A Massachusetts Power of Attorney allows the agent to make legal, financial, and medical decisions for the principal.

These decisions can come in many shapes and forms and vary in specificity. Therefore, there are many types and lengths of the forms. For example, a POA can come in the form of medical, financial, tax, vehicle, or parental powers, among others.

There are many reasons to draft a Massachusetts POA.If the principal wants to prepare for unexpected emergencies, if they are aging, or intend to live out of state, a POA can come in handy.

The principal may use a Massachusetts POA to address a temporary situation. For example, a it can help with financial tasks, such as a principal who needs an agent to take care of debt. However, agents can be both short-term and long-term. An example is when the principal anticipates a medical emergency. In this case, they can designate an agent to help them decide on their care if they become incapacitated.

It’s advisable for all adults to have a POA for emergency situations. For example, if you become sick or start to have limited mobility, a POA can help you deal with paperwork. Likewise, if you decide to move out of your home, travel to another state, or just find yourself absent from financial duties for a time, then a POA may be beneficial.

In short, it is a document that allows an agent to take sensible actions for someone incapable. This article will explain all of the available power of attorneys and the relevant laws and processes in Massachusetts.

Editable Forms

10 Types of POA

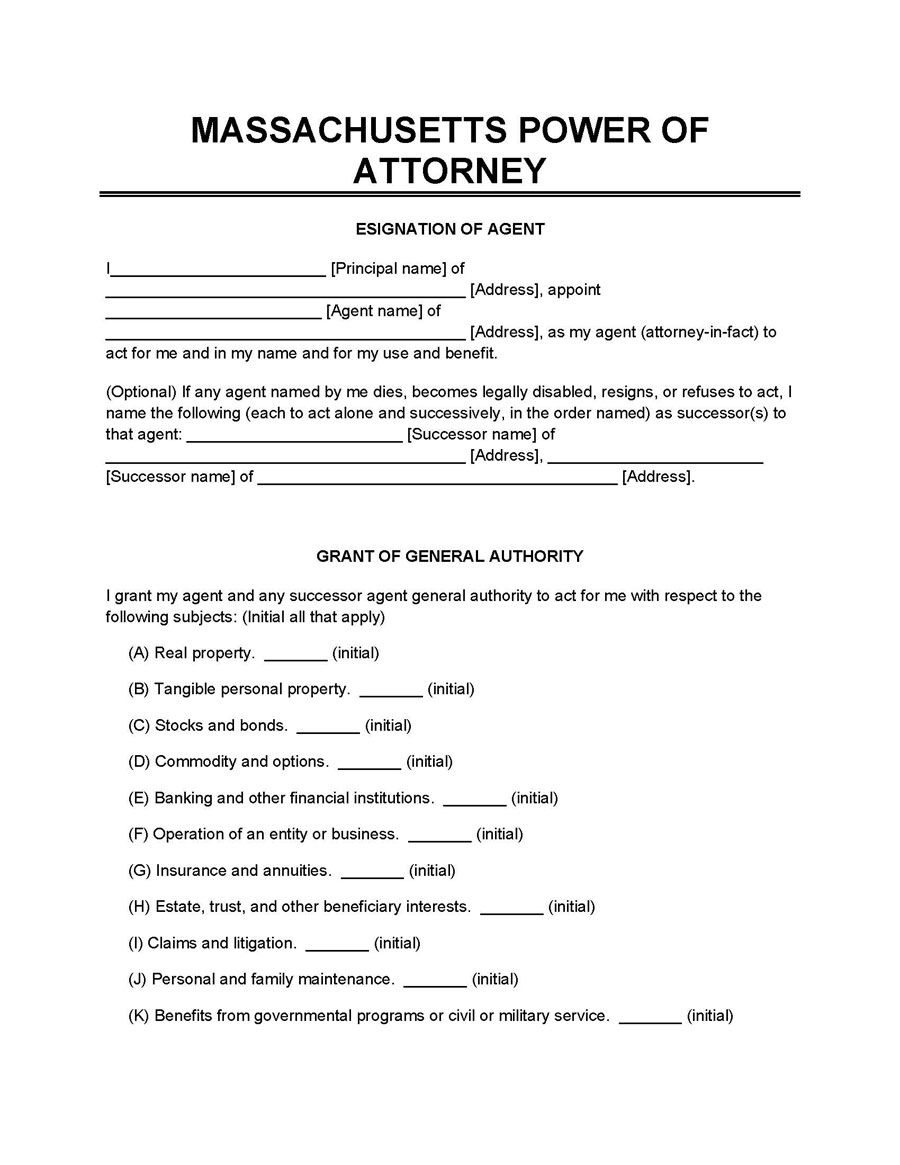

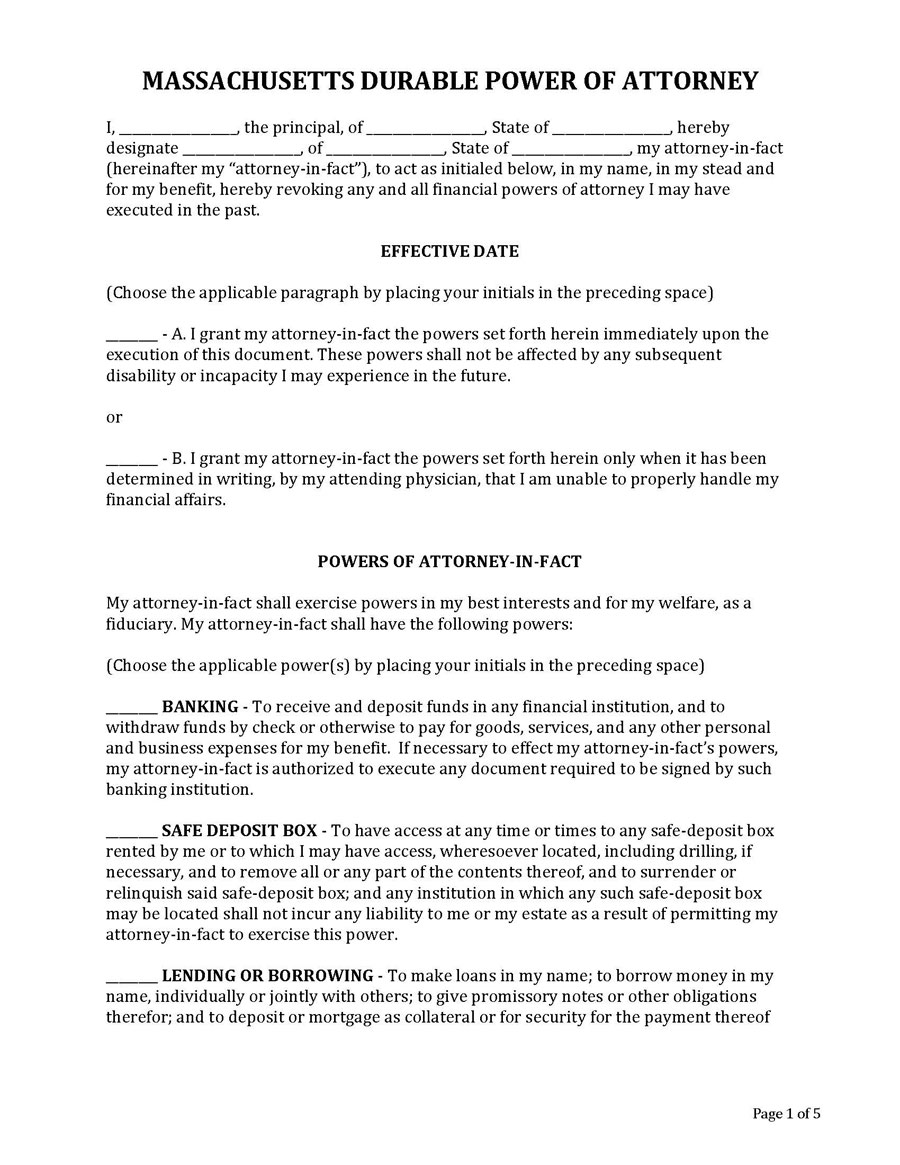

A Massachusetts POA is a general term. There are many kinds of power of attorney specific to the actions that the named agent may take. This is to ensure the safety of the involved parties and protect them. The agent can’t assume all of life’s decisions. In general, only the authority specifically provided in the forms is relevant.

This article will cover the ten most popular POA forms in Massachusetts. This article can also find the supporting laws and statutes describing them.

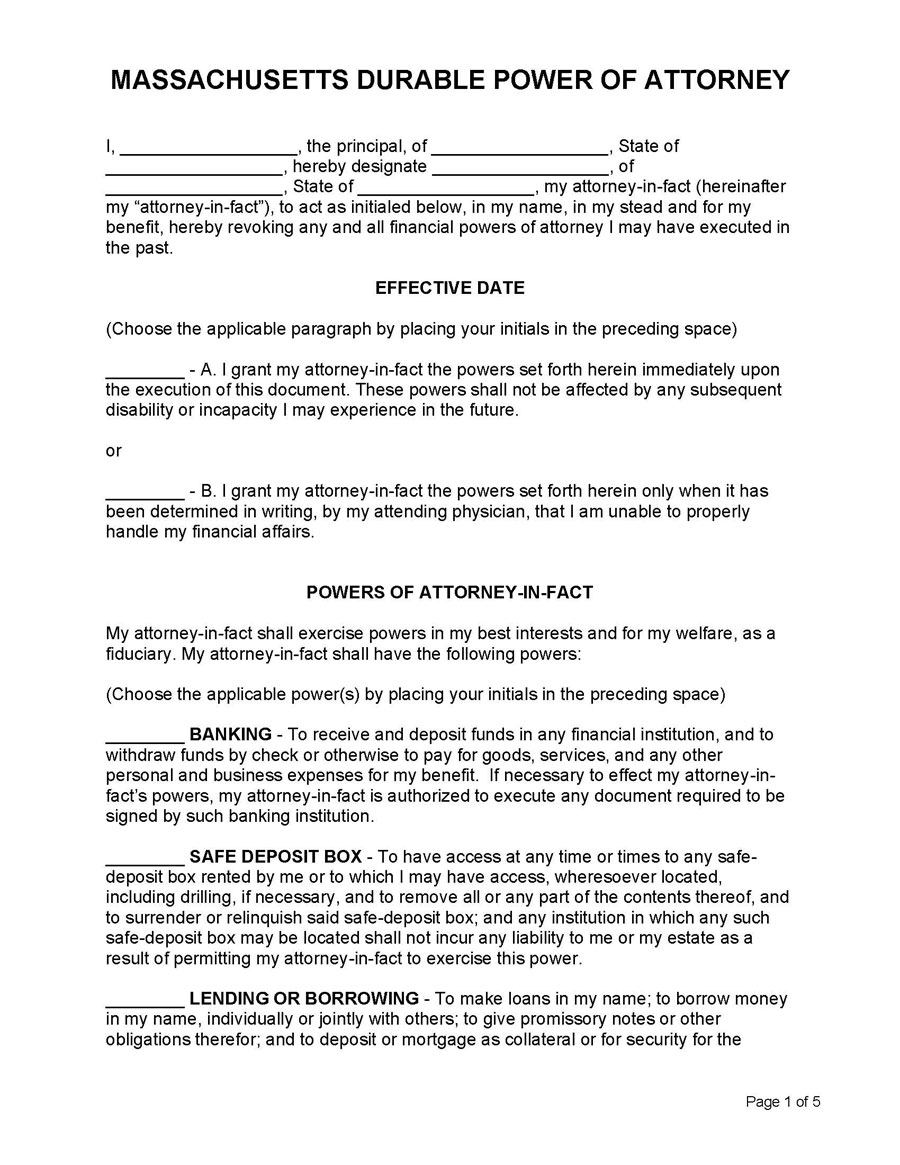

Durable Power of Attorney Form

Download: Microsoft Word (.docx)

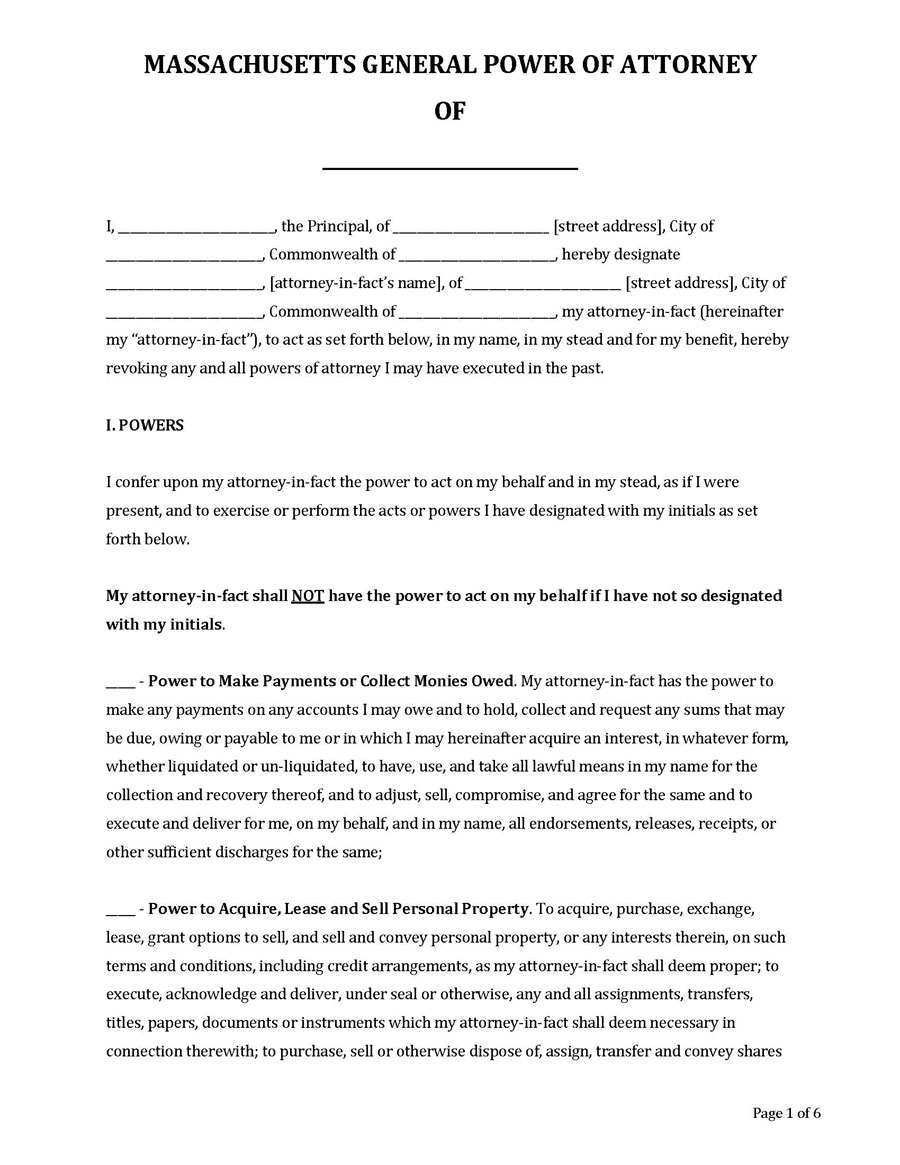

General Power of Attorney Form

Download: Microsoft Word (.docx)

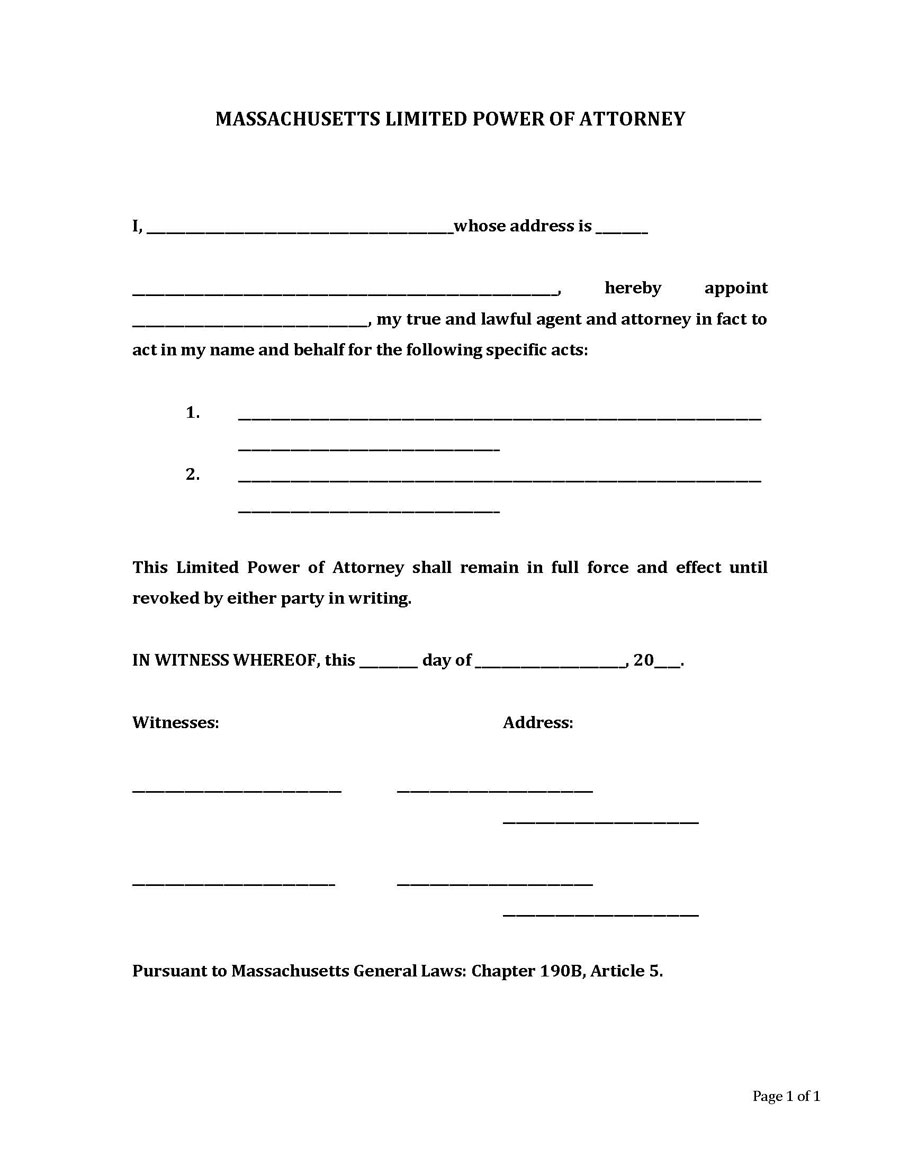

Limited Power of Attorney Form

Download: Microsoft Word (.docx)

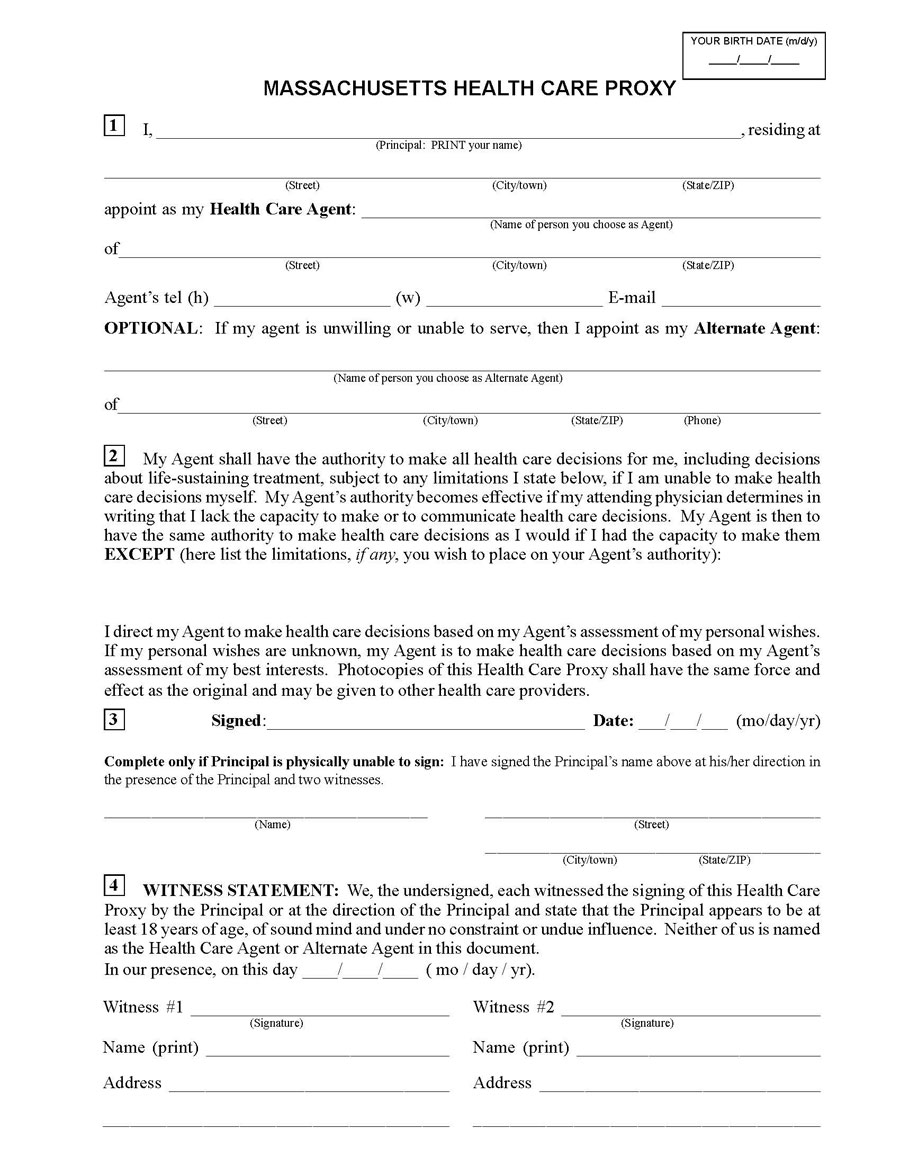

Medical Durable Power of Attorney Form

Download: Microsoft Word (.docx)

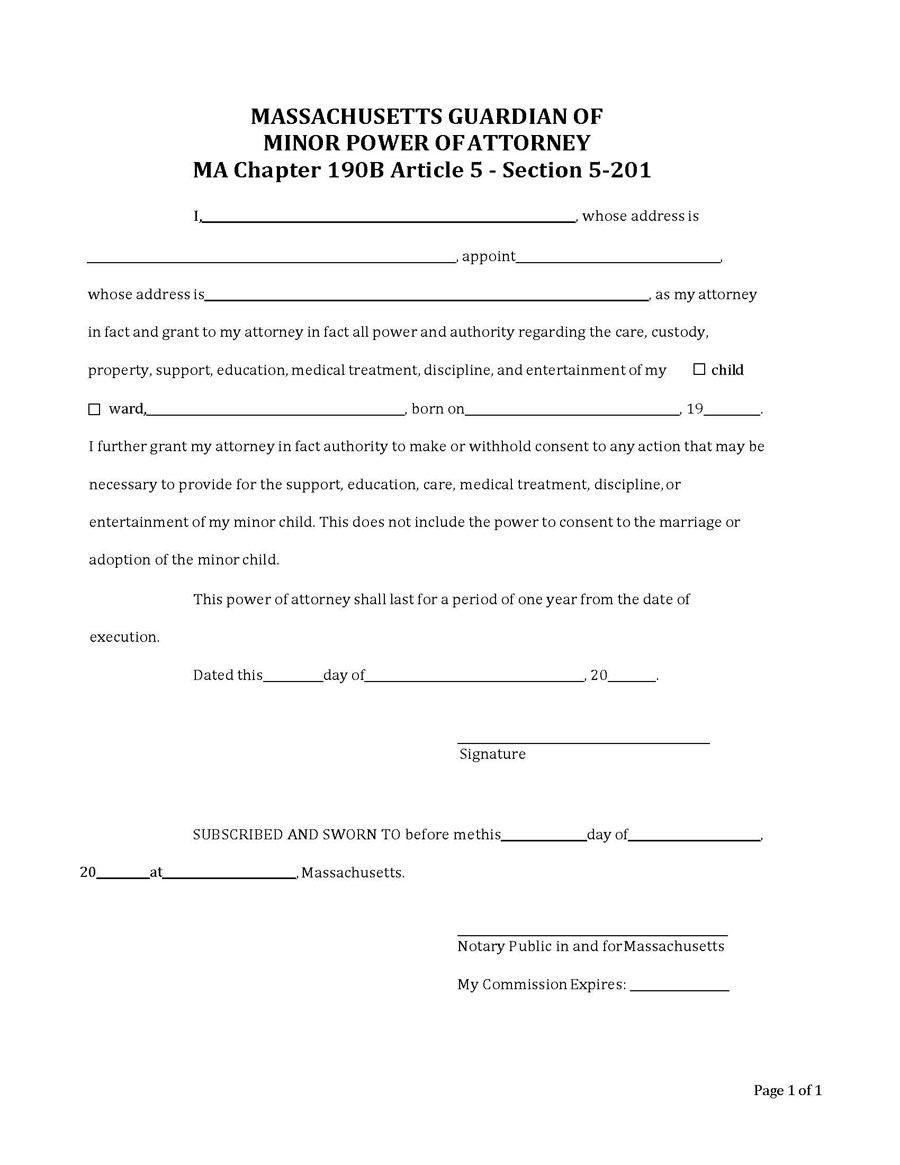

Minor Power of Attorney Form

Download: Microsoft Word (.docx)

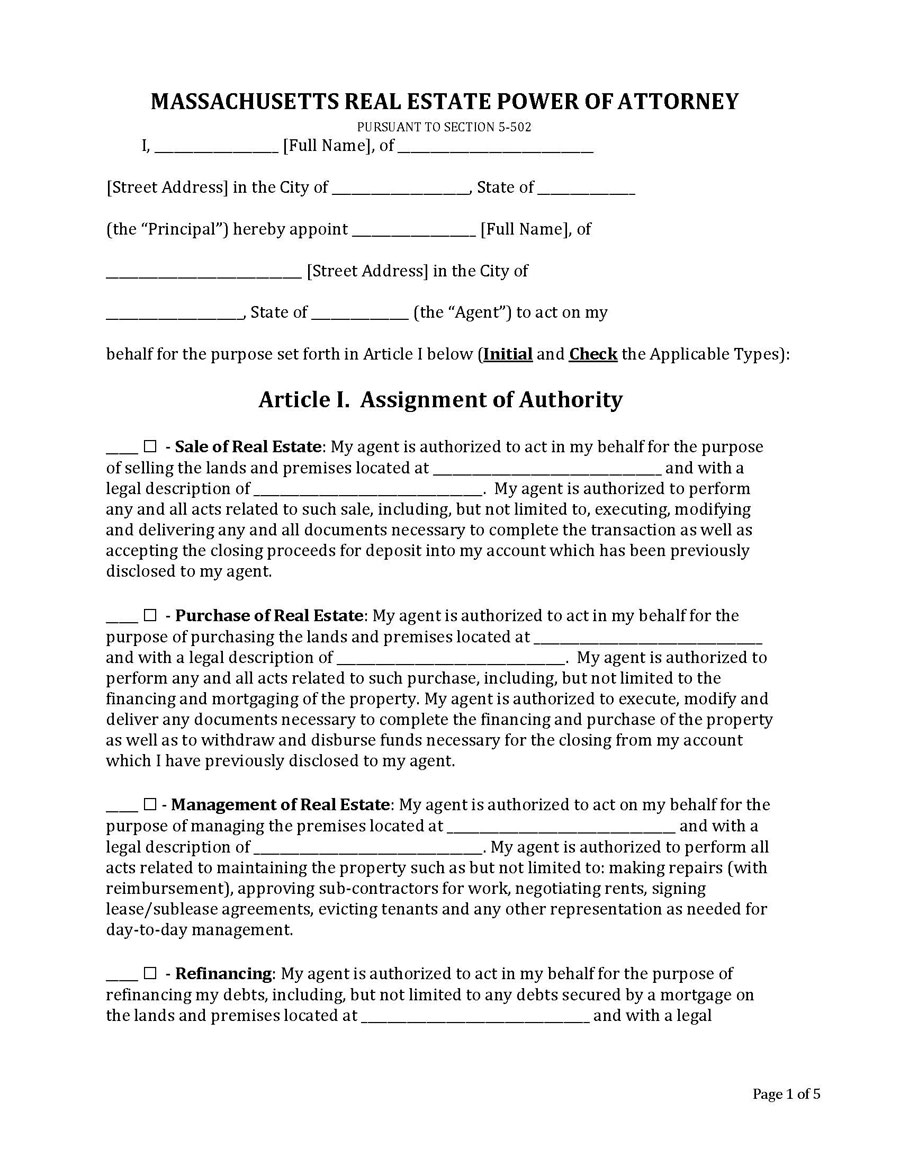

Real Estate Power of Attorney Form

Download: Microsoft Word (.docx)

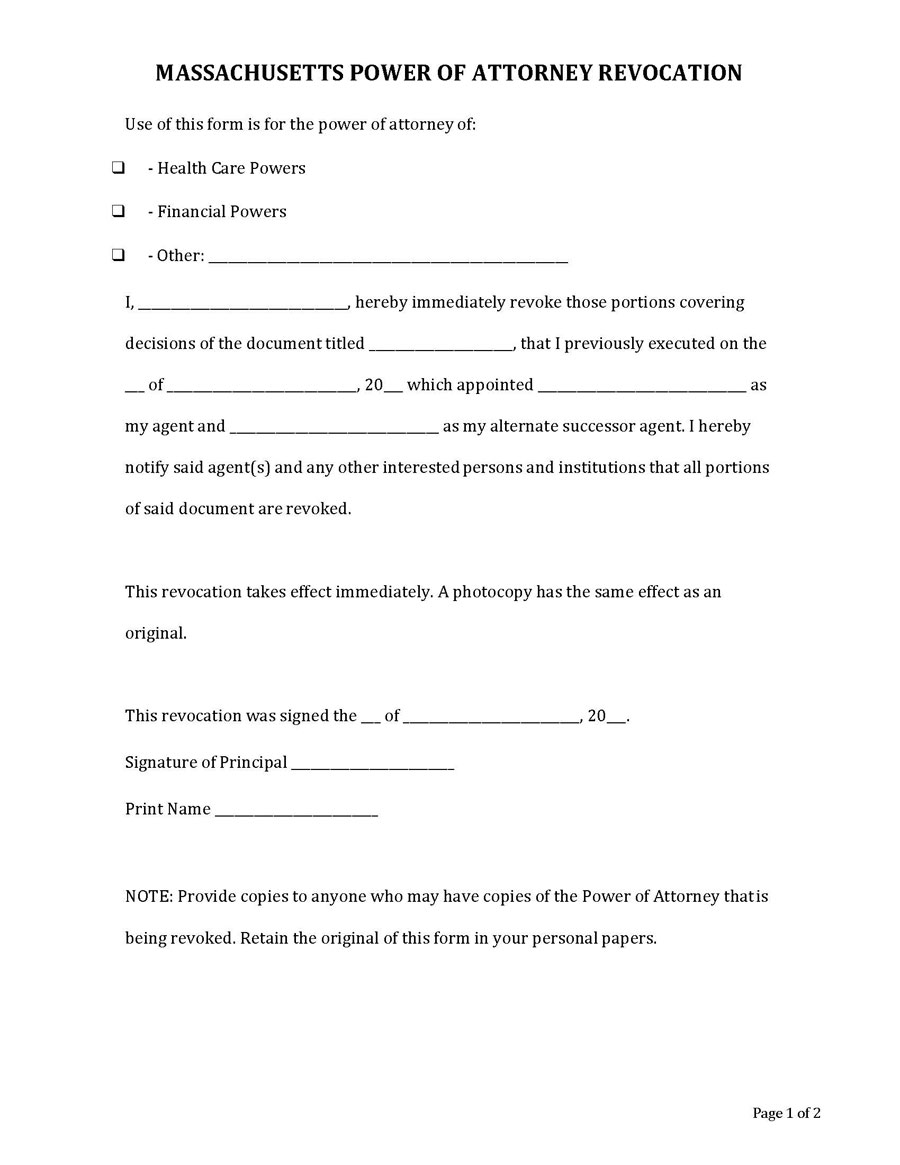

Revocation of Power of Attorney Form

Download: Microsoft Word (.docx)

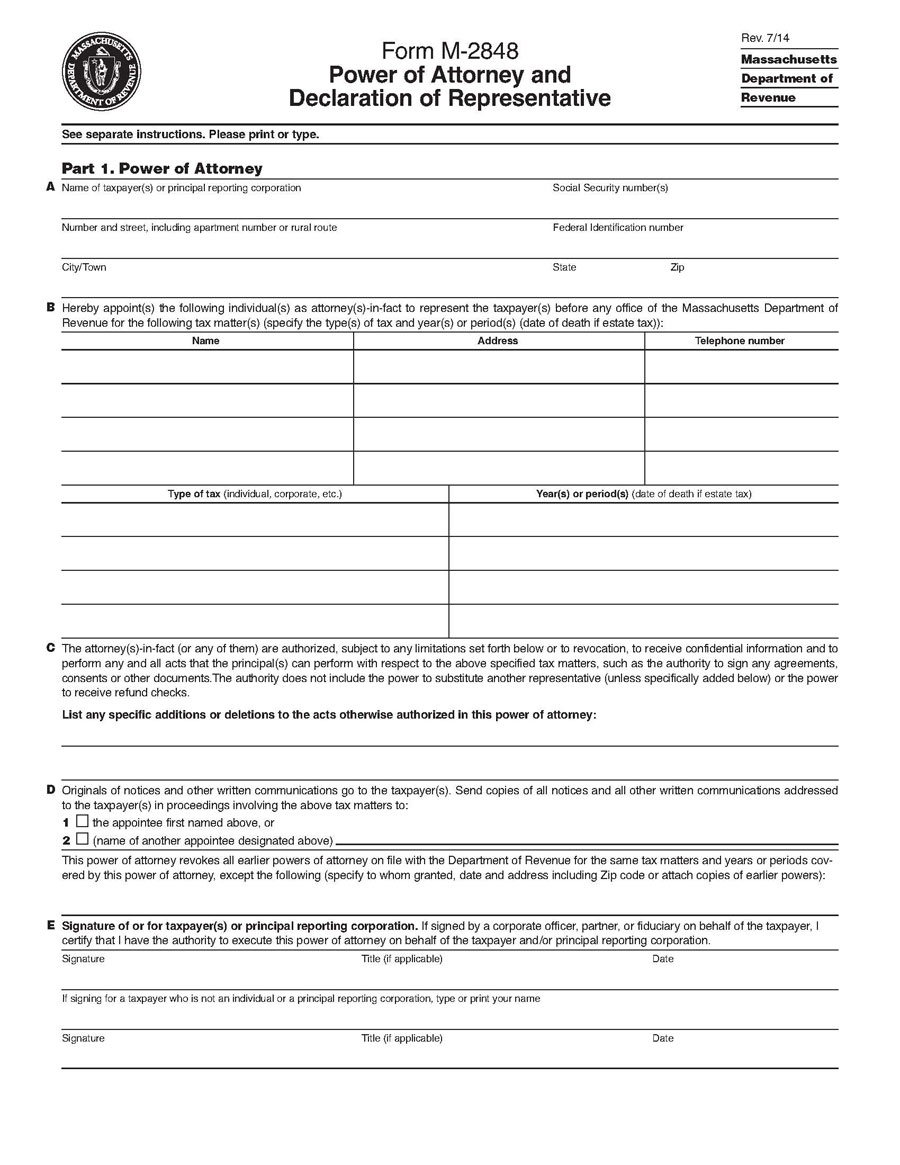

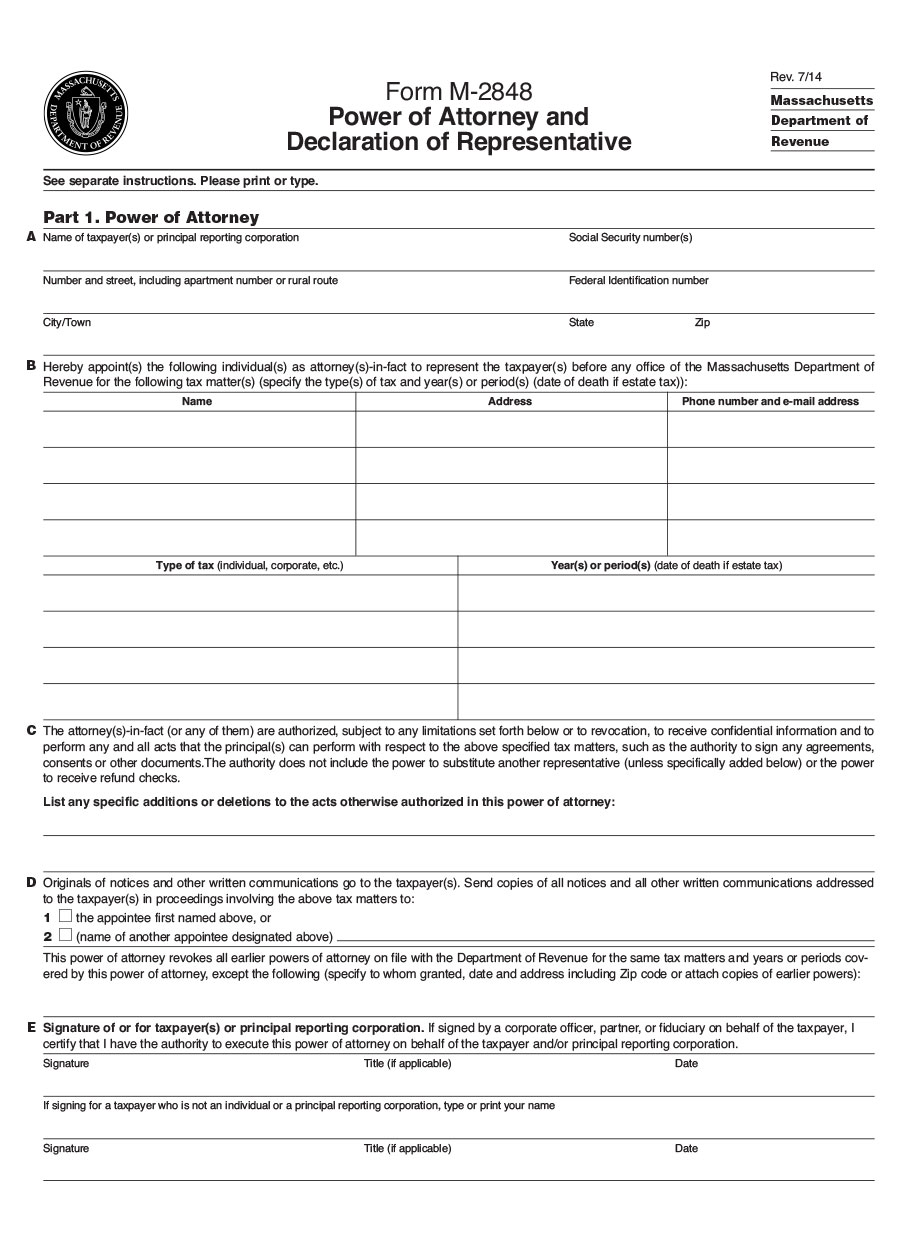

Tax Power of Attorney Form

Download: Microsoft Word (.docx)

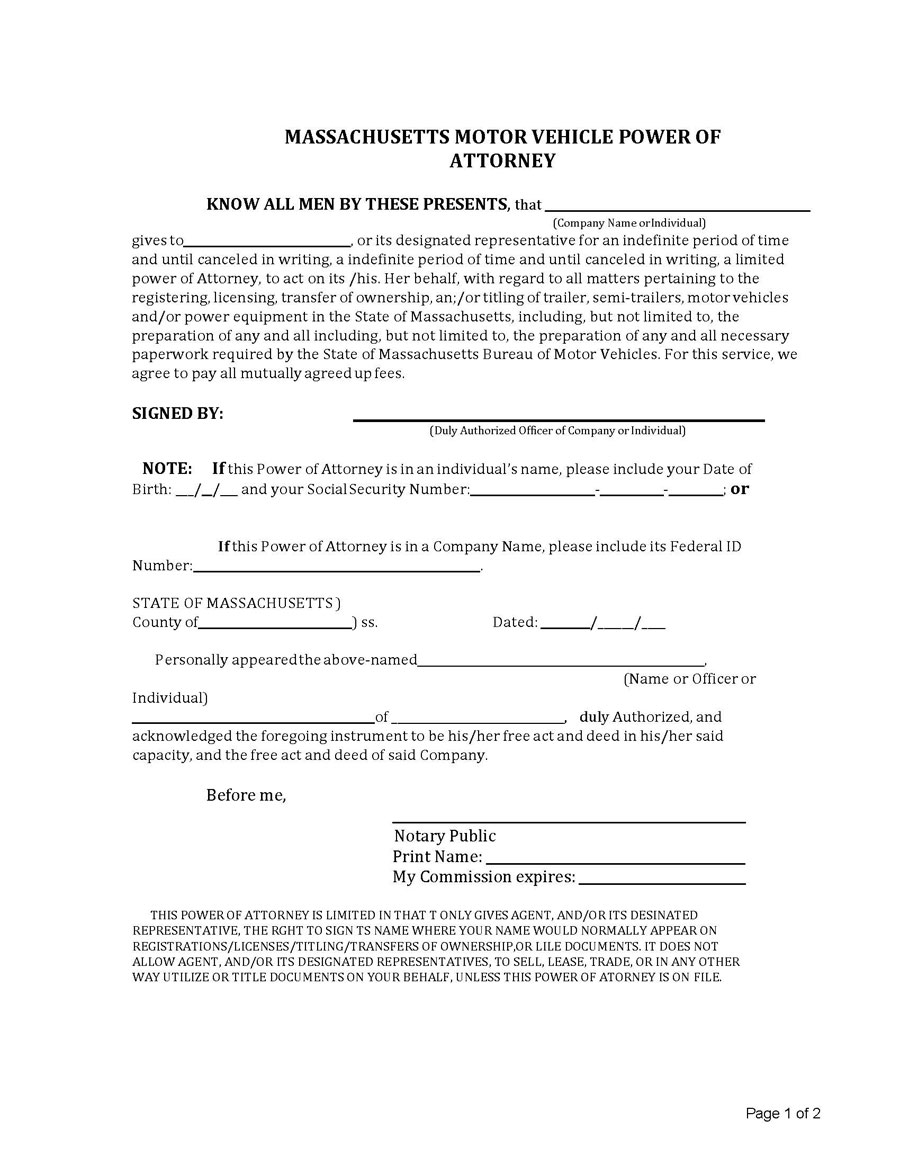

Vehicle Power of Attorney Form

Download: Microsoft Word (.docx)

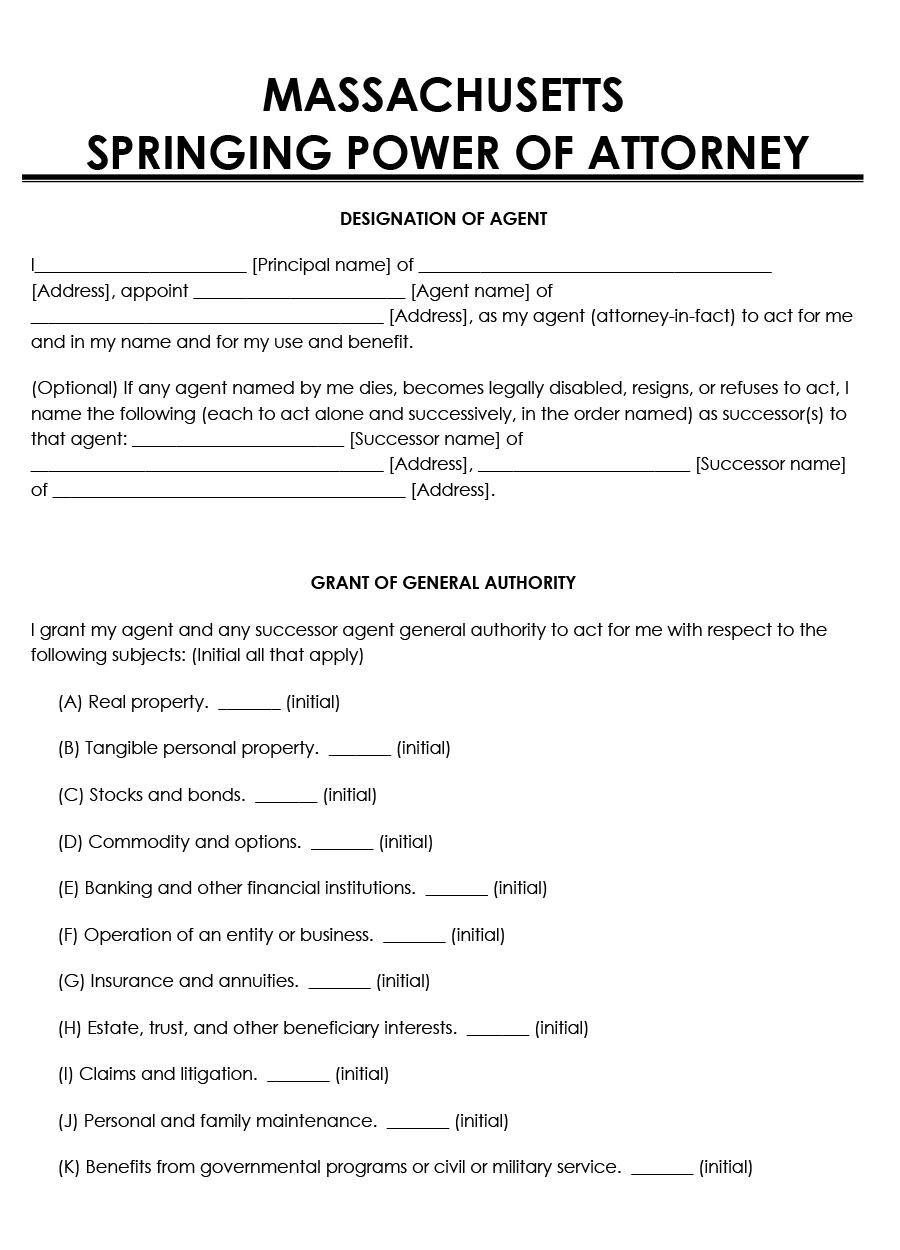

Springing Power of Attorney Form

Download: Microsoft Word (.docx)

Revenue Power of Attorney Form

Download: Microsoft Word (.docx)

Massachusetts Requirements for POA

There are several requirements for a POA in the Commonwealth of Massachusetts. These requirements must be met for the POA to be legally binding.

Massachusetts’s law requires that a POA list the full name, social security number, and address of the principal. In addition, all names, and signatures of other parties (agents) should be included. Finally, the date should be included when the agreement was signed and the date acknowledging the time when the powers begin and end.

Two witnesses and the primary individual must sign a POA. In many cases, a notary public can sign the document as well.

How to Get Power of Attorney in Massachusetts?

To establish a POA in the Commonwealth of Massachusetts, the principal and agent must fill out and sign the form. The statute M.G.L. c.190B § 5 establishes the laws and regulations regarding this requirement.

Frequently Asked Questions

Hiring an attorney to establish a POA in Massachusetts is not always required, especially as it can be a costly service. However, both the principal and the agent may have specific questions or concerns, in which case a legal professional may be helpful.

The fees can vary depending on the type of POA needed and the location. However, you can expect to pay between $200-$500.

After establishing a POA in Massachusetts, there are a few steps to take. Most importantly, both the agent and an individual’s financial institutions should be notified and given copies.

The only legal requirement in Massachusetts is to have a POA signed by two impartial witnesses. Notary publics are not typically required, except in real estate affairs. However, it is generally advisable to have a notary sign the documents.