A promissory note is a legal document used to clarify and formalize loan agreements between two parties. It is a legal document that can be used in Florida for business transactions involving loans or credit.

The agreement states that it is enforceable in court and that both parties must maintain written records of all terms and conditions.

If you are a lender offering loans to borrowers or a borrower seeking financial assistance from lenders, you may require a written agreement outlining the terms of the transaction. This note is a contract between two parties that establishes certain terms and conditions for lending money for use over time. The lender provides funds to the borrower, who agrees to pay back the principal amount of money and interest at an agreed-upon time known as “maturity time.” It is then written as a promise to pay a specific amount of money at a later date, on demand, or under agreed-upon terms.

In Florida, borrowers and lenders can use it to cover loans of up to $500,000. Note that for higher amounts, state law requires that the money be secured, for example, by a mortgage or deed of trust. This article will explain how to write a promissory note in Florida, cover all of the essential elements of it, and provide free templates for your convenience.

Free Templates

Types of Promissory Notes in Florida

There are two kinds of promissory notes that can be used by lenders or borrowers, depending on their purpose and the amount being borrowed.

The different types of promissory notes available in Florida include the following:

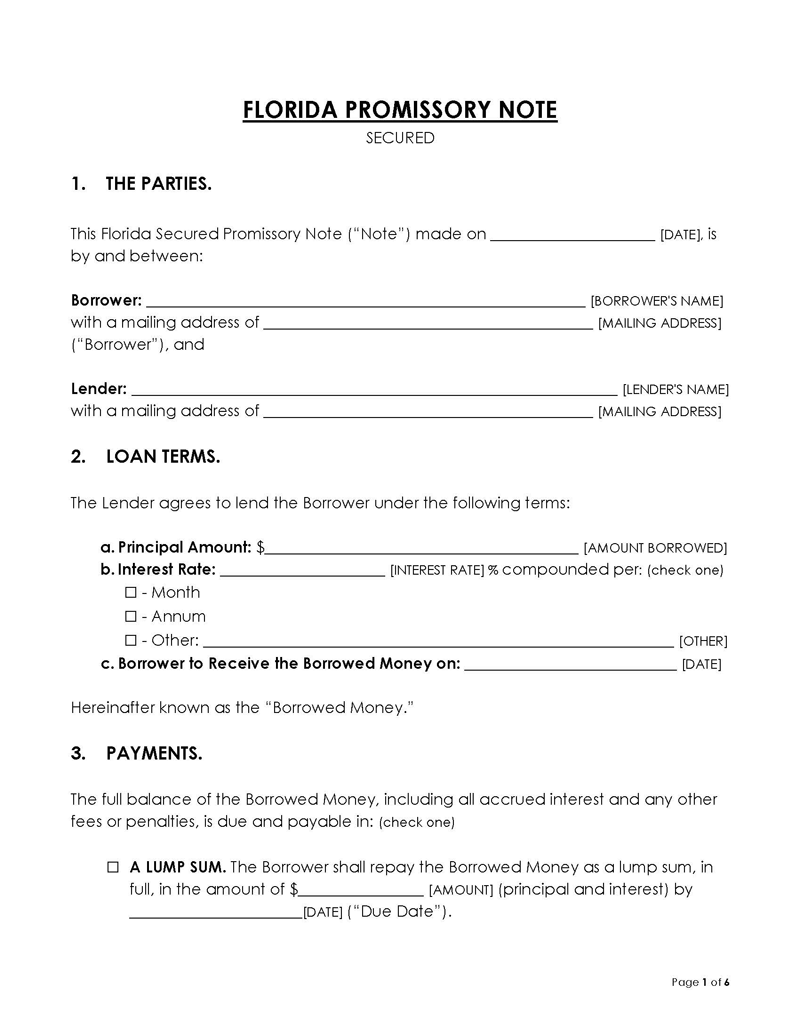

Secured Florida promissory note

This type of note requires collateral (a mortgage, a vehicle, a pledge, or a deed of trust) as security to secure a specific amount of money as specified in the lending agreement. Should the borrower or debtor default on the loan in question, the lender can confiscate the secured property. This type of note is sometimes referred to as a “collateral loan,” “collateralized loan,” or “security loan.” It must specifically mention that the promissory note is “secured.”

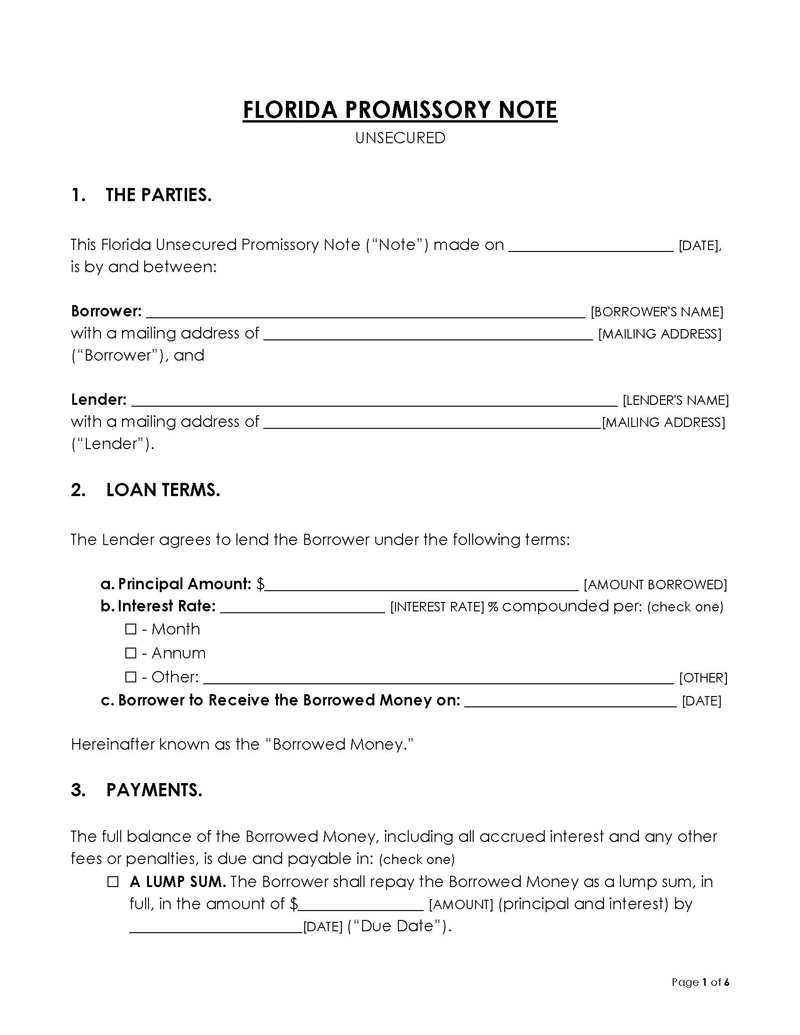

Unsecured Florida promissory note

This type is sometimes called unsecured commercial paper (CP). The debtor or borrower is not required to pledge any property as collateral for this form of financing. As a result, in the event of a default by the borrower, the lender is left with no choice but to file a small claims lawsuit against the borrower or inform credit reporting companies of the default in an effort to recover his money.

The amount of risk taken on by the lender is the key distinction between the two types of these notes. In addition, the first one is used to lend or borrow large amounts of money, whereas the latter is used for relatively fewer amounts.

Unlike unsecured notes, secured promissory notes use collateral to secure the loan. For lenders, a secured loan poses less of a risk because they can get their money back if the borrower defaults. A borrower can choose to use it if he or she has collateral that can be used as security for a loan. Unsecured promissory notes are used for a variety of purposes in business. A retail store owner, for instance, might use it to get money to buy inventory. The promise to pay the funds back with interest is the sole source of security for the lender in this instance.

Why is a Promissory Note Needed in Florida?

It ensures that every detail of their agreement is expressly set forth in a single document, protecting both the lender and the borrower. This way, there is no ambiguity about what each party expects of the other.

note

These notes are less sophisticated than loan agreements but more detailed and complex than verbal agreements, and thus enjoy the flexibility of less formal agreements and the enforceability of formal agreements.

How to Draft a Promissory Note?

A template will make the writing and subsequent preparation of a promissory note easier. A template contains the specific components that must be present in it.

The steps below should be followed when writing it for use in Florida:

Step 1: Choose an appropriate template

Start by selecting an appropriate template. You can make sure that your note is enforceable and legally binding in Florida by simply selecting the right document. It is critical to choose a template that is thorough and can be customized. They are reusable and can be used for future transactions. This could save time and effort by avoiding the need to write a new note for every transaction.

Step 2: Determine the type of the promissory note

After selecting a template, you must determine the type of promissory note. This is dependent on the amount of money you intend to borrow and the length of time it must be repaid. Generally, the notes with a principal sum of $25,000 or less require minimal security according to Florida laws, but those over $250,000 need full legal collateral security. Choose the type according to your situation. When selecting one, it is useful to review Florida laws that cover the creation and execution of such notes.

Step 3: Add a title

After you have determined the type, you must now add the title to the note. For instance, it must have the term “secured” in their title, such as “Secured Florida Promissory Note.” If it is not clearly stated in the title, it will be difficult to legally enforce the document.

Step 4: Enter basic information

The basic information should be added next. This includes the names and addresses of both parties involved (the borrower and the lender), details such as when and where the loan is due, and other important information like the amount of money being borrowed, interest, and payment plans. This is where a template comes in handy because it contains all of this basic information that will allow you to put together a sound legal document.

Step 5: Include important clauses

Once you have entered the basic information, you should add the essential clauses that make up any promissory note.

EXAMPLE

Non-waiver, severability, integration, conflicting resolution terms, notice, governing law, etc.

Step 6: Execute the promissory note

Finally, when all the steps above have been completed, the document should be signed and dated. Note that there are no signing requirements in Florida. However, it may be impossible to legally enforce it unless it is signed by the borrower and the lender. Doing this allows you to verify that the details written in it are accurate and true, so they can be proven in court should the need arise.

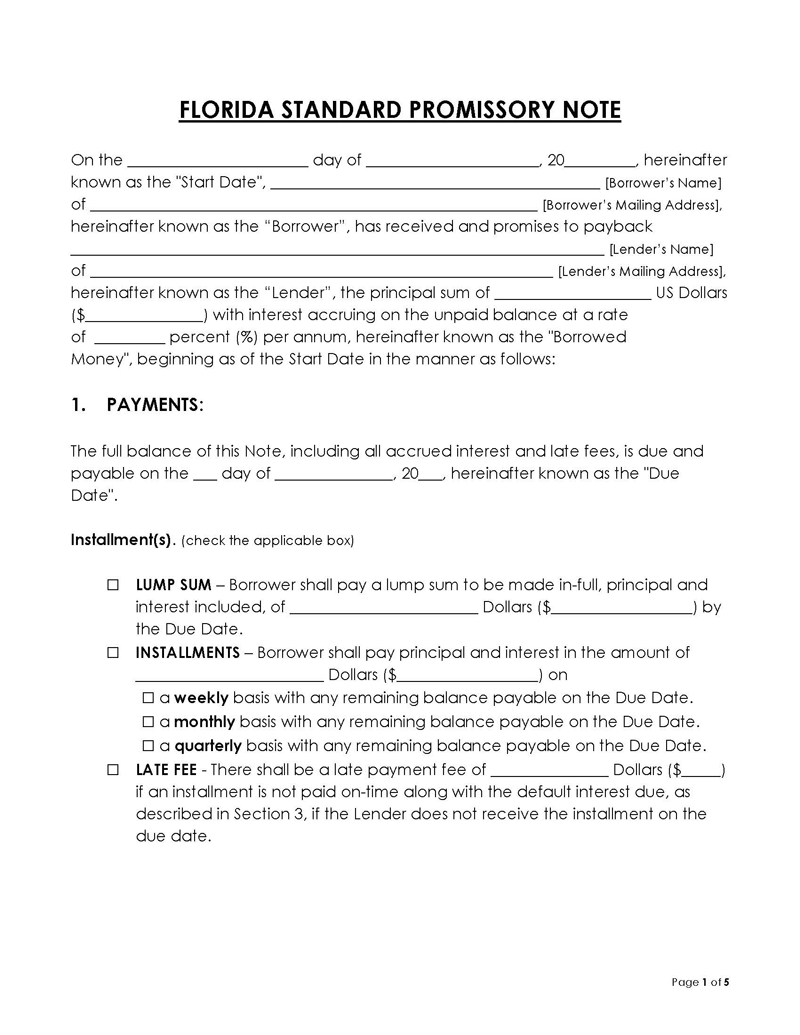

Florida Promissory Note Template

SECURED PROMISSORY NOTE IN FLORIDA

1. THE PARTIES. The parties to this note are the party of the first part (Borrower) and the party of the second part (Lender).

Borrower:(Name of Borrower) _______________

Address:_______________

City/State/Zip code: _______________

Phone Number: _______________

Lender: (Name of Lender) _______________

Address:_______________

City/State/Zip code:_______________

Phone Number:_______________

2. LOAN TERMS. The Lender consents to lend to the borrower under the following terms:

a. Principal Amount: The Principal Amount shall be$[AMOUNT BORROWED]

b. Interest Rate: [RATE OF INTEREST]% per annum and not subject to change

c. Borrower to Receive the Borrowed Money on: [DATE].

Hereinafter known as the “Borrowed Money.”

3. PAYMENTS. The borrower agrees to pay the Principal Amount of the Note, and the Borrowed Money is due and payable on [DATE].

Hereinafter known as “Payment Date.”

☐ – A LUMP SUM. The borrower will pay the Total Balance due under this note in the form of a lump sum at the end of the loan term. The sum will be in the amount of $[AMOUNT] (principal and interest) by [DATE] (“Due Date”).

☐ – INSTALLMENTS. The borrower shall repay the borrowed money in the following amounts and with the following frequency:

a. Installments: [AMOUNT OF INSTALLMENTS] (principal and interest) per [INTEREST RATE]% per [INTEREST RATE PERIOD].

b. First Installment: $([AMOUNT TO BE repaid])

c. Second Installment: $([AMOUNT TO BE repaid])

d. Third Installment: $([AMOUNT TO BE repaid])

e. Fourth Installment: $([AMOUNT TO BE repaid])

f. Fifth, Sixth, and Seventh Installments: $([AMOUNT TO BE repaid]), and so on, and in the following amounts [INTEREST RATE]% per [INTEREST RATE PERIOD] (principal and interest) each.

g. Other Installments: other.

Hereinafter known as the “Repayment Period.”

4. PAYMENT IS DUE. The borrower shall pay the Borrowed Money in full on the Due Date as specified above. Any late payment, or failure to make payment in full, shall be considered an Event of Default.

5. TERM. This Note will mature, and be due and payable in full, on _________________ (the “Maturity Date”).

6. LATE FEE. If the borrower’s payment falls due on a (1) day before or (2) day after the Maturity Date, there shall be: (check one)

☐ – NO LATE FEE.

☐ – LATE FEE. [AMOUNT OF LATE FEE]% per annum of the Principal Amount.

☐ – OTHER: [OTHER]

7. SECURITY.

7.1. This Note is secured by ___________________________ (The “Security”).

7.2. The security may not be transferred or sold without the Lender’s consent until the Maturity Date.

7.3. If the borrower breaches this provision, the Lender may declare all sums due under this note immediately due and payable, unless prohibited by the Governing Law.

7.4. The Lender shall possess the sole option to accept the security as full- payment for the Principal Amount without additional liabilities or obligations. Should the security’s market value not exceed the Principal Amount, the borrower shall remain liable for the balance due while accruing interest at the maximum rate allowed by law.

8. CO-SIGNER. (check one)

☐ – NO CO-SIGNER. This note shall not have a Co-Signer.

☐ – CO-SIGNER. [NAME OF CO-SIGNER] shall co-sign this note. The Co-Signer agrees to assume the liabilities and obligations on behalf of the borrower stipulated in this note. If the borrower fails to make payment, the Co-Signer will be personally responsible and guarantee all payments, including the payment of the principal, late fees, and any accrued interest under the terms of this note.

9. PREPAYMENT PENALTY. The borrower shall be charged: (check one)

☐ – NO PRE-PAYMENT PENALTY. There shall be no prepayment penalty.

☐ – A PRE-PAYMENT PENALTY. If the borrower pays any Borrowed Money to the Lender with the specific purpose of paying less interest, there shall be a pre-payment fee of (check one)

☐ – $[AMOUNT]

☐ – [PERCENT]% of the pre-paid amount.

☐ – Other. [OTHER]

10. INTEREST DUE IN THE EVENT OF DEFAULT. In the event of default due to late payment, all accrued interests of the Principal Amount and all other fees shall be due and payable.

11. ALLOCATION OF PAYMENTS. All amounts due under this note shall be paid by the borrower to the Lender or Co-Signer on the Due Date on [DATE]. PAYMENTS MADE BY THE BORROWER SHALL BE DEEMED PAID TO THE LENDER FIRST. Any payments made by the borrower shall first go towards any fees due, any other penalties or fees owed, or to the Principal Amount. Payment shall be unconditional and shall not be deducted from any other amount due to the Lender or Co-Signer.

12. ACCELERATION TERMS. If the borrower defaults payment under this note or is in default regarding the Security instrument of this note, and such default is not cured within ____ days after written notice of such default, then the Lender may, at its option, declare all unpaid sums owed on this note to be instantly due and payable, in addition to any other rights or remedies that the Lender may have under the security instrument or by law. This includes any possession or recovery rights in relation to the security outlined in Section 6 as well.

13. ATTORNEYS’ FEES AND COSTS.

13.1.The borrower shall pay all costs and expenses of collection, including, but not limited to, reasonable attorneys’ fees and other costs of collection plus interest on the accrued interest at the maximum rate allowed by law.

13.2. Nothing in this Note shall prevent the Lender from recovering any costs or expenses of collection under applicable law and contract provisions.

14. BORROWER’S WAIVERS. The borrower agrees to the terms and conditions contained in this note. The borrower shall waive any right to change, amend or modify any of the terms and conditions contained herein, except as prohibited by law. The borrower also agrees that he or she shall not directly or indirectly contest or oppose any series of payments made under this note in an attempt to collect all unpaid principal plus accrued interest.

15. NON-WAIVER. The failure of the Borrower or Lender to enforce any provision of this note shall not be construed as a waiver of the enforcement of that provision.

16. SEVERABILITY. Suppose one or more of the provisions contained herein, or the application thereof to any person or circumstance, shall, for any reason and to any extent, be invalid or unenforceable. In that case, the remainder of this note (including all remaining provisions), and the application of such provision(s) to parties or situations excluding those as to which it is held unenforceable or invalid, shall not be affected thereby but shall be enforced to the maximum extent permitted by law.

17. INTEGRATION. This note may not be amended, modified, or altered without the Lender’s prior written consent.

18. CONFLICTING TERMS. The terms of this note are complete, and accepted by the borrower and shall supersede all other prior or contemporaneous agreements, representations, or understandings.

19. GIVING OF NOTICES. Any notices required or permitted to be issued hereunder shall be given in writing and shall be delivered (a) in person, (b) by certified mail, postage prepaid, return receipt requested, (c) by facsimile, or (d) by a commercial overnight courier that warranties next day delivery and issues a receipt, and such notices will be made to the parties at the addresses listed above.

20. EXECUTION. This note shall be executed by both Borrower and Lender in their respective capacities. Unless otherwise agreed to in writing, this note shall be signed by both parties on a form approved by the other party. The Lender shall not be bound by any oral or written representations, commitments, obligations, or representations with respect to the Loan other than those contained in this note. The Lender shall have the right to rely on any evidence which it has procured by its own investigation and inquiry with respect to this note, including notices of default and demands for payment hereunder.

21. CONSENT AND CONSIDERATION.

21.1. Lender shall not be required to make Loans hereunder unless Borrower consents to same and Lender otherwise agrees.

21.2. By execution of this Note, Borrower, and Lender hereby agree that the terms of this note shall bind their respective successors, heirs, and assigns.

21.3. Borrower’s signature on this note is in full consideration for the Lender to lend the Borrower the Borrowed Money.

21.4. Lender agrees to make Loans hereunder under such terms and conditions as Lender may determine in its sole discretion without any further obligation or liability to borrower except as provided by this note or by law.

22. GOVERNING LAW. This note and the loan agreement contained herein shall be interpreted according to and governed under the laws of Florida.

23. ADDITIONAL TERMS & CONDITIONS. [ADDITIONAL TERMS & CONDITIONS]

24. ENTIRE AGREEMENT. This note contains all the loan terms agreed to by the parties relating to its subject matter, including any attachments or addendums. This note replaces all previous discussions, oral agreements, and understandings. The Borrower and Lender named in this note agree to the terms and conditions and shall be bound until the borrower reimburses the Borrowed Money in full.

Lender Signature: ____________________________ Date: ____________

Print Name: ____________________________

Borrower’s Signature: ____________________________ Date: ____________

Print Name: ____________________________

Co-Signer Signature (if any): ________________________ Date: ____________

Print Name: ____________________________

Legal Considerations

When using a promissory note, you have to be familiar with the general legal rules that apply to it.

Below are some important considerations that should be taken into account when using it:

Usury rate

This rate is the maximum amount that a lender can charge in relation to the principal sum of money borrowed. Typically, the permitted usury rate for loans not exceeding $500 000 is not more than 18% simple interest and not more than 25% for loans exceeding $500 000 (Fla. Stat. § 687.03 and § 687.01).

Applicable laws

The most important thing is the fact that it must be legally enforceable in Florida and elsewhere. It is governed by the laws of the state. The terms and the interest that are agreed upon must be consistent with the applicable laws. Such laws include Title XXXIX Chapter 679 of the 2018 Florida Statutes and Florida Statute 95.11(2)(b), which govern how real property can be confiscated through these notes.

Taxes

Depending on the interest rate, the payment, and the amount of the principal, various tax implications could be present. You must determine the applicable penalties and taxes that may be applicable to the loan in question. The applicable taxes are the federal income tax (FIT), the state income tax (SIT), and sales taxes. As a result, this note requires specific documentary taxes and, in some cases, non-recurring intangible taxes. Typically, a $0.35 documentary stamp tax will be paid to the Florida Department of Revenue for every $100 of the loan. Secured Florida promissory notes have to cover $2,000 in non-recurring intangible tax if they are secured by real property.

Final Thoughts

These notes are one of the oldest types of legal obligations, and they have been used for centuries in business and commercial transactions. They make sure that agreements made regarding loans between people or organizations are honored while avoiding costly legal fees.

They can be used for loans of all types without any difficulty. However, it is important for lenders and borrowers to make sure that the terms are fully compliant with all applicable laws. Using a template and being aware of general legal considerations are two ways to make sure your contract is legally sound. Failure to do so may make enforcing your promissory note in court difficult.