In Texas, a promissory note is a legally binding financial document that allows the lender and borrower to enter into an agreement that requires the borrower to repay the loan in full. Usually, the borrower makes specific, complete payments regularly, as indicated. This note assures the lender that they will receive their money in full. It can be used by both individuals and companies, like banks, across the state of Texas.

A template is used to prepare this important document so that both parties can correctly fill in the required details. The details of the money-lending transaction, the lender’s information, the borrower’s information, and signatures from both parties are included in the template. The document must also be signed by a witness for it to be enforceable.

Apart from holding the borrower accountable for repaying the loan, the promissory note also ensures, in Texas, that the lender provides the loan as agreed. In Texas, it can include a co-signer who will be required to step up and repay the loan if the borrower fails to do so.

Across the United States, when it comes to lending and borrowing money, Texas goes a step further in ensuring the process is legally secure by using one. You can read more about Texas promissory notes in the article, which also explains their structure, what information to put in the template when to use it, and how it protects both the lender and the borrower.

Free Standard Template

Types of Promissory Notes

There are two types of promissory notes that you can prepare in Texas, and they are as follows:

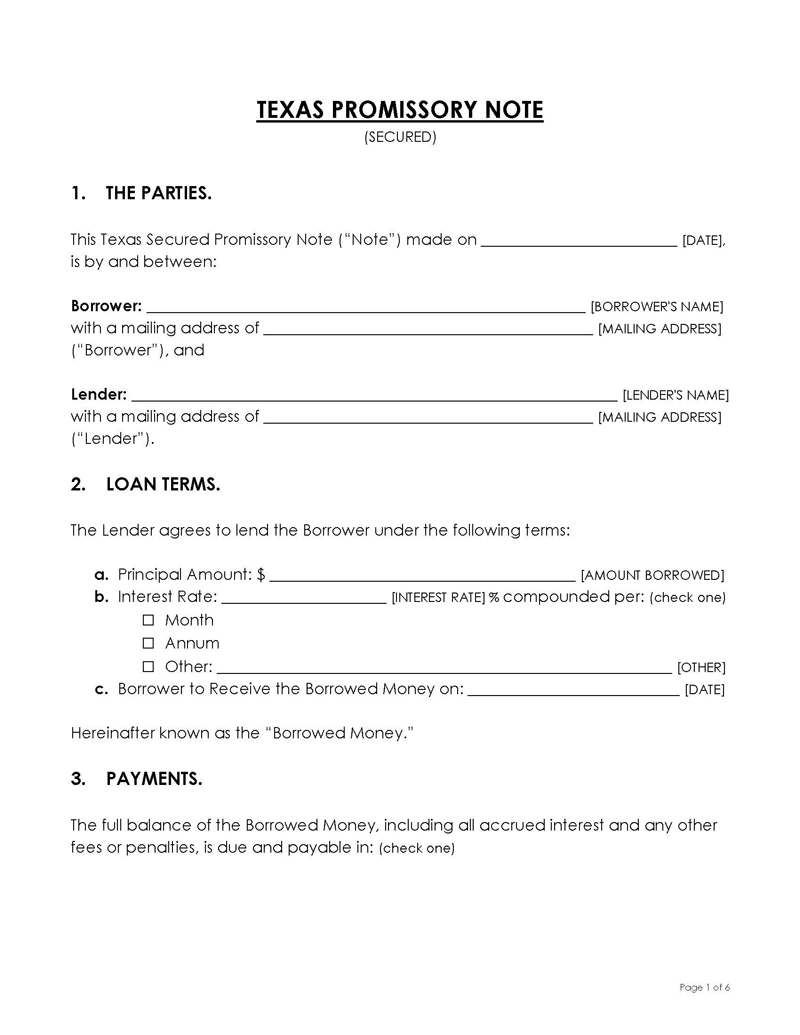

Secured texas promissory note

A secured Texas promissory note involves collateral. A piece of property that will be used as security until the loan is repaid is typically included by the borrower. Usually, the item being used as collateral is of the same value as the loan that the borrower has taken. The item in question will only be given to the lender if the borrower has broken the terms of the agreement and has not paid back the loan.

An example of a secured Texas promissory note is a loan for a vehicle.

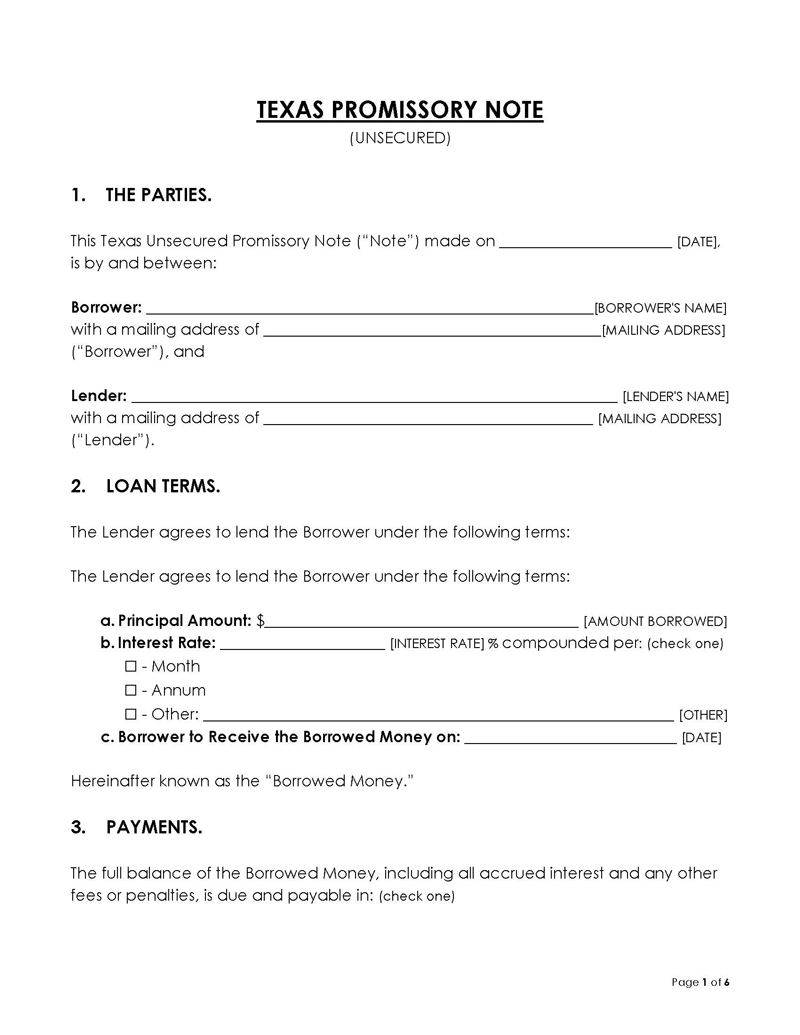

Unsecured texas promissory note

An agreement without any kind of collateral or property is known as an unsecured Texas promissory note. This means that if the borrower does not repay the loan within the predetermined time frame, the lender has no security against which they can make a claim. This type of agreement is risky, which means that the lender should properly screen the borrower before lending them money. Usually, such a note is best if a lender is dealing with reliable friends and relatives or a trustworthy borrower with high credit scores.

note

The secured and unsecured promissory notes are different in that, while the secured one entails collateral, the unsecured one does not. The secured note allows the lender to claim the collateral property if the borrower fails to pay the loan, unlike the unsecured one, where the lender will have to go through legal procedures and court proceedings to get payment for their unpaid loan.

Also, the template can only be used when preparing a secured note. That means the unsecured one must be properly drafted and contain all the required signatures for it to be acceptable in court. Finally, compared to using a secured one, using an unsecured promissory note typically entails a higher interest rate on the loan because of the risk involved.

Why You Should Use a Promissory Note in Texas

In Texas, using a promissory note is crucial when taking out a loan or borrowing money for various reasons. To ensure that you complete all of the legal forms required by the state of Texas, you should use one.

Another reason why it is required in Texas is that it records all the loan transaction’s details. This means that both parties are aware of what is expected of them. The lender understands the loan that should be provided, and the borrower understands the regular payments that must be made until the loan is paid in full. Also, it is important and required in Texas in case you need to claim the collateral in the case of a secured promissory note. It will serve as proof and grant you the right to seize the collateral property.

The promissory note ensures that you have all the necessary documentation for court proceedings and other legal requirements if the borrower fails to pay the loan.

What is the Procedure

There are steps that you should observe when preparing and writing a promissory note that can be used in Texas.

The step-by-step process that you should follow is given in detail below.

Step 1: Choose an appropriate template

The first step is to select an appropriate template that complies with all Texas laws and requirements. Following that, select a template that meets your needs in terms of the type of loan transaction. With a template, the process of preparing a promissory note in Texas is much more effective, faster, and easier than drafting it yourself. A template also saves time because a well-chosen one can be used repeatedly.

Step 2: Determine the security

You must decide whether the promissory note will be secured or unsecured after selecting the appropriate template. For a secured one, you will have to include the term “secured” in the title, use specific language, and have a security and priority section that provides details of the security interest or collateral, unlike the unsecured one.

Step 3: Check applicable laws

The third step is to review the applicable laws in Texas that must be followed when preparing a template.

The two applicable laws include the following:

Texas usury laws

This is the maximum annual interest rate that a lender can charge on the loan he or she has given to the borrower. If the agreement is not in writing, the usury laws allow an interest rate of up to 6% per year, while if it is in writing, the interest rate is 18% per year.

To avoid state penalties, lenders must adhere to the Texas usury rate. In other cases, the parties may agree on a 10% annual interest rate if the agreement is not in writing and a maximum rate up to the weekly ceiling according to the Texas Credit Letter if the agreement is in writing.

State laws

In the case of state laws, the State of Texas requires borrowers and lenders to observe Tex. Fin. Code Ann. § 302.001(b), §303.002, which is the legal interest rate concerning a promissory note. This state law states that the interest rate is only applicable if the borrower is more than 15 days late on a payment. It also applies if the borrower defaults on the loan balance. That indicates that they have not made the required installment payments necessary to pay back the loan in full.

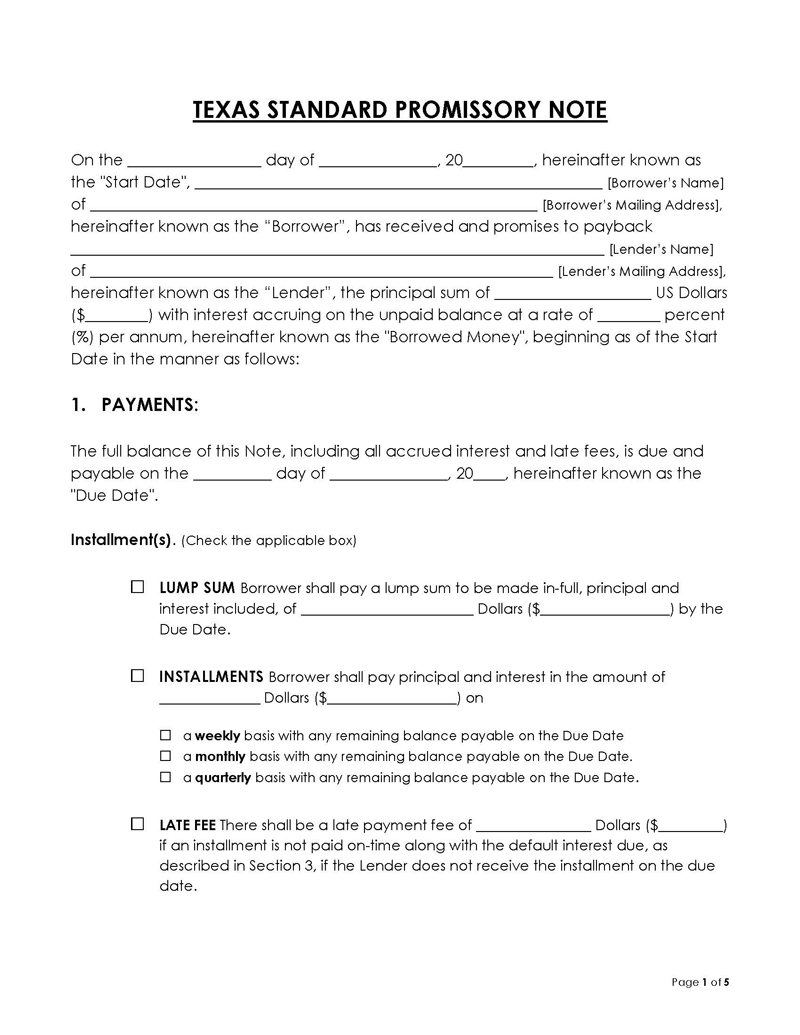

Step 4: Fill out the template

The template must then be filled out in the designated blank spaces with the necessary information. This includes the names of the parties, the lender and the borrower, the amount borrowed, the agreed-upon interest rate per applicable laws, the time that is given to the borrower to repay the loan, and the installment amount.

Step 5: Execute it

The last step is to execute it. You do not have to notarize it, but you are required to have signatures from all required parties. This includes the borrower, the lender, and the co-signer. To make the agreement valid for execution, the date of the agreement should also be included.

Items to Include

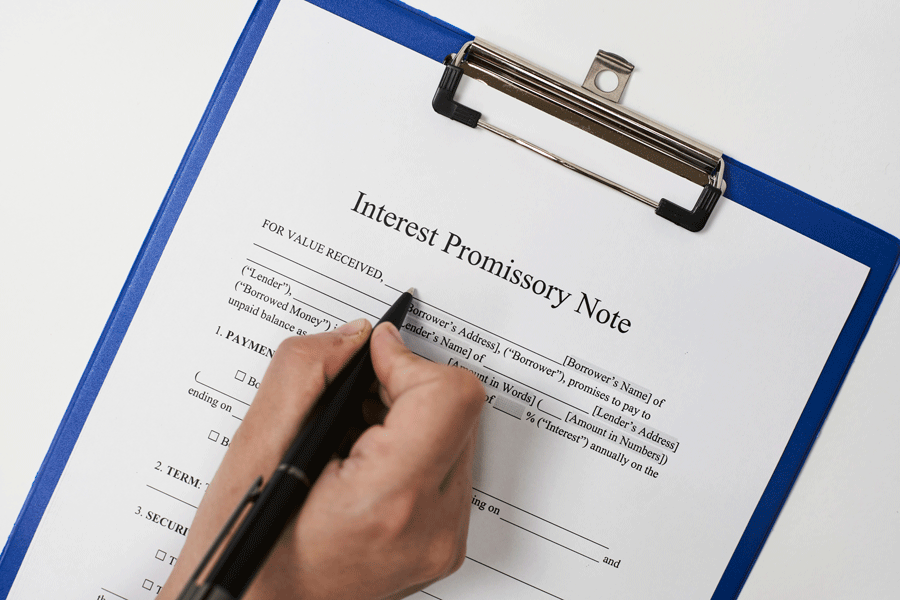

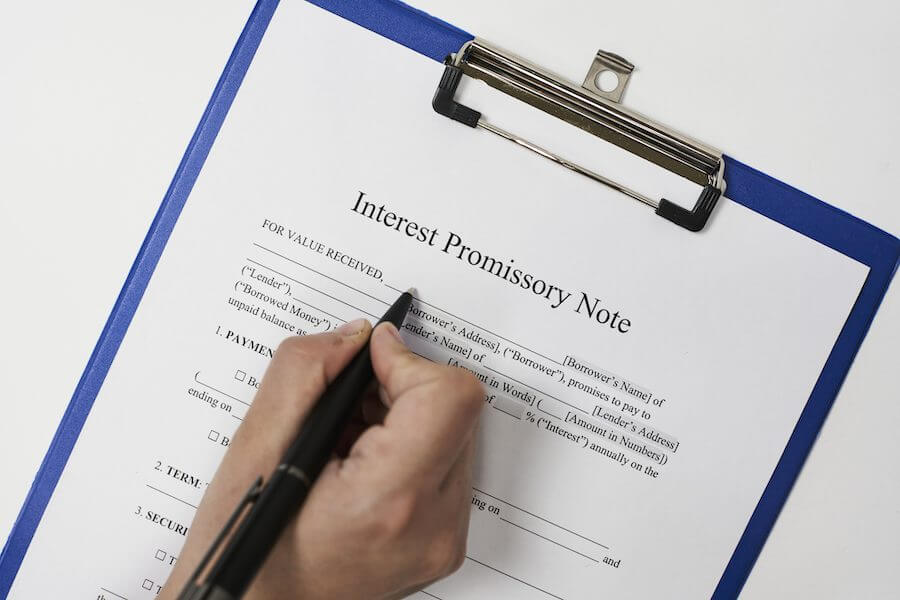

There are specific components and details that you must include. These components include the following:

Basic information

The basic information is the first element and should include the document’s start date, typically the date of the agreement or the date on which the two parties drafted the promissory note. The date is typically written in the order of month, day, and year after the title. This data is provided to help the borrower remember when they have taken out loans that they must repay, as well as to make it easier to establish deadlines.

The full and legal names of the borrower, the lender, and the co-signer must also be included in the note. Alongside their names, their roles in the contract must be indicated. Additionally, all parties’ complete mailing addresses, particularly those of the borrower and lender, must be provided. The physical address must also be provided if any party’s mailing address differs from their physical address.

The principal sum should also be included in the basic information section. This is the total amount of the loan that the lender provides to the borrower. It is usually the sum of the loan without interest. The percentage of the interest per year is the interest rate that will be charged on the loan every year. It is usually written as “per annum,” “yearly interest rate,” or “annual percentage rate” (APR) in the promissory note.

Payments and payment method

You will need to provide the full details of the payments and the payment method in your template. This component is an important detail. You will need to provide information about the total payments to be made, the amount required for each payment, and the due date for each payment. Additionally, you must specify how much late fee the borrower will be required to pay and when (timeframe) those fees will be applied. The payment method, as well as the payment processing address, are also required.

Due date

The due date is when the lender expects full loan repayment. In Texas, failure to observe the due date means the borrower risks having their collateral claimed by the lender in the case of a secured promissory note or facing court proceedings in the case of an unsecured note.

The interest rate in the event of default

If the borrower defaults on the loan and does not repay it following the terms of the agreement, a higher interest rate will be charged.

Security

The note’s status as secured or unsecured is stated in this section. If the loan is secured, specifics about the collateral and how the lender will be able to claim it if the loan payment is not made should also be stated.

Titled sections and subsections

The following clauses and details are included in the title sections and subsections of the Texas promissory note:

Interest due in the event of default

This interest rate increases if the borrower defaults on the loan, that is, fails to make payments within the provided time frame.

Allocation of payments

These are the specifics of how the payments will be divided between the principal balance (the amount owed to complete the loan) and interest.

Prepayment

This is a clause that specifies whether there will be a financial penalty or premium for repaying the loan early.

Acceleration (and 6A)

If the borrower defaults, the lender has the right to demand an immediate full loan payment.

Attorney’s fees and costs

These are details of how attorney fees and costs will be handled by the two main parties if there is an issue with the promissory note.

Waiver of presentments

A provision stating that the lender is not required to be physically present with the promissory note each time the borrower makes a payment.

Non-waiver

This clause guarantees that the note is not waived, even if a particular section is waived or abandoned.

Severability

This clause ensures that the promissory note is still valid even if a portion of it is found to be illegal.

Integration

The promissory note comprises the whole agreement made between the borrower and the lender.

Conflicting terms

This section allows any section of the agreement with an issue(s) to be resolved with an amendment if it is determined to have terms of conflict.

Notice

This section establishes whether the lender will inform the borrower (or make any other form of communication) about a legal action they are taking because the borrower defaulted.

Co-Signer

The co-signer’s name and address are required.

Execution

All signatures that are necessary for the note to be executed or fully completed are listed in this section.

Governing law

In the event of a disagreement, this section includes the Texas state laws that will govern and apply to the draft.

Signatures

The lender’s signature, the borrower’s signature, the co-signer’s signature, and the witness’ signature are all required in the promissory note. Apart from that, the date of signatures and the full name of each party must be included at the end of the template.

Although it is not required by Texas law, the parties have the option to have it notarized.

Final Thoughts

In Texas, it is recommended that borrowers and lenders use a promissory note to create a record of their loan transactions. A premade template helps ensure that all the required content is included. The two parties have a legally binding document that ensures the lender provides the loan and the borrower pays it back in installments for a specific time until the loan payment is complete. These parties can either choose a secured or unsecured promissory note.