A power of attorney is a relatively common document in Florida. It allows you to select a trustworthy person to make decisions or perform specific tasks such as signing documents, depositing checks, and buying, and selling property. The powers conveyed through this POA are diverse and will thus vary from one situation to the other. The document is standard for financial transactions, estate planning, and medical care.

Such form from Florida is subject to state laws – Part II of Chapter 709 of the Florida Statutes. Therefore, an attorney is not required when preparing a Florida (POA), even though it is advisable. This article will discuss the different types of forms, applicable laws, and the document’s requirements within the state of Florida.

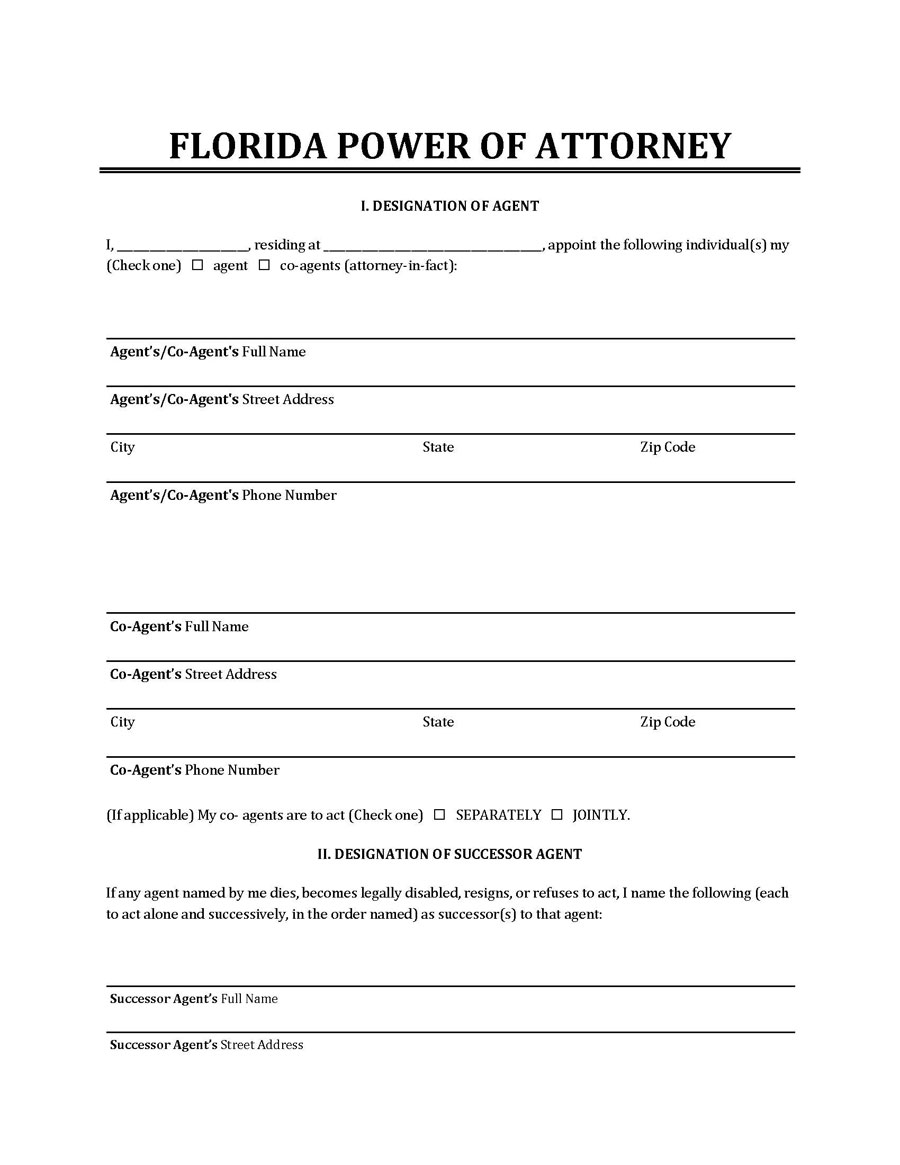

A POA form from Florida is a legal form that appoints an agent. It grants them the legal authority to perform specific tasks on behalf of the principal.

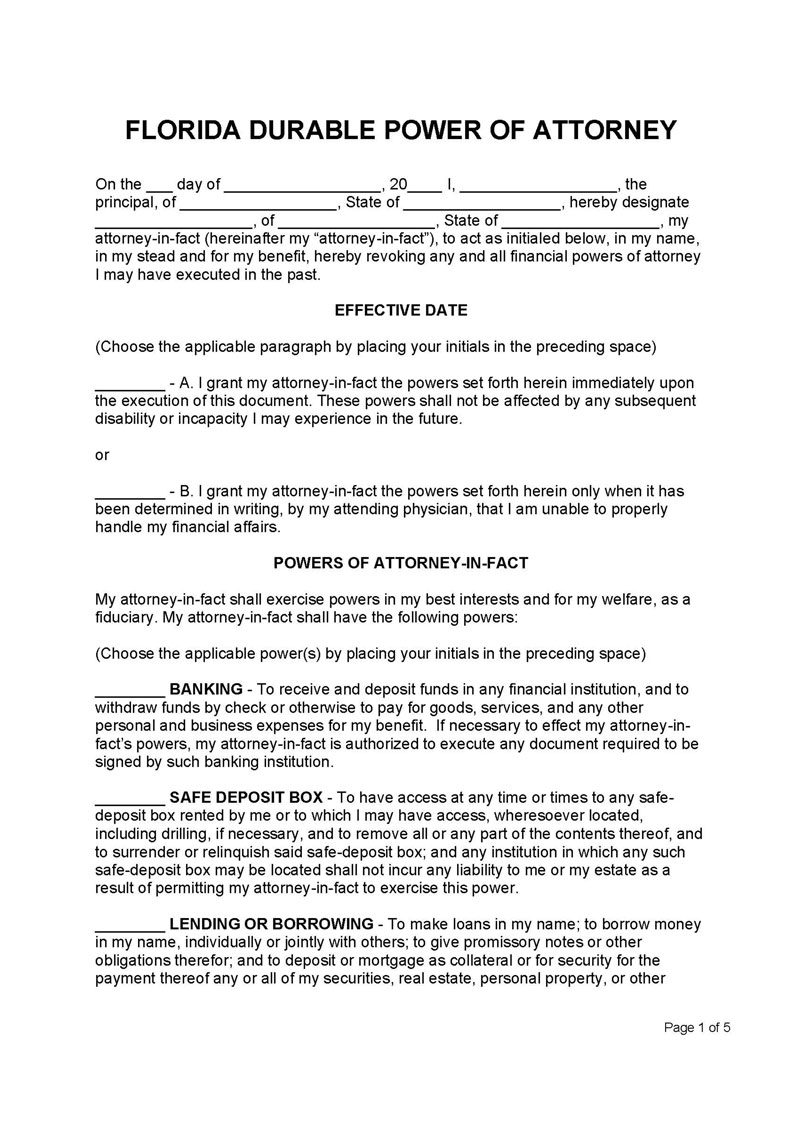

For example, a POA can be used to appoint a tax professional, accountant, lawyer, or any other party that can be tasked with legal obligations specified in the document. This form is used as an insurance document when the principal wants to ensure personal responsibilities will be taken care of in their absence or when they are incapacitated. These forms from Florida can be durable or non-durable. Durable means that its validity extends even after the principal’s incapacitation, and non-durable means that its validity is nullified by the principal’s incapacitation.

Free Forms

Types of POA in Florida

There are different types of these forms available for use within Florida. A principal can use one of the different Florida POA forms depending on the purpose or what they wish to accomplish. Each type serves a unique purpose and designates specific unique powers to the agent.

These types of forms include:

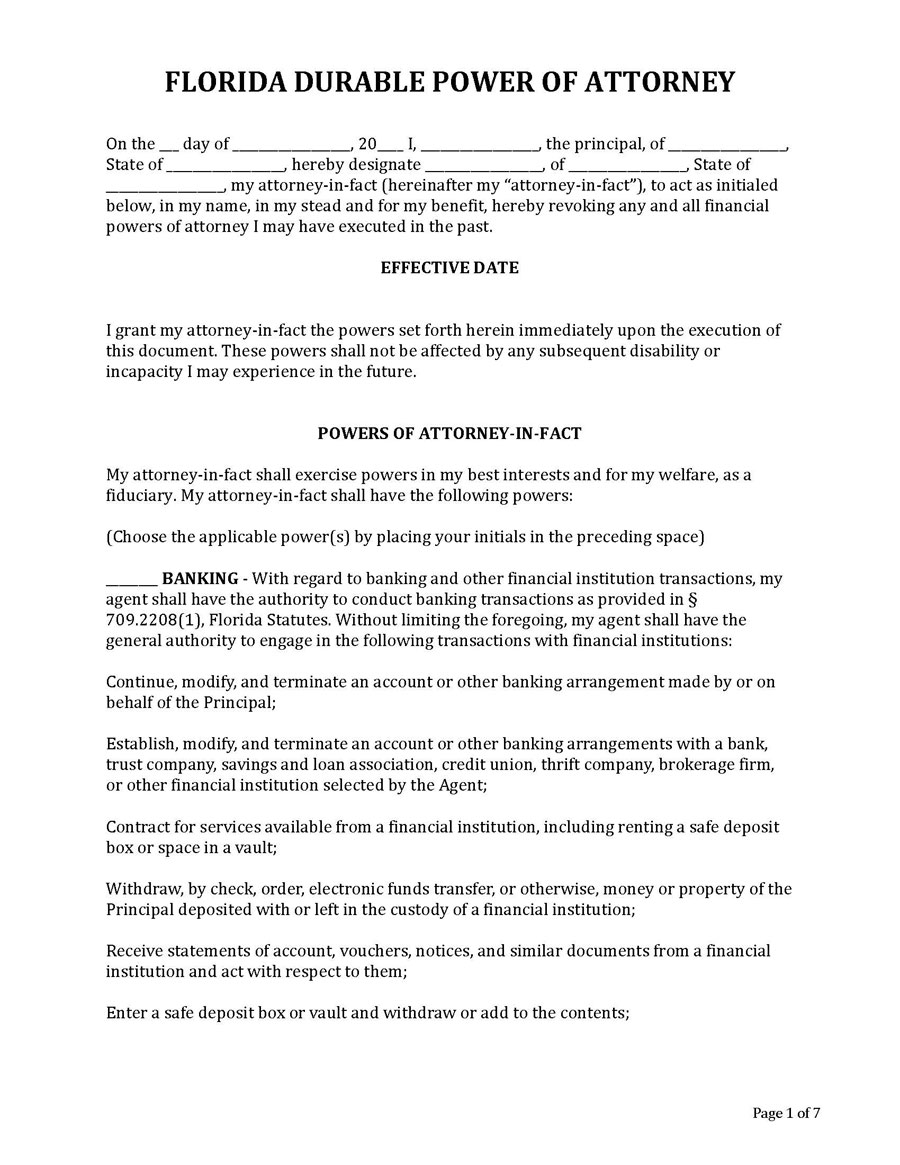

Durable (Statutory) Power of Attorney Form

Download: Microsoft Word (.docx)

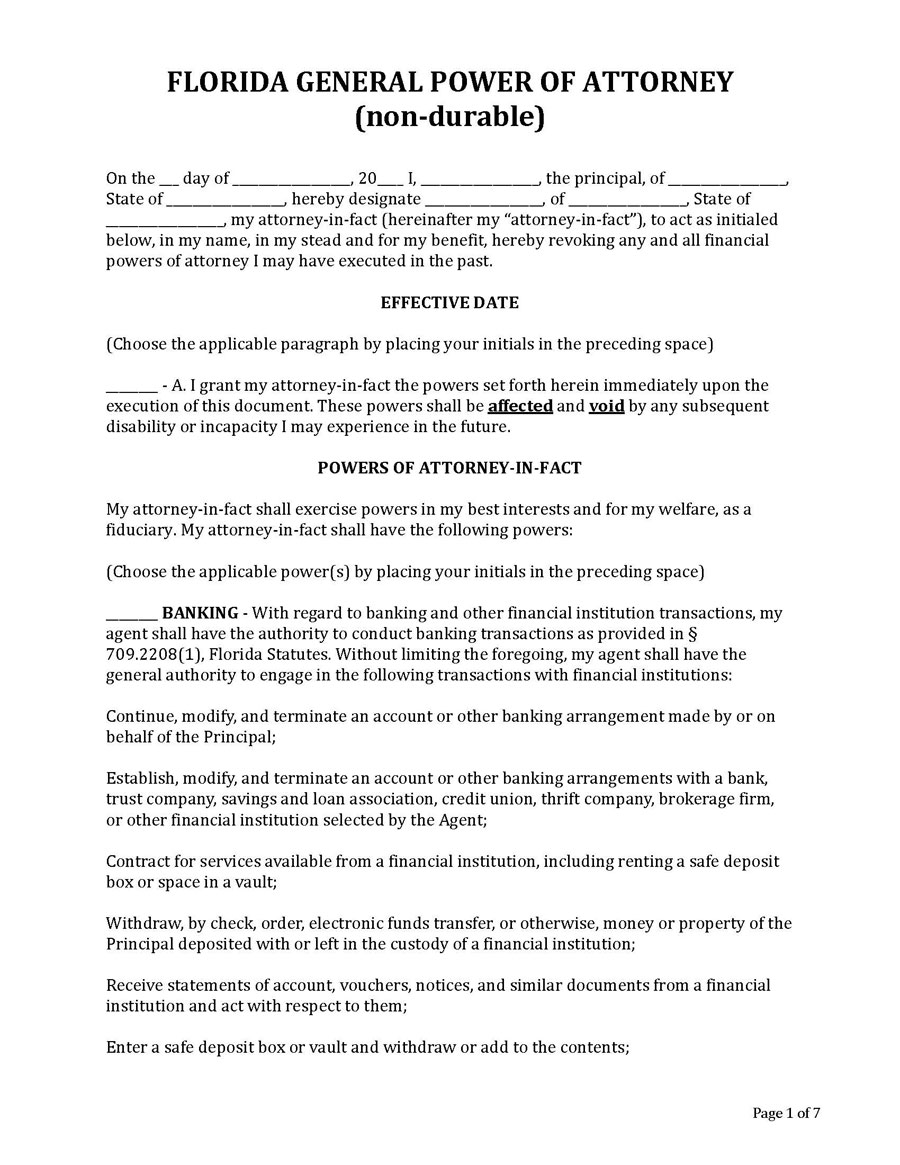

General (Financial) Power of Attorney Form

Download: Microsoft Word (.docx)

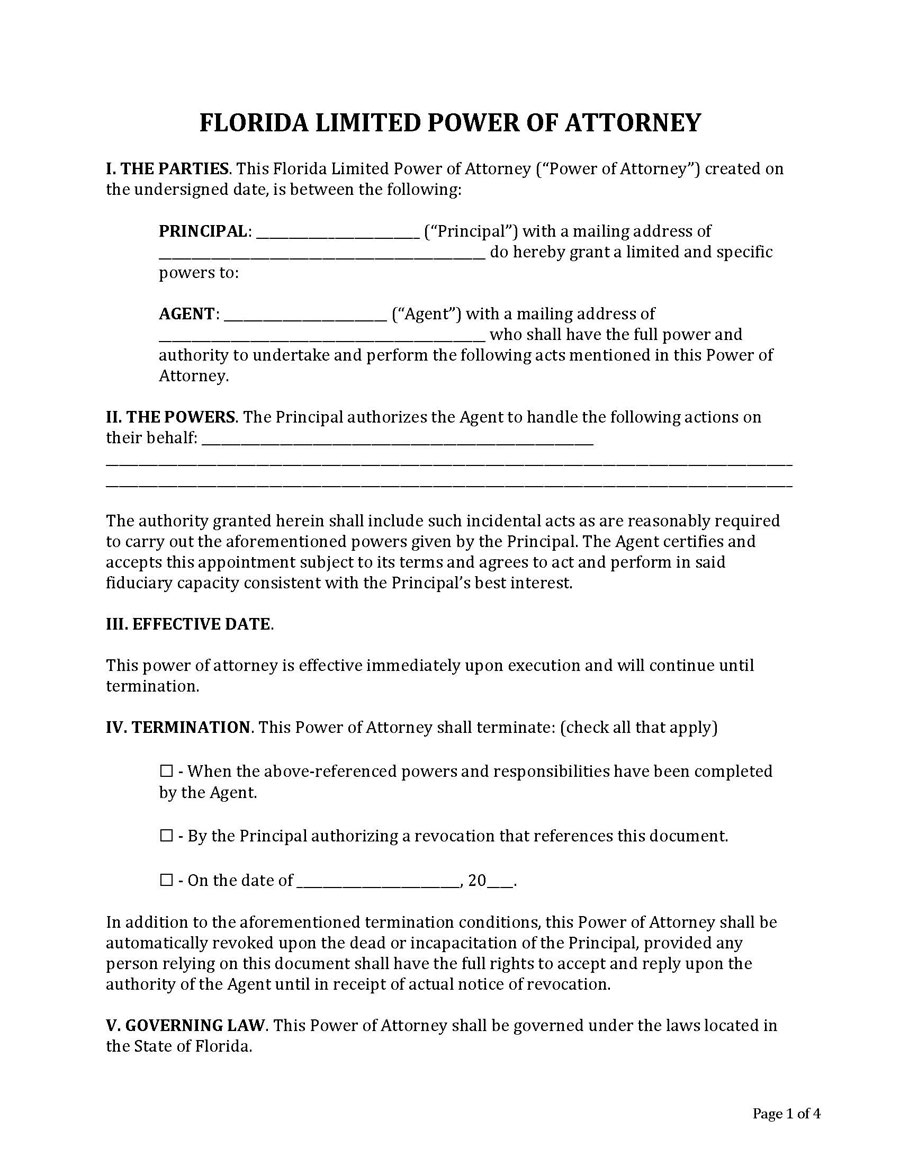

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

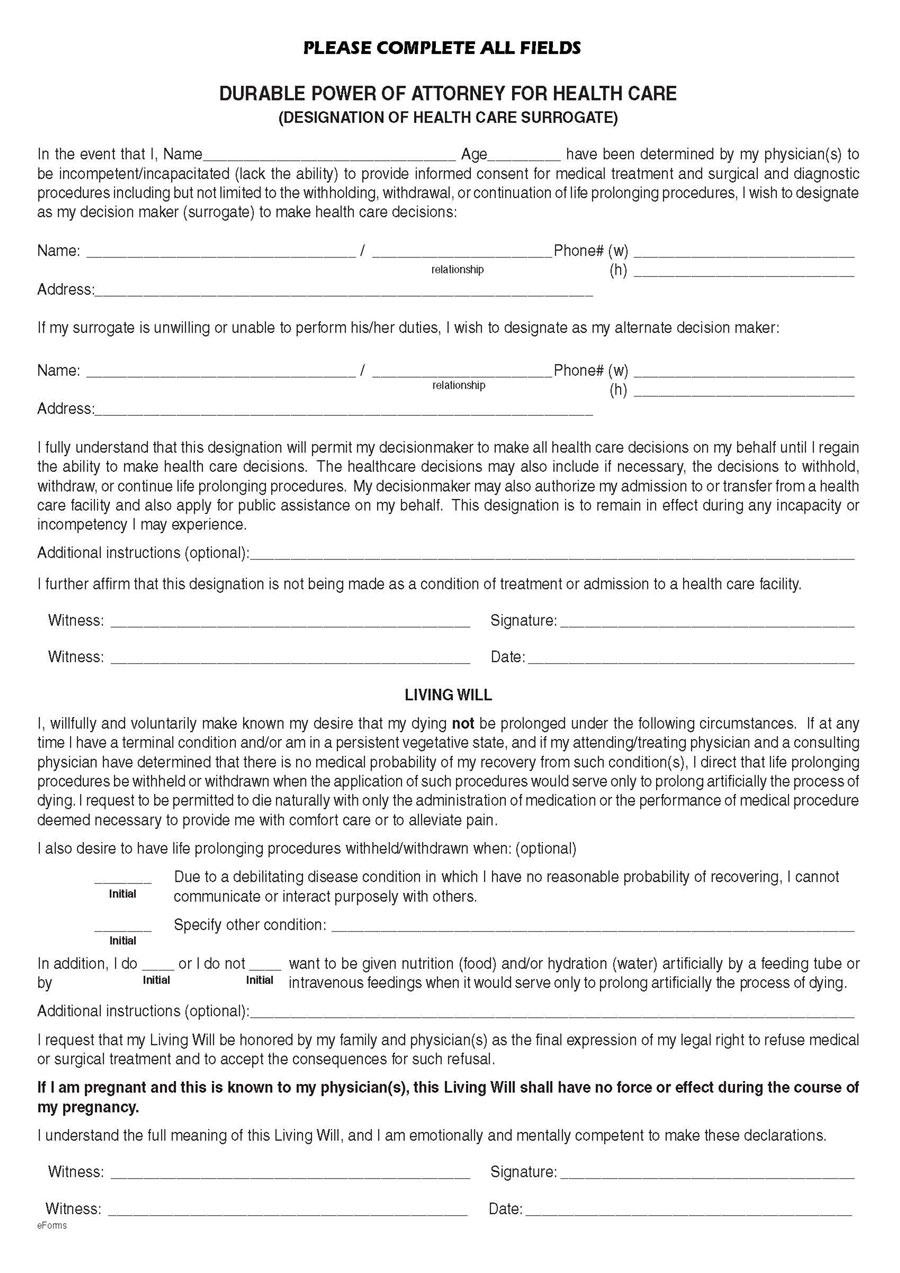

Medical Power of Attorney Form

Download: Microsoft Word (.docx)

Minor Power of Attorney Form

Download: Microsoft Word (.docx)

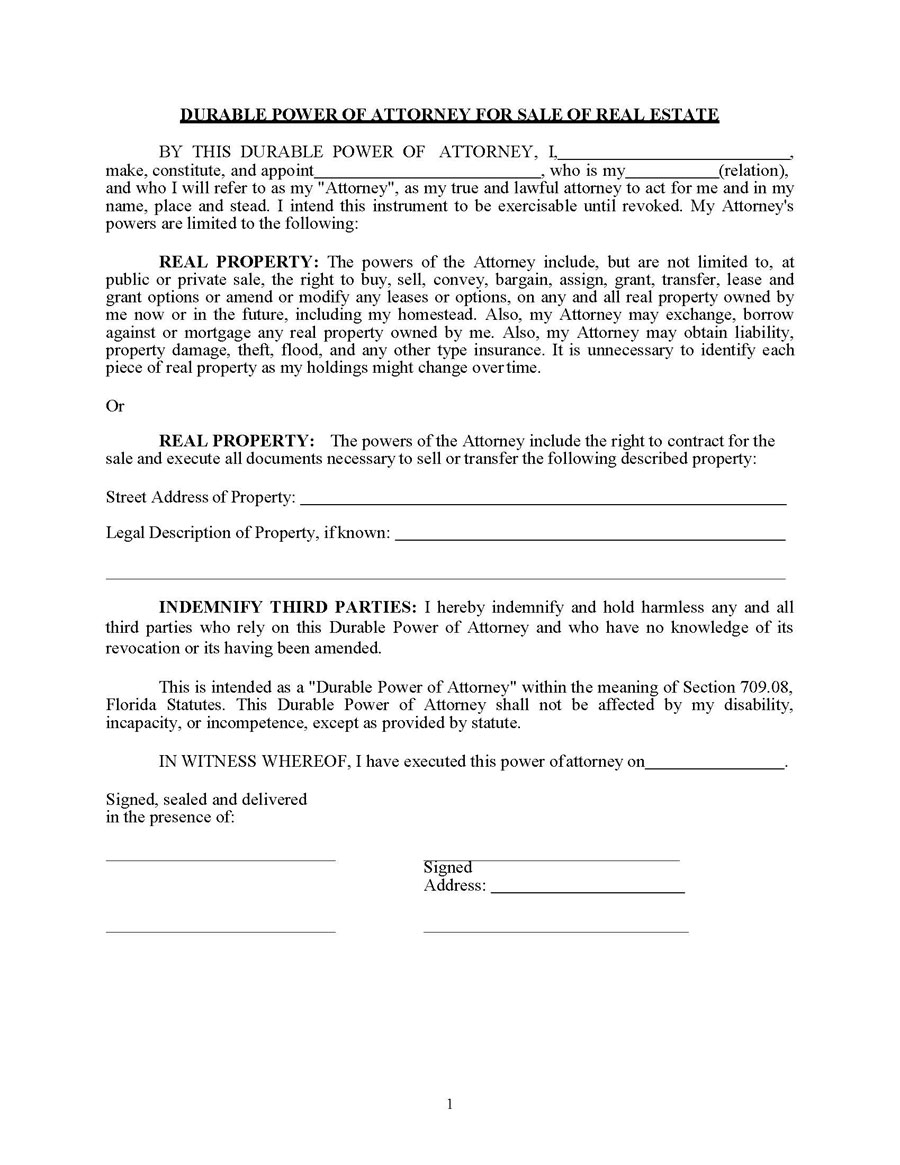

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

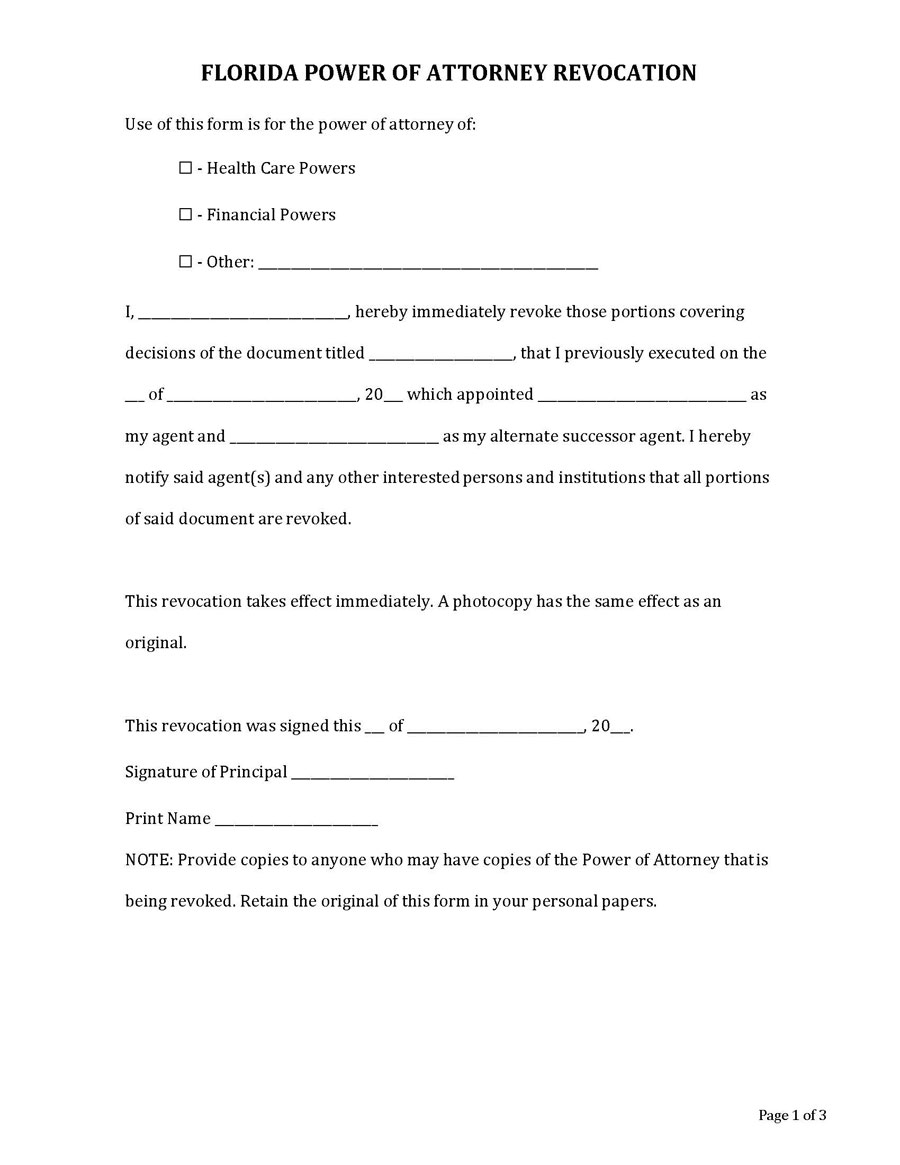

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

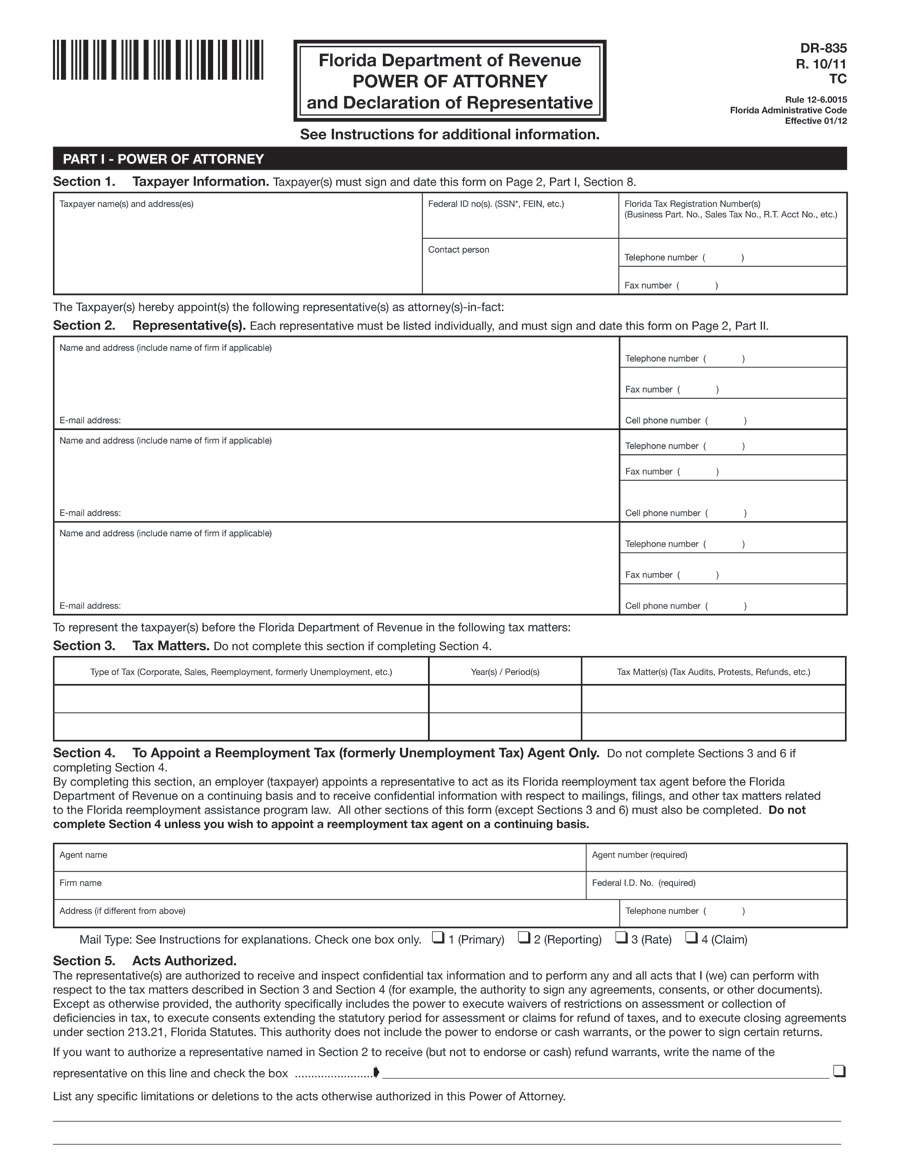

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

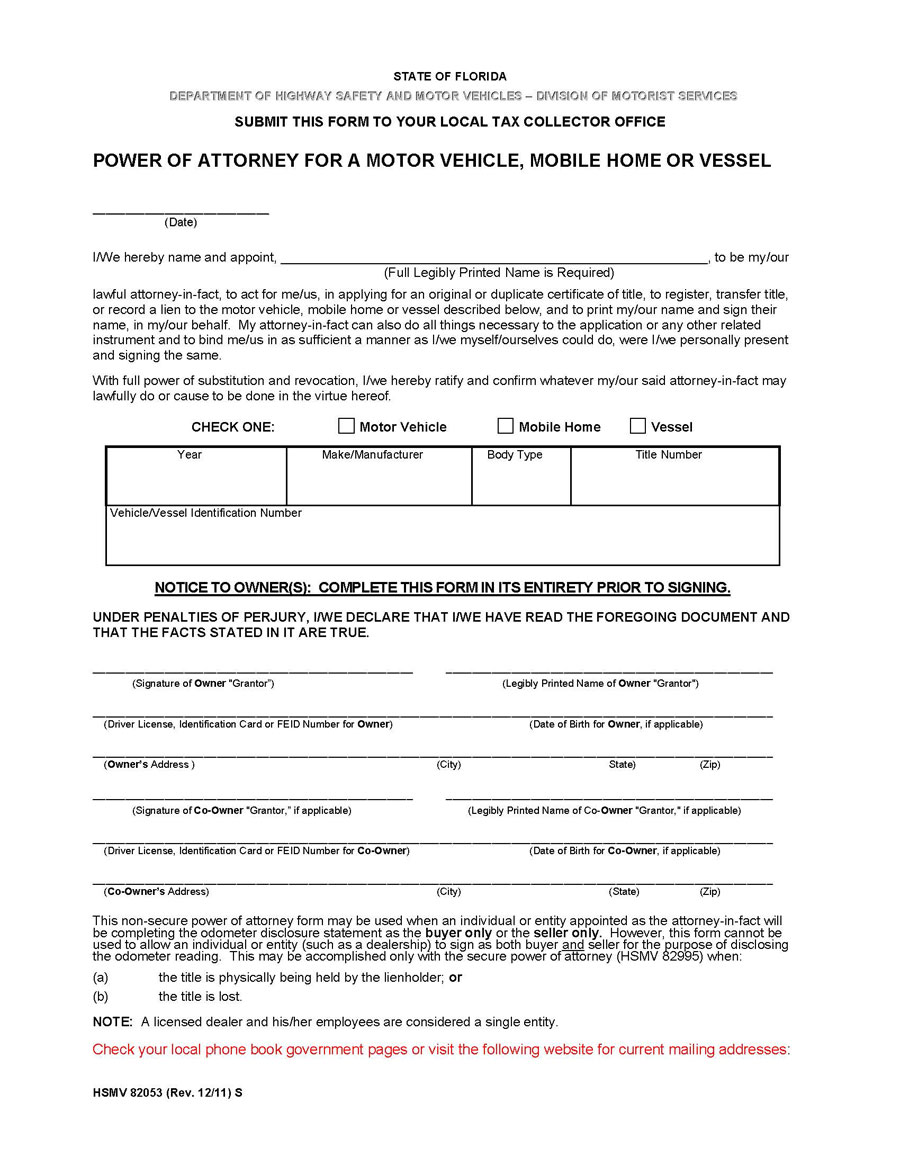

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

Springing power of attorney Florida

It is used to designate power when a person who would typically be capable enough to make their own decisions becomes incapacitated. This type of power the law gives becomes effective under specified or pre-determined conditions such as incapacitation or any other. However, Florida removed the principal’s leeway to create “springing powers” on October 1, 2011. However, any springing POA form from Florida executed before this date is considered to be legally enforceable.

Governing Laws

The Florida POA act (ss. 709.2101-709.2402) governs the creation and execution of this form. However, the Florida Health Care Advance Directives (Chapter 765) governs a medical power of attorney.

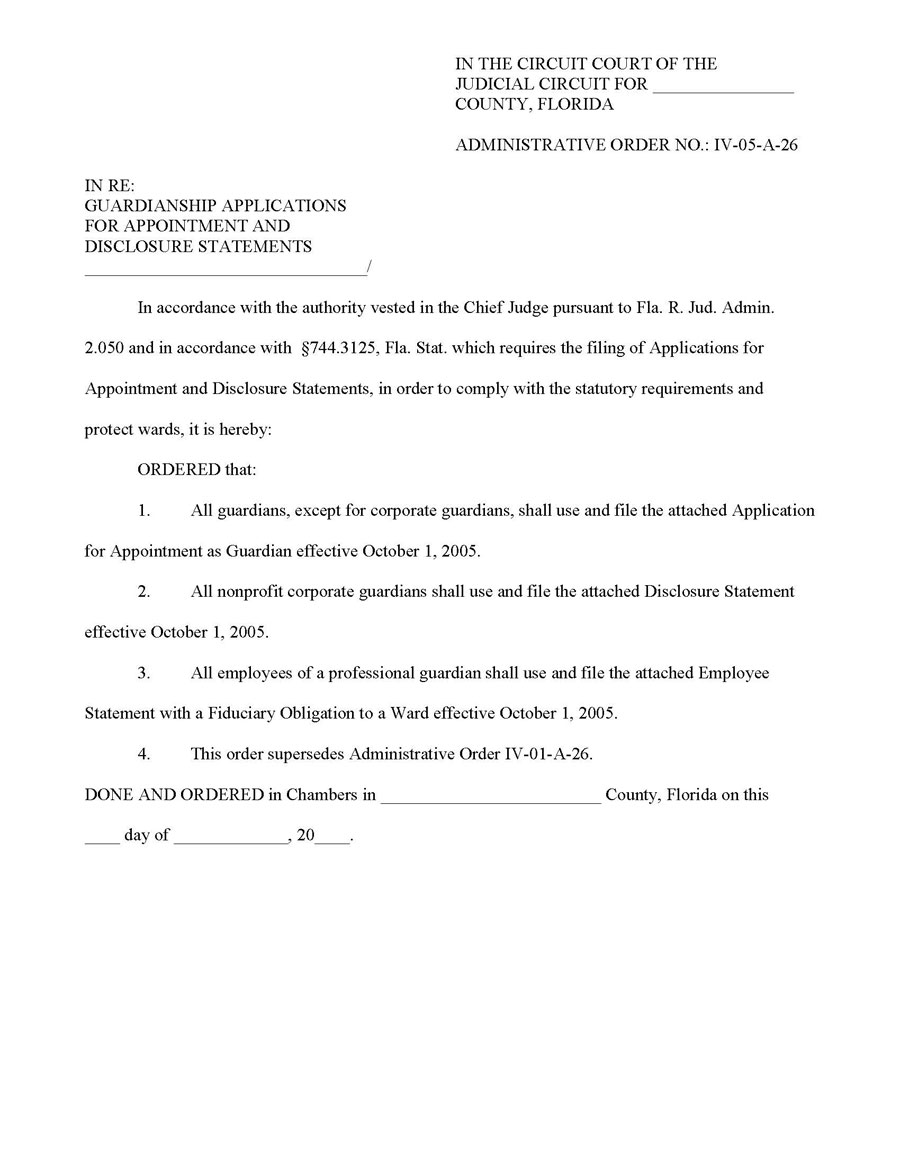

Other laws are applicable in particular situations, such as minor guardianship and tax POAs. Additionally, Florida does not issue an authorized or statutory POA form, thus making it more challenging to acquire a POA in Florida than in most states.

Requirements for POA in Florida

Each state will typically have its specific requirements for the preparation and execution of a POA. However, some of these requirements are common among different states to standardize the execution of POAs.

Below is a discussion of the requirements that must be satisfied to qualify as legally enforceable:

Content requirements

The state requires that the content of the POA forms from Florida be provided in clear language. The powers or legal authority granted to the agent must thus be explicitly stated and not implied. This avoids confusion or misinterpretation of responsibilities. Also, suppose the principal wants a POA to be durable. In that case, the phrase

“This durable power of attorney is not terminated by subsequent incapacity of the principal except as provided in Chapter 709, Florida Statutes”

must be provided. The document must also indicate the names of the principal and agent, effective date, list of powers and responsibilities bestowed upon the agent.

Agent requirements

The state of Florida has provided guidelines or criteria for selecting an agent of a power of attorney. First and foremost, the agent must be a trustworthy party as there isn’t an agency that oversees the functions of an agent; it is the principal’s responsibility to oversee the execution of the POA.

As a result, most agents are close family members, friends, or professionals. The agent should be at least eighteen (18) years of age if it is an individual. The agent can also be a financial organization with “trust powers,” a physical address in Florida, and legal authority to operate within the state. Note that a principal can appoint more than one agent if necessary.

Execution requirements

The state requires that all forms from Florida be compliant with Florida laws – Chapter 709 of the Florida Statutes. Additionally, all signatories must sign the form, including the principal, agent, or attorney-in-fact, two witnesses, and the notary public. The notary public can sign on behalf of the principal if they are physically unable to sign the document.

How to Get Power of Attorney in Florida?

There isn’t a specified method of acquiring forms from Florida. However, to ensure the form is legally enforceable and effective, there is a simple procedure principle to follow. This begins with obtaining or creating a template or lawyer. This is followed by completing or filling out the document with the appropriate details, such as principal and agent details and functions designated to the agent.

The form should then be signed in the presence of two witnesses and notarized. The principal should then make copies of the form and store the original copy safely. Finally, each agent should receive a copy of this. Copies of POA form can then be given to associated financial institutions or filed with relevant authorities.

Conclusion

Power of attorney forms from Florida are an effective way for individuals to create peace of mind by ensuring there is someone to oversee certain functions even if they cannot carry out the functions themselves. The responsibilities and legal authority principals assign to agents include real estate transactions, stocks, bonds and other securities transactions, tax obligations, finance management, etc. Therefore, the principal must be of sound mind when creating a Florida power of attorney.

It is worthy to note that Florida recognizes valid out-of-state POAs. Therefore, non-residents of Florida can exercise the rights of a form as long as its execution is legally valid in another state. Also, third parties are expected to honour a power of attorney. However, if they choose to reject it, they must provide a written explanation. Principals should note that they still hold the right to revoke the power of attorney forms from Florida if the agent is deemed unfit or incompetent to carry the responsibilities assigned to them through the POA. Other reasons that may invalidate a POA include the demise of the principal or agent, incapacitation for non-durable POAs, the purpose of the document is accomplished, and invalidation by the court.