An authorization letter to authorize someone else to operate a bank account is a letter written to the bank by an owner/signatory of a bank account, also referred to as the principal, allowing a proxy, representative, financial power of attorney (FPOA), or substitute for conducting a specified transaction(s) on their behalf.

It is an essential document as it is used to authorize another party to hold legal or financial powers on behalf of another party unable to do so due to various reasons such as sickness, being out of the country, or simply unable to make it to the bank. An authorization letter to authorize someone else to operate a bank account seeks to grant a third party limited or unlimited powers over a bank account. Regardless of the powers granted, however, the bank account owner may choose to revoke the powers in writing or as specified in the authorization letter.

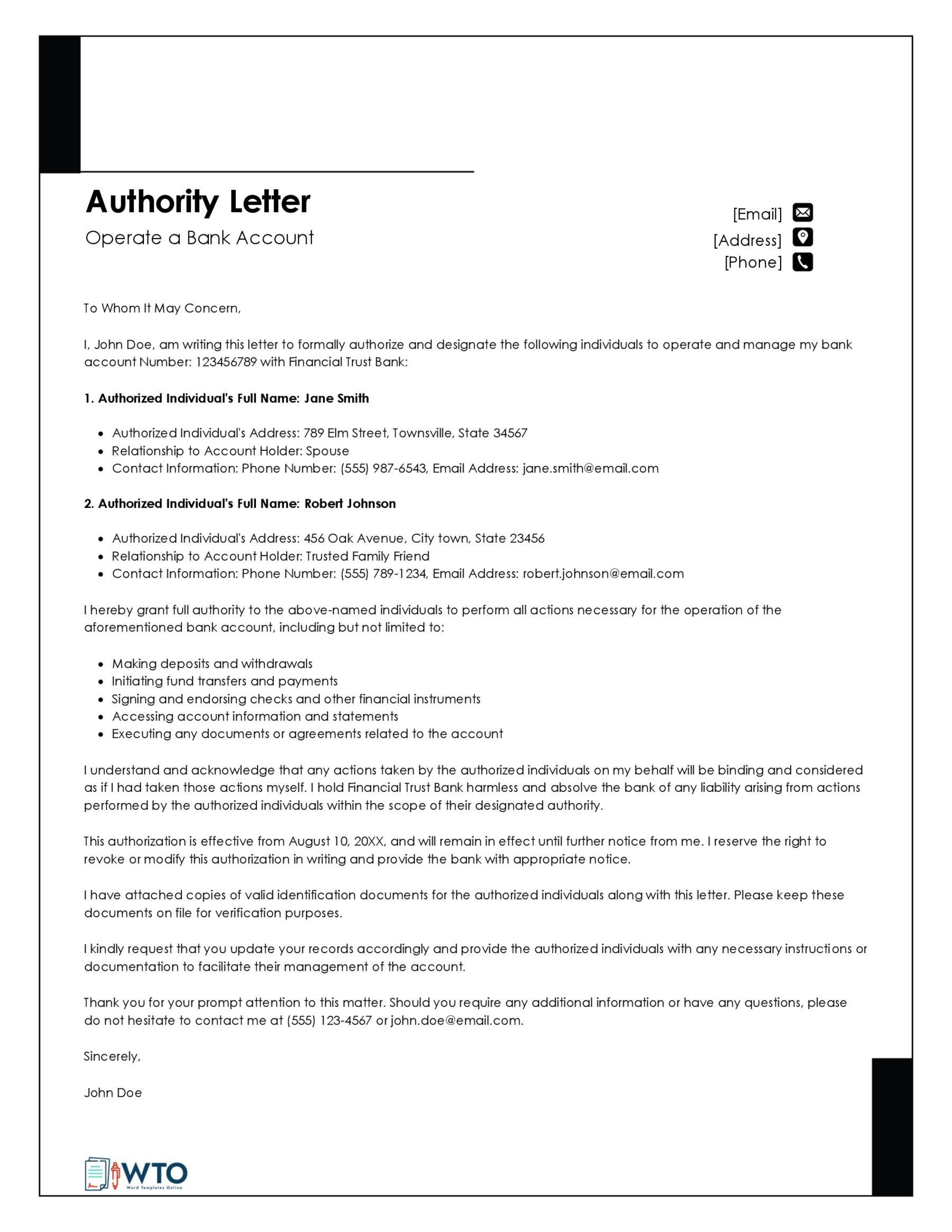

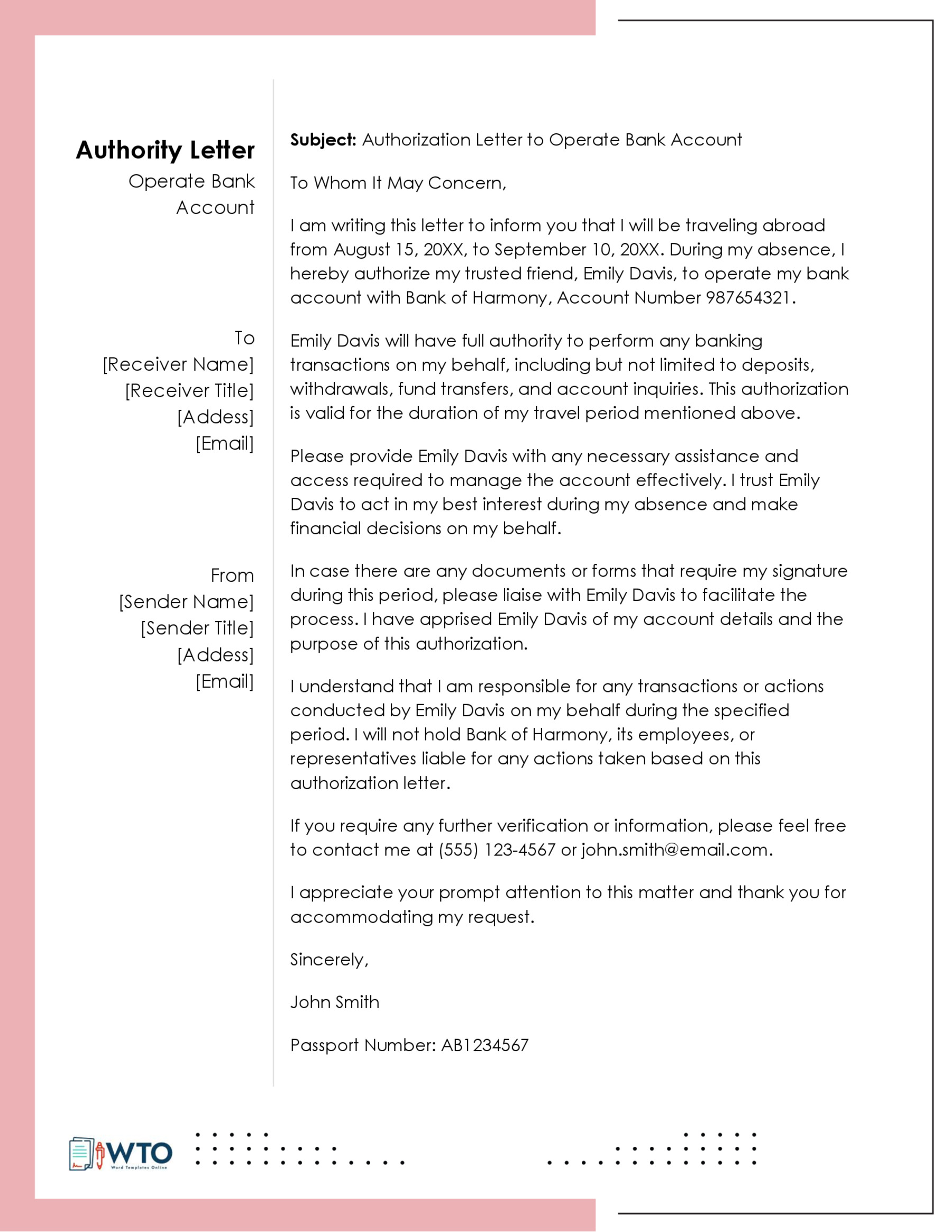

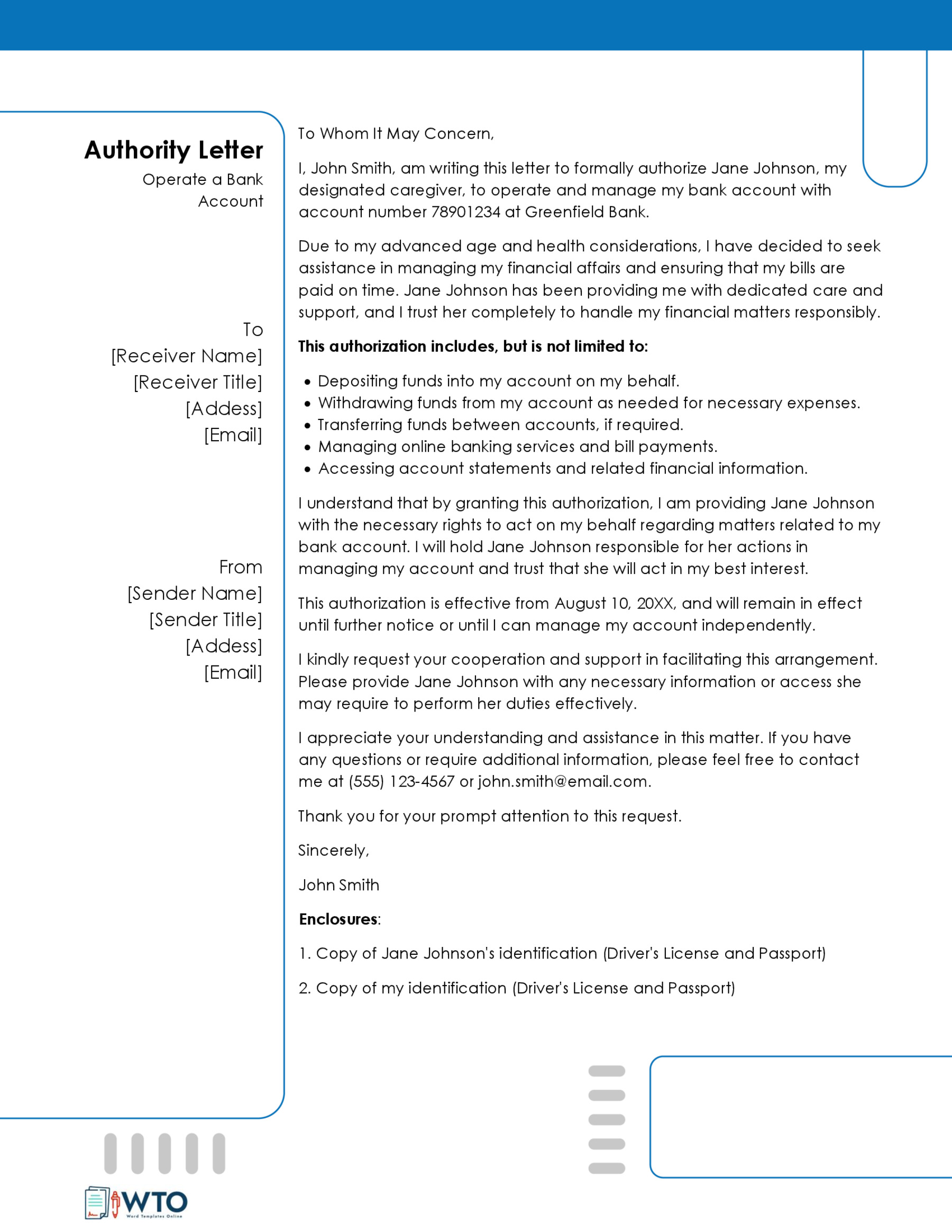

Sample Letters

More: 6 Sample Authority Letters for Bank

Methods of Authorization

Without proper authorization, banks cannot allow a third party to process any transaction on behalf of someone else. To properly authorize a third party to operate a bank account, one should consider the following methods:

Method 1: Contact the bank for an FPOA

When looking to allow another party to operate your bank account, the first method to utilize is contacting the bank for an FPOA. An FPOA (Financial Power of Attorney) is a type of POA (power of attorney) that authorizes a third party to act on behalf of an account owner regarding their financial matters. By granting a third party POA, one submits that they authorize the third party to make withdrawals, deposits, write cheques, and take any other actions deemed fit in their absence.

There are two different types of FPOA that one should consider depending on the type of powers they are looking to grant the third party;

- Limited FPOA: Limited FPOA is a document that grants the third-party legal authority to perform certain actions as specified on the document for a limited amount of time on behalf of the principal.

- Durable FPOA: A durable FPOA grants the person, named agent or attorney, the legal authority to perform all actions regarding a bank account.

Banks usually have different policies on how one can grant FPOA. Some of the commonly used ways include:

Visiting the bank

When granting FPOA, one may be required to visit their bank in person to make clear that they would like to grant FPOA and provide all the details regarding the same.

Filling and submitting a form

The other method usually used depending on the type of POA being granted is filling in a form and submitting it online, via registered mail, or in person. To fill out the form, one is usually required to provide information, i.e., to whom they are granting the FPOA and the type of transaction they are authorizing them to conduct on their behalf.

NOTE: When submitting the forms, follow instructions outlined by the bank on submitting such documents.

Method 2: Create your power of attorney

Most banks usually have a standard POA form that customers fill when looking to grant a third-party POA. If your bank doesn’t have this form, however, you can simply craft one. To ensure that the authorization form is legally valid, make sure to:

Follow state laws

Different states have different laws when it comes to granting POA. By following the state laws, you will use the correct language that is required to make the FPOA legally valid.

Get help from a lawyer

It is recommended to get help from a lawyer to give the POA a formal and legal touch. The lawyer will help you include essential clauses, such as termination of the POA and what may render the POA invalid. By affixing their seal and signature on the document, the lawyer renders the document admissible in court.

Meet with an agent

After drafting the document, make sure to meet with an agent and have them go through the document to ensure that you have covered all crucial clauses. Once they’ve made sure that the document is well crafted, the transfer will be approved, and the third party will be allowed to make the transactions specified in the document.

Submit the form

After filling and signing the form, ensure that you have met all the state requirements and submit the form to the bank. Make sure to follow the state and bank protocol when submitting the form.

Method 3: Open a convenience account

Opening a convenience account is another option that one should consider when looking to authorize a third party to operate their bank account. A convenience account is an account on which the account holder adds someone else to act on their behalf for convenience only. By opening a convenience account, the other person would have access to the bank account but would only conduct a transaction on behalf of the account holder. Simply put, the party authorized would be able to pay bills, make purchases on behalf of the account holder, but they are not authorized to make any cash withdrawals for their personal use.

However, it is important to note that opening a convenience account is not permitted in all states; before doing so, it is important to check with your State’s requirements and contact your bank to find out whether doing so will be the best option for you.

Method 4: Create a Joint Account

Another option to consider when looking to authorize someone else to operate a bank account is to create a joint account. Just as the name suggests, a joint account is a bank account shared between two or more individuals. Joint bank accounts are usually used by relatives, couples, or business partners who have a level of familiarity and trust with each other. A joint account allows the person named to conduct all transactions on behalf of the other as long as they all affix their signatures approving the transaction. When creating a joint account, make sure to consider the following:

Add a co-owner

A joint account, if not specified as an “and” account, may limit the party authorized to perform transactions on behalf of the account owner, mainly if they are not available to affix their signatures to approve the transaction. Therefore, you may consider adding a co-owner, giving the other party FPOA to do any transactions without requiring your signature.

Meet with a lawyer

Before adding a co-owner or granting a POA, it is crucial to meet with a lawyer and inform them of your situation. The lawyer will help you choose the best option depending on your situation.

Be cautious

When granting POA, it is important to be very cautious. Ensure that if the POA is limited, you specify all the transactions that the other party is authorized to conduct on your behalf. Also, make sure that you only grant POA to someone you trust to act on your behalf.

Allow third party deposits

Banks do not usually have regulations on who can make cash deposits into an account. Therefore, if you are looking to have someone make a deposit on your behalf, you may not have to grant them special authorization. However, it is important to contact your bank for more information before authorizing anyone to conduct any transaction on your behalf.

Allow third party withdrawals

Depending on the trust level with a third party, you may allow them to make withdrawals from your bank account on your behalf. For example, you may give them your bank card or account to transact. However, before doing so, it is recommended to explore other methods available since by authorizing a third party to make withdrawals, you won’t have control over how much they withdraw. Also, make sure to check with your bank to see whether one is allowed to authorize a third party to make cash withdrawals on their behalf.

Use Caution

Granting FPOA is a very crucial matter, and one should be very cautious when doing so. Opening a joint or convenience account are both very risky options, and so is adding a co-owner. It is because in doing so, you grant the other party powers to do transactions on your behalf, and they may be tempted to do other unauthorized transactions. Trust is vital when granting POA. Make sure that you have trust in the person you are authorizing to do the transaction. Also, make sure to consult with your lawyer when authorizing someone else to operate a bank account on your behalf.

Remember that this is a general authorization to operate a bank account letter template. Depending on the policies of your financial institution(s), you may have to attach copies of forms, or anything else they require.

Once you are finished, carefully proofread the letter for errors. Next, give the original to your appointed representative, or ‘proxy’, and copies to all parties involved, and keep one for your records.

How to Write this Authorization Letter

Crafting an effective authorization letter requires clear language and adherence to legal and procedural requisites. In the guide below, we will take you through the process of drafting a well-structured and comprehensive letter:

Step 1: Write the letter’s heading

The heading sets the foundation of the letter. It presents a concise and organized start to your correspondence. The heading contains your personal details, the current date, and the recipient’s details.

Add your personal details

Begin the letter by including your personal details. Include your full name, physical address, phone number, and email address. Ensure this information is accurate and up-to-date for seamless communication and correspondence.

For example:

Trevor Kinzie

453 Halton Rd.

Marydel, Delaware (DE), 19964

(302) 492-1689

t.kinzie@email.com

Include the current date

Skip one line and include the current calendar date. Present this in a simple format, for example, “11-02-2023” or “November 2, 2023.” This helps the recipient establish the authorization’s timeline and that of the letter.

For example:

November 2, 202x

Write the recipient’s information

After the date, skip one line and add the recipient’s details. Include the recipient’s name, designation, bank name, branch name, and physical address. You should also add the recipient’s contact information, including phone number and email address, for effective communication.

For example:

Accounts Manager

Pinegrove Bank

46 Airdrie Dr.

Bear, Delaware (DE), 19701

(302) 836-4524

accounts@pinegrove.com

Step 2: Address the letter

After the recipient’s details, skip one line and address the letter to the recipient in a formal manner. If you know the recipient personally, use the salutation “Dear [Recipient’s Name]” for a more personalized touch. If you do not know the recipient personally, you may write “Dear Sir/Madam” or contact the bank to confirm the recipient’s details.

For example:

Dear Sir/Madam,

Step 3: Write the introduction

In the first paragraph, introduce yourself as an account holder and include details about your bank account. Include your full legal name, bank name, and account number. Provide a clear statement that the purpose of the letter is to grant authorization for an individual or entity to operate your account on your behalf. Including these details allows the recipient to establish the basis of ownership of your account.

For example:

I hope this letter finds you well My name is Trevor Kinzie, and I hold a current account with Pinegrove Bank, identified by account number 123-4567-89. The purpose of this correspondence is to formally grant authorization to Ted Cody to operate and manage my bank account on my behalf.

Step 4: Add an authorization statement

In the next paragraph, provide a clear authorization statement in an unambiguous manner. Outline the specific activities the authorized individual or entity can perform on your behalf. These could include making deposits and withdrawals, transferring funds, checking account balances, generating account statements, managing investments, issuing checks, or conducting online transactions.

For example:

I hereby authorize Ted Cody to perform the following activities on my bank account:

- Make deposits and withdrawals.

- View account statements and transaction history.

- Initiate funds transfers between accounts.

- Pay bills and other financial obligations.

Step 5: Define temporal framework and conditions

Next, specify the duration for which the authorization is valid. You can set specific start or end dates or indicate the authorization is effective until you provide a written revocation notice. You may also include any limitations, conditions, or circumstances that may warrant termination of the authorization.

For example:

This authorization is effective from November 3rd, 2023, until otherwise revoked in writing. Furthermore, the authorized agent is not permitted to initiate transactions over $100,000.

Step 6: Conclude the letter

Conclude the letter by extending your gratitude to the recipient for their attention. Highlight your trust in the authorized agent’s ability to operate the account on your behalf.

Express appreciation and reiterate trust

Thank the recipient for their time, attention, and cooperation. Reiterate your trust in the capacity of the authorized agent to manage your account effectively. You may also inform the recipient to contact you should they have any concerns regarding the authorization.

For example:

Thank you for your prompt attention to this matter. I believe Ted Cody will efficiently manage my bank account as required. Your cooperation and support are greatly appreciated.

Provide your signature and contact information

Finally, add a formal sign-off, such as “Sincerely”, and provide your handwritten signature to authenticate the authorization. Follow this with your full legal name and current calendar date. If the letter is being issued together with supporting documents such as copies of IDs or bank statements, mention them in this section.

For example:

Sincerely,

Trevor Kinzie

[Your Signature]

(302) 492-1689

t.kinzie@email.com

Attachments:

1. Copy of Trevor Cody’s ID

2. Copy of six months’ bank statement

Free Templates

Final Thoughts

It’s never easy to realize that you’ll need to compose one of these letters. However, as these are your finances, you must do so and do it with a clear and level head. In other words, don’t be afraid to place limits on what the individual can do. Feel free to contact your lawyer as well, to inform him or her of the FPOA. Finally, always look into your state’s legal requirements, so everything you do is on the up and up, and no one can take advantage of you. With all precautions taken, you should be able to have peace of mind, knowing your finances will be taken care of in the proper manner, as you requested.