You do not want to think about the worst-case scenario if things go wrong for you. However, whether you are away, become incapacitated, or pass on, it is crucial to think about how you would like your affairs to be put in order and who can take care of different critical items, such as your finances and medical health, during that time. A Maryland POA can help make this easier.

As you consider filing a POA in Maryland, you will quickly see different types. You can choose to have one person handle it all or split it up to different individuals you trust. Filing the paperwork and getting these implanted can keep you and your assets safe. And it is possible to change these later too. So let’s take a closer look at some of the different types of POA available in Maryland and how you can get the ball rolling on forming your own!

An individual can set up a POA in Maryland in order to assign someone to take control over their health decisions, money, and assets if they become incapacitated or unable to make these decisions.

Through such POA the principal will be able to appoint another person to be responsible for representing the best interest of the principal in certain situations and circumstances. The exact terms of how this works and when the appointed party can hold this power will depend on the documents the principal will set up.

Before the principal writes out these papers, they must make sure the person they choose is someone they can rely on. The principal will want their appointed person to take care of their finances and property well while the POA is effective.

Basics of POA

There are many areas this power of attorney in Maryland will be able to cover. All aspects of your health and finances can be covered through different types of POA, from your healthcare treatment, financial affairs, and even real estate transactions.

You are in full control over the Maryland POA. You can allow the scope of responsibilities to be broad, or you can set out specific things that the agent is allowed and not allowed to do.

For example, you may choose to have an agent handle all of your finances, or you can give them permission to only do work on one bank account. Without the proper authorization from you, the agent will be limited on what they are able to do.

For most POAs, this arrangement will end if you become incapacitated. It is possible to add a durability clause to the POA, which will allow this agreement to remain in effect if you do become incapacitated.

All the rules about POA will be outlined in the Maryland General and Limited Power of Attorney Act. All agreements are considered durable in Maryland, which means that this will not end if you become disabled unless you specifically list that out in your document.

Free Forms

Who Can Create a POA?

Anyone can set up a POA in Maryland at any time. Even if you are in perfect health right now, it is a good idea to assign a POA to help if something happens to you, like an accident or illness, where you can no longer manage your property and finances. You can change the POA later on if situations change.

Maryland dictates that certain criteria should be met before you can set up a POA. The principal must be a minimum of 18 years old at the time of signing. They must be seen as mentally competent, which means that the principal must understand the document they are signing, which powers they are granting, and which property is affected by this power. Moreover, the principal must intend to give the power to the exact person they list in the document.

Types of POA

There are different types of POAs in Maryland that you can choose to pull out. The chosen one will help determine the exact responsibilities and limitations of the appointed person. Some of the different types of POAs allowed in Maryland include:

Advanced Directive or Medical POA Sample

Download: Microsoft Word (.docx)

Durable Power of Attorney Form

Download: Microsoft Word (.docx)

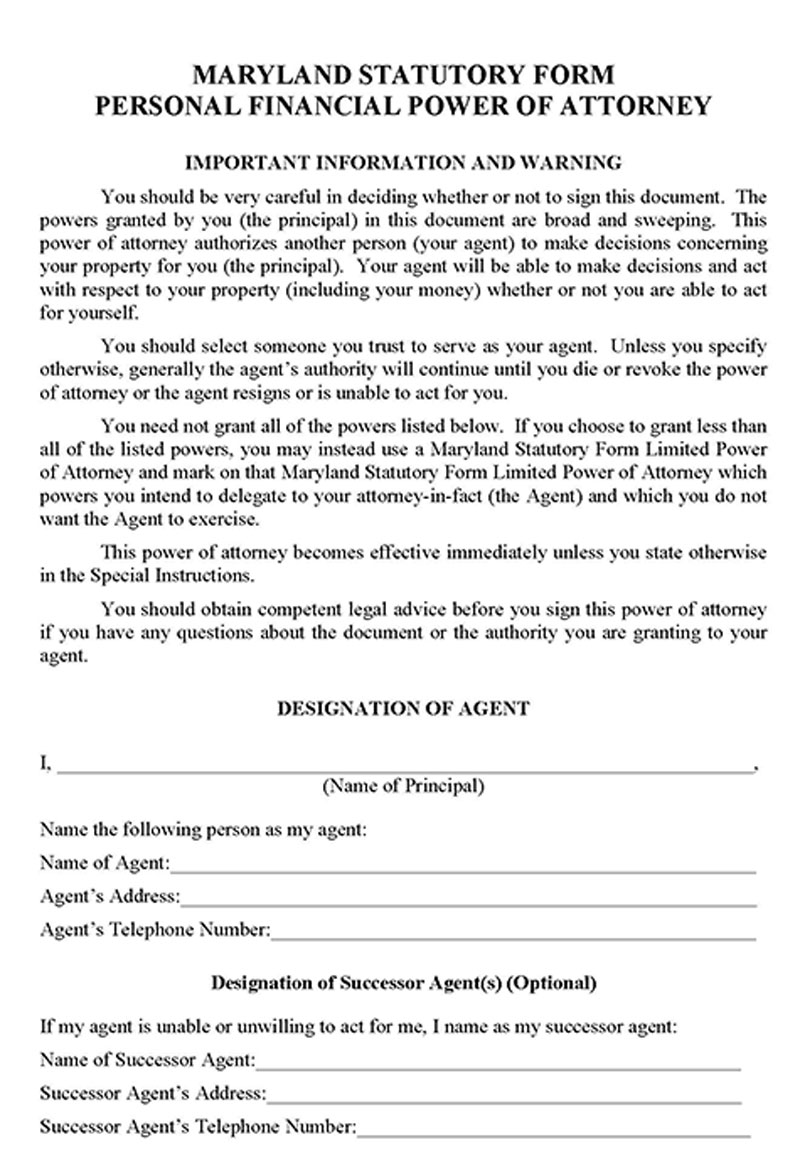

Financial Power of Attorney Form

Download: Microsoft Word (.docx)

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

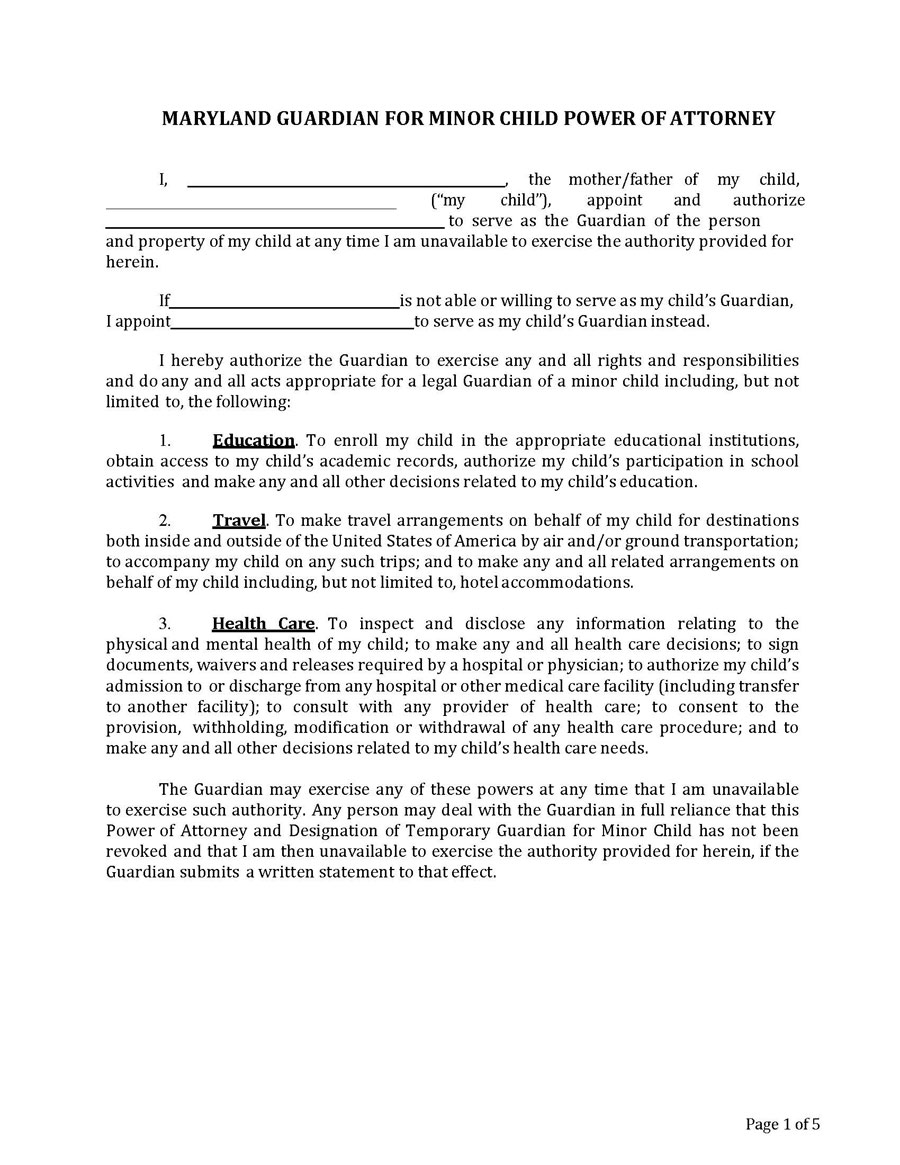

Minor Power of Attorney Form

Download: Microsoft Word (.docx)

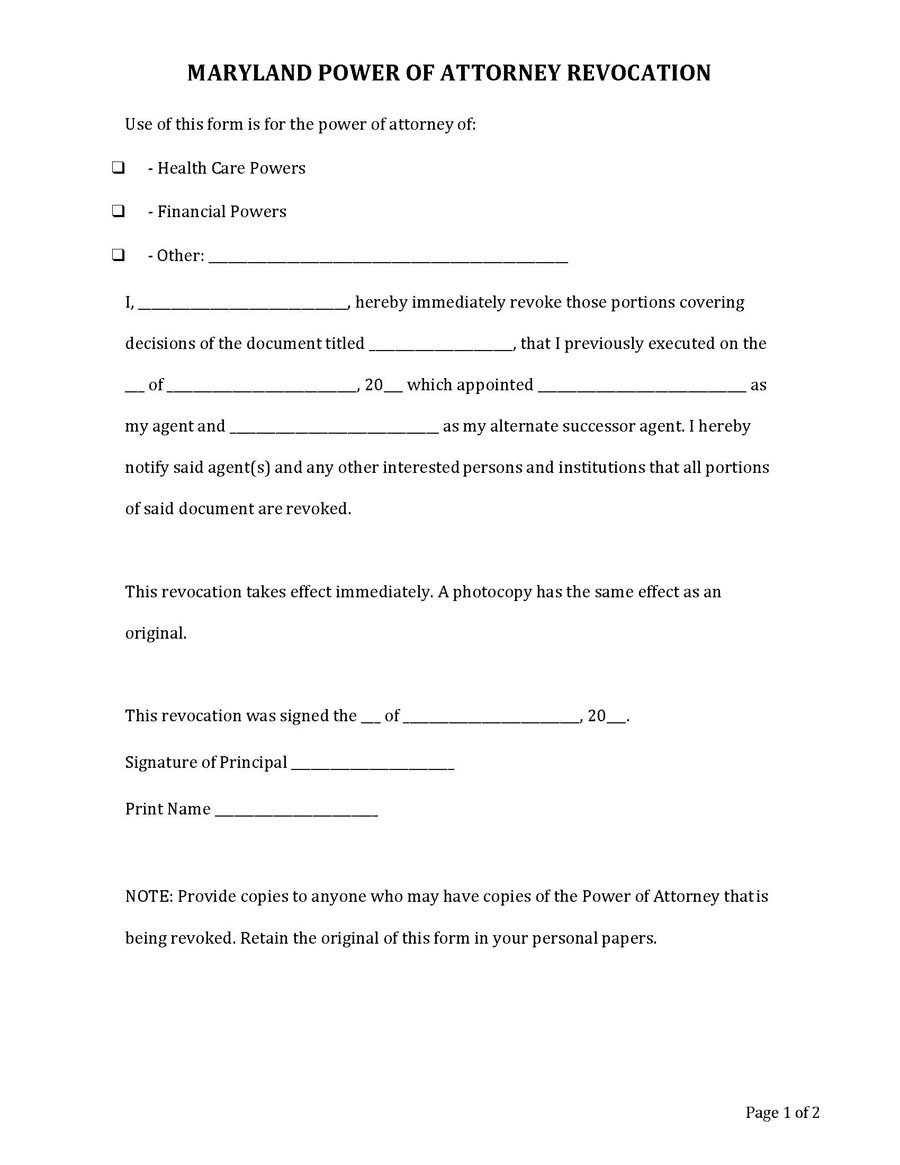

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

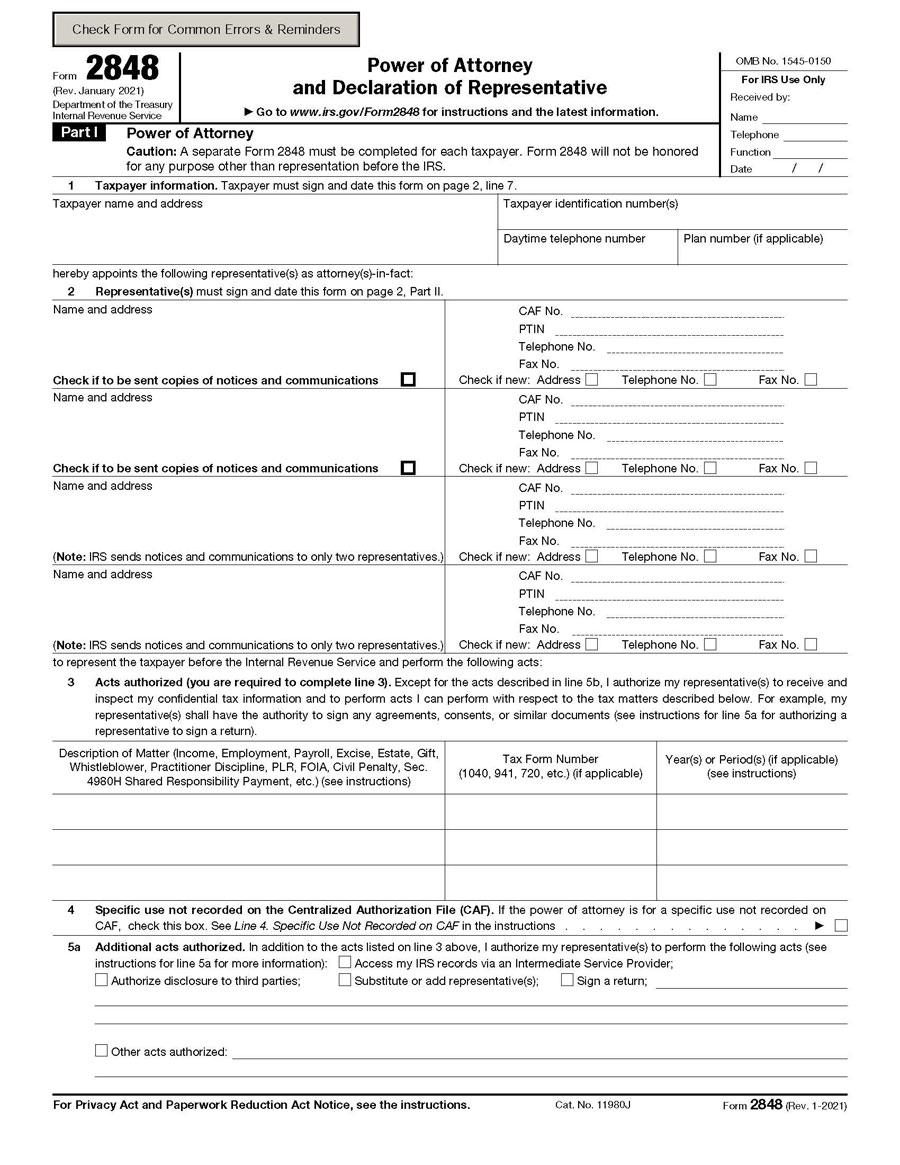

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

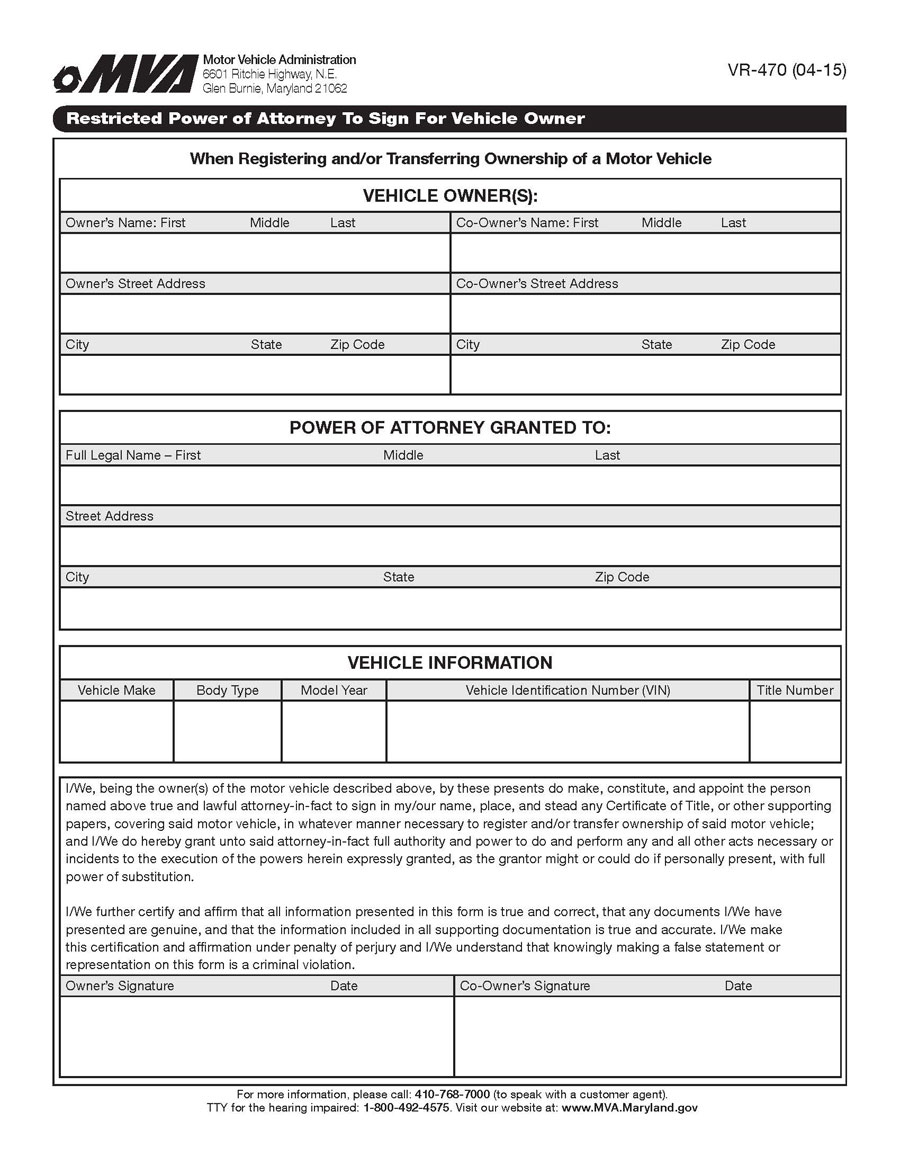

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

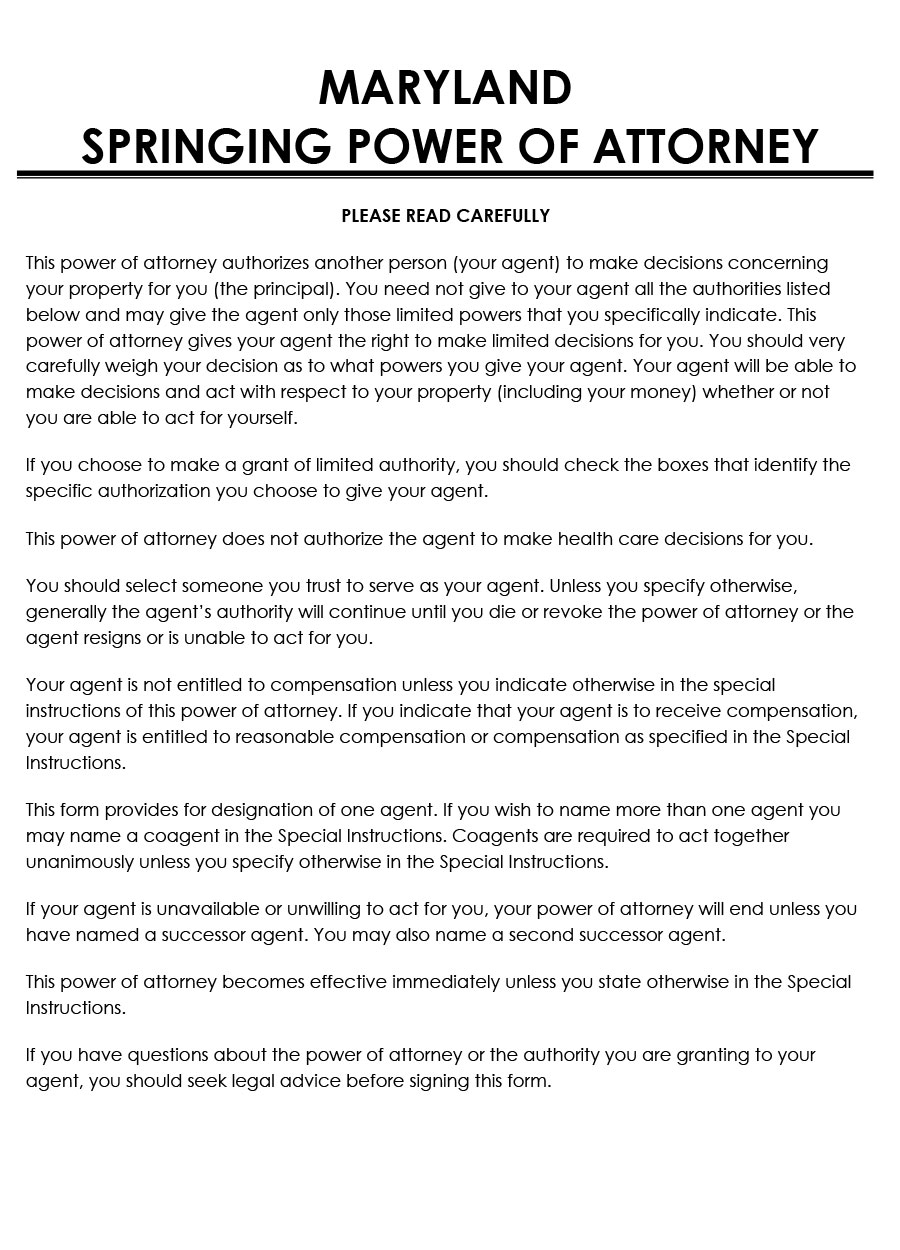

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Each type has a place in your plans, and it is essential to look into each one and determine which power of attorney for Maryland is right for you.

Real Estate POA in Maryland principals can also set up a limited POA to help protect their property. This type of POA will restrict the agent on what they can do when acting on your behalf for all of your property and any real estate affairs.

This could be as simple as letting a POA make mortgage payments, finish up a home sale if you were already doing it before becoming incapacitated, or sell your home if you do pass on.

On the form, you will be able to create this type of attorney, strike out any of the powers you do not want to let the agent hold, and then sign your name to the bottom. This helps keep you in charge of your property, even if you can’t make decisions later.

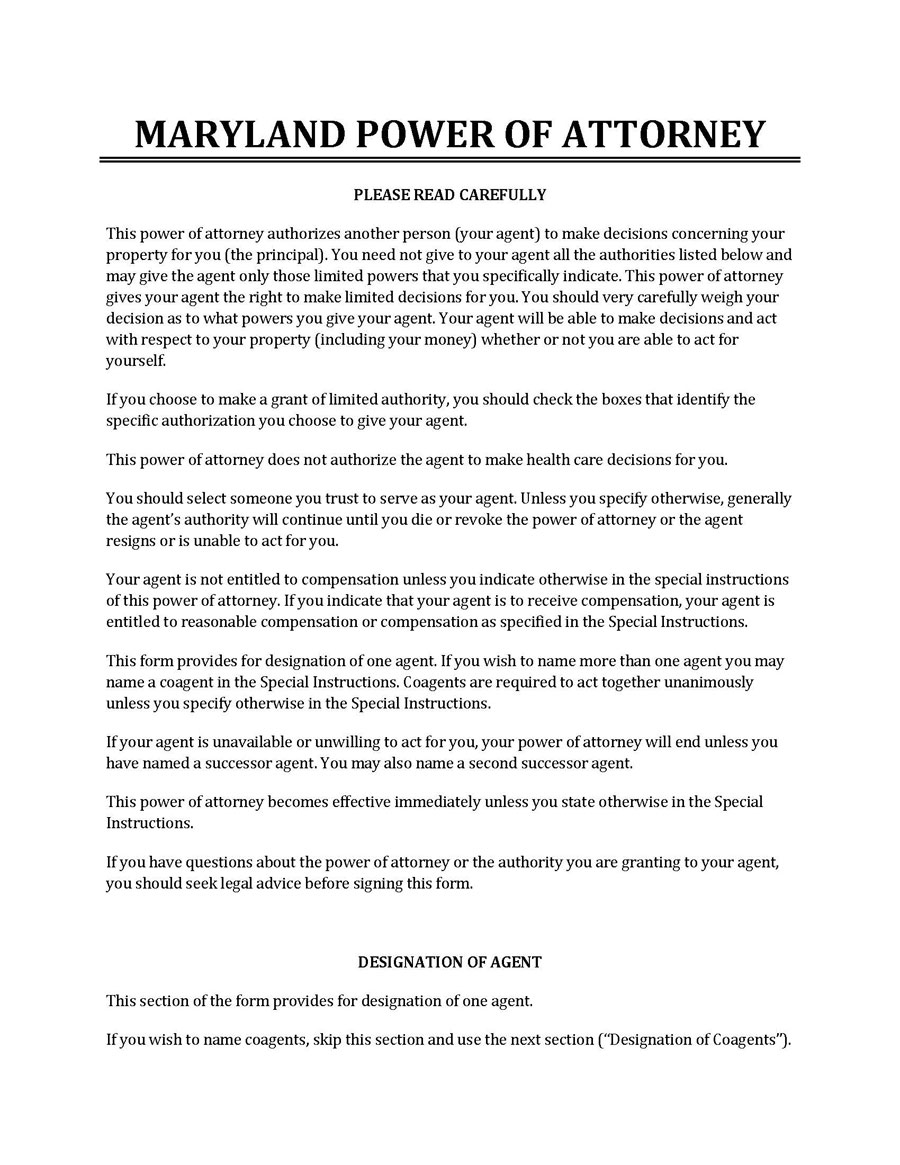

Maryland Power of Attorney Requirements

It is not enough to tell an agent that you would like them to be your POA. You need to go through the proper steps and paperwork to set up your POA in Maryland. The principal needs to follow the Maryland Estates and Trusts Article for this to be valid.

This information can get a little long, but some of the basic requirements include:

- The document needs to list the signature and the complete contact information of the principal.

- The name of any agent you would like to list out

- The date that this agreement is made. This helps to separate it if there are other agreements made.

- The powers that the principal would like to grant to the agent.

- When the powers are to begin and when they should end.

- The form for a power of attorney needs to be signed in front of a notary public.

- Witness requirements. At least two witnesses must be present when the papers are signed to make it legal.

If any of these components are missing, the documents are not legal, and Maryland’s POA has not been formed.

Drafting a Power of Attorney in Maryland

When the principal is ready to draft this POA, they will need to go through a few different steps to get it done. Some of the steps will include:

Choose an agent

The principal should consider who should be their agent. This will be the person who acts as attorney-in-fact and can make decisions on behalf of the principal. They must choose someone who is responsible and will keep the principal’s best interests at heart.

Determine the POA type and scope

Once the principal has chosen the agent they would like to work with, it is time for them to determine what the POA can do. This is best determined by the type of POA the principal will choose. Decide what kind of protection you would like and which powers and responsibilities you are comfortable providing to your agent if you cannot make decisions by yourself.

It is possible to have a POA for your financial and healthcare decisions. To do this, you will need to fill out two separate POA documents, even if you use the same agent to do both. Any document that grants both financial and healthcare POA to one person is not legally valid in Maryland.

Create a POA document

With the agent chosen and the type of POA and scope determined, it is time to create a POA document. You should work with your attorney to write out your POA and to ensure that all your documents are created and filed legally. The exact form you need to fill out depends on the type of Maryland POA you wish to set up.

Execute the document

When both the principal and the agent are happy with the document, it is time for them to execute the document. This will happen when the principal and the agent sign the paperwork in front of a notary and witnesses. Once both parties have signed the document, a POA is ready.

Powers and Duties of an Agent in POA

There are several powers and duties that the agent will need to follow. The principal’s forms will help describe all of that agent’s powers and some of the limits placed on the agent.

Some of the primary powers and duties of POA will include:

- The agent needs to act in the best interest of their principal, performing acts based on how the principal would want it done.

- The agent needs to keep records of all the transactions made for the principal, and they must act loyally to benefit the principal’s interests.

- The agent can ask for reimbursement for any reasonable expenses they pay for acting as the agent. However, they can’t make payment beyond the rules.

When does a power of attorney go into effect?

A POA in Maryland will usually go into effect once the principal has signed the document. It will remain that way until the principal makes changes or they pass on. After that, a POA will not be used until an event specified occurs.

The document will spell out when a POA should be exercised. This needs to be specific to ensure that there are no questions about what will match its requirements and avoid issues with using a POA. The principal can also choose to have a third-party help determine that the situation warrants a POA. A judge or doctor can help with this too.

How to Get Power of Attorney in Maryland?

When it is time to set up a Maryland POA, the principal, and the agent will need to get together to fill out a few papers. Next, both parties will need to fill out and sign a form for a POA. This needs to be done in front of a notary and includes all necessary information to get the work done. Sections 17-101 – 17-204 of the Estates and Trusts Article of the Annotated Code of Maryland figure out the rules that should be a part of durable POA for Maryland.

How to End a POA?

It is possible to end a POA. For example, suppose the principal decides that they do not want to have a power of attorney for Maryland or want to change their agent on the form. The principal can choose to change the agent or just get rid of the POA altogether.

The principal can revoke the document at any time if they wish. They can also write a new one to change the agent or go without a POA. It can also end if the agent passes on or is no longer available or if there is something wrong with the document and the court decides to invalidate it.

Final Remarks

A power of attorney for Maryland is an excellent way for the principal to protect their assets and property if they cannot take care of things. For example, they may become sick or get hurt in an accident, and this POA will allow someone else to step in and perform specific tasks to keep the principal safe.

The principal will have complete power over all of the responsibilities they hand to an attorney-in-fact and can choose from several different options for the type of POA they would like to have. Once the paperwork is filed, you can have some peace of mind knowing that your health and assets will be protected.