Petty cash is a particular kind of cash fund that is used to pay for insignificant purchases and the day-to-day operations of a business. Such expenses include postage fees, office supplies, cab fares, delivery charges, etc. Businesses often have such funds set aside for their employees in secure storage and appoint a custodian or controller.

Rather than going through the regular expense reimbursement process, employees can directly access the petty cash fund to make small purchases or cover incidental expenses. The petty cash amount varies from one company to another, but mostly it ranges from $50- $300. Each payment made from the petty cash fund is recorded in the receipt.

While it is true that petty cash funds may not require the same level of oversight as larger funds, they still need to be managed and tracked to prevent fraud or misuse. And this is why businesses should rely on receipts.

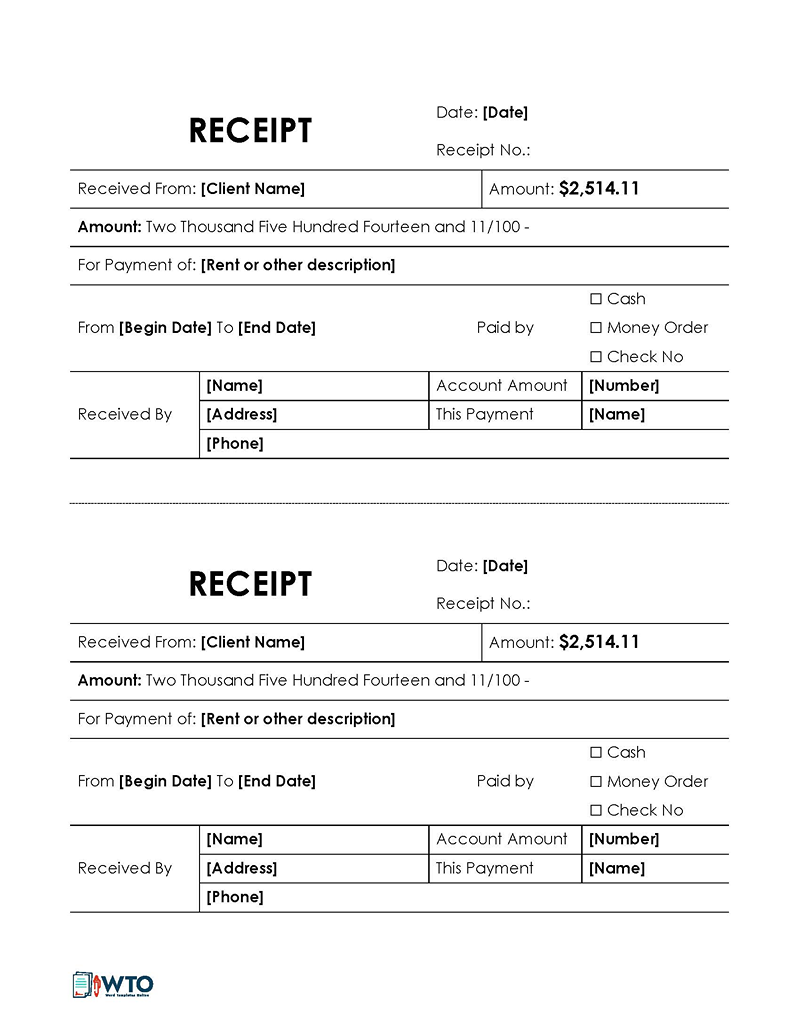

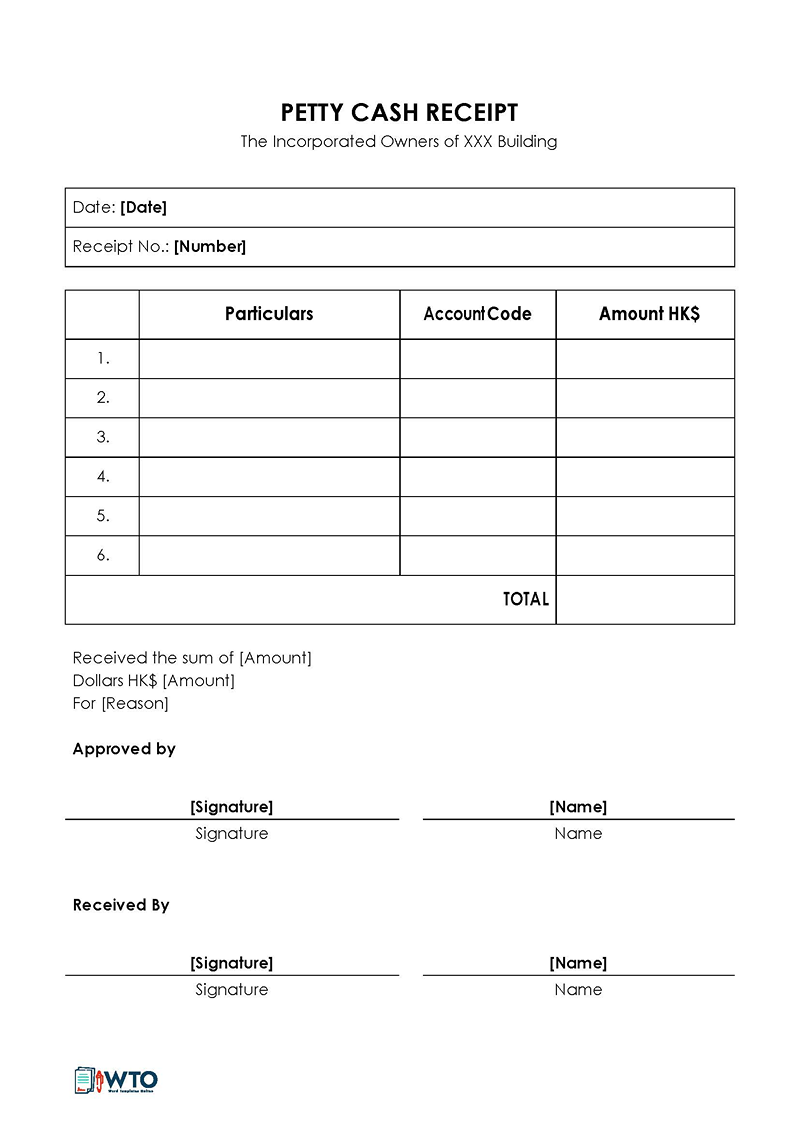

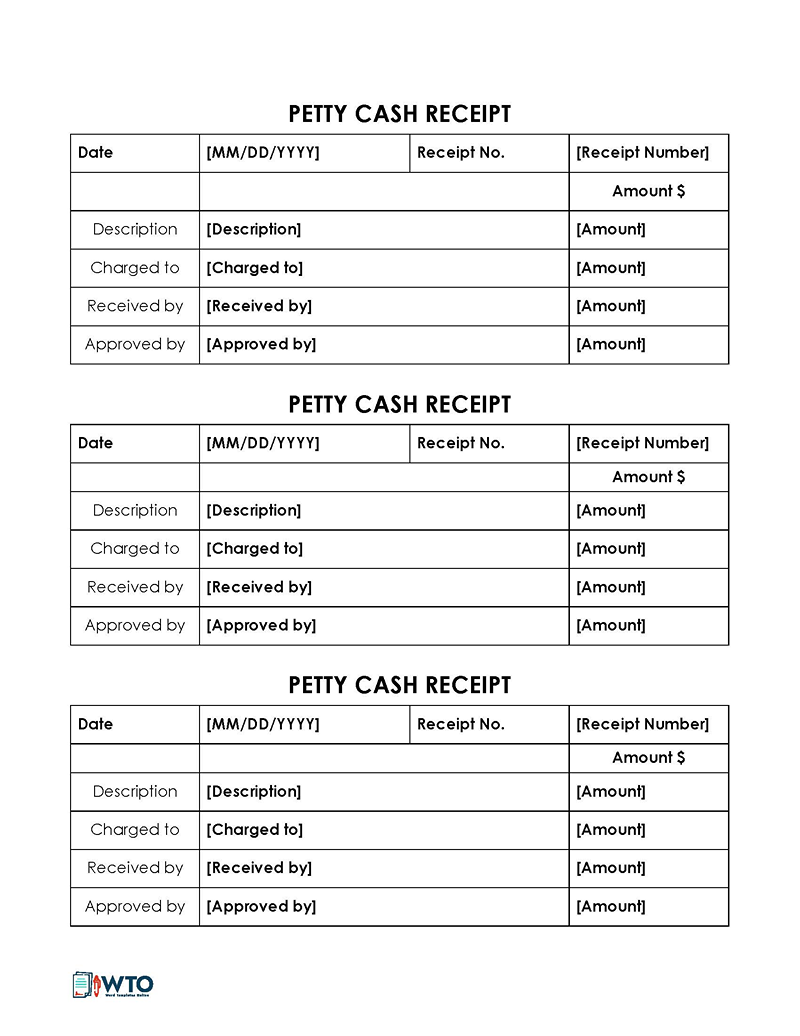

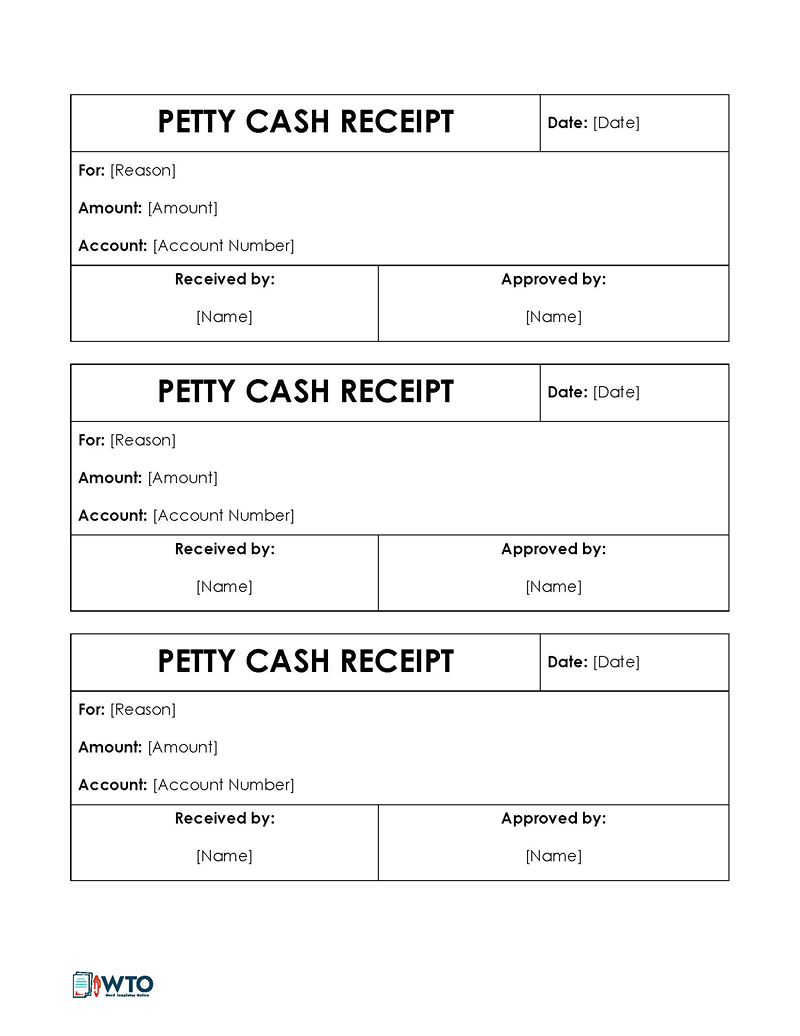

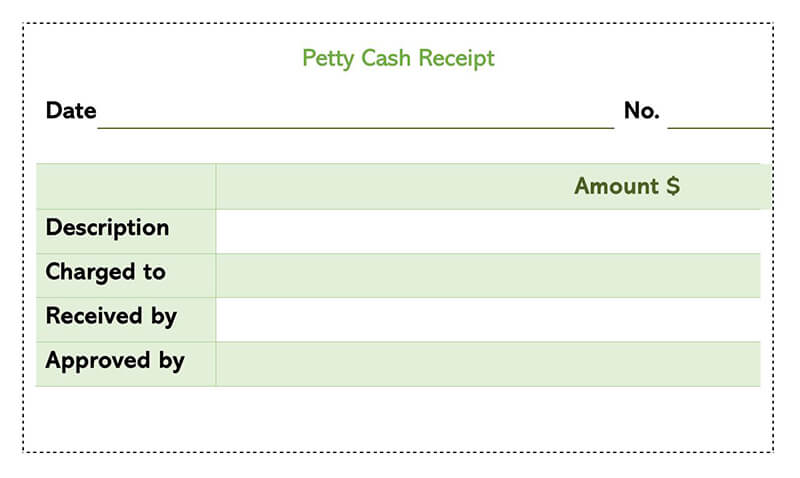

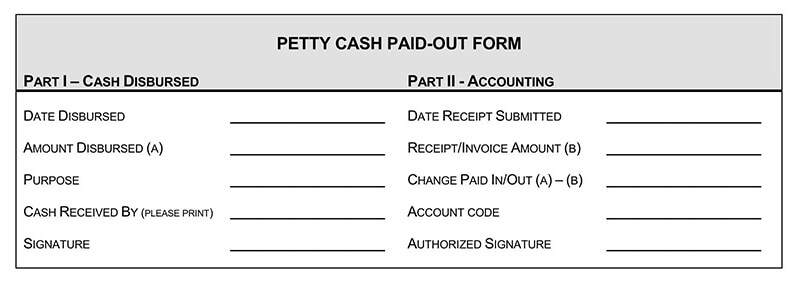

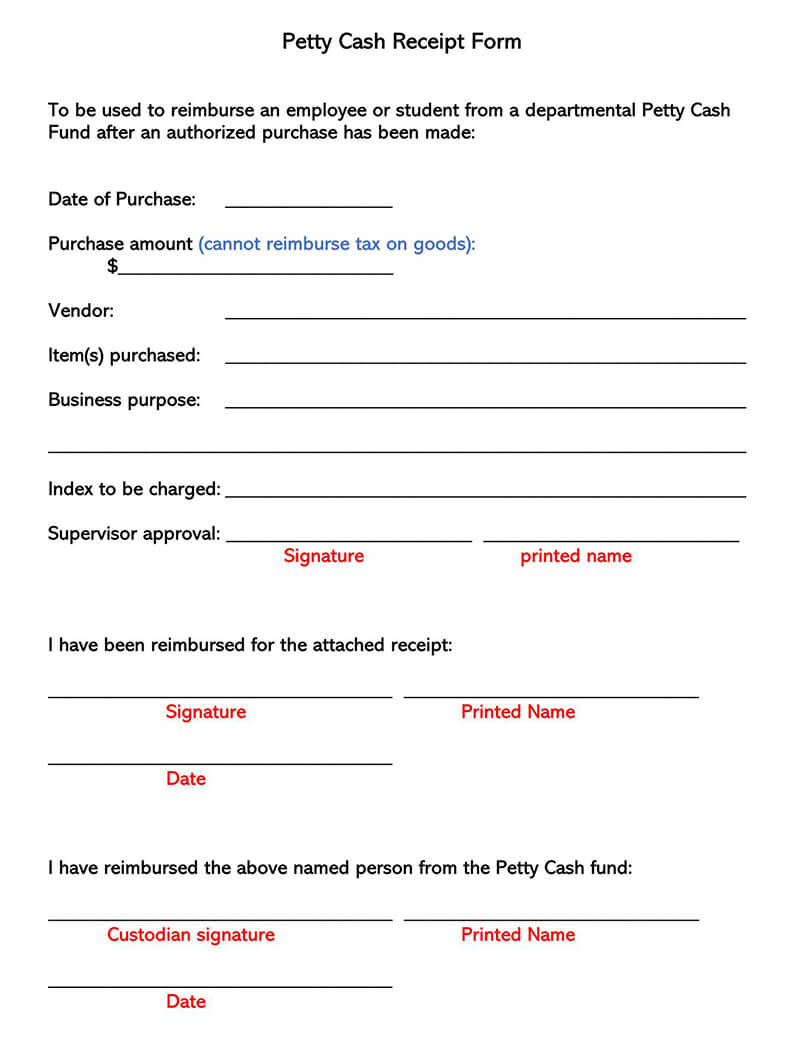

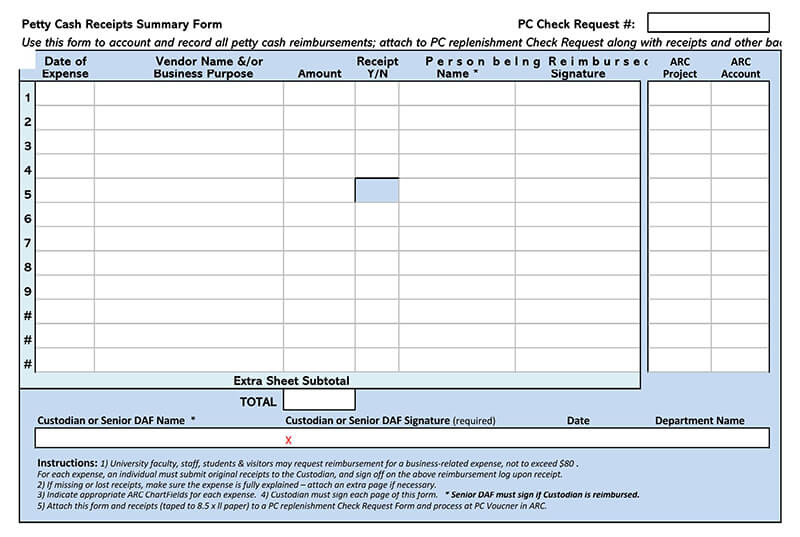

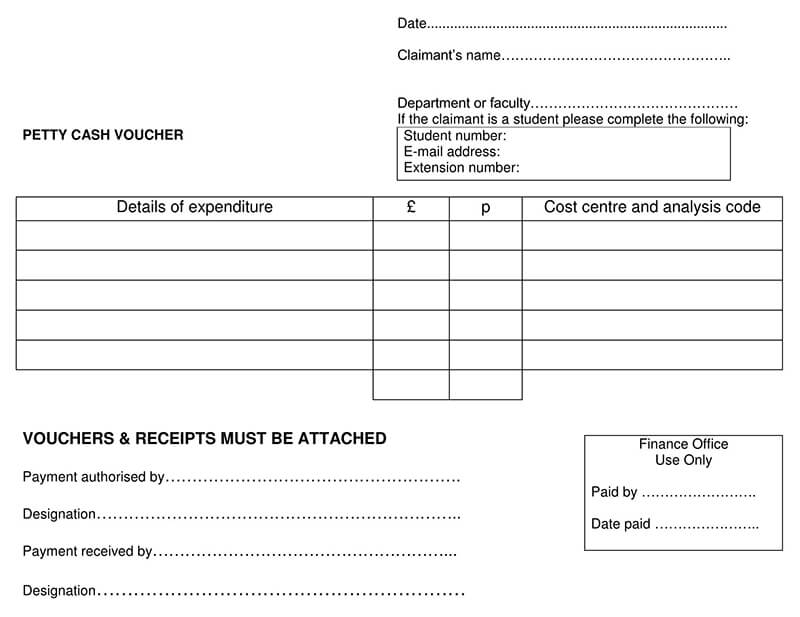

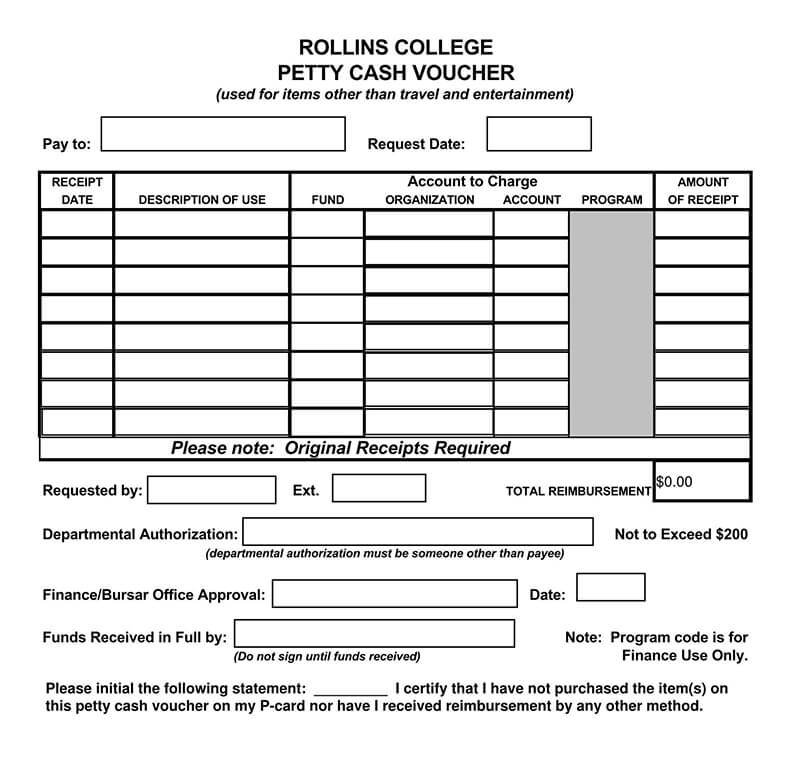

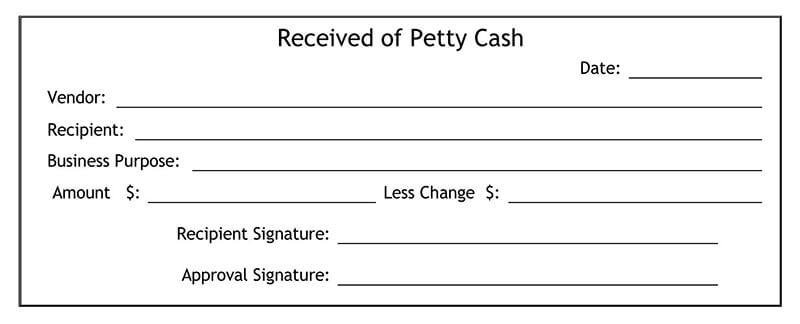

When an employee withdraws cash from the petty cash fund to make a purchase or cover an expense, they typically provide the receipt to document the transaction. It indicates the date of issue, the employee’s or recipient’s name, amount, type of purchase, and the custodian’s signature. The amount spent in the receipts should equal the opening balance of the petty cash funds. Once audited, the funds are reimbursed for the subsequent period.

Companies should use a fillable and printable template that they can complete to expedite the payment processing time.

This article explains how to document petty cash transactions using receipts. It discusses the fundamental components of such a receipt. It also provides free templates that can be utilized to make professional receipts for petty cash.

What is a Petty Cash Receipt?

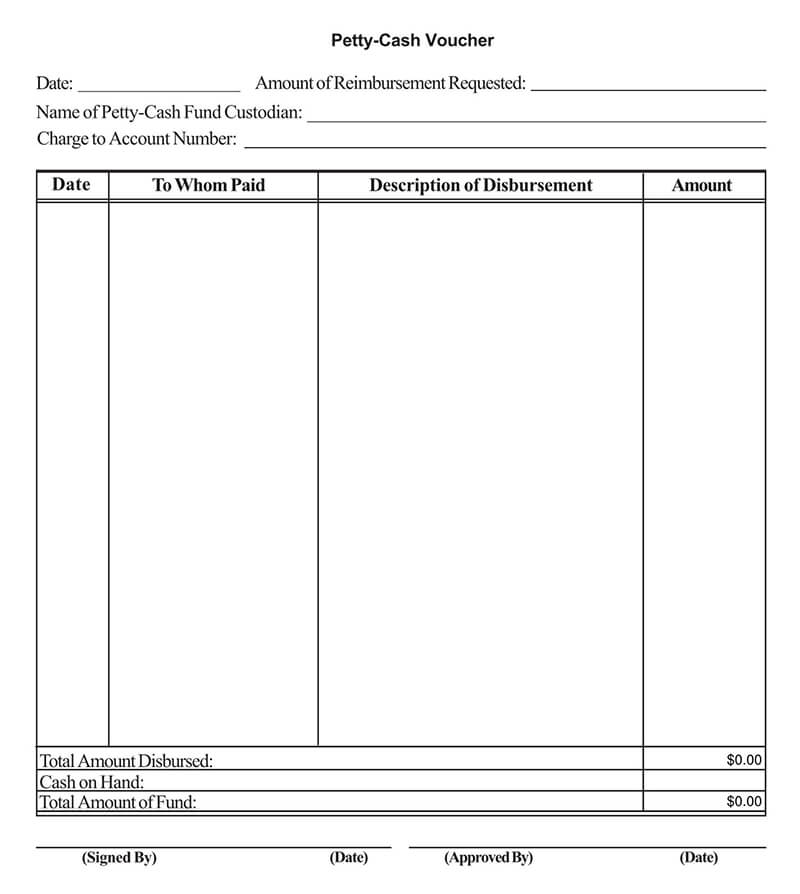

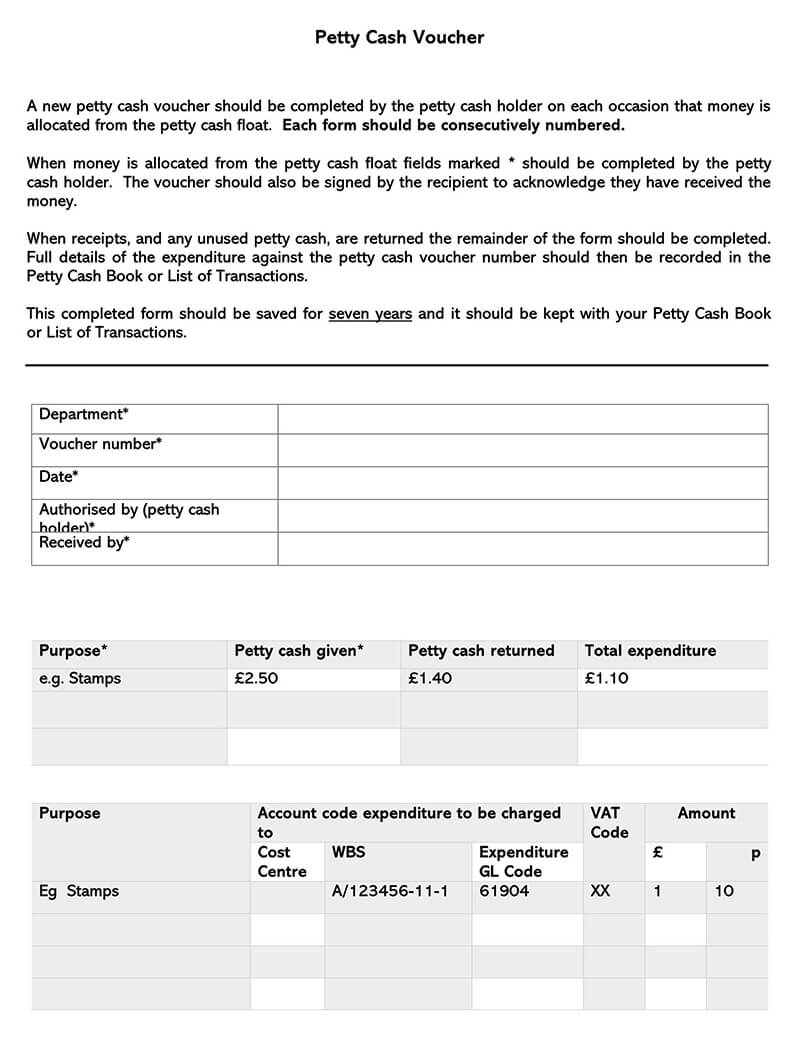

The petty cash fund is managed via the receipts; when any money is withdrawn from the fund, a receipt must be issued to record the transaction. This receipt is also known as the petty cash voucher.

The petty cash voucher features essential details about the transaction, including:

- The recipient

- The person issuing the money

- Amount issued

- How the funds will be used

- Date of issue

The receipt is used to justify any spending from the petty cash fund. These vouchers help in tracking money taken from the fund, which is also logged into the petty cash logs.

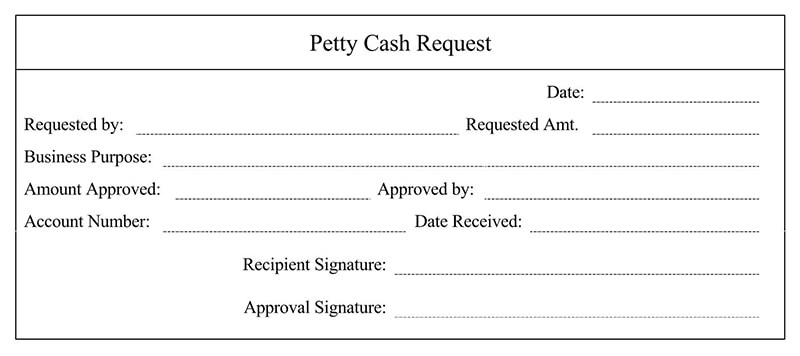

A petty cash voucher can also be used alongside petty cash request forms to replenish the petty cash fund if it’s depleted. The amount on the cash request forms should be equal to the amount of cash withdrawn from the fund.

What is a Template for Petty Cash Receipts?

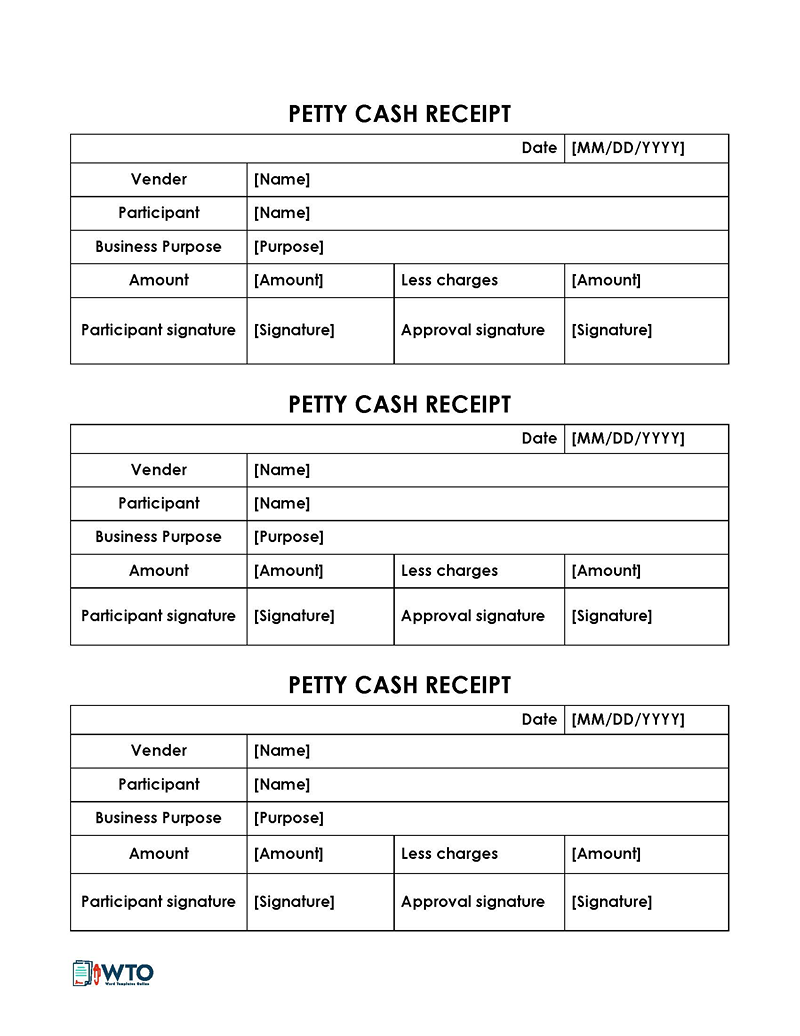

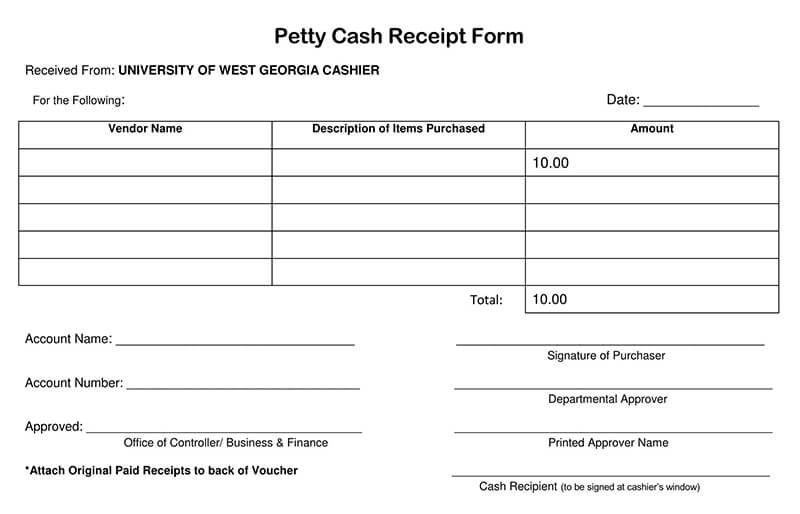

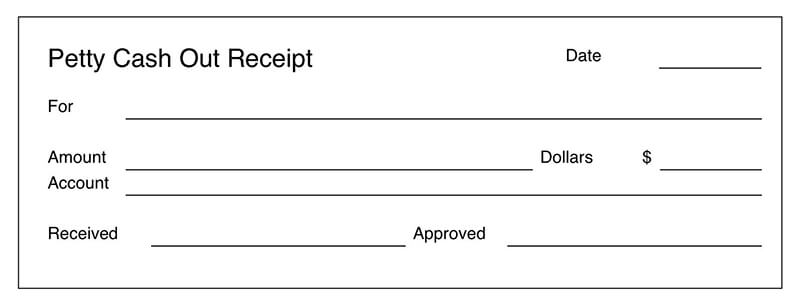

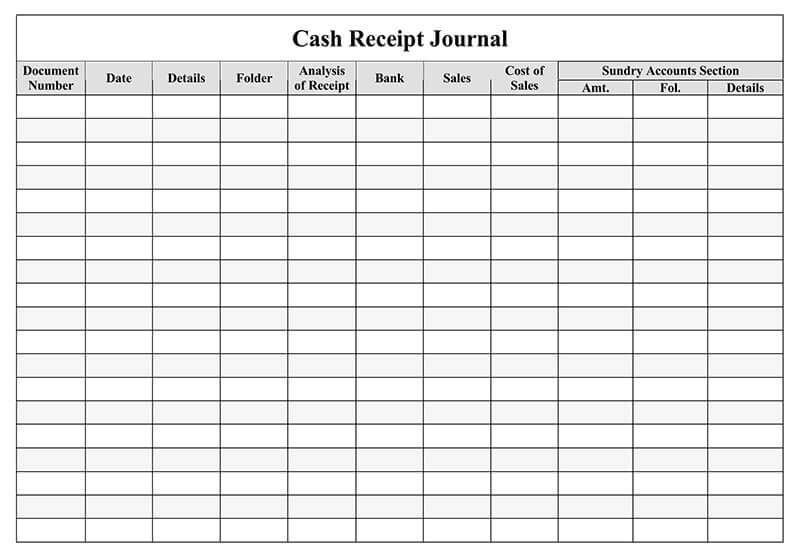

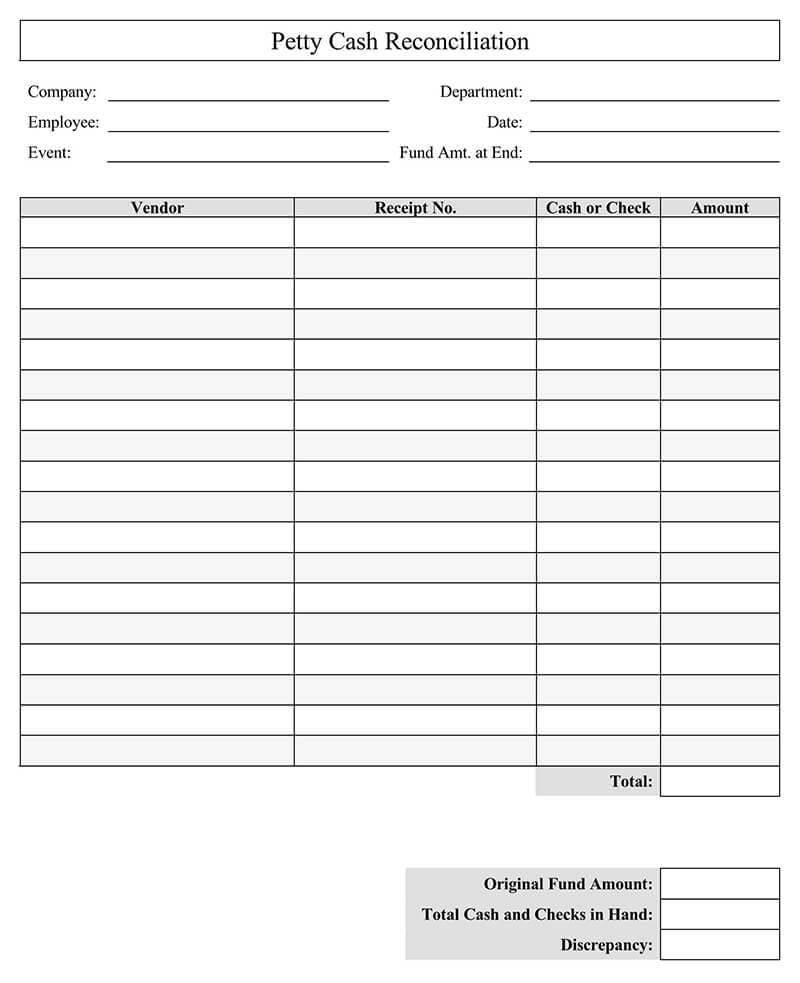

A petty cash receipt template is a pre-designed document that facilitates accurate documentation of small transactions.

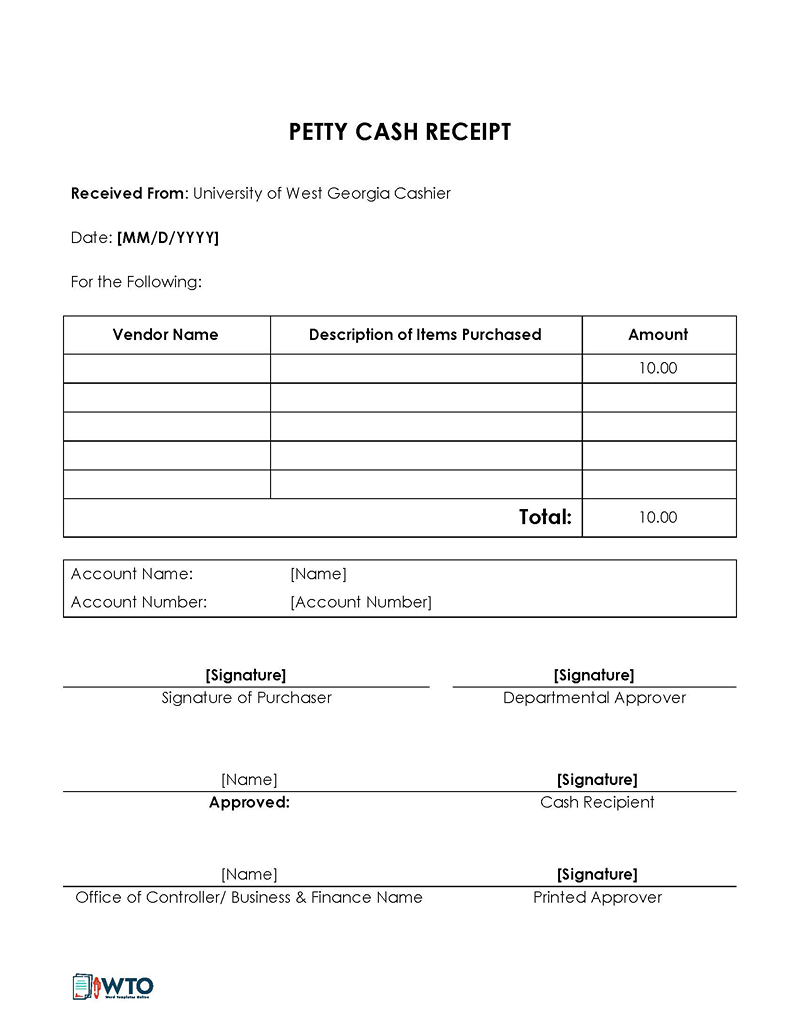

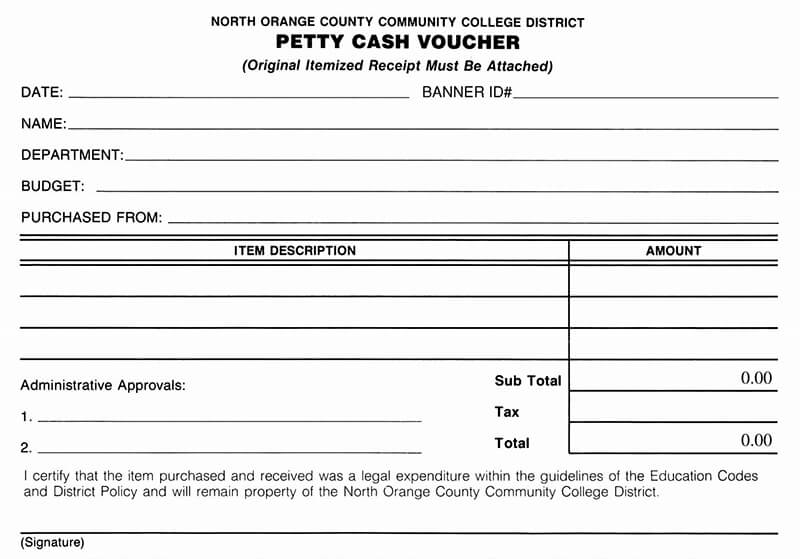

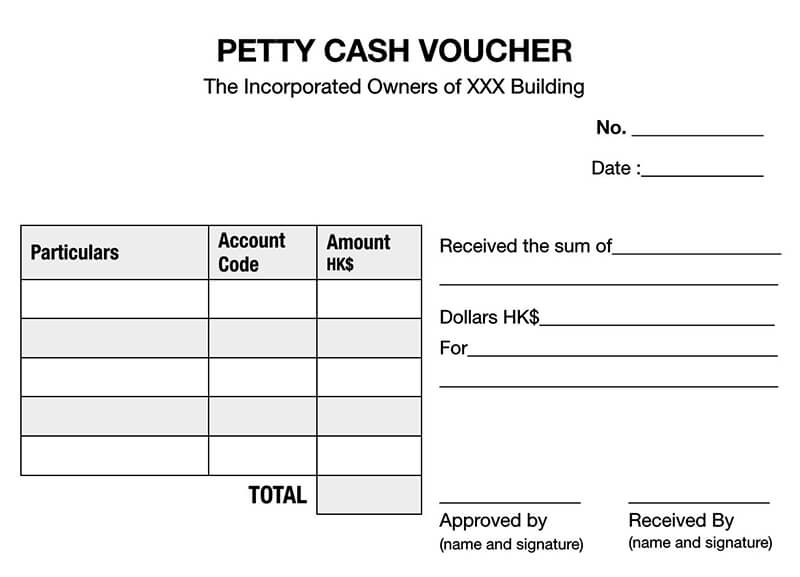

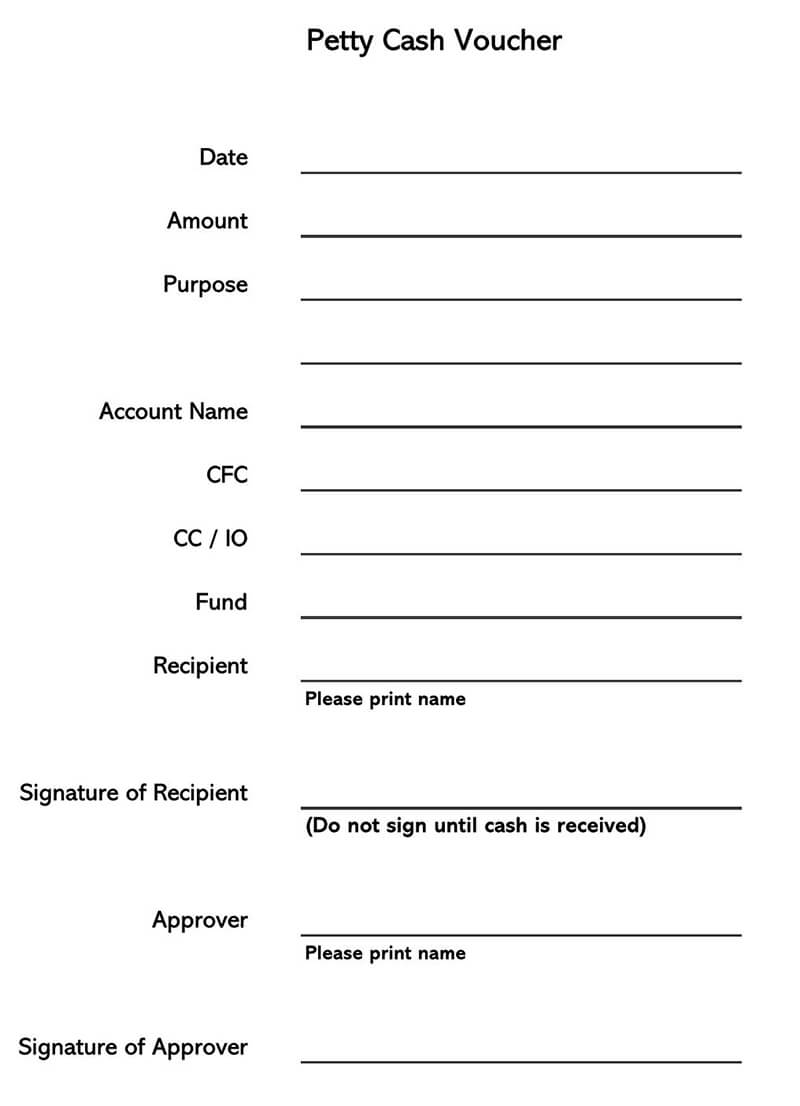

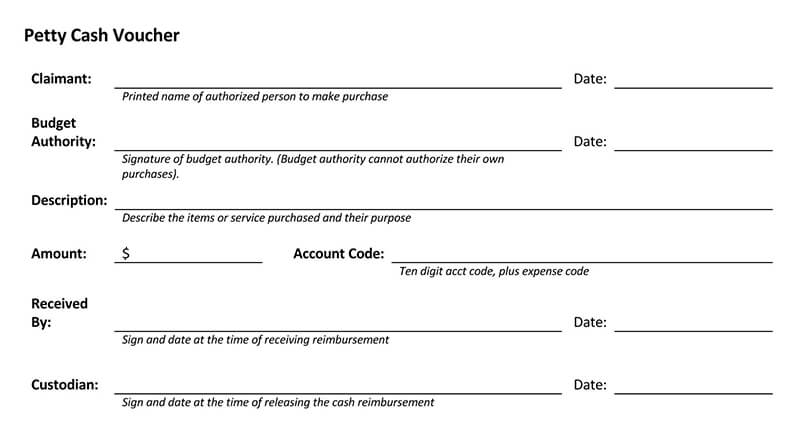

It includes fields to record important details such as the date, receipt number, amount disbursed, purpose, recipient’s name, description of expenses, and custodian’s signature. It can be customized and edited using software such as MS Word and Excel to incorporate business-specific items such as the company name, logo, and contact information.

Free Templates

Benefits of Using a Petty Cash Receipt

The receipts are essential accounting documents used to record payments made from a company’s petty cash funds. By using these receipts, businesses can streamline the process of tracking expenditures and enjoy several associated benefits, including:

Financial reporting

The information recorded on receipts can be used to generate reports on petty cash expenditures. These reports provide insights into spending patterns, identify areas of high or unnecessary expenses, and assist in budgeting and financial decision-making.

Accurate accounting

A business can define metrics to use to determine the accuracy of expense records. Metrics refer to the type of information collected for each transaction. You can create a standardized document that ensures the same type of information is recorded, thus reducing errors and discrepancies in accounts. Remember, accuracy is a huge consideration during the reconciliation and auditing of petty cash. So, accurate records reduce the chances of misreporting the financial position of your company or department.

Increased transparency and accountability

You are expected to produce receipts for all small expenses when asking for a reimbursement of the money spent. This, in turn, ensures all parties involved remain accountable when utilizing the available money. Receipts serve as supporting documents during internal or external audits. They enable auditors to verify the legitimacy of transactions and ensure compliance with financial regulations. Receipts also aid in reconciling petty cash balances by cross-referencing them with the recorded transactions.

Easy tracking of expenses

The receipts provide a clear record of each transaction, allowing for accurate tracking of how the funds are being spent. This helps in monitoring expenses and maintaining an organized financial record.

Essential Parts of a Petty Cash Receipt

Free templates for making receipts for petty cash can be downloaded from here. You can modify which entry fields you can include in the template to track cash flow in and out of petty cash funds. However, certain sections are common in all such receipts.

These include:

For a petty cash voucher to help track the small amounts of money being spent, an employer should confirm if all the elements mentioned below have been included in the receipt.

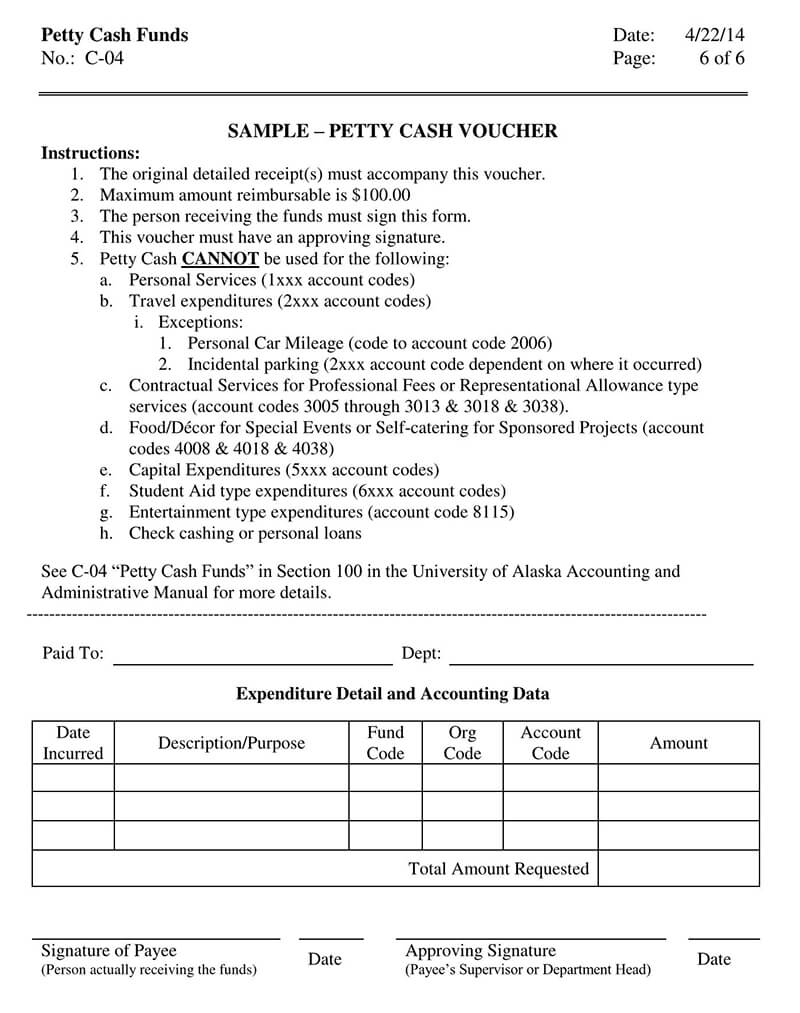

- How to use – Most companies include short guidelines on how to use petty cash.

- Title – This is the heading on the receipts, and it usually reads “petty cash”; this description also includes the name of the company or business using the voucher.

- The sequel no. – The sequel number has been assigned by the Custodian of the petty cash fund. This individual has been chosen to secure and protect the money in the petty cash fund and is responsible for controlling and assigning the sequel number on the petty cash voucher.

- Date – The date is also mandatory on the petty cash voucher. There are two dates mentioned on the receipt as:

- Request date: This is the date when the petty cash is requested.

- Receipt date: This refers to the date when the cash is issued.

- Pay to – For this section, the employer should see to whom the money was paid or rather the party that received the money indicated on the receipt.

- Dollar amount – the total amount of the payment made should be indicated on the receipt in dollars.

- Description – It is also necessary to include why the funds were taken out of the petty cash fund and what they were used for. The description should be brief but specific.

- Account number – the account number is a unique 10–12-digit number specific to the back account owner and is used for transactions. The employer can check this FAS 10-digit number to know where the money was sent to.

- Dept. Ref. number –it is optional to include this, but if it is included, then it is a field to be used by the department only. The department uses a department reference number to track the payment.

- Chargeable amount – this field indicates the chargeable amount related to the FAS 10-digit number recorded in Field 6

- Remaining balance – This is the amount of money that remains in the fund after the present request is deducted.

- Employee’s signatures and date when cash was received – This section indicates the employee’s information who received the cash since their signature is required. The date when the employee received the cash should also be indicated.

- Custodian’s name& signature – The person issuing/approving the petty cash request must indicate their name and append their signature on the receipt to acknowledge they approved the transaction.

note

According to the Internal Revenue Service (IRS), petty cash slips should be filled and attached to the receipts for documentation of expenses.

More Templates

Tips for Creating a Professional Template for a Petty Cash Receipt

A well-crafted premade template is invaluable to any business that wants to monitor their petty cash expenditures. So, whether creating your own in Word or Excel or customizing templates from the internet, following certain tips can result in more efficient and organized templates.

They include:

Consistent formatting

Consistent formatting for receipts is important as it simplifies accounting and provides some uniformity in company records. Modify the template to incorporate the desired style, color, and size. The sections and bullet points required to make the document comprehensive and easily readable can also be added to a template.

Clarity and readability

The receipt should be presentable, professional-looking, and legible. Use clear and concise language that others can understand. Also, ensure that all key components, such as item description, unit price, and quantity, are present in any template you decide to use. Also, avoid using abbreviations or acronyms excessively.

Customization and flexibility

Make the templates easy to customize and flexible to use. This will make it possible to reuse them. It should be easy to modify the different entry fields (which can be done through the addition or removal of entries) so that they align with the requirements for a specific transaction. This can be helpful for a large company where a single template has to be used by multiple departments and different categories of expenses. It must also be customizable to allow for any changes in the company’s cash management practices.

Accuracy and completeness

Accurate and reliable information is crucial for business records. Templates should thus have sections to record all the relevant information, such as the recipient’s name, the transaction date, the amount paid, and both parties’ signatures. This way, whenever it is being completed, the custodian and employee do not miss or forget to record important information.

Clearly label and format fields

Ensure that each field, such as date, receipt number, the amount disbursed, purpose, recipient’s name, etc., is clearly labeled and formatted consistently throughout the template.

Provide ample space for descriptions

Allocate enough space for describing the purpose of the expense and any additional details. Use separate lines or expandable text boxes if necessary.

Frequently Asked Questions

The custodian and recipient must both sign the receipt. The custodian’s signature serves as proof that they authorized the disbursement of the funds and that the receipt is accurate. The recipient’s signature is an attestation that they received the money.

The amount of money to be put in a petty cash fund depends on the needs and expenses of your business. It should be an amount that is sufficient to cover small day-to-day expenses. However, this amount can be more or less depending on the size of the company and the nature of its expenses. The amount should not be so large that it poses a security risk to a company’s finances but should be enough to cover trivial expenses. Most companies will set aside around $50-$500.

The receipts are normally reconciled to audit spending before the petty cash funds are replenished. The frequency will depend on the volume of transactions and the needs of your business. Therefore, companies typically decide on a reasonable period to reconcile the receipts.