It is a kind of document that is signed and intended to acknowledge that some money is owed and is to be paid in the future. It is secured in that it is backed by collateral that may be sold or confiscated in the event of a default. This note is hence safer than the unsecured one.

Legally, it is defined as:

A secured promissory note is an agreement between a lender (also referred to as a Promisee) and a borrower (also addressed to as a Promisor) that allows the promisor/collateral of a borrower to offer assets or property, when borrowing money, as security and insurance if the borrower her or himself cannot pay back the loan (defaults); hence the name “secured.”

This way, the lender is assured of getting their due at the end of the day. This document outlines the terms and conditions of receiving and paying back the loan. With the added assurance, the lender bears minimal risk, and as a result, the borrower can pay back the loan at a lesser interest rate.

Secured Promissory Note- Introduction

It is a document that is drafted with the main aim of proving that an amount of money has been borrowed by one party from another. It also expresses the intention of the borrower to return the money to the creditor at a specified future date. Lastly, it is secured in that it is backed by some guarantee.

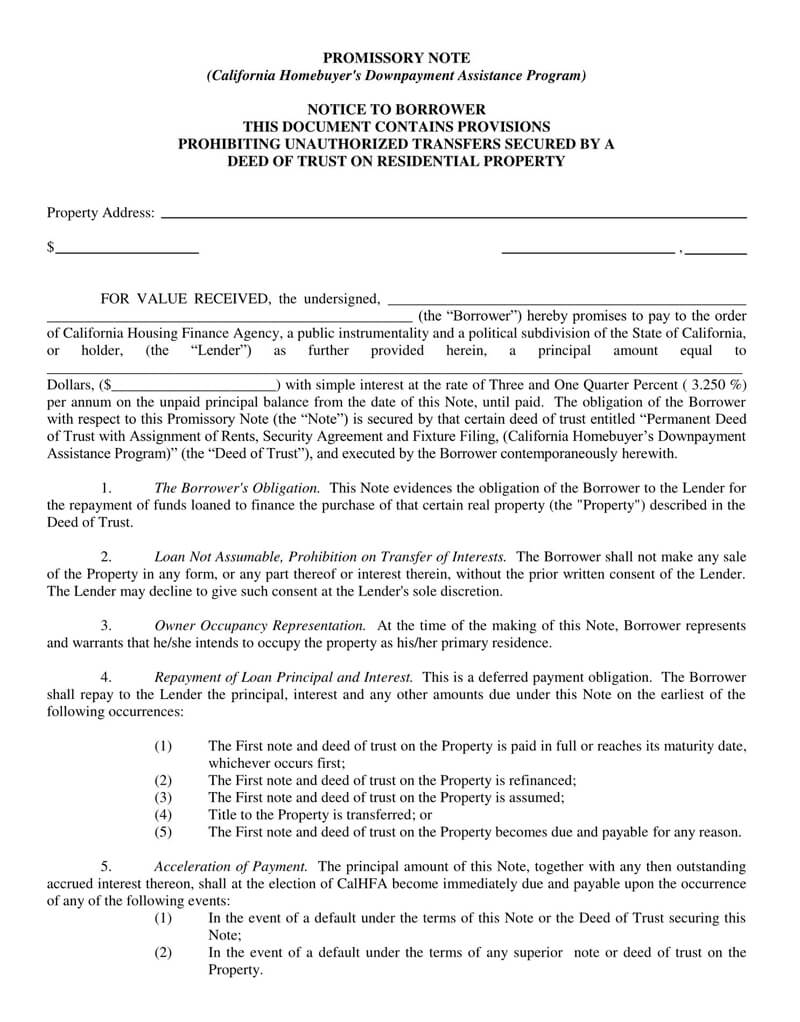

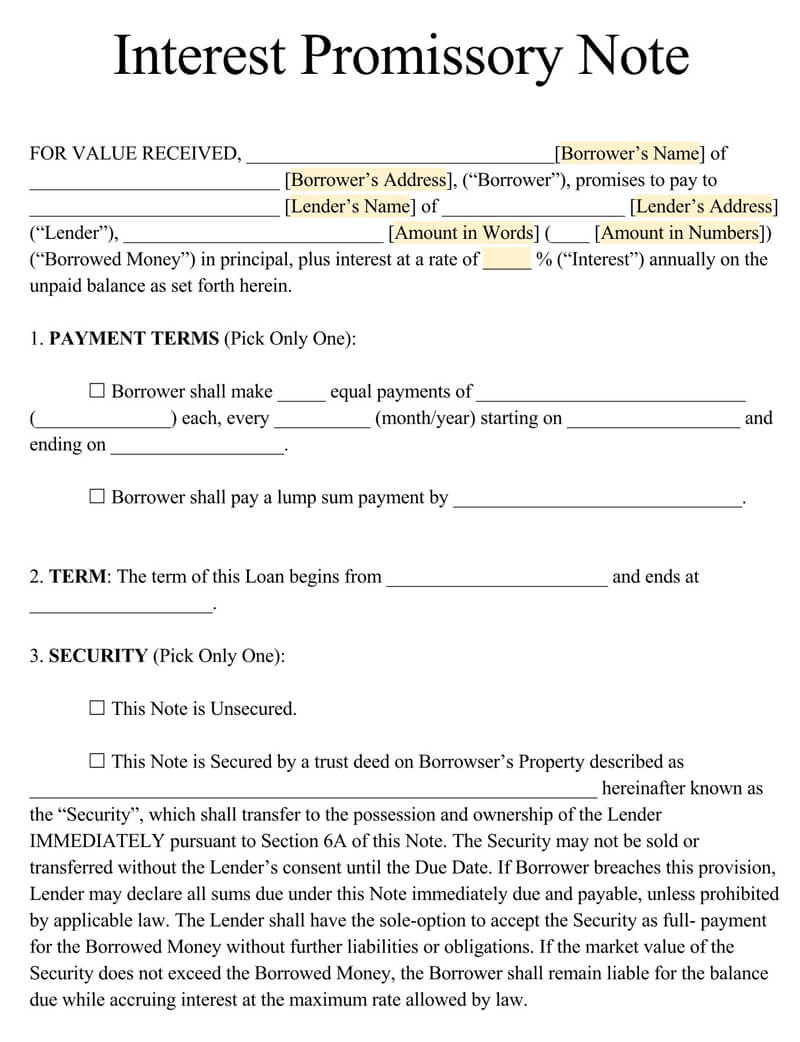

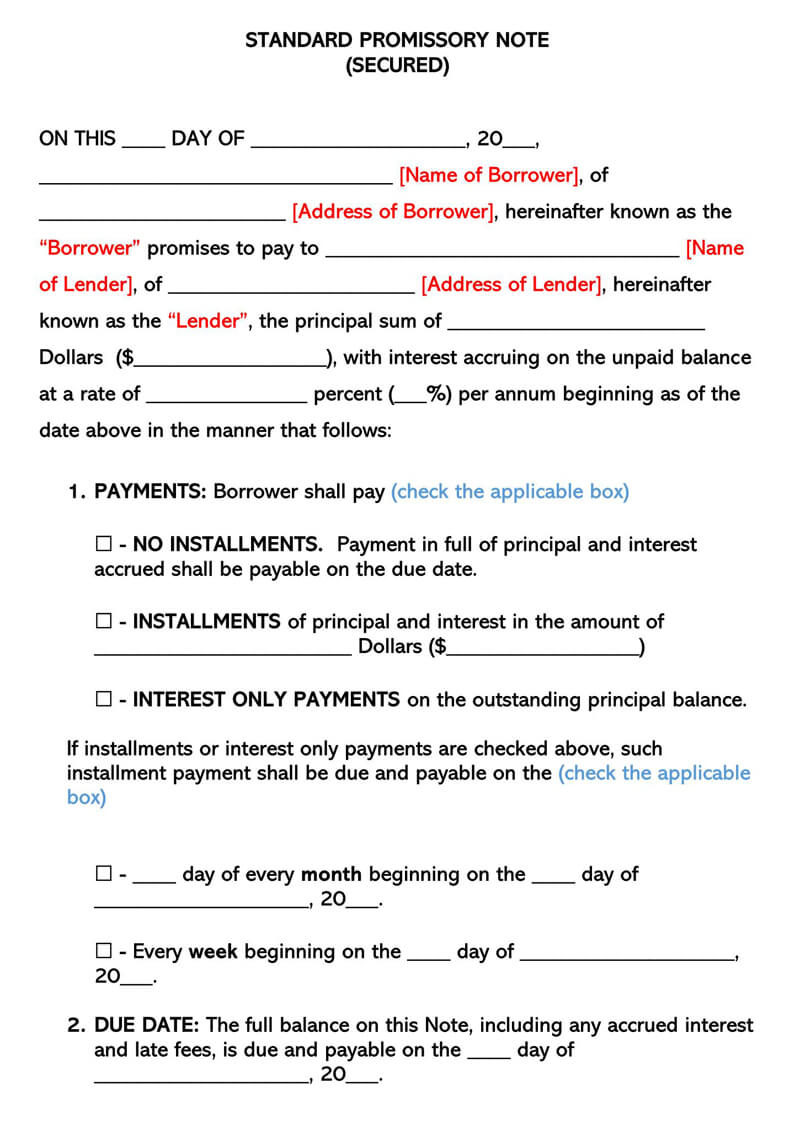

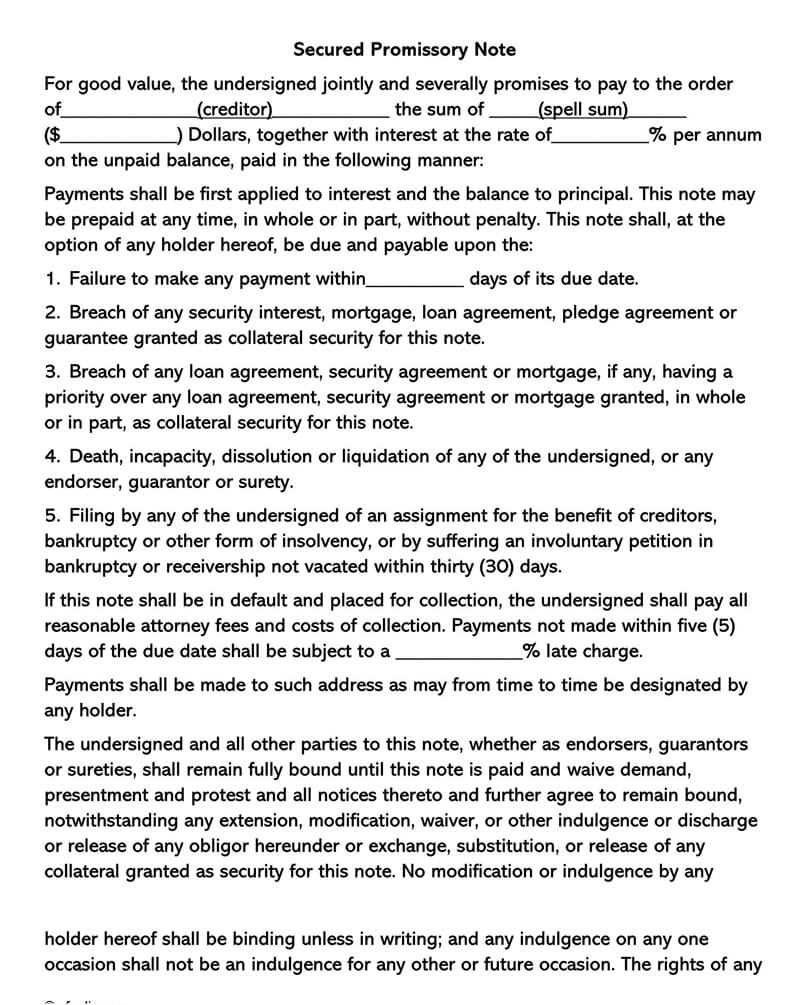

Free Templates

Here are Free Templates that can be customized as per need:

Standard Templates

Templates By State

Purpose

This note is often used when lending or borrowing a significant amount of money. It becomes a vital financial document during such agreements as it helps with the mitigation of risks between the involved parties. This note is legally binding, and caution should be taken when utilizing one, especially to borrowers, as it can be why they lose ‘secured’ assets or property.

Therefore, borrowers need to ensure they are financially capable of paying back the awarded loan before signing the document.

Generally, this note is less authoritative than a loan agreement but more potential than an IOU. Therefore, it applies to some and not all different loan agreements, and, as a result, knowing when to use it is imperative.

Typical situations where its use is feasible to include;

- A situation where a person plans on selling an item or product to a client who does not have the total asking price of the product at hand.

- When selling a product or item through credit to a buyer who presents a risk to making payments of the total amount owed.

- When a lender opts to loan money to a borrower accompanied by instructions and consequences of default.

- When lending money, whose repayment should not be in installments, should repayment be through installments, it is advised that a Loan Agreement be used.

Secured vs Unsecured Promissory Note

The secure note differs only slightly from its unsecured counterpart. Below are the three main differences that these two kinds of notes exhibit:

- Collateral: This is by far the most significant difference between these two notes. The secured promissory note is backed by some collateral whose value is equivalent to or more than the amount owed. In case the borrower defaults, the lender has the leeway to confiscate or dispose of the collateral to recover his due.

- Legality: Most jurisdictions acknowledge and recognize the secured note over and above its unsecured counterpart. In case any disputes touching on this note spills over to the courtroom, chances of a favourable ruling are rife. The unsecured one is only backed by goodwill, nothing more. It is hence riskier to work with.

- Applicability: Generally speaking, The unsecured promissory notes are limited to high net worth individuals or those with excellent credit ratings. That is because such individuals are unlikely to default on their borrowings. The secured ones are universal though and are mandatory for use in almost all jurisdictions.

So by summarizing all :

| Secured promissory note | Unsecured promissory note |

|---|---|

| Offers assurances and securities for the promisee against defaulted loans | Does not offer assurances or securities should the borrower default (no collateral) |

| Minimal risks involved for lenders | High risk when lending |

| Used for loans with a significant amount of money | Used for loans with a less significant amount of money |

| Used when the borrower has poor credit | Used when the borrower is a high-worth client with good credit or more familiar to the lender, e.g., family or friends |

Crafting Secured Promissory Notes

Once it has been ascertained that a secured promissory note is feasible with a particular situation, the lender can write one. The following steps can be implemented to ensure its outstanding creation.

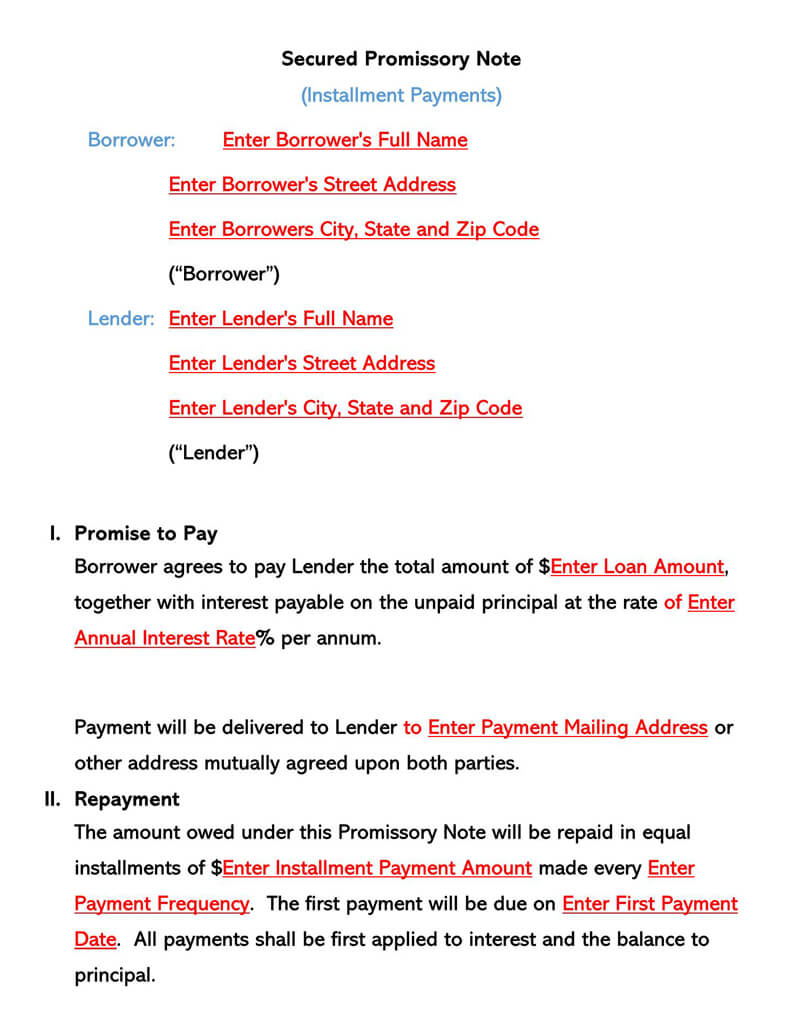

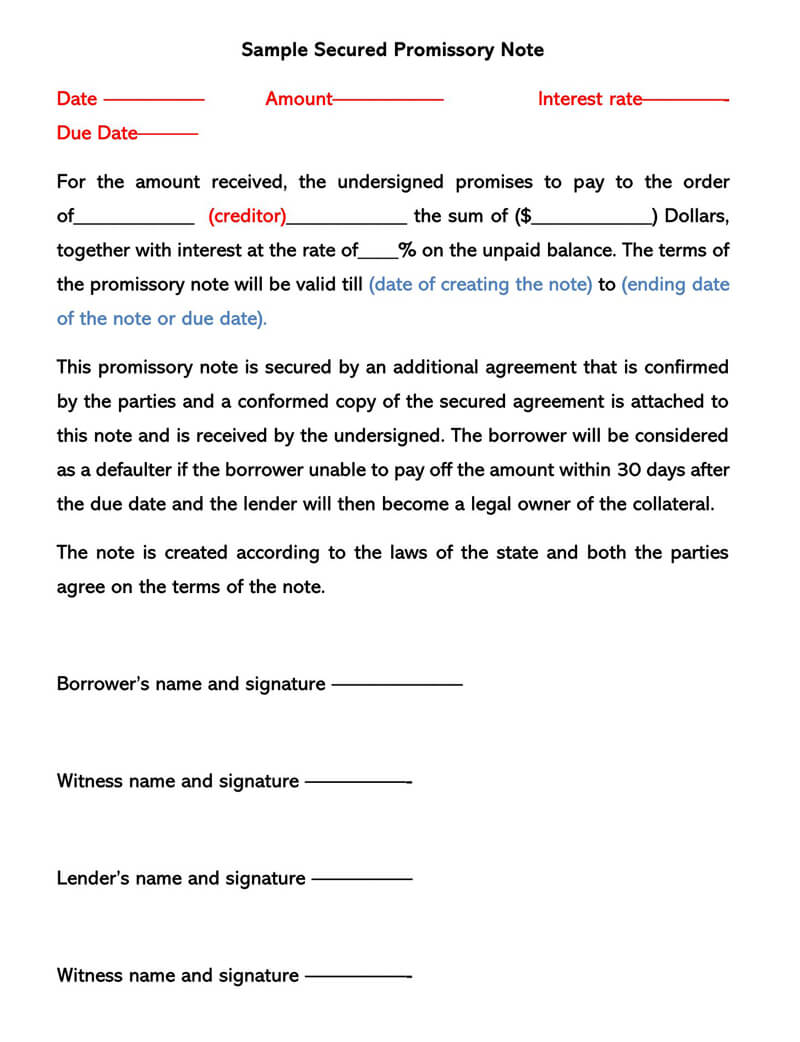

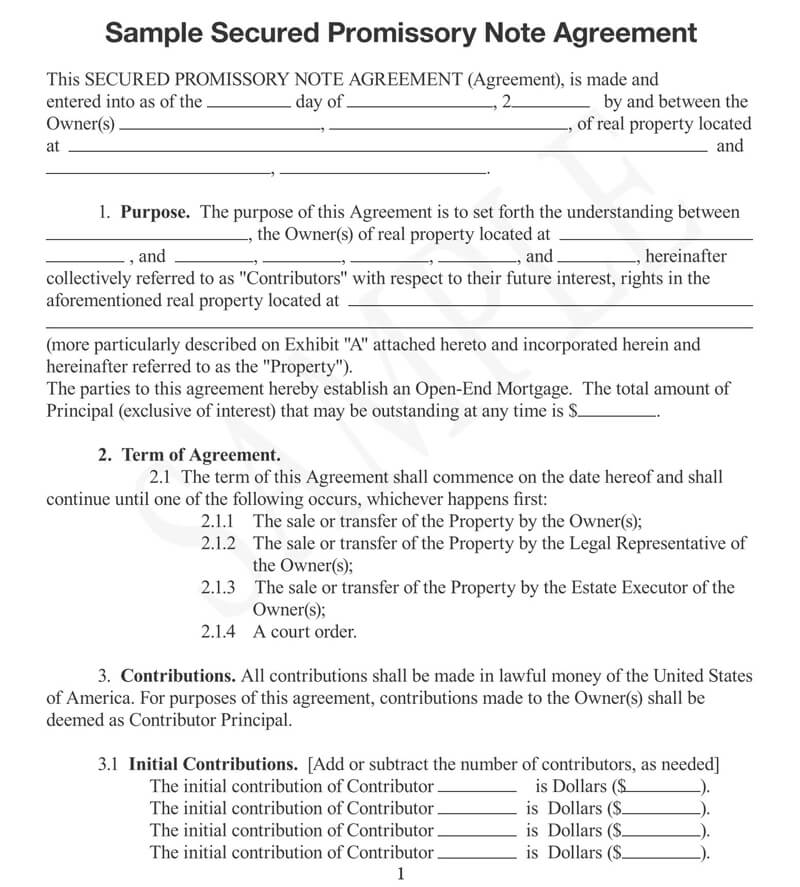

Secured promissory note template

There are numerous templates available online in Word or PDF format. These templates are easily accessible and are created to satisfy the fundamental components of a standard secured promissory note. With that in mind, acquiring one should be the first step. One can choose to fill it through a computer or print it to do so manually.

Fill in key information

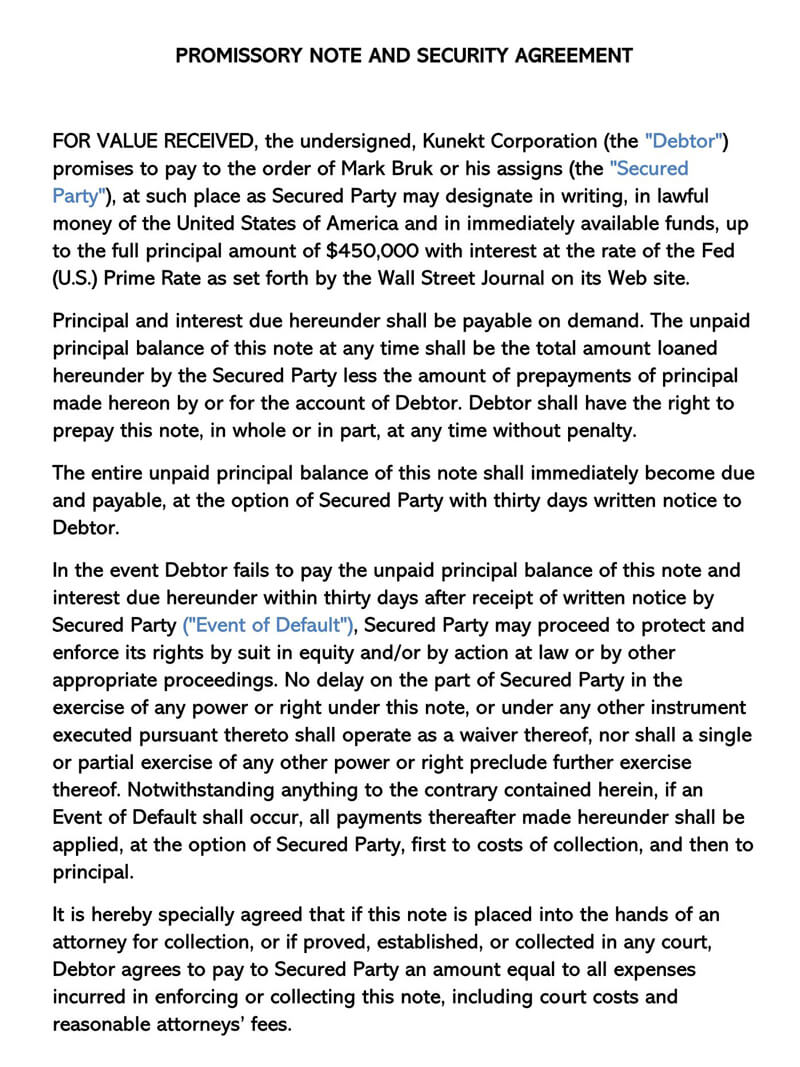

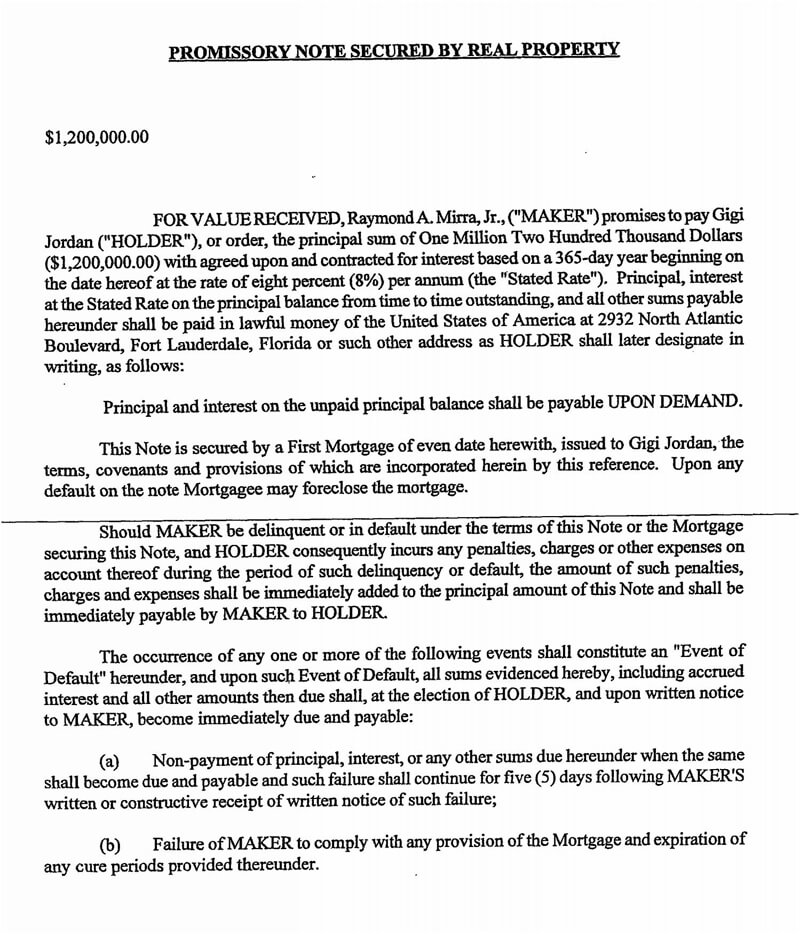

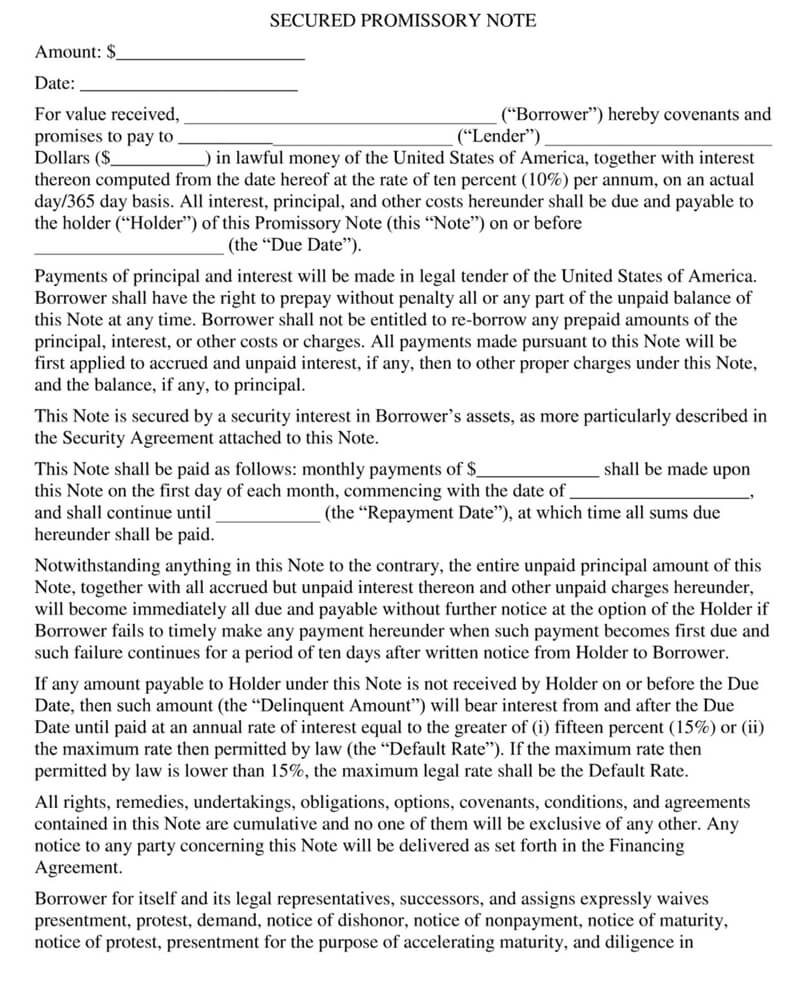

As earlier mentioned, a secured promissory has to have a date from which it is to be valid. This effective date should be provided detailing the specific date, month, and year. It is usually the date of signing or disbursing funds. The borrower and the lender should be identified by name and address. This information should be as it appears on official and legal documents. Once the involved parties have been declared, the amount being lent (principal) should be indicated in figures, numerals, and monetary units. The applicable interest rate should then follow.

Asset or property being “Secured”

The lender should identify an asset or property of the borrower whose value equals the amount to be loaned out. Otherwise, it would not be sensible to have a secured promissory note if at all nothing is acting as “security.” The collateral can be anything of significant value, from personal to real property, depending on the situation, such as a motor vehicle, a motorbike, boat, luxury piano, artifact, etc. The identified property must retain its value and be less prone to damage throughout the payment period. Should the borrower default on payment, the lender is lawfully allowed to recoup the asset or property to recover their money.

Discuss the terms

Like any other legal financial agreement, a tied note must have set terms and conditions. These terms vary from one note to the other, but fundamental aspects should be addressed in a typical secured promissory note.

They include;

- Payments – The lender and the borrower must agree on how payments should be collected. This section should address how the loan is to be paid back (payment plan). There are typically three means of payment lenders, and borrowers can use;

- No installments

- Installments

- Interest-only

If payments are not in installments, the promissory note should indicate the exact date, month, and year when the total amount should or is expected to be paid. If an installment or interest-only payment plan will be adopted, then the exact date when the first payment should be made and which day of every month payment is expected. For an installments plan, the exact amount expected from every installment should be indicated. Alternatively, payments can be made every week; if this is the case, it should be indicated accordingly.

Applicable interests of the principal (monthly or weekly) and the due date of final payment should also appear in the secured promissory note.

- Interest Due in the Event of Default – The next section addresses how defaulting should be penalized. The note should show how many days past the borrower’s due date will be awarded as a grace period before being termed a defaulting borrower. This declaration should be followed by the penalty, which can be a predetermined interest rate or as outlined by the state laws. Some borrowers may choose to incur an interest rate higher than that provided by the State’s Usury Laws rather than lose possession of the property or get indicted.

The next item determines the priority of allocation for any payments made by the borrower, with any late fees being the priority, followed by interest due. Then the balance is added to the principal. - Late Fees – Alternatively, the lender may opt to impose a fee on the borrower for failure to settle the debt on time. The late fees could be a fixed fee or a rate that increases the longer the loan is overdue. If any late fees are imposed, it should be stated in the secured promissory note. The number of days after the due date when late fees will be billed should be outlined as well as the number of late fees.

Sometimes a borrower may continue to neglect making payments even after being issued with a notice of default or late payments. It should be outlined in the note the number of days after a notice is issued that further actions should be taken. - Acceleration – This note gives the lender the option to demand the total amount or claim the security property immediately should the borrower fail to make a scheduled payment or default.

Execute

Once the terms have been laid out, an in-depth description of the security property should be provided. This could sometimes mean outlining the brand name of the item, serial number, and any other specific information that can be used to identify it.

Lenders are advised to file a UCC Financing Statement that declares that they are interested in the asset or property used as security for the pending loan.

Validate the document

The last step is validating the document. Like all other legally binding documents, this note requires the borrower and the lender to sign. All the mentioned parties at the beginning, be it a business entity or an individual, should be signatories of the promissory note. For business entities, they should elect a representative to sign.

The date of signing should be declared accordingly by indicating the date, month, and year. The lender writes down their name and signature, and the borrower follows suit. Once signed, the document binds both parties according to law.

Frequently Asked Questions

The secured promissory note is legally binding. That is because it is backed by collateral which guarantees the recoupment of the amount advanced even in the event of a default. The unsecured promissory note, on the other hand, is largely not binding in a court of law. It has to be notarized and signed by two or more witnesses before the same might hold in a court of law.

As stated above, the secured promissory note holds in a court of law. Its unsecured counterpart, however, does not hold. For it to hold, it has to be notarized and signed by two or more witnesses.

On the whole, promissory notes are governed by the laws where they are entered into. In most cases, this is the same jurisdiction where the lender, not the borrower, resides. In case the note touches on the purchase of some assets, the jurisdiction chosen is that of the place where the asset is located.

In case the parties to the agreement are from different states, the state law applicable should be expressly stated in the document to ward off any ambiguities.

A. Late payments usually attract some penalties. The disputes arising from such payments are mostly sorted out ‘in-house’ though i.e. between the various parties involved. The non-payments though are more serious and will usually spill over to a courtroom or have the borrower listed in the credit bureau.

Yet again, the precise course of action taken is largely at the discretion of the lender. The finer details of these actions are also clearly spelled out in the agreement.

For a promissory note to be deemed valid, it has to incorporate some traits and features. These are duly signed by all parties to the deal, flawless, notarized (if applicable), and written in a company’s official letterhead.