Power of attorney in Illinois implies that a resident (regarded as the “principal”) of Illinois has the right to have an agent who can make decisions for them if they are debilitated.

Supported by the Illinois Power of Attorney Act, Ill. Com. Stat. 755/45, POA is the right of a person to select a representative (known as an “agent”) who can make property, financial, and health decisions on their behalf.

Power of Attorney is commonly abbreviated to POA. However, there is something tricky about “power of attorney”. It is used interchangeably: to regard the authority given to a person to make decisions on behalf of another person and the document used to issue this authority. Although, there are unique situations where the agent can make decisions for the principal when they are not debilitated. This article will shed more light on these technicalities, clarify what each type of POA does, itemise the requirements for POA in Illinois, and provide steps to draft one.

Customizable Forms & Templates

Why Use Statutory Forms?

As a resident of Illinois, a POA must be in line with the state law, i.e., using the state-recognized official document.

Creating a valid POA in Illinois can be a very detailed process since you must consider the rights of both parties and what is legal. Using the proper forms and terminologies dramatically increases the likelihood that your POA will be accepted by the authority to receive it, so be sure to consult local law experts whenever possible. Staying informed and updated on this process will prepare you for a time that may need a POA, or you get appointed as one.

Most Common Types Used

Such POA is supposed to provide you with an added level of protection and ensure that someone you trust can help uphold your best interests. Still, you must be able to recognize the type of POA that corresponds with your needs.

Below, we will be discussing each type under Illinois law, when it’s needed, their versions, supporting laws, and their statutory forms:

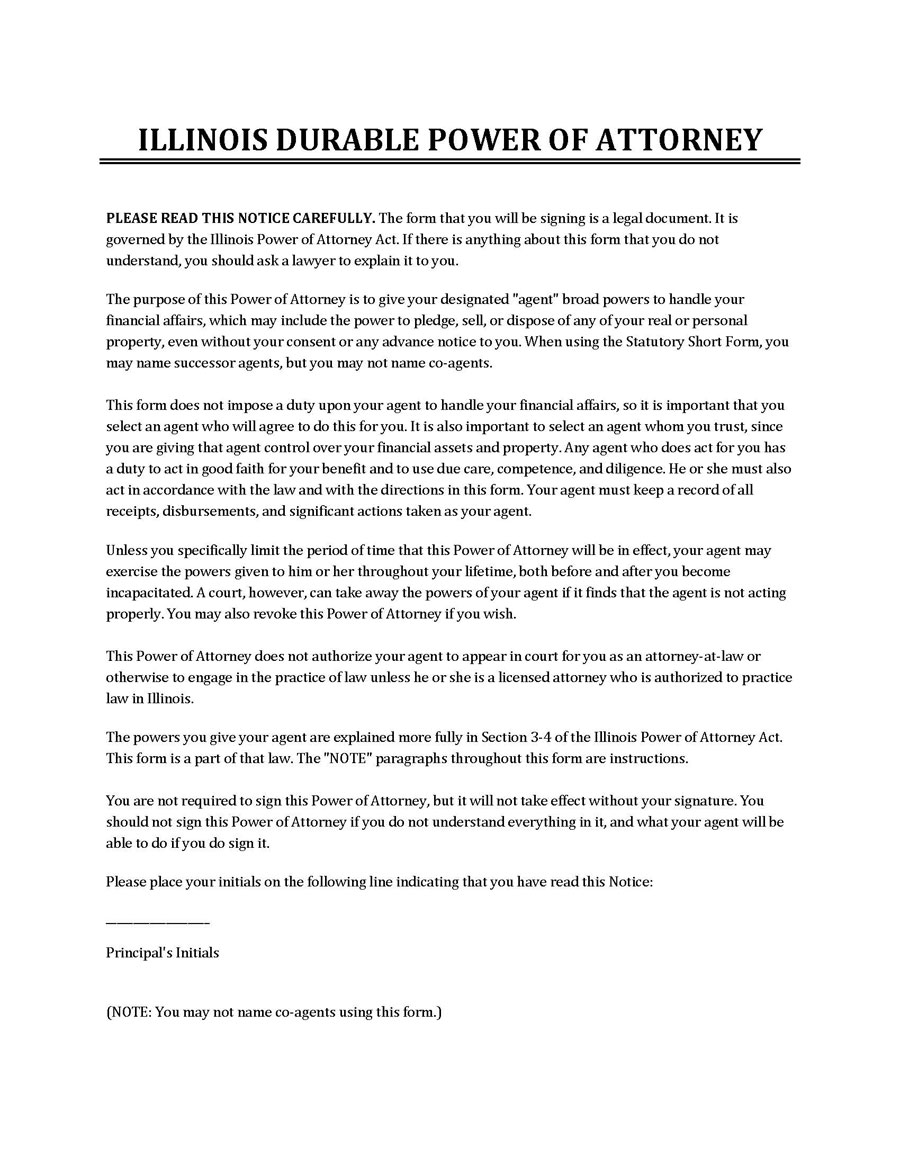

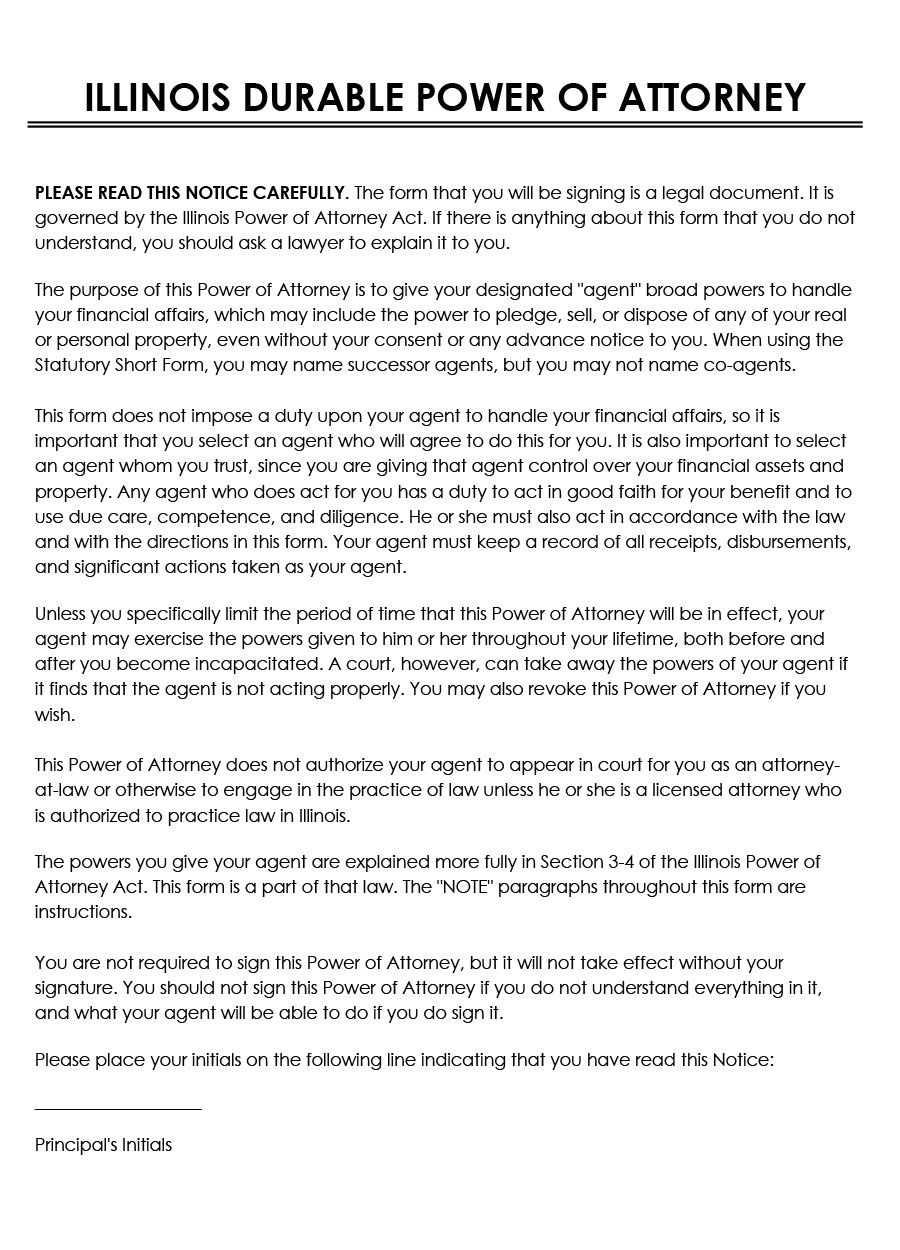

Durable (Statutory) Power of Attorney Form

Download: Microsoft Word (.docx)

General (Financial) Power of Attorney Form

Download: Microsoft Word (.docx)

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

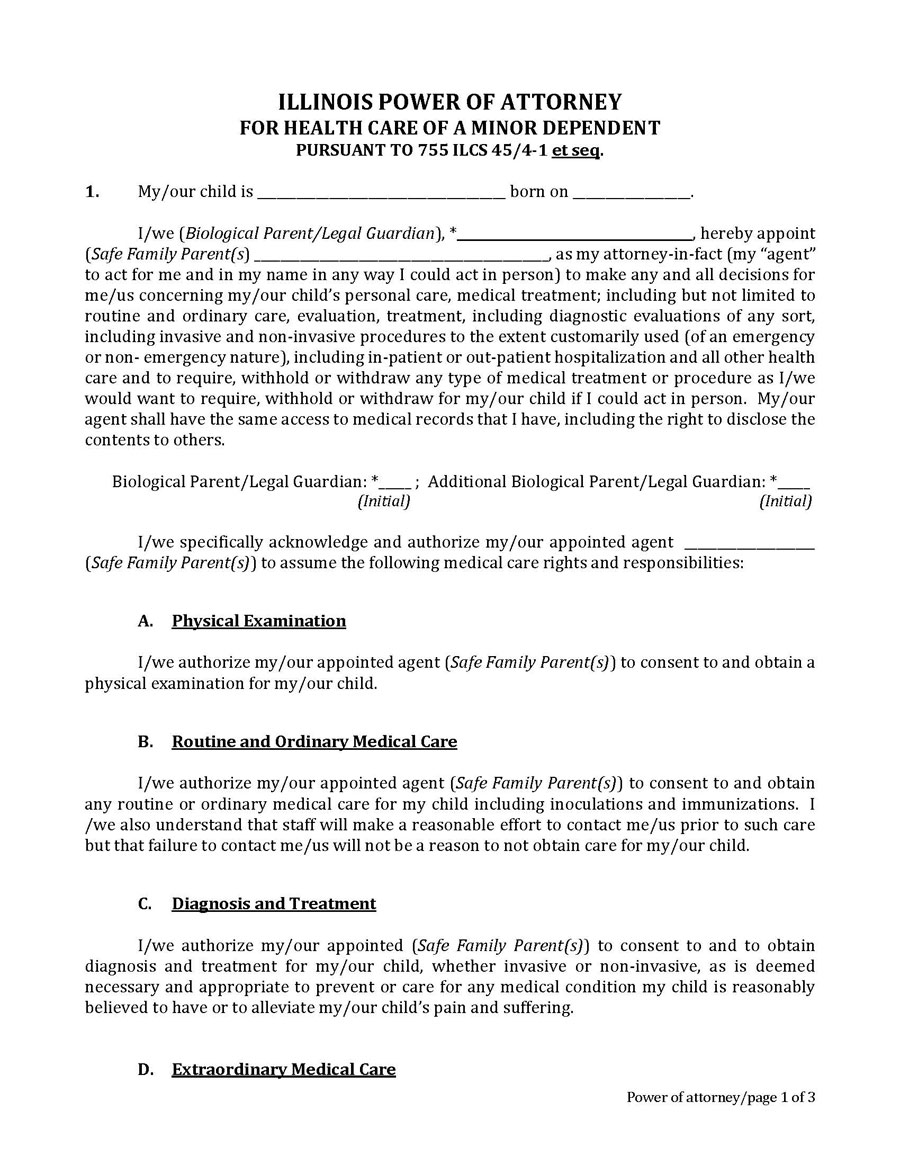

Minor (Child) Power of Attorney Form

Download: Microsoft Word (.docx)

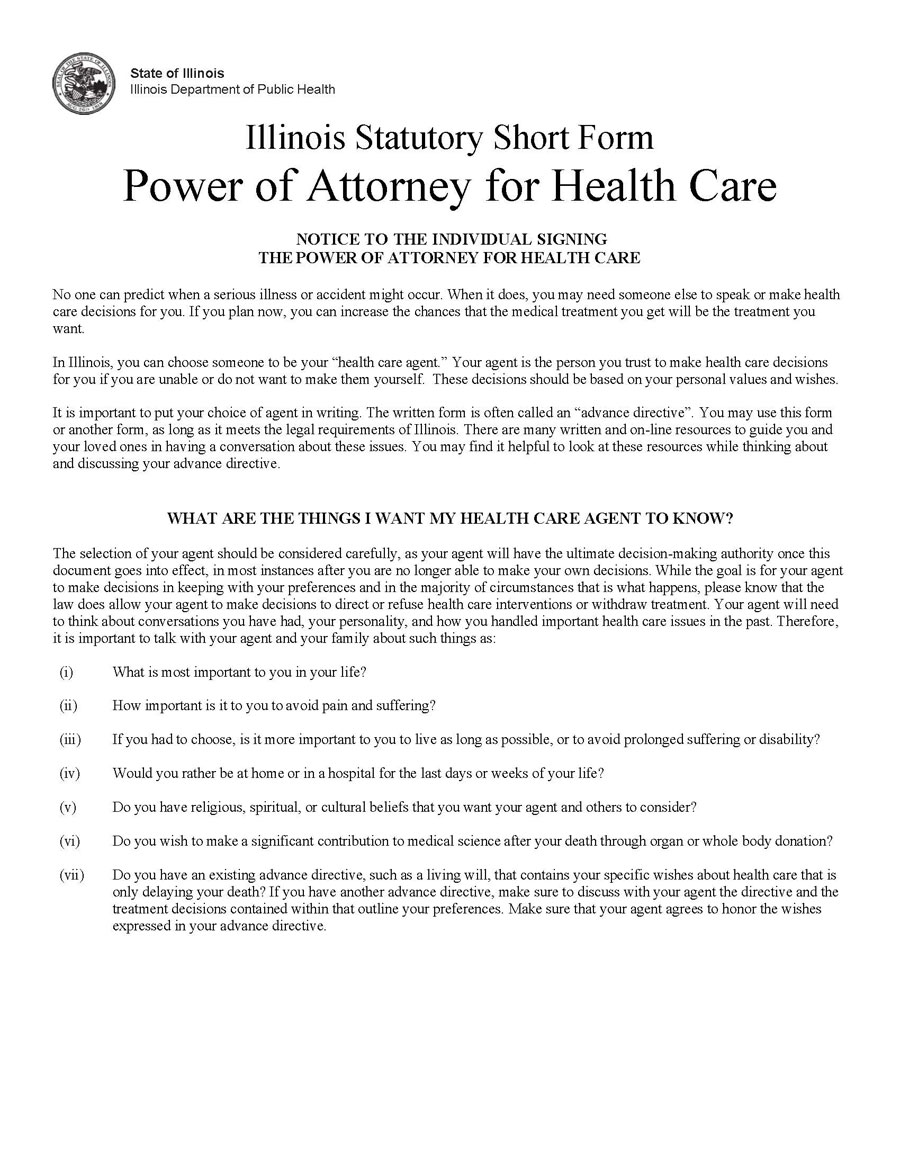

Medical Power of Attorney Form

Download: Microsoft Word (.docx)

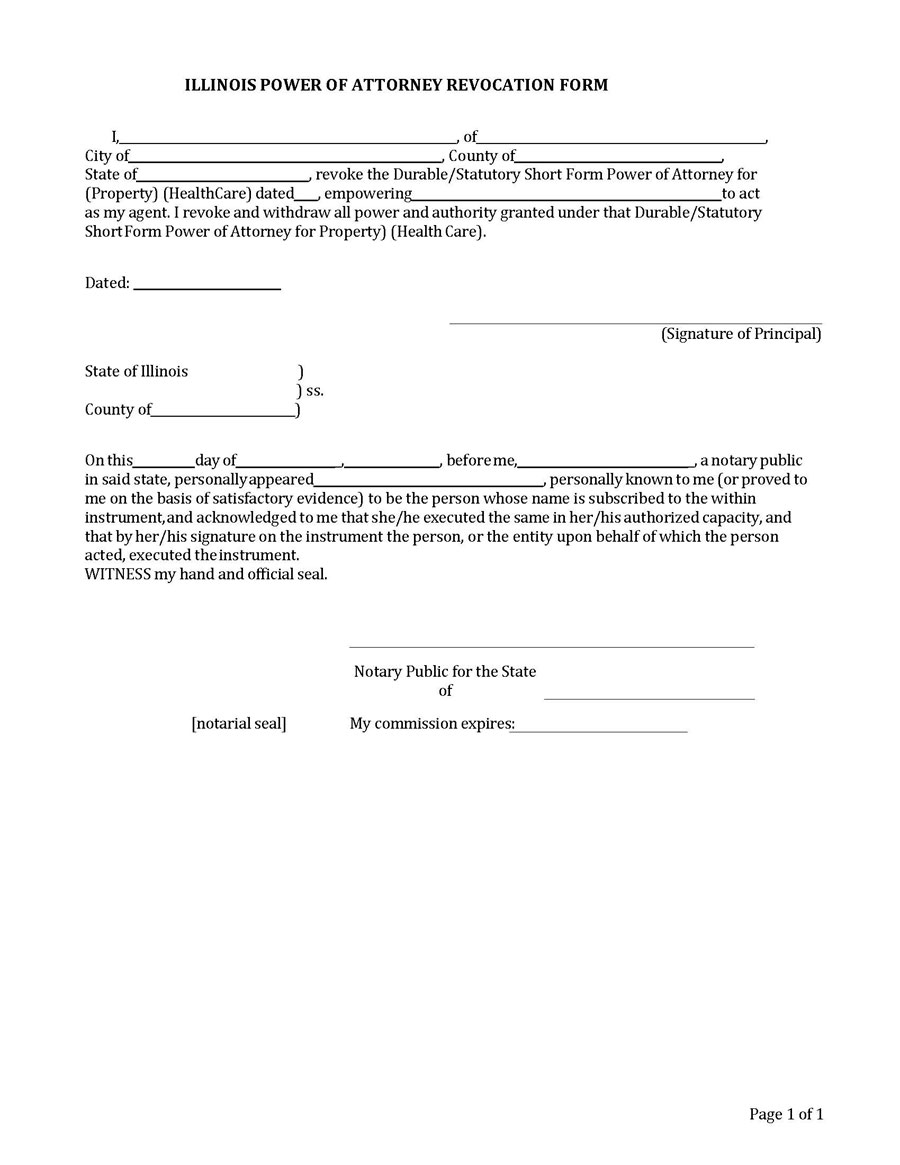

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

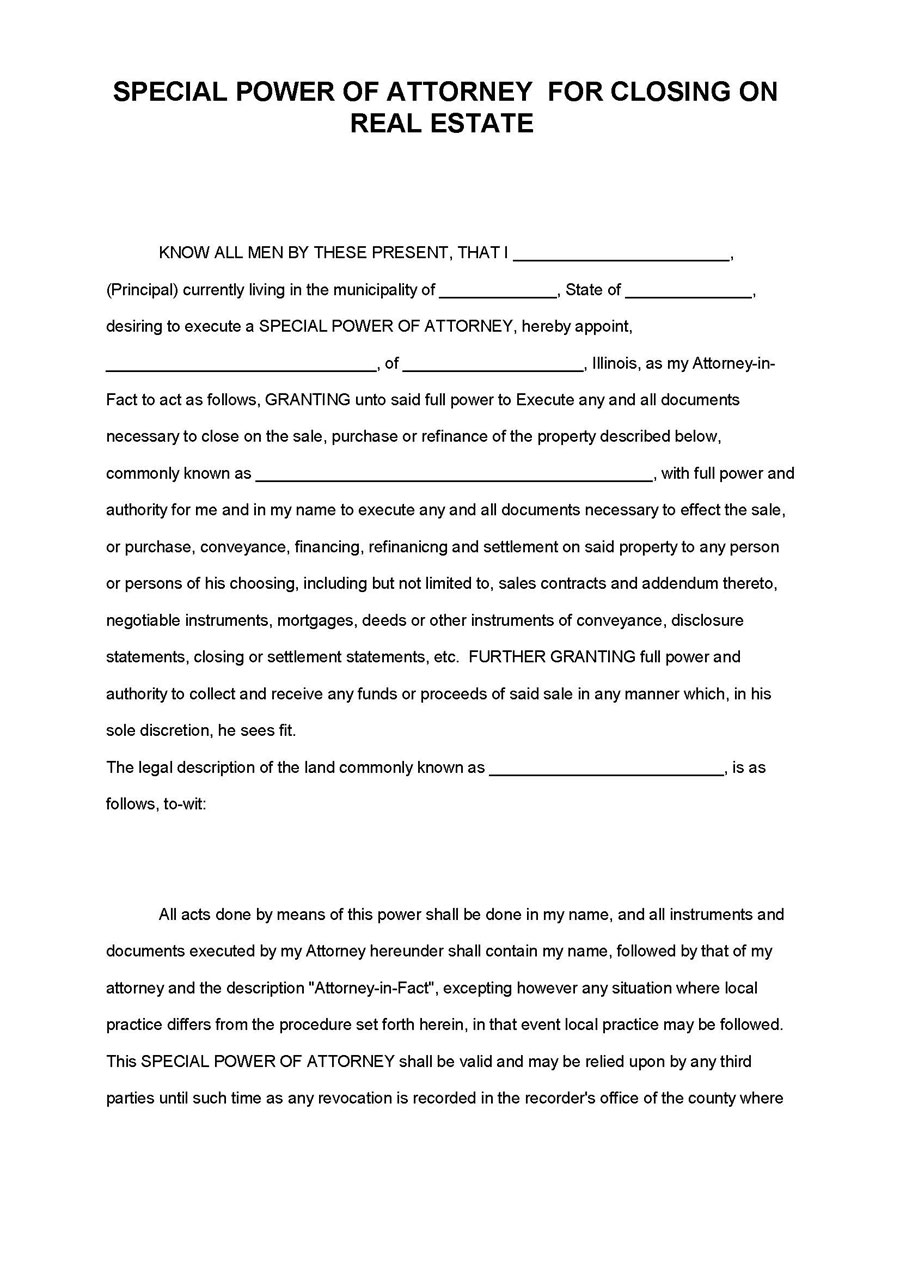

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

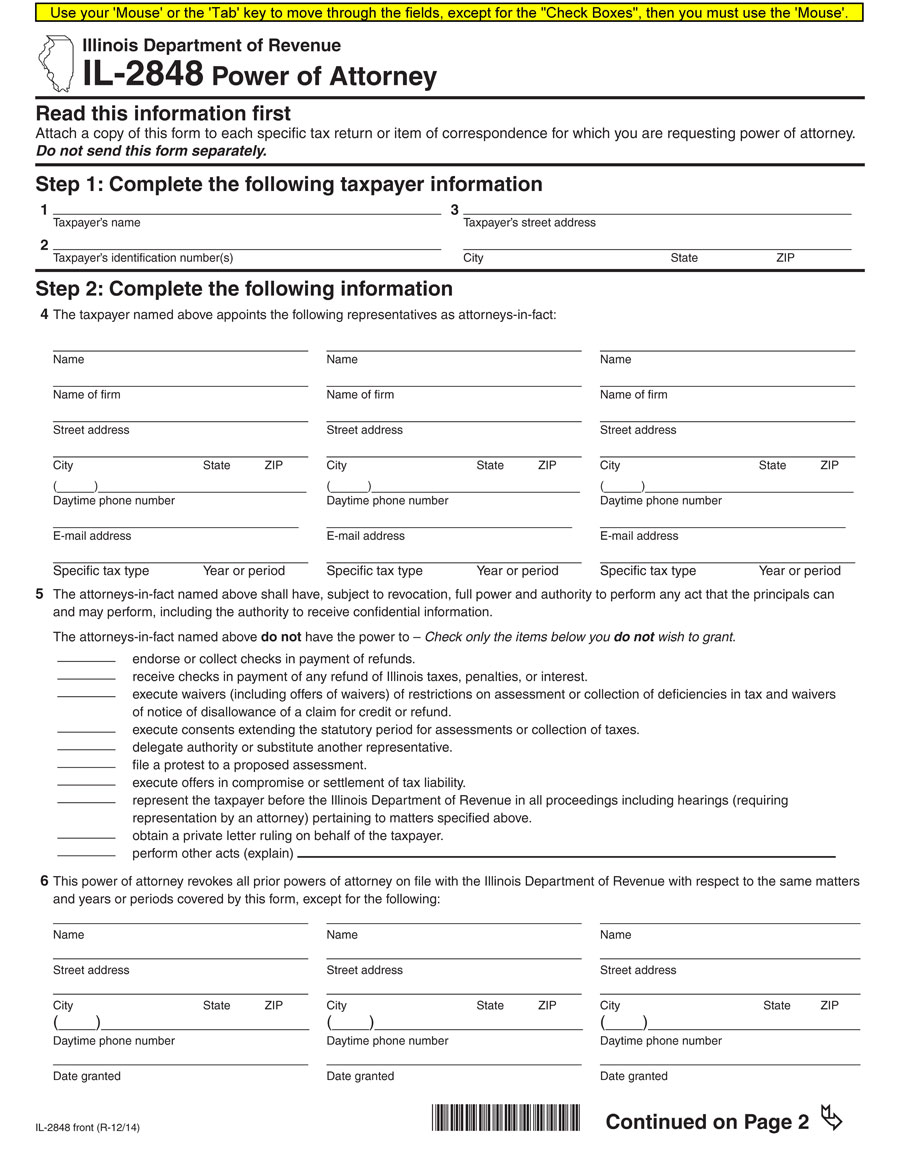

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

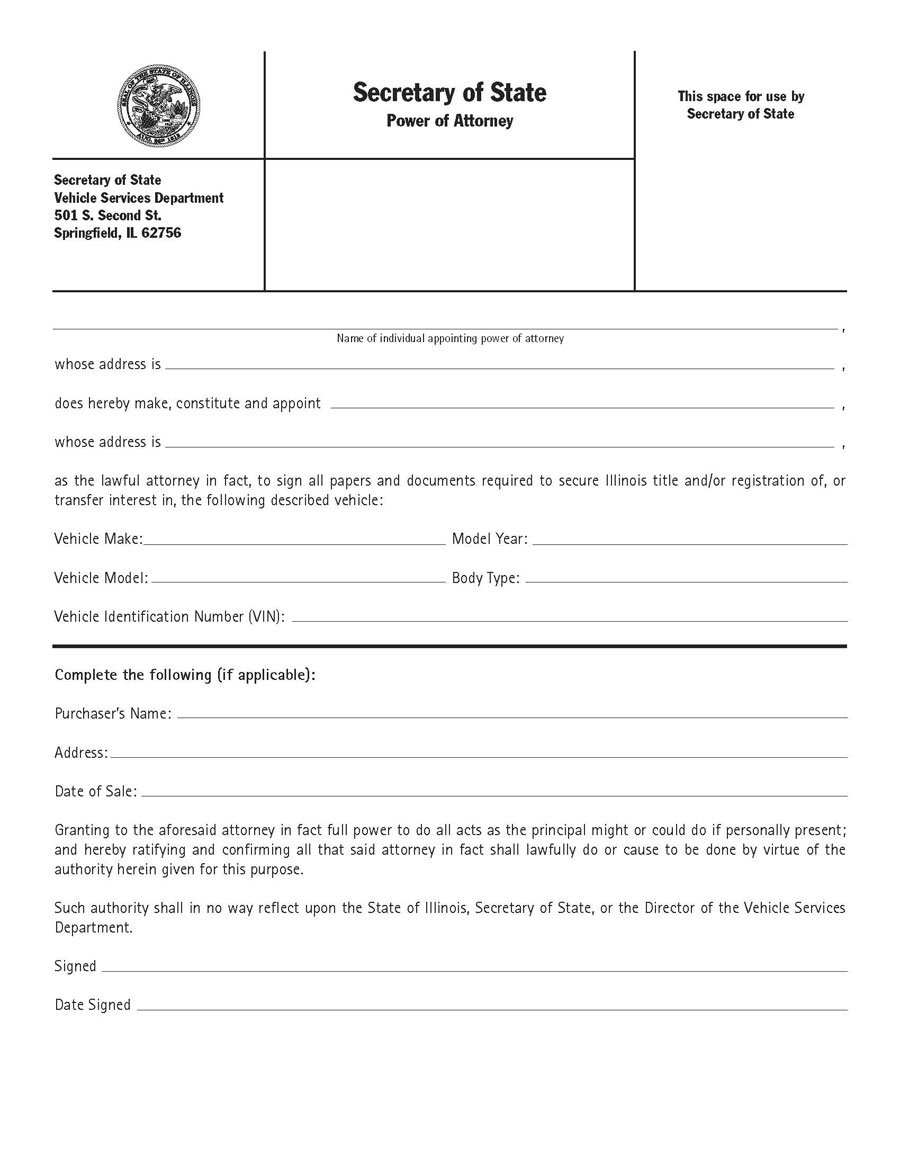

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

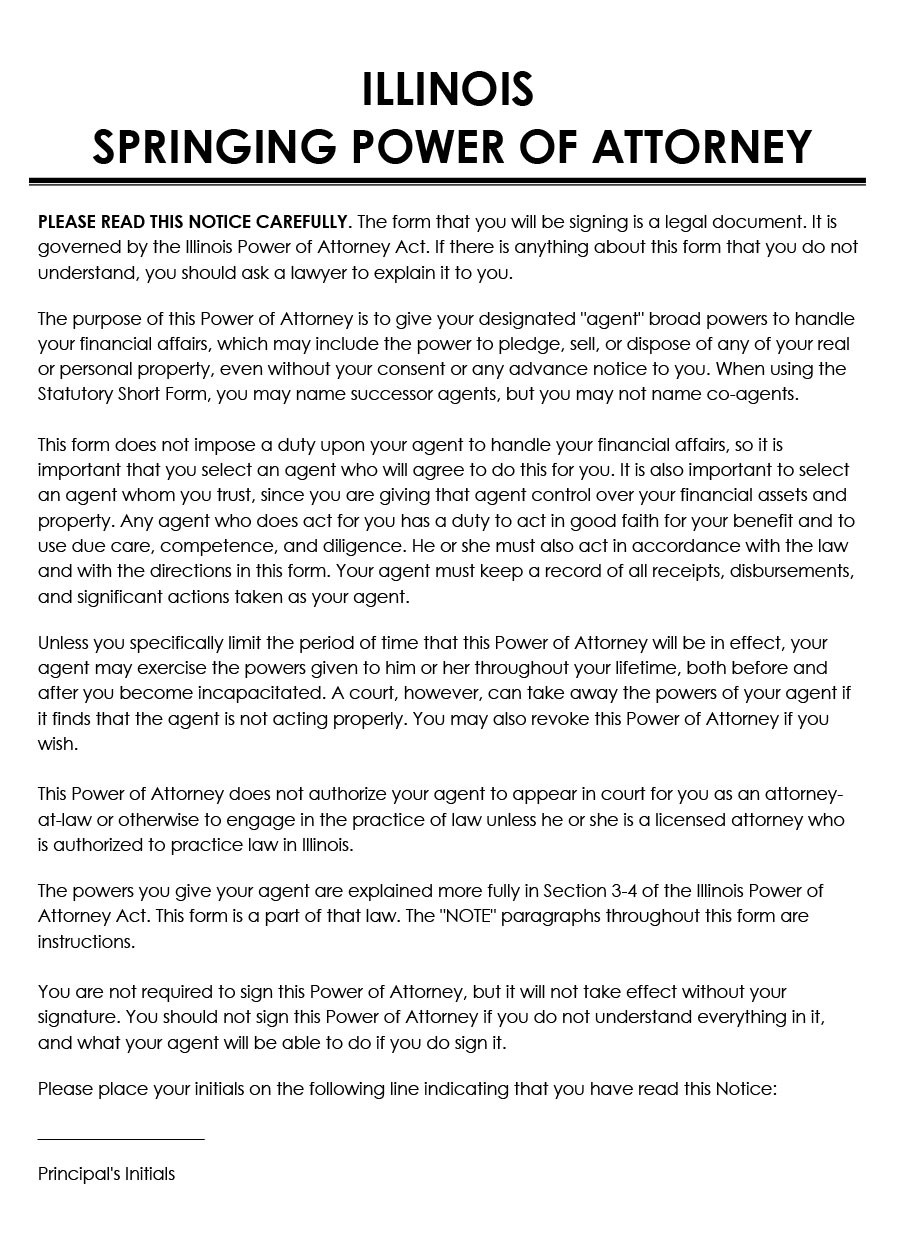

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Property Power of Attorney Form

Download: Microsoft Word (.docx)

Illinois Power of Attorney Requirements

This POA must follow the precise laws outlined by the Illinois Compiled Statutes, Chapter 755, Article 45. This document is considered to be a legally binding document. For this reason, if a principal has given an agent some powers over their affairs, whether for medical or financial decisions, they must understand the requirements and legal repercussions.

The general requirements are as follows:

- The principal should assign an agent and expound on the extent of the assigned agent’s power or authority.

- The document should be signed and executed appropriately by the principal.

- There must be at least one witness who will be present to sign the document.

- The document must prove that a notary public acknowledged the principal’s signature.

- These POAs require that the principal, agent, and witness involved be 18year and above.

- All limitations associated with the witness status must be considered before selecting a witness.

- A notary can not simultaneously act as a witness.

Meanwhile, there is some pivotal information that must be included in the POA form:

- Full name of the principal

- Full contact details of the principal

- Full name of the assigned agent

- The agreement execution date

- The specific power the principal is conferring to the agent

- Name of successors

- Address of successors

- Name of witness(s)

In any given case where someone becomes incapacitated or legally incompetent, they cannot revoke a power of attorney. The principal must have prepared and executed a revocable living trust, then friends and family will have to petition the court to remove an agent who is not acting in good faith.

How to Get Power of Attorney in Illinois?

To establish a power of attorney, the agent and the principal will need to fill out a POA form and sign it as indicated by the law in Chapter 755 ILCS 45 of the Illinois Compiled Statutes known as the Illinois Power of Attorney Act.

In addition, POAis constructive when specific incidents render you unable to address business matters, such as renovating your home, attending to a car crash, or having an upcoming medical procedure that requires extended recovery time.

Making this decision is easy and can be done by following the steps below:

Have a discussion

The principal must speak with their designated agent beforehand to ensure a smooth transition. Only the principal can genuinely know what they want and as such, only they can accurately assess whether or not giving a particular person POA over their affairs is in their best interest.

They must consult with an agent or attorney who will act on their behalf if they become incapacitated and ensure that the agent understands the unique needs of their situation to make decisions that are in their best interest.

Create POA

Once the principal has had the discussion with their agent and are comfortable taking on those responsibilities, it’s time to create the document. There are two types of powers of attorney in Illinois: property and health care. Whether a principal has decided to create a POA for property or medical purposes, it is vital to know their needs first.

Execute the document

Every state has its guidelines: Illinois, for example, requires the signer of a document to be in a physical room with two witnesses who have been adequately identified and an authorized notary. The notary’s role is to verify the identity of each person and that they’re acting under their “free and voluntary consent”.

Agent or notary cannot stand in as a witness. Each state has its guidelines for proper execution. In Illinois, the document must be signed in the presence of two witnesses and a notary. It won’t be official if the POA is not signed under Illinois law. This means the agent may not be able to act on the principal’s behalf.

Make copies

It is not necessary to file a POA document with the court in Illinois. However, it’s good to make copies of it while keeping the original in a safe location.

Keep one copy for yourself. Provide several copies to your agent. If you have a health care power of attorney, the doctor or medical office may require a copy on file so they can deal directly with the agent. If you executed a property POA, the banks or other institutions might also require a copy on file.

Final Remarks

A power of attorney can be used to make sure that your wishes are followed if you cannot speak for yourself on healthcare and financial matters. In addition, this document can be critical if you become incapacitated, unavailable to make financial or business dealings, and physically disabled or legally incapable of making decisions.

We hope this article helped you learn more about the Illinois POA process and that you can find the right type of POA for your needs