A promissory note in California is a written statement of the debt obligation of a borrower to a lender. The note adds structure and formality to the loan agreement and guarantees debt repayment by providing the terms for repaying a loan, like the interest rate and term length, and other crucial details of the debt. This note protects both the lender and the borrower.

Not all loans necessitate the use of complex and long loan agreements. A promissory note is common in California and is the most effective method of transferring debt from lender to borrower. Such a note in California is a contract between the lender and the borrower outlining how and when the loan or debt will be repaid. This note can be used for many different types of loans.

Debt obligations for these include business loans and personal loans. California State Law allows for all kinds of financial obligations, such as commercial and residential mortgages, school fee installments, and credit card debt. A promissory note acts as proof of the existing debt obligation. It can therefore be referred to in the event that there are future disagreements over debt repayment. California state laws govern the execution of loans under a promissory note. Therefore, this note must comply with applicable laws to be enforceable in California.

This article is a general guide regarding promissory notes, emphasizing how to write one and outlining its basic components. Also, there are premade note templates available to download for free that you can use in California and avoid the inconvenience of preparing one yourself.

Free Template/Form

Types

There are different types of promissory notes based on the level of security they offer to the lender. Two main types of promissory notes are:

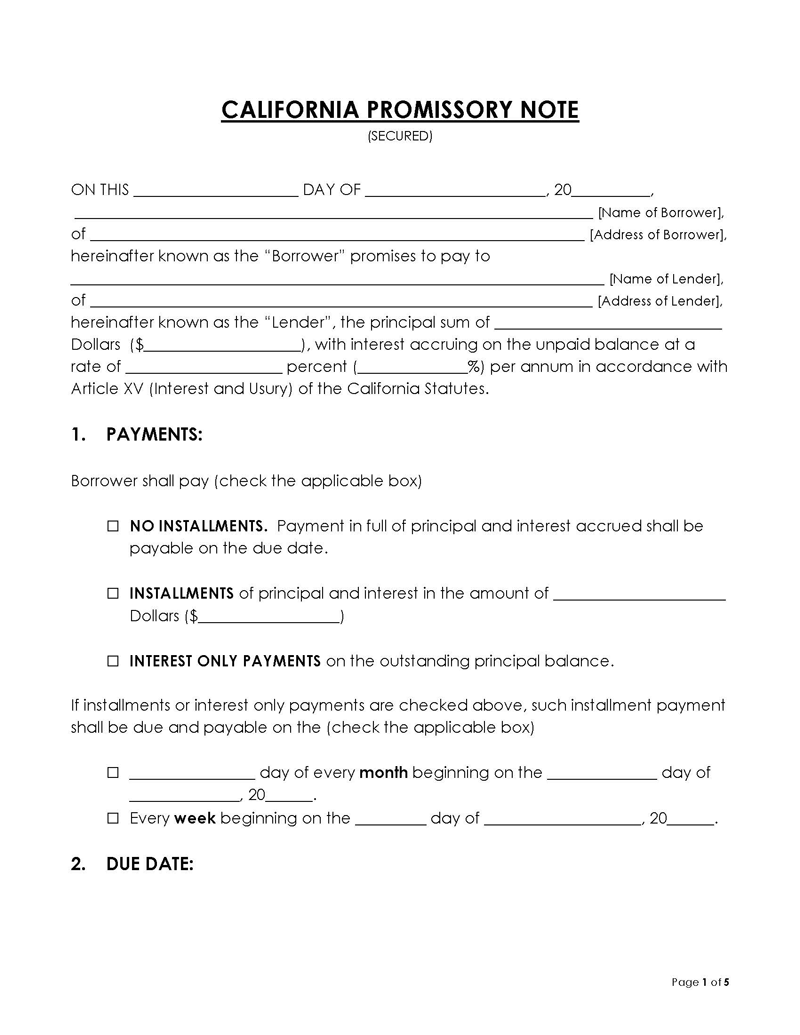

Secured promissory note

A secured note of promissory in California is a note of promissory where the borrower pledges an asset as security for the debt. This indicates that if the borrower fails to repay the debt, then this asset will be repossessed and sold to recover the lost loan amount. This type of promissory note should be titled “secured promissory note.” It must also have a “Security and Priority” clause that declares that the loan is secured by the specified document and describes the particular security or collateral. Next, a security agreement that permits the lender to repossess the collateral upon default should be crafted.

The lender’s security interest in the collateral should then be put in a UCC-1 Financing Document, which is then filed with the appropriate government agency. Once filed, this interest is regarded as “perfected” and awards the lender top priority over any other future lenders listing the property as collateral.

Secured California promissory notes are more suitable for long-term loans, which are usually for larger amounts and have a longer repayment period. These types of notes are more common among business owners who need financing for new equipment or expansions.

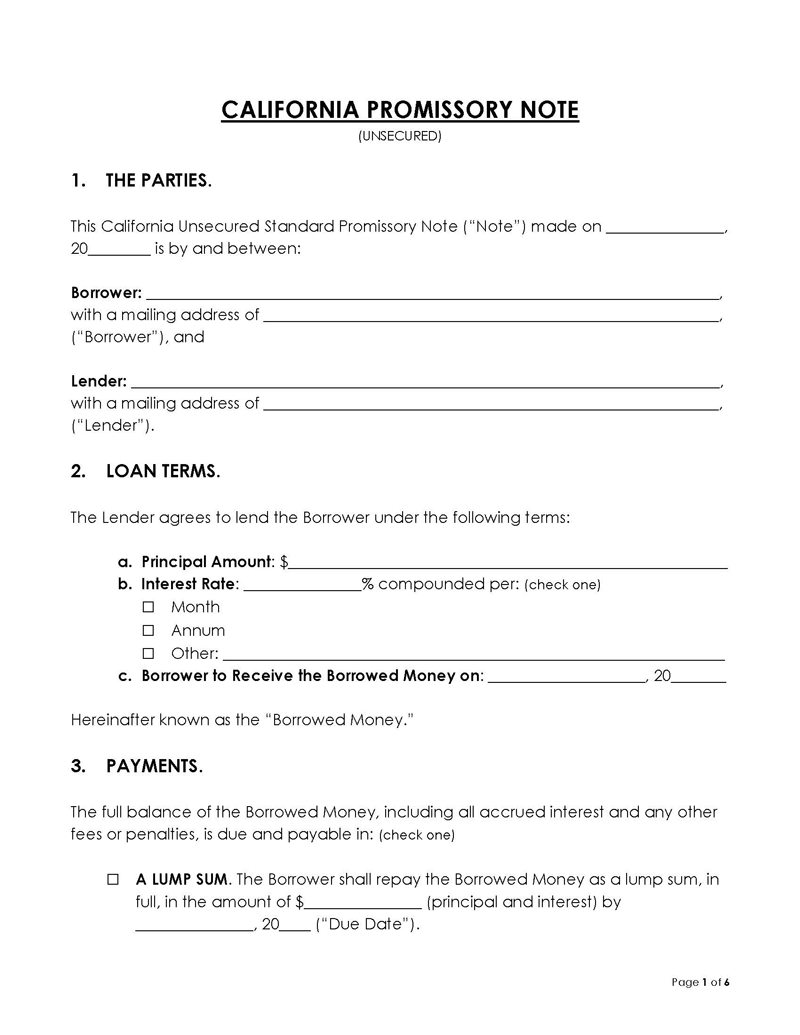

Unsecured promissory note

An unsecured California promissory note is one without any form of asset pledge. Therefore, the lender has no security against the loan besides the borrower’s promise to repay the debt. When using an unsecured promissory note, therefore, you would only lend money to people or businesses that you trust and who have a good credit history. An unsecured note of promissory is often used for short-term and small loans.

How to Write a Promissory Note

A promissory note must meet certain prerequisites to be enforceable in the state of California.

To ensure these elements are included, the following steps should be followed when writing such note that can be used in California:

Step 1: Choose an appropriate template

Promissory note templates are designed to provide maximum legal protection to lenders and borrowers in California. These are available on the Internet and can be downloaded for free. The template should comply with California state law. Moreover, in California, a promissory note template will contain standard sections that are required for loans of all kinds. You should select an appropriate template that is suitable for your needs. Using a template simplifies the process of writing a promissory note and makes it efficient, especially for creditors and businesses in California that use promissory notes regularly.

Step 2: Add the title

Make sure that the title of the document is correct. This must accurately represent the type of the document and safeguard it from upcoming legal challenges. First, determine whether the note of promissory is secured or unsecured. All secured promissory notes should be titled “Secured California Promissory Note” or “California Secured Promissory Note.”

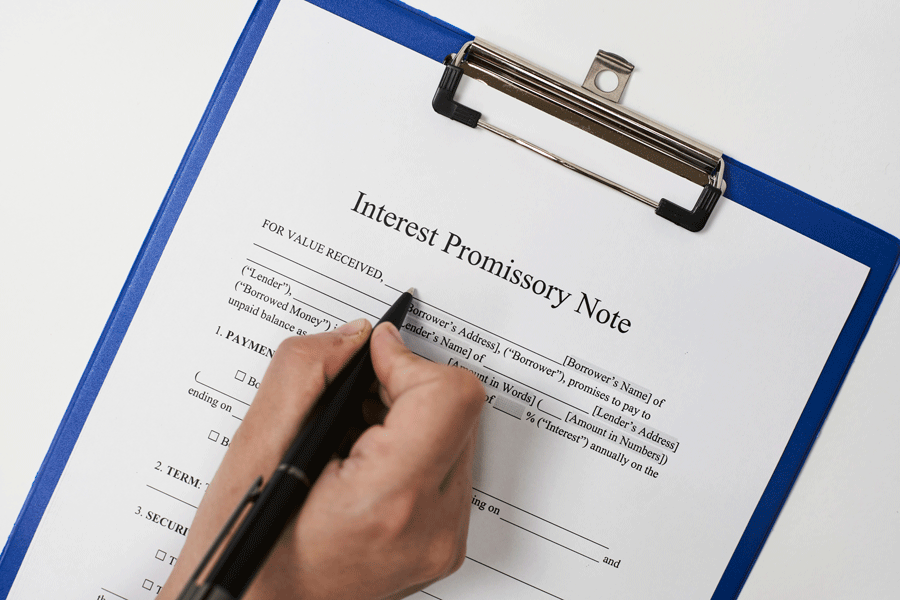

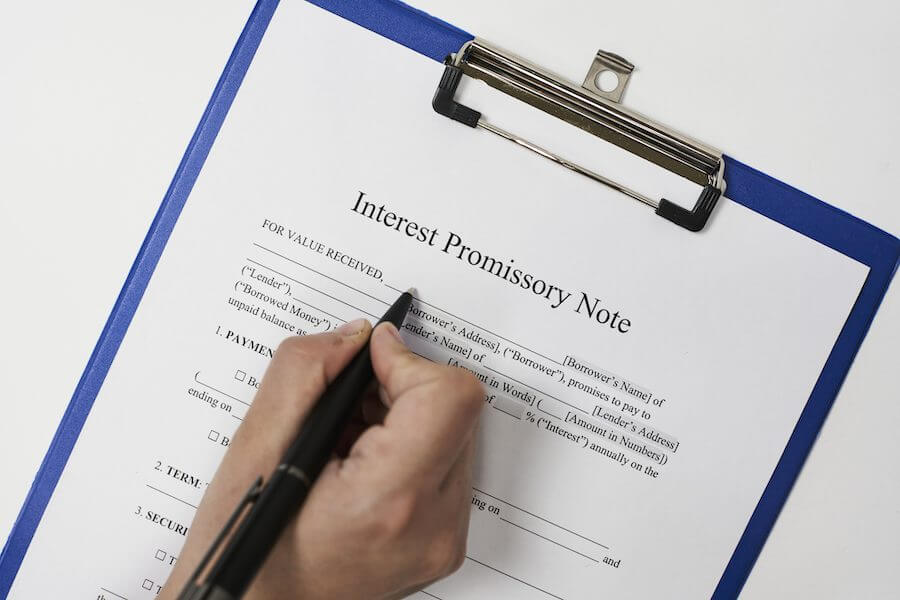

Step 3: Add basic information

A California promissory note template has information fields that are required regardless of the type of loan. These fields usually include a section about basic details about the creditor, borrower, and date that must be filled in. Write the lender’s full name, address, and contact number(s), as well as those of the borrower(s). California promissory notes should state how much money was borrowed, as well as when it was borrowed and for what purpose. Moreover, there is a “description” field that stipulates that all amounts stated in the document refer to US dollars and not any foreign currency or unit. Other details regarding the loan and payments should be added. This includes interest rates and payments that will be made by the borrower, whether in a lump sum or in installments. The collateral should be described in this section if the loan is secured.

Step 4: Include important clauses

Ensure that the promissory note template has standard clauses that are required in California. These clauses include default fees, payment allocation, prepayment, loan acceleration, attorney fees, waivers or presentments, severability, conflicting terms, notice, and governing law.

Step 5: Execute the promissory note

A promissory note ought to be signed in order to be considered valid. The borrower, the lender, and a witness should sign and date the document. This section of the note should also include the effective date. Once all parties have signed, this note is legally enforceable in California.

California Promissory Note

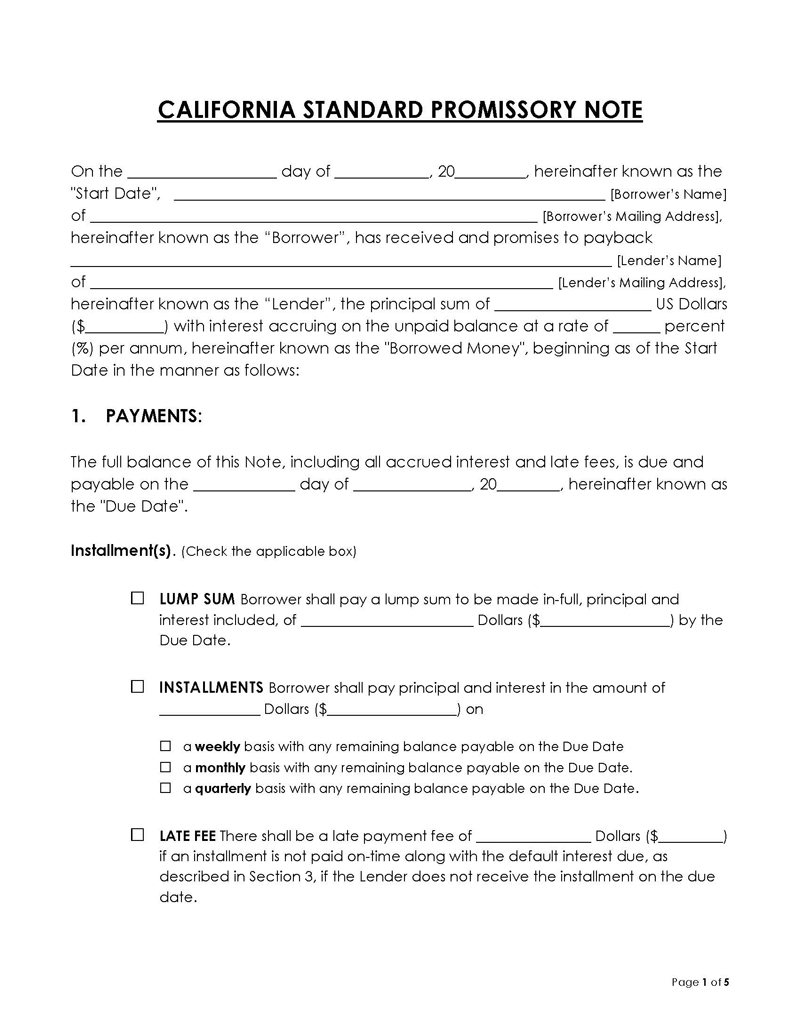

The template for a standard secured California promissory note is provided below:

template

CALIFORNIA

SECURED PROMISSORY NOTE

1. THE PARTIES TO THIS PROMISSORY NOTE

a. Creditor(s): ________________________________________

b. Borrower(s): _________________________________________

c. Witness:_____________________________ ______________________________

2. DATE OF ISSUANCE – The date on which the promissory note was written.

3. PRINCIPAL – The amount of money being borrowed or loaned.

4. INTEREST – The rate of interest being charged on the principal sum. This rate is an important factor in how much money must be repaid within a specific timeframe and also helps determine whether legal action can be taken against the loaner for failing to pay on time.

5. PAYMENTS – This part will list out information about how payments will be made. This tells if payment will be due periodically. In some cases, the borrower may only be able to make one payment at the beginning of each month or quarter, while other borrowers make smaller payments spread out throughout the year. Additionally, it can provide guidelines for the payment method to pay off the debt, such as cash, check, or bank deposit.

6. DEFAULT – This section notes events or actions that will be termed as default and the consequences of defaulting. This often means that if the borrower does not make payments, then the promissory note holder (lender) can demand immediate payment, or they may be able to charge interest back on previous payments. Applicable interest or late fees should be declared here.

7. SECURITY – The security clause details whether the borrower will use collateral, such as land, vehicle, or property, to secure the loan.

8. ACCELERATION – If the note of promissory is in danger of not being paid, then this section will list how to deal with that situation. For example, if the borrower fails to make a payment when due or if they fail to make any payments at all, then the holder of the note can demand immediate payment.

9. REPRESENTATIONS AND WARRANTIES – This section will state that the borrower has accurately represented the purpose of your development project, has accurately stated all of the terms and conditions of the promissory note and has accurately described any features of your property. As a result, they offer a warranty if this information is found to be inaccurate.

10. WAIVER – This part will declare that you waive the right to object to any provision in the promissory note. For example, the borrower can waive their right to demand the note be presented every time the lender collects or demands payment.

11. GOVERNING LAW AND JURISDICTION – Governing law section of the promissory note states where and under what laws this note is issued.

12. SEVERABILITY – The severability clause declares that if a clause in the note becomes illegal or unenforceable, then it can be removed and as such, the remainder of the promissory note remains valid and can still be used.

13. NOTICES – This part of the promissory note states how notice must be made and how notice will be handled. This is very important, as any notices that are required under the note must be sent through an agreed-upon method. For example, if the borrower is making payments each week and the lender demands payment immediately, then they need to make sure that they send a notice to the borrower right away through an agreed-upon method.

14. AWARD OF ATTORNEY FEES AND COSTS OF COLLECTION – The clause states that the creditor may recover reasonable attorney fees and costs if any action is brought to enforce this note.

15. COVENANTS – This section will specify all of the covenants you agree to, such as timely payments.

16. AGREEMENT – This is a valid promissory note when signed by all parties in the presence of a notary public or any other state government officer authorised to take acknowledgments and administer oaths, attested by the signature and seal of the notary public or another officer.

17. SIGNATURES:

All parties must sign and date this document.

Lender signature: _____________ Signed by:______________

Date:_____________

Borrower’s signature: _____________ Signed by:_____________

Date:___________________

Notary Public Seal/Signature and Title (if not recognized by the state, the officer’s seal may be used): ____________________________,

Name and Address of Notary Public or other Officer to be Attested to Signature:(This form must include the appropriate number on this form) _________________________________

Legal Considerations

A promissory note issued in California has to comply with common law requirements that govern its creation and performance under Cal. Const. Article XV, § 1. Moreover, like a contract, a note of promissory also needs to comply with specific state laws in order to be enforced in court.

Article XV, § 1 declares that interest rates on promissory notes should be 7% per annum. The California Civil Code declares that interest should be between $7 to $100 per annum for promissory note loans in California, whether greater, lesser, or longer. The interest can increase to $12 to $100 per annum. If the rate exceeds 7%, this rate shall be declared in writing.

Usury laws govern the interest rates of loans made under promissory notes. Loans borrowed for family or household purposes should not have an interest rate of more than 10%. Other loans should have an interest rate of not more than 5% or 10% of the rate charged by the San Francisco Federal Reserve Bank for the period the loan was borrowed. However, the maximum interest rate on any consumer loan is 36%.

Regardless of the amount, loans over $500 or repaid in more than a year shall be considered contracts under California Civil Code §1624(a). Associated promissory notes should be in writing.

Final Thoughts

A promissory note is a financial agreement that allows any borrower to borrow money from a lender in return for paying back the borrowed amount with interest within a stipulated period. The most common method of repayment on these notes is in installments. Promissory notes are legally binding and enforceable under both state laws and common law because they are contracts.Any violation of the terms stated in these agreements will result in legal disputes that can only be resolved by courts of law. It will be beneficial to use promissory note templates when creating one in California because they make it simple to meet all the conditions set forth by the state. These templates include all of the necessary elements to be used for both secured and unsecured promissory notes.