The Credit Card Authorization Form is a formal document signed by a cardholder to approve a charge to their credit card for one-time or recurring payments during a specified period.

The form authorizes the third party to make a payment by using the cardholder’s written consent and credit card information.

Primarily, the form is used for two key functions. First, it authorizes a business to charge a credit card without the cardholder being physically present. Second, it helps prevent unwanted or fraudulent chargebacks that may deform the relationship between the merchant processor and the business.

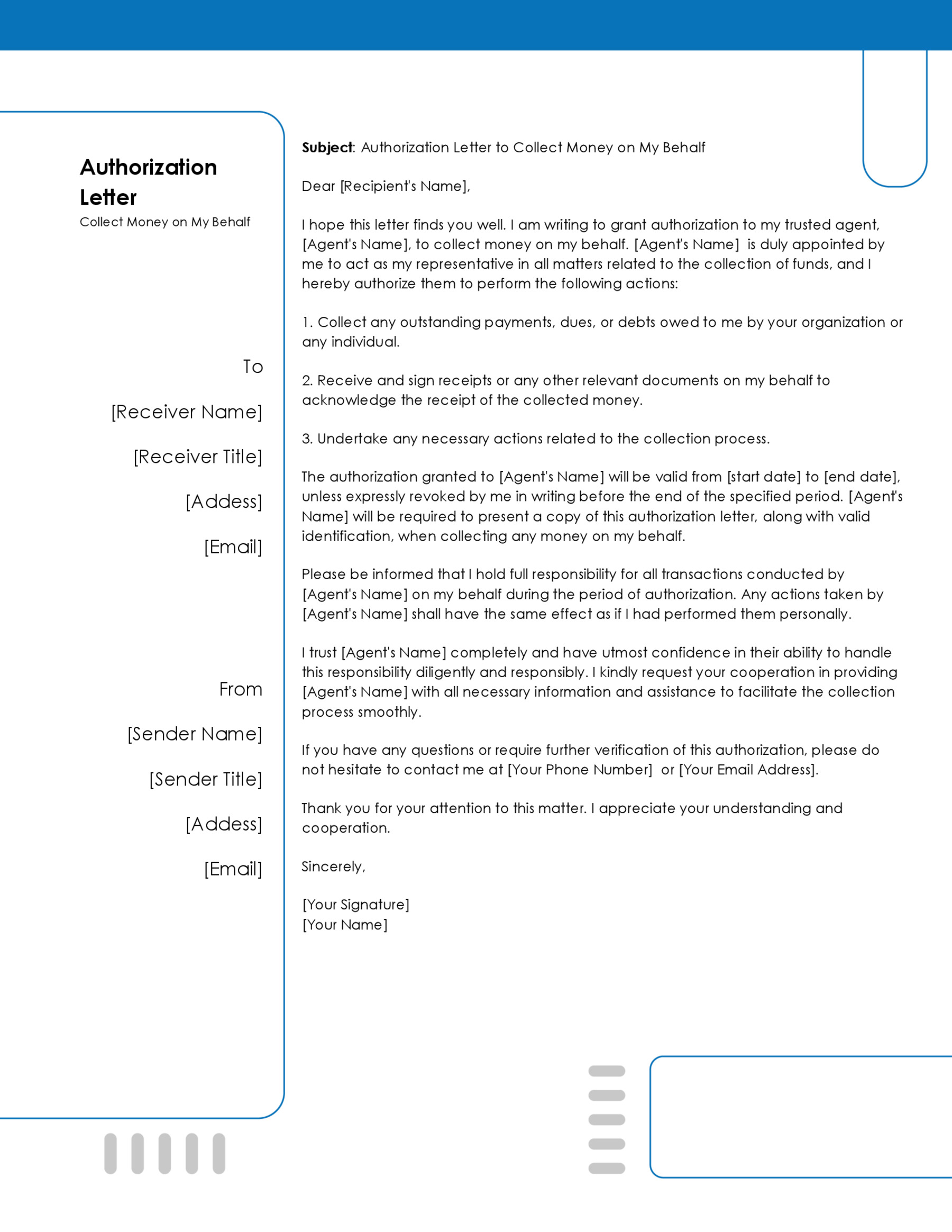

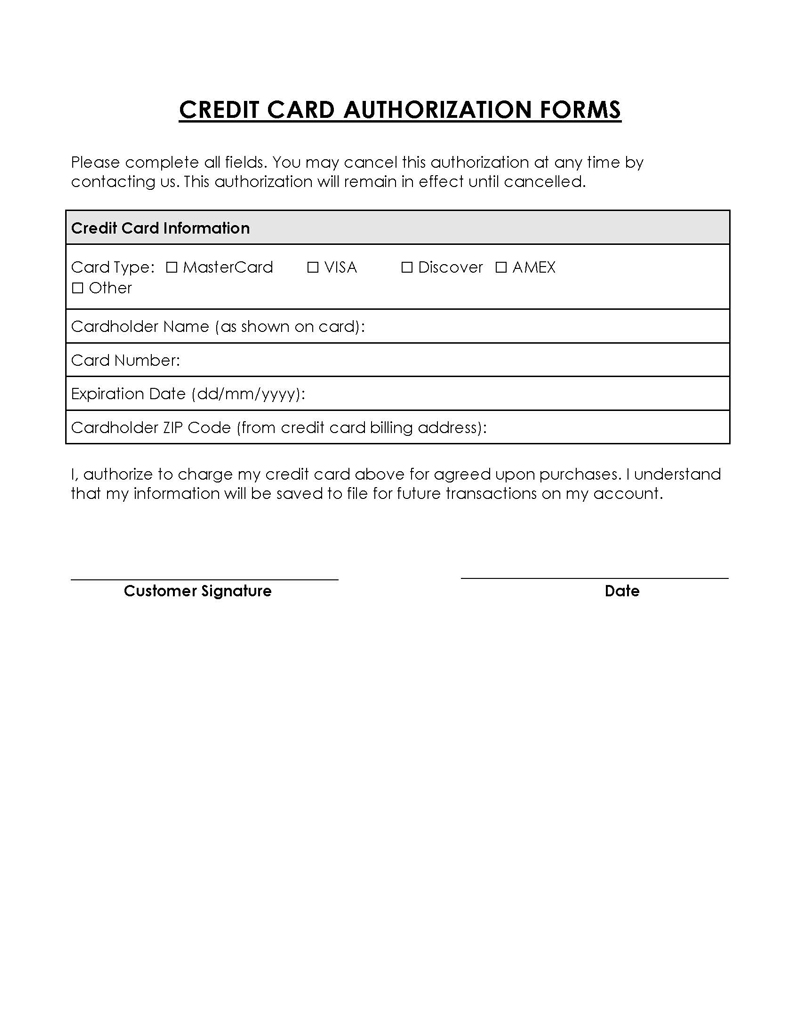

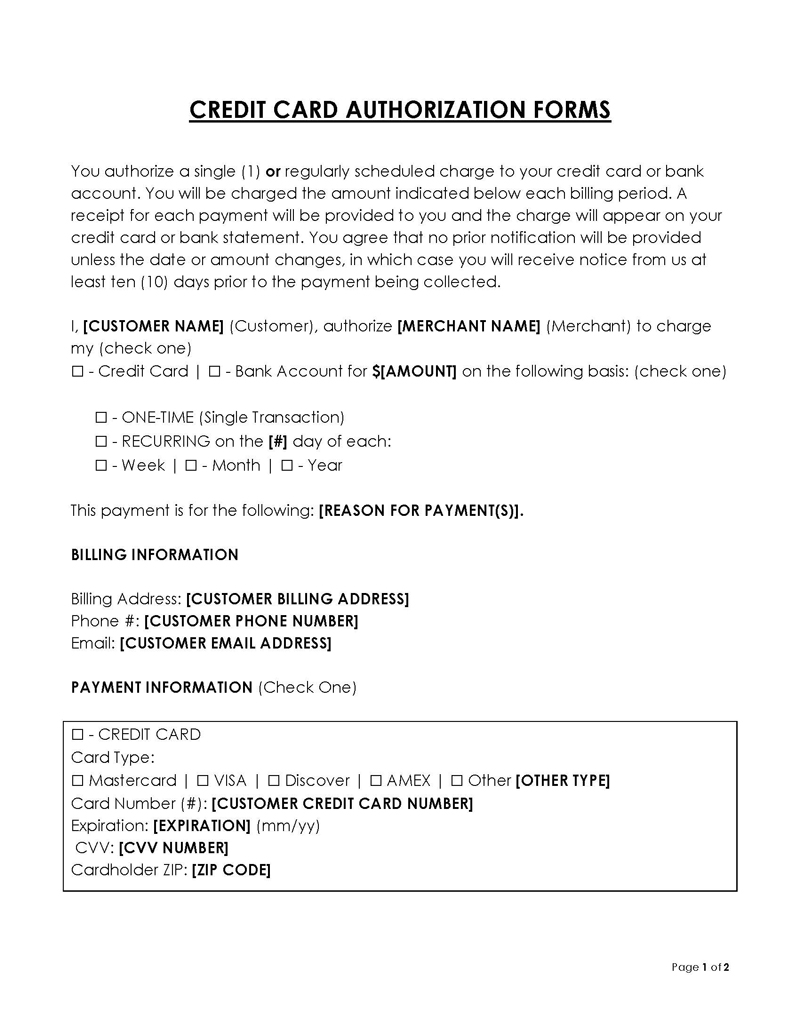

Free Templates

Uses of a Credit Card Authorization Form

When a cardholder uses their card to make payments, the details about the card are usually procured by swiping the card at the cash counter. However, in the case of the form, the form containing the details about the card and the transaction is sent to the concerned company to aid in recurring payments. Other than aiding in the processing of one-time and recurring payments, the form helps in many other ways.

These include:

Protection from chargebacks and disputes

A chargeback is a security feature devised by credit card processing merchants to help protect customers from unauthorized transactions.

EXAMPLE

When a customer’s card is charged without their consent, they may request their bank or the card processing merchant to reverse the charges.

Disputes and chargebacks can adversely affect the relationship between a business and the merchant processor. Businesses and merchants need to be one step ahead of those looking to take advantage of their businesses and conduct fraudulent activities using stolen credit cards.

Most card processing merchants usually allow businesses no more than 1-3% dispute range on all the transactions processed by the merchant. If the disputes exceed the threshold set by the merchant, the merchant may choose to suspend or stop their relationship with the business.

The form is a great way for businesses and merchants to protect themselves against chargebacks. If you have a signed authorization form from the cardholder permitting you to charge their credit card for your products/services, you may be able to dispute the chargeback request with the card issuer.

Recurring transactions

The forms are very important, especially for recurring transactions. It is also important for manually entered transactions as well as card-not-present and card on file transactions. Using a the form helps the business mitigate the risks of customers saying the transaction was fraudulently made on their card.

Card-not-present transactions

Card-not-present, denoted as CNP, is a type of transaction that happens when the cardholder and the physical credit card are not present at the time and place of the transaction. Using the form serves as an extra form of security and proof for all CNP transactions. In the event of a dispute or chargeback on the charges made on the credit card, you can present verifiable proof to help settle the case.

B2B payments

B2B payments– Business-to-business payments are usually made for various reasons, and businesses may choose to use the authorization forms for different reasons.

EXAMPLE

A business may decide to use the form to make pre-authorized purchases so that when the stock levels are low, they can be restocked; they can also use the forms for subscription-based services and utility payments.

Using the form enables the business to make timely payments and avoid being inconvenienced in any way.

Saves time

Using the form will save much time as you will not have to contact the cardholder every time to make payments for the products/services supplied to them. You will simply use the information provided on the authorization form to process the payment.

To take a deposit for future purchases

Credit card authorization warrants the merchant to make an authorization hold on the customer’s credit card and set it as a pending transaction to ensure that they have enough funds to make the current and future payments. The authorization hold can range from $1 to the total amount depending on the type of products/services being sold or the level of commitment required for the customer to reserve such services.

Types of Credit Card Authorization Forms

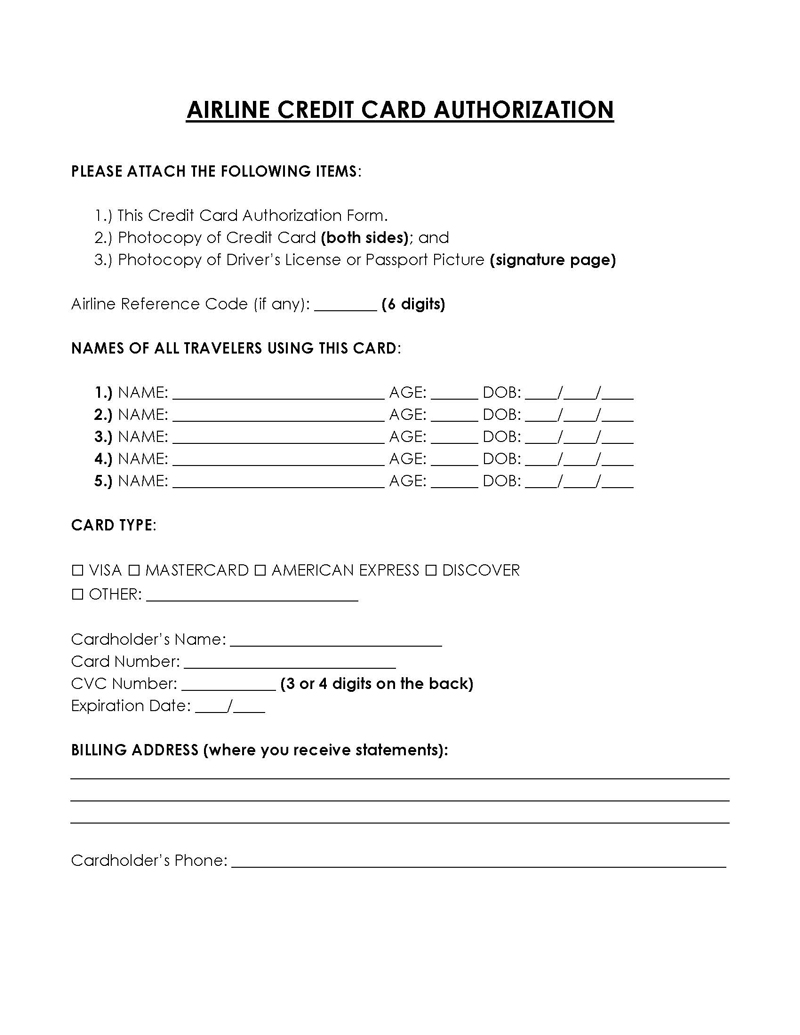

Airline credit card authorization form

An airline credit card authorization form is a document that allows a passage to pay for their flight ticket by completing and signing the form. The authorization form serves as consent by the credit card holder to authorize the use of the credit card by the passenger. Airline credit card authorization forms are commonly used when an individual or an organization pays for a flight ticket on behalf of someone else.

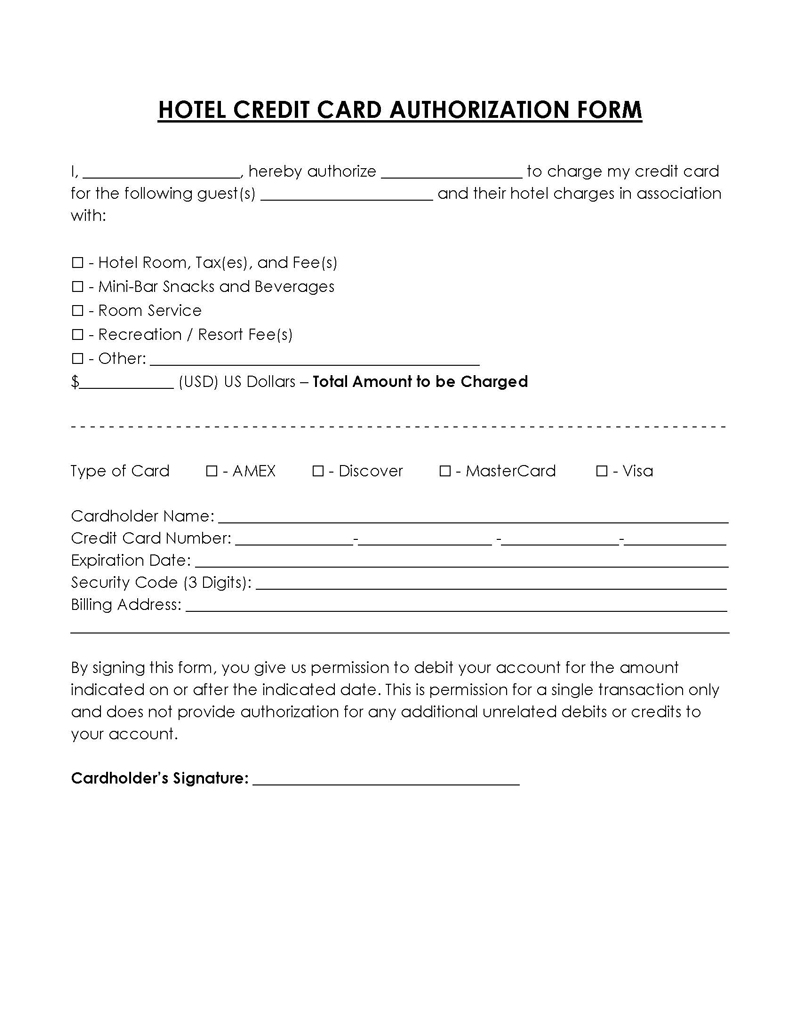

Hotel credit card authorization form

Hotel credit card authorization forms are used by hotels for guests who do not have their physical credit card at hand but have a written and signed authorization from the credit card holder, authorizing them to use the credit card to stay at the hotel.

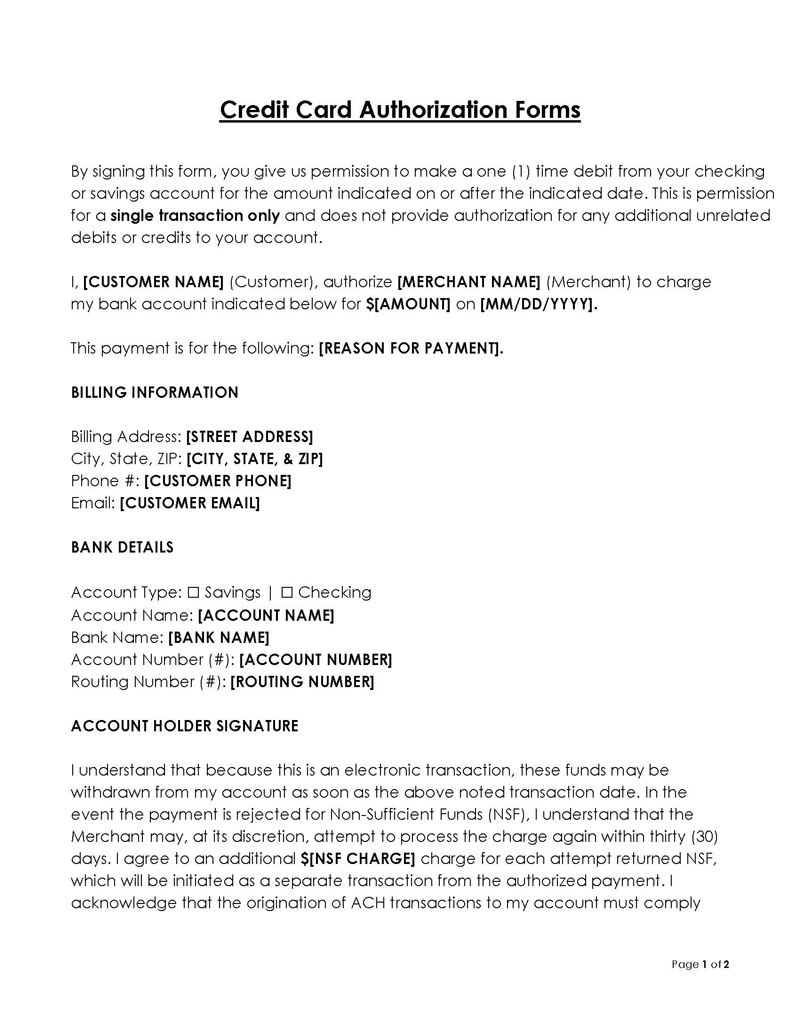

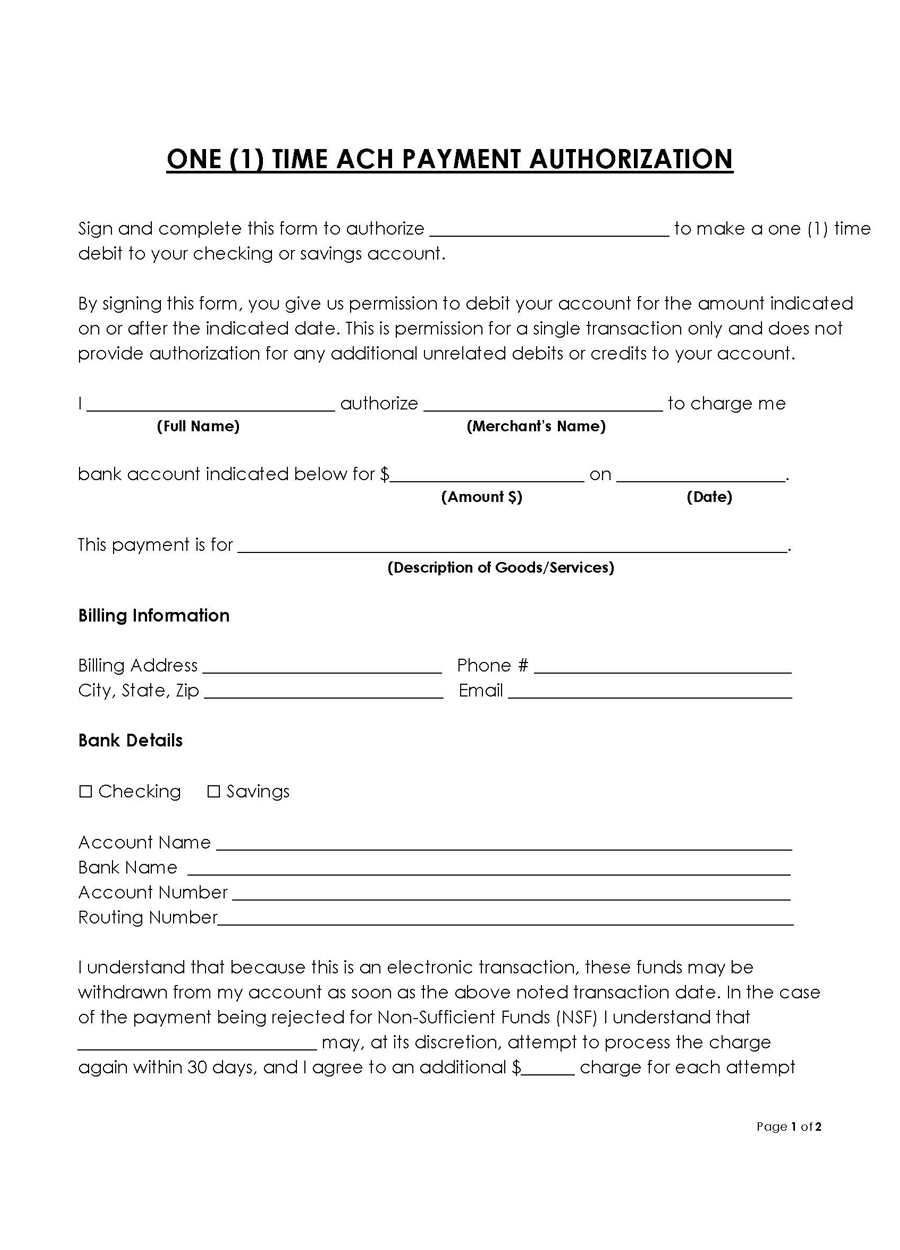

1-time ACH authorization form

A 1-time ACH payment authorization form is a document issued by a cardholder providing permission to a merchant or company to deduct a single payment from their credit card. Once the payment has been made, the authorization for allowing the deduction becomes invalid.

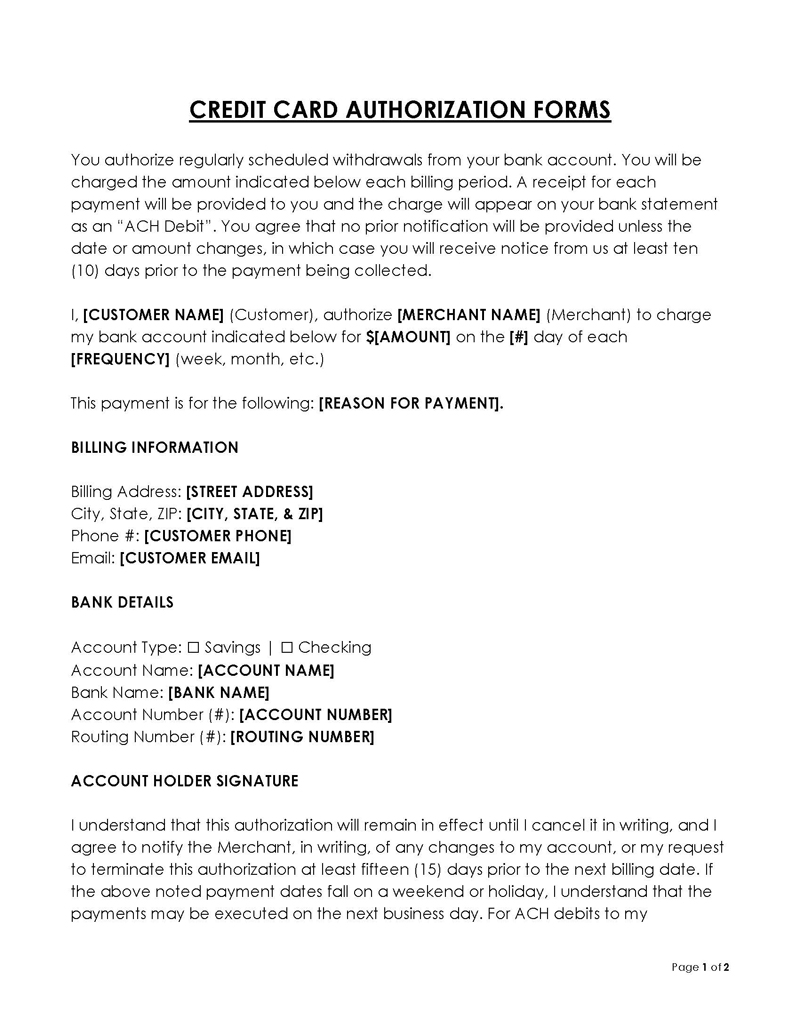

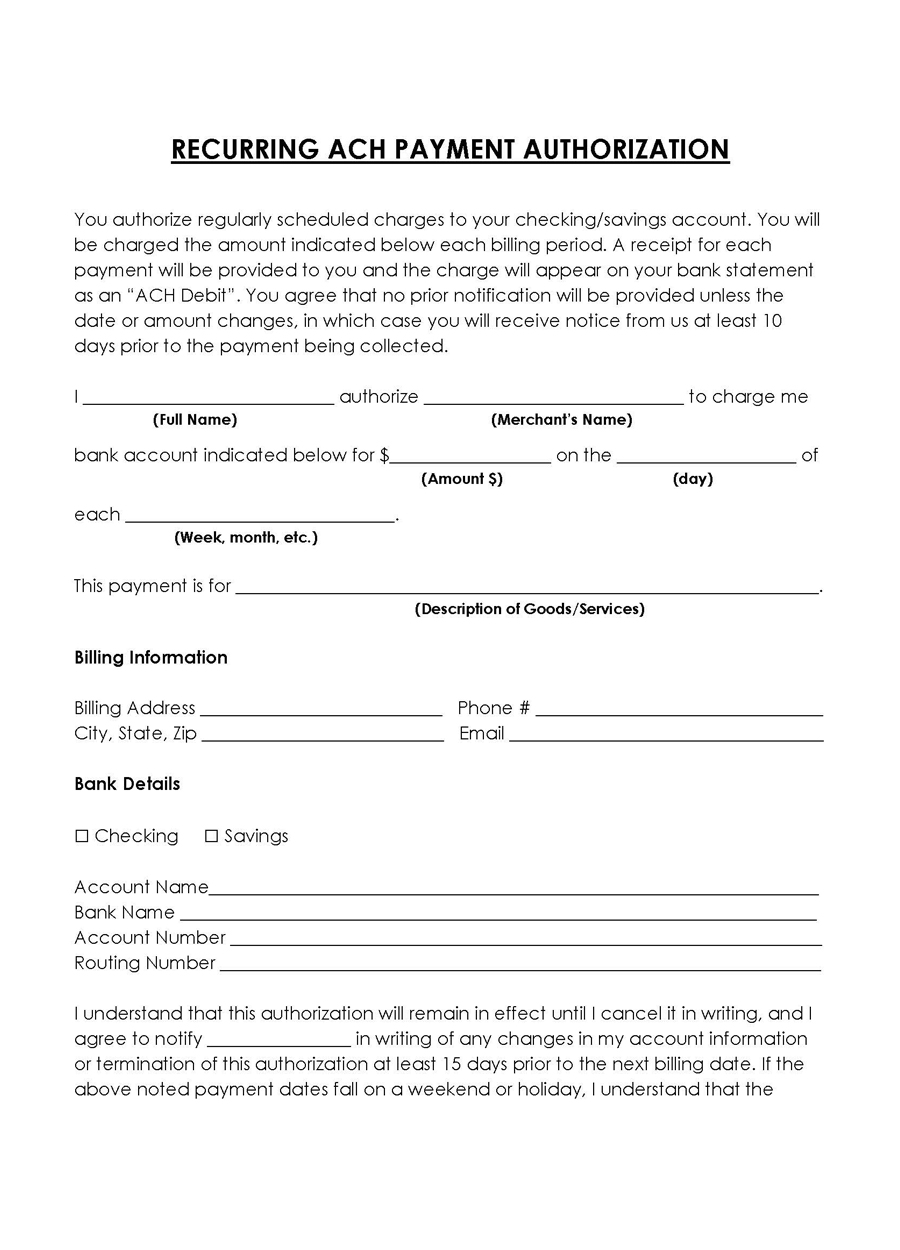

Recurring ACH authorization form

A recurring ACH authorization form is a type of credit card authorization form that authorizes a company, merchant, or property owner to deduct recurring payments from a client’s credit card as agreed upon. The payments are deducted at the end of each billing cycle or on the date specified on the form by the credit cardholder.

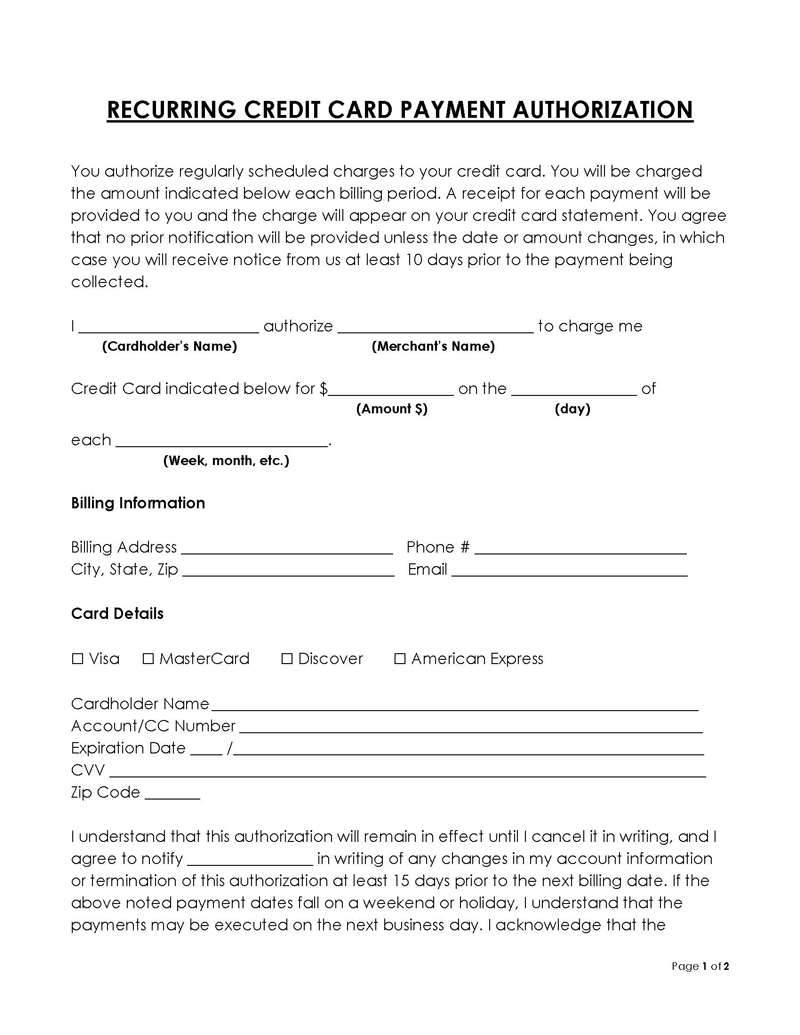

Recurring credit card authorization form

A recurring credit card authorization also referred to as a “card on file” transaction, is a type of authorization that a cardholder makes authorizing a business to charge them for recurring payments.

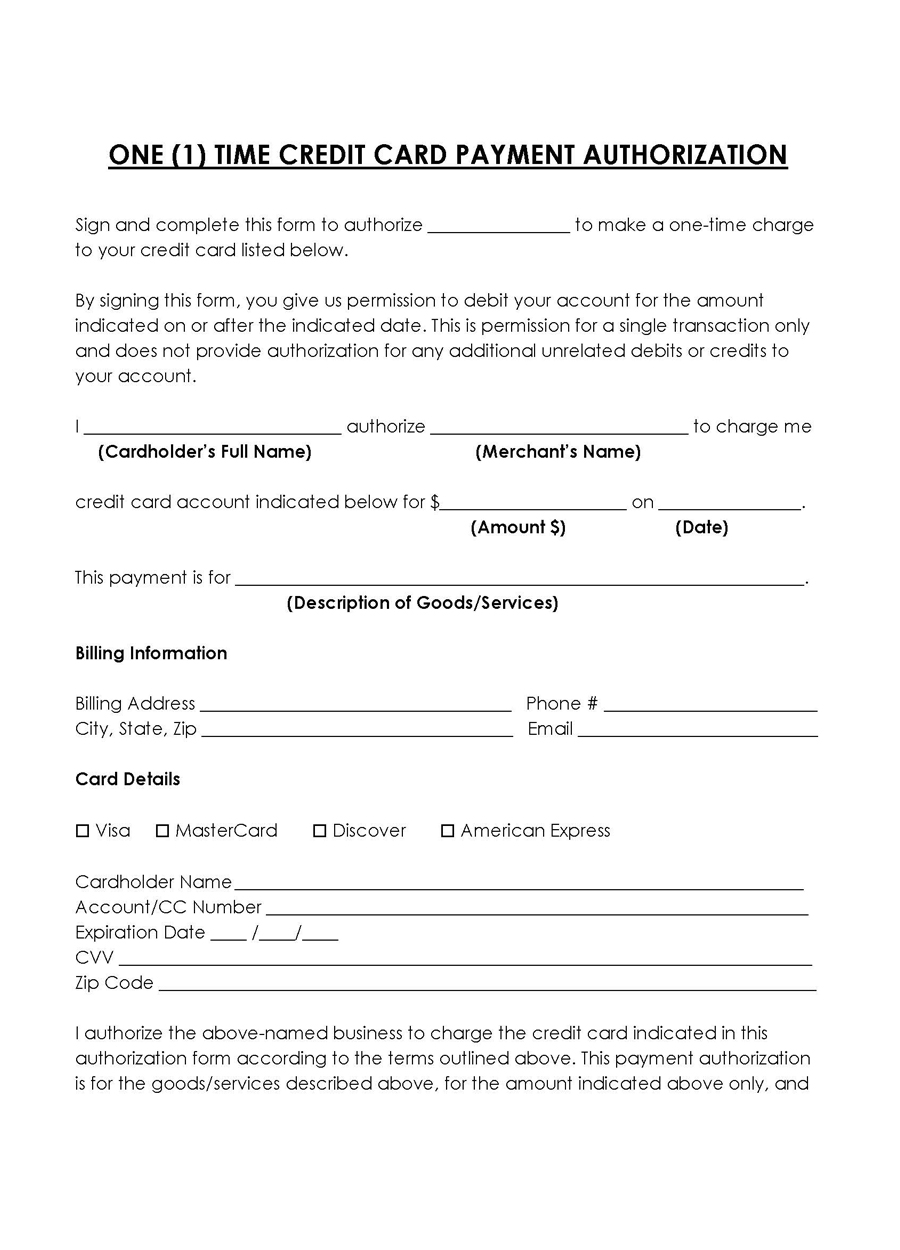

1-time credit card authorization form

A 1-time credit card authorization form is used when authorizing a single transaction. It is usually simple and pretty straightforward and does not require much information.

How a Credit Card Authorization Form Works

Before using this form, it is important to understand how the form works, i.e., how to request the authorization and what should be included in the form.

Below is a breakdown of how the form works:

Ask the customer to fill the form

Once the customer has decided to sign up for a membership or subscription with the merchant, they should give them the form to complete. It is important to have the customer complete the form to avoid future disputes and chargebacks, especially when the payments will be recursive.

Frequency of payment

The customer should specify the frequency of such payments in the authorization form.

EXAMPLE

If the payments are recurring, the customer should specify the date for when the payments should be deducted from their accounts. If it is only a one-time payment, they should put a disclaimer that the authorization form will become invalid after the payment has been deducted.

Cardholders sign the form

Once the required information has been provided in the form, the customer should affix their signature followed by their name. The cardholder needs to affix their signature on the authorization form as, without it, the form may not be deemed valid and may not be accepted as proof in the event of a dispute.

Charge card/withdrawal from a bank

After the cardholder has provided all the required information and signed the authorization form, the merchant can charge the client’s credit card. The amount charged on the card should match the one specified on the authorization form, and should there be any changes in the prices, the client should be notified and a new authorization form signed by them to show that they acknowledge being charged with the new rates.

Credit Card Authorization Hold

A credit card authorization hold is a temporary hold placed on a portion of the whole amount in the cardholder’s account. A credit card hold is usually done when the final total of the transaction is not known at the time of the authorization, such as at gas pumps or hotels.

How to Make a Credit Card Authorization Form

The forms are useful when processing payments as they help avoid future disputes and chargebacks.

Here is a step-by-step process of making the form:

Create a template

Use MS word or any other related software to create a template. A template will come in handy, especially if you are dealing with several customers at once. You can simply give them a copy of the template and have them provide the required information.

Provide customer and merchant’s information

The next step is to provide both the customers’ and merchant information in the form.

Some of the information to include in this section include:

Cardholder’s name

The authorization form should include the cardholder’s full name as is in their registration documents. The names must match the ones included in the credit card to enable payment processing.

Merchant’s name

The name of the merchant processing the payment should also be included in each authorization form. This information is important, especially when dealing with multiple merchants.

Amount to be charged

The exact amount to be deducted from the credit card should be included in this section. And only the stipulated amount should be deducted from the credit card.

Date of authorization

The date on which the authorization was made should also be included in the form for reference. The date can also help you track when specific payments were made and when such payments should be deducted again for recurring payments.

Description of goods/services

A complete description of the products/services being paid for. It is important to include a description of the goods and services being paid for by the customer to be able to defend why such payments were deducted in the event of a dispute.

Merchant’s business information

The authorization form should also include the merchant’s business information, including their; company name, address, and contact information to aid in raising disputes and dispute resolution.

Transaction type

The form should describe the type of transaction to be charged on the card.

It should specify whether the transaction is a:

Recurring charge

When filling in the authorization form, one should tick the recurring charge box to show that they have authorized recurring charges on the credit card

One-time charge

One should also specify whether the authorization form is for a one-time charge. For one-time charges, the authorization form becomes void after the transaction is completed.

Billing information

The next item to include in the form is the billing information.

This includes the following:

Billing address

The client’s billing address should be included in the form. It is important to include the billing address, i.e., city, state, zip code, building number, street name/number, and unit number, especially if billing receipts will be sent to the client after they have been billed.

Contact

The client’s contact information, i.e., phone number and email, should also be included in the form for communications and contact should there be a query, failed payment, or disputes on chargebacks.

Method of payment being authorized

The authorization form should specify the authorized payment method to ensure that only authorized payments are billed, especially for recurring payments.

Here are the two common payment methods and the information that should be captured for each:

Bank (ACH)

When billing a client via bank, some of the information to capture on the authorization form include:

- Checking/Saving: The client should specify the type of account being billed, whether it is a checking or a savings account

- Name on account: For the payments to be processed, the client must provide the name on the account, i.e., the account holder’s name

- Bank name: The name of the bank being billed should also be included in the authorization form

- Account number: The client should provide the account number for the account being billed. It is important to counter check that the digits are well captured in the authorization form before signing, as a missed digit may cause the transaction to fail

- Routing number: The routing number should also be included in the authorization form as it helps identify the specific bank being charged.

Credit card

If the payments are to be made via credit card, the following information should be captured in the authorization form:

Type of card

The type of card should be specified in the authorization form. Commonly used cards include; Visa, Mastercard, Discover, Amex

Cardholder’s name

The cardholder’s name will be required by the merchant when processing the payment and hence must be included in the authorization form.

Card number

Since the authorization form will be used in the absence of the physical card, the card number must be provided, and the client must check to make sure that the digits are correctly entered.

Expiration date

The cards’ expiration date is usually included on the card either below or above the card number.

CVV

The CVV is the three-digit number usually included at the back of the credit card.

Acknowledgment statement

The last step is for the party authorizing a charge on their credit card to provide an acknowledgment statement stating that they approve of the charges that are to be made on their credit card. They should also sign and date the authorization form to show that they are aware of its contents and agree to the terms of use of the authorization form.

The party authorizing the payment should also be notified of any charges or penalties incurred, should the payments be rejected due to insufficient charge. This information should be provided to them prior to signing the authorization form.

Frequently Asked Questions

It is considered best practice to use the authorization forms; however, you are not legally obliged to use them.

It is considered a violation of PCI standards to record a customer’s CVV; therefore, the form will not have a section to include it. If you would like to manually input the payment, you will have to contact the client to provide you with the CVV each time you input the card.

A card on file is a type of authorization that a cardholder makes authorizing a business to charge them for recurring payments.

The PCI standards require that all businesses that process credit card information ensure that their client’s information is kept in a secure room or filing cabinet and restrict access to employees who require it to fulfill their assigned duties.

Credit card authorizations can last for as long as the client wishes to continue the service, i.e. until they decide to cancel their membership or subscription.

Credit card authorization forms are not legally required but are a great tool for businesses to limit chargebacks and disputes, which may hurt their relationship with both the client and the card processing merchants.