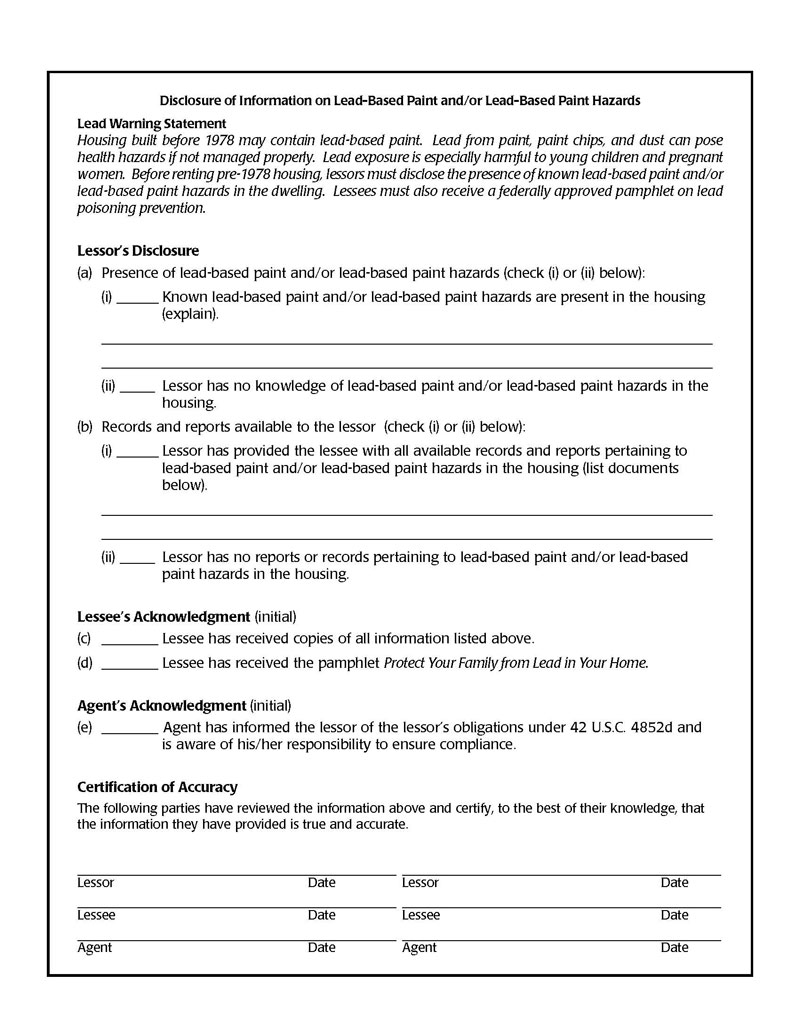

Disclosure of lead-based hazards

Landlords are obliged to provide a warning statement on whether there are any lead-based hazards present in the rental unit. This disclosure is meant for all rental units built before 1978. This disclosure is provided by completing and attaching a lead-based paint disclosure form to the lease agreement.

The landlord should also provide an EPA (Environmental Protection Agency) approved pamphlet that discloses the dangers of lead-based paint. They must also provide any additional reports and records pertaining to the presence of known lead-based paint on the premises. A building-wide evaluation report should be issued for multi-unit buildings.

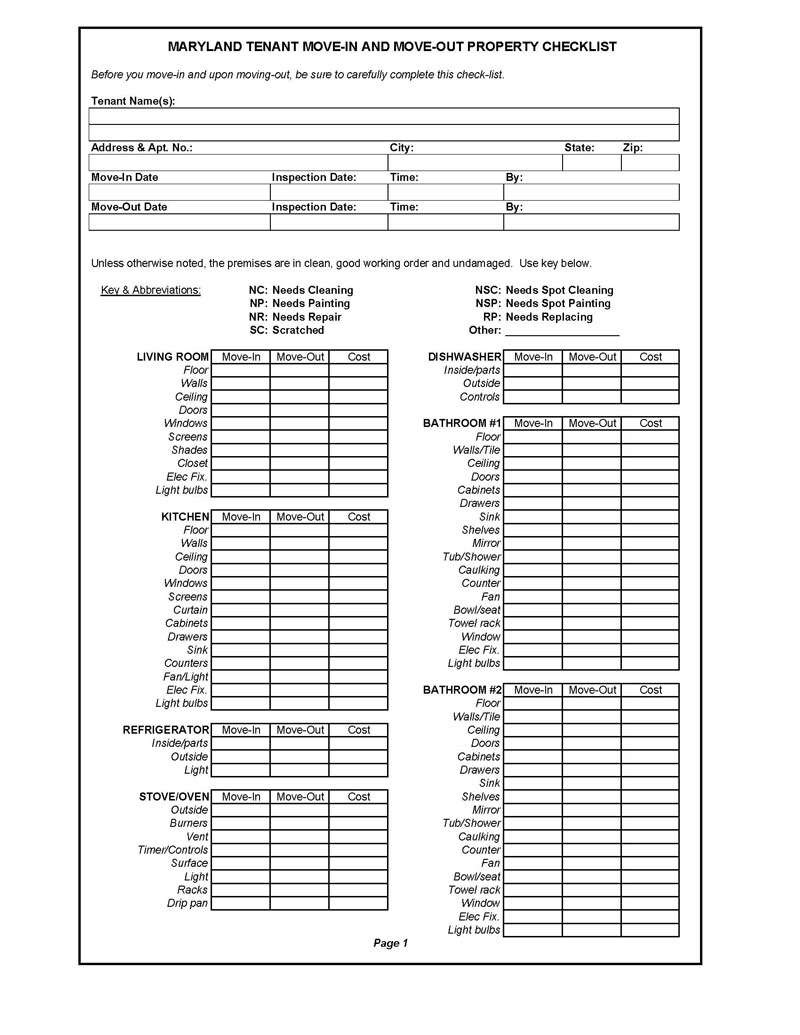

Move-in/move-out checklist

Before a tenant (lessee) takes possession of the property, they must conduct an inspection of the property and sign a move-in form with the landlord. In this form, the tenant will be required to list all items that are damaged or broken and the condition of the premises. This addendum is required for all rental units that have a security deposit (§ 8-203.1(a)).

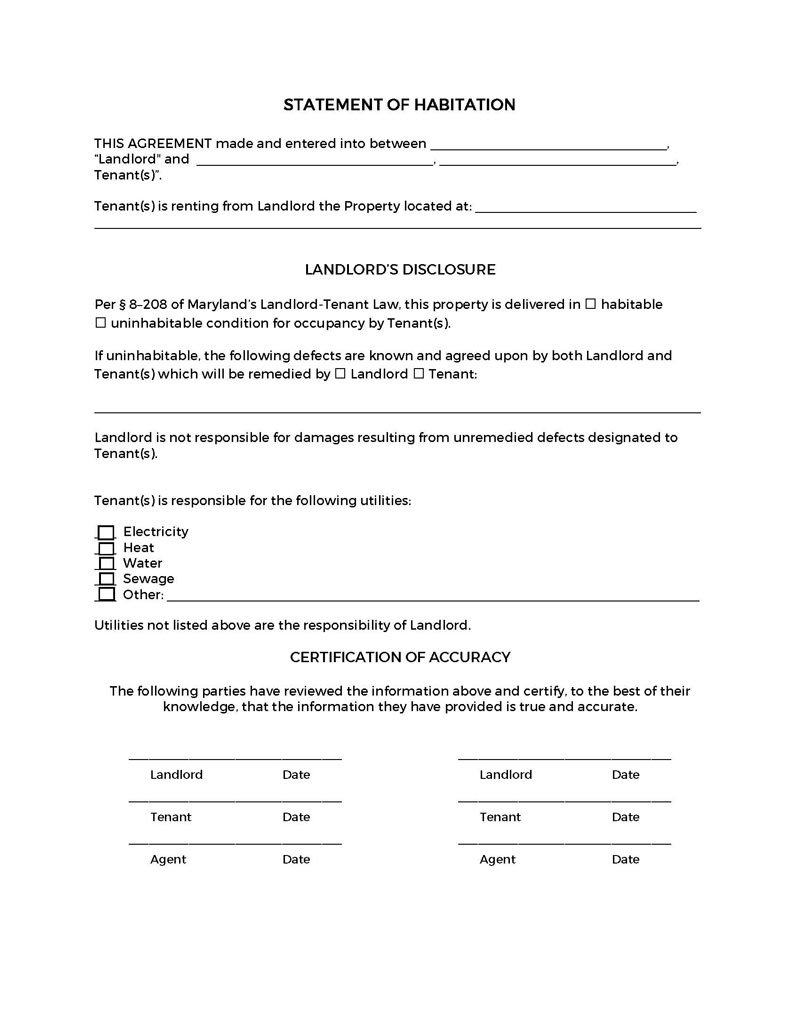

Habitability and safety

In order to be eligible for a security deposit refund, the rental unit must be deemed habitable, meaning it must have acceptable conditions such as not having any insect infestations or plumbing leaks. Also, the tenant must have safe access to the property and be able to use all of its utilities (heat, gas, electricity, water, etc.) in a safe manner. The landlord must certify that the property is habitable in order to accomplish this (§ 8–208).

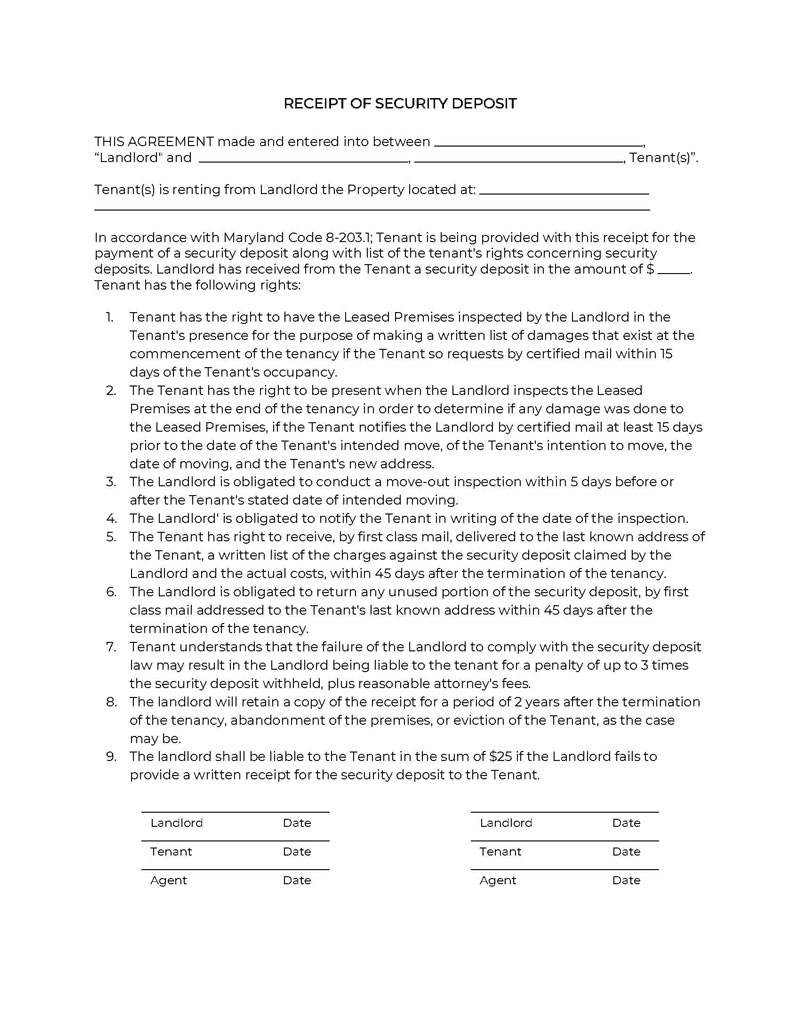

Security deposit receipt

During the tenant’s move-in, the landlord must provide a security deposit receipt (8-203). The receipt should also enumerate the tenant’s rights as stipulated under § 8–203.1. This addendum is required for all rental units for which a security deposit has been charged.

Some of the landlord’s obligations to enforce the tenant’s rights include:

- The obligation to inspect the property with the tenant present and complete a move-in and move-out checklist 15 days after the move-in and move-out dates, respectively,

- The landlord is obliged to notify the tenant of the inspection day in writing.

- After inspection, the landlord should send a first-class mail with an itemized list of all deductions from the security deposit, if any. This is within 45 days of vacating the property.

- The security deposit ought to be returned within 45 days after vacating the property.

- The receipt must declare that if the security deposit laws are not implemented, the landlord is liable for 3 (three) times the security deposit and applicable attorney fees.

Utilities and repairs

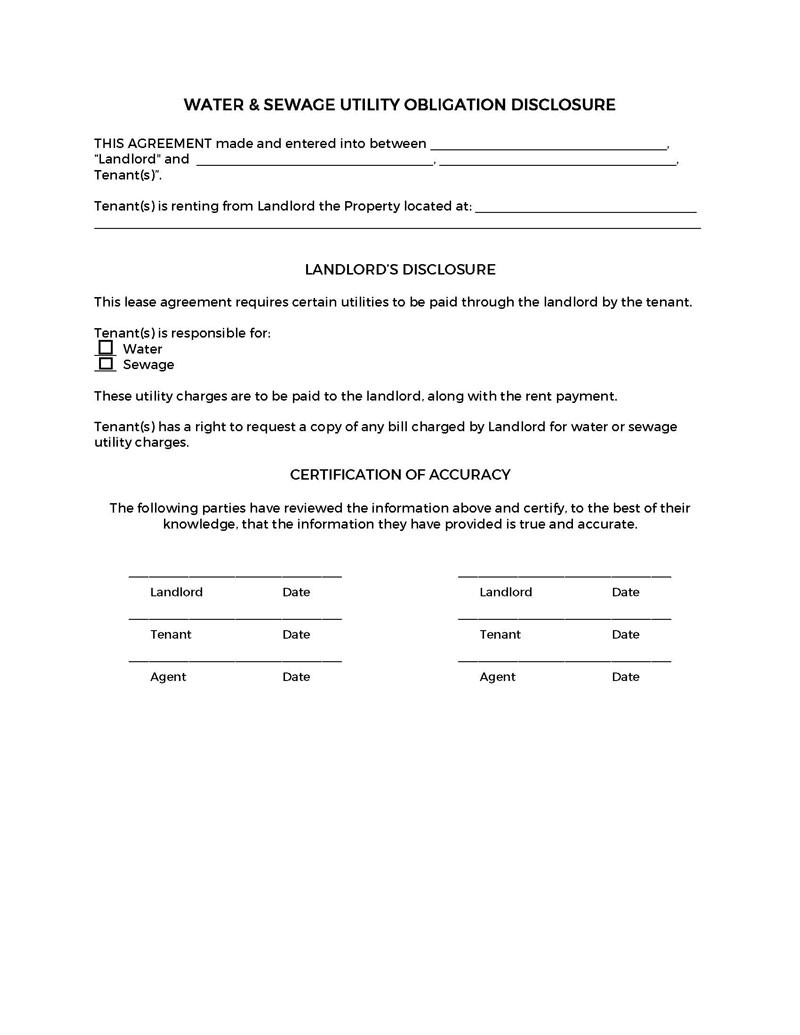

The Maryland lease agreement should outline the party responsible for utility costs (§ 8–208(c)(2)). These utilities include gas, electricity, water, and sewage. Either party can assume or share responsibility.

Water & sewage utility obligation disclosure

In a situation where the tenant pays for utilities via the landlord, a disclosure stating this is the tenant’s obligation to the landlord should be included in the lease agreement. The disclosure should also declare that the landlord is obligated to issue a copy of the bill(s) to the tenant. However, if the tenant pays the cost of utilities directly to the company, then this disclosure is not needed.

Recommended disclosures and addenda

Landlords are allowed to include other disclosures and addenda that discuss various aspects of a lease at their discretion or depending on the situation.

EXAMPLE

It includes medical marijuana use, late and returned check fees, bed bug disclosure, asbestos disclosure, shared utility disclosure, and mold disclosure.

Maryland state laws do not mandate these disclosures and addenda.

Types of Rental Agreements in Maryland

Different types of lease agreements can be executed in Maryland. These agreements are typically used in various leasing scenarios to align with the specific terms of each.

Types of lease agreements include the following:

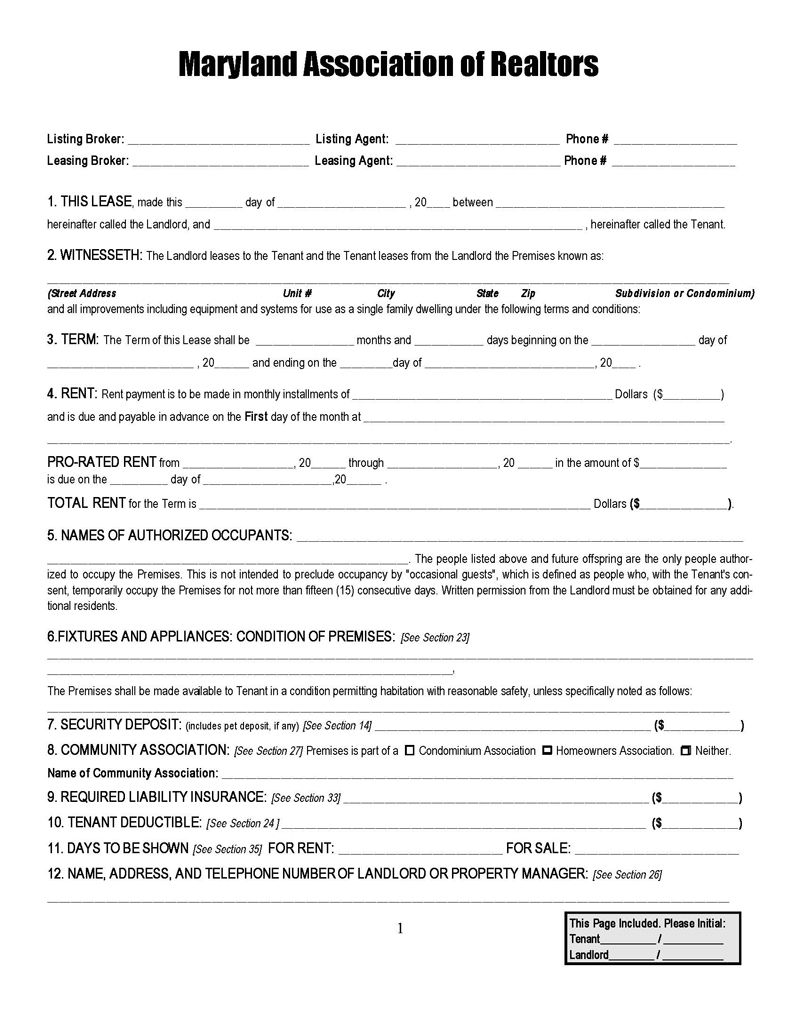

Association of realtors

This type of agreement is used when a landlord is represented by a real estate broker or an association of realtors. Unless otherwise agreed, the broker or association is responsible for collecting payments and executing the contract on behalf of the landlord.

Commercial lease agreement

For commercial properties such as restaurants, retail stores, or offices, commercial lease agreements are used between a tenant and a landlord. These agreements are executed in accordance with Title 2A: Maryland Code Commercial Law.

Month-to-month lease agreement

A month-to-month lease is ideally a type of short-term rental agreement that is executed on a monthly basis. This kind of contract is typically signed by a tenant who is not obligated to any particular terms and who has the right to terminate it at any time with 30 days’ notice from either the landlord or the tenant. This type of lease agreement is sometimes referred to as an “at-will” lease agreement.

Rent-to-own lease agreement

A rent-to-own lease agreement is used when an individual wants to rent-purchase or lease-purchase a property. In this case, the tenant is contributing rent to the purchase of the property. Thus, the seller is required to give the buyer a purchase option following the conclusion of the lease period.

Roommate lease agreement

Often two or more people can be living in the same rental unit. In this scenario, they can use a roommate lease agreement detailing their obligations towards the lease and responsibilities towards each other. This type of lease relies on the mutual consent of all parties involved.

Standard lease agreement

A standard or fixed-term lease is a rental agreement that lasts for a predetermined period of time, typically one year. The end of this lease period marks the end of the rental period. This type of lease is used for residential leasing only.

Sublease agreement

This allows one tenant to sublet or assign their lease to another party with the landlord’s consent. For the remainder of the lease, the original tenant transfers their rights to a new tenant. However, they remain obligated to the landlord.

Should a Landlord issue a Notice to the Tenant Before Entering the Property?

In most states, landlords are required to give notice before entering the property. Maryland does not, however, have any laws pertaining to the landlord’s right of entry. Although it is advised that the landlord schedule the time during regular business hours (9 am to 5 pm) and provide the tenant with written notice of the entry, typically 24 to 48 hours in advance.

Frequently Asked Questions

In Maryland, there is no minimum or maximum length for a lease agreement. However, typically, a residential lease will last for one year. However, the tenant and landlord can agree on the terms of their tenancy and put them in a signed lease agreement.

This agreement may be legally binding if both parties sign it and it contains certain rights and obligations for each party, but only if it is legally validly executed.

In Maryland, lease agreements do not need to be notarized but should be signed by both parties. If the agreement is written and signed, it is considered legally binding without notarization.

Unless specifically stated in the lease document or by a written agreement between the parties, the lease agreement can typically be automatically renewed in Maryland. The lease should, however, be renewed through a written renewal clause that is attached to the agreement.